Crypto exchange-traded products (ETPs) have experienced a remarkable surge in investor interest, marking their highest weekly inflows in over a year, as reported by CoinShares, a prominent asset management platform.

The data released on October 30 reveals that inflows for the week ending October 27 amounted to a staggering $326 million, dwarfing the previous week’s meager $66 million.

ETPs are investment instruments that offer exposure to the performance of specific assets, with crypto ETPs typically tracking the prices of major cryptocurrencies like Bitcoin and Ether.

Many investors opt for these funds to gain crypto exposure, avoiding the complexities of holding these digital assets directly, as ETP shares can be held in conventional brokerage accounts.

In the world of ETPs, “inflows” occur when the fund’s price rises more rapidly than the underlying asset, prompting the fund to acquire more of the asset, generally considered a bullish indicator.

Conversely, “outflows” transpire when the fund is forced to sell the asset due to declining note or share prices relative to their target, typically seen as bearish.

CoinShares’ latest report underscores the impressive nature of this surge in investor interest, with the $326 million weekly inflow being the most substantial since July 2022, a span of 15 months. Moreover, this marked the fifth consecutive week of positive ETP inflows.

READ MORE: Gary Gensler’s Critique of SEC’s Inconsistent Bitcoin ETF Approach Resurfaces

One potential explanation for this sudden uptick in inflows, according to CoinShares, may be the mounting optimism among investors regarding the potential approval of a spot-based Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC).

Such approval could pave the way for substantial inflows into U.S.-based funds upon acceptance.

Despite the significant rise in inflows, this week’s figures only rank as the 21st largest increase ever recorded, as per CoinShares.

The lion’s share of the weekly inflows went into Bitcoin ETPs, accounting for a remarkable 90% of the total.

Solana’s SOL also benefited from the prevailing market optimism, garnering $24 million in inflows. However, Ether funds experienced an adverse trend, witnessing outflows of $6 million.

Despite numerous applications submitted over the years, the SEC has yet to grant approval for a spot Bitcoin ETP.

Some companies, like Van Eck, recently amended their applications to address the agency’s concerns, while Hashdex engaged with the SEC on October 25 in pursuit of approval for their spot Bitcoin ETP.

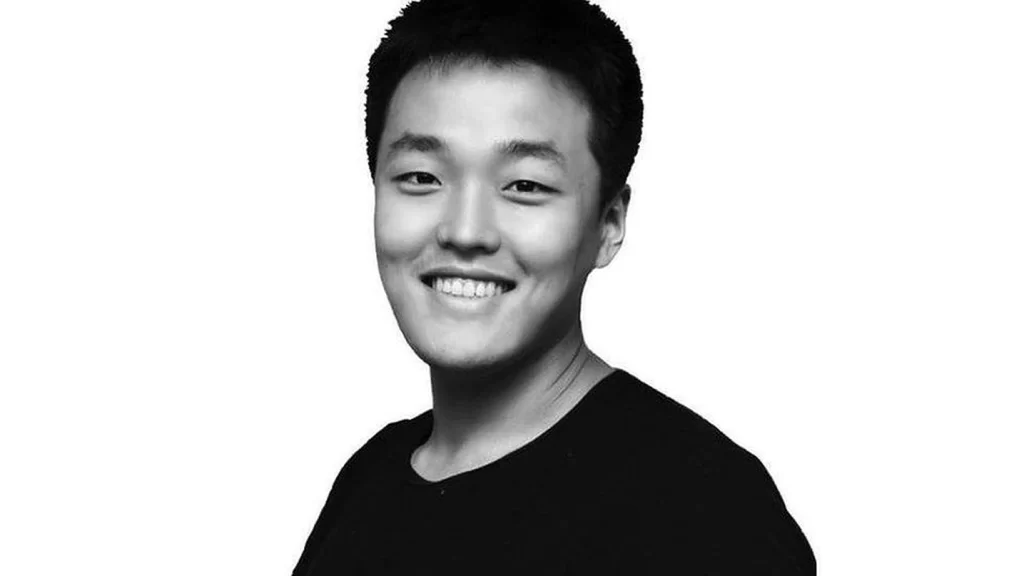

Do Kwon, the co-founder of Terraform Labs, has formally requested that a United States district judge dismiss a securities and fraud lawsuit initiated by the United States Securities and Exchange Commission (SEC), arguing that the SEC has failed to provide evidence of wrongdoing by him or his firm.

In a legal filing submitted on October 27th to the U.S. District Court for the Southern District of New York, legal representatives for both Do Kwon and Terraform presented their case, asserting that the cryptocurrencies associated with Terraform, namely Terra Classic (LUNC), TerraClassicUSD (USTC), Mirror Protocol (MIR), and the mirrored assets (mAssets), which replicate traditional stocks on the blockchain, should not be classified as securities as alleged by the SEC.

The lawyers emphasized that, despite an extensive two-year investigation, the completion of a thorough discovery process involving over 20 depositions and the exchange of more than two million documents and data, the SEC has failed to substantiate its claims of wrongdoing.

They contended that there is insufficient evidence to support many of the SEC’s allegations, suggesting that the regulator was aware that some of its claims were unfounded, particularly the allegation that Kwon and Terraform secretly transferred millions of dollars into Swiss bank accounts for personal gain.

READ MORE: Crypto Platform Expands Institutional Crypto Custody Services Amid Surging Demand

In the lawsuit filed against Kwon and Terraform in February, the SEC accused the duo of sending 10,000 Bitcoins to a Swiss financial institution and withdrawing $100 million, further alleging that they engaged in fraudulent activities by repeatedly making false and misleading statements.

Kwon’s legal team insisted that the SEC knew the falsity of this allegation when initiating the case, emphasizing that Terraform Labs had no customers and therefore, no customer funds.

The Terra ecosystem, valued at $40 billion, experienced a significant collapse in May 2022 due to the devaluation of TerraUSD (UST), its algorithmic stablecoin, which lost its peg to the U.S. dollar.

Additionally, Kwon and Terraform sought to exclude the opinions of SEC experts, including a report by Rutgers University economics professor Bruce Mizrach, which they criticized as “junk science.”

Judge Jed Rakoff, presiding over the case, had previously rejected Terraform’s attempt to have the lawsuit dismissed.

It’s worth noting that Do Kwon is currently detained in Montenegro and has previously requested that the court reject the SEC’s motion to extradite and interview him in the United States.

Bulgaria’s oldest football club, Botev Plovdiv FC, has taken a significant step towards cryptocurrency adoption by integrating Bitcoin (BTC) and the Lightning Network into its payment systems, as well as joining the decentralized protocol, Nostr.

This move aims to enhance fan engagement and bring the benefits of digital currencies to the world of sports.

Starting immediately, fans can make peer-to-peer payments using Bitcoin at Botev Plovdiv FC’s fan shops and stands during matches in the top-flight Bulgarian Parva Liga.

The club also has plans to expand Bitcoin payments for ticketing and its online store, making it easier for supporters to interact with the club.

Anton Zingarevich, the club’s president, expressed his excitement about the integration and the potential of the Lightning Network, stating that they envision Bitcoin payments becoming as commonplace as the internet in daily life.

He believes this initiative aligns with the club’s vision and offers unparalleled convenience to fans and stakeholders.

The adoption of Bitcoin was made possible through a partnership with BTCPay Server, a reputable Bitcoin payment processor known for its open-source architecture, secure infrastructure, and low merchant fees.

CryptoDesk.bg, in collaboration with Bitcoinize.com, provided the necessary payment hardware and point-of-sale devices.

READ MORE:Bitcoin Holds Steady at $34,000 Amidst Growing Macro Asset Comparisons

George Manolov, Bitcoin director at Botev Plovdiv FC, emphasized the vast opportunities that Bitcoin offers in terms of technology, social impact, and finance. He expressed enthusiasm for leading innovative initiatives in sports and elevating the club’s stature.

In addition to integrating Bitcoin, the club has revamped its online presence, updating its official website and expanding its English social media channels.

Furthermore, Botev Plovdiv FC has joined Nostr, a decentralized protocol that offers censorship-resistant social media, strengthening its commitment to decentralized technologies.

This move towards Bitcoin and decentralized technologies echoes the pioneering efforts of Real Bedford, a UK-based football club that was the world’s first to adopt Bitcoin.

Peter McCormack, chairman of Real Bedford, commended Botev Plovdiv FC’s decision, emphasizing how Bitcoin adoption can bring success to clubs while raising awareness about the cryptocurrency.

McCormack, who integrated Bitcoin at Real Bedford in 2021, believes that Bitcoin’s unique characteristics act as a “cheat code for life.”

He anticipates more football and sports teams to follow suit and adopt the “cheat code” strategy to build their clubs on solid financial foundations.

To celebrate their cryptocurrency adoption, Botev Plovdiv FC allowed fans attending their home game against Lokomotiv Plovdiv to pay using Bitcoin and the Lightning Network.

This announcement, made on Bitcoin white paper day, further underscores the club’s support for Bitcoin and its commitment to embracing innovation in the world of sports.

According to Mark Nuvelstijn, the CEO of Bitvavo, the looming Bitcoin mining reward halving in 2024 may not necessarily trigger a supply shock in the market due to the dynamics of supply and demand.

Nuvelstijn, who co-founded the Netherlands-based cryptocurrency exchange, shared his insights on the state of the Bitcoin market during the European Blockchain Convention in Barcelona.

Nuvelstijn’s perspective is grounded in the idea that as demand for Bitcoin grows, so does its price. He noted that this price increase will continue until it reaches equilibrium with demand.

Consequently, he is optimistic that exchanges like Bitvavo will be able to meet the demands of traders, as they act as intermediaries matching buy and sell orders.

In discussing Bitcoin exchange-traded fund (ETF) applications filed in the United States, Nuvelstijn highlighted the increasing attention and interest in the cryptocurrency market.

He pointed out that the recent substantial surge in the Bitcoin price, up by 20% to 30% over two weeks, is indicative of this growing interest. Bitvavo has also witnessed a surge in web traffic, customer visits, and app usage, resulting in an influx of new customers.

Nevertheless, the CEO emphasized that this is still a pre-event, as the ETF approvals have not materialized yet.

READ MORE:3 Best Cloud Mining Platforms 2023 (Earn Money at Home)

Bitvavo, primarily focused on the Netherlands and Belgium, has plans for expansion into other European jurisdictions such as France, Spain, and Italy.

Nuvelstijn anticipates that the European Union’s Markets in Crypto-Assets (MiCA) regulation will play a pivotal role in advancing market maturity and facilitating cross-border business operations.

MiCA is expected to harmonize regulations across European countries, simplifying the licensing process and promoting a more conducive environment for crypto and financial services.

Additionally, Nuvelstijn sees MiCA as a catalyst for greater integration between traditional financial services and cryptocurrency companies, predicting a blending of business models in the financial sector.

Furthermore, a report from a Standard Chartered analyst in July 2023 suggests that the rising institutional demand for Bitcoin may drive its price to approximately $120,000 by the end of the year.

This increase is attributed to enhanced mining profitability, reducing the necessity to sell newly mined coins.

As Bitcoin’s ecosystem continues to evolve, the industry remains dynamic, with market participants like Bitvavo adapting to meet the evolving demands of the crypto market.

Former FTX CEO Sam Bankman-Fried’s legal team has once again appealed to the presiding judge, Judge Lewis Kaplan, in a bid to alter the jury instructions in his ongoing legal case.

The defense attorneys have specifically requested that the jury take into account the role of English law in shaping FTX’s terms of service.

In their proposal to Judge Kaplan, the defense team argues that in order for misappropriation to be established, there must have existed a trust, fiduciary, or similar relationship between FTX and its customers.

However, they highlight that FTX’s terms of service have explicitly stated that no such relationship existed between the company and its users.

The defense attorneys articulated their argument as follows: “Under English law, the Terms of Service do not create a trust relationship or similar fiduciary relationship between FTX and its customers.

Nor, under English law, do any representations made after a customer agreed to the Terms of Service create a trust relationship or similar fiduciary relationship.”

READ MORE: El Salvador Poised to Emerge as the Singapore of the Americas

They emphasized that even if a customer subjectively expected, understood, or believed in such a relationship, it does not legally create one under English law.

To bolster their case, the defense team cited precedents from various cases in the United Kingdom, underscoring the consistency of English law in not recognizing implied trust or fiduciary relationships based solely on subjective expectations.

Throughout the course of the case, Bankman-Fried’s legal representatives have made numerous requests to the judge, including appeals for early bail before the trial due to insufficient amenities for adequate preparation.

However, most of these requests have been denied by the court.

Sam Bankman-Fried, the former CEO of FTX, currently faces multiple charges related to fraud and misappropriation of customer funds for personal expenses.

Bankman-Fried has consistently maintained his innocence throughout the trial, vehemently denying any misuse of funds and asserting that he did not defraud his customers.

Additionally, he has faced previous allegations of witness tampering in connection to the ongoing legal proceedings.

Warren Buffett, often critical of cryptocurrencies like Bitcoin, finds himself profiting from his investment in a crypto-friendly bank, Nu Holdings, in 2023.

The “Oracle of Omaha” acquired 107 million shares of Nu Holdings, the parent company of Nubank, a Brazil-based fintech company known for its crypto-friendly approach.

Berkshire Hathaway, Buffett’s firm, made two significant investments in Nu Holdings in 2021, totaling $750 million.

As of the second quarter of 2023, Berkshire Hathaway has not sold any of its Nu shares, and the investment has grown to approximately $879.50 million, despite peaking at over $1 billion in February 2022.

Nubank’s crypto-friendly reputation stems from divisions that provide crypto-related services to over 1.35 million users.

This indirect exposure to the cryptocurrency industry includes Easynvest, a trading platform offering a Bitcoin exchange-traded fund (ETF), and Nubank, a digital financial services platform that facilitates BTC and ETH trading.

READ MORE: Former FTX CEO Sam Bankman-Fried Testifies on Relationship and Political Donations in Trial

Nubank also launched a loyalty token on the Polygon blockchain and allocated 1% of its cash holdings to Bitcoin in May 2022, emphasizing its belief in Bitcoin’s potential to disrupt financial services in the region.

Nubank is the largest fintech bank in Latin America, boasting over 80 million customers in Brazil.

In terms of stock performance, Nu Holdings has outperformed other top holdings in Buffett’s portfolio, such as Amazon and Apple, which have seen gains of 54.65% and 36%, respectively.

Apple represents a significant portion of Berkshire Hathaway’s investment portfolio, constituting approximately 45% of its $354 billion portfolio as of September 2023.

Nu Holdings’ stocks have also outperformed Berkshire Hathaway’s stock, which has risen by 9.25% year-to-date.

Remarkably, in 2023, Bitcoin’s price performance has finally caught up with Nu Holdings’ stock, both experiencing a 106% increase year-to-date, coinciding with Bitcoin’s decoupling from the stock market in October.

While some view this as a bullish sign, others attribute Bitcoin’s recent price gains to optimism surrounding Bitcoin ETFs.

Historical data has shown a close correlation between Bitcoin and the stock market, and the recent “decoupling” may be driven by hopes for ETF approval.

However, some caution that a significant stock market downturn could bring Bitcoin back to earth, highlighting the complex interplay between traditional financial markets and the cryptocurrency world.

Around 25 individuals have allegedly fallen victim to a cryptocurrency heist amounting to a staggering $4.4 million, compromising 80 wallets.

The breach, which transpired in 2022, was attributed to vulnerabilities in the password storage software, LastPass.

On October 27, in a Twitter post, a pseudonymous on-chain researcher known as ZachXBT and MetaMask developer Taylor Monahan jointly revealed their tracking of the illicit fund movements across the compromised wallets.

Monahan pointed out that most of the victims had been long-standing users of LastPass and admitted to storing their crypto wallet keys or seeds within the compromised software.

The heist, which unfolded on October 25, 2023, alone resulted in the siphoning of approximately $4.4 million from over 25 victims who had fallen prey to the LastPass hack.

The severity of the situation prompted a stern warning from ZachXBT, urging anyone who may have entrusted their seed phrases or keys to LastPass to immediately transfer their crypto assets to more secure storage.

This troubling incident traces its origins back to December 2022 when LastPass publicly disclosed that an assailant had exploited information pilfered during a breach in August.

This data breach allowed the attacker to target a LastPass employee, acquiring their credentials and successfully decrypting stored customer data.

READ MORE; Bitcoin Holds Steady at $34,000 Amidst Growing Macro Asset Comparisons

Among the stolen assets was a backup of encrypted customer vault data, with LastPass sounding the alarm that this data could be decrypted if the attacker engaged in a brute-force guessing of the account’s master password.

The repercussions of this breach became shockingly evident when cybersecurity journalist Brian Krebs reported in September that several LastPass customer vaults had been seemingly breached, leading to the theft of over $35 million in crypto from approximately 150 victims.

The fallout from this security debacle extended into January when LastPass found itself embroiled in a class-action lawsuit.

The lawsuit, filed by affected individuals, alleged that the August 2022 breach had resulted in the theft of roughly $53,000 worth of Bitcoin (BTC).

In his most recent post, ZachXBT offered a final piece of advice to those who had ever entrusted their wallet seed or private keys to LastPass: “migrate your crypto assets immediately.”

The urgency of his words underscores the critical importance of safeguarding one’s digital assets in the face of relentless cyber threats.

The Dubai Virtual Assets Regulatory Authority (VARA) has recently granted a Virtual Asset Service Provider (VASP) license to the cryptocurrency wallet company known as Backpack.

This development marks the inception of Backpack Exchange, a platform exclusively designed for crypto exchange services within the Dubai market.

Notably, the VARA license confines Backpack to offering only crypto exchange services and doesn’t encompass their other virtual asset-related products and services.

The newly launched Backpack Exchange boasts cutting-edge features, including zero-knowledge (ZK) proof-of-reserves, multi-party computation (MPC) for secure custody, and low-latency order execution.

In a significant revelation, it was disclosed that Backpack Exchange had successfully acquired operational licenses in multiple jurisdictions worldwide over the preceding five months.

While the flagship Backpack Wallet remains an unregulated product, it is strategically engineered to facilitate users’ transition from fiat to on-chain applications in the future.

Armani Ferrante, the CEO and co-founder of Backpack, emphasized his commitment to bringing greater transparency to crypto exchanges and eliminating opacity.

READ MORE: El Salvador Poised to Emerge as the Singapore of the Americas

He outlined the company’s vision, stating, “Using cryptographic techniques like zk-proofs, MPC, and state machine replication, Backpack Exchange hopes to raise the bar for transparency and compliance to demonstrate the best this technology has to offer. Don’t trust, verify.”

Existing users of Backpack and Mad Lads will have exclusive access to Backpack Exchange starting from November 2023, with plans to make it accessible to the general public in Q1 2024.

During this period, Backpack intends to introduce various trading functionalities, including derivatives, margin trading, and cross-collateralization, to enhance its service offerings.

As of now, Backpack has not responded to requests for comments from Cointelegraph.

Dubai’s VARA regulator has been actively granting operational licenses to numerous crypto exchanges over the past year, solidifying its reputation as a crypto-friendly jurisdiction.

In February 2023, the regulator introduced new guidelines for VASPs operating in the emirate, mandating adherence to marketing, advertising, and promotion regulations.

Violators will face fines ranging from 20,000 UAE dirhams ($5,500) to 200,000 dirhams ($55,000), with repeat offenders potentially subject to fines as high as 500,000 dirhams ($135,000).

In a recently resurfaced video from 2019, Gary Gensler, now the head of the United States Securities and Exchange Commission (SEC), criticized the SEC’s approach to spot Bitcoin products, calling it “inconsistent.”

The video, which has gained renewed attention on social media, captures a discussion on blockchain regulation between Gensler and SEC Commissioner Hester Peirce during the 2019 MIT Bitcoin Expo.

During the conversation, Gensler expressed his views on the regulatory landscape for Bitcoin and other cryptocurrencies.

He pointed out the perceived inconsistency in the treatment of Bitcoin futures and Bitcoin exchange-traded funds (ETFs). Gensler noted that while Bitcoin futures and possibly Ethereum futures were allowed, Bitcoin ETFs had not received approval.

He highlighted the similarity in the underlying technologies and suggested that this inconsistency was a concern.

In the wake of the video’s resurgence, the cryptocurrency community on social media platforms, including Twitter, couldn’t help but draw attention to the contrast between Gensler’s past and present views on spot Bitcoin ETFs.

READ MORE: Sam Bankman-Fried Denies Wrongdoing But Acknowledges His Mistakes

Some users humorously remarked on the change in Gensler’s stance, with one market analyst posting, “Gary Gensler says Gary Gensler is wrong,” and another user commenting on the shift in his approach.

As of now, the SEC has granted approval for Bitcoin and Ether futures ETFs but has consistently rejected spot Bitcoin ETF applications since 2017.

This pattern of rejections continued under Gensler’s leadership at the SEC. Gensler has justified these rejections by citing concerns about the lack of adequate protections against market manipulation in spot Bitcoin ETFs.

Notably, Gensler’s SEC faced a lawsuit from asset manager Grayscale after it rejected the company’s proposal to convert its existing Bitcoin trust into a spot ETF.

A court ultimately ruled that the SEC’s rejection of the application was “arbitrary and capricious,” and the SEC did not pursue an appeal against this decision.

The resurgence of this video has sparked discussions and debates about the evolving regulatory landscape for cryptocurrencies in the United States and the SEC’s role in shaping it.

It remains to be seen how Gensler’s current position as SEC chairman will influence future decisions regarding spot Bitcoin ETFs and other cryptocurrency-related matters.

Zodia, the institutional cryptocurrency custody platform jointly owned by financial giants Standard Chartered, SBI Holdings of Japan, and Northern Trust, is set to extend its services to the bustling financial hub of Hong Kong.

This expansion, revealed by Zodia CEO Julian Sawyer, is in response to the burgeoning demand for cryptocurrencies among institutional investors in the region.

Sawyer emphasized that the surge in crypto interest in Hong Kong primarily stems from institutional players rather than individual retail customers.

This aligns perfectly with Zodia’s core offering, which is tailored to cater to the needs of institutional clients.

He further highlighted that Hong Kong’s regulatory stance on cryptocurrencies is in harmony with Zodia’s ambitions.

The local government recognizes digital assets as the future and is actively positioning Hong Kong to become a pivotal hub in this rapidly evolving landscape.

Zodia’s entry into Hong Kong is part of its broader strategy to aggressively expand its footprint across Asia.

READ MORE: Kraken Suspends Tether, Dai, and More in Canada Amid Regulatory Changes

In recent months, the platform has launched its services in Japan, Singapore, and Australia, tapping into the growing demand for secure cryptocurrency custody solutions.

The CEO stated, “What we’re seeing is there are absolutely clients in all of those four markets who want to do things,” indicating a robust appetite for crypto-related services in these regions.

Moreover, Zodia is also exploring opportunities beyond these jurisdictions, with interest coming from institutional clients and prospects worldwide.

The initial phase of Zodia’s expansion in Hong Kong will involve limited support for a select number of cryptocurrency assets.

Additionally, the platform is actively engaging with Hong Kong’s regulatory bodies, such as the Securities and Futures Commission and the Hong Kong Monetary Authority, to seek regulatory approval and ensure compliance within the financial district.

While Zodia has not responded to requests for comments at the time of writing, it’s worth noting that this development follows Standard Chartered’s original announcement in late 2020 to establish an institutional custodial platform for cryptocurrencies.

Launched in 2021, Zodia secured $36 million in a Series A funding round led by SBI Holdings in April 2023.

In conclusion, Zodia’s expansion into Hong Kong signifies its commitment to meeting the rising institutional demand for cryptocurrency services in Asia, reinforcing its position as a key player in the rapidly evolving digital asset custody space.