In December 2023, the cryptocurrency world was rocked by a significant security breach on Orbit Chain’s cross-chain bridge, resulting in the theft of nearly $100 million in digital assets, as reported by leading blockchain security firms.

On January 1st, PeckShield, a prominent blockchain security company, confirmed that the exploit on Orbit Bridge had led to losses of $81.5 million, marking December as the fifth-highest month for crypto hacks throughout the year.

This breach also ranked as the ninth-largest attack on a cross-chain bridge over the past three years. Orbit Bridge is the bridging service affiliated with Orbit Chain, a cross-chain protocol originating from South Korea in 2018.

The breach occurred on December 31st, 8:52 pm UTC, due to unauthorized access to Orbit Bridge’s ecosystem.

In response to this alarming incident, the Orbit Chain team swiftly sought assistance from major global cryptocurrency exchanges, urging them to freeze the stolen assets.

They also emphasized their close collaboration with law enforcement agencies to trace and immobilize the illicitly obtained funds.

Estimates provided by blockchain security firms, including PeckShield, CertiK, and Beosin, revealed that crypto losses in 2023, stemming from hacks, scams, and exploits, ranged from $1.51 billion to $2 billion.

READ MORE: Former Trump Lawyer Michael Cohen’s AI-Generated Legal Citations Spark Controversy

Notably, September and November witnessed particularly devastating losses, surpassing $700 million during those two months alone, based on PeckShield’s data.

The unfortunate events included the Mixin Network’s loss of $200 million in September and major exploits in November, with Poloniex and HTX/Heco Bridges experiencing losses of $131.4 million and $113.3 million, respectively.

Other noteworthy incidents throughout the year included a $197 million exploit on Euler Finance in March and a $125 million hack on Multichain in July.

Despite the overall increase in crypto-related security incidents, Beosin, another blockchain security firm, highlighted a notable decline in hacks, phishing scams, and rug pulls compared to 2022.

Total losses dwindled from approximately $4.38 billion, with the most significant reduction occurring in hack-related losses, decreasing from $3.6 billion in 2022 to $1.4 billion in 2023, marking a substantial decline of about 61.2%.

These statistics reflect a mixed landscape for cryptocurrency security, with improvements in certain areas but ongoing challenges in safeguarding digital assets.

In 2023, the crypto world witnessed a staggering surge in phishing scams, with over 324,000 cryptocurrency users falling prey to these fraudulent schemes.

According to the “2023 Wallet Drainers Report” by Scam Sniffer, a blockchain security platform, the total digital asset losses due to these scams reached an alarming $295 million.

The report shed light on the persistent growth of phishing activities throughout the year, signaling a dire need for enhanced security measures within the crypto community.

Disturbingly, even when notorious drainers shut down, so-called “phishing gangs” promptly relocate their operations, as there appears to be an abundance of platforms catering to these malicious endeavors.

On March 2, a notorious player in the crypto phishing world, Monkey Drainer, responsible for orchestrating high-profile phishing exploits, decided to cease its illicit operations.

However, rather than exiting quietly, Monkey Drainer recommended an alternative scam service to its criminal clientele.

Scam Sniffer’s estimates reveal that Monkey Drainer managed to pilfer approximately $16 million in digital assets before its shutdown.

Likewise, Inferno Drainer, another infamous player in the crypto phishing scene, also closed its doors in 2023, having successfully absconded with around $81 million in digital assets.

According to Scam Sniffer’s findings, Angel Drainer seems to have assumed the mantle of leadership in this nefarious realm after Inferno Drainer’s departure.

READ MORE: VanEck Adviser Foresees Trillions Pouring into Cryptocurrency Sector with Bitcoin ETFs

In a bid to understand how these phishing sites attract unsuspecting victims, Scam Sniffer delved into the tactics employed by crypto thieves.

One prevalent method involves infiltrating official project Discord and X (formerly Twitter) accounts, subsequently disseminating phishing links through posts on these platforms.

Phishing websites further bolster their visibility by orchestrating fake airdrops of crypto assets or nonfungible tokens (NFTs).

Additionally, they exploit expired Discord links and inundate X with spam comments and mentions, creating an illusion of legitimacy.

To compound the problem, scammers have managed to circumvent advertising guidelines imposed by Google and X.

Scam Sniffer reported that phishing websites have successfully published paid Google Search and Twitter ads, further perpetuating the widespread deception.

In light of these alarming trends, the crypto community faces an urgent imperative to heighten awareness, bolster security protocols, and remain vigilant against the persistent and evolving threat of phishing scams that continue to plague the digital asset landscape.

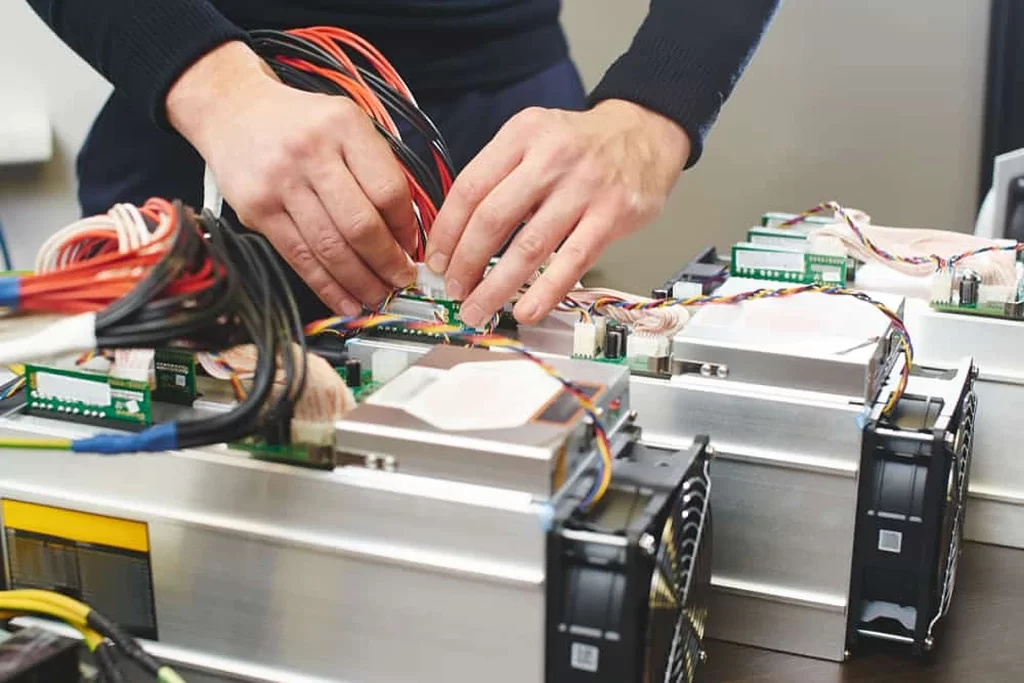

In the first 11 months of 2023, the government of Kyrgyzstan witnessed a significant surge in tax revenue from cryptocurrency miners, as reported by the Finance Ministry, collecting a total of 78.6 million soms, equivalent to almost $883,000.

This marked a substantial increase compared to the previous year’s earnings.

The cryptocurrency mining tax income experienced notable fluctuations throughout 2023 in Kyrgyzstan. It ranged from 738,000 soms ($8,284) in February to a peak of 11.6 million soms ($130,212) in August.

However, by November, the last reported month, the receipts had stabilized at 7.6 million soms ($85,767) after declining from the August high.

Interestingly, there is now only one officially operating cryptocurrency mining company in the country, a stark contrast to the past when there were numerous players in the industry.

For context, in the first 11 months of 2022, crypto mining tax revenue amounted to a mere 11.1 million soms ($133,200).

The tax rate imposed on these miners is calculated at 10% of the electricity cost, inclusive of value-added and sales taxes.

READ MORE: VanEck Launches Pro-Crypto Ad Campaign Amid Pending Bitcoin ETF Application

Kyrgyzstan boasts abundant water resources in the form of glaciers, high-altitude lakes, and rivers, with a combined length exceeding 35,000 km, according to government data. Despite this, many of these resources remain underdeveloped.

Cryptocurrency miners in the country heavily rely on hydropower sources for their operations.

In a significant move in July 2023, Kyrgyz President Sadyr Japarov approved the construction of a cryptocurrency mining facility at the Kambar-Ata-2 Hydro Power Plant.

It’s worth noting that crypto miners are subject to a rate that is five times higher than what the general public in Kyrgyzstan pays for electricity.

However, cryptocurrency production faced challenges in 2023 due to low water levels at dams and contractual limitations with neighboring countries, leading to the need for power imports.

At times, even the government had to source imported power, and crypto miners struggled to secure adequate imported power supplies.

By October 2023, the crypto mining industry had already consumed a substantial 17 million kilowatt-hours of electricity.

The issue of energy consumption by crypto miners has been a longstanding source of controversy.

While cryptocurrency exchanges are legal in Kyrgyzstan, the circulation of cryptocurrencies remains unregulated within the country, posing unique challenges for policymakers and regulators.

US prosecutors have chosen to drop the remaining charges against Sam Bankman-Fried, which include allegations of foreign bribery and bank fraud.

The decision, however, has stirred significant concern within the crypto community, particularly concerning the dropped charge of unlawful political donations, given Bankman-Fried’s extensive contributions to politicians from both major parties.

Prosecutors had asserted that he misused customer funds, diverting approximately $100 million for political contributions.

The decision drew sharp criticism from Coinbase’s Chief Legal Officer, Paul Grewal, who condemned it as a “miscarriage of justice.”

Grewal stressed the importance of public accountability, particularly in cases related to campaign finance charges, stating, “The public interest in a public airing of charges almost always matters.

Campaign finance charges are at the very top of this list.” He also emphasized the need for transparency regarding what politicians and others knew and when they knew it.

Scheduled for March 28, 2024, Sam Bankman-Fried’s sentencing remains on the horizon, surrounded by controversy.

Independent presidential candidate Robert F. Kennedy, Jr., voiced concern, noting that this case underscores the broader issue of normalized corruption, saying, “No one is even surprised.

READ MORE: Bitcoin ETF Race Heats Up as Top Contenders Submit Final Applications

THAT is a bigger problem than the fraud itself. It shows how normalized corruption has become.”

The sentiment found resonance within the community, with figures like Elon Musk expressing agreement with a simple “!!” in response.

Prosecutors, led by U.S. Attorney for the Southern District of New York Damian Williams, also opted not to pursue the charge of unlawful political donations, which had been separated from the initial indictment due to an extradition dispute with the Bahamas.

In their explanation, prosecutors cited the presentation of evidence related to several charges during Bankman-Fried’s original trial, where he was found guilty of all seven counts of fraud and conspiracy associated with his leadership of FTX and Alameda Research, its sister trading firm.

They indicated that the forthcoming sentencing would address critical aspects, including forfeiture and restitution for the victims.

Looking ahead, Bankman-Fried faces the prospect of a potentially lengthy prison sentence, with US District Judge Lewis Kaplan presiding over the case in Manhattan.

The prosecution believes that a second trial would be redundant, as most relevant evidence for the additional charges had already been presented in the first trial.

Despite his conviction, Bankman-Fried intends to appeal, maintaining that while he made operational errors in managing FTX, such as neglecting risk management, he did not steal customer funds.

Bitcoin has surged above the $45,000 mark for the first time in almost two years, driven by market anticipation of a forthcoming approval for a spot Bitcoin exchange-traded fund (ETF).

The digital currency has experienced a rapid ascent from $42,000 at the beginning of the year, with a remarkable 6% increase in the last 24 hours and an impressive 170% gain over the past year, according to CoinMarketCap data.

This milestone places Bitcoin at a price level exceeding any seen in 2023, signifying a notable start to 2024.

The surge in Bitcoin’s price coincides with the cryptocurrency community’s hopeful outlook for the potential approval of one or more of the 14 pending applications for a spot Bitcoin ETF product, currently awaiting a decision from the Securities and Exchange Commission (SEC).

The last time Bitcoin surpassed the $45,000 mark was nearly 20 months ago on April 5, 2022, before it entered a prolonged bear market, eventually reaching a low of $15,600, as indicated by TradingView data.

Market experts hold differing opinions on how an ETF approval would impact Bitcoin’s short-term price.

Analysts at crypto options trading platform Greeks.live anticipate that Bitcoin might not witness a significant immediate rally, citing diminishing implied volatility in Bitcoin options.

READ MORE: VanEck Launches Pro-Crypto Ad Campaign Amid Pending Bitcoin ETF Application

Conversely, traders such as Scott Melkor, with a substantial following of 925,000, believe that Bitcoin is currently forming a “bull pennant” after a month of consolidation around the $40,000 range.

Melkor envisions the possibility of Bitcoin surging to as high as $54,000 in the days following the SEC’s potential approval.

Meanwhile, Gabor Gurbacs, an advisor at VanEck, predicts that the initial days of a spot Bitcoin ETF may be considered somewhat of a “letdown” by broader market standards.

Nevertheless, he anticipates that these products will eventually attract trillions of dollars in inflows over the next few years, emphasizing their long-term significance.

In conclusion, Bitcoin’s remarkable price increase to over $45,000 marks a significant milestone, driven by optimism surrounding the pending spot Bitcoin ETF approvals.

As the cryptocurrency market awaits the SEC’s decision, the community remains divided on the short-term and long-term implications of this potential development.

Greeks.live, a cryptocurrency options trading platform, has cast doubt on the possibility of a significant price surge following the approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. regulator, the SEC.

The platform has analyzed data from its trading platform, revealing that despite widespread speculation about the SEC granting approval for the Bitcoin Spot ETF application in the near future, there has been minimal volatility in major term implied volatilities (IVs) and prices.

Term IV is a metric that measures the market’s expectations regarding future price movements in options contracts.

While the crypto market eagerly awaits the SEC’s decision, Greeks.live’s tweet pointed out the unexpectedly subdued market activity in response to the news.

Their options data showed that the implied volatility for Jan12 options, closely linked to the ETF, has actually decreased rather than rising.

Furthermore, the trading volume for these options accounted for only 2% of the day’s total turnover.

From these observations, Greeks.live has concluded that the market may have already factored in the potential approval of the spot Bitcoin ETF.

READ MORE: Avalanche Foundation Allocates $100 Million NFT Incubator Fund to Purchase Memecoins

Essentially, market participants might have anticipated this event and adjusted their positions accordingly, resulting in the actual approval having a limited impact on prices and volatility.

Several prominent asset managers, including BlackRock, Valkyrie, and Van Eck, submitted amended S-1 forms to the United States Securities and Exchange Commission on December 29, which was the final day for the SEC to consider such applications in January 2024.

Invesco Galaxy, Bitwise, WisdomTree, and Fidelity have also submitted their Form S-1 applications subsequently.

BlackRock’s updated filing has named Jane Street and JPMorgan Securities as “authorized participants” in their proposed spot Bitcoin ETF application.

BlackRock has already specified that it will utilize a cash-only model for the ETF.

Interestingly, BlackRock was the first entity to settle a trade on JPMorgan’s Tokenized Collateral Network service on October 11, highlighting the increasing collaboration and integration within the cryptocurrency ecosystem.

Artificial intelligence (AI) may play a pivotal role in the possible scenario where Bitcoin’s price surges to $100,000 in 2024, as suggested by GPT-4, the latest iteration of the AI chatbot ChatGPT.

Inquiries directed at ChatGPT on January 1, as reported by Cointelegraph, sought insights into the feasibility of Bitcoin reaching this milestone and the potential contributions of AI to this outcome.

ChatGPT cautiously deemed it “theoretically possible” for Bitcoin to achieve $100,000 in 2024, contingent on several favorable factors aligning.

Nonetheless, it emphasized that this remains within the realm of high speculation.

The AI chatbot went on to enumerate a series of general factors that could propel such a surge.

These factors encompassed positive regulatory developments, an upswing in retail and institutional adoption, as well as currency devaluation or inflation.

ChatGPT underscored the significance of a potential approval of a spot Bitcoin exchange-traded fund (ETF) in influencing the price.

It contended that the greenlighting of a spot BTC ETF could significantly bolster accessibility and liquidity for the asset, potentially luring institutional investors into the market, interpreting it as a sign of regulatory acceptance.

READ MORE: Indonesian Authorities Shut Down Ten Bitcoin Mining Operations Over Electricity Theft Allegations

Subsequently, Cointelegraph inquired about the role AI might play in propelling Bitcoin to $100,000 in 2024.

ChatGPT elucidated that AI could indeed be a catalyst in this hypothetical scenario.

AI’s contributions would be seen through its influence on market analysis, trading strategies, and broader technological innovations in blockchain technology.

The AI chatbot elaborated on the capabilities of AI algorithms, which are adept at processing extensive market data, discerning trends and patterns that might elude human analysts.

Furthermore, it underscored the potential of AI-driven trading bots to execute trades precisely at optimal moments, contingent on market conditions.

ChatGPT stressed that these bots could outpace human reactions in a fast-paced market environment.

Nonetheless, the implementation of AI in trading came with inherent risks, according to ChatGPT.

It highlighted the vulnerability to hacking and cyberattacks, citing a 2022 incident where a trading bot netted $1 million through an arbitrage trading opportunity.

Unfortunately, a hacker manipulated the bot into authorizing a malicious transaction, resulting in a complete drain of the funds.

In conclusion, while ChatGPT acknowledges the potential role of AI in Bitcoin’s ascent to $100,000 in 2024, it cautions against underestimating the risks associated with deploying AI in the cryptocurrency market.

Hackers have managed to exploit Orbit Bridge, the cross-chain bridging service of the Orbit Chain protocol, just hours before the new year, making off with a staggering $82 million.

This shocking breach was brought to light on December 31st by a pseudonymous Twitter user known as Kgjr, who raised the alarm regarding significant outflows from the Orbit Chain Bridge protocol.

Subsequently, blockchain investigators Officer CIA and cybersecurity firm Cyvers corroborated these findings.

Based on data from the blockchain analytics platform Arkham Intelligence, the hackers successfully siphoned off a grand total of $81.68 million.

This sum was divided among five separate transactions, involving $30 million in Tether, $10 million in USD Coin, $21.7 million in Ether, $9.8 million in Wrapped Bitcoin (WBTC), and $10 million worth of the algorithmic stablecoin DAI, all of which were swiftly moved to new wallets.

The Orbit Chain protocol is closely intertwined with the Klaytn network (KLAY), a modular layer-1 blockchain.

READ MORE: Bitcoin ETF Race Heats Up as Top Contenders Submit Final Applications

Notably, Klaytn’s block explorer indicates that eight of the highest-valued assets on the Klaytn network are actually wrapped assets that rely on the Orbit Bridge for cross-chain transfers.

Despite the gravity of the situation, the exact nature of the exploit remains shrouded in mystery. Attempts to solicit comments from Orbit Chain and Klaytn regarding this incident yielded no immediate response, leaving the crypto community in suspense.

Orbit Chain, which was launched in South Korea in 2018, is a versatile multi-asset blockchain primarily designed for facilitating cross-chain transfers across various decentralized networks.

Its typical use case involves the seamless transfer of assets between EVM-compatible networks and the Klaytn network.

It is crucial to distinguish Orbit Chain from another cross-chain bridging protocol called Orbiter Finance, which shares a somewhat similar name but operates independently.

As the crypto space grapples with the fallout from this high-profile breach, security measures and risk assessments across the ecosystem are expected to be scrutinized and enhanced.

The United States Department of Justice’s recent decision to forgo a second trial against Sam Bankman-Fried has ignited controversy within the crypto community.

In a letter filed on December 29th, prosecutors argued that the case’s significant public interest necessitated a “swift resolution.”

This choice implies that Bankman-Fried will not be subjected to further charges related to his alleged involvement in unlawful campaign contributions.

The document states, “Much of the evidence that would have been presented in a second trial was already presented in the first trial and can be considered by the Court at the defendant’s March 2024 sentencing.”

This decision has been met with widespread criticism among crypto enthusiasts. Paul Grewal, Coinbase’s chief legal officer, branded it a “miscarriage of justice,” emphasizing the importance of a public airing of charges, especially those involving campaign finance.

He stressed that questions about what politicians knew and when they knew it are crucial and must be answered.

Simon Dixon, co-founder of BnkToTheFuture.com, an online investment platform, pointed out that the decision also shields U.S. politicians from further scrutiny concerning campaign contributions and clawbacks during the upcoming 2024 election season.

READ MORE: US Prosecutors Hint at No Second Trial for Ex-FTX CEO Sam Bankman-Fried

Bankman-Fried himself admitted to being a “significant donor” to both sides of the political spectrum leading up to the 2022 midterm elections. Court documents revealed that he contributed over $100 million to politicians.

During his trial in October, he explained that these donations made in his name were funded by loans from Alameda Research, FTX’s sister company.

The aim was to influence U.S. government policies on cryptocurrency regulation. Before FTX’s collapse in November 2022, Bankman-Fried had plans to donate $1 billion for political causes by 2024.

In addition to the campaign contribution allegations, Bankman-Fried has also been cleared of charges related to a conspiracy to bribe Chinese officials.

Prosecutors argue that a second trial would not impact the U.S. Sentencing Guidelines range for him.

It’s worth noting that Bankman-Fried had previously been found guilty of all seven fraud charges by a jury during his criminal trial.

These charges included wire fraud, wire fraud conspiracy, securities fraud, commodities fraud conspiracy, and money laundering conspiracy.

His sentencing is scheduled for March 28, 2024, and he could potentially face a maximum sentence of 115 years in prison.

Former Donald Trump attorney, Michael Cohen, has publicly acknowledged a significant error in his legal research process, attributing it to the use of Google Bard, an artificial intelligence (AI) chatbot.

Cohen, who is preparing to testify against Trump in upcoming trials, admitted to unintentionally forwarding inaccurate legal citations generated by Google Bard to his lawyer, David Schwartz, in support of his case.

Cohen’s confession came to light in a recent court filing, where he clarified his misunderstanding of Google Bard’s capabilities.

He had mistakenly assumed it to be a highly advanced search engine rather than a generative AI service similar to Chat-GPT.

The problematic citations, as well as several others that were not included in the motion, were attributed to this misunderstanding.

Critics argue that Cohen, not being an active legal practitioner, bore no ethical obligation to verify the accuracy of the information he provided.

They contend that Schwartz, as a legal professional, should have reviewed the citations before incorporating them into official court documents.

Cohen’s legal team emphasized this point, stating, “Mr. Cohen is not a practicing attorney and has no concept of the risks of using AI services for legal research.”

READ MORE: Federal Judge Rules in Favor of SEC in Terraform Labs Securities Case

To further highlight the issue, Cohen’s statement outlined the sequence of events: He had sourced citations and case summaries online, believing them to be authentic, which were then added to the motion by Schwartz without proper validation.

This incident is not the first involving attorneys relying on AI tools only to discover inaccuracies.

Earlier this year, a similar case emerged when Steven Schwartz, an attorney at the New York law firm Levidow, Levidow & Oberman, faced criticism for incorporating AI-generated court citations that turned out to be false.

The judge presiding over the case expressed strong dissatisfaction with Schwartz’s reliance on AI for legal research, pointing out that six of the submitted cases contained fabricated judicial decisions, false quotes, and fictitious internal citations.

In both instances, the misuse of AI tools for legal research underscores the importance of thorough verification and the ethical responsibility of attorneys to ensure the accuracy of the information they present in court.

These cases serve as cautionary tales for legal professionals exploring the integration of AI technology in their practice.