Bitcoin investor Strategy is facing scrutiny after a steep decline in its share price this year, but long-term data shows the company’s Bitcoin-driven model remains far more resilient than short-term charts suggest.

Google Finance data shows Strategy’s stock has dropped nearly 60% over the past year and more than 40% year-to-date.

The stock was trading near $300 in October but has since fallen to around $170.

Despite Declines, Bitcoin Holdings Still in Profit

Some investors have interpreted the slump as evidence that Strategy’s approach has been “exposed.”

However, BitcoinTreasuries.NET data shows the company acquired its Bitcoin at an average cost of $74,430.

With Bitcoin trading near $86,000, Strategy remains up about 16% on its overall Bitcoin purchases.

The company’s long-term stock performance also paints a different picture.

Over the past five years, Strategy shares have climbed more than 500%.

For comparison, Apple gained 130% over the same period, while Microsoft increased by 120%.

Even over two years, Strategy’s stock rose 226%, outperforming Apple’s 43% and Microsoft’s 25%.

Why Investors Are Shorting Strategy

The recent price decline may have less to do with Bitcoin’s fundamentals and more to do with how institutional investors hedge their crypto exposure.

In a CNBC interview, BitMine chairman Tom Lee said Strategy has become the most convenient vehicle for hedging Bitcoin.

“Someone can use MicroStrategy’s options chain, which is so liquid, to hedge all of their crypto,” he said. “The only convenient way to hedge someone’s long is to short MicroStrategy or buy puts.”

This dynamic has effectively turned Strategy into a pressure valve for the broader crypto market, absorbing volatility, hedges and short positions that may not reflect its underlying business strategy.

Strategy Expands Its Bitcoin Holdings

Despite the turbulent market, Strategy continues building its Bitcoin treasury.

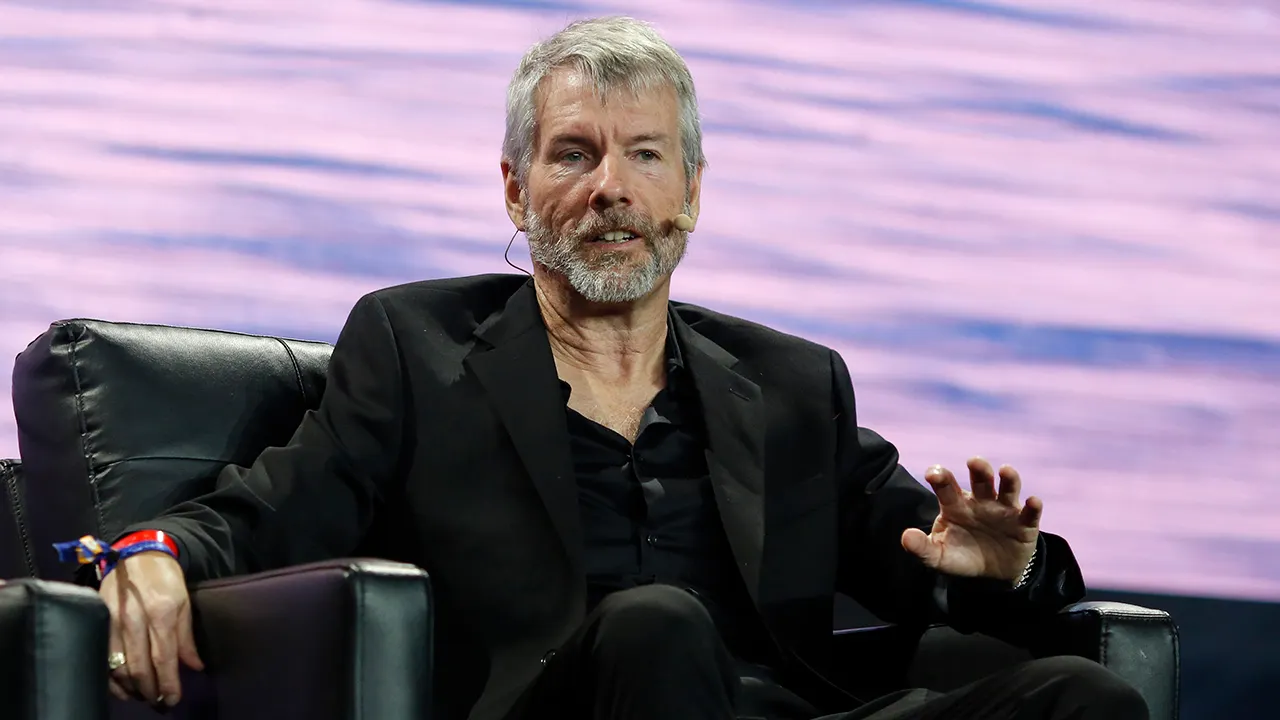

Chairman Michael Saylor reaffirmed his commitment to the company’s approach, writing on X that he “won’t back down.”

On Nov. 17, the company announced the purchase of 8,178 BTC for $835.6 million.

The acquisition — significantly larger than its typical weekly purchases — brought Strategy’s total holdings to 649,870 BTC, valued at nearly $56 billion.

Liquidity Slowdown Adds to Market Pressure

On Nov. 6, crypto market-maker Wintermute attributed recent market weakness to slowing liquidity flows across stablecoins, exchange-traded funds and digital asset treasuries.

The firm said inflows in all three areas had flattened, contributing to widespread price pressure.

Data from DefiLlama shows digital asset treasury inflows fell from almost $11 billion in September to just $2 billion in October — an 80% decline following the liquidation of around $20 billion in crypto positions.

Inflows decreased further in November, reaching about $500 million as of Monday, marking a 75% drop from October.

Despite these conditions, Strategy’s long-term performance continues to outpace major tech benchmarks, underscoring the company’s conviction in Bitcoin even amid near-term turbulence.