Singapore, Singapore, September 30th, 2025, Chainwire

SINGAPORE, Sept. 30, 2025 – The Sandbox, a leading gaming and immersive experience platform and a subsidiary of Animoca Brands, today shared its future vision for the company. In a message authored by CEO Robby Yung, the company outlined how it is positioning itself at the intersection of AI, Web3, and mobile to expand its platform and empower creators globally.

“Since the release of our original mobile game in 2012, The Sandbox has focused on creators,” said Robby Yung, CEO of The Sandbox. “In 2020, The Sandbox evolved from a traditional 2D, singleplayer game into an immersive, 3D multiplayer platform powered by emerging blockchain technologies that enabled true digital ownership and monetization for our creators.”

Over the past five years, The Sandbox has grown to include over 400 major brand partners, more than 400,000 creators, and over 8 million users. Its $SAND token has consistently ranked among the top five gaming tokens, solidifying The Sandbox as one of the most prominent Web3 projects.

“While the broader industry has faced headwinds, we have kept building with our most recent seasons reaching all-time highs in both player volume and engagement,” Yung said. “But it’s still not enough and we know there is more work to be done. We believe that we are once again at the start of a new technological wave marked by the convergence of Web3 and AI that will change the creator status quo, and we are determined to position The Sandbox at its forefront.”

New AI Initiatives

The Sandbox is investing heavily in AI across two dimensions: operational efficiency and user-facing creation.

On the operations side, the company is using both existing AI tools and developing its own to drive efficiency in functions ranging from agentic coding to cheat detection and customer support.

On the creation side, The Sandbox sees AI as a transformative force.

“Immersive content creation at scale, whether games or other forms of experiences, has continued to be constrained by time, skillset, and cost,” Yung noted. “We have made significant progress in addressing this via our no-code creation tools (VoxEdit, Game Maker), but AI will revolutionize this space and we plan to lead the charge.”

The company has begun training custom AI models for asset generation and is actively working on user-facing generative AI tools, leveraging its extensive library of 1.7 million assets, hundreds of game templates, and its global community of over 400,000 creators.

Additionally, The Sandbox announced a partnership with Rosebud AI, the fast-growing vibe-coded games platform. This partnership will allow creators to be whitelisted to vibe code games using custom templates and assets from The Sandbox. More details will be shared soon.

New Web3 Initiatives

The Sandbox is also expanding its Web3 infrastructure to help creators succeed beyond content creation.

“While we have seen the creation of thousands of amazing games and immersive experiences on our platform, the biggest challenge for creators very often occurs post-creation in the form of distribution, engagement, and monetization. This problem exists not only in The Sandbox but also in many other content creation ecosystems, including popular traditional platforms. We believe Web3 infrastructure is uniquely suited to address these challenges. With blockchain being a core part of our DNA at The Sandbox, we feel this gives us a significant advantage, and we are actively investing in the development of new Web3 infrastructure that will support creators beyond content creation itself,” Yung said.

The first major investment is SANDchain, developed by The SANDChain Foundation with support from The Sandbox. This dedicated cross-platform layer enables creators to bridge engagement into ownership and rewards. SANDchain was formally unveiled today at TOKEN2049 in Singapore, with its Testnet set to launch on October 14.

The second initiative centers on monetization. By supplementing SANDchain’s engagement layer with an economic layer based on Internet Capital Markets (ICMs), The Sandbox aims to provide creators with flexible, dynamic monetization options. “Where the monetization frameworks of traditional creator platforms are typically rigid and very limiting, we see an opportunity for token bonding curve mechanics to provide something much more dynamic in order to maximize creators’ opportunities to monetize their current work,” Yung explained.

This first-of-its-kind platform is under active development and is expected to launch by the end of the year, with an early access waitlist to follow in the coming weeks.

Mobile

Mobile has always been central to The Sandbox’s DNA.

“Thirteen years ago, The Sandbox was born on mobile. Launching on mobile has always been on the roadmap, thanks to its unparalleled accessibility and reach,” Yung said.

The Sandbox is actively developing multiple mobile concepts. The first is currently being playtested internally, with a larger closed playtest for community members planned next. “We fully expect mobile to be a big part of our future and are excited to continue progressing our current ideas with the end goal of bringing one or more of them to market,” Yung added.

$SAND

The $SAND token continues to serve as the transactional backbone of The Sandbox ecosystem. Each of the new initiatives announced further builds upon the financial rails of $SAND, accruing more utility and value as The Sandbox ecosystem expands. “$SAND holders are the nodes of our network, and we also plan to provide more direct innovative initiatives and programs focused on generating benefits for our holders,” Yung said.

The Road Ahead

Looking forward, The Sandbox is clear about its focus: leveraging AI to transform content creation, building Web3 infrastructure to support creators. The company recently restructured itself to ensure teams are aligned with these priorities and to take advantage of AI-driven operational support.

“As we progress, we remain fully committed to building and improving The Sandbox,” Yung said. “We will also be centering our LiveOps strategy around the success of our seasons format, increasing the frequency and consistency of major platform events to provide our creator and player base with more opportunities for engagement. The Sandbox’s virtual assets, including LANDs, all NFT collections, and various ecosystem assets remain unchanged. Alpha Season 6 is now live in The Sandbox along with new brands, experiences, gameplay, features, and more. We hope to see you there.”

From its origins as a 2D mobile game to becoming a 3D multiplayer immersive platform, The Sandbox is preparing for the next chapter.

“We remain focused on building the best tools for creators to create and the best ecosystem to support them,” Yung concluded. “The Sandbox 3.0. We are deeply appreciative of the many who have been on this journey with us and hope you’ll join for the one ahead.”

Additional information on The Sandbox 3.0 Vision is available at The Sandbox blog.

The Sandbox is available for free on Windows and Mac computers via sandbox.game.

Follow or join in the conversation via The Sandbox Discord, X, and Instagram.

About The Sandbox

The Sandbox, a subsidiary of Animoca Brands, is an immersive platform in which users play, create, and monetize unique experiences alongside their favorite brands, IPs, and celebrities across gaming, entertainment, music, art, and more. The Sandbox leverages web3 technologies to fully enable end-user creation and creator economies, disrupting existing platforms by providing both players and creators with true ownership of their assets, creations, and rewards as non-fungible tokens (NFTs). Over 400 partners have joined The Sandbox, including Warner Music Group, Gucci, Ubisoft, Paris Hilton, Jurassic World, The Walking Dead, Snoop Dogg, Attack on Titan, Lacoste, Steve Aoki, The Smurfs, and many more. The Sandbox has been named a TIME100 Most Influential Company by TIME Magazine.

For more information, please visit www.sandbox.game and follow regular updates on X, Medium, and Discord.

Contact

Senior Vice President

Chase Colasonno

47 Communications on Behalf of The Sandbox

thesandbox@fortyseven.com

Central, Hong Kong, September 30th, 2025, Chainwire

With over 2 million downloads globally, Nodepay introduces a real-time prediction signal marketplace that provides intelligence for traders and growth insights for companies.

Nodepay, the AI data infrastructure company backed by investors including OKX Ventures, Animoca Brands, and Jump Crypto, today launched the world’s largest consumer-driven sentiment engine and predictive intelligence platform. The release marks Nodepay’s transition from a decentralized bandwidth-sharing network for validated AI data to a structured sentiment and prediction signal provider within the cryptocurrency sector.

In today’s fast-paced cryptocurrency markets, extreme volatility in asset prices forces traders into a constant reactive mode. Fragmented information and the lack of reliable real-time insights create unmanaged trading risks—where minutes can cost millions. Nodepay resolves this challenge by integrating consumer sentiment inputs, social signals, and quantitative data to deliver clear insights and predictive intelligence that anticipates upcoming market movements.

From Sentiment to Prediction

The platform aggregates user inputs from signal prompts with market analytics, and more than 50,000 global social and web data sources. Nodepay provides traders and analysts with dynamic insights, offering personalized notifications for assets and a clear view of the sentiment shaping market trends in real time. Companies is able to leverage the platform’s distribution tools to launch customized signal campaigns that surface community sentiment while amplifying user growth.

Users earn rewards for contributions that shape the data and grow the network, creating a reinforcement feedback loop that improves insight quality.

Nodepay’s new model rethinks how prediction markets work. Traditional prediction platforms have contended with limited liquidity and data depth. Nodepay shifts the emphasis from speculative betting to providing upstream infrastructure, generating sentiment at scale and transforming it into intelligence to develop more real time and better curated markets.

“Prediction markets have lacked reliable inputs and scale,” said Darren Nguyen, Nodepay’s co-founder and CEO. “Nodepay addresses this by turning community conviction into structured signals. That creates useful intelligence for traders, measurable reach for projects, and direct rewards for contributors.”

Users can access advanced platform features through subscription, creating revenue that is reinvested to support token sustainability. Early access has been opened to token holders, with a global rollout underway for the 89,000 users from the initial waiting list. Nodepay is building today’s predictive intelligence platform with a vision to expand across industries where real-time decision-making is critical.

About Nodepay

Nodepay is the world’s largest sentiment and intelligence network, with more than 2 million infrastructure users across 180 countries. By turning community activity, social data, and market signals into a predictive intelligence system, Nodepay gives traders real-time insights and projects verified reach. Backed by institutional investors including Jump Crypto, Animoca Brands, OKX Ventures and 20+ funds, Nodepay is developing a platform that is at the frontier of intelligence and prediction systems.

Site: https://nodepay.ai/

Contact

Head of Public Relations

Ashley Summer

Nodepay

media@nodepay.ai

Zug, Switzerland, September 30th, 2025, Chainwire

Solstice Finance, the onchain asset manager backed by $1 billion digital asset investment firm Deus X Capital, today officially launched its USX and YieldVault Program to the public. The Solana-native protocol delivers a Solana-native stablecoin that gives all users permissionless access to institutional grade yields via Solstice’s YieldVault.

USX and YieldVault bring a new category of stablecoin – purpose-built for composability, transparency, and native yield through Solstice’s protocol – to Solana with over $160 million in locked capital (TVL) at launch, backed by Galaxy Digital, MEV Capital, Bitcoin Suisse, Auros and Deus X Capital. Solstice enters this launch with a battle-tested strategy which has historically generated a 13.96% Net IRR with no recorded month-over-month losses since inception.

“Legacy stablecoins maintain majority market share, yet not a single leading stablecoin was born natively on Solana and no dominant yield-native stablecoins currently exist in the ecosystem. We see stables often being bridged to other chains for best-in-class yield – that’s stable TVL leaving our ecosystem to try and earn elsewhere. We built USX addressing this market gap on day one, a stablecoin that maintains all of the frictionless transaction benefits while giving access to institutional-grade yields that are native to the protocol,” said Ben Nadareski, CEO and Co-Founder of Solstice.

“Solstice is driving real, sustainable onchain revenues within the Solana ecosystem and the launch of USX and YieldVault unlocks new opportunities for builders, users, and investors,” said Lily Liu, President of the Solana Foundation.

A deeper look into Solstice’s ecosystem:

- USX: A synthetic stablecoin designed for velocity of capital and transparency, backed 1:1 by stable collaterals with real-time Proof of Reserves via Chainlink.

- YieldVault: As Solstice’s flagship yield engine, YieldVault offers institutional-grade returns generated from proven delta-neutral trading strategies. YieldVault’s returns maintain a trusted three-year track record with 21.5% performance in 2024 and zero months of negative returns since inception.

- SLX: Solstice’s future native utility token is driven by a community-first distribution model with no VC-backing to align long-term protocol success with community incentives.

- The Team: Solstice core contributors consist of 30+ crypto and TradFi veterans across 10 countries, with deep experience from Solana Labs, Coinbase, Galaxy Digital, Standard Chartered, Deloitte, UBS, NAB, BlackRock, UXD, ConsenSys, and more.

USX holders are now able to access Solstice’s YieldVault by locking their USX into the protocol, receiving eUSX, which represents their share of the underlying net asset value of the licensed yield generating fund.

“Solstice Labs is now working with over 30 partners in the ecosystem for integration with a sole focus on the Solana ecosystem. We’re excited to finally have USX live and in the market, bringing the best-in-class yield to everyone. Whether you’re managing $5 or $50 million, Solstice unlocks delta-neutral, institutional-grade returns in a transparent and fully permissionless way.” Nadareski continued.

USX is now live on Solana and available to all users. To learn more or access USX today, users can visit https://solstice.finance or follow @solsticefi on X.

About Solstice Finance

Solstice Finance is a decentralised finance protocol developed by Solstice Labs AG, a Deus X Enterprise company, in partnership with the Solstice Foundation. Collectively they are reimagining asset management for the onchain era. Solstice’s Protocol leverages a licenced approved manager and fund to offer institutional-grade access to DeFi and TradFi investors. Key products include USX, a Solana-native stablecoin alongside Solstice’s YieldVault, a democratized yield-bearing protocol that allows participants to access institutional-grade delta-neutral yields.

Bolstering the group’s crypto credentials, Solstice Labs AG also operates Solstice Staking AG, one of the most trusted infrastructure providers in the industry, securing over $1 billion in assets across 9,000+ validator nodes.

Users can learn more at https://solstice.finance and follow @solsticefi as well as @solsticestaking.

Contact

PR Director

Leslie Termuhlen

leslie@serotonin.co

VICTORIA, Seychelles, September 30th, 2025, Chainwire

As Newcastle United’s Official Partner, BYDFi displayed its slogan “BUIDL YOUR DREAM FINANCE” on the pitchside LED boards during the club’s Premier League home match against Arsenal at St. James’ Park on September 28. Soon after, they received kind messages on social media suggesting that “BUIDL” might be a typo. They appreciate the care behind those notes and would like to share the story of BUIDL and why it matters to their brand.

BUIDL: From Meme to Mindset

In crypto culture, BUIDL is a deliberate play on “build,” echoing the earlier community meme HODL (“hold”). If HODL speaks to staying the course through volatility, BUIDL shifts the emphasis to doing the work: shipping products, improving infrastructure, and contributing to the ecosystem. BUIDL is a call to keep building—especially when it’s hard.

For BYDFi, BUIDL is intentional—not a typo. They use it to honor a builder ethos and a long-term view of value. As Newcastle United’s Official Partner, they treat club-adjacent communications seriously and value open dialogue with supporters. It’s a builder’s mindset they share.

Why It Resonates with BYDFi

At BYDFi, BUIDL isn’t a matchday slogan—it’s how they operate: clarity instead of hype, progress measured in shipped improvements, and accountability that shows up in transparent communication, user education, and responsive support. BYDFi pairs accessibility with responsibility so participation feels simple without being careless, and they prefer steady, verifiable steps over grand promises.

BYDFi’s role as Newcastle United’s Official Crypto Exchange Partner gives this philosophy a visible moment on matchdays, but the work is daily: listening to users, refining what’s confusing, strengthening safeguards, and keeping iterating. That is what “BUIDL Your Dream Finance” means to them: taking ideas off the page and into practice, where consistent effort turns them into reality.

“BUIDL captures what we stand for—turning intent into lasting outcomes through deliberate action,” said Michael, Co-founder & CEO of BYDFi. “The attention paid to ‘BUIDL’ serves as a catalyst, forging a meaningful bridge between the BYDFi and Newcastle United communities.”

From Slogan to Practice

This philosophy translates into clear operating habits: keeping users front-and-center, acting with transparency, and building for the long term. It shapes our view of market structure and product craft. In practice, that means steady execution: launching MoonX, an onchain trading tool for Web3 discovery; extending Smart Copy Trading; and collaborating with Ledger on a limited hardware wallet. In parallel, we reinforce safeguards with publicly verifiable Proof of Reserves and an 800 BTC Guardian Fund, maintaining clear guardrails so participation remains responsible.

About BYDFi

Founded in 2020, BYDFi now serves over 1 million users across 190+ countries and regions. BYDFi is Newcastle United’s Exclusive Official Crypto Exchange Partner. Recognized by Forbes as one of the Best Crypto Exchanges In Canada For 2025, BYDFi offers a full range of trading services—from Spot and Perpetual Contracts to Copy Trading, Automated Bots, and Onchain Tool (MoonX)—empowering both novice and experienced traders to navigate the digital asset market with confidence.

BYDFi is dedicated to delivering a world-class crypto trading experience for every user.

BUIDL Your Dream Finance.

- Website: https://www.bydfi.com

- Support email: cs@bydfi.com

- Business partnerships: bd@bydfi.com

- Media inquiries: media@bydfi.com

Twitter( X ) | LinkedIn | Telegram | YouTube | TikTok | How to Buy on BYDFi

Contact

Senior Marketing Director

Chloe

BYDFi Fintech LTD

chloe@bydfi.com

Unveils ‘Power of 8’ Initiative: 800M Worldcoin (WLD) Tokens and 8B Verified Humans

Dan Ives, renowned technology and AI expert and Wall Street analyst, serves as Chairman of the Board

World is the single sign-on for the AI era

“If we succeed on our mission, World might become the largest network of real people online, fundamentally changing how we interact and transact throughout the Internet,” says Sam Altman

Investors include MOZAYYX, BitMine Immersion (BMNR), World Foundation, Wedbush, Coinfund, Discovery Capital Management, FalconX, Kraken, Pantera, GSR, Brevan Howard and more

EASTON, Pa., Sept. 29, 2025 /PRNewswire/ — Eightco Holdings Inc. (NASDAQ: ORBS) today unveiled its ‘Power of 8’ initiative, targeting 800 million Worldcoin (WLD) and 8 billion verified humans. Since launching its Worldcoin treasury strategy on September 8, World has added over 1.9 million verified humans, bringing the total to 16.9 million, with a goal of reaching 100 million within the next 12 months.

“World is the single sign-on for the AI era, making it possible to trust and transact anonymously online for the first time,” said Dan Ives, newly appointed Chairman of Eightco Holdings Inc. (ORBS). “In the AI value chain, LLMs are valued at $3 trillion, hyperscalers $3 trillion, cybersecurity $1-2 trillion and the most important of these, ‘Proof of Human,’ or human cybersecurity is $10 billion. Over time, ‘Proof of Human’ verification should easily match the value of a single LLM, or have a value of $200 to $300 billion, implying the Worldcoin value of $20 to $30 per WLD coin.”

Ives continues, “We believe in the ‘Power of 8‘: ORBS reaching 800 million WLD tokens and verifying 8 billion humans. The momentum of the past few weeks is only the beginning.”

The issue of trust in the agentic age and the urgent demand for digital verifications systems is more important than ever before, recently voiced by President Trump in his address to the United Nations announcing that he’ll be “meeting with the top leaders of the world by pioneering an AI verification system that everyone can trust.”

“We also talked a lot about the need to include a financial network of some sort. It was clear to us that authentication and proof of humanity was an important component,” said Sam Altman, Co-founder of World and OpenAI, on the creation of World. “But it was also clear that one of the most important problems, one of the reasons you needed this was for people to be able to exchange value, for people and AI’s to exchange value, someday for AI’s and AI’s to do it.”

Blockchain technology enables the safest solution to secure human verifications in the digital age, echoed by industry leaders, “The internet-native money is crypto. It’s a bearer instrument,” said Ben Horowitz, Co-founder of Andreessen Horowitz, “So crypto is kind of like the economic network for Al.”

Eightco Holdings Inc. (ORBS) is committed to establishing a universal foundation for digital identity. World’s proprietary verification Orb technology is designed to meet the security and identity challenges of the future, offering a path to a universally trusted digital identity and the foundation for the next generation of online trust, verification and economic exchange. The Orbs are the hardware backbone of Worldcoin, verifying unique humans, distributing tokens fairly, and creating a trusted digital identity system. World will be the leading verification platform for consumers around the world.

ABOUT EIGHTCO HOLDINGS INC.

Eightco Holdings Inc. (NASDAQ: ORBS) is delivering a first-of-its-kind Worldcoin (WLD) treasury strategy. With this digital asset treasury (DAT), Eightco is advancing the AI revolution, implementing a technology infrastructure layer that is integral to the future of authentication, verification and Proof of Human (PoH). In an increasingly agentic world, Eightco aims to achieve a universal foundation for digital identity.

For additional details, follow on X:

https://x.com/iamhuman_orbs

https://x.com/divestech

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this press release other than statements of historical fact could be deemed forward looking. Words such as “plans,” “expects,” “will,” “anticipates,” “continue,” “expand,” “advance,” “develop” “believes,” “guidance,” “target,” “may,” “remain,” “project,” “outlook,” “intend,” “estimate,” “could,” “should,” and other words and terms of similar meaning and expression are intended to identify forward-looking statements, although not all forward-looking statements contain such terms. Forward-looking statements are based on management’s current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: Eightco’s ability to maintain compliance with the Nasdaq’s continued listing requirements; unexpected costs, charges or expenses that reduce Eightco’s capital resources; Eightco’s inability to raise adequate capital to fund its business; Eightco’s inability to innovate and attract users for Eightco’s products; future legislation and rulemaking negatively impacting digital assets; and shifting public and governmental positions on digital asset mining activity. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Eightco’s actual results to differ from those contained in forward-looking statements, see Eightco’s filings with the Securities and Exchange Commission (the “SEC”), including in its Annual Report on Form 10-K filed with the SEC on April 15, 2025. All information in this press release is as of the date of the release, and Eightco undertakes no duty to update this information or to publicly announce the results of any revisions to any of such statements to reflect future events or developments, except as required by law.

Singapore, Singapore, September 29th, 2025, Chainwire

Wrapped Bitcoin (WBTC), the tokenized version of Bitcoin used in Decentralized Finance (DeFi), has announced its expanded integration across several blockchain networks and protocols. This expansion is part of an effort to improve cross-chain functionality and support broader usage of Bitcoin within the DeFi ecosystem. By increasing compatibility with high-performance networks, WBTC continues to serve as a standardized vehicle for representing Bitcoin across diverse decentralized applications.

Launched in early 2019, WBTC enables Bitcoin holders to access decentralized applications with a fully custodied, verifiable 1:1 token. Today, WBTC represents approximately USD 14.5 billion in market capitalization, offering some of the deepest liquidity across DeFi markets.

WBTC is Setting a New Bitcoin Standards, Bitcoin Multichain

Building on its recent native launch on Solana, WBTC continues to expand into additional chains, enabling developers and users to transact Bitcoin with lower costs and higher efficiency. Its design emphasizes institutional-grade custody, transparency, and compatibility across ecosystems.

By anchoring Bitcoin in the multichain economy, WBTC extends the utility of the world’s largest digital asset and sets a benchmark for tokenized assets at scale.

Protocols Engaging with WBTC This Season:

WBTC is integrated across hundreds of protocols in DeFi, powering exchanges, lending, staking, and cross-chain applications. During the New Bitcoin Era season, a number of protocols are introducing opportunities where WBTC plays a role, including Tapp Exchange, Hyperion, NAVI protocol, Volo, Thala, Echelon, Shadow Exchange, Beefy, PancakeSwap, Sonic Labs, TeleSwap, Hemi, Renzo Protocol, Structured, Saros, Concrete, Starknet.

About WBTC – Bitcoin’s Passport to DEFI

WBTC is the new Bitcoin standard. A singular identity for Bitcoin across multiple chains. It brings Bitcoin into environments where speed, capital efficiency, and scale are essential, while maintaining fidelity to Bitcoin’s original principles. There is no second. WBTC stands alone in its role, trusted, verifiable, and engineered for a multichain world.

Website: wbtc.network

Disclaimer: This press release is for informational purposes only and does not constitute financial advice. Participation in DeFi protocols carries risks, and users should conduct their own research before engaging with any DeFi protocols.

Contact

Director of Marketing Operation

YC Song Nadia

WBTC

nadia.song@wbtc.network

BitMine now owns greater than 2% of the ETH token supply as it moves towards the ‘Alchemy of 5%’

BitMine leads Crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of BMNR stock

BitMine Crypto + Cash Holdings + “Moonshots” total $11.6 billion, including 2.651 million ETH Tokens, unencumbered cash of $436 million, and other crypto holdings

BitMine is the 26th most traded stock in the US, trading $2.6 billion per day (5-day avg)

BitMine remains supported by a premier group of institutional investors including ARK’s Cathie Wood, MOZAYYX, Founders Fund, Bill Miller III, Pantera, Kraken, DCG, Galaxy Digital and personal investor Thomas “Tom” Lee to support BitMine’s goal of acquiring 5% of ETH

LAS VEGAS, Sept. 29, 2025 /PRNewswire/ — (NYSE AMERICAN: BMNR) BitMine Immersion Technologies (“BitMine” or the “Company”) a Bitcoin and Ethereum Network Company with a focus on the accumulation of Crypto for long term investment, today announced crypto BitMine crypto + cash + “moonshots” holdings totalling $11.6 billion.

As of September 28th at 7:00pm ET, the Company’s crypto holdings are comprised of 2,650,900 ETH at $4,141 per ETH (Bloomberg), 192 Bitcoin (BTC), $157 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and unencumbered cash of $436 million.

BitMine crypto holdings reigns as the #1 Ethereum treasury and #2 global treasury, behind Strategy Inc (MSTR), which owns 639,835 BTC valued at $71 billion. BitMine remains the largest ETH treasury in the world.

“As we enter the final months of 2025, the two Supercycle investing narratives remain AI and crypto. And both require neutral public blockchains. Naturally, Ethereum remains the premier choice given its high reliability and 100% uptime. These two powerful macro cycles will play out over decades. Since ETH’s price is a discount to the future, this bodes well for the token and is the reason BitMine’s primary treasury asset is ETH,” said Thomas “Tom” Lee of Fundstrat, Chairman of BitMine. “As we mentioned in our August Chairman’s message, the power law benefits large holders of ETH, hence, we pursue the ‘alchemy of 5%’ of ETH.”

The GENIUS Act and SEC’s Project Crypto are as transformational to financial services in 2025 as US action on August 15, 1971 ending Bretton Woods and the USD on the gold standard 54 years ago. This 1971 event was the catalyst for the modernization of Wall Street, creating the iconic Wall Street titans and financial and payment rails of today. These proved to be better investments than gold.

“We continue to believe Ethereum is one of the biggest macro trades over the next 10-15 years,” continued Lee. “Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum.”

BitMine is now one of the most widely traded stocks in the US. According to data from Fundstrat, the stock has traded average daily dollar volume of $2.6 billion (5-day average, as of September 26, 2025), ranking #26 in the US, behind Marvell Technology (rank #25) and ahead of Visa (rank #27) among 5,704 US-listed stocks (statista.com and Fundstrat research).

“At BitMine, we are leading our crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” said Lee.

The company recently released a corporate presentation, which can be found here: https://bitminetech.io/investor-relations/

The Chairman’s message can be found here:

https://www.bitminetech.io/chairmans-message

To stay informed, please sign up at: https://bitminetech.io/contact-us/

About BitMine

BitMine is a Bitcoin and Ethereum Network Company with a focus on the accumulation of Crypto for long term investment, whether acquired by our Bitcoin mining operations or from the proceeds of capital raising transactions. Company business lines include Bitcoin Mining, synthetic Bitcoin mining through involvement in Bitcoin mining, hashrate as a financial product, offering advisory and mining services to companies interested in earning Bitcoin denominated revenues, and general Bitcoin advisory to public companies. BitMine’s operations are located in low-cost energy regions in Trinidad; Pecos, Texas; and Silverton, Texas.

For additional details, follow on X:

Forward Looking Statements

This press release contains statements that constitute “forward-looking statements.” The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. This document specifically contains forward-looking statements regarding progress and achievement of the Company’s goals regarding ETH acquisition and staking, the long-term value of Ethereum, continued growth and advancement of the Company’s Ethereum treasury strategy and the applicable benefits to the Company. In evaluating these forward-looking statements, you should consider various factors, including BitMine’s ability to keep pace with new technology and changing market needs; BitMine’s ability to finance its current business, Ethereum treasury operations and proposed future business; the competitive environment of BitMine’s business; and the future value of Bitcoin and Ethereum. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond BitMine’s control, including those set forth in the Risk Factors section of BitMine’s Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on April 3, 2025, as well as all other SEC filings, as amended or updated from time to time. Copies of BitMine’s filings with the SEC are available on the SEC’s website at www.sec.gov. BitMine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

GENEVA, Paris and OAKLAND, Calif., Sept. 29, 2025 /PRNewswire/ — McKay Brothers, the worldwide leader in providing data transport for digital and FX traders, today announced the launch of a new transport service interconnecting London and Singapore in less than 137 milliseconds round trip. McKay’s new network provides the fastest path between Slough-LD4, which hosts leading crypto platforms including Deribit, LMAX and Kraken, and Singapore, where it connects directly into the AWS cloud which hosts crypto platform Bybit. The network is purpose-built for asset classes where risk management increasingly depends on microseconds.

McKay’s Level Playing Field policy ensures that all subscribers can purchase the best latency. The London-Singapore transport service is optimized for the unique requirements of cloud-based digital asset trading. McKay provides the data transport used by the world’s most demanding firms and makes it equally accessible to all subscribers, leveling the playing field. McKay’s networks for traders of digital assets are designed to deliver the highest levels of reliability and resiliency, maintaining the same rigorous standards as the company’s networks serving traditional financial markets.

McKay offers digital trading firms a portfolio of long-haul transport at the lowest latency, connecting Tokyo with Hong Kong, Singapore, London, Chicago, and Ashburn, VA.

McKay will attend the Token 2049 conference in Singapore and can be found at Booth MB4 81.

About McKay Brothers

McKay Brothers is the leading provider of data transport services for financial markets. The company designs, owns, and operates the world’s most advanced short- and long-haul networks, delivering transport with a focus on speed, reliability, and resiliency. McKay is relied upon by the most sophisticated market participants. All McKay’s services are provided to clients on an equal footing.

Panama City, Republic of Panama, September 29th, 2025, Chainwire

Web3 creator growth platform Alt.town has officially enabled $TOWN token utility within its service, opening the door for real in-platform use. To commemorate the update, Alt.town has launched the “ValueFi Deposit Event.”

With this update, $TOWN can now be freely swapped into KEY, the core point of Alt.town. KEY is used for DNA (creator token) trading and content payments, transforming $TOWN from a mere trading asset into a structurally significant utility token tied directly to platform demand.

The newly launched deposit event allows users who swap $TOWN into KEY and hold their KEY on the platform to receive MILE point rewards as interest. While holding, KEY remains fully tradable and usable within the platform, with rewards maintained as long as it is not withdrawn. The total reward pool is set at approximately $10,000, designed to encourage stable holding behavior that supports long-term value growth and ecosystem stability.

This update follows the August 26th listing of $TOWN on Binance Alpha, Bitget, Gate.io, and MEXC, which marked a significant milestone in Alt.town’s global expansion. Unlike many Web3 projects that focus primarily on short-term liquidity, Alt.town emphasizes a ValueFi model centered on real utility and user participation, rapidly expanding a use-case driven ecosystem for both fans and creators.

Alt.town was developed by a team led by a former CTO of SM Entertainment, together with experts in content and blockchain. The platform pursues a “ValueFi” ecosystem where fans and creators grow together. At its core is the DNA tokenization system, which transforms creator IP into tradable tokens while reflecting fan engagement and creator activity in real time on-chain.

Eugene, CEO of bitBLUE, commented: “This update marks a key turning point in building a real utility foundation for $TOWN. Going forward, we will continue expanding utility and global partnerships to create a sustainable Web3 ecosystem.”

About bitBLUE

bitBLUE is a startup with the vision of becoming a “Web3 Culture Company,” building a digital ecosystem based on content IPs and NFTs. Its flagship service, Alt.town, tokenizes the activities of virtual creators into DNA tokens and on-chains fandom participation to realize value growth within a ValueFi platform. Alongside operating its own IPs, bitBLUE works with global partners to expand the Web3 cultural ecosystem worldwide.

Website: https://www.bitblue.team/en

Contact

CEO

Eugene Joo

ky-international

contact@ky-international.xyz

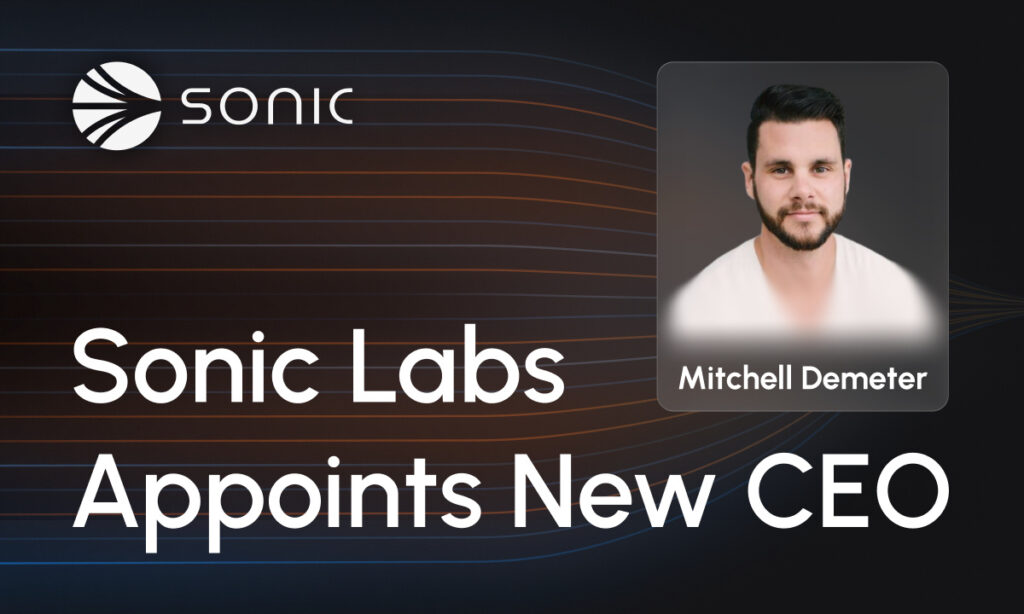

George Town, Cayman Islands, September 29th, 2025, Chainwire

Sonic Labs, the team behind the highest-performing EVM blockchain Sonic, is pleased to announce the appointment of Mitchell Demeter as its new Chief Executive Officer. Demeter, a pioneer in digital assets and seasoned entrepreneur, will lead Sonic Labs in its next phase of global growth, accelerating the adoption of Sonic as one of the world’s leading blockchains. His mandate includes expanding developer and ecosystem adoption worldwide, strengthening institutional relationships, and building bridges into U.S. and global capital markets as part of Sonic’s broader mission to redefine the future of finance.

Since the launch of the Sonic network in December 2024, the organization has achieved many milestones, including having a proven mainnet that can confirm up to 400,000 transactions per second with confirmation times consistently under 1 second, coupled with successes such as the Coinbase listing for S, native issuance of USDC, integration of Chainlink’s CCIP, and many others.

However, what’s missing are strong institutional connections in the U.S. and elsewhere backing the Sonic network and its ecosystem projects. This is a necessary component—coupled with great technology, business functions, and exchange listings—that will take Sonic to the next level. Under Demeter’s leadership, Sonic Labs will be assembling a strong executive team around him, bringing in proven operators with deep experience across both traditional finance and crypto to complement the foundation’s technology strengths. Sonic Labs is expanding its business development efforts in the United States and globally, actively recruiting and hiring leaders to deepen institutional relationships and build lasting partnerships with major U.S. and global investors and enterprises alike.

This transition is coming at a pivotal moment. Industry leaders have forecast that within the next decade, as much as 10% of global GDP could be transacted on blockchain rails, representing over $10 trillion in on-chain economic activity. Sonic is uniquely positioned to capture this growth, combining unmatched speed and scalability with developer and institutional incentive models designed for mass adoption.

Demeter said he has always believed blockchain would fundamentally reshape global markets, but that success now depends on building the right bridges between decentralized innovation and institutional frameworks. “Sonic’s technology is unmatched in speed and scalability, and our mission is to bring that performance directly into institutional finance and global markets,” he explained. He continued, “Our mission is not just adoption, it’s to make Sonic indispensable to the future of global finance. That means scaling our business development and partnership efforts with large, well-known U.S. and global entities, and supporting lighthouse applications through strategic partnerships that will serve as proof points for the entire industry. The world’s financial infrastructure is moving on-chain, and Sonic intends to be at the very center of that transition.”

Under his leadership, Sonic will continue to expand its presence among institutional investors and builders alike, bridging global markets without losing sight of its decentralized roots.

Michael Kong, who has guided Sonic Labs (and previously Fantom) to this stage, will continue serving on the Board of Directors and take on the role of Chief Information Officer, remaining actively involved in the company’s leadership. Michael has been central to the evolution of Fantom, now Sonic, since 2018, and will remain fully engaged in guiding and supporting Demeter as he leads the network into its next phase of growth.

Kong noted that he has watched Demeter bridge public markets with blockchain for more than a decade and believes this is the right moment for his leadership. “Mitchell’s extensive network and trusted relationships across the blockchain ecosystem, traditional finance, and beyond will be critical in driving the partnerships and real-world applications that will take Sonic to the next level. Myself and the entire Sonic Board of Directors are fully committed to supporting him in achieving this vision.”

About Mitchell Demeter

Mitchell Demeter is widely recognized as a pioneer in the blockchain industry. He launched the world’s first Bitcoin ATM in Vancouver and co-founded Cointrader Exchange, one of Canada’s earliest digital currency trading platforms. Over the years, his work has been featured in Forbes, Time, Fast Company, Wired, Huffington Post, and other major outlets.

As a serial entrepreneur and investor, Demeter has founded and scaled multiple ventures across industries, consistently demonstrating an ability to anticipate market shifts and deliver innovative solutions. As part of this transition, he will step back from his role as CEO of SonicStrategy and assume the position of Executive Chair, where he will continue to provide leadership on strategy and capital markets development. This move allows Demeter to shift his primary focus and attention to leading as CEO of Sonic Labs, while still supporting SonicStrategy’s ongoing growth.

Demeter brings extensive capital markets and business development experience, helping organizations navigate the intersection of blockchain innovation and institutional finance.

About Sonic

Sonic is the highest-performing EVM blockchain built for the future of finance. The network achieves sub-second finality and ultra-high throughput, delivering institutional-grade settlement speed for trading, real-world assets, and next-generation DeFi.

At the heart of Sonic’s developer incentive model is Fee Monetization, a system that lets developers earn 90% of the network fees generated by their apps. Inspired by Web2 ad-revenue sharing models, Fee Monetization rewards developers for driving usage, growth, and real activity.

Media Contact

Contact

Sonic Labs

press@soniclabs.com