Four U.S. Senators have penned a letter to Federal Trade Commission (FTC) Chair Lina Khan, seeking information about the FTC’s initiatives to combat the use of artificial intelligence (AI) in scams targeting older Americans.

Senators Robert Casey, Richard Blumenthal, John Fetterman, and Kirsten Gillibrand emphasized the importance of addressing AI-enabled fraud effectively.

In their correspondence, the senators emphasized the necessity of comprehending the scope of the threat posed by AI-driven scams in order to devise suitable countermeasures.

They requested the FTC to share insights into its efforts to collect data on AI-related scams and ensure their accurate representation in the Consumer Sentinel Network (Sentinel) database.

Consumer Sentinel serves as the FTC’s investigative cyber tool, assisting federal, state, and local law enforcement agencies in combating various scams.

To gain a comprehensive understanding of the FTC’s approach, the senators posed four specific questions regarding AI scam data collection practices.

First, they inquired about the FTC’s capabilities in identifying AI-powered scams and appropriately tagging them in the Sentinel database.

They also sought clarification on whether the FTC could recognize generative AI scams that may go unnoticed by victims.

READ MORE: BlackRock Secures $100,000 Seed Investment for Bitcoin ETF as Approval Nears

Furthermore, the lawmakers requested a detailed breakdown of Sentinel’s data to identify the popularity and success rates of various scam types.

Lastly, they inquired whether the FTC employs AI in processing the data collected by Sentinel.

Notably, Senator Casey, in addition to his role in this inquiry, serves as the chairman of the Senate Special Committee on Aging, which focuses on issues affecting older Americans.

In related news, on November 27, the United States, along with the United Kingdom, Australia, and 15 other nations, collectively released global guidelines aimed at safeguarding artificial intelligence (AI) models from tampering.

The guidelines underscore the importance of ensuring AI models are “secure by design.”

Key recommendations include closely monitoring the AI model’s infrastructure, both before and after release, and providing cybersecurity training to staff.

However, it is worth noting that these guidelines do not address potential controls related to image-generating models, deepfakes, data collection methods, or their use in training AI models.

As AI technology continues to evolve, policymakers and regulators are actively exploring ways to mitigate associated risks and protect vulnerable populations.

Riot Blockchain, a prominent Bitcoin mining company, has announced a significant expansion of its mining operations in preparation for the Bitcoin halving event scheduled for April 2024.

The company is acquiring 66,560 mining rigs from MicroBT, a leading manufacturer, marking one of the most substantial increases in hash rate capacity in Riot’s history.

This substantial purchase amounts to $290.5 million, averaging around $4,360 per machine.

The option to purchase these additional miners was part of Riot’s initial agreement with MicroBT when it initially procured 33,280 machines back in June.

This arrangement has been revised, allowing Riot the option to acquire up to 265,000 more miners under the same terms as the recent order.

Riot’s CEO, Jason Les, referred to this purchase as the “largest order of hash rate” in the company’s history and anticipates that the updated agreement will further enhance Riot’s mining performance.

Of the newly acquired miners, 72% will be MicroBT’s latest model, the M66S, boasting an impressive hash rate of 250 terahashes per second (TH/s).

The remaining machines will include the M66 (14,770) and M56S++ (3,720) models, adding a total of 18 exahashes per second (EH/s) to Riot’s mining operations.

READ MORE: Ben Zhou Addresses Crypto Regulation As Bybit Celebrates 5-Year Anniversary

Riot plans to deploy the first batch of 33,280 miners from the June purchase in the first quarter of 2024, while the newly acquired 66,560 miners will be deployed in the second half of the same year.

The company expects its self-mining hash rate capacity to reach 38 EH/s once all 99,840 rigs are fully operational, which they anticipate happening in the second half of 2025.

Riot’s motivation for this significant expansion is primarily attributed to the upcoming Bitcoin halving event in April 2024, which is expected to impact Bitcoin mining rewards.

This news has driven positive investor sentiment, with Riot’s stock surging nearly 9% on December 4, leading to an impressive year-to-date growth of over 345% in 2023.

In other developments in the Bitcoin mining industry, CleanSpark reported mining 666 BTC in November, showcasing a 5.2% increase from October and a substantial 24% growth from the same period in 2022.

CleanSpark attributes this growth partly to rising transaction fees and the growing interest in Bitcoin’s various use cases.

TeraWulf, listed on Nasdaq, mined 323 BTC in November, a 3% increase from October, primarily driven by higher network transaction fees.

Additionally, Hut 8 completed its merger with Bitcoin Corp to form Hut 8 Corp, commencing trading on Nasdaq and the Toronto Stock Exchange on December 4, albeit with a less-than-ideal debut performance, experiencing a notable decline in its stock price on the same day.

Bitcoin futures open interest on the global derivatives giant, the Chicago Mercantile Exchange (CME), has surged to $5.2 billion, just $200 million shy of its previous all-time high in late October 2021.

Over the last 30 days, open interest in CME’s Bitcoin futures has grown from $3.63 billion to $5.20 billion, mirroring Bitcoin’s 26% gain during the same period, with the cryptocurrency currently trading at slightly above $44,000.

Between October 1 and 21, 2021, CME’s Bitcoin futures open interest saw a substantial increase from $1.46 billion to $5.45 billion.

This rapid growth in open interest coincided with a significant price surge for Bitcoin.

IG Australia analyst Tony Sycamore noted that the surge in open interest indicates renewed interest in Bitcoin, but it does not provide insight into the positioning of CME traders.

Sycamore referred to CME’s November 28 report to the United States Commodities Futures Trading Commission (CFTC), which revealed that “big players” on the platform were net short at the time, with 20,724 short positions compared to 18,979 long positions.

READ MORE: Thirdweb Identifies Critical Security Vulnerability in Web3 Smart Contracts

Sycamore emphasized that it’s crucial to wait for CME’s upcoming report on December 12 to determine the current positioning of these major players.

He stated, “What we can’t see right now is whether the big players have gone from a net short to a net long.

If we saw the market getting extremely long, you’d be very worried about a snapback. The market that we could see last week was short, so I don’t think we’re at that point yet.”

The recent surge in Bitcoin’s price is not solely due to speculation regarding the SEC’s potential approval of spot exchange-traded fund (ETF) products, according to Sycamore.

He believes that other factors, such as the crypto market’s connection to the macroeconomic environment, play a more significant role in driving price action.

This includes the Federal Reserve’s signals to begin cutting interest rates, which can impact Bitcoin’s performance.

In November, CME overtook Binance in Bitcoin futures open interest, signaling increased interest from traditional financial institutions in crypto products.

While many analysts anticipate a spot ETF approval to lead to a significant price increase for Bitcoin, some are cautious, predicting a “sell the news” event in the days and weeks following such an approval.

Smart contract development firm Thirdweb recently identified a critical security vulnerability that has the potential to impact a wide range of smart contracts within the Web3 ecosystem.

On December 4th, Thirdweb disclosed this vulnerability, which was found in a commonly used open-source library.

The vulnerability could affect specific pre-built smart contracts, including some developed by Thirdweb itself.

Fortunately, the firm’s investigation revealed that this security flaw has not been exploited yet, providing a limited window of opportunity for Web3 entities to address the issue before any potential security breach occurs.

Thirdweb emphasized the significance of this vulnerability, stating that it could lead to substantial damage if left unaddressed.

The affected pre-built contracts encompass various types, such as DropERC20, ERC721, ERC1155 (across all versions), and AirdropERC20.

Thirdweb promptly alerted users who had deployed its contracts before November 22nd to take independent mitigation steps or utilize tools provided by the company.

Additionally, Thirdweb encouraged developers to assist users in revoking approvals on all affected contracts using the revoke.cash platform.

This measure aims to protect users who choose not to address the contract vulnerability. A developer known as “0xngmi” from DefiLlama supported this approach.

READ MORE: Crypto Hacker Executes $2 Million Heist through Address Poisoning Attacks

Thirdweb has taken proactive steps to address the issue. They have contacted the maintainers of the open-source library responsible for the vulnerability and reached out to other potentially affected teams.

To bolster security, the company has decided to increase its investment in security measures and double bug bounty payouts from $25,000 to $50,000.

They also plan to implement a more stringent auditing process and are offering grants to cover contract mitigations.

In their commitment to resolving the issue and ensuring the security of the Web3 ecosystem, Thirdweb stated, “We understand that this will cause disruption, and we are treating the mitigation of the issue with the utmost seriousness.

We will be offering a retroactive gas grant to cover fees for contract mitigations.”

For security reasons, Thirdweb has not disclosed the full details of the vulnerability. Further inquiries by Cointelegraph were directed to a blog post for additional updates.

It’s worth noting that Thirdweb recently secured $24 million in a Series A funding round, with notable investors including Haun Ventures, Coinbase, Shopify, and Polygon.

The company, known for providing multichain smart contract deployment tools for gaming, minting, marketplaces, and wallets, boasts a user base of over 70,000 developers who utilize its services on a monthly basis within the Web3 space.

In October 2023, BlackRock, the world’s largest asset manager, received a noteworthy infusion of $100,000 in seed funding for its Bitcoin (BTC) exchange-traded fund (ETF), as reported in their recent filing with the United States Securities and Exchange Commission (SEC).

The SEC disclosure shed light on the specifics of this investment, revealing that an undisclosed investor had committed to purchasing 4,000 shares at a price of $25.00 per share, totaling $100,000, on October 27, 2023.

This investor also assumed the role of a “statutory underwriter” concerning the Seed Creation Baskets.

Additionally, BlackRock disclosed its strategy for managing sponsor’s fees, indicating that it intends to acquire Bitcoin or cash through short-term trade credit from a trade credit lender.

This approach allows BlackRock to collect its fees via loans, mitigating the need to sell BTC from the ETF assets. Consequently, this method minimizes any significant impact on the BTC price.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

Trade credit settlements are scheduled to transpire on the subsequent business day following the execution date and incur a financing fee.

This fee is calculated at 11%, plus the federal funds target rate divided by 365. For instance, if the federal funds target rate was 5.50% on November 20, 2023, the hypothetical financing fee on borrowed funds would amount to (11% + 5.5%) divided by 365.

Eric Balchunas, an ETF analyst, described these revelations as an intriguing development within the financial sector.

BlackRock emerged as an early pioneer among institutional giants by filing for a spot Bitcoin ETF back in July. Notably, their application is among the 13 awaiting a verdict from the SEC.

Although the SEC has previously rejected applications for spot BTC ETFs, market experts speculate that the agency is likely to grant approval for the first spot BTC ETF in the United States by early 2024, reflecting the growing acceptance and integration of cryptocurrencies into traditional finance.

Phoenix Group, a prominent cryptocurrency mining firm, has achieved a historic milestone by making its debut on the Abu Dhabi Securities Exchange (ADX), marking it as one of the Middle East’s pioneering publicly listed companies in the crypto industry.

This momentous event unfolded on December 5th, with Phoenix Group’s stock initially trading at 2.25 dirhams ($0.6) as per data from the ADX exchange.

Remarkably, this price skyrocketed by an astonishing 50% from the IPO price of 1.50 dirhams ($0.41), as outlined in the Phoenix IPO prospectus.

This momentous public listing follows closely on the heels of Phoenix Group’s immensely successful IPO closure on November 18th, where it garnered a staggering 33 times oversubscription.

During this process, the company managed to sell a substantial 907,323,529 shares, amassing a remarkable sum of around 1.3 billion dirhams ($371 million).

It is worth noting that the retail investors’ portion of the IPO witnessed a jaw-dropping oversubscription of 180 times, while professional investors oversubscribed the offering 22 times.

The primary purpose behind this IPO was to secure funds that would propel Phoenix Group’s future growth and deliver lucrative returns to its investors.

READ MORE: Crypto Hacker Executes $2 Million Heist through Address Poisoning Attacks

CEO Bijan Alizadeh delineated the company’s ambitions, which revolve around four core pillars: spearheading innovation in Bitcoin mining, venturing into renewable energy projects, enhancing advanced manufacturing capabilities, and executing strategic acquisitions.

Phoenix Group, founded in 2015 by Alizadeh and Munaf Ali, has emerged as a significant player in the Middle East’s blockchain landscape, actively collaborating with regional authorities.

A significant milestone in this journey was the August 2023 agreement, where Phoenix signed a pact to construct a $300 million cryptocurrency mining farm in Oman, with the presence of Omani Minister of Transport Saeed Al Maawali and the chairman of the Abu Dhabi Stock Exchange, Hisham Malak.

One of Phoenix’s standout attributes is its unwavering commitment to sustainability in cryptocurrency mining, with a strong emphasis on utilizing renewable energy sources.

As of September 2023, approximately 95% of the company’s power is sourced from renewables, predominantly hydropower.

Further underscoring Phoenix Group’s significance, in October 2023, the Abu Dhabi conglomerate International Holding Company acquired a substantial 10% stake in the firm through its subsidiary, International Tech Group.

This strategic move highlights the growing interest and confidence in the cryptocurrency mining sector within the Middle East region and beyond.

Blockchain analysis firm Lookonchain has revealed that cryptocurrency giants FTX and Alameda Research are currently involved in a significant transfer of digital assets, amounting to an impressive $22 million.

This diverse mix of cryptocurrencies includes $IMX, $GMT, $ETH, UNI, $SHIB, $BAL, $LOOKS, and $WOO.

Since declaring bankruptcy, FTX and Alameda Research have been actively engaged in maneuvering within the cryptocurrency space, transferring substantial amounts of assets to prominent exchanges.

This ongoing activity began in October 2023 and has resulted in a cumulative total of $551 million transferred across 59 different tokens.

In their most recent move, a $10.8 million transfer occurred across platforms such as Wintermute, Binance, and Coinbase.

This transfer involved eight different tokens: $2.58 million in StepN’s GMT, $2.41 million in Uniswap’s UNI, $2.25 million in Synapse’s SYN, $1.64 million in Klaytn’s KLAY, $1.18 million in Fantom’s FTM, $644,000 in Shiba Inu’s SHIB, as well as small amounts of Arbitrum’s ARB and Optimism’s OP.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

On October 24, FTX and Alameda wallets moved $10 million to a single wallet address, which was later distributed to Binance and Coinbase accounts.

Then, on November 14, 2023, a significant transfer of $24 million in cryptocurrency assets occurred across Kraken and OKX exchanges.

This move was enabled by a U.S. court-approved plan that allows them to sell digital assets, initially up to $100 million, with the possibility of increasing it to $200 million, subject to special committee approval.

The initial chapter of this financial saga unfolded in March 2023, with a skillful transfer of $145 million in stablecoins to various platforms, including Coinbase, Binance, and Kraken.

Despite recovering assets exceeding $5 billion, FTX still faces a challenging scenario, burdened by liabilities surpassing $8.8 billion.

The seriousness of this financial strain is evident as FTX and Alameda continue to navigate ongoing liquidations, making significant efforts to address substantial debts while offering some relief to creditors.

The ultimate outcome of this liquidation process remains uncertain, leaving the cryptocurrency community eagerly awaiting the conclusion of this intricate financial story.

AstraZeneca, the pharmaceutical company renowned for its development of a COVID-19 vaccine, is embarking on an exciting new venture.

Teaming up with Absci, a United States-based Artificial Intelligence (AI) biologics firm, they intend to revolutionize cancer treatment through the creation of innovative antibodies.

As of December 3, a report from the Financial Times unveils AstraZeneca’s substantial commitment to this partnership, with investments totaling up to a staggering $247 million.

This substantial sum encompasses research and development expenses, milestone payments, and an initial upfront fee for Absci.

Their collective goal is to craft a cutting-edge generative AI model, specifically geared towards generating novel antibody therapeutics for cancer.

The report, however, remains discreet regarding the specific types of cancer that will be targeted.

Absci’s claims on their website shed light on their impressive AI capabilities, asserting their ability to screen “billions of cells” on a weekly basis.

Furthermore, they boast the capability to progress from antibodies to wet “lab-validated candidates” in an astonishingly brief six-week timeframe.

Currently, Absci is actively involved in 17 distinct projects. AstraZeneca’s Senior Vice-President, Puja Sapra, emphasizes the invaluable role of AI in advancing their biologics discovery process.

Sapra elucidates that AI not only accelerates the pace of discovery but also diversifies the range of biologics they can uncover.

READ MORE: North Korean Hackers Steal $3 Billion in Cryptocurrency

Absci’s CEO, Sean McClain, has publicly confirmed the partnership, highlighting AstraZeneca’s pivotal role in amplifying the impact of their AI initiatives, according to a report by Reuters.

While Cointelegraph reached out to Absci for additional insights, a response from the firm is yet to be received.

The collaboration between AstraZeneca and Absci underscores the increasing momentum of AI within the healthcare sector.

AI’s potential to expedite groundbreaking research and enhance data analysis accuracy has not gone unnoticed.

In a recent development, Hong Kong’s Hospital Authority introduced an AI pilot program designed to combat multidrug-resistant organisms or “superbugs.”

This AI system evaluates clinical data to determine the necessity of prescribing antibiotics, ultimately addressing the overuse of antibiotics that has contributed to the rise of these resistant superbugs in the region.

In conclusion, the strategic alliance between AstraZeneca and Absci is poised to harness the power of AI in the fight against cancer.

With substantial investments and cutting-edge technology at their disposal, the prospects for innovative antibody therapeutics appear promising.

This collaboration exemplifies the growing influence of AI in revolutionizing healthcare research and treatment methodologies.

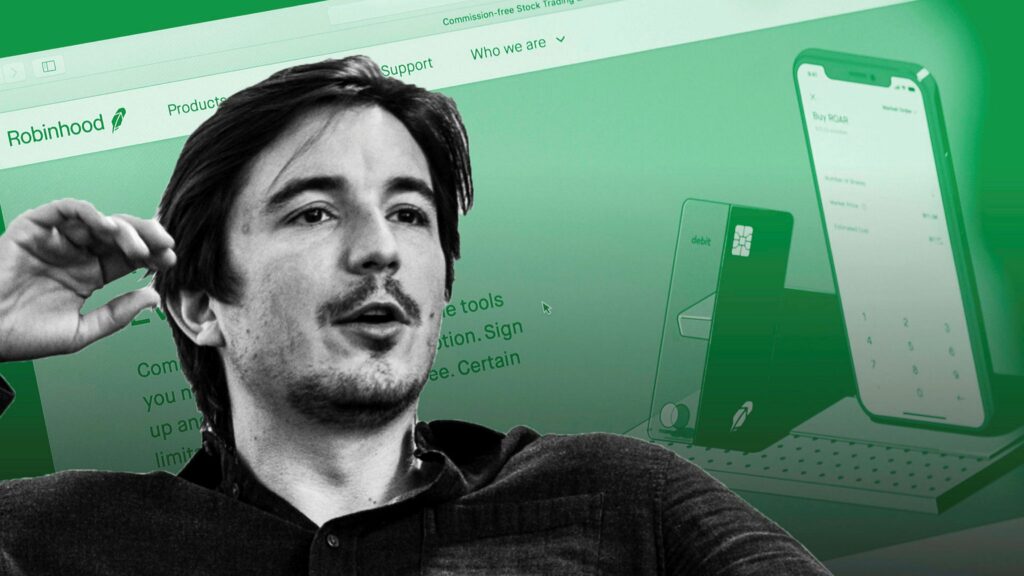

Robinhood, the crypto-friendly trading platform, has experienced a significant surge in digital asset trading volume in November, reporting a staggering 75% month-on-month increase.

This exciting development was disclosed in a Form 8-K filing submitted to the United States Securities and Exchange Commission (SEC) on December 4th, where Robinhood explicitly stated, “November Crypto Notional Trading Volumes were roughly 75% above October 2023 levels.”

While the crypto sector witnessed this remarkable upswing, it did not have a corresponding impact on equity and options contract trading volumes, which remained relatively flat compared to the previous month.

This impressive performance in November marks a noteworthy turnaround for Robinhood, which had reported a substantial 55% decline in cryptocurrency notional volumes over the course of the year in its Q3 results filing. Consequently, its Q3 revenue fell below analyst estimates, standing at $467 million.

Transaction-based revenues also experienced an 11% year-on-year decrease to $185 million, largely attributed to the decline in crypto volumes throughout 2022.

READ MORE: Space Force Member Calls for Bitcoin’s Role in National Cybersecurity

However, with the recent crypto market rally that has seen the total capitalization surge by 40% to reach $1.6 trillion in just two months, Robinhood appears poised for a more profitable fourth quarter.

CEO Vlad Tenev had previously hinted at the platform’s potential, suggesting that it could eventually generate “nine figures” in annual revenue during an earnings call in November.

Tenev noted that retail investors were showing renewed interest in crypto, explaining, “You’re starting to see retail investors wake up to certain segments of the rally, and in crypto activity, you’re seeing a groundswell.”

Despite a fluctuating stock performance, Robinhood’s stock prices have risen by 18% since the start of 2023. However, the company’s stock had been on a downward trend since mid-July after reaching its 2023 peak at just over $13.

As of the time of writing, Robinhood’s stock was trading at $9.95 in after-hours trading, following a 2.5% daily gain.

Furthermore, Robinhood has ambitious plans for expansion, including launching equities in the United Kingdom markets and venturing into futures trading in 2024, contingent upon regulatory approval.

Notably, in August, it was reported that Robinhood had accumulated 118,000 BTC, valued at approximately $3 billion at that time.

The Arbitrum DAO has given the green light for the allocation of millions of extra tokens to finance all the projects approved in its most recent Short-Term Incentive Program (STIP), significantly augmenting its budget by a substantial $23.4 million.

This momentous decision, ratified by the Arbitrum community during the voting period spanning from November 18 to December 2, was aimed at dispersing additional funds to projects that had previously secured grants but were unable to secure funding due to the STIP’s imposed cap of 50 million ARB tokens.

As a result of the recent vote, an impressive 21.1 million ARB tokens, with a total value of $23.4 million, will be allocated to an additional 26 projects.

The approval of this supplementary capital was achieved with 216.7 million votes in favor, outnumbering the 73.1 million votes against, thus bolstering the STIP’s overall budget to a substantial 71.4 million ARB tokens.

This enhanced budget will support a total of 56 projects, all geared towards fostering a diverse and inclusive environment for emerging builders and new projects alike.

Arbitrum stands as a layer-2 network designed to enhance the scalability of transactions on the Ethereum blockchain, making it possible to transfer funds more expeditiously and at a lower cost.

The governance of this protocol is entrusted to ARB token holders, with revenue generated primarily through transaction fees.

READ MORE: British Legislators Urge Cautious Approach to Retail Digital Pound Implementation

DefiLlama data has highlighted Arbitrum’s remarkable financial performance, with a staggering $180,165 in fees and $43,342 in revenue generated on December 1 alone.

In the preceding month of November, the protocol raked in $5.93 million in fees, complemented by revenue reaching $1.47 million.

The expanded budget now encompasses funding provisions for notable projects such as Gains Network (4.5 million ARB), Wormhole (1.8 million ARB), and Stargate Finance (2 million ARB).

It’s worth noting that PancakeSwap withdrew a proposal requesting 2 million ARB tokens due to the STIP’s Know Your Customer (KYC) requirements.

However, it’s important to acknowledge that the decision to allocate additional funding was not without its share of controversy.

Delegates from MUX protocol voiced their concerns, arguing that the injection of extra funds could potentially mix projects of varying quality.

They emphasized the importance of supporting proposals with solid protocol fundamentals, proper incentive execution strategies, and reasonable grant sizes, but not necessarily in a bundled format with proposals of mixed quality.

In addition, some members of the Arbitrum DAO contended that a full second round, rather than a backfund, would have constituted a more equitable approach for including additional protocols in an incentives program.