The United States and Vietnam have entered into groundbreaking business agreements worth billions of dollars, aimed at fostering collaboration in cutting-edge technologies, most notably artificial intelligence (AI).

The announcement was made during a joint press conference on September 11, underscoring the significance of this move.

U.S. President Joe Biden described this as a formal “upgrading” of the bilateral relationship between the two nations, highlighting key sectors like cloud computing, semiconductors, and AI.

He emphasized the deepening cooperation in critical and emerging technologies, particularly in building a resilient semiconductor supply chain.

President Biden also expressed optimism that this economic partnership would catalyze increased trade and investment between the two countries.

Importantly, he clarified that this initiative is not aimed at containing China but rather at establishing a stable foundation in the region.

Dignitaries from major tech companies, including Google, Intel, Boeing, Amkor, Microsoft, and Nvidia, were present at the conference.

Boeing and Amkor, in particular, announced additional deals, with Amkor planning to establish a new factory near Hanoi, Vietnam’s capital, starting in October of this year.

READ MORE: Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

This facility will be dedicated to assembling, packaging, and testing AI chips.

Vietnam has emerged as one of the world’s fastest-growing economies, ranking 34th globally with a GDP of $450 billion, as per data from Acclime, a regional corporate services provider in Asia.

Vietnam’s transition from centralized economic control to a more open approach has enabled the United States to become one of its largest export markets.

This AI-centric agreement has reportedly elevated the United States by two levels in Vietnam’s bilateral hierarchy, a position traditionally held by China, Russia, India, and South Korea.

Historically, the U.S.-Vietnam relationship had been restrained due to concerns about upsetting China and the remnants of a tumultuous past stemming from the Vietnam War.

These developments come at a time when governments worldwide are actively competing to develop and deploy advanced AI systems, particularly in the ongoing rivalry between the U.S. and China.

In October 2022, the Biden administration imposed an export ban on the latest and most potent semiconductor chips to China, a policy that is under consideration for further tightening.

China, on the other hand, introduced new AI regulations in August, resulting in the release of more than 70 AI models with over a billion parameters.

The AI landscape is rapidly evolving, and partnerships like the one between the U.S. and Vietnam are pivotal in shaping the global AI landscape.

Other Stories:

Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Binance.US has firmly responded to the United States Securities and Exchange Commission’s (SEC) recent motion to compel and reply, characterizing most of the SEC’s demands as “unreasonable” and “unduly burdensome.”

In a legal move made on September 12, attorneys representing BAM Trading Services, the entity operating the Binance.US cryptocurrency exchange, submitted confidential documents contesting the SEC’s request for additional information from Binance.US.

The defendants contended that the SEC’s requests for production and interrogatories were excessively broad, imposing an undue burden and extending beyond the scope defined in the consent order.

They further criticized the SEC’s pursuit of certainty and their requests for depositions of BAM CEO Brian Shroder and CFO Jasmine Lee, deeming them “unreasonable.”

BAM’s legal representatives emphasized that the SEC’s motion failed to identify any evidence implicating Shroder and Lee in the day-to-day management details related to the custody and transfer of customer assets at Binance.US.

The attorneys argued, “BAM’s CEO and CFO have no unique knowledge regarding facts relevant to the limited topics identified in the consent order’s expedited discovery provision.”

They also highlighted that BAM had presented alternative witnesses, like BAM’s Chief Information Security Officer, Erik Kellogg, who possessed more pertinent insights into BAM’s operations.

READ MORE: Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

The lawyers contended that the burden imposed by the requested depositions far outweighed any potential benefits and that the discovery sought was disproportionate to the needs outlined in the consent order.

Moreover, BAM’s legal team contended that the SEC had failed to provide any substantive evidence to support its allegations of asset diversion, characterizing these allegations as “misleading and mistaken.”

The attorneys pointed out a “complete disconnect” between the SEC’s “overbroad and abusive approach” and the limited expedited discovery framework to which the SEC had previously agreed in the consent order.

BAM’s response came shortly after both the SEC and Binance reached an agreement on a protective motion.

This motion mandated the filing of confidential information under seal, with restricted access only to specific parties including the judge, attorneys, plaintiffs, and defendants.

This joint motion was submitted on September 11, ensuring the confidentiality of protected materials in the ongoing legal proceedings.

Other Stories:

Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

United States Commodity Futures Trading Commission (CFTC) Commissioner Christy Goldsmith Romero has called for a modernization of protection measures using advanced technology to safeguard American investors.

Speaking at the annual meeting of the North American Securities Administrators Association in San Diego, Romero emphasized the need for government regulators to keep up with technological advancements to protect vulnerable investors.

Romero stressed the importance of regulators having a strong understanding of emerging technologies and their implications for the financial and legal sectors as they make policy decisions regarding next-generation financial technology.

In a significant move, Romero appointed technology experts in fintech, responsible artificial intelligence (AI), cryptocurrency, blockchain, and cybersecurity to the CFTC’s Technology Advisory Committee (TAC).

These experts are tasked with identifying ways to incorporate Know Your Customer (KYC) and Anti-Money Laundering (AML) processes into decentralized finance and cryptocurrency investment channels.

Furthermore, the TAC will play a crucial role in promoting responsible AI development within the financial industry, focusing on governance for decision-making that impacts investors and markets.

Romero highlighted a shift in federal crypto investigations from trade activities to monitoring social media platforms such as X (formerly Twitter), Reddit, and Facebook.

She recommended the use of tools like blockchain analysis, link analysis, and data analytics to aid these investigations.

Romero emphasized that statements made on social media platforms can serve as strong evidence of intent, and regulators can use these platforms to issue warnings about scams to protect investors.

READ MORE: Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

To combat financial fraud effectively, Romero proposed the establishment of a National Financial Fraud Registry.

This centralized database would maintain records of all crimes and fines related to financial fraud, allowing investors to conduct background checks on companies and ongoing investigations or fines related to fraud.

Romero initially proposed the registry in December 2019 to enhance investor protection.

Romero believes that this one-stop-shop platform can deter financial fraud and improve overall investor safety.

In conclusion, she emphasized that federal and state officials must work together to enhance investor protection and safety.

In April, Romero urged crypto companies to verify the digital identity of users to mitigate risks associated with anonymity.

She encouraged both exchanges and decentralized finance (DeFi) platforms to adopt digital identity verification while still providing financial privacy for customers.

This approach aligns with her commitment to enhancing investor safeguards in the rapidly evolving cryptocurrency and blockchain space.

Other Stories:

Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Bitcoin experienced a notable recovery from its recent three-month lows on September 12, sparking skepticism among traders regarding the cryptocurrency’s price behavior.

Market data from Cointelegraph Markets Pro and TradingView reflected a rapid return to levels seen immediately after the weekly close of BTC/USD.

The preceding day had witnessed a sudden decline in Bitcoin’s value upon Wall Street’s opening, briefly pushing it below the $25,000 mark.

This performance marked its most significant decline since mid-June.

However, Bitcoin embarked on a subsequent comeback, surging by $1,000. Nevertheless, as of the time of writing, it was encountering resistance at the $26,000 level.

In anticipation of future price movements, on-chain monitoring resource Material Indicators had already issued a warning about an imminent “support test.” This was due to a decrease in bid liquidity in the order book’s lower levels.

Further analysis, both from Material Indicators and others, pointed out that previous occurrences of “rug pulls” in support levels had paradoxically led to positive outcomes in the Bitcoin market.

Large-volume traders were effectively clearing liquidity from the immediate vicinity of the spot price.

Co-founder Keith Alan even predicted that $24,750 would hold as support during a potential downturn, a prediction that remained accurate at the time of writing.

In a separate development, the DeFi Education Fund (DEF), an advocacy group for decentralized finance (DeFi), submitted a petition to the United States Patent and Trademark Office (USPTO) on September 7.

READ MORE: Coinbase CEO Foresees Crypto’s Major Role in 2024 Elections, Urges Clearer Regulations

This petition aimed to prompt a review of a patent owned by True Return Systems, a company accused by DEF of being a “patent troll.” Such entities seek to profit from patent-related lawsuits.

The patent, granted in 2018, claimed ownership of a process for “linking off-chain data to a blockchain.” DEF’s legal chief, Amanda Tuminelli, revealed that True Return had attempted to sell the patent as a nonfungible token (NFT) before subsequently filing lawsuits against DeFi protocols MakerDAO and Compound Finance in October.

Tuminelli asserted that True Return’s intention was to name defendants who couldn’t respond to the complaint, obtaining a default judgment.

The company would then seek to enforce the court’s ruling against token holders and repeat the process with other protocols that lacked the resources or means to challenge them in court.

DEF argued that the technology described in the patent was not innovative at the time of its granting and cited existing tech such as the InterPlanetary File System (IPFS) and decentralized storage platforms like Sia, Storj, and Swarm.

True Return Systems acknowledged a request for comment from Cointelegraph but had not provided an immediate response.

DEF’s petition to the USPTO aimed to protect the use and development of open-source software, prevent potential legal actions by True Return against crypto projects, and aid in the legal defense of MakerDAO and Compound.

True Return has a three-month window to optionally respond to the petition, after which the USPTO must decide whether to review the patent within six months and, ultimately, whether to cancel it within 12 months.

Other Stories:

Vitalik Buterin’s X Account Breached: Over $691K Lost to Malicious NFT Link

Rise of Senior Executives Leading Digital Asset Strategies Signals Investment Firm Transformation

Terra Classic Community Proposes Minimum Deposit Hike to Combat Spam

The Federal Reserve Bank vice chairman delivered a speech at the Philad elphia Fed’s fintech event on September 8, focusing on the central bank’s role in financial innovation, which primarily encompasses research and supervision, with a notable mention of the FedNow Service.

Michael Barr, the vice chair for supervision at the Federal Reserve, emphasized their commitment to central bank digital currency (CBDC) research, framing it as fundamental research that could potentially support a CBDC payments infrastructure or enhance the existing payments system.

Barr specifically highlighted the importance of system architecture for recording transactions and ownership in ledgers and explored tokenization models, in line with a FEDS Notes publication that underlined the compatibility of tokenized platforms with central bank money functioning as a settlement asset.

In an unusual punctuation choice for Federal Reserve communications, Barr underscored the significance of the Fed’s novel activities supervision program, introduced the previous month.

READ MORE: Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulator

This program entails a dedicated team of supervisors providing feedback to federally supervised banks, enabling them to obtain “written supervisory non-objection” for novel activities involving stablecoins and related endeavors, aligning with Office of the Comptroller of the Currency (OCC) policies outlined in interpretative letters 1174 and 1179.

Barr stressed the importance of strong federal oversight of stablecoins, in line with the OCC’s guidance, asserting that dollar-pegged stablecoins rely on the trust of the central bank and indicating support for ongoing legislative efforts.

He voiced concerns, stating, “If non-federally regulated stablecoins were to become a widespread means of payment and store of value, they could pose significant risks to financial stability, monetary policy, and the U.S. payments system.”

Barr also highlighted the Federal Reserve’s role in facilitating 24-hour instant payments through the FedNow Service, which was introduced in July. While current usage volumes of the service remain modest, he emphasized that it falls on depository institutions to make this service widely accessible, encompassing large banks, regional banks, community banks, and credit unions.

Other Stories:

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

Coinbase CEO, Brian Armstrong, has made bold predictions regarding the pivotal role of cryptocurrency in the upcoming United States elections in 2024.

In a recent interview with Yahoo Finance, Armstrong emphasized that many officials in Washington, D.C. do not yet grasp the substantial influence wielded by the crypto community’s voting bloc.

Armstrong firmly asserted, “I don’t think everybody in DC actually fully realizes how powerful the crypto voting community block is.

And I think 2024 is an election where the voters of America are really going to hold candidates’ feet to the fire and say, what is your position on crypto?”

Highlighting the growing crypto adoption in the U.S., Armstrong pointed out that approximately 56 million Americans have already engaged with cryptocurrencies, a number five times larger than electric vehicle users.

These crypto enthusiasts represent a formidable voting demographic that is expected to demand answers from candidates about their stance on cryptocurrency-related policies.

Presidential hopefuls have already begun addressing the cryptocurrency issue in their campaigns.

For instance, Florida’s Governor Ron DeSantis has pledged to prohibit central bank digital currencies (CBDCs) if he secures the presidency, citing privacy concerns as a primary reason.

READ MORE: Ripple’s Chief Legal Officer Lambasts SEC’s ‘Contradictory Shift’ in Latest Submission

Similarly, Robert F. Kennedy Jr. has expressed reservations about exploring the concept of a digital dollar. Despite these reservations, both candidates have adopted crypto-friendly campaign strategies.

In terms of the current political landscape, crypto asset manager Grayscale recently reported that Joe Biden and Donald Trump, who are leading in their respective parties’ 2024 presidential polls, have expressed a favorable attitude towards exploring CBDCs.

Coinbase, a prominent cryptocurrency exchange, has actively lobbied in Washington, D.C. for a clear regulatory framework within the crypto space.

Congressional discussions on bipartisan bills aimed at establishing comprehensive rules for crypto firms and users are currently underway.

However, Armstrong also suggested an alternative route, hinting at the possibility of a new chair at the Securities and Exchange Commission (SEC) in 2024.

This reference alludes to a potential replacement for Gary Gensler, who had filed a lawsuit against Coinbase in June, alleging violations of securities laws related to several tokens traded on the platform.

The crypto industry awaits the outcome of these regulatory discussions and the potential impact of the 2024 elections on cryptocurrency policy in the United States.

Other Stories:

Congressman Takes Aim at SEC’s Digital Asset Enforcement Spending

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Ripple Bolsters U.S. Regulatory Presence with Fortress Trust Acquisition

Vitalik Buterin’s X (previously Twitter) account was reportedly hacked.

Blockchain expert ZachXBT revealed that the hack resulted in losses exceeding $691,000 from users who clicked on a malicious link.

On September 9, Dmitry Buterin, Vitalik’s father, warned on X that his son’s account had been breached.

He urged followers to disregard a particular post, which has since been deleted.

This misleading post celebrated “Proto-Danksharding’s” introduction to Ethereum.

The hacker baited users with a link for a free commemorative NFT, tricking them into connecting their wallets, and then stole their assets.

Ethereum developer Bok Khoo, aka Bokky Poobah on X, has stated that his CryptoPunk NFTs were among the assets lost.

At present, a CryptoPunk NFT’s floor price is 46.99 Ether, translating to roughly $76,837.

ZachXBT has kept his 438,200 followers updated on the hacker’s moves.

He disclosed that the most valuable stolen NFT is CryptoPunk #3983, valued at 153.62 ETH or about $250,543.

READ MORE: Ripple’s Chief Legal Officer Lambasts SEC’s ‘Contradictory Shift’ in Latest Submission

An X user, Satoshi 767, speculated that Buterin might have skimped on security measures for his X account.

This user suggested that Buterin should admit to his operational security lapses and reimburse the affected individuals.

He theorized that the breach could either be an internal job at X, a direct physical threat to Buterin, or, most probably, a SIM swap.

Yet, ZachXBT countered this by highlighting Buterin’s prominence, suggesting he’s an attractive target for various hacking methods.

He emphasized the uncertainty around the breach being a SIM swap and proposed that an insider might have been bribed or used a panel.

Other Stories:

Ripple Bolsters U.S. Regulatory Presence with Fortress Trust Acquisition

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

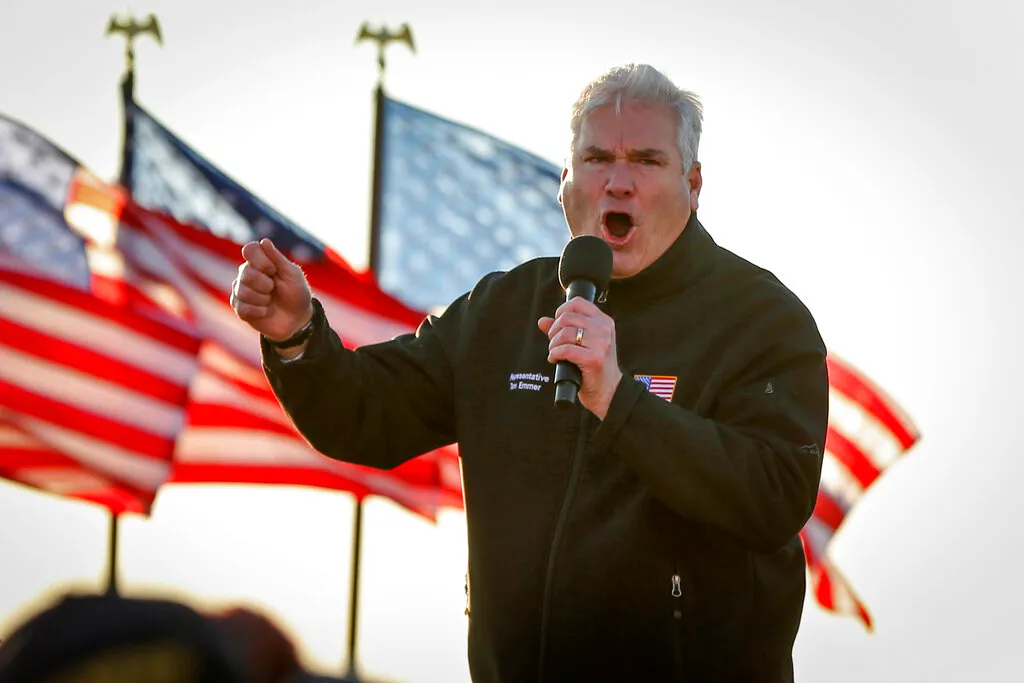

On September 8, United States Representative Tom Emmer, the Majority Whip of the U.S. House of Representatives, sponsored an appropriations amendment aimed at restricting the U.S. Securities Exchange Commission’s (SEC) use of funds for digital asset enforcement.

Emmer, a vocal critic of the SEC’s actions in the cryptocurrency industry, particularly the leadership of SEC Chair Gary Gensler, alleged that Gensler had exceeded his authority, resulting in adverse consequences for the American people.

Emmer urged Congress to employ available methods and proper procedures to prevent potential misuse of taxpayer funds by Gensler and the SEC.

Emmer’s history includes co-sponsoring several bills designed to improve regulatory transparency within the United States.

He asserted that Gary Gensler had abused his authority to expand the Administrative State, to the detriment of the American people, emphasizing the necessity for Congress to employ all available tools, including the appropriations process, to restrain Gensler from further leveraging taxpayer dollars.

READ MORE: Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

The appropriations amendment Emmer introduced will limit the SEC’s use of funds for digital asset enforcement until comprehensive rules and regulations are established.

Concerns have arisen due to the absence of cryptocurrency regulations, with Emmer suggesting that the SEC’s substantial expenditures on legal disputes with numerous crypto entities might constitute a “weaponization” of taxpayer funds.

In a separate legislative move, Emmer introduced the Blockchain Regulatory Certainty Act, which clarifies that blockchain developers and service providers should not be classified as money transmitters, as they do not hold consumer funds in custody.

This distinction is intended to relieve non-custody providers from unnecessary compliance burdens that could hinder innovation in the United States, ensuring that validators, miners, and other noncustodial service providers are not grouped together with custody providers.

Prominent figures in the blockchain sector, including Blockchain Association CEO Kristin Smith and Crypto Council CEO Sheila Warren, voiced their support for Emmer’s proposed legislation.

Additionally, Emmer threw his support behind Representative Warren Davidson’s SEC Stabilization Act, which aims to remove Gary Gensler from his position as SEC chair.

Other Stories:

Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulator

Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

Stuart Alderoty, Ripple’s chief legal officer and general counsel involved in the SEC vs. Ripple Labs case, has labeled the SEC’s most recent submission as a “contradictory shift,” asserting that it carries little weight.

In response to the SEC’s recent filing to bolster its interlocutory appeal, Alderoty took to X (formerly Twitter) to characterize the submission as yet another instance of a “hypocritical pivot.”

Within his statement, Alderoty pointed out what he perceives as inconsistencies in SEC Chair Gary Gensler’s stance, citing manipulative actions and a desire for increased regulation.

Alderoty emphasized that despite Gensler’s prior assertion that cryptocurrency regulations were clear and non-negotiable for the industry, the SEC now urgently seeks an appeal to address complex legal issues.

READ MORE: Crypto Exchange CEO and Siblings Sentenced to Over 11,000 Years in Prison

Another attorney, James Filan, took a swipe at the SEC, mocking its newfound concern for conserving judicial resources and highlighting the SEC’s previous attempt to halt proceedings in the case.

Pro-XRP lawyer John Deaton noted that, to those unfamiliar with the case, Alderoty’s response might seem harsh; however, among those well-versed in the matter, it merely reflects the sentiments of the federal judge overseeing the proceedings.

In the Grayscale lawsuit, federal judges have criticized the SEC’s claims as “arbitrary and capricious.”

Furthermore, Ripple’s executive chairman, Chris Larsen, anticipates that the SEC’s strategy of enforcing regulations through legal actions may soon reach a conclusion in the near future.

Other Stories:

Block Earner Forges Ahead with Crypto-Backed Loans Despite Legal Battle with Regulator

Singapore’s MAS Maintains Strict Stance on Crypto Participation in Regulatory Sandbox

Ant Group Unveils ZAN Sub-Brand for Web3 Blockchain Development Services

Australian fintech firm Block Earner is moving forward with its plans to launch a crypto-backed loans product, despite facing an upcoming court date with the financial regulator over alleged unlicensed financial product offerings.

This new crypto loan offering allows Australian crypto investors to leverage their digital assets as collateral for cash loans.

Similarly, SALT, a lending platform based in Colorado, provides crypto-backed loans to U.S. clients, while Coinbase previously offered a similar service to its U.S. customers before discontinuing it in May this year.

Block Earner’s initial rollout of this crypto loan product is slated for the end of September, initially supporting loans using Bitcoin as collateral.

The co-founder of Block Earner, Charlie Karaboga, has emphasized that these loan products have been meticulously designed to align with existing licensing models in a cautious manner.

Karaboga’s firm faced legal troubles last November when it was sued by the Australian Securities and Investments Commission for allegedly offering crypto-linked fixed-yield earning products without an Australian Financial Services (AFS) license.

At that time, Karaboga criticized the regulator for its lack of clarity and asserted that Block Earner had diligently developed products in line with ASIC’s guidelines.

Karaboga explained that Block Earner’s regulatory challenges and actions against competitor Finder appeared to be reactionary, possibly linked to the collapse of FTX in November.

However, Block Earner decided to close its “earn” products and refund all users in response to ASIC’s legal actions.

READ MORE: Sam Bankman-Fried’s Bail Revocation Upheld Amid Witness Tampering Concerns

Learning from past experiences, James Coombes, the head of business at Block Earner, stated that the new product launch had already obtained the necessary Australian credit license, distinguishing it from the earlier “Earn” product.

Looking ahead, Karaboga anticipates that rapid regulatory advancements in jurisdictions like Singapore, Hong Kong, and the United Kingdom will compel the Australian government to keep pace or risk losing its share of the crypto enterprise market.

He expects increased regulatory clarity in the next 12 to 18 months.

Karaboga emphasized that Australia’s high per-capita GDP and its early adoption of crypto technology have made its citizens prime targets for scammers.

Nonetheless, he believes that domestic regulators are pro-crypto and inclined to support innovation in the industry.

Binance Australia General Manager Ben Rose shares this view, expressing confidence that Australian regulators will favor crypto in the long run.

Furthermore, Coinbase’s recent listing of Australia as a primary expansion location outside the U.S. underscores the country’s growing significance in the crypto space.

Block Earner’s Federal Court hearing is scheduled for November, with a decision expected by January.

Other Stories:

Former OpenSea Manager Chooses Prison as Insider Trading Appeal Looms

Self-Custody Platform Enhances User Privacy with New ETH Pay Wallet Relay Feature

Race for First U.S. Ethereum ETF Heats Up as CBOE Files 19b-4 Applications