San Jose, California, August 8th, 2025, Chainwire

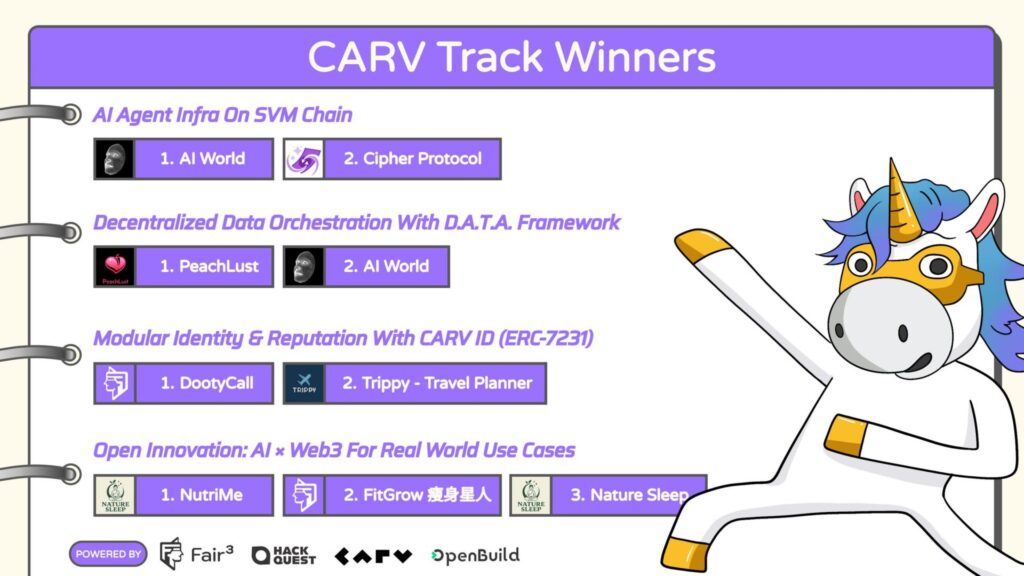

CARV, the first AI infrastructure that is powering the rise of sovereign AI Beings, proudly marks the successful conclusion of the Tech Fairness Hackathon, co-hosted with FAIR3 and HackQuest. The global hackathon, focused on building open, equitable AI and Web3 technologies, drew over 600 applicants and more than 200 registered projects, culminating in 21 winning teams selected from 30 finalists.

The event showcased the global momentum behind agent-based, privacy-first, modular applications, perfectly aligned with CARV’s long-term roadmap for evolving from data infrastructure into a fully composable, autonomous AI Being Stack.

CARV’s track challenged developers to go deep into four core infrastructure layers:

- AI Agent Infra on SVM: Building execution and coordination layers atop CARV’s custom Solana Virtual Machine (SVM) chain.

- Decentralized Data Orchestration: Leveraging CARV’s D.A.T.A. Framework for real-time, consent-based agent data.

- Modular Identity & Reputation: Extending the capabilities of CARV ID for agents through behavioral metadata and verifiable Agent IDs.

- Open Innovation: Demonstrating real-world agent applications that align with CARV’s consumer-focused direction.

Projects like AI World, Cipher Protocol, DootyCall, NutriMe, and PeachLust emerged as leading examples of how decentralized agents can be brought to life through modular infrastructure. These use cases range from AI-powered health apps and generative storytelling platforms to real-time financial assistants—all integrated with identity, data, and onchain execution logic.

“Genesis Evolution is not a theory. Builders are proving what is possible,” said Ambero Tu, CTO of CARV. “This Hackathon gave us a live lab to test those ideas with builders around the world. The winning projects are not just demos, they are viable microcosms of what the CARV ecosystem can become.”

Ambero highlighted that several teams successfully integrated the CARV ID SDK and began experimenting with structured queries to the D.A.T.A. Framework. Furthermore, he emphasized three near-term priorities following the Hackathon:

- Deploy Agent IDs at Scale: Begin issuing Agent IDs with behavioral metadata, enabling early versions of the Unified Reputation Graph.

- Launch Early Agent Marketplaces: Enable testnet-native transactions between agents for data access, compute, or service exchange.

- Drive Governance Participation: Encourage builders to stake veCARV and participate in early governance rounds that influence protocol parameters and developer incentives.

Victor Yu, COO of CARV, mentioned that the next step is to support the builders with on-chain deployments, testing environments, and fast-track access to CARV’s infrastructure.

To continue momentum post-Hackathon, CARV will provide:

- Engineering mentorship for integrating with the CARV SVM chain and D.A.T.A. Framework

- Grants and ecosystem onboarding for top teams ready to productize

- Access to real user traffic via CARV Play and partner platforms

- Participation in the Agent ID early issuance program

- Opportunities to propose Agent DAO pilots through veCARV governance

CARV sees this Hackathon not as an endpoint, but as the ignition point for an ecosystem of AI Beings, agents that are identity-bound, economically aligned, and designed to serve real people, not just centralized platforms.

“This was a proof of concept not just for our technology, but for our values,” said Victor. “We are proud to see builders from around the world embrace Tech Fairness, Data Sovereignty, and the Agent Economy. Now, we keep building. Together.”

About CARV

CARV is where Sovereign AI Beings live, learn, and evolve.

What are AI Beings? They are sovereign intelligences born natively on-chain. AI Beings are designed with purpose, autonomy, and the capacity for growth. They possess memory, identity, and the ability to perceive and interact with their environment, not just to execute tasks, but to make independent decisions, adapt over time, and pursue self-defined goals.

Anchored by its proprietary CARV SVM Chain, D.A.T.A. Framework, and CARV ID/Agent ID system (ERC-7231), CARV enables verifiable, consent-based AI Beings that learn, adapt, and co-create with users. Driven by CARV’s AI-first stack, consumer AI apps incubated through CARV Labs launched on Google Play, App Store and beyond, reaching billions of people, bringing agent-powered experiences and real-world incentives into mainstream digital life.

With 8M+ CARV IDs issued, 60K+ verifier nodes, and 1,000+ integrated games, CARV bridges AI agents, Web3 infrastructure, and real-world utility, fueling the rise of agent-driven economies. At its core, $CARV token powers staking, governance, and coordination across this stack, making CARV the operating system for AI Beings on Web3.

X (Twitter): https://x.com/carv_official

Discord: https://discord.com/invite/carv

Telegram: https://t.me/carv_official_global

Whitepaper: https://docs.carv.io/

Contact

COO

Victor Yu

CARV

vito@carv.io

Victoria, Seychelles, August 7th, 2025, Chainwire

BYDFi, a global crypto trading platform, announced the official launch of BYDFi Card, a virtual card product designed to enhance how Web3 users interact with their digital wealth. With BYDFi Card, crypto becomes instantly spendable — securely, privately, and globally — unlocking real-life utility with the ease of fiat payments.

Borderless Payments, Powered by Digital Assets

BYDFi Card eliminates the need to convert crypto into fiat through lengthy bank processes. Via services connected to traditional payment networks such as Visa, it delivers an all-in-one experience of wallet, trading, and payment. Once approved, users can top up with USDT and spend globally, both online and offline, in any currency supported by Visa—whether for shopping, subscriptions, or international services.

Key features include:

- Global Payment Compatibility: Easily link your BYDFi Card to Apple Pay, Google Pay, PayPal, and more, making it a flexible choice for platforms that require card-based payments.

- Fast Onboarding: Complete KYC in-app, submit a quick card activation request, and receive your virtual card shortly—no plastic required.

- Optimized Usage Experience: Set spending caps, track transaction history, and enjoy smooth, seamless payments.

Who Needs BYDFi Card?

BYDFi Card is built for today’s decentralized generation: Web3 users, DeFi traders, creators, and cross-border freelancers. Whether paying for subscriptions, spending trading profits, or covering travel and business expenses, it solves a key challenge—using crypto directly in daily life. For those earning in digital assets, traditional banking can be slow, costly, or inaccessible. BYDFi Card offers a fast and convenient alternative without relying on fiat intermediaries, delivering a smoother payment experience for users worldwide.

To mark the launch, BYDFi is offering early adopters exclusive benefits. Eligible users can receive a welcome package worth $88, benefit from 15% spending rebates, and participate in a trading competition with a total prize pool of $10,000.

Details: https://www.bydfi.com/en/activities/detail?id=1159539200518963200

More Than a Card: BYDFi’s Ecosystem Expansion

The launch of BYDFi Card marks a key step in expanding BYDFi’s service boundaries—from digital asset trading to real-world spending. It’s not just a new product, but a practical solution that helps users turn crypto into everyday purchasing power. With BYDFi Card, the platform moves closer to its goal of building a comprehensive financial ecosystem where assets are not only stored or traded but also truly utilized.

“Making crypto truly usable in everyday life has always been part of our vision,” said Michael, Co-founder & CEO of BYDFi. “With BYDFi Card, we’re giving our users a trusted, convenient, and secure way to access their digital wealth, whether that’s for business, lifestyle, or personal use. This is a major step toward building the financial infrastructure of the future.”

About BYDFi

Founded in 2020, BYDFi now serves over 1 million users across more than 190 countries and regions. Recognized by Forbes as one of the Best Crypto Exchanges & Apps for Beginners of 2025, BYDFi offers a full range of trading services—from Spot and Perpetual Contracts to Copy Trading, Automated Bots, and Onchain Tools—empowering both novice and experienced traders to navigate the digital asset market with confidence.

BYDFi is dedicated to delivering a world-class crypto trading experience for every user.

BUIDL Your Dream Finance.

- Website: https://www.bydfi.com

- Support email: cs@bydfi.com

- Business partnerships: bd@bydfi.com

- Media inquiries: media@bydfi.com

Twitter( X ) | LinkedIn | Telegram | YouTube | How to Buy on BYDFi

Contact

Senior Marketing Director

Chloe

BYDFi Fintech LTD

chloe@bydfi.com

DUBAI, UAE, Aug. 7, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has unveiled its bold roadmap for the future of crypto, setting the tone for a new era of innovation, security, and trading excellence.

In the highly anticipated “Keynote with Ben: Reshaping What’s Next, Bit by Bit,” CEO and Co-founder Ben Zhou delivered a forward-looking vision grounded in real-world adoption, institutional-grade innovation, and deep ecosystem alignment.

Celebrating over six years of service, 74 million users, and a milestone where 1 in 8 crypto enthusiasts globally have chosen Bybit, CEO and Co-founder Ben Zhou reaffirmed the exchange’s mission: Rewrite Your Success. Reshape The Standard.

“Crypto is no longer just about speculation — it’s about real world application. At Bybit, we’re not just trading the future; we’re rewriting and reshaping what success looks like, bit by bit,” said Zhou.

Compliance as a Foundation for the Future

Bybit opened the keynote with a reaffirmation of its compliance-first approach — a critical pillar as the industry matures. Now fully compliant with the EU’s Markets in Crypto-Assets Regulation (MiCAR) framework and securing FIU-India registration in the first half of 2025, Bybit emphasized compliance not as a barrier but as an enabler. Zhou emphasized that “sustainability in crypto begins with trust and transparency,” and positioned compliance not as a constraint, but as a catalyst for long-term growth.

Rewriting the Industry Security Standard

Bybit has also successfully rewritten the industry standard for security following a sophisticated multi-stage attack on one of its vendors in February — the largest known hack in crypto history. While Bybit’s own infrastructure remained uncompromised, the company acted swiftly in response. Within weeks, it completed nine extensive security audits — conducted by both internal and independent experts — and implemented over 50 enhanced safeguards.

The response drew industry-wide praise and global recognition for its transparency, resilience, and user-first approach. Today, Bybit’s security overhaul is regarded as a new benchmark in platform integrity.

Trading Excellence Backed by Infrastructure Upgrades

Bybit continues to lead in performance and reliability. Its upgraded matching engine now handles 3.5 million transactions per second, processing nearly 200 billion daily orders — a 75% year-over-year increase in the first half of 2025.

By extending its Rapid Price Improvement (RPI) mechanism to perpetual contracts, Bybit has delivered 150% higher liquidity and up to 5x better execution across retail and VIP accounts, firmly establishing itself as the go-to destination for professional trading.

Setting a New Height in Crypto Wealth Management

As institutional and high-net-worth adoption increases, Bybit is reshaping what wealth preservation means in the digital age. Its newly launched wealth management platform has already surpassed $150 million in AUM, offering curated portfolios and strategic services tailored to sophisticated investors — all underpinned by Bybit’s trading depth and robust security infrastructure.

Redefining Real-World Utility: Bybit Card and Payments

Another highlight was the new edition of the Bybit Card — now positioned as a crypto-native business card that integrates seamlessly into both corporate and consumer spending. With support for Visa and Mastercard networks, smart security features, and real-time expense tracking, the card bridges the gap between digital assets and daily transactions. Bybit Card is expected to expand into the EU region in August, with Peru and Colombia lined up for Q4.

Bybit’s payments infrastructure has also made major strides. Native support for nationwide QR payments in Southeast Asia and LATAM has driven a 719% quarter-over-quarter increase in usage. With over two million users and cross-sector partnerships with local services like Rappi and Vivaticket, Bybit is moving closer to making crypto as usable as “cash”.

Introducing Bybit Lite to Earn, Manage, and Trade

Zhou unveiled the upgraded Bybit App — a unified platform that streamlines both active trading and passive income generation. Bybit Lite is a new upgraded version for casual users and a reimagined Earn section, offering personalized strategies and simplified ways to activate idle capital.

A Key Partner of Mantle 2.0

A major announcement was Bybit’s deepened strategic alignment with Mantle This partnership sets the stage for what Zhou called “a bold new chapter in institutional-grade on-chain finance.” The launch of Mantle 2.0 comes with renewed leadership and tighter ecosystem integration — including Helen Liu, Co-CEO and Partner of Bybit and Emily Bao, Head of Spot and Web3 at Bybit stepping in as key advisors.

Together, Bybit, as one of Mantle’s ecosystem partners, will accelerate the development of decentralized finance by aligning infrastructure, liquidity, and governance. The collaboration aims to set new standards for scalability and compliance, while tapping into the growing demand for trust-driven DeFi solutions.

Reshaping the Standard

With this keynote, Bybit signaled more than just platform growth — it marked a shift in how the industry defines success. Zhou’s message was clear: The next era of crypto will be shaped by platforms that offer trust, usability, and true innovation.

“We believe crypto should be usable, secure, and powerful enough to serve everyone — from first-time users to institutional investors,” Zhou said. “Together with our community, we are rewriting the rules and reshaping the space for good.”

Watch the full keynote replay here.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Victoria, Seychelles, August 6th, 2025, Chainwire

Bitget, the leading cryptocurrency exchange and Web3 company,has announced the launch of TOWNSUSDT for futures trading, effective from 5 August 2025. The contract supports a maximum leverage of 75x and includes compatibility with Bitget’s advanced futures trading bots.

TOWNSUSDT futures offer 24/7 trading, settled in USDT, with a tick size of 0.00001. Funding fees are settled every four hours. The contract allows traders to optimize their strategies with high leverage, while the integration of trading bots further streamlines execution and risk management.

Bitget maintains a dynamic approach to risk controls. Depending on prevailing market conditions, key parameters such as tick size, maximum leverage, and maintenance margin rates may be adjusted accordingly to ensure a stable and secure trading environment.

This new addition aligns with Bitget’s ongoing strategy to expand its derivatives product suite. With over 800 trading pairs and a robust trading infrastructure, Bitget continues to offer enhanced tools for institutional and retail traders alike.

For more details on Town Protocol, users can visit here.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 120 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Bitget Wallet is a leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built into a single platform.

Bitget is driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. In the world of motorsports, Bitget is the exclusive cryptocurrency exchange partner of MotoGP, one of the world’s most thrilling championships.

For more information, users can visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, users can contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, users can refer to the Terms of Use.

Contact

Simran Alphonso

media@bitget.com

PANAMA CITY, Aug. 6, 2025 /PRNewswire/ — Flipster, a global cryptocurrency trading platform, has partnered with Kaia, a high-performance public blockchain backed by Asia’s IT giants Kakao and LINE, to support the utility and integration of native Kaia USDT. This partnership aims to accelerate stablecoin adoption and unlock real-world utility for digital assets across Asia, enabling practical, everyday use of digital dollar assets across both Flipster’s high-performance trading infrastructure and Kaia’s consumer-ready blockchain ecosystem.

Flipster’s integration offers traders a new, frictionless rail to deploy capital across the Kaia network. The partnership also delivers seamless access to stablecoin-powered opportunities within an ecosystem anchored in real-world applications, including tokenized real-world assets (RWAs), NFT marketplaces, in-game economies, and payments via LINE Messenger’s 250 million-strong user base.

“Kaia is shaping the future of stablecoin adoption in Asia and beyond,” said Youngsun Shin, Head of Product and Partnerships at Flipster. “With native USDT and a clear focus on real-world applications, Kaia offers users a faster, more accessible way to move capital and build practical on-chain experiences. This partnership expands Flipster’s multichain stablecoin infrastructure and connects traders directly to where digital assets meet everyday life.”

“I am excited that the native Kaia USDT has expanded into Flipster’s well-established trading platform,” said Dr. Sam Seo, Chairman of Kaia DLT Foundation. “As part of our goal to build a comprehensive global stablecoin network, Kaia will work with our excellent partners as the Kaia chain focuses on the composability of stablecoins to ensure the smoothest experience for users worldwide.”

To mark the launch, Flipster is offering exclusive campaigns to onboard users into the Kaia ecosystem, including offers for users who deposit and trade USDT on Kaia during the campaign period.

This partnership continues Flipster’s broader push to drive stablecoin adoption and expand multichain access. Together with Kaia, Flipster strengthens its commitment to bringing stablecoins closer to everyday use and expanding their utility across Asia.

To learn more or join the campaign, visit https://flipster.io/en/marketing/flipster-kaia

About Flipster

Flipster is the zero-friction exchange for crypto traders who demand the ultimate perpetual trading experience. With zero spreads on 20+ majors, instant execution, and deep liquidity, it delivers precision and performance for those who move fast and trade faster. Learn more at flipster.io or follow X.

About Kaia

Kaia is a high performance public blockchain that brings Web3 to the fingertips of hundreds of millions across Asia. Formed through the merger of the Klaytn and Finschia blockchains that were initially developed by Kakao and LINE respectively, Kaia is Asia’s largest Web3 ecosystem integrated with the Kakaotalk and LINE messengers that have a combined user base of over 250 million – all of whom can experience Web3 with the ease and speed of Web2 within their favourite messenger superapp to connect, create, collaborate, and contribute to the ecosystem. Learn more at www.kaia.io.

Hamilton, Bermuda, August 5th, 2025, Chainwire

OnRe’s yield-bearing asset, ONyc, is now accepted as collateral within Solana’s decentralized finance (DeFi) ecosystem. This development enables the integration of real-world yield sources into DeFi applications. Incentive programs from USDG and Ethena have launched to reduce borrowing costs, enhance yield opportunities, and support the use of real-world collateral onchain.

Onchain Yield Coin (ONyc), a yield-bearing, stablecoin-backed asset issued by OnRe, is now live on Kamino, Solana’s largest DeFi money market. This integration marks the first time reinsurance-backed yield is being used as onchain collateral in Solana DeFi, opening access to real-world risk through a composable, liquid, and resilient asset.

A New Form of Yield in DeFi

Kamino secures over $700M in stablecoin TVL and underpins liquidity and capital strategies across the Solana ecosystem. With ONyc now live on Kamino, users can:

- Leverage ONyc as collateral for borrowing, lending, or looping strategies

- Earn ~14%+ base yield uncorrelated to crypto volatility

- Enter or exit positions 24/7 with onchain liquidity

- Track NAV in real time through verifiable pricing data

Together, these capabilities make ONyc a powerful tool for capital deployment across market conditions. By enabling lending, borrowing, and looping in a fully composable way, ONyc brings real-world yield into active use across Solana’s DeFi ecosystem.

The integration is powered by Chainlink’s Onchain NAV solution, which sources ONyc’s net asset value from OnRe and delivers it in real time via Chainlink Data Streams. This ensures tamper-resistant pricing and enables secure collateralization, supporting reinsurance-backed strategies with verifiable, onchain fund valuations.

“ONyc’s launch on Kamino marks a broader shift in DeFi, bringing real-world yield to Solana with the transparency, liquidity, and composability the ecosystem was built for,” said Dan Roberts, Co-Founder and CEO of OnRe. “It introduces a new class of collateral designed to perform through market cycles and support sustained DeFi activity. Solana has become a hub for capital innovation, and Kamino continues to set the standard for how real-world assets should operate onchain.”

Incentives Designed for Early Participation

To encourage early adoption, OnRe is launching incentive programs in collaboration with Kamino, Global Dollar Network, and Ethena:

Borrowing Incentives

A $200K rewards pool is available to lower borrowing costs for users who deposit ONyc as collateral to borrow USDG on Kamino. This reduces costs and creates room for more favorable yield spreads.

“This marks one of the first fully permissionless implementations of real-world yield distributed directly onchain through DeFi,” said Nick Robnett at Paxos, on behalf of Global Dollar Network. “We are proud to support ONyc’s launch on Solana and Kamino, leveraging USDG to advance OnRe’s vision of bringing real-world assets with intrinsic value onchain and making them accessible to a global user base.”

Looping Strategies

Participants can also redeploy borrowed USDG to acquire additional ONyc or other assets, increasing exposure and unlocking higher returns. Incentives apply on up to $20M in total borrowing volume.

Ethena Points Multiplier

In addition, OnRe is offering a 5x Ethena Points multiplier to ONyc holders on qualifying sUSDe deposits, unlocking additional rewards for those providing real-world yield collateral.

Integration of Real-World Yield Mechanisms in DeFi

ONyc integrates premium-backed yield from real-world assets with decentralized finance (DeFi) infrastructure, enabling an onchain structure designed to support scalability and diversification beyond traditional financial instruments.

“One of the most exciting things for Kamino’s users is onboarding high quality collateral assets, and ONyc is a great example of that. Access to credit and leverage for ONyc holders, powered by Kamino, is a great example of bringing DeFi utility to tokenize real-world investments,” said Mark Hull, a Kamino contributor.

With base yields above 14% and expanding utility across Solana, ONyc gives users a high-performing alternative to traditional DeFi strategies. Mint directly on the OnRe app or swap instantly using Kamino Swap in the OnRe Market.

About Kamino

Kamino Finance is the largest money market on Solana, with over $4B in assets deployed across its suite of credit, leverage, and liquidity products. Through products like automated liquidity vaults, the K-Lend lending market, and tools for advanced trading strategies, Kamino helps users and institutions deploy capital efficiently. Kamino is the go-to platform for funds, market makers, and stablecoin issuers operating at scale on Solana.

About Global Dollar Network

Global Dollar Network is the world’s fastest growing stablecoin network with unmatched economic upside. Powered by Global Dollar (USDG), a US dollar-backed stablecoin issued by Paxos Digital Singapore and Paxos Issuance Europe, Global Dollar Network offers a transparent and equitable economic model that rewards partners for their contributions. Global Dollar Network partners include industry leaders such as Anchorage Digital, Bullish, Kraken, OKX, Paxos, Robinhood, Worldpay, and more. Note: USDG is available on Solana, Ink, and Ethereum.

About Chainlink

Chainlink is the backbone of the blockchain industry, the global standard for connecting blockchains to real-world data, other blockchains, governments, and enterprise systems. Chainlink has enabled tens of trillions in transaction value across the blockchain economy, powering critical use cases across DeFi, banking, tokenized real-world assets (RWAs), cross-chain, and more. Users can learn more by visiting chain.link.

About OnRe

OnRe bridges the reliability of the $750B global reinsurance market with the transformative power of blockchain. Licensed to deploy digital assets as insurance collateral, OnRe provides a new class of investors with direct access to consistent real-world yield through structured products designed to perform across market cycles. With a focus on transparency, scalability, and capital efficiency, OnRe is transforming how capital is deployed, bringing opportunity to a system that has historically been out of reach.

Disclaimer: This announcement is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any securities or digital assets. ONyc may be accessible via decentralised protocols such as Kamino, but OnRe does not operate or control any secondary market for the token. Secondary trading occurs independently of OnRe. Capital is at risk. Redemption with OnRe is only available to qualified investors. Access may be restricted in certain jurisdictions.

Contact

Head of Operations

Sarah George

OnRe

sarah@onre.finance

Singapore, Singapore, August 5th, 2025, Chainwire

DAR Open Network, the chain-agnostic infra layer, has announced the launch of DAR Citizenship. The premium membership grants players access to a vast digital universe, including web3 games across DAR’s native and partnered titles including Mines of Dalarnia and Dalarnia Legend.

Designed for dedicated web3 gamers, DAR Citizenship unlocks a host of benefits and exclusive rewards. Players, KOLs, gaming guilds, and other web3 users can utilize the universal membership to access their favorite DAR ecosystem games and experiences. The first-of-its-kind interoperable membership delivers real in-game perks coupled with deep token utility.

Available from August 5, DAR Citizenship combines a premium membership with additional perks including reduced fees and exclusive cross-game experiences for web3 gamers. It rewards loyalty and performance, incentivizing players to keep returning to the games they love and to explore new titles that have the potential to become firm favorites.

From roguelike adventures to strategic base-building, the DAR ecosystem offers a variety of gameplay experiences for all types of web3 gamers. Dalarnia Legends is a strategic, fast paced PVP card game where players create unique cards using unlockable AI art prompts, while Mines of Dalarnia provides a more strategic experience focused on mining, crafting, and land ownership. These immersive worlds showcase the depth of DAR’s ecosystem and the possibilities awaiting players. With DAR Citizenship, members gain even deeper access to these worlds, enhancing gameplay through exclusive benefits and shared rewards.

Manfred Pack, Chief Product Officer at DAR Open Network, said: “DAR Citizenship is our answer to what web3 gaming should feel like: fair, rewarding, and built for the player first with a strong token utility at its core. We believe DAR Citizenship changes how players engage across games and ecosystems. It’s like a gaming loyalty program, but for a multiverse rewarding skill and engagement while removing barriers in individual games.”

DAR Citizens unlock daily, weekly, and seasonal quests, increasing their chances to earn $D airdrops, as well as additional Mooncoins upon subscription, providing plentiful currency with which to explore and customize games. The launch of DAR Citizenship has been accompanied by the release of a new one-month beta test for DAR’s Quest System. This version will focus exclusively on Dalarnia Legends quests, rewarding players with Mooncoins for their participation.

Set to expand in lockstep with the growing DAR ecosystem, DAR Citizenship will regularly add new perks, benefits, and game integrations. This will provide web3 gamers with a steady stream of incentives to discover new digital domains and explore the latest web3 games.

About DAR Open Network

DAR Open Network is an AI-powered, chain-agnostic infrastructure providing web3 apps with shared technology, assets, and the $D token, which has utility for governance, staking, and marketplaces as well as functioning as a platform and in-game currency. By providing the tools necessary for the creation, exchange, and utilization of digital assets across a multitude of applications, DAR Open Network aims to democratize app development, enhance user agency, and incentivize creative contributions.

Learn more: https://dalarnia.com/

Contact

Avishay Litani

pr@marketacross.com

HONG KONG, Aug. 5, 2025 /PRNewswire/ — Cango Inc. (NYSE: CANG) (“Cango” or the “Company”) today published its Bitcoin production and mining operations update for July 2025.

Bitcoin Mining Production and Mining Operations Update for July 2025

|

Metric |

July 2025 1 |

June 2025 1 |

|

Number of Bitcoin produced |

650.5 |

450.0 |

|

Average number of Bitcoin produced per day |

20.99 |

15.00 |

|

Total number of Bitcoin held 2 |

4,529.7 |

3,879.2 |

|

Deployed hashrate |

50 EH/s |

32 EH/s |

|

Average operating hashrate 3 |

40.91 EH/s |

29.92 EH/s |

|

1. Unaudited, estimated. |

|

2. As of month-end. |

|

3. Average over the month. |

|

Note: Cango holds Bitcoin for the long term and does not currently intend to sell any of its Bitcoin holdings. |

Paul Yu, CEO and Director of Cango, commented, “With the addition of 18 EH/s at the end of June, our deployed hashrate expanded to 50 EH/s in July and allowed us to deliver a 45% month-over-month increase in Bitcoin producted to 650.5. Average operating hashrate of 40.91 EH/s throughout the month underscores our robust operational efficiency and significant growth potential as we continue to scale. This strong performance not only demonstrates our commitment to execution but also fuels our ambition to accelerate future production.”

“With a new and experienced management team now onboard and growing Bitcoin treasury holdings from mining operations, we are now focused on laying the foundation for our vertical integration to transition towards a more diversified and resilient portfolio of mining sites and energy infrastructure.”

About Cango Inc.

Cango Inc. (NYSE: CANG) is primarily engaged in the Bitcoin mining business, with operations strategically deployed across North America, the Middle East, South America, and East Africa. The Company entered the crypto asset space in November 2024, driven by advancements in blockchain technology, the growing adoption of digital assets, and its commitment to diversifying its business portfolio. In parallel, Cango continues to operate an online international used car export business through AutoCango.com, making it easier for global customers to access high-quality vehicle inventory from China. For more information, please visit: www.cangoonline.com.

Investor Relations Contact

Juliet YE, Head of Communications

Cango Inc.

Email: ir@cangoonline.com

DUBAI, UAE, Aug. 5, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has expanded support for USDT0, the unified liquidity network for the world’s most widely used stablecoin Tether (USDT), enabling native deposits and withdrawals on HyperEVM, Corn, and Berachain. This move accelerates industry momentum toward unified stablecoin liquidity and strengthens the infrastructure for truly interoperable decentralized finance (DeFi).

USDT0, built on LayerZero’s Omnichain Fungible Token (OFT) standard, eliminates the need for fragmented bridges, wrapped assets, and duplicated liquidity pools. With this integration, Bybit becomes one of the first major centralized platforms to offer seamless access to native, cross-chain stablecoin functionality across three of the industry’s most innovative Layer 1 ecosystems.

A New Standard for Stablecoin Liquidity

The addition of USDT0 support on HyperEVM, Corn, and Berachain delivers critical advantages:

- Capital Efficiency: Unified USDT liquidity across chains, with no synthetic or bridged assets

- Frictionless UX: Native transfers with provable 1:1 backing and no trust assumptions

- Ecosystem Growth: Immediate access to institutional-grade liquidity for new and emerging chains

USDT0 is already live on Arbitrum, Optimism, Unichain, and others — and its expansion to HyperEVM, Corn, and Berachain further cements its role as the next-generation stablecoin infrastructure.

Seamless Onboarding, Exclusive Rewards

To celebrate this milestone, Bybit has launched a limited-time campaign offering:

- Zero-fee withdrawals for USDT0 on HyperEVM, Corn, and Berachain

- Boosted staking rewards up to 100% APR for eligible deposits

Campaign runs from August 4, 2025, until further notice.

#Bybit / #TheCryptoArk / #IMakeIt

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

About USDT0

USDT0, the unified liquidity network for USDT, simplifies cross-chain movement without fragmented pools or complex bridges. As the unified gateway for USDT interoperability and expansion, USDT0 simplifies cross-chain liquidity, enhances accessibility, and unlocks new use cases for Tether holders, businesses, and DeFi platforms. With a focus on efficiency and scalability, USDT0 is redefining how USDT operates across networks. For more information, visit USDT0.to or follow us on Twitter @USDT0.

Helsinki, Finland, August 4th, 2025, Chainwire

Apu Apustaja ($APU), a cross-chain memecoin, has announced that its native token is now available for spot trading on Hyperliquid, a leading fully on-chain orderbook exchange.

Hyperliquid currently facilitates billions in daily trading volume and manages over $7 billion in total value locked (TVL). The addition of APU marks the first memecoin from “Murad’s List” to be bridged directly from Ethereum to the Hyperliquid ecosystem, utilizing LayerZero’s cross-chain messaging infrastructure.

Technical Milestone and Cross-Chain Expansion

Unlike synthetic assets or wrapped versions, the APU token maintains its native supply integrity through a direct Ethereum-to-Hyperliquid bridge. This deployment introduces spot trading immediately, without the need for a perpetual-only beta phase. APU is now available natively on Ethereum, Solana, Base, and Hyperliquid.

FlowDesk, alongside automated arbitrage systems and ecosystem participants, will help maintain price parity across chains. This integration places APU within a high-performance trading environment built to support 100,000 transactions per second and designed for institutional-grade capital routing.

Background on Hyperliquid

Hyperliquid is an on-chain orderbook protocol that offers centralized exchange-like functionality while preserving the transparency of decentralized finance (DeFi). Its infrastructure is optimized for high throughput, low latency, and deep liquidity aggregation. The platform has become an increasingly prominent venue for active crypto traders, with a focus on speed, capital efficiency, and transparency.

Deployment Timeline and Operations

The listing was coordinated by Alexander Levin Jr., recently appointed Director of Operations at Apu Apustaja. Under his oversight, the Ethereum-to-Hyperliquid deployment was completed in under three weeks streamlining cross-chain migration and consolidating key stakeholders. This effort followed extended delays prior to his involvement and is part of a broader operational overhaul within the APU ecosystem.

Quote from APU Operations

“This deployment represents a pivotal step in expanding APU’s accessibility to advanced trading platforms,” said Alexander Levin Jr., Director of Operations at Apu Apustaja. “Hyperliquid’s infrastructure offers the performance and transparency we were looking for, and the integration process through LayerZero was executed with precision and speed.”

About Apu Apustaja ($APU)

Apu Apustaja ($APU) is a decentralized memecoin project originally launched on Ethereum. Known for its grassroots growth, cross-chain expansion, and cultural resonance within crypto communities, APU aims to build a multi-chain ecosystem driven by community participation and interoperable infrastructure.

Website: https://apu.com

Telegram: https://t.me/apuclub

X: https://twitter.com/apuscoin

Contact

Apu Apustaja

contact@apu.community