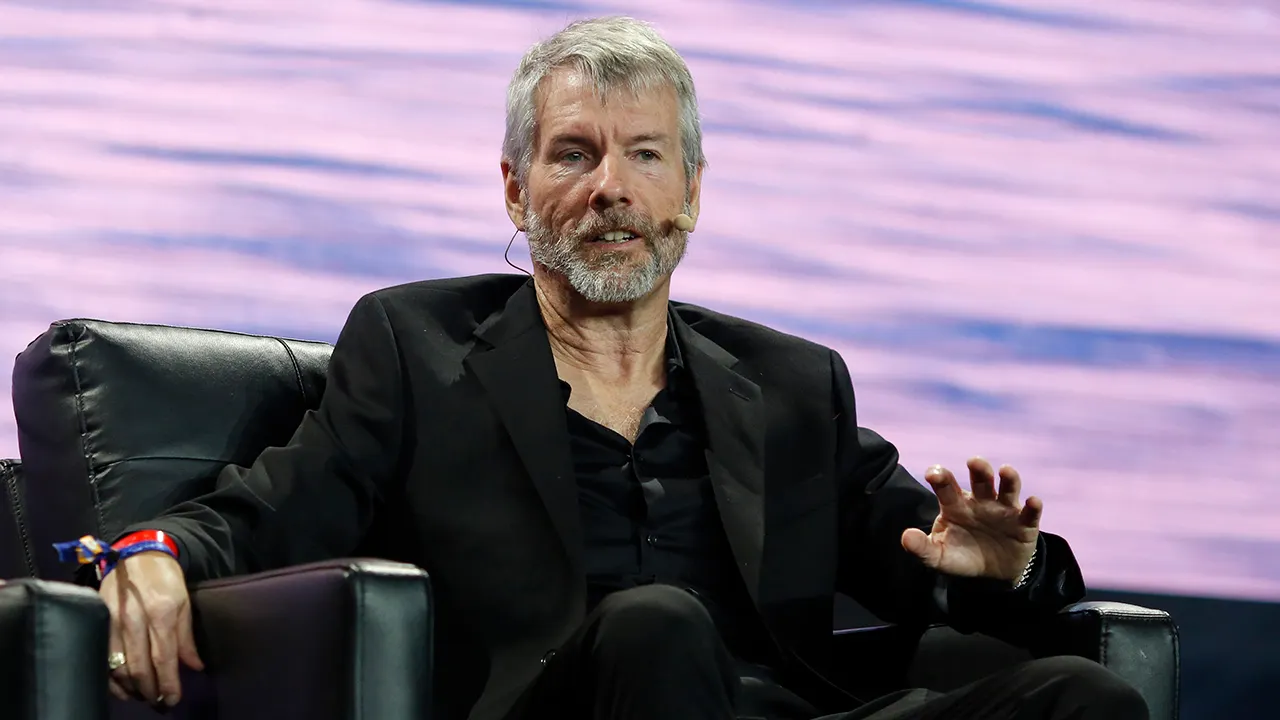

MicroStrategy Chairman Michael Saylor has called on Microsoft to abandon traditional financial strategies like stock buybacks and bonds in favor of Bitcoin, which he claims offers better long-term value and reduced risk.

A Radical Proposal for Microsoft’s Capital Allocation

Speaking at the Strategy World 2025 conference, Saylor said, “Microsoft should be powered by digital capital. Bitcoin is the highest-performing uncorrelated asset.” He pointed out that Bitcoin has significantly outperformed Microsoft stock over the past five years, yielding over 950% gains compared to MSFT’s 148%.

Despite this disparity, Saylor criticized Microsoft’s use of its large cash reserves, arguing that the current focus on stock repurchases and low-yield bonds weakens the company’s flexibility and leaves shareholders more exposed to risk. “Buying Bitcoin would be 10x better than buying your own stock,” he said.

Critique of Bonds and Buybacks

Saylor was scathing in his view of bonds, calling them “toxic,” and claimed that stock buybacks “destroy 97% of your capital over 10 years.” Instead, he advocated redirecting funds toward Bitcoin, which he believes could increase Microsoft’s enterprise value by up to $5 trillion.

“Bitcoin…emerged as the alternative to bonds in 2024. That was the point at which the SEC endorsed Bitcoin ETFs,” he noted. “That was kind of year zero. We’re now in year one.”

Bitcoin as the Future of Capital

Saylor characterized Bitcoin as the modern alternative to outdated investment strategies. “Bitcoin is the universal, perpetual, profitable merger partner,” he declared. He believes it is a “dirt cheap, one-time revenue that’s growing 30% to 60% a year.”

Previously, Saylor made a direct pitch to Microsoft’s board, delivering a three-minute presentation with 44 slides urging a strategic shift toward Bitcoin. However, a shareholder proposal to allocate 1% of Microsoft’s cash into Bitcoin was ultimately voted down, following opposition from the board.

Despite the rejection, Saylor’s push highlights a growing debate over how corporations should manage capital in a rapidly changing economic landscape.