Concerns about deeper Bitcoin price declines are growing after several prominent long-term holders began offloading major portions of their holdings.

Gold investor and economist Peter Schiff believes these moves signal a structural shift in the market that could amplify future volatility.

He argued over the weekend that Bitcoin is “finally having its IPO moment,” claiming the market has matured enough for early adopters to exit with significant liquidity.

“This much Bitcoin moving from strong to weak hands not only increases the float, but also means future selloffs will be bigger,” Schiff said.

Long-Term Holders Increase Selling Activity

Fresh blockchain data shows that whales and other long-established Bitcoin holders sold more than 400,000 BTC throughout October.

That level of selling contributed to meaningful downward pressure and pushed Bitcoin’s price below the $85,000 mark.

The cryptocurrency market has been split in recent weeks, with some analysts expecting the bull cycle to resume once liquidity conditions improve, while others warn that these movements may be early signs of a broader bearish reversal.

Exchange inflows, which track the amount of Bitcoin being sent to trading platforms, remain elevated and indicate that additional selling could be underway.

Prominent Investors Exit Positions Amid Market Uncertainty

Notable early holder Owen Gunden became one of the most significant sellers this cycle after liquidating his entire 11,000 BTC position across October and November.

The stash, valued at approximately $1.3 billion, was accumulated during the earliest stages of Bitcoin’s development.

His exit was followed by another high-profile sale from Robert Kiyosaki, the “Rich Dad, Poor Dad” author and long-time Bitcoin supporter.

Kiyosaki disclosed on Friday that he sold all of his Bitcoin holdings, worth around $2.25 million.

He explained that he originally bought Bitcoin at approximately $6,000 and decided to take profits after the asset reached the $90,000 range.

According to Kiyosaki, the capital will now be redirected into income-producing ventures, though he stressed that he remains optimistic in the long term.

“I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow,” he said.

Analysts Identify Key Drivers Behind the Price Decline

Market analysts at crypto exchange Bitfinex attribute the latest correction to two primary catalysts.

The first is the wave of large-scale selling from long-term holders seeking to lock in profits.

The second is heightened leverage in derivatives markets, which has led to liquidations that further intensified downward momentum.

Despite the short-term pressure, Bitfinex maintains that Bitcoin’s underlying fundamentals remain strong.

Institutional interest continues to increase, and analysts expect professional investors to keep accumulating BTC as part of long-term portfolio strategies.

Retail Investors May Struggle to Withstand Volatility

While institutions may continue building positions during market weakness, retail investors could amplify the next downturn.

Vineet Budki, CEO of venture firm Sigma Capital, said many retail participants lack conviction in the asset during periods of stress.

He warned that this behaviour could create extreme volatility if the market enters a new bearish phase.

Budki believes that retail selling could ultimately trigger an estimated 70% price decline in the next major bear cycle.

According to him, this dynamic—combined with the recent migration of Bitcoin from long-term holders to newer, less resilient market participants—may set the stage for a more dramatic correction than previous cycles.

Solana’s Uncertain Future

Solana has also suffered during the broader crypto market sell-off in recent weeks. However, many analysts remain bullish on SOL and have been accumulating at these lower prices.

Furthermore, the Solana blockchain is continuing to be used to transactions and Dapps. Those curious are Solana casinos can read analysis on Esports Insider and learn how Solana is powering many emerging digital sectors.

Market Braces for Potentially Wider Price Swings

Bitcoin’s recent movements highlight a growing divergence between long-term conviction holders and short-term participants seeking liquidity.

As early adopters exit with substantial profits and retail investors prepare for further volatility, analysts caution that the market may be entering a phase where price swings become even more pronounced.

While institutional inflows offer some stability, the broader market appears increasingly sensitive to selling events and macroeconomic shifts.

For now, traders continue to watch exchange inflows, whale behavior, and derivatives market positioning for signals on whether the selling pressure will ease or intensify in the weeks ahead.

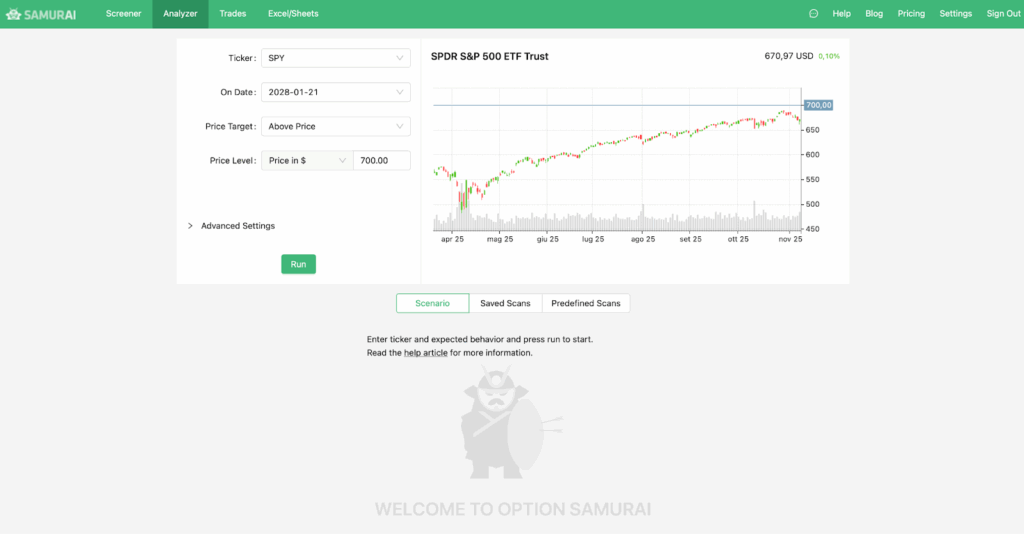

Every trader has asked the same question at some point: “What’s the best option strategy for this stock right now?” Option Samurai’s Analyzer feature gives you a direct, data-driven answer. Instead of running separate scans or manually testing trades, you can define a stock scenario – and the Analyzer will find the optimal strategy automatically.

Whether you’re expecting a rally, a pullback, or range-bound action, this tool compares every supported strategy side by side, calculating expected value, probability of profit, and return using real options data.

Define Your Stock Scenario

Start by entering your ticker, price target, and date, like this:

You can choose between directional or range-based targets, such as:

- Above or Below a certain price

- Between two price levels

- Outside a range

As you input your scenario, a chart updates showing recent price action and the target range you’re planning for. This makes it easier to visualize your thesis before running the analysis.

Let the Analyzer Do the Work

Once you define your scenario, Option Samurai uses its next-gen screening options tools to scan all supported strategies – calls, puts, spreads, condors, covered calls, and more – and calculates which one offers the best balance between expected return and probability of profit.

Each strategy appears on its own card, showing:

- Expected P/L and risk (calculated with a Monte Carlo simulation)

- Probability of profit (from the Black–Scholes model)

- Return on risk and breakeven levels

- A P&L chart with your target, breakeven, and expiration lines clearly marked

You can even slide between prioritizing maximum return or maximum probability of profit – letting you tailor results to your own risk profile.

Hover over the chart to compare different trades or even benchmark them against a simple buy & hold position.

Explore Related Scans and Saved Ideas

Below the main results, you’ll find two additional tabs:

- Saved Scans: Lists all the custom scans where your ticker already appears – helpful if you’ve found setups for it before.

- Predefined Scans: Shows all the built-in scans that currently include that stock.

Both are clickable, so you can jump directly from the Analyzer into the screener for deeper filtering or customization.

This feature is especially useful when you’ve analyzed a specific stock and want to see how it also fits across different strategies in your saved workflows.

Bonus: Fine-Tune Advanced Settings

For traders who like precision, the Analyzer includes advanced simulation controls to adapt results to your style:

- Include unbalanced spreads – expands the search to asymmetrical iron condors or butterflies.

- Bid/ask level – switch between mid or conservative pricing.

- Volatility source – use implied, realized, or custom volatility.

- Drift – simulate bullish or bearish directional bias, or link to the risk-free rate automatically.

These settings allow you to test realistic market conditions instead of textbook ones – especially valuable if you trade events or short-term volatility.

Turn Analysis into Action

Once you’ve found your preferred trade, click “Trade” to open it directly in your Trade Log or send it to your connected broker.

You can tweak strikes, expiration, or quantity – and instantly see how the expected value and probability metrics update. It’s the fastest way to go from idea to execution using real data and clearly defined risk.

Final Thoughts: From Scenario to Strategy in One Click

Option Samurai’s Analyzer takes the guesswork out of options strategy selection.

By running Monte Carlo simulations and comparing every possible trade side by side, it helps you find the most efficient strategy for your price outlook – long, short, or neutral.

Instead of asking “Which strategy should I use?” you’ll know exactly which one fits your scenario, risk tolerance, and timeframe.

Start your free trial today (no credit card required) and discover the most effective option strategy for any stock, any outlook, and any market condition – instantly.

This year marks WhiteBIT’s seventh anniversary, a milestone that reflects its journey from a single European cryptocurrency exchange to a global force in digital finance. Over the past seven years, WhiteBIT has expanded its user base, services, markets, and partnerships, setting new standards in the crypto industry.

Introducing W Group: A Global Fintech Ecosystem

In 2025, WhiteBIT proudly introduces W Group, a global fintech ecosystem built on the values of security, professionalism, and innovation, serving 35 million users worldwide with a total capitalization of $38.9 billion.

W Group unites seven companies:

- WhiteBIT — the largest European centralized crypto exchange by traffic

- Whitepay — SaaS company that provides cryptocurrency solutions

- Whitechain — Low-cost, fast and secure EVM blockchain platform

- white.market — An innovative P2P marketplace for CS2 skins trading

- The Coinomist — Analytical platform and news portal about the crypto industry

- ByHi show — educational entertainment show about the blockchain industry

- PayUniCard — The first non-banking institution in Georgia

“Our vision is a world where blockchain empowers everyone—making finance simple, secure, and part of everyday life. We believe that mass adoption of blockchain will unlock new opportunities, drive innovation, and create a more inclusive financial future. At W Group, we are committed to building the tools that make this future possible for everyone, everywhere,” said Volodymyr Nosov, Founder and President of W Group.

The W Group brings together a team of 1,300 professionals across 15 locations in Lithuania, Estonia, Spain, Italy, Croatia, Kazakhstan, Australia, Georgia, Turkey, Ukraine, UK, British Virgin Islands, Argentina, Brazil, and Hong Kong, reflecting its commitment to global reach and trusted service.

Seven Years, Millions in Trust

At the center of W Group remains the WhiteBIT exchange, which serves 8 million users across 150 countries, facilitating $2.7 trillion in annual trading volume, and has seen its native WhiteBIT Coin (WBT) grow 27-fold since launch, underscoring user confidence and steady adoption. Over the past year, the WhiteBIT exchange accelerated its global expansion, expanding to Australia, Kazakhstan, Croatia, Italy, Argentina, and Brazil.

Guys, meet Harry!

— WhiteBIT (@WhiteBit) November 19, 2025

He lives in 2025 but sends money like it’s still 1825 — because “apps are complicated” and his nerves have limits.

Harry, come on. The future’s already here: fast, digital, WhiteBIT-powered… and pigeon-free.

WhiteBIT. 7 years. Millions in trust:… pic.twitter.com/gbDKTZy6j8

To mark its anniversary, WhiteBIT is launching a global brand campaign centered on trust in modern technology. Through three ironic short films, the campaign humorously explores everyday doubts about crypto— and how WhiteBIT has earned the trust of millions.

Security remains central to this trust. WhiteBIT ranks among the top three most reliable exchanges with an AAA rating from CER.live and was the first crypto exchange to achieve the highest Cryptocurrency Security Standard (CCSS) Level 3 certification.

Setting Industry Firsts

WhiteBIT has had a landmark year with major firsts. It hosted the first International Crypto Trading Cup (ICTC 2025), which brought top traders together on one stage in a live-streamed competition, setting a new standard for crypto trading events. In an unprecedented moment, the winner’s name was displayed on the LED screens during the El Clásico football match — blending the excitement of esports, crypto, and world-class football.

WhiteBIT also held the first-ever metaverse graduation ceremony for students of its “Blockchain Technologies” program at Ukrainian National University of “Kyiv-Mohyla Academy”, The company also held the first metaverse graduation ceremony for students of the “Blockchain Technologies” program at Kyiv-Mohyla Academy, issuing NFT certificates on Whitechain as the company’s commitment to education and pioneering digital experiences.

SportsFi Leadership

WhiteBIT solidified its position at the intersection of sports and crypto, becoming Juventus FC’s sleeve partner and official cryptocurrency exchange partner. As part of this collaboration, WhiteBIT launched the Crypto Fan Zone for Juventus supporters. This partnership leverages digital finance to enhance fan engagement and integrates crypto into sports, setting new standards for how SportsFi can connect clubs and communities globally.

Product and Institutional Growth

WhiteBIT continues to expand its product suite and strengthen its ecosystem. The WhiteBIT Nova debit card processed over $50 million in transactions in the first year. New features — Flexible Crypto Lending and Hedge Mode — give users additional control, while WhitePool is among top 15 global mining pools, increasing its hashrate from 7 to 10.5 EH/s. The company also introduced WB Check, a tool that enables seamless asset transfers without requiring the recipient to onboard to the platform.

On the institutional side, WhiteBIT now serves over 1,300 institutional clients with solutions including Crypto-as-a-Service, OTC trading, liquidity provision, custody, wallet-address generation, and Portfolio Margin. WhiteBIT also hosted an exclusive Institutional Night at the FC Barcelona Museum, bringing select financial leaders together for a private discussion on the future of stablecoin adoption.

Looking Ahead

From a single European exchange to a global ecosystem, WhiteBIT’s journey demonstrates its commitment to innovation and trust in crypto and blockchain. With W Group, the company remains focused on building secure, user-friendly, and comprehensive solutions for retail and institutional clients alike.

Author: Mark Travoy

WhiteBIT, the largest European cryptocurrency exchange by traffic, has entered into a strategic cooperation agreement with Durrah AlFodah Holding, represented by His Royal Highness Prince Naif Bin Abdullah Bin Saud Bin Abdulaziz Al Saud, to drive the Kingdom’s advancement in blockchain technology, digital finance, and data infrastructure.

This landmark agreement was facilitated by Seaside Arabia, which served as the strategic consultant and subject matter expert throughout the process, guiding the framework and objectives of the partnership. This cooperation aligns directly with the strategic pillars of Kingdom of Saudi Arabia Vision 2030, fostering economic diversification, technological innovation, and digital transformation across the Kingdom’s public and private sectors.

The partnership sets the foundation for key national-scale projects within the Kingdom, including:

• Stock Market Tokenization – introducing blockchain-based digital securities to enhance transparency, accessibility, and liquidity in the Saudi financial market;

• Central Bank Digital Currency (CBDC) Framework Development – supporting infrastructure research and design for a sovereign digital currency ecosystem;

• National Data Computing and Mining Centers – building secure and large-scale facilities for data processing, blockchain computation, and digital asset mining.

Under the agreement, Durrah AlFodah will facilitate WhiteBIT’s market entry, regulatory engagement, and partnership development across Saudi Arabia, while WhiteBIT will provide technological expertise and infrastructure design. The collaboration also envisions the formation of a joint venture company to manage and scale these initiatives.

Volodymyr Nosov, Founder and President of W Group, which WhiteBIT is, stated:

“It is an honor to work alongside the Holding of His Royal Highness Prince Naif Bin Abdullah Bin Saud to build the foundations of Saudi Arabia’s digital transformation. Together, we aim to establish secure and sovereign blockchain systems that will shape the Kingdom’s technological future.”

This agreement reinforces a shared vision between both parties — to make Saudi Arabia a regional hub for blockchain innovation, digital finance, and data sovereignty.

Author: Thomas Goldstein

Imperium Comms, a PR, SEO and publisher management agency specializing in the blockchain and crypto space, has announced the launch of its new editorial placement service, allowing clients to submit guest posts, thought leadership articles, and press releases to leading business, crypto, tech, and casino/iGaming news outlets through a unified platform.

This expansion marks a significant enhancement of the agency’s integrated communications offering, enabling companies to secure high-authority guest posts, op-eds, and thought leadership articles in top-tier publications that influence key decision-makers and high-intent audiences.

Companies and key opinion leaders interested in submitting a business, crypto, tech or casino guest post or sponsored article should direct their query to J.clifford@imperium-comms.com.

A Strategic Step to Strengthen Brand Authority

The new service is designed for organisations aiming to elevate their visibility in competitive sectors. Imperium Comms – which has a publisher management division and has exclusive media deals with several leading publications, including Reuters – has established relationships with a broad roster of mainstream business publications, fast-growing tech and crypto news platforms, and major casino and iGaming industry outlets.

Through these partnerships, clients will gain access to premium editorial opportunities, enabling them to showcase expertise, build trust, and enhance their online presence through authoritative mentions and coverage.

The agency noted that the expansion reflects growing demand from brands seeking credible, strategic media coverage that supports both PR visibility and SEO performance.

Existing clients of Imperium Comms include financial services companies, tech startups, partnered PR agencies which outsource accounts to them, and governmental clients, such as the Kurdish Regional Government.

Thought Leadership, Op-Eds & Executive Profiles

As part of the new offering, Imperium Comms will deliver a full suite of content formats for publication, including:

- Executive thought leadership articles

- Opinion editorials

- Industry commentary

- Market analysis pieces

- Founder interviews and profile stories

- Strategic guest posts

Each article is crafted by seasoned editors and strategists to ensure high editorial value and alignment with publisher guidelines.

Expanding Opportunities for Businesses Seeking to ‘Write for Us’

Write for Us

A dedicated component of the service focuses on organisations looking to publish expert content through “write for us” opportunities on high-authority tech, crypto, business and casino news sites.

Imperium Comms will manage the full process — topic development, editorial creation, and placement — ensuring each piece meets publication standards while reinforcing the client’s brand positioning and search ranking performance.

This approach helps businesses bypass the complex and time-consuming process of securing guest post placements while guaranteeing alignment with the editorial tone and compliance requirements of major platforms.

Guest Posts Across Business, Tech, Crypto & iGaming Verticals

The agency’s media network spans multiple high-value sectors:

- Mainstream business outlets covering entrepreneurship, tech, finance, leadership, and corporate strategy.

- Cryptocurrency and blockchain news platforms, ideal for exchanges, Web3 startups, DeFi projects, and institutional players.

- Tech news sites, covering everything from AI to Web 3.0.

- Casino and iGaming news sites that target operators, affiliates, game providers, and industry executives.

This broad range ensures that brands in dynamic, fast-moving industries can position themselves effectively and reach audiences with strong buying intent.

A Full-Service PR Solution for Modern Brands

With this launch, Imperium Comms continues to evolve as a comprehensive communications partner offering:

- PR and media outreach

- Content creation

- Editorial strategy

- SEO-driven publications

- Guest post acquisition

- Reputation building initiatives and crisis management

Coinbase is reintroducing U.S. retail investors to regulated crypto fundraising through a new platform dedicated to primary token offerings, marking the first such opportunity since the 2018 ICO boom.

The American exchange announced it will launch the initiative later this month, aiming to restore public participation in early-stage crypto projects under strict compliance controls.

The first token to debut on the new platform will be from Monad, a blockchain protocol whose sale will run from November 17 to 22, as Bitzo reported.

Coinbase plans to host roughly one token sale per month going forward, creating a structured, recurring schedule for new digital asset launches.

A Fairer Model for Token Distribution

Each token sale will be open for one week, during which verified users can submit purchase requests.

Once the sale period ends, Coinbase’s allocation system will prioritize smaller buyers first, gradually expanding to fill larger orders.

This approach, the company said, is meant to ensure broader participation and prevent large investors from dominating the process.

Coinbase has also added a mechanism to discourage rapid speculative selling.

Users who immediately offload their tokens after launch will see their allocation potential reduced in future offerings.

The exchange described the system as a way to promote fairer distribution and reduce “dumping” behavior that has historically plagued public token sales.

Compliance and Settlement in USDC

Only verified Coinbase users will be eligible to participate, and all purchases will be settled in USDC, the dollar-backed stablecoin issued by Circle.

Token issuers listing through the platform will face a six-month lockup period, preventing project founders and affiliates from selling or transferring tokens on secondary markets without Coinbase’s prior approval and public disclosure.

This restriction aims to maintain price stability and protect investors from insider selling shortly after launch.

Participation will be free for retail buyers, but token issuers will pay a fee based on the total amount of USDC raised, along with any associated listing costs.

Renewed Access for U.S. Retail Investors

The move represents a major milestone for the U.S. crypto sector, where retail access to regulated public token offerings has been virtually nonexistent since 2018.

Coinbase’s regulated approach seeks to fill a long-standing gap between private fundraising rounds—typically reserved for venture capitalists—and the broader investing public.

By implementing compliance safeguards and transparent rules, the platform could set a precedent for how token sales are conducted in the United States going forward.

Remembering the ICO Boom and Its Collapse

Coinbase’s new offering arrives years after the spectacular rise and fall of the Initial Coin Offering (ICO) era.

ICOs emerged in 2017 as a novel method for blockchain startups to raise capital directly from the public by selling newly minted tokens.

By the first half of 2018, ICOs had raised an estimated $13.7 billion, more than double the total collected in 2017.

However, the boom quickly attracted regulatory attention.

In 2017, the U.S. Securities and Exchange Commission (SEC) signaled that some tokens could qualify as securities under the Howey test, bringing them under existing investment laws.

A 2018 report by Ernst & Young examined over 140 major ICOs and revealed that 86% of tokens were trading below their launch prices within a year, while nearly a third had lost almost all their value.

The combination of regulatory crackdowns, investor losses, and a deep crypto bear market effectively ended the ICO frenzy.

Coinbase’s Attempt to Modernize the ICO Model

By introducing transparency, compliance oversight, and anti-dumping mechanisms, Coinbase appears to be reviving the ICO model with institutional-grade safeguards.

If successful, the platform could usher in a new era of compliant token fundraising, bridging the gap between the innovation of crypto’s early days and the regulatory expectations of today’s markets.

Earlier this month, Coinbase clashed with several US banks over a key stablecoin interest rule as part of the recently passed GENIUS Act.

French crypto hardware wallet provider Ledger is exploring a potential listing in New York as demand for its devices surges due to escalating cyberattacks.

The company, founded in Paris in 2014, has reported record revenues in 2025, reaching triple-digit millions, driven by both individual and institutional demand.

CEO Pascal Gauthier told the Financial Times that this year has been the company’s strongest yet, as hackers increasingly target digital assets.

“We’re being hacked more and more every day … hacking of your bank accounts, of your crypto, and it’s not going to get better next year and the year after that,” he said.

Crypto Thefts Hit New Highs

The surge in Ledger sales coincides with a record year for crypto-related thefts.

According to Chainalysis, hackers stole $2.2 billion worth of digital assets in the first half of 2025, surpassing the total losses recorded in all of 2024.

Approximately 23% of these attacks targeted individual wallets, highlighting the growing need for secure hardware solutions.

Ledger Secures $100 Billion in Bitcoin

Gauthier revealed that Ledger currently secures around $100 billion worth of Bitcoin for its customers.

He also suggested that the company may benefit from seasonal spikes in sales during Black Friday and the Christmas period.

Looking ahead, Ledger plans to raise funds in 2026, either through a private funding round or a US listing.

The company is increasing its New York headcount, with Gauthier noting, “money is in New York today for crypto, it’s nowhere else in the world, it’s certainly not in Europe.”

Competitors such as Trezor and Tangem offer similar “cold storage” wallets, but Ledger remains the market leader.

The company was last valued at $1.5 billion in 2023, with backing from 10T Holdings and True Global Ventures.

Multisig App Upgrade Sparks Debate

Last month, Ledger launched a new multisignature (multisig) interface, receiving mixed reactions from its user base, as reported by Bitzuma.

While many praised the upgrade as a technical improvement, the new fee structure—including a $10 flat fee per transaction and a 0.05% variable fee for token transfers—drew criticism.

Developers such as pcaversaccio accused Ledger of moving away from its Cypherpunk roots, arguing the app has become a centralized “choke point” aimed at extracting revenue from users.

XRP has fallen sharply following Ripple’s annual Swell conference, erasing much of the brief rally seen during the event.

After reaching highs near $2.40 on November 5, XRP dropped over 9% to $2.19, despite several major announcements by Ripple, including a $500 million funding round led by Citadel Securities and Fortress Investment Group.

The company also unveiled new integrations for its RLUSD stablecoin and hinted at a decentralized lending protocol on the XRP Ledger (XRPL).

“Buy the Rumor, Sell the News” Trend Persists

The decline reflects a familiar pattern where XRP tends to fall after Ripple’s flagship event — a trend observed in four of the past five years.

Historically, XRP has posted negative returns between the Swell conference and year-end, as investor excitement fades following the announcements.

Technical Indicators Signal Further Downside

The broader crypto market’s pullback, including Bitcoin’s dip below $100,000, has also weighed on altcoin sentiment.

Technically, XRP’s recent price action has confirmed a bearish “flag” pattern, compounded by an impending death cross — when the 50-period exponential moving average drops below the 200-period EMA.

This setup suggests the potential for XRP to fall toward the $1.65–$1.70 range, aligning with previous support levels from April.

Bitcoin hovered around $102,000 on Thursday, as traders struggled to push the price beyond the $105,000 resistance level amid rising sell pressure.

Selling Pressure Builds Around $105,000

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin’s rebound losing steam following the daily open.

Analyst Skew noted that Bitcoin’s price appeared capped by a cluster of sell orders just above $105,000, adding that this was “not surprising.”

He warned that the increase in sell-side liquidity could be a deliberate attempt to suppress prices during Asian trading hours.

Trading analytics platform Material Indicators highlighted that the significant ask liquidity had not yet caused a price correction, suggesting the seller could be trying to drive Bitcoin down toward the $98,000 to $93,000 range.

“If price hits $105k, I’d expect part if not all of those asks to get pulled,” the group said, noting that Bitcoin’s bounce from its 50-week simple moving average still carries “macro bullish implications.”

Traders Eye Potential Dip

Market commentator Exitpump described the $105,000 sell wall as “insane,” while other analysts suggested the liquidity might not be genuine.

Meanwhile, veteran investor Kyle Chasse cautioned that another short-term price drop could occur, pointing to a buildup of bid liquidity below current levels.

“Confidence could get wiped in a heartbeat,” he said, referencing CoinGlass data showing clusters of liquidations awaiting lower price zones.

External Market Factors at Play

Bitcoin’s latest movements also coincided with cooling momentum in U.S. equities, which have been retreating from all-time highs.

Speculation around the Supreme Court possibly overturning international trade tariffs added uncertainty to broader markets.

Analysts believe that if the Court strikes down the tariffs, it could trigger a rally in equities — but potentially divert short-term liquidity away from Bitcoin.

As of Thursday afternoon, Bitcoin remained volatile, trading narrowly between $101,500 and $103,500, with traders keeping a close watch on the critical $105,000 resistance zone.

Tokyo-listed Bitcoin treasury company Metaplanet has secured a $100 million loan backed by its Bitcoin holdings.

The funding, disclosed in a Tuesday filing, was borrowed on October 31 under a credit agreement that allows the company to use its Bitcoin as collateral for short-term financing, amid BTC dropping in the last week.

Metaplanet did not reveal the lender’s identity but confirmed the loan carries a benchmark US dollar rate plus a spread and can be repaid at any time.

The company described the structure as conservative, noting it holds 30,823 BTC, valued at roughly $3.5 billion as of the end of October.

Metaplanet said this position is large enough to maintain strong collateral coverage even if Bitcoin’s price declines.

Loan Proceeds to Support Bitcoin Purchases and Share Buybacks

Proceeds from the credit line may be deployed in several areas, the company said.

These include additional Bitcoin purchases, its Bitcoin income business — where holdings are used to earn option premiums — and share repurchases, depending on market conditions.

Shares in Metaplanet fell 2% following the announcement.

The move comes just days after the company unveiled a 75 billion yen ($500 million) share buyback program.

Like the recent loan, the buyback program is also backed by Bitcoin-collateralized financing.

Metaplanet said the program is designed to restore investor confidence after its market-based net asset value (mNAV) fell below 1.0.

mNAV Dip and Company’s Acquisition Plans

The mNAV, a metric comparing the company’s market value to its Bitcoin holdings, briefly dropped to 0.88 last month.

It has since rebounded to above parity, according to the company.

During the dip, Metaplanet temporarily paused new Bitcoin purchases but reiterated its commitment to acquire 210,000 BTC by 2027.

The company expects the financial impact of the $100 million drawdown on its 2025 fiscal results to be minor.

It also pledged to disclose any material changes to investors should they arise.

Market Context: Bitcoin Treasury Companies

Metaplanet’s move occurs amid wider scrutiny of Bitcoin treasury firms.

Last week, S&P Global Ratings assigned a “B-” speculative-grade rating to Michael Saylor’s Bitcoin treasury company, Strategy.

S&P cited heavy Bitcoin concentration, limited liquidity, and a narrow business focus as key weaknesses.

Critics have increasingly questioned the crypto treasury model.

A report from 10x Research noted that some Bitcoin treasury companies have seen their net asset values collapse, erasing billions in paper wealth.

Analysts argued that the boom in Bitcoin treasury firms, which issued shares at multiples of their actual Bitcoin value, has “fully round-tripped,” leaving retail investors with losses while firms accumulated real Bitcoin.

Investor Takeaways

Metaplanet’s $100 million Bitcoin-backed loan and share repurchase program reflect a broader strategy to maintain investor confidence and expand its BTC holdings.

The company’s large Bitcoin position provides a buffer against market volatility, allowing it to secure financing while continuing operations.

Investors should note, however, that Bitcoin treasury companies carry inherent risks, including high concentration in a single volatile asset and dependency on market sentiment.

The recent attention from credit rating agencies and research firms underscores the importance of monitoring liquidity, collateral coverage, and net asset value trends.