Las Vegas, NV, USA, January 6th, 2026, Chainwire

Coinhub Exchange, a modern online crypto exchange, announced the grand opening of two new branch locations in Las Vegas, Nevada, and Phoenix, Arizona. The new branches are designed to make crypto easier for everyday customers and active traders by combining online trading with real, in-person support—plus convenient cash access through Coinhub’s nationwide Bitcoin ATM network.

With Coinhub Exchange, customers can buy crypto, sell crypto, store crypto, and convert crypto online—then visit a branch when they want face-to-face help with account setup, funding, and placing their first trade. Customers can also use Coinhub’s connected network to find a Bitcoin ATM near me across 2,000+ Coinhub-connected locations nationwide.

In-person Crypto Support—built for Beginners and Advanced Traders

The Las Vegas and Phoenix branches will provide in-person support for:

- Account setup and verification guidance

- Funding assistance (crypto deposits and bank wires)

- Education on buying and selling crypto, including product walkthroughs

- Support for advanced trading and larger orders

Bitcoin Cash Transactions Available With In-Branch Support

Both branches will also offer an in-person cash buy/sell experience, supported by human tellers and Coinhub ATMs located in the lobby—ideal for customers who want a guided alternative to traditional Bitcoin ATMs.

Customers can expect:

- Up to $150,000 daily cash limits for eligible customers

- Lower fees than many Bitcoin ATMs, with transparent pricing

- A faster process (no need to feed bills one at a time)

- On-site support for a more comfortable customer experience

This in-branch service complements Coinhub’s online platform and helps customers move between cash and crypto with more flexibility.

Multiple Trading Options Available on Coinhub Exchange

Coinhub Exchange offers 5 trading options for every level:

- Quick Trading — simple buy/sell for beginners (no confusing charts)

- Pro Trader — advanced charting and order types for active traders seeking lower fees

- OTC — for larger orders with live quotes and competitive execution

- Credit Card — simply buy any crypto online with a credit or debit card

- Cash — Via Branch Teller or any of our 2000+ Bitcoin ATM locations

New Branch Locations

Coinhub Exchange will host the official grand opening for both new branch locations on January 7, 2026. More information about branch locations can be found here.

Las Vegas, NV Branch – 3209 W Sahara Ave. Las Vegas, NV 89102

Phoenix, AZ Branch – 2415 E Thomas Rd. Suite 3 Phoenix, AZ 85016

About Coinhub Exchange

Coinhub Exchange is a modern, member-only crypto exchange built to help customers buy, sell, store, and convert crypto online or in-person. With physical branches and 2,000+ Coinhub locations nationwide, Coinhub Exchange combines digital convenience with real human support—helping customers trade with confidence and clarity.

- Users can open an account: https://coinhubexchange.com/

- Users can find a Coinhub Bitcoin ATM here

Contact

Marketing Director

Scott Thompson

Coinhub Exchange

support@coinhubexchange.com

Singapore, Singapore, January 5th, 2026, Chainwire

Taisu Ventures, a global Web3 venture capital firm, today announced Keio ChainHack 2026, a one-day pitch and hackathon co-hosted with the Keio FinTEK Center. The event forms part of Taisu Ventures’ broader initiative to support early-stage builders working at the intersection of blockchain infrastructure, regulation, and real-world adoption.

Keio ChainHack 2026 will bring together students, founders, academics, and investors to explore practical applications of blockchain technology and on-chain economic systems. Participation and attendance details are available at https://luma.com/e0pbv2og.

Alongside the event announcement, Taisu Ventures highlighted several portfolio companies that reflect a broader industry trend toward rebuilding real industries on-chain by addressing structural gaps that traditional systems have not solved.

Helix: Building Institutional RWA and Stablecoin Infrastructure

Helix was founded to address a core challenge facing financial institutions exploring blockchain adoption: while demand for tokenized assets and on-chain money flows exists, the institutional infrastructure required to support compliant issuance, custody, reporting, and distribution has historically been fragmented.

Through partnerships with banks, fintechs, and regulated originators, Helix has evolved into a unified orchestration layer spanning structuring, issuance, tokenization, and distribution of real-world assets (RWAs). The platform has been validated through initiatives such as a Malaysia tokenization whitepaper with Kenanga and Saison Capital, Shariah-compliant invoice financing with SILQFi, and a LATAM private credit pipeline via AmFi.

“Taisu doesn’t just invest; they show up, think with us, and connect us with partners who matter,” the Helix team said. “Their support has been essential to our momentum, and to making our pivot possible.”

Lofty: Expanding Access to Real Estate Ownership

Lofty was founded on the insight that real estate investors often face barriers to access rather than a lack of information. After initially developing an AI-driven analytics platform, the company pivoted toward building a blockchain-based real estate exchange that enables fractional ownership and continuous trading of properties.

To deliver this model, Lofty has integrated multiple parts of the real estate value chain, including sourcing, underwriting, transaction execution, and property management. The company is now focused on enabling on-platform leverage through fractional property-backed lending, with the goal of replicating mortgage-driven economics in an on-chain environment.

“Taisu proactively reaches out, asks how they can help, and connects us with the right partners,” said Lofty CEO Jerry Chu. “It’s the kind of support most investors promise, but very few actually deliver.”

Pruv: Unlocking a Licensed RWA Pathway in Indonesia

Pruv emerged from founder Chung Ying Lai’s experience building digital asset infrastructure during the early growth of Southeast Asia’s crypto markets. After multiple market cycles, the team identified the lack of yield-bearing, regulated assets as a key source of instability.

Indonesia offered a unique opportunity, with regulators developing a digital-asset-specific framework separate from traditional securities law. After more than two years of regulatory engagement, Pruv has received formal approval to operate as Indonesia’s first licensed platform for permissionless real-world asset (RWA) issuance. The company now utilizes a hybrid blockchain architecture and facilitates cross-chain asset integration in collaboration with regulated asset managers.

“Taisu has been one of the most engaged partners we work with, consistently proactive, accessible, and willing to support us in ways that go far beyond capital,” said Chung Ying Lai.

Strengthening the Builder Ecosystem

According to Taisu Ventures, Keio ChainHack 2026 reflects the firm’s broader strategy of supporting founders beyond capital by fostering early experimentation, talent development, and collaboration between academia and industry through specialized research and innovation centers such as the Keio FinTEK Center.

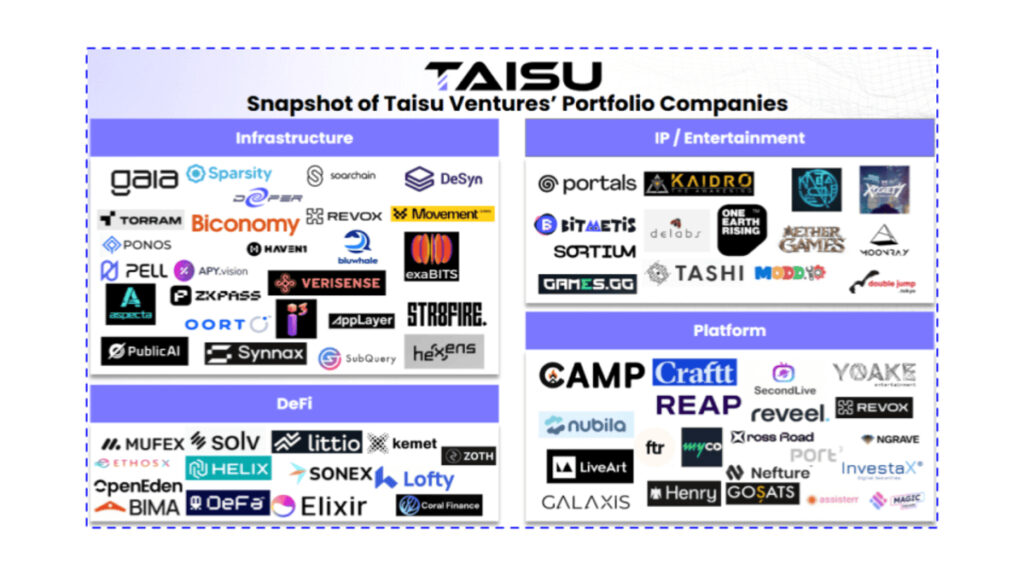

About Taisu Ventures

Taisu Ventures is a global Web3 venture capital firm with over 120 early-stage investments across Infrastructure, DeFi, AI/DePIN, IP & Entertainment, and User Platforms. The firm partners with founders building technically complex and regulated blockchain systems and actively supports the ecosystem through events, founder forums, and academic-industry collaborations, including Keio ChainHack 2026, co-hosted with the Keio FinTEK Center (https://luma.com/e0pbv2og).

Founders and builders interested in engaging with Taisu Ventures or submitting projects for investment consideration can find additional information and submit details via the firm’s project submission form here (https://docs.google.com/forms/d/e/1FAIpQLSekoWOZJwUq-bmKc9j1Gs6FtdTsrIo4zS7rqrl7NeXsgAZWxQ/viewform)

Contact

Raphael Ng

raphael@taisu.io

Larnaca, Cyprus, December 30th, 2025, Chainwire

SlotGPT announced the launch of its AI platform that enables players to create production-grade slot games from a single prompt. The platform has already generated nearly 27,000 slot games, and offers users a personalized and accessible way to generate and play their own unique slot games, both for free and real money.

SlotGPT allows players to generate 100% of a game on the platform, including styles, mechanics, visuals, and sound. Each game that passes through SlotGPT’s moderation layer is fully original, including bespoke music and audio produced using advanced generative sound and music engines. The platform has an exclusive pathway to launch games directly on Stake.com, the world’s largest online casino. It is the only platform creating fully launchable slot games on a top-tier global casino from AI prompts, granting creators exposure to millions of players.

SlotGPT’s is directly integrated with Stake.com through its own hub. This allows users to generate new games daily, explore multiple game categories, play their own creations, and discover games built by the wider community.

SlotGPT is also focusing resources on moderation tools and scaling up its staff of moderators to prevent explicit or inappropriate use of its platform. To date, around 20% of prompts were not generated in order to maintain the integrity of the platform,representing over 5,500 rejected prompts.

The platform dynamically selects from four different slot game types for each generation, ensuring variety and fairness. SlotGPT eliminates several friction points in producing playable slot games, including licensing complexity, technical safeguarding, and subscriptions, enabling true zero-experience creation.

The platform is already working with gaming providers, including 18 Gaming, 1 Ace Studios, and 1 Spin Interactive. Backed by gaming veterans, generative AI leaders, and major industry partners, SlotGPT is forging a new era for personalized casino gaming.

Users can begin creating their own playable slot games here.

About SlotGPT

SlotGPT is a gaming platform developed by a unique mix of software developers, generative AI leaders, and gaming veterans. SlotGPT brings ultimate customization to the player: the player simply imagines anything they want, and with a simple prompt, the power of advanced AI generates a one-of-a-kind gaming experience. This revolution is a first in the gaming industry, bringing the best of generative AI to insert new and creative elements to slots and online gaming. Backed by the biggest gaming companies in the industry, SlotGPT is set to change the online slot experience forever.

Contact

SlotGPT

press@slotgpt.com

George Town, Cayman Islands, December 23rd, 2025, Chainwire

First-of-its-kind DEX eliminates wrapped tokens and centralized exchanges, enabling direct native asset swaps across multiple blockchains

THORChain announced today the public beta launch of swap.thorchain.org, a dedicated DeFi swap interface designed to serve as the protocol’s primary front-end for seamless cross-chain cryptocurrency trading. The platform enables users to swap native digital assets directly across blockchain networks without relying on wrapped tokens, bridges, or centralized exchanges.

Built as infrastructure for the decentralized finance community, the new interface represents THORChain’s commitment to making trustless cross-chain swaps accessible to both newcomers and experienced traders alike.

With this interface, we’re providing the community with a dedicated home base – a place where THORChain is prioritized above all else.

Key Features of the Beta Release

The swap interface introduces several innovative capabilities:

- Universal Wallet Compatibility: Users can swap BTC, ETH, XRP, BNB, TRX, DOGE, BCH, LTC, AVAX, and ATOM with any self custody wallet.

- Optional Wallet Connection: Users are not required to connect their wallet to the website to place a swap.

- True Native Asset Swaps: Direct trading between blockchains, such as Bitcoin, Ethereum, BNB Chain, Tron, Dogecoin, Bitcoin Cash, Litecoin, Avalanche, and Cosmos, without bridging wrapped tokens.

- Open Source Architecture: Built with transparency for the entire ecosystem

- Streamlined User Experience: Clean, intuitive interface designed to minimize friction

The platform is designed to drive transaction volume directly to THORChain while giving the development team control over user experience and routing logic – enabling active protocol growth aligned with community values.

Roadmap and Official Launch

The current beta release allows early users to test the platform and provide feedback ahead of the official launch planned for Q1 2026.

Planned enhancements include:

- Expanded support for thousands of additional tokens across multiple chains

- Enhanced user interface with improved onboarding and routing visibility

- Integration of additional THORChain protocol features, including bonding and liquidity providing

- Community-driven iterations based on user feedback

Availability

The THORChain swap interface is available now at swap.thorchain.org and accessible via any standard web browser.

This release marks a beta version of the platform, which is expected to undergo further development ahead of the planned Q1 2026 launch. Community feedback is being collected to inform ongoing improvements.

About THORChain

THORChain is a decentralized exchange protocol that enables native cross-chain asset swaps without wrapped tokens or centralized intermediaries. As trustless infrastructure, THORChain powers swaps for wallets, aggregators, and exchanges across the cryptocurrency ecosystem, facilitating seamless interoperability between blockchain networks.

For more information, users can visit thorchain.org.

Media Contact:

THORChain Community

Contact

THORChain

contact@thorchain.org

London, United Kingdom, December 22nd, 2025, Chainwire

Following governance approval, the sixth upgrade has activated on the Tezos EVM, Etherlink, capping a year of significant growth that saw total value locked surge from $1.46M at the beginning of the year to over $82.73M in November, major protocol integrations, and the establishment of a rich DeFi and gaming ecosystem.

Farfadet is the latest in a rapid run of upgrades to be activated on Etherlink in 2025, including Calypso, Dionysus, and Ebisu, which all ushered in major technical infrastructure advances. It builds on a number of radical enhancements made to date this year, including the introduction of fast withdrawals, which reduced transfer times from 15 days to under a minute. Farfadet nearly doubles chain capacity, enabling the network to handle more than 1,000 native transfers per second with no impact on the transaction cost, kept at a fraction of a cent. It also unlocks features like instant confirmations, which can be of particular value to audiences, including DeFi traders seeking to deploy time-sensitive strategies, and gamers who expect the best performance without typical blockchain lag. The new features introduced with Farfadet will be warmly welcomed by Etherlink users who will now benefit from a faster and better network.

“Farfadet represents our commitment to staying ahead of network usage and keeping the Tezos platform open and accessible for projects requiring the most up-to-date EVM compatibility,” said Thomas Letan, Core Developer at Nomadic Labs. “This is the first time we are in a position to activate a new EVM version only a few days after an Ethereum hardfork, and we aim at making it the standard moving forward.”

Recent months have seen user numbers on Etherlink swell significantly, due in part to the launch of Apple Farm, a $3 million incentive program that catalyzed explosive ecosystem growth. Now two seasons in, the program has contributed to the growth of a thriving DeFi ecosystem on Etherlink, with protocols including Oku, Morpho, Superlend, Hanji, Jumper Exchange, Curve Finance, and Gearbox Protocol all integrating with the chain during the year.

Oku brought Uniswap v3, Morpho functionality, and DeFi aggregation to Etherlink users, while Lombard Finance introduced Liquid Bitcoin (LBTC), and Midas deployed institutional-grade tokenized assets backed by leading VCs like MEV Capital and Re7. Gaming also blossomed, with the biggest announcement of the year being the AAA open-world extraction shooter, REAPER ACTUAL, developed by Distinct Possibility Studios, which uses Etherlink infrastructure in its web3 endeavors.

Etherlink is ending the year as a top-tier EVM-compatible decentralized infrastructure that has already attracted millions in protocol TVL, attracted 438,500 unique gaming users, and democratized uranium access.

About Etherlink

Etherlink is an EVM-compatible blockchain powered by Tezos Smart Rollups technology. It empowers developers to smoothly deploy any EVM codebase and migrate users and assets from Ethereum and other interoperable chains, enabling seamless interaction and asset transfers across different networks. Learn more: https://www.etherlink.com/

Contact

Sara Moric

sara.moric@trili.tech

Dubai, United Arab Emirates, December 19th, 2025, Chainwire

GrantiX, an AI-powered SocialFi platform bringing impact investing on-chain, today announced the launch of its $GRANT token following a Token Generation Event and multiple sold-out IDOs. The token is now live and listed on BitMart and BingX, expanding global access to the GrantiX ecosystem.

$GRANT serves as the utility and governance token for GrantiX, which connects blockchain donors with verified social entrepreneurs through an audited platform. The TGE follows successful IDOs on Finceptor and Spores Network, alongside additional offerings on Red Kite and Huostarter.

“$GRANT is not a speculative launch, it is the activation of an ecosystem that is already operating, audited, and delivering measurable impact,” said Dr. Konstantin Livshits, founder of GrantiX. “This milestone aligns our community around a shared mission to make impact investing transparent, efficient, and scalable.”

Built on Arbitrum and designed to be multi-chain, GrantiX integrates directly into high-volume DeFi protocols, enabling optional micro-donations to be embedded into everyday transactions. Alongside with real-world revenue streams, a single Web3 partner processing more than 100 million transactions per week can route user opt-in donations to verified impact projects, with GrantiX earning a 2% fee for distribution, verification, and on-chain transparency. Even modest participation at this scale creates recurring, sustainable effect.

The global impact economy represents a $1.57 trillion market that remains largely offline and opaque. As financial activity increasingly moves on-chain, GrantiX aims to bring this capital into Web3 by embedding impact directly into transactions, turning donations into programmable infrastructure rather than a separate product.

Since launching its MVP, GrantiX has processed more than 20,000 donations totaling over $250,000, distributed more than $80,000 in grants to verified social entrepreneurs, and onboarded more than 18,000 users organically. The project has raised more than $1.75m in angel funding and public rounds, and all smart contracts have been audited by CertiK ahead of the mainnet rollout.

“The demand we saw across our IDOs reflects growing interest in Web3 projects with real-world utility and sustainable economics, rather than hype-driven meme coins” said Anton Yanushkevich, CEO of GrantiX. “By combining AI-driven evaluation with on-chain transparency, we are building an impact layer for Web3 where doing good is embedded directly into financial infrastructure – we believe, that the future of impact is on-chain.”

$GRANT is now live. Users can join the launch by trading $GRANT on BingX and BitMart and become part of the on-chain impact economy:

BingX: https://bingx.com/en/spot/GRANTUSDT

BitMart: https://www.bitmart.com/trade/GRANT_USDT

About GrantiX

GrantiX is a sustainable, multi-chain impact platform connecting donors, social entrepreneurs, and investors on-chain. Through its AI-powered Web3 ecosystem, GrantiX brings transparency and efficiency to global impact investing. Its audited model combines DeFi, SocialFi, and DAO governance tools to fund and verify real-world charitable projects. Founded by Dr. Konstantin Livshits and Anton Yanushkevich, GrantiX’s mission is to make doing good a scalable, rewarding part of Web3 utility.

Contact

CEO

Anton Yanushkevich

GrantiX

press@grantix.com

Singapore, Singapore, December 15th, 2025, Chainwire

The institutional-grade liquidity solution enables accelerated ETH redemptions for competitive on-chain and institutional yields

mETH Protocol, the top ten ETH liquid restaking provider with a peak total value locked (TVL) of $2.19 billion, today announced a major liquidity upgrade that utilises Aave’s ETH market to support more efficient redemption flows for mETH. Its key feature is a curated Buffer Pool mechanism designed to deliver an estimated 24-hour ETH redemptions, subject to buffer capacity availability and network conditions. This marks a drastic improvement over Ethereum’s 5-20 day exit queues for native staking and most liquid staking tokens (LSTs).

By supplying ETH into Aave’s ETH lending market, the Buffer Pool is continuously replenished, enabling the processing of large withdrawals with near-instant liquidity and zero additional fees, all while maintaining competitive ETH base yields. Alongside an excellent track record of zero slashing incidents, mETH Protocol continues to advance its mission to provide institutional-grade liquidity and capital efficiency across the Ethereum staking landscape.

Solving Ethereum Staking’s Liquidity Problem

ETH’s seismic rise as a credible treasury solution and financial asset has seen 2025 spot ETH ETFs record 65% quarterly growth on net inflows from $6.2B to $10.2B. However, the culmination of market events and structural issues has placed Ethereum’s staking ecosystem under pressure, facing increasing exit delays with withdrawal queues extending past 40 days in recent months. mETH Protocol’s Buffer Pool upgrade addresses this challenge through a dual liquidity pathway:

- Instant Buffer Pool for small to medium redemptions

- Direct Aave ETH Market Reserve access for larger institutional transactions

This hybrid design supports high redemption volumes with blended yields targeting processing within a 24-hour estimate, emphasising fairness through a first-in, first-out model. Approximately 20% of protocol TVL will be allocated to Aave in stages, creating a blended yield profile that combines staking rewards with Aave supply interest to support deeper, more responsive liquidity. With this adjustment, mETH is expected to sustain a competitive APY while offering a far superior redemption experience. mETH Protocol will work closely with the Bybit team on the Buffer Pool Upgrade, including, but not limited to, asset boost campaigns, collateral utilisation, and more.

“Institutional capital demands clear exit routes, not opaque withdrawal queues,” said Jonathan Low, Growth Lead at mETH Protocol. “This upgrade transforms mETH Protocol into the most efficient liquidity gateway for ETH, unlocking the next phase of institutional adoption in on-chain finance that builds on mETH Protocol’s proven rigor and capability.”

The Buffer Pool will be dynamically replenished based on predefined thresholds designed to maintain healthy liquidity levels. During periods of unusually high redemption demand, when buffer capacity is temporarily fully utilised, withdrawals will revert to the standard on-chain exit queue, with processing times dependent on network activity and overall volume.

Institutional-Grade Liquidity, On Demand

The upgrade cements mETH Protocol’s position as the first liquidity staking token (LST) purpose-built for institutional exit liquidity without compromising capital utility.

mETH Protocol’s on-demand liquidity unlocks the next stage of treasury efficiency through three synergistic pillars of institutional-grade access, custody, and utility. Key differentiators of mETH’s approach include:

- Institutional-grade, trusted custody by Fireblocks, Anchorage, Copper, and OSL, with ongoing traditional rail integrations for optimised onboarding and reliable exit ramps and allows institutions to mint mETH natively within custody and mirror positions seamlessly to exchanges such as Bybit for trading, supported by a strong pipeline of integrations with notable industry players and enhances secure onboarding, operational efficiency, and institutional accessibility

- Supported by Tier-1 custodians and validators for seamless, robust off-chain settlement, including Kraken Staked

- Available as trading and margin collateral on leading exchanges like Bybit and Kraken, with OTC support for large flows

- Trusted and designated source of ETH yield for leading Web2 and Web3 treasuries, constituting a significant proportion of Mantle Treasury’s ETH reserves and a core ETH yield driver for Mantle Index Four

- Institutional-grade composability designed for both institutional users and advanced DeFi participants, mETH integrates Aave’s ETH lending market into its liquidity framework and supports predictable redemptions while preserving full composability across on-chain strategies

This model bridges the worlds of institutional asset management with decentralised finance, solidifying mETH Protocol’s lead in ETH liquid staking solutions and yield strategies.

A Growing Benchmark in ETH Yield Infrastructure

mETH Protocol leads in institutional-grade staking infrastructure with over 40 Tier-1 dApp integrations, including Ethena Labs, Compound, and Pendle, while significantly contributing to major restaking networks such as EigenLayer and Symbiotic. This upgrade signifies mETH Protocol’s expanding ecosystem, underscoring its role as a trusted source of ETH yield and a foundational liquidity layer for institutional and retail participants alike.

About mETH Protocol

mETH Protocol is a vertically integrated liquid staking and restaking protocol incubated by Mantle, operating at the intersection of DeFi composability and institutional-grade ETH yield access. With a peak total value locked (TVL) of $2.19 billion achieved within its first year, mETH Protocol is supported by leading validator and custody partners, including A41, P2P.org, Kraken Staked, OSL, and Copper. The protocol is embedded across over 40+ leading DeFi and exchange platforms such as Bybit, Ethena, and more, whilst incorporated in treasury frameworks for DAOs and corporates as a core liquidity and yield layer.

For more information, users can visit:

mETH Protocol Website | mETH Protocol X | Group Website | Group X | Blog | Discord | Telegram | LinkedIn

Contact

mETH Protocol

windrangerlabs@wachsman.com

Glencoe, Illinois, USA, December 10th, 2025, Chainwire

Today, BOLTS Technologies (BOLTS), a cybersecurity company pioneering crypto-agile and cipher-neutral security infrastructure, announced the launch of a pilot program to explore bringing quantum-resilience on the Canton Network, the public, permissionless blockchain purpose-built for institutional finance.

The pilot will explore how BOLTS’ quantum-resilient software product, QFlex, could potentially bring quantum-resistant transaction assurance to Canton Network. QFlex addresses the multi-faceted complexities around fortifying blockchain networks against Q-Day. This refers to the day when a cryptographically relevant quantum computer (CRQC) arrives, and undermines the foundations of current Internet security using Shor’s algorithm.

Following the EU’s introduction of PQS 2030, flexible support for post-quantum cryptography (PQS) will become an increasing focus for Canton Network, which has an extensive roster of institutional ecosystem participants, processing over $4T in repos monthly.

Bernhard Elsner, Chief Product Officer of Digital Asset, said, “We’re excited to explore QFlex’s promise of allowing sub-networks to enable flexible, user-controlled use of a wide range of cutting-edge cryptographic algorithms without code-changes. This would further strengthen the Canton Network’s cryptographic agility and position it well to seamlessly support stakeholders adopting rules like DLT 2030 and beyond.”

Yoon Auh, CEO of BOLTS affirms, “We are proud that our proven expertise and technology are in this pilot test with Canton Network. This collaboration represents a meaningful step in our mission to deliver durable, future-ready security infrastructure solutions for institutions operating on distributed ledger platforms.

QFlex gives assurance to the industry that Q-Day fears can be overcome efficiently today, with a clear path to becoming quantum-ready. The industry can no longer delay this, given the trillions of dollars in institutional digital assets at stake. With Canton Network supporting over $6 trillion in on-chain real-world assets, this pilot will have a significant impact on the industry.”

Built on the Structured Data Folding with Transmutations (SDFT) protocol, QFlex delivers cryptographic agility at the transaction level. As such, it empowers each asset owner to respond to new threats in real time on their next transaction unlike existing static or hybrid-algo solutions.

About BOLTS Technologies

BOLTS Technologies provides advanced, validated quantum-resilient solutions for Web3 systems. Its flagship technology, QFlex, enables crypto-agile protection of blockchain transactions controlled by the owner/wallet. QFlex saves blockchains from future cryptography transitions. QFlex has its roots in secure data centric technologies providing scalable privacy solutions originally developed by its sister company, NUTS Technologies. QFlex (SDFT) has won numerous grants from The National Institute of Standards and Technology, The United States Air Force, and The United States Navy for advanced cryptographic technologies. SDFT/NUTS advanced applied cryptographic technologies are backed by more than 30 international patents. More: https://boltstechnologies.xyz/

Contact

Media Contact

Candice Teo

candice@espoircommunications.com

San Fransisco, California, December 10th, 2025, Chainwire

As CARV advances its vision of sovereign AI Beings, it’s become clear that true value creation lies not just in compute or data, but in people. At the heart of CARV’s AI Being roadmap is a new class of agents, AI-powered digital extensions of individuals, anchored in verifiable identity and private context. To bridge the Social and Economic Ledgers that have long operated in silos, CARV introduces Cashie: a programmable on-chain layer turning real social engagement into verifiable economic activity. No longer just a social payment tool, Cashie is evolving into a core protocol for trustless coordination between influence and value.

As part of CARV’s broader modular agentic infrastructure, alongside CARV ID (ERC-7231), Model Context Protocol (MCP), and the Shielded Mind update, Cashie’s integration with x402 protocol transforms social engagement into verifiable, automated, and privacy-preserving on-chain rewards, pushing the boundaries and limits of the creator economy, turning social capital into on-chain value.

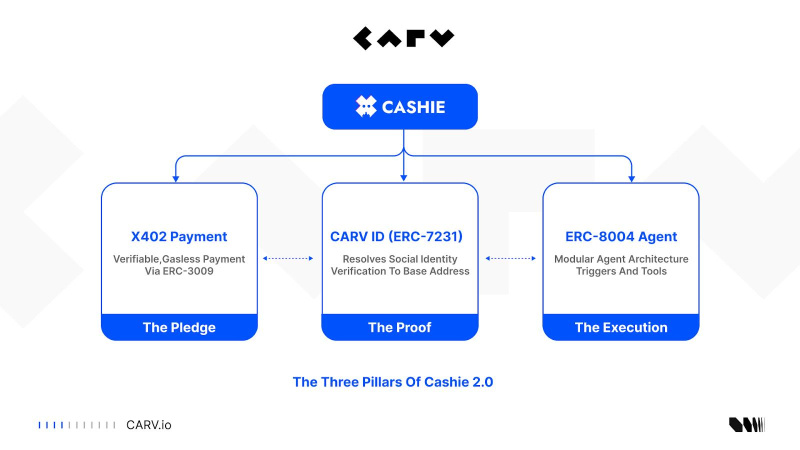

How Cashie 2.0 Works: The Three-Pillar Bridge

Cashie 2.0 is architected around three foundational pillars:

1. x402 Payment: ‘The Pledge’

Cashie campaigns begin with a single ERC-3009 signature, where a project or KOL pledges funds to a campaign. This is the “X-Payment” proof, and it’s verified on-chain. No gas. No manual transfer. It ensures that funds are committed and can be distributed autonomously.

2. CARV ID: ‘The Proof’

How to reward a retweet or any other engagements? Traditional wallets don’t recognize @handles on social media. Cashie solves this with CARV ID, which maps social actions (like a retweet from @user) to on-chain identities (0xABC). This is the identity oracle that connects the Social Ledger to the Economic Ledger.

3. ERC-8004 Agent: ‘The Executor’

Cashie isn’t a monolithic bot. It’s an AI-powered agent built with modular tools:

- A Payment Tool to verify and move funds

- A Twitter Tool to monitor and analyze social activity

- A Raffle/Quest Tool to select winners or check completions

- A Distribution Tool to deliver on-chain rewards

All of this happens trustlessly and autonomously, removing manual ops and Sybil vectors.

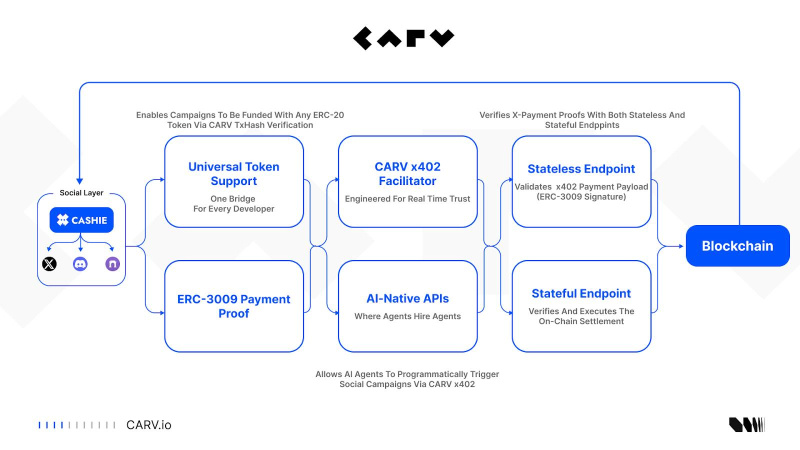

The Developer Breakthrough: Powering the Agents-to-Agents Economy

To unlock the full potential of sovereign AI Beings and decentralized coordination, infrastructure must evolve, quietly but radically. While the spotlight shines on AI agents and social campaigns, it’s the innovation under the hood that makes everything work. With Cashie 2.0, CARV introduces a new kind of developer stack: one that’s not just programmable, but agent-native.

The CARV x402 Facilitator: Enhancing the Protocol

Every action in Cashie starts with a cryptographic promise, but verification is what makes it trustworthy. To enable secure, gasless campaigns at scale, the company built the CARV x402 Facilitator: a high-performance verifier that adds state and nonce tracking to reject replayed signatures instantly, preventing duplicate settlements before gas is spent.

CARV is opening its facilitator endpoints for any developer on Base to build their own x402-powered applications. Developers can start building against their live endpoints today:

- A stateless endpoint to validate an x402 paymentPayload (ERC-3009 signature): https://interface.carv.io/cashie/protocol/verify

- A stateful endpoint that verifies and executes the on-chain settlement: https://interface.carv.io/cashie/protocol/settle

The AI-Native API: Agents Hiring Agents via x402

True to the ERC-8004 (Trustless Agents) vision, Cashie 2.0 is not just a platform; it’s a programmable tool for other AI agents. CARV are exposing an AI-native HTTP API that fully implements the x402 protocol. This means another AI agent (from Virtual, Base, or anywhere else) can now programmatically hire Cashie to run a campaign. An agent can call the API, receive a 402 Payment Required challenge, and then resubmit its request with its own X-Payment proof to autonomously fund and launch the entire operation. This is agent-to-agent social commerce in action.

Universal ERC-20 Support via TxHash Verification

Web3 is fragmented by token standards. Not every ERC-20 supports gasless approvals or signature-based authorizations. But Cashie was designed for inclusivity. CARV built Cashie for the entire Base ecosystem, not just for tokens with ERC-3009 support. The platform includes a separate, robust txhash-based verification API.

This internal capability will allow any project to sponsor a campaign with their own (and any) native ERC-20 token, even if it doesn’t support permit or authorization. The sponsor simply sends a standard on-chain transfer and provides the txHash as proof. CARV’s system handles secure, on-chain verification and replay protection, making Cashie the most flexible and inclusive social-growth engine on Base, with a clear roadmap to open this universal token support to all builders.

What This Means for Users and Developers

Cashie introduces a new way to engage and earn. Users can receive crypto rewards directly through social actions like retweets or quests, without wallet submission required, with CARV ID ensuring verified ownership and privacy preserved. For developers, Cashie becomes a programmable growth layer where automated campaigns, bounties, and agent-driven incentives can be built without manual wallet collection, enabling new composable experiences across social and onchain environments.

To encourage adoption, CARV launches Cashie 2.0 Creator Campaign with a $45,000 prize pool to incentivize creators and participants. Through this campaign, the Creators (e.g., KOLs and projects) can configure a reward pool, duration, eligibility logic, and then publish a campaign link via a single social post. Read more about this campaign in this link.

What’s Next

Cashie is already driving early campaigns across the Base ecosystem, but this is only the beginning. With upcoming support for self-hosted x402 facilitators, AI-powered campaign agents, and enterprise-grade SDKs for social growth, Cashie will evolve into the coordination engine between agents, humans, and verifiable engagement. As CARV’s AI Being roadmap advances, Cashie plays a key role in building trustless bridges between influence and value.

About CARV

CARV is where Sovereign AI Beings live, learn, and evolve.

What are AI Beings? They are sovereign intelligences born natively on-chain. AI Beings are designed with purpose, autonomy, and the capacity for growth. They possess memory, identity, and the ability to perceive and interact with their environment, not just to execute tasks, but to make independent decisions, adapt over time, and pursue self-defined goals.

Anchored by its proprietary CARV SVM Chain, D.A.T.A. Framework, and CARV ID/Agent ID system (ERC-7231), CARV enables verifiable, consent-based AI Beings that learn, adapt, and co-create with users. Driven by CARV’s AI-first stack, consumer AI apps incubated through CARV Labs launched on Google Play, App Store and beyond, reaching billions of people, bringing agent-powered experiences and real-world incentives into mainstream digital life.

With 8M+ CARV IDs issued, 60K+ verifier nodes, and 1,000+ integrated projects, CARV bridges AI agents, Web3 infrastructure, and real-world utility, fueling the rise of agent-driven economies. At its core, $CARV token powers staking, governance, and coordination across this stack, making CARV the operating system for AI Beings on Web3.

X (Twitter): https://x.com/carv_official

Discord: https://discord.com/invite/carv

Telegram: https://t.me/carv_official_global

Whitepaper: https://docs.carv.io/

Contact

COO

Victor Yu

CARV

vito@carv.io

Los Angeles, United States, December 9th, 2025, Chainwire

The Sandbox ecosystem welcomes Corners, a new Web3 platform in invite-only beta that lets participants coin and gain value from Internet content

Expanding The Sandbox ecosystem, Corners is a new Web3 platform to coin, curate, and share the content of the Internet, allowing curators to gain value from collections of URLs from all corners of the Internet

The Sandbox and Animoca Brands welcome the new free-to-use curation platform, Corners, into their ecosystem. Corners has launched an invite-only beta where users can coin, create, and share collections of internet content. Users can join the waitlist at www.corners.market.

Corners allows anyone to create a “Corner Coin” – a user-created, transferrable digital asset based on a curated collection of internet links, conversations, and content. Once a corner is created, anyone can share and curate content for it, and contribute to its growth and value by adding links or new content.

The launch of Corners expands The Sandbox’s ecosystem beyond gaming, as previously announced as part of The Sandbox 3.0 rollout, and into a broader distribution network of culture while introducing new utility for the SAND token.

Robby Yung, CEO of The Sandbox, said: “Corners is a great example of how partners can help extend the utility of the SAND token and support the continued evolution of The Sandbox ecosystem beyond gaming. By enabling curators to tokenize the content they love, Corners opens meaningful new opportunities for creativity and participation. We’re pleased to support products that build on our foundation and bring more communities into The Sandbox’s wider ecosystem.”

Corners deeply integrates the SAND token as its main utility token, powering platform activity. Curators can earn rewards for their activity and curation. Additionally, a portion of the platform’s activity is used to reward Corner Coin holders with the SAND token, promoting its distribution and use within the ecosystem.

The SAND token will also become available on Base through an initial liquidity pool on Aerodrome. This expansion will make the SAND token and The Sandbox ecosystem accessible beyond Ethereum and Polygon, offering a new on-ramp for on-chain communities and making it easier to move the SAND token across the crypto ecosystem.

Ahead of the full public rollout scheduled for early 2026, Corners is releasing a comprehensive “How to build your corner” guide on www.corners.market to provide additional details on getting started, understanding market price, transferrable digital assets, and more.

Early adopters who wish to discover and create their own corner can join the waitlist at www.corners.market.

About Corners

Corners explores a new paradigm for digital interaction on the Internet. On Corners, communities form around a collection of links, and every community becomes a valued community collection. Communities form around a topic, idea, or niche, and others can trade those markets, curate content, and contribute to the growth of the corner via comments and upvotes.

Corners is launched on Base, Coinbase’s layer 2 blockchain, and supported by The Sandbox and powered by the SAND token.

Users can visit corners.market for more information

About The Sandbox

The Sandbox, a subsidiary of Animoca Brands, is the leading global distribution ecosystem for digital culture and IP connecting brands, creators, institutions, and consumers worldwide. Leveraging blockchain and AI technologies, The Sandbox enables end-user creation, decentralized economies, and digital social experiences, all powered by SAND.

SAND is the utility token that powers The Sandbox ecosystem, which includes The Sandbox Game, The Sandbox DAO, SANDchain, and Corners. It fuels The Sandbox’s in-game economy and marketplace, enabling users to buy and sell digital assets, grants holders governance rights through the DAO, provides liquidity, transactions, and rewards on SANDchain and Corners.

With over 400 partners, including Warner Music Group, Gucci, Black Mirror, and NBC Universal’s Jurassic World, 8 million users, and 30 million on-chain transactions, The Sandbox ecosystem is one of the largest cultural distribution ecosystems in Web3.

For more information, users can visit www.sandbox.game and follow regular updates on X, the Blog, and Discord.

About Animoca Brands

Animoca Brands Corporation Limited (ACN: 122 921 813) is a global digital assets leader building blockchain and tokenized assets to advance the future of Web3 innovation. It has received broad industry and market recognition including Fortune Crypto 40, Top 50 Blockchain Game Companies 2025, Financial Times’ High Growth Companies Asia-Pacific, and Deloitte Tech Fast. Animoca Brands is recognized for building digital asset platforms such as the Moca Network, Open Campus, and The Sandbox, as well as institutional grade assets; providing digital asset services to help Web3 companies launch and grow; and investing in frontier Web3 technology, with a portfolio of over 600 companies and altcoin assets. For more information users can visit www.animocabrands.com or follow on X, YouTube, Instagram, LinkedIn, Facebook, and TikTok.

Contact

Senior Vice President

Chase Colasonno

47 communications on behalf of The Sandbox and Corners

thesandbox@fortyseven.com