In response to our readers’ requests to talk about earning through cryptocurrency arbitrage and its potential opportunities, we have written this guide. Our team conducted market research and spoke with numerous individuals who hold cryptocurrencies and occasionally engage in arbitrage.

As we believe, we have found the optimal way to earn through cryptocurrency arbitrage.

However, before presenting the best option to you, let’s first understand what cryptocurrency arbitrage is.

In simple terms:

Cryptocurrency arbitrage is a method of earning that is based on buying and selling cryptocurrencies with the aim of profiting from price differences on different exchanges. For example, if a cryptocurrency has varying prices on different exchanges, an arbitrageur can buy it on an exchange with a lower price and sell it on an exchange with a higher price, thereby making a profit from the price difference. This allows for exploiting inconsistencies in cryptocurrency prices to generate additional income.

There are different types of arbitrage, including intra-exchange and inter-exchange arbitrage.

Intra-exchange arbitrage is a type of arbitrage where buying and selling operations of cryptocurrencies are conducted on the same exchange. In this case, the arbitrageur looks for price discrepancies across different trading pairs or instruments within that exchange.

Inter-exchange arbitrage is a more attractive option, especially when combining a major and a smaller exchange. On projects like Bitcoin and Ethereum, there is practically no difference in prices, but on smaller projects, it is much easier to capture price differences.

Inter-exchange arbitrage also works well when a coin experiences sharp drops or rises, such as the case with FTT when there were rumors of its resumption of operations.

Major token doubled in value in less than 5 hours.

During that time, arbitrage spreads reached 20% in a cycle on major projects for several hours.

If you were holding FTT, not only could you sell it at double the entry price within a couple of hours, but you could also make 3-4 cycles of arbitrage, earning around 70% of your capital as a bonus. Subscribing to a scanner for $70 would have paid for itself for a year ahead.

Remember to familiarize yourself with how the notifications are sent so that you are aware of changes and possible arbitrage opportunities.

Cryptocurrency arbitrage between DEX exchanges and blockchains.

Arbitrage between DEX exchanges and blockchains: the best way to earn money currently, as confirmed by expert opinions and practicing arbitrageurs.

Let’s consider an example of arbitrage between the Arbitrum network and BSC, where a significant difference exists.

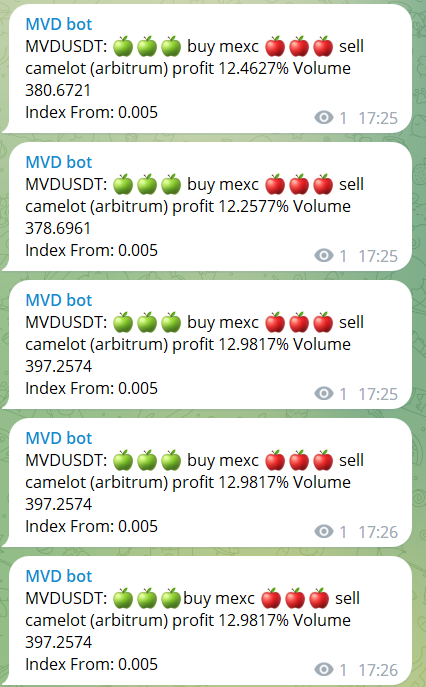

Let’s assume we have a cryptocurrency called MVD, which is traded on both the Arbitrum network and the MEXC exchange. Considering that withdrawing from Arbitrum to the Ethereum network is time-consuming and there is not much competition among arbitrageurs, the price difference can reach up to 30%.

As an example, we found a spread of 12% for this particular coin.

Why an automated bot is not suitable for arbitrage:

Our editorial team wants to warn about the possible risks associated with using APIs, NFTs, and cryptocurrency market arbitrage. All of these methods can lead to financial loss, especially if you are not familiar enough with them. We do not recommend risking all of your savings, as unforeseen events can occur at any time, such as a project turning out to be fraudulent or becoming a victim of hacking. Instead, we strongly recommend using only trusted manual bots to safeguard your investments.

Analysis of Arbitrage Scanners:

After studying various arbitrage bots, we found that most of them are limited to working with 10 exchanges. Almost all automated bots require access to exchange APIs. However, there is one bot that has access to a whopping 50 exchanges and tracks arbitrage opportunities on DEX exchanges and over 40 blockchains in real-time, without using APIs.

Introducing the best cryptocurrency arbitrage bot in our opinion – ArbitrageScanner.

Arbitragescanner.io: Functionality and Advantages for Profiting from Cryptocurrency Price Differences

ArbitrageScanner is a powerful tool that offers numerous opportunities to profit from cryptocurrency price differences. Here are its key features and advantages that make it indispensable in the world of arbitrage:

1. Support for over 50 centralized (CEX) exchanges and 25 decentralized (DEX) exchanges, as well as 40 different blockchains. This means you can track and find arbitrage opportunities virtually anywhere. If a specific exchange you need is not initially included, the ArbitrageScanner team adds exchanges upon user requests.

2. Flexible tracking configuration for any exchange. You can easily add multiple new exchanges to the scanner and monitor their prices and spreads simultaneously.

3. User-friendly administrative panel and quick integration of any cryptocurrency. Setting up the scanner takes just 1 minute.

4. A unique feature of the scanner is displaying the difference between different networks and blockchains. This allows you to discover and profit from cryptocurrency price differences across various platforms.

5. The ability to receive assistance from a VIP manager. If you prefer to have all the parameters and coins set up for you, the VIP manager can help you find the most profitable pairs.

6. Free tutorials and case studies for beginners. When purchasing different usage packages of the scanner, you’ll receive free tutorials and case studies to help you familiarize yourself with its functionality and start earning.

7. A private chat for clients where you can receive support and answers to your questions. They will assist you in setting up the scanner, suggest profitable pairs, and support you on your path to successful arbitrage.

Conclusion: The main advantage of the arbitrage scanner is its ability to work with decentralized exchanges (DEX), where few people track real-time price differences. Additionally, you have the potential to connect to any centralized exchange through technical support, expanding your potential for earning from cryptocurrency arbitrage.

Inter-exchange cryptocurrency arbitrage on DEX exchanges: Key opportunities and profitability

If you are looking for a way to profit from cryptocurrency price differences, inter-exchange arbitrage on decentralized (DEX) exchanges is your best option. Here, you can find significant price differences that often reach 10-15%. One of the arbitrage traders in the chat shared with us the spread he captured when using Arbitragescanner.io.

A Step-by-Step Guide to Using ArbitrageScanner:

We have purchased a 30-day access to fully evaluate the functionality of the Screener. Now, we will provide you with a detailed guide on how to use this tool.

Let’s start by going through the registration process on the website and payment methods. Please note that access to the service is granted only after payment. However, you can also request a trial day by contacting the scanner’s support team.

Registration: You will need to provide your email, phone number (optional), Telegram, or WhatsApp.

Choose the subscription plan that suits your needs. For this review, we have selected the Expert plan.

After payment, it is quick and easy enough to set up the service. The team has prepared a special guide for you. It is recommended to start by setting thresholds and triggers as shown here:

Start with small values, for example 0.001, and check how it works. Then you can gradually increase the parameters.

Remember to familiarise yourself with how the notifications are sent so that you are aware of changes and possible arbitrage opportunities.

Ready-made cases to help you make money using ArbitrageScanner.

We’ve highlighted a couple of interesting cases in the ArbitrageScanner private chat and in chats with arbitrators who use the service:

ArbitrageScanner Reviews

Based on our surveys of the scanner’s audience and online reviews, the comments have been overwhelmingly positive. You can conduct your own search and explore other articles, reviews, and overviews. We have been satisfied with the product, and the Arbitragescanner.io team promises to continue developing it. We eagerly anticipate the additional services they will showcase. Below, we provide the reviews we found.

Arbitragescanner.io Free Trial Day

As mentioned earlier, you can request a trial day from the ArbitrageScanner team, but in just one day, you may not have enough time to catch something interesting. However, you can still familiarize yourself with the product and how it works. Before making a purchase, we also requested a free day, but we didn’t manage to earn much during that day, plus we wanted to see how arbitrage would work between DEXs. Therefore, we calculated and concluded that if we were able to earn even during the trial day, then over 30 days, we would definitely recoup our subscription and not be mistaken.

Arbitrage Profitability Calculator

Another useful feature is the profitability calculator on the Arbitrage Scanner website. This is a free tool available to every user.

The calculator has explanations for each cell and shows an example of profit calculation.

This is a handy feature when setting up your bot, you can immediately see which pairs are worth your attention and which are not.

Referral System

The service has a generous referral system where you receive 30% of all purchases made by your referrals throughout the entire duration. However, if you are a blogger or involved in online media activities, upon your request, the amount can be increased to 50% of sales.

Arbitrage cryptocurrency pairs, cases, examples

We are ready to show you pairs and examples of how you can earn with the help of an arbitrage bot. In these examples, you will see how other traders have used the bot for their profit.

- Investing in IDOs (Initial DEX Offerings) and coins that have just been listed on an exchange presents an excellent opportunity for arbitrage, especially for small coins like NEUT, MEX, and others. When a coin gets listed on 2-3 exchanges, there can be a significant price difference due to low liquidity.

- Let’s say you purchased a certain coin for $500 and connected it to the arbitrage trading bot without withdrawing funds from the exchange. Let’s assume you have a combination of Gate-MEX. You sell this coin and simply wait – it could be a couple of hours or maybe a day – until the arbitrage starts working in the opposite direction. This way, you won’t incur losses on fees, especially if the coin is only available on the ERC network, where withdrawal fees are expensive.

- Even if withdrawals are closed, you can still arbitrage on coin listings. For example, you acquire tokens on exchange “A” with higher liquidity, and the price is rising. Then you sell and buy on a smaller exchange “B.” When the prices align, you can either switch directions or wait for the coin’s price to start falling. On a larger exchange, the coin may drop faster, and the arbitrage will work in the opposite direction. High volatility always characterizes the initial period.

- Below is a pairing for those holding ARB tokens:

1. Buy ARB tokens on the Arbitrum network or on a centralized exchange (CEX) and withdraw them to an Ethereum wallet on the Arbitrum network to obtain ARB tokens in that network.

2. Transfer ARB tokens from the Arbitrum network to the ERC20 network using the official ARB token. The fee will be approximately $15 on the ERC20 network and $1 on the Arbitrum network. Make sure you have some Ether in the ERC20 network in advance, for example, around $100, so that you don’t run out of enough Ether to complete the transaction in case of high fees.

3. After sending the tokens through the bridge, you will need to wait for 7-8 days or more for the tokens to transfer to the ERC20 network.

The spread (difference) between the networks remains relatively stable, at least until centralized exchanges start withdrawing ARB tokens on the Ethereum network. Until that point, you can earn 10% to 30% in a week or one cycle.

P.S. Remember that ARB is not the only coin on the Arbitrum network, and you can find many other pairings.

- If you don’t want to wait for the prices to align, you can set a profit percentage of 5% to 8% in the trading bot. Execute the pairing with a 10% profit, withdraw it to the Ethereum network, and it will take about a week. Then return the tokens to the exchange and wait for another 10% profit.

- Arbitrage between different exchanges is an interesting scenario, especially between small and large platforms. For example, the founder of Alameda Research started by buying Bitcoin on Coinbase and selling it on a Korean exchange where the price was higher, and there was always a difference. You can also use a similar approach. There are purely Turkish, Brazilian, or Korean exchanges that arbitrageurs cannot access. Simply add these exchanges to your bot and take advantage of the significant differences in exchange rates.

Conclusion

We’ve analyzed the market and we can say that this is the best ArbitrageScanner today: Reasonable price, supports a large number of CEX, DEX exchanges and blockchains, simple intuitive operation, no API required, there are really working cases for arbitrage, useful yield calculator on website, training for beginners, generous referral program, it’s possible to buy franchise business, it’s possible to get your own VIP manager, positive feedback from clients.

We definitely recommend trying this bot yourself.

Telegram ArbitrageScanner: https://t.me/arbitragescanner_eng

Twitter ArbitrageScanner: https://twitter.com/ArbitrageScan