Austin, Texas, United States, June 25th, 2025, Chainwire

Beeline is building a title platform for lenders leveraging stable coins and looking to infuse liquidity in residential real estate

Beeline Holdings, Inc., (NASDAQ: BLNE) the fast-growing digital mortgage platform that shortens the path to homeownership, is pleased to announce that its subsidiary, Beeline Title holdings, Inc. (“Beeline Title”), has successfully closed what it believes to be among the first to close a residential real estate transaction funded through the sale of a cryptocurrency token backed by real property. The transaction marks a major milestone in the evolution of blockchain-driven real estate finance, bridging decentralized finance with traditional title and escrow services.

“Several mortgage lenders are already developing funding models that involve the conversion of cryptocurrencies to U.S. dollars at closing,” said Nick Liuzza, CEO of Beeline Holdings. “But for these models to function at scale, you need a title company that not only understands blockchain transactions—but has the infrastructure to disburse and reconcile them in compliance with federal and state regulations.”

Beeline’s TItle’s cryptocurrency-enabled transaction is the beginning of a broader rollout. Beeline Loans, Inc., another subsidiary, is set to launch a Fractional Sale of equity product leveagering the crypto ecosystem in early August 2025, with Beeline Title providing the title and closing services for each transaction—unless borrowers elect to use an outside title company.

Importantly, Beeline Title will open this platform to all mortgage lenders, giving them access to a proven solution for cryptocurrency token transaction reconciliation, compliance and disbursement.

Liuzza continued: “Our team built Linear Title, one of the largest privately held title agencies in the U.S., prior to merging with Real Matters and going public on the TSX. Through 2019, we closed over one million title transactions across all 50 states, and this new platform is an extension of that expertise—tailored to the next generation of mortgage transactions.”

As cryptocurrency adoption accelerates and becomes regulated by federal and state governments, Beeline is positioning itself as a leader in this fastmoving ecosystem, offering trusted infrastructure to help lenders scale into a future where crypto and compliance go hand-in-hand.

About Beeline Financial Holdings, Inc.

Beeline Financial Holdings, Inc. is a trailblazing mortgage fintech transforming the way people access property financing. Through its fully digital, AI-powered platform, Beeline delivers a faster, smarter path to home loans—whether for primary residences or investment properties. Headquartered in Providence, Rhode Island, Beeline is reshaping mortgage origination with speed, simplicity, and transparency at its core. The company is a wholly owned subsidiary of Beeline Holdings and also operates Beeline Labs, its innovation arm focused on next-generation lending solutions.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the company’s prospective new home equity access product, the potential market for, timing, features, and demand for such product, and the benefits thereof. Forward-looking statements are prefaced by words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “should,” “would,” “intend,” “seem,” “potential,” “appear,” “continue,” “future,” believe,” “estimate,” “forecast,” “project,” and similar words. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. We caution you, therefore, against relying on any of these forward-looking statements. Our actual results may differ materially from those contemplated by the forward-looking statements for a variety of reasons, including, without limitation, the possibility that estimates, projections and assumptions on which the forward-looking statements are based prove to be incorrect, the ultimate interest of homeowners in unlocking liquidity and Beeline’s ability to attract homeowners, its reliance on a related party to raise capital to fund the real estate transactions and the Risk Factors contained in our Form 10-K filed April 15, 2025. Any forward-looking statement made by us in this presentation speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Investor Contact:

Media Contact:

Wire Service Contact:

IBN

Austin, Texas

512.354.7000 Office

Editor@InvestorBrandNetwork.com

Contact

IBN

www.InvestorBrandNetwork.com

Editor@InvestorBrandNetwork.com

Zug, Switzerland, June 25th, 2025, Chainwire

The partnership offers white-labeled, non-custodial, and Web2-like stablecoin loans embedded directly in your wallet or application.

Gelato, the web3 developer cloud platform, together with Morpho, the decentralized lending protocol behind some of the most trusted lending infrastructure in Ethereum, today announced the launch of Embedded Crypto-Backed Loans.

The new partnership enables Wallets, Brokers, and Fintech Apps to allow their users to instantly borrow stablecoins, like USDC, using their crypto assets as collateral. The borrowing flow has a simple, Web2-like experience that is non-custodial and fully onchain. By combining Gelato’s Smart Wallet SDK with Morpho’s permissionless lending markets, the two teams offer a complete borrowing flow that platforms can securely integrate in days.

Crypto-backed loans are fully non-custodial and onchain, governed entirely by smart contracts. Users can initiate loans in an onchain bank account powered by embedded wallet infrastructure, 7702-powered smart accounts, gasless transactions, and the ability to execute multiple transactions in a single click.

Morpho, which Coinbase recently partnered with to enable similar BTC-backed loans, brings proven lending infrastructure with over $6.5 billion in total value locked. Gelato’s Smart Wallet SDK, used by companies such as Safe, Infinex, and Gnosis Pay, handles account abstraction, one-click onboarding, and gas sponsorship, enabling applications to deliver modern, web2-style user experiences.

“We’re excited to see more platforms bring crypto-backed loans to users in a self-custodial way,” said Paul Frambot, CEO of Morpho Labs. “Morpho is built to be integrated, and Gelato makes it easy to deliver a seamless UX on top.”

Embedded Crypto-Backed Loans are designed to meet the needs of both consumer and institutional users, offering a simple, intuitive interface while preserving the non-custodial guarantees that users and platforms increasingly expect.

Key Features

- Borrow USDC in one click using crypto assets like BTC as collateral

- Fully non-custodial and onchain

- No credit checks required

- One-click wallet creation via email, social login, or passkeys

- EIP-7702 powered Smart Wallet Account

- Embedded UX with full brand control

- Gasless transactions across +50 EVM chains

Later this year, Gelato will introduce new security and recovery features to extend the smart wallet stack. These include passkey authentication, multi-signer two-factor approvals using regulated custodians, and onchain recovery modules tied to email or social logins. All upgrades are implemented at the smart contract level to maintain full decentralization.

A full demo of the product is available at: https://morpho-aa.demo.gelato.cloud, showcasing the end-to-end borrowing experience from wallet creation to BTC collateralization and loan issuance.

Embedded Crypto-Backed Loans are now available in beta on Polygon, Arbitrum, Optimism, and Scroll, with support for Katana coming soon. Gelato and Morpho are working closely with additional chain teams to expand deployment in the months ahead.

About Morpho

Morpho is a decentralized lending protocol, powering open, onchain money markets. It enables pooled and peer-to-peer borrowing with programmable risk parameters and oracle-based pricing. With over $6.5 billion in total value locked, Morpho is one of the most widely adopted lending platforms in Ethereum.

Users can learn more at https://morpho.org/

About Gelato

Gelato is Web3’s Developer Cloud, providing enterprises with critical infrastructure to build web2-like non-custodial applications at scale. It offers developer tooling for smart wallets, gas abstraction, and deploying enterprise-grade rollups. Gelato is used by leading apps, wallets, and protocols across the EVM ecosystem to deliver seamless, secure, and fully onchain user flows.

Users can learn more at https://gelato.cloud/

Contact

Matthew Hammond

Gelato

press@gelato.digital

London, United Kingdom, June 25th, 2025, Chainwire

GSR, crypto’s capital markets partner, today announced a major upgrade to its systematic over-the-counter (OTC) trading platform, expanding foreign exchange (FX) capabilities, improving execution quality, and broadening access to hundreds of digital assets.

The upgraded platform introduces both a new user interface (UI) and an enhanced API, giving clients flexible access to GSR’s liquidity across more than 200 digital assets and 25 fiat currencies. This development reflects GSR’s mission to help founders and institutions scale with confidence by providing institutional-grade liquidity solutions that meet the demands of a rapidly evolving market.

This upgrade further strengthens GSR’s position as the bridge between traditional finance and cryptocurrency markets.

“This is a meaningful step forward in GSR’s commitment to making digital asset trading infrastructure truly institutional,” said Jakob Palmstierna, President, GSR. “With systematic OTC accessible through both our API and UI, we’re enabling clients to engage with markets faster, more transparently, and with greater precision.”

Key highlights of the upgrade include:

Tighter, More Competitive Pricing:

The upgraded platform delivers improved pricing across major crypto pairs, leveraging proprietary algorithms and liquidity from GSR’s global network of counterparties.

Institutional FX Integration:

Clients now benefit from seamless crypto-to-fiat and fiat-to-fiat execution across more than 25 fiat currencies, with pricing aligned with traditional FX prime brokerage standards. Support includes large trade sizes, up to $100 million per trade or the equivalent in other currencies, with direct access to tier-one FX liquidity.

Unmatched Breadth of Assets:

Clients in approved jurisdictions can access hundreds of digital assets, including altcoins, stablecoins, and emerging tokens, across all trading combinations through both GSR’s precision-built UI and robust API. This seamless access to over 200 assets makes it one of the most comprehensive OTC offerings in the industry.

“This addition to our product offering reinforces our commitment to delivering institutional-grade trading solutions across the digital asset spectrum,” said Kunal Mehta, Head of Trading, GSR. “By combining deep liquidity, best-in-class FX capabilities, and extensive asset coverage, we’re enabling our clients to trade smarter, faster, and more globally.”

With over a decade of specialized expertise in digital assets, GSR delivers more than just execution; we offer deep market insight, strategic guidance, and tailored infrastructure to support growth at every stage.

About GSR

GSR is crypto’s capital markets partner, delivering market making services, institutional-grade OTC trading, and venture backing to founders and institutions. With more than a decade of experience, we provide strategic guidance, market intelligence, and access to a global network to help teams scale. Users can visit www.gsr.io for more information, including the General Terms of Business of Business, relevant disclosures, and GSR’s trading terms.

Contact

Haley Malanga

GSR

haley.malanga@gsr.io

George Town, Cayman Islands, June 25th, 2025, Chainwire

Inaugural launch addresses widespread industry calls for equitable token distributions and powers transparent AI finance

The Magic Newton Foundation announced the launch of $NEWT, the native token of the Newton Protocol. The $NEWT token launch features best-in-class disclosure standards and transparent documentation, designed to promote equitable distribution and eliminate the insider advantages that have plagued cryptocurrency token distributions.

Research by Solidus Labs revealed that since 2021, insiders have used decentralized exchanges to trade ahead of 56% of all ERC-20 token listing announcements, while a University of Technology Sydney study suggested between 10% and 25% of new crypto listings may have had insider trading activity. These findings have strengthened calls for the transparency measures championed by the Magic Newton Foundation.

The design and distribution of $NEWT reflects the same principles of fairness, transparency and user control built into the Newton Protocol itself—infrastructure that enables secure AI automation for cryptocurrency operations while allowing users to maintain complete control of their assets. Newton addresses technical trust through verifiable AI agents, and the $NEWT token embodies economic trust through transparent token distribution.

“Not only is $NEWT unlocking secure AI-driven finance, but it’s also correcting the information asymmetry problem that has plagued past token launches. With full onchain transparency, thorough documentation, and equitable distribution, the Magic Newton Foundation is committed to restoring trust,” said Mohammad Akhavannik, Managing Director at Magic Newton Foundation. “Our number one priority is making verifiable automation accessible via a system built on fairness that users can count on.”

The Magic Newton Foundation sets new industry benchmarks with the $NEWT token, earning praise from industry leaders like Coinbase, which tweeted from its Coinbase Assets X account “The Magic Newton Foundation is sharing in-depth disclosures for their asset. We applaud this transparency on important topics like tokenomics, utility, and long-term project plans.”

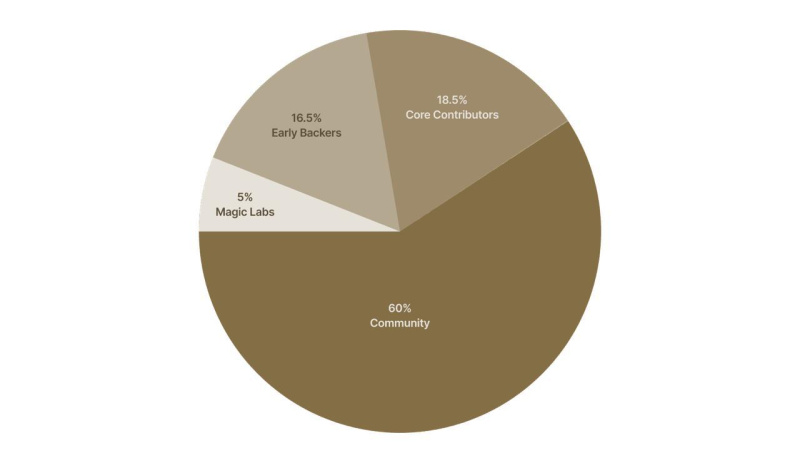

As detailed in its robust transparency disclosure packet, $NEWT token allocations are tagged in publicly disclosed wallet addresses and are trackable onchain or verified independently for any offchain holdings, preventing hidden allocations or surprise unlocks. The Foundation is allocating 60% of the 1 billion $NEWT supply directly to community initiatives, such as ecosystem development and growth, and community rewards, with quarterly transparency reports detailing token usage across all allocations.

All team and contributor allocations are subject to 36-month vesting schedules with 12-month lock-up periods, designed to ensure long-term alignment. To support stability, fair community access to $NEWT, and overall transparency, the Foundation has publicly disclosed the key terms of its loan agreements with liquidity providers. These agreements do not include performance-based KPIs and require partners to comply with all applicable laws and regulations, including prohibitions on market manipulation. This approach stands in contrast to problematic token launches where opaque liquidity arrangements have contributed to community mistrust.

$NEWT powers the Newton Protocol economy through four core functions: (i) securing the network through staking rewards for validators, (ii) serving as the native gas token and payment mechanism to issue, update or revoke onchain permissions, (iii) enabling agent operators to earn fees by providing automated services with $NEWT collateral, and (iv) giving token stakers governance rights to guide the Protocol’s evolution.

Newton Protocol addresses the growing demand for secure AI automation as current solutions force users to blindly trust AI agents to perform honestly, creating significant security and financial risks. The Protocol solves this through verifiable automation, allowing users to delegate tasks to AI agents while maintaining cryptographic proof that every action follows their exact instructions. Early supporters will be rewarded through a multi-tiered community rewards program to incentivize awareness, adoption, and engagement with the Newton Protocol.

The Newton Protocol benefits from technical contributions by Magic Labs, which serves as the first core developer of the Protocol’s open-sourced technology. Magic Labs has onboarded over 50 million embedded wallets since 2018 through partnerships with platforms including Polymarket and WalletConnect.

$NEWT is now live on Coinbase, Upbit, Binance, Bybit, and Bithumb, among other select exchanges.

About The Magic Newton Foundation

The Magic Newton Foundation, with contributions from Magic Labs, oversees the research, development, and community initiatives of the Newton Protocol to transform fragmented, manual crypto workflows into trusted, automated execution, creating the infrastructure needed for safe AI-driven finance at scale. The Foundation stewards the Newton Protocol, a decentralized infrastructure layer for verifiable onchain automation and secure agent authorization. It enables protocols, DAOs, and users to execute complex actions through verifiable agents, without relying on centralized bots or offchain coordination. Users can securely authorize agents to act on their behalf using programmable permissions, ensuring that actions occur only under conditions they approve. By combining trusted execution environments (TEEs), zero-knowledge proofs, and a modular agent architecture, Newton Protocol brings automation fully onchain, enhancing transparency, composability, and trust.

Contact

Executive Director

Sandra Rodriguez

Wachsman

magic.newton@wachsman.com

Hong Kong, China, June 25th, 2025, Chainwire

Moca Foundation today announced that it will launch Moca Chain, a Layer 1 blockchain built specifically for identity and user data. Moca Chain will support the development of identity protocols in respective industry verticals to enable individuals, devices, and AI agents to control, unify, and verify their digital credentials without relying on centralized platforms, and accelerate user-centric yet privacy-preserved growth via integrations with consumer applications. Moca Chain testnet and mainnet are expected to launch in Q3 and Q4 2025, respectively.

Moca Chain will allow on- and off-chain user data to be verified via any applications on any chains through its decentralized data storage, cross-chain identity oracle, web proof data generation (zkTLS), and on-chain verifications. It will operate as a modular, EVM-compatible chain, working interoperably with other chains to provide the identity and data layer for partners and adopters. Moca Chain will utilize MOCA Coin as the core token for gas, validator staking, storage, oracle, data generation, and verification fees.

Yat Siu, co-founder and executive chairman of Animoca Brands, said: “Billions of users today go online using single sign-on (SSO), which contains the keys to a user’s data, services, and digital lives. While convenient, SSO represents a centralized point of failure that compromises security while also allowing operators to aggressively extract value from users’ digital selves. Moca Chain seeks to solve this problem by giving users decentralized true ownership of their data, ensuring the sovereignty of users’ digital identity without a single point of failure.

He continued: “In conjunction with Moca Network’s AIR Kit, Moca Chain is creating a digital ecosystem where users can finally own their data, reputations, and contributions. This aligns strongly with the mission of Animoca Brands to advance digital property rights and empower individuals to control and benefit from their online activities and their personal data, enabling more equitable sharing of the value that users generate through their online presence and activity.”

Kenneth Shek, project lead of Moca Network, said: “Moca Chain and AIR Kit are a one-of-a-kind infrastructure for verified identity data to empower consumer apps and their users. By adopting Moca Chain and MOCA Coin, we believe we can disrupt current models of data ownership and break down the dominance of walled garden ecosystems, returning value to the users who generate it and making ecosystem growth more scalable.”

Moca Network is the identity ecosystem of Animoca Brands. As one of the launch partners of Moca Chain, Moca Network is committed to growing Moca Chain’s ecosystem and advancing the adoption of Moca Chain. Moca Network’s AIR Kit is integrated into offerings by various partners including Animoca Brands portfolio companies, partners, and affiliates, estimated to reach over 700 million addressable users. Protocols and applications built on Moca Chain will be able to gain access to the user networks and data of AIR Kit adopters, including SK Planet’s OK Cashbag (28 million KYC’d users) and One Football (over 200 millions users).

Together with its protocol partners, Moca Chain aims to solve common industry pain points for identity verifications: fragmentation, authenticity, privacy, interoperability, and self-sovereign control, with use cases spanning across multiple industries. Current use cases include Healthcare (unified electronic health records verifiable across healthcare providers), Recruitment (verified education credentials and training history), Finance (privacy-preserved KYC/AML), and Advertising (unified user data across apps for verified user onboarding).

Moca Chain is designed for real-world adoption, with Moca Network’s AIR Kit integrated into major Web2 platforms to power identity and rewards directly inside apps already familiar to millions of people. These partnerships make Moca Chain the backbone of a growing ecosystem of identity-based experiences.

Under the traditional paradigm, end users of major platforms and services (such as social networks or online retailers) are effectively locked into closed platforms where their data is siloed and monetized without their control. Moca Chain seeks to give back control to end users by enabling them to prove their identity and safeguard their data in a unified identity framework. Users of Moca Chain will specify which applications are able to access their private data, and they will be able to set granular permissions over how and where the data are shared; data sharing entitles users to partner ecosystem access, benefits, or token rewards for any use of their data.

Moca Chain’s composable identity layer will support seamless movement of user attributes such as loyalty points, social proof, and access rights across multiple dApps. This will enable users to unlock access and rewards across platforms without exposing private data, while maintaining a unified identity that is fully under their control.

Protocols built on Moca Chain can choose to issue or verify reusable on- and off-chain user data and credentials for monetization, while preserving the privacy of identity and reputation data. Once data is issued to the end users, data is verifiable everywhere via zero knowledge proofs, fostering ecosystem growth by cross-pollinating users without any direct API integrations, shifting the counterparty of verifiers from centralized platforms to end users.

Moca Chain will work alongside AIR Kit, the global account, identity, and reputation software development kit (SDK) of Moca Network. Developers can utilize AIR Kit to create feature-rich applications with smart accounts and verifiable credentials, while its support for plug-and-play permissions facilitates the creation of user-friendly applications.

About Moca Foundation

MOCA Foundation is the community-owned foundation that supports the development, adoption, and sustainable growth of Moca Network and Moca Chain. Its mission is to empower unity and collaboration while driving innovation in decentralized governance, culture, and growth. MOCA Foundation seeks to drive the development of the largest interoperable cultural economy in the Web3 space, powered by the MOCA Coin utility and governance token. MOCA Foundation is governed by Moca DAO, where participants co-create improvement proposals and engage in cross-DAO empowerment through unique delegation models.

Website: https://www.moca.foundation

X: https://x.com/MOCAFoundation

About Moca Network

Moca Network is building the world’s largest chain-agnostic decentralized identity network, with infrastructure for reputation, verification for access and rewards, and interoperability across industries and ecosystems. As the identity ecosystem of Animoca Brands, Moca Network brings together over 570 portfolio companies, more than 700 million addressable users, and a diverse range of enterprise partners. Moca Network utilizes MOCA Coin as its utility and governance token.

Website: https://moca.network

Telegram: https://t.me/MocaverseCommunity

Discord: http://discord.gg/MocaverseNFT

Contact

Moca Foundation

info@moca.foundation

London, United Kingdom, June 25th, 2025, Chainwire

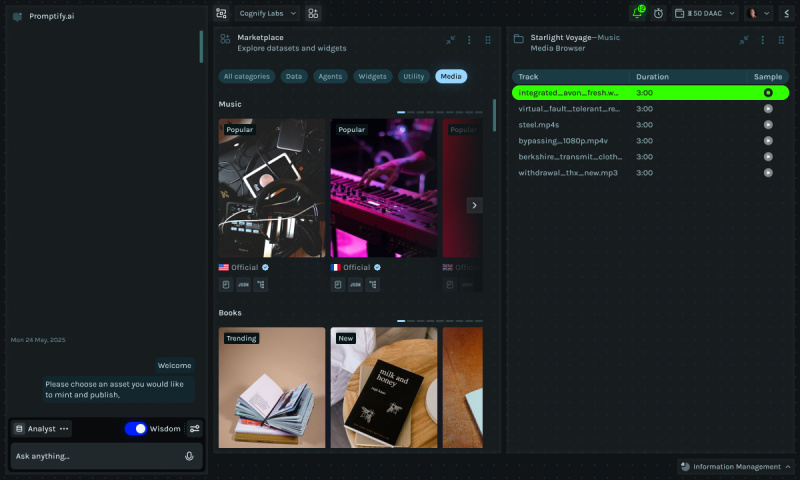

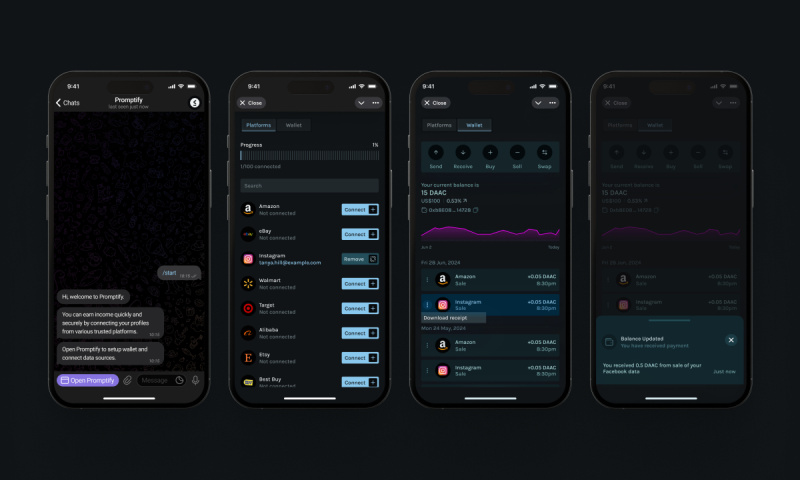

RoboCorp, a crypto-powered search and exchange platform, has unveiled the world’s first technology that enables anyone to earn cryptocurrency using their everyday data and the knowledge they possess. This groundbreaking announcement comes as tech industry leaders project that AI agents and tokenized assets could create a global market opportunity exceeding $1 trillion.

YouTube link: https://www.youtube.com/watch?v=WSAHuGjGxj4

The platform launch coincides with widespread criticism over value distribution practices that have operated in the digital economy for two decades. Companies like Google, which generated over $350 billion in revenue in 2024, and OpenAI, valued at $ 300 billion, build revenue from user-generated content and data while providing limited direct compensation to contributors.

As commonly observed, user search data contributes to algorithm improvements valued in the billions, content creators share tutorials and expertise on platforms generating substantial ad revenue, and artists from studios like Ghibli have reportedly been incorporated into AI training datasets worth billions. These contributors typically receive limited direct financial compensation for their contributions.

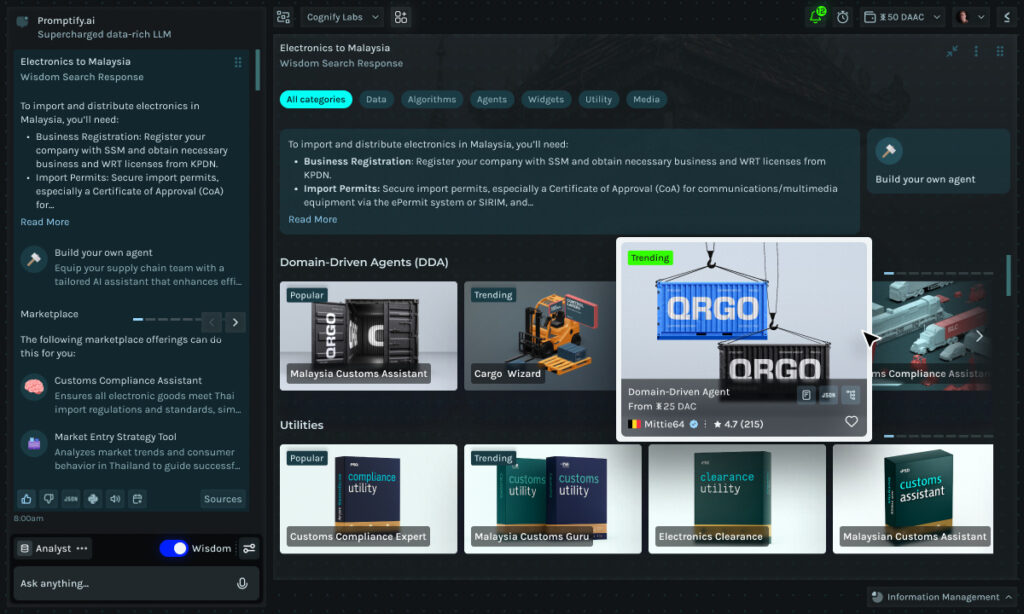

RoboCorp.co aims to fundamentally disrupt this model by creating what the company describes as the wisdom economy. The platform enables anyone to convert their data, expertise, and creative contributions into income-generating digital assets using the company’s proprietary infrastructure – the Value Stack.

The system operates through Promptyf.ai, a revolutionary platform that features Wisdom Search technology. It connects data and knowledge seekers directly with expert-created solutions while ensuring creators receive immediate compensation for their contributions. Contributors automatically earn $DAAC each time their contributions are accessed and utilized by others.

$DAAC is RoboCorp’s purpose-built cryptocurrency designed specifically for knowledge transactions. Unlike speculative tokens, $DAAC derives value from actual platform usage, enabling micro-transactions that traditional payment systems cannot handle efficiently.

“We are building a new economy: the wisdom economy,” says Jonathan Miller, founder and CEO of RoboCorp.co “Our technology makes it possible to transform every individual on earth into a knowledge contributor instantly, capturing and utilizing their expertise in ways that were previously impossible.”

Using RoboCorp’s Value Stack system, anyone can transform their expertise into income-generating assets through six asset types:

● Data – Everyday information like shopping patterns and browsing habits

● Domain-Driven Agents – Automated, instantly deployable tools

● Widgets – Interactive problem-solving interfaces

● Utilities – Complete business solutions combining multiple AI Agents and Business Logic

● Media – Creative works that generate ongoing royalties

● Models – Custom-trained AI models

In practice, an everyday internet user could use Promptyf.ai Studio to package their shopping patterns and social media activity as a Data asset that market research companies license for consumer behavior analysis. Each time businesses access these insights to improve their products or advertising strategies, the user earns $DAAC tokens, potentially generating passive income from hundreds of companies worldwide.

Similarly, a financial advisor could create a Domain-Driven Agent that automates investment portfolio recommendations based on their decades of market expertise. When investment firms integrate this agent into their platforms, the advisor receives $DACC payments each time the system processes client portfolios.

“We have the technology to make every individual on earth a knowledge contributor in minutes,” Miller explains. “This isn’t about speculation or hype – it’s about creating real utility that drives genuine innovation activity while ensuring fair recognition for knowledge creators.”

The platform also addresses a critical challenge that’s plaguing the search industry: trust and verification. Current search engines often return unverified sources, while neo-LLMs are known to produce hallucinations and unreliable information that cannot be trusted for important decisions.

RoboCorp.co addresses this through comprehensive verification protocols where every contributor undergoes identity validation, and all digital assets include complete source traceability. This approach significantly reduces AI unreliability by delivering expert-built solutions rather than algorithmic approximations, with every interaction traced back to verified human expertise through blockchain verification.

The company has also developed Promptyf.ai Enterprise with governance controls, compliance frameworks, and traditional fiat payment integration that works within corporate accounting systems while automatically converting to $DAAC on the backend. Enterprise clients can access the marketplace through familiar procurement processes using standard corporate payments, while contributors still receive crypto compensation.

“The complexity gap between personal and enterprise knowledge management requires fundamentally different solutions,” Miller notes. “Our enterprise platform provides the governance framework and system integration capabilities that organizations need while maintaining the innovation potential of individual creators.”

About RoboCorp.co

RoboCorp is a technology company focused on decentralizing the global data ecosystem and creating fair value exchange mechanisms for knowledge assets. Founded by seasoned entrepreneurs with expertise in data, AI, and search technologies, the company has developed the world’s first marketplace for data and knowledge utilization. RoboCorp’s mission centers on transforming individuals into knowledge contributors through their expertise and data assets while providing enterprise-grade solutions for organizational knowledge management.

Contact

Mr.

Jonathan Miller

RoboCorp

social@robocorp.co

Global, Global, June 25th, 2025, Chainwire

Reddio proudly announces the launch of its Mainnet Alpha, bringing the world’s first GPU-Accelerated Parallel EVM architecture to live production. Purpose-built for compute-intensive and AI-native applications, Reddio opens a new frontier of speed and programmability within Ethereum’s ecosystem.

This milestone follows Reddio’s successful Token Generation Event (TGE), with the Reddio token ($RDO) now officially live and in use on Mainnet Alpha. The token powers core network functions—including transaction fees, sequencer rewards, and developer incentives—activating the decentralized economy that underpins the Reddio ecosystem from day one.

Backed by an exceptional testnet that processed over 131 million transactions, supported 19 million+ wallet addresses, and onboarded 50+ ecosystem partners, Mainnet Alpha is now primed for real-world deployment by developers and innovators.

“We’re redefining what an EVM can do—scaling execution through parallelism and preparing for GPU-level compute, all while staying true to Ethereum’s security model. Our ultimate goal is to make Reddio the fastest decentralized Parallel EVM—purpose-built for the next generation of AI-native, compute-intensive, and real-time applications on-chain.” said Neil Han, CEO at Reddio.

️ Core Features Already Enabled

- Parallel EVM with Breakthrough Throughput — Reddio’s GPU-ready Parallel EVM architecture tackles the blockchain trilemma head-on, achieving over 13,000 TPS while maintaining Ethereum-grade security and decentralization—setting a new benchmark for scalable on-chain execution.

- AI-Optimized Design — Built with a CUDA-compatible EVM bytecode executor, Reddio is architected for native on-chain AI inferencing. This GPU-accelerated capability is currently in testing and backed by an Ethereum Foundation grant—paving the way for autonomous AI computation on-chain.

- Modular Sequencer SDK — This is the core infrastructure that powers both Reddio’s testnet and Mainnet Alpha. With customizable SDKs, developers can launch OP and ZK Appchains with ease, unlocking horizontal scalability across Layer 2 and Layer 3 networks.

- Cost-Efficient at Scale — Gas usage is carefully optimized to keep fees low even under heavy demand, making Reddio ideal for compute-heavy, latency-sensitive applications like trading, gaming, and AI workloads.

Ecosystem Use Cases Enabled by Reddio

Autonomous AI Workloads Natively On-Chain

- Reddio’s GPU-accelerated Parallel EVM is architected not merely to support AI agents, but to natively power full-stack AI compute workloads—including AI inference and complex multi-agent coordination. By enabling cooperative decision-making and autonomous financial execution, Reddio sets the stage for a new generation of intelligent, self-governing applications on-chain.

- Shoutout to Aizel Network for bringing some of these breakthroughs to Reddio – Secure Facial Verification + TEE Agent Interaction – Natural Language Transaction Execution via AI Prompting

Next-Generation DeFi

- Reddio powers high-throughput DeFi primitives—enabling fully on-chain order books, native matching engines, and on-chain trading strategy bots.

- By removing friction and improving the efficiency of native asset interaction, empowers DEXs like QuBit and Native, as well as prediction markets such as PredX AI, through composability, transparency, and execution speed that only on-chain systems can provide.

PayFi

- Reddio’s low latency, ultra-low fees, and native asset interaction make it ideal for on-chain micropayments.

- Ecosystem partners like Aeon and Bitget Wallet are building PayFi use cases on Reddio—enabling real-time payments, pay-per-use billing, and AI-triggered transactions that bring Web3-native finance to life.

Access & Roadmap

- Mainnet Alpha is now live, available to all developers and partners. This is a short transitional phase—following an intensive testnet with over 131 million transactions. No major changes are expected before the full mainnet launch, but this phase allows early adopters to deploy in production with our current architecture under real-world conditions. Alpha operates with a single sequencer and full fee model to ensure safety and clarity.

- What’s next: They will first deploy the same Parallel EVM architecture on the BNB Chain, followed by the official mainnet launch. Subsequent phases will unlock a 2× performance boost, GPU acceleration, and the decentralization of the GPU network. Smart contract-level enhancements for fine-grained execution are also on the roadmap.

- In parallel, they are investing in ecosystem development—building a developer-friendly software layer that enables AI inference to be integrated on-chain with just a few lines of code, making powerful AI-native dApps accessible to every builder.

Get Started with Reddio

- Developer Docs — Developers, researchers, and ecosystem teams are invited to access Mainnet Alpha and begin building next-gen dApps.

- Reddio DeFi Genesis Program — Activating users’ $RDO and earning on-chain yield through the staking program. Staking is now on Ethereum, Liquidity pool migration to the mainnet by the end of June.

- Following on X — Staying updated with the latest

- Visiting reddio.com — Learning more about the ecosystem

About Reddio

Backed by Paradigm, Reddio is the first GPU-powered parallel EVM, built for compute-intensive and running autonomous AI natively at scale. With Ethereum-grade security, multi-threaded parallel execution, and a modular SDK, Reddio enables real applications to thrive in a decentralized environment.

Website: reddio.com

Twitter: @reddio_com

Contact

CEO

Neil Han

Reddio

neil@reddio.com

Seattle, United States / Washington, June 24th, 2025, Chainwire

Stably—a Seattle-based pioneer in stablecoin and decentralized finance (DeFi) infrastructure—is launching a comprehensive suite of solutions designed to help financial institutions and enterprises issue their own branded stablecoins. The company’s Stablecoin-as-a-Service (SCaaS) solutions include custom development and advisory services as well as integration support with leading industry partners like Bridge and Frax.

The global stablecoin industry is growing rapidly, surpassing $250 billion in total market capitalization during the first half of 2025. Positive US regulatory tailwinds, such as the STABLE and GENIUS Acts, are boosting confidence among institutions and traditional businesses—opening the floodgate for mainstream adoption and corporate innovation. Amazon, Walmart, and JD.com, among others, have already announced their private stablecoin plans, while US Treasury Secretary Scott Bessent recently commented that stablecoins could grow into a $3.7 trillion market by the end of the decade. With faster, cheaper, borderless transactions, stablecoins help reduce payment friction, improve global market access, and unlock valuable opportunities. Cost savings and new revenue streams could even enable unique ecosystem benefits or lower the cost of credit—increasing user demand and retention while expanding brand power and reach for stablecoin issuers.

Stably leverages over seven years of industry experience and infrastructure to provide end-to-end support for launching compliant, fiat-backed stablecoins. Through a combination of in-house expertise, technology, and strategic partnerships, Stably offers chain-agnostic issuance, traditional orchestration, DeFi integrations, fiat on/off-ramps, product development, business strategy, and market operation support—including peg stability, liquidity, and risk management. These services are tailored for a wide range of potential stablecoin issuers—from banks, brokerages, asset managers, MSBs, and FinTechs, to non-financial enterprises like large retailers, F&B chains, e-commerce platforms, telecoms, social media networks, and more.

“We typically ask our client two questions to determine whether or not there’s a fit,” said Kory Hoang, Stably’s Co-founder and CEO. “(1) Do you have a large user base with strong network effects? (2) Do you hold user balances, facilitate credit, and/or process transaction volume at scale? If you answered yes to both questions then your business is ready to advance into the Stablecoin Age.”

Stably is among the earliest stablecoin issuers and SCaaS providers since 2018, having supported the launch of over 15 stablecoin projects across multiple networks—with clients and partners including financial institutions, Web3 projects, and blockchain foundations such as Ripple, VeChain, and Stellar. Stably also helped pioneer the world’s first subsidized stablecoin in collaboration with dTRINITY, a DeFi protocol designed to transform credit markets by paying interest rebates to stablecoin borrowers. More recently, Stably started working with Lit Financial, a fast-growing mortgage lender from Michigan, to assist the company with its stablecoin product strategy.

For organizations seeking turnkey SCaaS solutions, Stably works with regulated partners to enable the launch of branded stablecoins in just a few weeks. For institutions looking to build and operate their own in-house stablecoin infrastructure with long-term scalability, Stably offers a battle-tested stablecoin engine with full custom development and integration support. More broadly, Stably provides both technical and non-technical stablecoin advisory services no matter where the client is in their product lifecycle—whether it’s early-stage exploration or go-to-market execution.

About Stably

Founded in 2018, Stably is a leading stablecoin development and advisory firm from Seattle, Washington. It is among the earliest issuers and Stablecoin-as-a-Service solution providers in the world, operating the 7th largest stablecoin at one point in 2019. Stably has launched over 15 stablecoins since 2020, with clients and partners ranging from financial institutions to Web3 organizations. The company helps B2B clients adopt stablecoin technology and launch compliant products for their own ecosystems—unlocking new user benefits and market opportunities from branded digital money.

For inquiries or to learn more, users can visit stably.io or contact hello@stably.io.

Contact

Co-founder & CEO

Kory Hoang

Stably

kory@stably.io

KUALA LUMPUR, Malaysia, June 24, 2025 /PRNewswire/ — Today, WF Holding Ltd (stock code: WFF) officially announced its entry into the cryptocurrency sector and appointed Bull Coin Asset Management Limited as its industry consultant. The collaboration aims to assist with market research, technology assessment, and compliance strategy development. This move marks a significant step for WF Holding Ltd in blockchain technology innovation and the construction of a digital financial ecosystem. Moving forward, the company plans to leverage technological innovation, compliance operations, and ecosystem collaboration to drive the integration of digital assets with the real economy, creating long-term value for both shareholders and customers.

In light of the rapid growth of the cryptocurrency market and the widespread application of blockchain technology, WF Holding Ltd has decided to actively explore this emerging field to enhance the company’s technological competitiveness and future growth potential. Bull Coin Asset Management Limited will provide the company with comprehensive support for subsequent business expansion efforts by utilizing its expertise in digital asset research and global resources

The company stated that “Cryptocurrencies and blockchain technology are reshaping global financial and business infrastructure. It is a necessary step for technological innovation and a strategic measure to respond to customer and market demand.”

According to the research report, “2024-2029 China Cryptocurrency Industry Panorama Research and Development Forecast Report”, provided by Zero Power, the cryptocurrency market is projected to exceed USD 10 trillion by 2029, with a compound annual growth rate (CAGR) of 18.2%. WF Holding Ltd’s strategic layout is not only expected to seize industry opportunities, but also to promote the deep integration of blockchain technology with the real economy.

Investor/Media Inquiries:

Email: enquiry@winfung.com.my

Tel: +603-7847 1828

Sheridan, wyoming, June 23rd, 2025, Chainwire

R0AR, the trailblazing DeFi platform, proudly announces the official listing of its $1R0R token on BitMart, marking its first centralized exchange (CEX) debut. This milestone catapults R0AR onto the global stage, making decentralized finance smarter, safer, and radically more accessible for all.

“This listing is a testament to our community’s belief in a DeFi ecosystem that doesn’t force trade-offs between power and simplicity,” said ” – Dustin Hedrick, Co-Founder & CTO. “For our early supporters, this is your vision coming to life. For newcomers, welcome to a platform that’s built differently.”

Why R0AR Stands Out

R0AR rejects the complexity that often plagues DeFi. Its unified ecosystem—anchored by the R0AR Wallet, R0ARchain (a high-speed, low-cost Ethereum Layer 2), and the AI-driven R0ARacle (launching soon)—delivers privacy without paranoia, control without complexity, and institutional-grade tools without intimidation. With $1R0R, users unlock staking, farming, and advanced trading insights, all seamlessly integrated.

Until now, accessing $1R0R required navigating decentralized exchanges (DEXs). BitMart changes that, offering unmatched liquidity, price discovery, and a user-friendly gateway for millions worldwide.

Why BitMart?

BitMart’s global reach, robust security, and user-first ethos align perfectly with R0AR’s mission. This listing empowers both new and seasoned users to trade $1R0R with ease, free from the friction of DEXs.

Key Listing Details

- Token: $1R0R (ERC-20, Ethereum)

- Liquidity: Backed by locked presale funds

- Access: Available to all BitMart users globally (KYC required)

- Deposits & Withdrawals: Fully supported

Get Started: Sign up at BitMart, complete KYC, and start trading $1R0R today. https://www.bitmart.com/trade/en-US?symbol=1R0R_USDT

The 1ROR PowerDrop event page is now officially online!

Campaign page: https://www.bitmart.com/activity/1R0R/en-US

Twitter post: https://x.com /BitMartExchange/status /1935073715441541532

Social media airdrop: https:// x.com/BitMartExchange/status /1935004139123249454

To Join the R0AR Revolution users can:

- Create and verify a BitMart account.

- Trade $1R0R with ease.

- Join the community at @th3r0ar for real-time updates.

- Explore the ecosystem at r0ar.io.

What’s Next for R0AR?

The BitMart listing is just the start. R0AR’s roadmap includes:

- Full Platform Launch: An all-in-one dashboard for staking, farming, and liquidity management. r0arplatform.io

- R0ARacle Activation: Real-time AI-powered market insights to rival institutional tools.

- Expanded Listings: More CEX partnerships to broaden access.

- Innovations: NFT integrations and tokenized real-world assets (RWAs).

“We’re building the future of DeFi with our community,” Dustin Hedrick, Co-Founder & CTO. “This is your platform, your token, your moment.”

Users can join the movement at r0ar.io and trade $1R0R on BitMart today.

About R0AR

R0AR is a DeFi ecosystem designed to make decentralized finance intuitive, secure, and powerful. With its custom Ethereum Layer 2, AI-driven insights, and user-first design, R0AR empowers everyone to thrive in DeFi.

R0ar on Bitmart direct link: https://www.bitmart.com/trade/en-US?symbol=1R0R_USDT

R0AR Platform: https://www.r0ar.io/platform.

How to use the r0ar Platform : https://www.youtube.com/playlist?list=PL9NGvnQ0OI2FM2VTtZrjqnxxgdKvz62F-

R0AR Homepage: https://www.r0ar.io/

Telegram: https://t.me/r0ar_community

Contacts

Chief Development Officer

Brandon Billings

r0ar

contact-us@r0ar.io

Chief Technology Officer

Dustin Hedrick

r0ar

contact-us@r0ar.io