Cryptocurrency treasury management has become an increasingly important aspect of corporate finance for companies holding digital assets. While traditional treasury functions focus on fiat currencies, corporate crypto treasuries manage large positions in digital assets such as Bitcoin (BTC) and Ethereum (ETH). These companies are navigating uncharted waters, balancing risk management, liquidity needs, and regulatory compliance while leveraging the growth potential of cryptocurrencies.

In this article, we explore BTC and ETH treasury companies, their funding strategies, associated risks, and emerging trends in corporate crypto management.

What Are BTC and ETH Treasury Companies?

BTC and ETH treasury companies are corporations or investment vehicles that maintain substantial holdings in Bitcoin or Ethereum as part of their financial strategy. Unlike typical investment firms that allocate a small percentage of capital to cryptocurrencies, treasury companies treat digital assets as core components of their balance sheets.

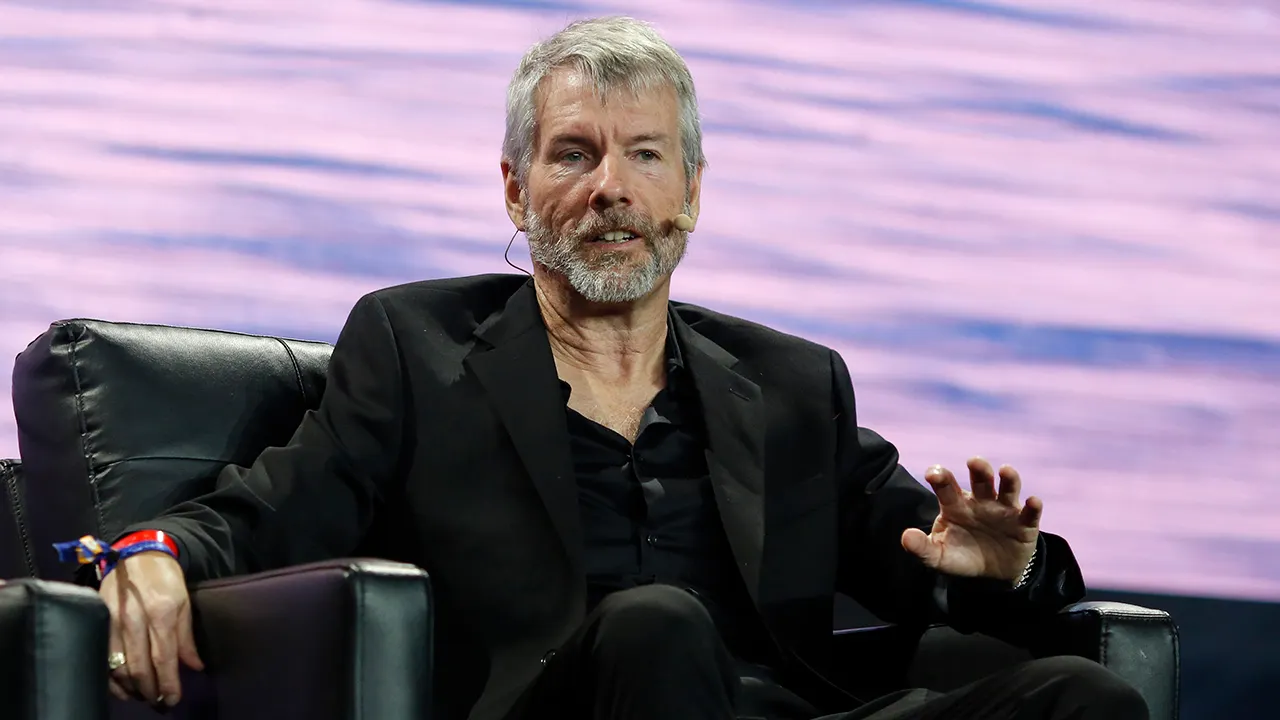

Companies like MicroStrategy, Tesla, and Galaxy Digital are examples of entities that have integrated cryptocurrencies into their treasury operations. BTC treasury companies focus primarily on Bitcoin, often positioning it as a store of value, while ETH treasury companies may hold Ethereum to capitalize on its network utility, DeFi applications, and staking rewards.

These treasury holdings are not just for investment purposes; they also serve as tools for strategic capital allocation, liquidity management, and hedging against fiat currency devaluation.

How BTC Treasury Companies Raise Funds

Raising capital for BTC-focused treasuries often involves a combination of traditional and crypto-specific financing methods:

1. Public or Private Equity

Some treasury companies issue equity to raise capital. This can involve selling common stock or preferred shares to institutional or retail investors, allowing them to acquire funds that are then converted into BTC. Companies like MicroStrategy have famously raised billions through equity offerings specifically to purchase Bitcoin.

2. Debt Financing

Corporate bonds or convertible debt are often used to fund crypto acquisitions. Debt financing allows companies to leverage capital without diluting equity. Convertible bonds may include a conversion clause into equity at a future date, making them attractive to investors willing to accept some risk in exchange for potential upside tied to the company’s overall performance and crypto holdings.

3. Revenue-Backed Funding

Some ETH treasury companies generate revenue directly through staking, lending, or operating blockchain infrastructure. Staking ETH on proof-of-stake networks allows companies to earn regular yields, which can then be reinvested into additional ETH purchases. Similarly, lending ETH through DeFi protocols provides liquidity while generating interest income.

4. Institutional Investment

Large institutional investors, such as family offices, hedge funds, or venture capital firms, may provide capital in exchange for a share of treasury holdings. These investors often seek exposure to BTC or ETH without directly buying cryptocurrencies themselves, relying on the company’s expertise in custody and asset management.

5. Strategic Partnerships

Some treasury companies form partnerships with crypto exchanges, fintech companies, or blockchain projects to raise capital or liquidity. These collaborations may involve shared investment vehicles, joint venture funds, or access to specialized crypto lending platforms.

How ETH Treasury Companies Raise Funds

ETH treasury companies often employ strategies similar to BTC treasuries but may leverage Ethereum’s programmable network:

- Staking Rewards: By staking ETH, companies earn yield that can be reinvested or distributed to investors.

- Decentralized Finance (DeFi) Protocols: Lending, liquidity provision, or yield farming generates capital that can fund additional ETH purchases.

- Equity Offerings: Like BTC companies, ETH-focused companies may raise equity in fiat to convert into Ethereum.

- Tokenized Securities: Some ETH treasury companies explore issuing tokenized equity or bonds, allowing investors to participate in crypto-backed corporate treasuries.

These approaches allow ETH treasury companies to generate ongoing revenue streams, unlike BTC treasuries that primarily rely on price appreciation.

Risks Facing BTC and ETH Treasury Companies

While crypto treasuries offer potential upside, they come with significant risks:

1. Market Volatility

Both BTC and ETH are extremely volatile. Prices can swing 10-20% in a single day, impacting the balance sheet of companies holding significant positions. A poorly timed purchase or sale can erode substantial value.

2. Regulatory Risk

Cryptocurrencies remain a gray area in many jurisdictions. Treasury companies face regulatory scrutiny related to reporting, taxes, and compliance. Unexpected regulations can freeze assets, limit transactions, or create legal exposure.

3. Custody and Security Risk

Digital assets require secure storage. Custodial failures, hacks, or loss of private keys can lead to irreversible losses. Companies often invest in multi-signature wallets, institutional custodians, and insurance coverage, but risk cannot be entirely eliminated.

4. Liquidity Risk

Large crypto holdings may be difficult to liquidate quickly without affecting the market price. Treasury companies need careful planning to manage cash flow requirements without triggering price drops.

5. Reputation and Market Perception

Companies holding cryptocurrencies face scrutiny from investors, media, and regulators. Public perception can impact stock prices, partnerships, and funding opportunities, particularly if the market experiences sharp downturns.

6. Operational and Strategic Risk

Managing a crypto treasury requires specialized knowledge in trading, risk management, and blockchain infrastructure. Poor operational decisions, lack of skilled staff, or misaligned strategy can result in financial losses.

Risk Mitigation Strategies

BTC and ETH treasury companies often employ a combination of the following strategies:

- Diversification: Holding a mix of BTC, ETH, and other digital assets to reduce reliance on a single cryptocurrency.

- Hedging: Using options, futures, or other derivatives to protect against price volatility.

- Multi-Signature Custody: Requiring multiple private keys for transactions to reduce security risk.

- Insurance: Purchasing crypto-specific insurance policies against theft or loss.

- Regular Reporting: Maintaining transparency with stakeholders to manage perception and comply with regulations.

Fundraising Considerations and Investor Expectations

Investors in crypto treasury companies often consider:

- Transparency: Detailed reporting of holdings, risk measures, and returns.

- Revenue Streams: For ETH treasuries, yields from staking and lending may attract investors seeking income, not just appreciation.

- Governance: Clear policies for asset management and decision-making.

- Exit Liquidity: The ability to convert holdings into cash or tokens without large losses.

Trends in Corporate Crypto Treasury Management

- Institutionalization: Increasingly, large corporations and hedge funds are professionalizing crypto treasury operations.

- Diversification Across Assets: Combining BTC, ETH, stablecoins, and tokenized securities.

- Integration With Traditional Finance: Using crypto as collateral for loans, or linking treasury strategies to fiat operations.

- Staking and DeFi Revenue Models: ETH treasuries are exploring decentralized finance as a source of consistent income.

These trends indicate that corporate crypto treasuries are evolving from speculative holdings to strategic, revenue-generating operations.

FAQ

Q1: Are BTC treasury companies riskier than ETH treasury companies?

Not inherently, but BTC is generally treated as a store of value with lower utility, while ETH offers staking and DeFi opportunities. ETH treasuries may have more operational complexity, increasing execution risk.

Q2: Can treasury companies lose all their crypto?

Yes, through hacks, loss of keys, or extreme market events. Risk mitigation strategies like multi-signature wallets and insurance help reduce this risk but cannot eliminate it entirely.

Q3: How do treasury companies generate returns aside from price appreciation?

BTC treasuries primarily rely on price appreciation. ETH treasuries can generate staking rewards, lending interest, or DeFi yields. Some companies may also earn transaction fees from network participation.

Q4: Are these companies regulated?

Regulation varies by country. Many operate in legal gray areas, but they are increasingly subject to financial disclosure, anti-money laundering (AML), and taxation rules.

Q5: How do investors participate in these treasuries?

Investors may buy equity in publicly traded companies holding crypto, participate in tokenized securities, or invest through private funds. Transparency and reporting are key considerations.

Q6: Is it better to hold BTC or ETH in a corporate treasury?

It depends on objectives. BTC is often seen as a store of value, similar to gold. ETH provides staking opportunities and exposure to DeFi but may require more active management. Many companies hold both to balance risk and reward.

Q7: What happens if crypto prices crash?

Treasury companies face unrealized losses, which may impact balance sheets and investor confidence. Risk mitigation strategies such as hedging or diversification can soften the impact.

Q8: Are there tax implications?

Yes. Treasury holdings may be subject to capital gains, income from staking, or corporate taxation depending on jurisdiction. Companies must track transactions carefully to ensure compliance.

Q9: Can small businesses implement crypto treasuries?

In theory, yes. But risks are higher due to limited expertise, capital, and access to secure custody solutions. Most treasury management strategies are tailored to institutional or corporate-level operations.

Q10: What is the future of crypto treasuries?

Corporate crypto treasuries are likely to grow as more companies adopt digital assets for liquidity, investment, and operational purposes. Integration with traditional finance, improved regulatory clarity, and innovation in DeFi and staking will shape the next decade.