Strategy, the largest corporate holder of Bitcoin, has expanded its cryptocurrency portfolio once again. On Monday, the company revealed it had acquired an additional 15,355 Bitcoin between April 21 and April 27, investing approximately $1.4 billion. The average purchase price was $92,737 per Bitcoin.

The move was made possible through proceeds raised from stock sales. According to a new SEC filing, Strategy sold 4.02 million shares of its Class A common stock (MSTR) and 435,069 shares of its 8.00% Series A preferred stock (STRK), generating the necessary funds.

Growing Holdings and Soaring Value

This latest acquisition brings Strategy’s total Bitcoin holdings to a staggering 553,555 BTC, currently valued around $52.7 billion. Bitcoin’s price surge to roughly $95,300 has significantly boosted the company’s portfolio value, turning a $37.9 billion investment — purchased at an average of $68,459 per Bitcoin — into nearly $15 billion in unrealized gains.

Strategy’s aggressive buying spree shows no signs of slowing. The recent purchase follows a similar move last week when the company announced the acquisition of 6,556 Bitcoin.

Market Response and Future Outlook

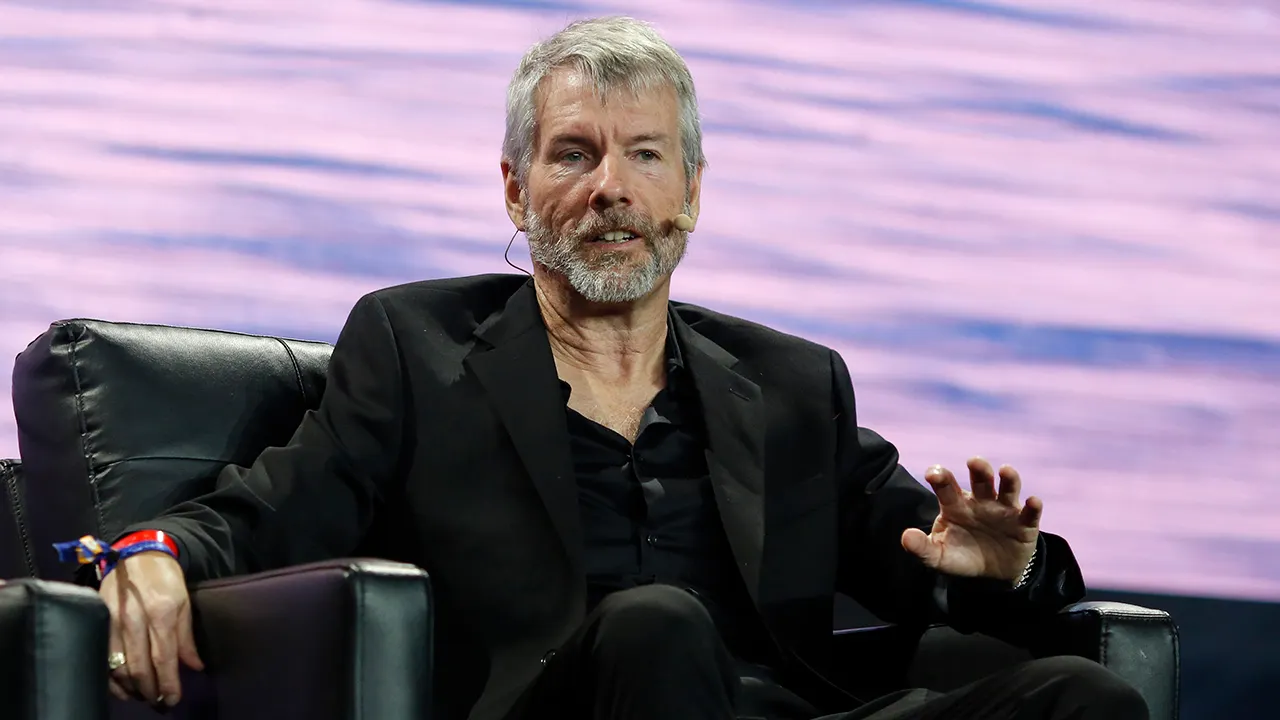

Market watchers anticipated this move following a post by Michael Saylor on Sunday, in which he highlighted Strategy’s Bitcoin portfolio tracker — often a precursor to major announcements.

Following the news, Strategy’s stock (MSTR) rose 1.6% in pre-market trading on Monday, building on a 5% gain from the previous Friday. With Bitcoin prices maintaining strength, Strategy’s bold bet on the cryptocurrency appears to be paying off handsomely.