Every trader has asked the same question at some point: “What’s the best option strategy for this stock right now?” Option Samurai’s Analyzer feature gives you a direct, data-driven answer. Instead of running separate scans or manually testing trades, you can define a stock scenario – and the Analyzer will find the optimal strategy automatically.

Whether you’re expecting a rally, a pullback, or range-bound action, this tool compares every supported strategy side by side, calculating expected value, probability of profit, and return using real options data.

Define Your Stock Scenario

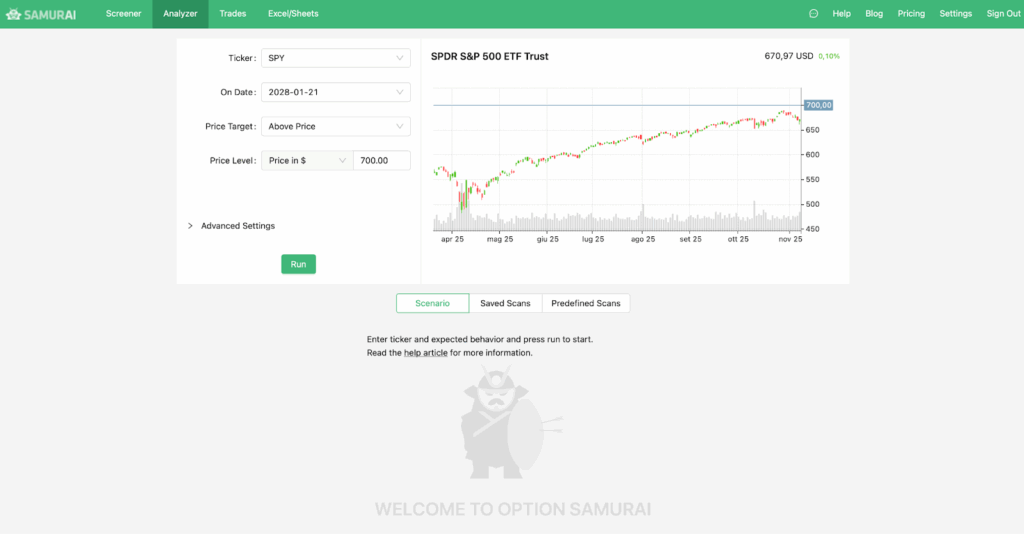

Start by entering your ticker, price target, and date, like this:

You can choose between directional or range-based targets, such as:

- Above or Below a certain price

- Between two price levels

- Outside a range

As you input your scenario, a chart updates showing recent price action and the target range you’re planning for. This makes it easier to visualize your thesis before running the analysis.

Let the Analyzer Do the Work

Once you define your scenario, Option Samurai uses its next-gen screening options tools to scan all supported strategies – calls, puts, spreads, condors, covered calls, and more – and calculates which one offers the best balance between expected return and probability of profit.

Each strategy appears on its own card, showing:

- Expected P/L and risk (calculated with a Monte Carlo simulation)

- Probability of profit (from the Black–Scholes model)

- Return on risk and breakeven levels

- A P&L chart with your target, breakeven, and expiration lines clearly marked

You can even slide between prioritizing maximum return or maximum probability of profit – letting you tailor results to your own risk profile.

Hover over the chart to compare different trades or even benchmark them against a simple buy & hold position.

Explore Related Scans and Saved Ideas

Below the main results, you’ll find two additional tabs:

- Saved Scans: Lists all the custom scans where your ticker already appears – helpful if you’ve found setups for it before.

- Predefined Scans: Shows all the built-in scans that currently include that stock.

Both are clickable, so you can jump directly from the Analyzer into the screener for deeper filtering or customization.

This feature is especially useful when you’ve analyzed a specific stock and want to see how it also fits across different strategies in your saved workflows.

Bonus: Fine-Tune Advanced Settings

For traders who like precision, the Analyzer includes advanced simulation controls to adapt results to your style:

- Include unbalanced spreads – expands the search to asymmetrical iron condors or butterflies.

- Bid/ask level – switch between mid or conservative pricing.

- Volatility source – use implied, realized, or custom volatility.

- Drift – simulate bullish or bearish directional bias, or link to the risk-free rate automatically.

These settings allow you to test realistic market conditions instead of textbook ones – especially valuable if you trade events or short-term volatility.

Turn Analysis into Action

Once you’ve found your preferred trade, click “Trade” to open it directly in your Trade Log or send it to your connected broker.

You can tweak strikes, expiration, or quantity – and instantly see how the expected value and probability metrics update. It’s the fastest way to go from idea to execution using real data and clearly defined risk.

Final Thoughts: From Scenario to Strategy in One Click

Option Samurai’s Analyzer takes the guesswork out of options strategy selection.

By running Monte Carlo simulations and comparing every possible trade side by side, it helps you find the most efficient strategy for your price outlook – long, short, or neutral.

Instead of asking “Which strategy should I use?” you’ll know exactly which one fits your scenario, risk tolerance, and timeframe.

Start your free trial today (no credit card required) and discover the most effective option strategy for any stock, any outlook, and any market condition – instantly.