Forex trading is one of the most in-demand and fascinating trading options in the world. You might think that it’s rather straightforward because you’re constantly trying to leverage between different currencies to make as much of a profit as possible. However, the forex market is dependent and influenced by many other elements, such as political, social and governmental changes. Every regulation or process change creates an upward or downward movement of a currency. As many people have noticed, these changes seem to be happening at a faster pace, which is especially noticeable in stock, gold and silver. Yet, somehow, these rapid changes have kept the forex market more secure and stable and the liquidity measure is still there. The global forex market is the world’s largest financial market, with recent figures showing an average daily trading volume of around $6.6 trillion to $9.5 trillion. This volume is much larger than other markets, being roughly 30 times larger than the combined U.S. stock and bond markets. Can you imagine something so large and instrumental?

Now, the question that most people ask themselves is how and why the forex market is able to stay liquid, even during times of turbulence around the world. And the answer to that is a lot more varied and intricate than you might think. There are many elements that come together to create the reality of the forex market today. If you’d like to understand this more, then keep reading and you’ll find out more.

Why Forex Liquidity Stays Consistent Even When the World Doesn’t

The forex market operates differently from most financial markets. While stocks rely heavily on specific exchanges, forex is decentralised and runs around the clock across major financial hubs worldwide. That structure alone keeps liquidity flowing because trading never stays stuck in one place.

Liquidity remains strong because forex is built on global currency demand, international trade, cross-border banking, central bank interventions and investment flows from institutions. Those forces don’t disappear when markets become uncertain. In fact, uncertainty often increases currency activity. When investors feel nervous, they shift money into currencies they trust or out of currencies tied to riskier regions. That movement keeps the market alive and, in many cases, even more liquid than usual. Interesting how that works, wouldn’t you say? It can sound pretty confusing, that’s true. Having a trusted trading broker on your side as you’re navigating these markets can be helpful.

While uncertainty might make stock markets jittery, it can push forex activity higher. When large volumes of money move internationally, liquidity naturally strengthens. Just because one commodity looks like it’s going down, doesn’t mean that this is the same with every other commodity. This is something you must keep in mind.

The Sheer Size of Forex Keeps It Liquid

One of the biggest reasons forex liquidity stays solid is simple: scale. The forex market is the largest financial market in the world, with daily trading volumes measured in the trillions. Yes, you heard that correctly. Trillions. Because of this scale, you benefit from tight spreads, faster order execution, less slippage under normal conditions and more opportunities to trade different currency pairs.

When a market is this big, individual events rarely shut down trading activity. News can trigger volatility but it rarely dries up liquidity completely. That’s why forex is often described as one of the most resilient and accessible financial markets, even during global shake-ups.

Institutional Players Help Keep the Market Moving

As much as retail traders influence sentiment, institutions are the real liquidity providers in forex. Banks, hedge funds, multinational corporations, central banks and large investors make up a huge portion of daily trading volume.

Institutional traders hedge currency exposure, trade based on global economic data, react to central bank policy changes, move capital across borders and execute massive orders regularly.

Those activities happen regardless of global uncertainty. A corporation still needs to convert currencies to pay international suppliers. A central bank still needs to intervene during a currency imbalance. A hedge fund still needs to rebalance positions based on interest rate changes. There are many things that these establishments need to do to help the financial market move forward and every time they put their hand in something, this impacts the liquidity of the forex market.

Why Liquidity Matters for You as a Trader

Strong liquidity can make your trading experience feel smoother and more predictable, even when market conditions aren’t calm. You’re able to execute trades quickly and at prices close to what you expect.

Good liquidity helps you enter and exit trades without major delays, which is excellent because delays can be costly. It also reduces unexpected slippage and keeps transaction costs manageable. Plus, you can trade with tighter spreads and manage risk more effectively.

When liquidity is stable, you’re less likely to see extreme price gaps or erratic movement caused by thin trading. It doesn’t eliminate risk but it gives you a more even playing field, especially compared to markets with lower volume.

Liquidity Isn’t the Same as Stability: A Common Misunderstanding

One of the biggest mistakes traders make is assuming that strong liquidity automatically means stable prices. That’s not how it works. Liquidity ensures smooth execution but it doesn’t guarantee predictable price movement.

You can still experience sharp volatility, sudden reversals, rapid breakouts, news-driven spikes and emotional reactions in the market. Forex liquidity helps maintain order but volatility can still shake things up quickly. It’s important to understand that you can have liquid markets and unpredictable movement at the same time.

Why Uncertainty Sometimes Boosts Liquidity Instead of Weakening It

Global uncertainty typically pushes more money into forex, not less. When things feel unstable, traders adjust their positions, investors move into safe-haven currencies and corporations shift capital to protect themselves from currency swings.

During periods of uncertainty, you often see:

- Higher trading volume

- Increased hedging

- Stronger activity around central bank decisions

- Faster price movements

- More interest in major currency pairs

This surge in activity increases liquidity because more orders are entering the market. Even though the atmosphere feels tense, the actual trading conditions can still remain robust.

Safe-Haven Currencies Keep the Market Busy

Safe-haven currencies play a huge role in maintaining liquidity during stressful economic periods. When global sentiment shifts, traders naturally move toward currencies known for stability and resilience.

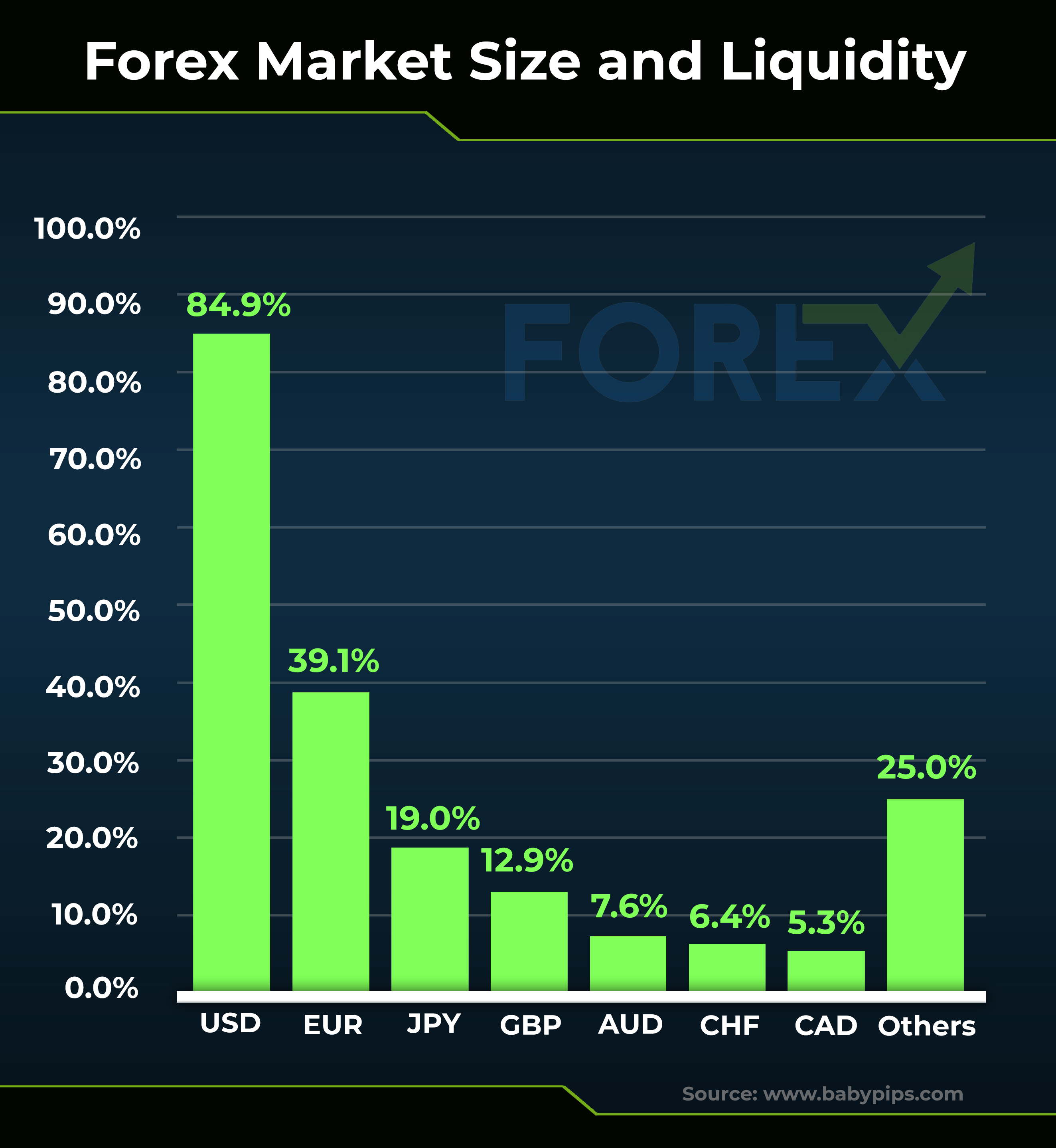

You just need to think about the countries that are seen as ‘financially savvy’ to understand which currencies would match. Think America’s USD, Japan’s JPY and Switzerland’s CHF. These currencies attract increased trading volume when the world becomes unpredictable. In fact, according to the International Monetary Fund (IMF), the U.S. dollar makes up about 62% of the world’s official foreign exchange reserves. According to the 2025 Triennial Survey of turnover in OTC FX markets, the US dollar continued to dominate global FX markets, making up 89.2% of all trades. This was an increase from 88.4% in 2022. The share of the euro fell to 28.9% (from 30.6%) and that of the Japanese yen was stable at 16.8%. The share of sterling declined to 10.2% (from 12.9%). The shares of the Chinese renminbi and the Swiss franc rose to 8.5% and 6.4%, respectively.

That movement adds liquidity to the market, especially in major pairs like USD/JPY and USD/CHF. It is clear to see the currency distribution in the market below:

Forex Keeps Moving Because the World Doesn’t Stop

Currencies aren’t optional parts of the global economy. Every country needs them to function, trade and run its financial system. Because of that, currency exchange never truly pauses.

No matter what’s happening in the world, governments still collect and spend money and businesses still trade internationally. Plus, investors still move capital and banks still process cross-border transactions.

This constant motion feeds directly into the forex market’s liquidity. Even if the world feels unpredictable, daily operations don’t disappear. Money keeps moving and that movement keeps the market alive.

The Role Central Banks Play in Supporting Liquidity

Central banks influence liquidity more than most traders realize. They constantly monitor financial stability and step in when necessary to keep markets functioning. Their actions can include adjusting interest rates, injecting liquidity into the banking system, managing currency reserves and stabilizing exchange rates during extreme volatility.

Even when uncertainty rises, central banks work behind the scenes to ensure currency markets stay orderly.

When Liquidity Can Temporarily Thin Out

Even though forex liquidity is known for its strength, there are still moments when it can tighten temporarily. These situations are rare but worth understanding so you know what to expect.

Liquidity can thin during major holidays, off-hours outside key sessions, unexpected geopolitical emergencies, large-scale economic announcements and periods of extreme volatility. During those moments, you may see slightly wider spreads or more slippage than usual. It doesn’t mean the market is shutting down; it just means trading is momentarily uneven.

How You Can Navigate the Market When Uncertainty Is High

Even though liquidity remains strong during uncertain periods, you still need a thoughtful approach to protect yourself from unnecessary risk. A few simple adjustments can make a big difference:

- Trade during the most active sessions

- Pay attention to economic calendars

- Keep position sizes reasonable

- Use stop-loss orders

- Avoid trading emotionally

- Wait for confirmation before entering trades

You have no control over global uncertainty, but you do have control over how you respond to it.

Liquidity Won’t Disappear But Your Strategy Still Matters

Image source: https://unsplash.com/photos/macbook-pro-on-brown-wooden-table-HASoyURgPMY

The forex market has built a reputation for resilience and it continues to prove that even when the world feels unpredictable, liquidity remains strong. You can count on the market’s scale, its institutional activity and its global nature to keep things moving smoothly.

But strong liquidity doesn’t replace careful planning. It doesn’t eliminate volatility and it doesn’t guarantee success. What it does give you is a more reliable environment to trade in, no matter what’s happening worldwide. But you still need to engage with responsibility, tact and care.