Amidst the growing anticipation and skepticism surrounding the potential approval of the first spot Bitcoin exchange-traded fund (ETF) in the United States, notable Bitcoin critic and advocate for gold, Peter Schiff, has issued a cautionary warning to Bitcoin enthusiasts.

In a tweet posted on the social media platform X (formerly Twitter), Schiff expressed concerns about the potential catastrophic impact of spot Bitcoin ETFs on the price of BTC.

He argued that the mere prospect of a U.S.-listed spot Bitcoin ETF has bolstered the price of Bitcoin and speculative demand for years.

Schiff’s contention is that if the expected institutional demand for Bitcoin doesn’t materialize following ETF approval, it could lead to a significant decline in BTC’s price.

Schiff has maintained his skepticism towards Bitcoin for an extended period, consistently predicting its downfall, although his predictions have been proven wrong in each market cycle.

His tweet drew responses from Bitcoin proponents who countered his argument by likening the potential ETF’s impact to that of a gold ETF on the demand for physical gold.

Despite the ongoing debate, those eagerly awaiting the launch of the first spot Bitcoin ETF in the U.S. may face further delays.

A data-focused consultancy firm, Matrixpoint, predicts that the Securities and Exchange Commission (SEC) is likely to reject all spot Bitcoin ETF applications before the final deadline of January 10.

READ MORE: Bitcoin Surges Above $45,000 Amid Anticipation of Spot ETF Approval

Matrixpoint’s forecast diverges from the consensus among many ETF analysts, who previously estimated a 90% likelihood of approval before the January 10 deadline.

Matrixpoint claims that all the applications submitted to the SEC fall short of a crucial requirement that must be met for approval.

Consequently, the firm anticipates that the first spot Bitcoin ETF may not receive approval until the second quarter of 2024.

Matrixpoint’s analysis factors in the current composition of the SEC’s leadership, where Democrats hold a majority among the five voting commissioners.

This political dynamic makes it less probable that any of the commissioners, including SEC chief Gary Gensler, would vote in favor of a spot Bitcoin ETF.

Contrary to earlier reports citing unnamed sources that predicted approval by January 2, the SEC has yet to make a decision as the January 10 deadline approaches.

This uncertainty has led to a shift in market sentiment from optimism to skepticism, evident in the weakness of crypto mining stocks and the sell-off of various crypto-related U.S. stocks.

Even Bloomberg ETF analyst Eric Balchunas, who initially believed there was a 99% chance of approval in the first quarter of 2024, now acknowledges a slim possibility that the SEC could reject the applications, describing it as the “rug pull of a decade.”

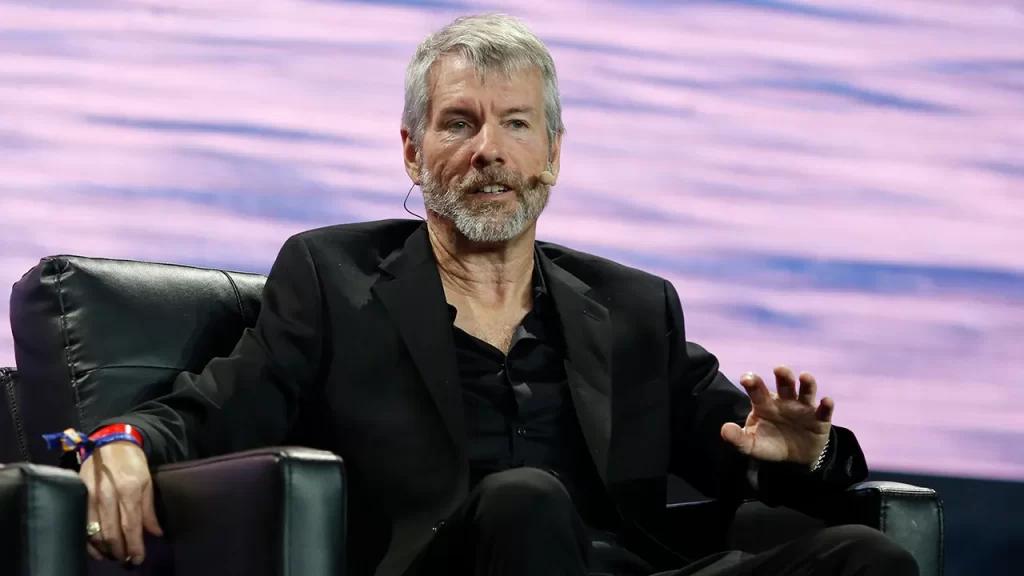

MicroStrategy’s Executive Chairman, Michael Saylor, has initiated a four-month process to sell $216 million worth of his shares in the company, with a portion earmarked for increasing his Bitcoin holdings.

This move was disclosed in a filing with the United States Securities and Exchange Commission (SEC) on January 2nd, where Saylor revealed that he had commenced the sale of his 315,000 stock options awards, originally granted to him in April 2014.

These stock options are set to expire on April 30, 2024.

As per the filing, Saylor began the sell-off on January 2nd, liquidating his first tranche of 5,000 shares.

This sale aligns with his announcement during MicroStrategy’s third-quarter earnings call on November 2nd, where he outlined his intention to sell 5,000 MSTR shares daily for the next four months.

The proceeds from these sales are intended to address “personal obligations” and bolster Saylor’s personal Bitcoin holdings.

Saylor expressed his rationale for the sale during the earnings call, stating that exercising this option would enable him to fulfill personal obligations and acquire more Bitcoin for his personal account.

READ MORE: Bitcoin Price Prediction: AI Suggests Potential $100,000 Milestone by 2024

He emphasized that his stake in the company’s equity remains “significant” despite these personal sales.

It’s worth noting that according to a November 1st Q-10 filing with the SEC, Saylor has the capacity to sell a maximum of 400,000 shares of his vested options between January 2nd and April 26th of the current year.

While Bitcoin experienced a remarkable 170% rally over the preceding year, MicroStrategy’s performance has eclipsed that of the cryptocurrency, boasting a staggering 411% gain during the same period, based on TradingView data.

In a significant move, on December 27th, MicroStrategy made a substantial purchase of 14,620 Bitcoins for $615 million, further expanding its already substantial Bitcoin holdings.

This acquisition brought MicroStrategy’s total Bitcoin stash to an impressive 189,150 Bitcoins, valued at approximately $8.5 billion at prevailing market prices.

Saylor’s ongoing share sales, coupled with MicroStrategy’s unwavering Bitcoin accumulation, underscore the company’s commitment to cryptocurrency as a core part of its corporate strategy.

The possibility of a Bitcoin exchange-traded fund (ETF) facing rejection by the Securities and Exchange Commission (SEC) this month is slim, according to Bloomberg ETF analyst Eric Balchunas.

While the outcome remains uncertain, Balchunas suggests that any delay or rejection is more likely to be due to the SEC’s need for additional time rather than an outright denial.

Balchunas, along with fellow ETF analyst James Seyffart, maintains a 90% probability of approval by January 10 but has refrained from raising the odds further due to this lingering concern.

He emphasizes that the 10% chance of rejection encompasses various scenarios.

However, Balchunas believes that the extensive time and effort invested by both the SEC and Bitcoin ETF issuers make an outright rejection at the last moment highly unlikely.

He characterizes such a rejection as the “rug pull of the decade,” considering the significant effort expended, particularly during the holiday season.

Vetle Lunde, an analyst from crypto research firm K33 Research, shares a similar outlook, estimating the chances of an ETF rejection at just 5% in a January 2 market report.

READ MORE: Data Suggests Limited Impact on Bitcoin Prices Despite SEC ETF Approval Speculation

Should the SEC issue an outright denial, Balchunas speculates that fund issuers might take legal action against the regulator, following the example of crypto asset manager Grayscale.

He believes that the substantial financial investments and efforts made thus far would discourage parties from giving up easily.

Public comments addressing the SEC’s request for feedback on the ETF filings continue to be submitted, with two recent submissions on January 2 advocating for an outright rejection.

One letter argued that Bitcoin’s decentralized nature and its potential to bypass traditional financial systems could make it attractive to authoritarian regimes seeking to evade sanctions and exert control over their citizens.

In summary, while the possibility of a Bitcoin ETF rejection remains, analysts like Eric Balchunas and Vetle Lunde view it as a low probability event, with the SEC more likely to request additional time for review rather than outright denial.

The significant investments and efforts put into this endeavor make an outright rejection less plausible, and legal action might follow if such a scenario were to occur.

Public feedback on the matter continues to be submitted to the SEC, reflecting ongoing discussions within the crypto community.

As of January 1, 2024, the global count of Bitcoin ATMs stands at 33,628, marking an 11.1% decrease from the previous year, defying a decade-long trend of annual growth in these cryptocurrency dispensing machines.

Coin ATM Radar, a reputable source for tracking such data, reported that on January 1, 2023, there were 37,827 Bitcoin ATMs worldwide.

While 2023 saw fluctuations in these numbers, the overall trend was downward, resulting in the reduced count by year-end.

Since October 2013, Coin ATM Radar has continuously monitored the installation of crypto ATMs.

The numbers consistently rose each month, peaking at an all-time high of 39,376 in August 2022.

However, this growth started to wane thereafter, especially throughout the year 2023.

The most significant decline in crypto ATMs was observed in the United States, where the count fell by 15.4% from 32,672 to 27,631, although it still accounts for 82% of all crypto ATMs globally.

Conversely, countries like Australia, Canada, Spain, and Poland steadily increased their crypto ATM counts.

A contributing factor to the overall decline was the crypto ATM manufacturer BitAccess, which experienced a 26% reduction in installations, dropping from 9,160 in August 2022 to 6,774 on January 1, 2024.

In contrast, manufacturers like General Bytes and Genesis Coin continued to add Bitcoin ATMs throughout the year.

READ MORE: US Department of Justice’s Decision on SBF’s Second Trial Sparks Crypto Community Controversy

Bitcoin Depot, a prominent player in the crypto ATM industry, made significant strides in 2023.

The company went public on the Nasdaq on July 3 and expanded its operations to its 28th U.S. state.

In addition, it reported a Q3 2023 revenue of $179.5 million, indicating a 3% year-on-year increase in earnings.

According to Coin ATM Radar, there are 498 crypto ATM operators spanning 71 countries.

Bitcoin remains the dominant cryptocurrency supported by these ATMs, although they also facilitate the purchase of other cryptocurrencies such as Bitcoin Cash, Ether, and Litecoin.

In summary, the global count of Bitcoin ATMs experienced an unusual decline in 2023, contrasting with the preceding decade of growth.

The United States, despite losing a substantial number of crypto ATMs, still maintains its position as the leader in this sector.

While some manufacturers faced setbacks, others continued to expand their presence, and notable players like Bitcoin Depot demonstrated growth and financial success in the industry.

Several potential issuers of spot Bitcoin exchange-traded funds (ETFs) may need to reveal their on-chain addresses for the underlying BTC holdings to remain competitive, according to industry activist Samson Mow, CEO of Jan3.

While the approval of spot Bitcoin ETFs is eagerly anticipated in the United States, concerns have arisen regarding the transparency and verification of these ETFs.

Mow suggests that providing verifiable on-chain proof of Bitcoin reserves would be the optimal way for spot Bitcoin ETF issuers to ensure the legitimacy of their holdings.

Surprisingly, none of the 14 existing applicants for these ETFs have taken steps to offer on-chain proofs, Mow noted in an interview with Cointelegraph.

Skepticism has arisen among cryptocurrency observers regarding the holdings of spot Bitcoin ETFs, with some fearing that they may create “millions of unbacked BTC.”

Bloomberg ETF analyst Eric Balchunas emphasized that holding actual Bitcoin is in the best interest of ETF issuers to maintain their reputation and trustworthiness.

READ MORE: Data Suggests Limited Impact on Bitcoin Prices Despite SEC ETF Approval Speculation

Leah Wald, co-founder and CEO of Valkyrie, suggests that investors can verify whether spot BTC ETF issuers truly hold Bitcoin by reviewing publicly available records from the ETF provider, similar to verifying equity ETF holdings.

Regulators will also monitor the underlying asset holdings, ensuring a level of transparency.

However, some spot Bitcoin ETF applicants, like Grayscale Investments, have refused to disclose addresses due to security concerns.

Mow acknowledges that there’s a hypothetical possibility of an issuer creating an “unbacked” spot Bitcoin ETF if they violate the rules, even though regulations are in place to prevent this.

Despite potential rule violations, Mow believes that transparency will be a crucial competitive aspect in the spot Bitcoin ETF race.

As the competition escalates, he anticipates that one or more funds may disclose their addresses to establish themselves as transparent and reliable issuers.

The United States Securities and Exchange Commission is expected to approve the first spot Bitcoin ETFs in early January, with many analysts targeting January 10 as the approval date.

However, there’s also anticipation of fierce fee competition among ETF issuers, with some, like Invesco and Galaxy, waiving fees for the first six months and for the first $5 billion in assets.

According to ETF analysts Balchunas and Seyffart, there’s a 90% chance of the SEC approving a spot Bitcoin ETF by January 10, though a rejection remains possible if the regulator requires more time for consideration, an event they describe as the “rug pull of a decade.”

On January 2nd, Bitcoin surged to fresh 21-month highs, igniting excitement in the Asian trading session.

Data from Cointelegraph Markets Pro and TradingView indicated that Bitcoin’s price momentum was gaining strength after the holiday season.

The primary catalyst for this surge was the renewed enthusiasm surrounding the United States’ first spot Bitcoin exchange-traded fund (ETF). BTC/USD gained momentum, reaching $45,922 on Bitstamp.

Speculation regarding the ETF was rampant, with rumors suggesting a potential decision might come ahead of the official approval window scheduled for January 4th.

Market participants were unanimous in attributing the recent upward movement in Bitcoin’s price to anticipation of the ETF’s approval.

Crypto analyst Tony, in an update to subscribers on X (formerly Twitter), described this anticipation as a driving force.

Trader and podcast host Scott Melker summarized, “Bitcoin is trading as if an ETF is on the verge of being approved.”

Analyzing changes in the order book, fellow trader Skew observed some selling activity, although the volume remained relatively low.

READ MORE: VanEck Launches Pro-Crypto Ad Campaign Amid Pending Bitcoin ETF Application

He confirmed in his latest X post that the price had stalled since spot selling began and highlighted the importance of previous highs as a key level to watch on a potential dip, specifically at $44.4K.

Estimates for Bitcoin’s potential price with the ETF focus centered around $48,000, despite the cryptocurrency already gaining up to 8% in the early days of 2024.

Interestingly, Bitcoin did not experience significant losses from traders betting against it. CoinGlass data indicated that only $38 million in Bitcoin shorts had been liquidated at the time of writing.

Previously, high funding rates across exchanges hinted at a widespread belief that the ETF event would trigger an upside move.

Cross-crypto short liquidations stood at $62 million. Skew pointed out that earlier short positions were caught off guard during the move past $45,000, particularly in the perpetual swap market.

This underexposure of the perpetual market to the current spot-driven surge suggested the potential for a feedback loop of volatility, especially around the $45,000 price level.

In summary, Bitcoin’s recent rally to 21-month highs was driven by excitement over the potential approval of the first U.S. spot Bitcoin ETF.

Traders and analysts closely monitored the market, with many anticipating further price gains and potential turbulence as the ETF decision date approached.

Bitcoin has surged above the $45,000 mark for the first time in almost two years, driven by market anticipation of a forthcoming approval for a spot Bitcoin exchange-traded fund (ETF).

The digital currency has experienced a rapid ascent from $42,000 at the beginning of the year, with a remarkable 6% increase in the last 24 hours and an impressive 170% gain over the past year, according to CoinMarketCap data.

This milestone places Bitcoin at a price level exceeding any seen in 2023, signifying a notable start to 2024.

The surge in Bitcoin’s price coincides with the cryptocurrency community’s hopeful outlook for the potential approval of one or more of the 14 pending applications for a spot Bitcoin ETF product, currently awaiting a decision from the Securities and Exchange Commission (SEC).

The last time Bitcoin surpassed the $45,000 mark was nearly 20 months ago on April 5, 2022, before it entered a prolonged bear market, eventually reaching a low of $15,600, as indicated by TradingView data.

Market experts hold differing opinions on how an ETF approval would impact Bitcoin’s short-term price.

Analysts at crypto options trading platform Greeks.live anticipate that Bitcoin might not witness a significant immediate rally, citing diminishing implied volatility in Bitcoin options.

READ MORE: VanEck Launches Pro-Crypto Ad Campaign Amid Pending Bitcoin ETF Application

Conversely, traders such as Scott Melkor, with a substantial following of 925,000, believe that Bitcoin is currently forming a “bull pennant” after a month of consolidation around the $40,000 range.

Melkor envisions the possibility of Bitcoin surging to as high as $54,000 in the days following the SEC’s potential approval.

Meanwhile, Gabor Gurbacs, an advisor at VanEck, predicts that the initial days of a spot Bitcoin ETF may be considered somewhat of a “letdown” by broader market standards.

Nevertheless, he anticipates that these products will eventually attract trillions of dollars in inflows over the next few years, emphasizing their long-term significance.

In conclusion, Bitcoin’s remarkable price increase to over $45,000 marks a significant milestone, driven by optimism surrounding the pending spot Bitcoin ETF approvals.

As the cryptocurrency market awaits the SEC’s decision, the community remains divided on the short-term and long-term implications of this potential development.

Leading Bitcoin mining companies are emphasizing the importance of efficiency to stay profitable and operational following the upcoming halving in 2024.

Bitcoin’s protocol mandates a reduction in the BTC rewarded to miners for adding blocks to the blockchain every 210,000 blocks, occurring roughly every four years.

The next halving, the fourth of its kind, will cut mining rewards from 6.25 BTC to 3.125 BTC. This reduction in rewards has significant implications for miners’ profitability and return on investment in hardware and operational costs.

Efficiency will be a key factor during the halving, according to Jaime Leverton, CEO of Hut8. Miners will need to optimize their operations to continue mining, leading Hut8 to develop specialized software for their Canadian mining sites.

They also plan to purchase four power plants in Ontario to power their operations, totaling 310MW.

Hut8 recently completed a merger with US mining firm USBTC, significantly increasing their hash rate from 2.6 EH/s to 7.3 EH/s in November 2023.

Taras Kulyk, CEO of SunnySide Digital, highlights the direct connection between the 50% reduction in block rewards and the price of BTC and transaction fees.

Lower-efficiency miners may need to shut down if these economic incentives don’t compensate for their costs.

Colin Harper, head of research at Luxor, also emphasizes efficiency and suggests that smaller miners may need to power down their machines due to reduced BTC rewards, unless there is a surge in Bitcoin’s price to boost profitability.

Core Scientific CEO Adam Sullivan states that the halving’s impact will depend on Bitcoin’s price and will directly affect how many miners can remain operational.

Lower Bitcoin prices could lead to more machines coming offline, reducing the network’s difficulty.

READ MORE: Bitcoin ETF Race Heats Up as Top Contenders Submit Final Applications

However, Sullivan believes that Bitcoin’s protocol inherently encourages mining, and the network will adjust as miners exit the industry.

This view is shared by others, with a consensus that as long as Bitcoin holds value, mining will continue.

Kulyk is optimistic about the influence of Bitcoin Ordinals and increased scarcity of new Bitcoin in 2024, which could sustain profitable mining.

Contrary to past concerns about a “Bitcoin death spiral,” Blockstream CEO Adam Back believes such a scenario is unlikely.

He points out that mining profitability has increased significantly, and sophisticated mining firms have prepared for the halving’s potential effects.

Back contends that the least efficient miners are likely to drop out, but Bitcoin’s price appreciation and increased hash rate may prevent a significant drop in hash rate during the halving.

2024’s outcome will hinge on Bitcoin’s price performance and mining efficiency.

In summary, the upcoming Bitcoin halving in 2024 is prompting miners to focus on efficiency to maintain profitability, with the hope that Bitcoin’s price will continue to rise and offset the reduction in mining rewards.

The mining industry remains adaptable, with experienced miners prepared for the challenges ahead.

Greeks.live, a cryptocurrency options trading platform, has cast doubt on the possibility of a significant price surge following the approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. regulator, the SEC.

The platform has analyzed data from its trading platform, revealing that despite widespread speculation about the SEC granting approval for the Bitcoin Spot ETF application in the near future, there has been minimal volatility in major term implied volatilities (IVs) and prices.

Term IV is a metric that measures the market’s expectations regarding future price movements in options contracts.

While the crypto market eagerly awaits the SEC’s decision, Greeks.live’s tweet pointed out the unexpectedly subdued market activity in response to the news.

Their options data showed that the implied volatility for Jan12 options, closely linked to the ETF, has actually decreased rather than rising.

Furthermore, the trading volume for these options accounted for only 2% of the day’s total turnover.

From these observations, Greeks.live has concluded that the market may have already factored in the potential approval of the spot Bitcoin ETF.

READ MORE: Avalanche Foundation Allocates $100 Million NFT Incubator Fund to Purchase Memecoins

Essentially, market participants might have anticipated this event and adjusted their positions accordingly, resulting in the actual approval having a limited impact on prices and volatility.

Several prominent asset managers, including BlackRock, Valkyrie, and Van Eck, submitted amended S-1 forms to the United States Securities and Exchange Commission on December 29, which was the final day for the SEC to consider such applications in January 2024.

Invesco Galaxy, Bitwise, WisdomTree, and Fidelity have also submitted their Form S-1 applications subsequently.

BlackRock’s updated filing has named Jane Street and JPMorgan Securities as “authorized participants” in their proposed spot Bitcoin ETF application.

BlackRock has already specified that it will utilize a cash-only model for the ETF.

Interestingly, BlackRock was the first entity to settle a trade on JPMorgan’s Tokenized Collateral Network service on October 11, highlighting the increasing collaboration and integration within the cryptocurrency ecosystem.

Artificial intelligence (AI) may play a pivotal role in the possible scenario where Bitcoin’s price surges to $100,000 in 2024, as suggested by GPT-4, the latest iteration of the AI chatbot ChatGPT.

Inquiries directed at ChatGPT on January 1, as reported by Cointelegraph, sought insights into the feasibility of Bitcoin reaching this milestone and the potential contributions of AI to this outcome.

ChatGPT cautiously deemed it “theoretically possible” for Bitcoin to achieve $100,000 in 2024, contingent on several favorable factors aligning.

Nonetheless, it emphasized that this remains within the realm of high speculation.

The AI chatbot went on to enumerate a series of general factors that could propel such a surge.

These factors encompassed positive regulatory developments, an upswing in retail and institutional adoption, as well as currency devaluation or inflation.

ChatGPT underscored the significance of a potential approval of a spot Bitcoin exchange-traded fund (ETF) in influencing the price.

It contended that the greenlighting of a spot BTC ETF could significantly bolster accessibility and liquidity for the asset, potentially luring institutional investors into the market, interpreting it as a sign of regulatory acceptance.

READ MORE: Indonesian Authorities Shut Down Ten Bitcoin Mining Operations Over Electricity Theft Allegations

Subsequently, Cointelegraph inquired about the role AI might play in propelling Bitcoin to $100,000 in 2024.

ChatGPT elucidated that AI could indeed be a catalyst in this hypothetical scenario.

AI’s contributions would be seen through its influence on market analysis, trading strategies, and broader technological innovations in blockchain technology.

The AI chatbot elaborated on the capabilities of AI algorithms, which are adept at processing extensive market data, discerning trends and patterns that might elude human analysts.

Furthermore, it underscored the potential of AI-driven trading bots to execute trades precisely at optimal moments, contingent on market conditions.

ChatGPT stressed that these bots could outpace human reactions in a fast-paced market environment.

Nonetheless, the implementation of AI in trading came with inherent risks, according to ChatGPT.

It highlighted the vulnerability to hacking and cyberattacks, citing a 2022 incident where a trading bot netted $1 million through an arbitrage trading opportunity.

Unfortunately, a hacker manipulated the bot into authorizing a malicious transaction, resulting in a complete drain of the funds.

In conclusion, while ChatGPT acknowledges the potential role of AI in Bitcoin’s ascent to $100,000 in 2024, it cautions against underestimating the risks associated with deploying AI in the cryptocurrency market.