Sam Bankman-Fried, the founder and former CEO of the now-defunct cryptocurrency exchange FTX, has submitted a memorandum on September 1st, urging the court to reject the in limine requests put forth by the United States Department of Justice (DOJ).

Drafted by SBF’s attorney Mark Cohen, the memorandum asserts that the DOJ’s requests are not only unfounded but also overly broad.

Cohen contends that several of the issues raised by the government are not appropriate for consideration at the current stage of the proceedings.

Furthermore, he highlights that the requests seek to introduce irrelevant and prejudicial evidence related to uncharged or past conduct.

This tactic is perceived as an attempt to weaken potential defense strategies and to admit a wide array of hearsay and other inappropriate evidence.

The memorandum goes on to assert that the prosecutor’s requests lack legal support and are practically unworkable, rendering them unfit for approval.

This memorandum follows a series of recent filings by the DOJ, wherein they requested the court’s intervention in multiple aspects of the case.

READ MORE: Ripple Challenges SEC’s Appeal Bid, Asserting Insufficient Grounds in Ongoing Lawsuit

On August 28th, the government motioned to disallow all of SBF’s proposed expert witnesses from testifying during the trial.

The DOJ argued that these experts and their accompanying disclosures were plagued by various shortcomings, warranting their exclusion from the proceedings.

A day later, on August 29th, the prosecutor submitted yet another motion, describing SBF’s defense against fraud allegations as “irrelevant” in its present state.

They requested additional disclosures to supplement the already planned defense strategy.

Concurrently, SBF’s legal team has been advocating for his temporary release, asserting that the provided accommodations are inadequate for adequately preparing for the trial scheduled for October.

Additionally, they are in the process of appealing the court’s decision to revoke SBF’s bail, a determination made on August 11th.

The defense argues that the bail revocation was an act of “retaliation” in response to SBF’s exercise of his First Amendment rights.

Other Stories:

Warren Buffett’s Strategy vs. Bitcoin: Analyzing Performance and Potential in a Shifting Landscape

Former SEC Chair Expresses Confidence in Eventual Approval of Spot Bitcoin ETFs

MakerDAO Co-Founder Proposes Solana Codebase for NewChain, Diverging from Ethereum Affiliation

Binance CEO Changpeng “CZ” Zhao envisions a future where decentralized finance (DeFi) surpasses centralized finance (CeFi) during the upcoming bull market.

Speaking on a live X Spaces event (formerly Twitter Spaces) on September 1, CZ expressed his optimism about DeFi’s trajectory.

He emphasized that an increasingly decentralized industry would be beneficial and indicated that DeFi’s trading volumes, currently comprising 5% to 10% of CeFi volumes, could soon eclipse CeFi:

“Crypto’s future lies in DeFi; with its volume accounting for a significant portion of CeFi trading, the forthcoming bull run could potentially elevate DeFi beyond CeFi.”

In early June, following legal actions against centralized exchanges Coinbase and Binance by the U.S. Securities and Exchange Commission (SEC), the trading volume on the top three decentralized exchanges (DEXs) surged by 444% within 48 hours.

At present, DEXs exhibit a combined 24-hour trading volume of $722,776,226.

CZ also praised the recent dismissal of a lawsuit against decentralized protocol Uniswap. He found the outcome to be reasonable, logical, and positive.

On August 30, a U.S. federal court rejected a class-action lawsuit against Uniswap, highlighting that regulatory uncertainty impacts investor protection.

READ MORE; MakerDAO Co-Founder Proposes Solana Codebase for NewChain, Diverging from Ethereum Affiliation

The case centered on plaintiffs’ claims of losses due to scam tokens on the decentralized exchange.

During the event, a participant recalled a judge’s ruling that developers cannot be held accountable for misuse of DeFi platforms, a stance deemed favorable for DeFi builders. CZ concurred, asserting that code written by developers is a form of free speech and emphasized the significance of developer support.

Recent data suggests a shift in venture capital investments from CeFi to DeFi projects. A March 1 CoinGecko report revealed that investment firms directed $2.7 billion towards DeFi initiatives in 2022, marking a 190% increase from 2021.

Concurrently, investments in CeFi projects declined by 73% to $4.3 billion during the same period.

This trend potentially indicates DeFi’s emergence as the new high-growth domain within the crypto sector, while the waning investments in CeFi could be attributed to saturation.

Changpeng Zhao’s outlook on DeFi’s potential dominance in the forthcoming bull market resonates with the ongoing shifts in the crypto landscape, with decentralized finance poised to redefine the industry’s dynamics.

Other Stories:

Ripple Challenges SEC’s Appeal Bid, Asserting Insufficient Grounds in Ongoing Lawsuit

Warren Buffett’s Strategy vs. Bitcoin: Analyzing Performance and Potential in a Shifting Landscape

Former SEC Chair Expresses Confidence in Eventual Approval of Spot Bitcoin ETFs

Bitcoin (BTC) closed the week below the $26,000 mark on Sep. 3, despite a dismissive stance on overly pessimistic trader sentiment by analysts.

Data derived from Cointelegraph Markets Pro and TradingView revealed that BTC exhibited minimal volatility over the weekend, maintaining a narrow range of $200.

The lack of definitive direction led to a feeling of déjà vu among market participants, reminiscent of the behavior observed during the previous month’s August closing.

The effects of two major volatility-inducing events from the previous week, involving Grayscale, a crypto asset manager, and regulators in the United States, were wiped clean from the charts. Consequently, traders evaluated the potential implications of different levels of weekly closure.

Prominent trader Skew offered insight into the market structure by highlighting the absence of a candle body closure below the Higher Low (HL) established in June, or below the $25.9K mark.

He stressed the significance of this point, suggesting that a 1-week closure below and subsequent price resistance in this range could lead to a downward move towards the prior 1-week resistance at approximately $24.3K.

READ MORE: Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

Looking ahead, Skew presented a “bearish scenario” that could bring about levels below $20,000.

Conversely, he expressed skepticism regarding a bullish revival that would involve reclaiming the $26,000 level and maintaining a higher low into the fourth quarter of the year.

Summarizing the events of the previous week, Keith Alan, co-founder of Material Indicators, advised against making definitive judgments on Bitcoin’s bullish or bearish nature.

He acknowledged the recent volatility resulting from Grayscale’s legal victory over the SEC and the SEC’s decision to delay judgment on the first U.S. Bitcoin spot price exchange-traded funds (ETFs).

Alan contended that despite these external events, the fundamental structure of the Bitcoin market remained unaltered.

He emphasized that neither a confirmed breakout nor a breakdown had occurred from a technical perspective, citing $24,750 as the crucial support zone to monitor.

A chart accompanying his analysis depicted the BTC/USD order book on Binance, showing increased buy liquidity just below the spot price at the $24,750 zone of interest.

Other Stories:

Crypto Community Joins Forces with Oprah and The Rock

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Decentralized finance (DeFi) has revolutionized the financial landscape, offering an array of innovative services challenging traditional finance (TradFi).

However, the main stumbling block to widespread DeFi adoption remains the user experience.

The DeFi sector has long sought an entry point to onboard new users effectively.

A potential solution to this issue lies in the realm of fintech.

By creating a financial technology app that caters to both TradFi and DeFi users, it becomes possible to showcase the advantages of self-custody—where users safeguard their digital assets without relying on intermediaries like banks.

While the self-custody movement gained momentum, the Web3 space introduced hybrid services that merge elements of centralized and decentralized finance.

Changex, an all-in-one mobile wallet, embraces this approach through its CeDeFi model, providing users from traditional services a familiar environment.

Changex’s app facilitates non-custodial crypto trading, empowering users to retain control of their crypto assets.

It supports buying, selling, and transferring crypto, even enabling debit card and bank transfer purchases.

Multiple blockchains, including Ethereum, Polygon, and Binance Smart Chain, are seamlessly integrated into the exchange.

READ MORE; Crypto Community Joins Forces with Oprah and The Rock

For DeFi enthusiasts, Changex offers a range of alternative financial practices such as staking, with plans to introduce lending and stablecoin interest features.

The platform’s native token, CHANGE, provides additional APR on staking rewards.

The app is also making strides in bridging the gap between traditional finance and the crypto world.

It plans to issue European Union-regulated IBANs for fiat asset management, facilitating cross-border transactions within the EU.

Moreover, the upcoming Changex Visa Debit Card promises cashback benefits and the ability to spend staked assets without affecting APR.

Changex’s selection by Cointelegraph Accelerator underscores its expertise, boasting a team of over 20 members, a Bulgaria office, and a track record of delivering robust financial solutions.

With an average of 25,000 monthly active users and nearly $3 million in staked assets, the platform has gained strong traction.

The roadmap ahead includes the integration of the Avalanche blockchain, accompanied by Avalanche-based staking pools.

Additionally, Changex plans to introduce a unique leveraged staking feature.

The forthcoming Changex Visa Debit Card and IBAN, scheduled for Q4 2023, represents a major update.

This release aims to provide users complete control over their finances, solidifying Changex as a comprehensive one-stop solution for both crypto and fiat needs.

Other Stories:

Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

Amid ongoing speculation regarding a potential resolution between Ripple and the United States Securities and Exchange Commission (SEC),

John Deaton, a prominent advocate for XRP and proponent of its legality, has outlined potential steps that Ripple and the SEC might take if they decide to pursue a settlement.

Deaton emphasized the importance of the ongoing legal battle between Coinbase and the SEC.

He pointed out that if the judge overseeing the Coinbase case grants the exchange’s motion to dismiss, it could establish a precedent indicating that token sales conducted on exchanges might not fall under U.S. securities regulations.

However, Deaton clarified that such a ruling would not necessarily apply to cryptocurrency staking activities.

In his analysis, Deaton stated, “The only plausible scenario for a Ripple-SEC settlement before year-end would be if Judge Failla endorses the Coinbase motion or partially approves it, signifying that token sales executed on an exchange, involving blind bid/ask transactions, may not be subject to U.S. securities regulations.”

Should the motion to dismiss receive approval, the SEC’s ability to pursue an appeal would be substantially limited, making a settlement a pragmatic consideration.

Deaton further explained that even if the SEC were to pursue an appeal in this context, its regulatory authority would likely be diminished.

READ MORE: Ripple Challenges SEC’s Appeal Bid, Asserting Insufficient Grounds in Ongoing Lawsuit

In a recent filing on September 1, Ripple indicated that the summary judgment failed to adequately address the legal foundation for an interlocutory appeal.

Ripple’s opposition to the judgment was rooted in its argument that the SEC had deviated from established legal norms, particularly with regard to applying the Howey test to determine whether XRP token sales qualify as securities.

The SEC had originally filed a lawsuit against Ripple, CEO Brad Garlinghouse, and co-founder Chris Larsen in December 2020, triggering several exchanges to delist XRP to avoid potential legal liabilities.

However, a favorable ruling by Judge Analisa Torres in July led numerous exchanges to express their intentions to relist the XRP token.

Throughout 2023, the SEC has pursued various cryptocurrency firms over allegations of securities violations, including notable names like Binance and Coinbase.

Notably, on August 29, asset manager Grayscale achieved a legal victory against the SEC through an appeal, compelling a reevaluation of its application for a Bitcoin exchange-traded fund in the spot market.

Other Stories:

MakerDAO Co-Founder Proposes Solana Codebase for NewChain, Diverging from Ethereum Affiliation

Former SEC Chair Expresses Confidence in Eventual Approval of Spot Bitcoin ETFs

Warren Buffett’s Strategy vs. Bitcoin: Analyzing Performance and Potential in a Shifting Landscape

Former chair of the United States Securities and Exchange Commission (SEC), Jay Clayton, remains optimistic about the eventual approval of spot Bitcoin exchange-traded funds (ETFs), despite recent delays in decision-making.

In a recent interview with CNBC on September 1st, Clayton noted that the backing of major financial institutions in the realm of spot Bitcoin investments signals a notable shift in providing retail investors with access to cryptocurrency exposure.

The SEC’s recent move to extend the review period for various spot BTC ETF applications from prominent entities such as BlackRock, WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, and Fidelity, was observed on August 31st.

This extension grants the commission an additional 45 days, following the notice’s publication in the Federal Register, to either approve, reject, or further delay the ETF applications from these influential firms.

Clayton expressed his belief in the forward momentum of these efforts, indicating that progress can be expected as the process unfolds.

The SEC retains the flexibility to extend the application deadlines until March 2024.

READ MORE: Bitwise Surprises Market by Withdrawing Bitcoin and Ether ETF Application Amid SEC Delays

Clayton emphasized that he envisions an “inevitable” approval for spot Bitcoin ETFs, highlighting the disparity between futures products and cash products, and asserting that this divergence cannot persist indefinitely.

Notably, Clayton’s viewpoint resonates with that of U.S. Court of Appeals Circuit Judge Neomi Rao.

In a recent ruling, Rao and two other judges directed the SEC to reevaluate the application of asset manager Grayscale, seeking to transform its Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

Rao highlighted that the SEC had previously greenlit BTC futures ETFs, implying a similarity between Grayscale’s proposition and the approved futures products.

The sequence of ETF application delays took place in rapid succession on August 31st, just prior to the Labor Day holiday weekend in the United States.

The following key deadline for the assessment of significant spot BTC applications is scheduled for October 7th, at which point the commission is expected to provide updates regarding the proposed offering from fund manager Global X.

Other Stories:

Robinhood Acquires Over 55 Million Shares From Former FTX CEO SBF in $606 Million Deal

UK MPs Call for Global Alliance to Safeguard Against AI Misuse and Deepfakes

MakerDAO co-founder Rune Christensen has proposed a novel direction for the decentralized finance project’s upcoming native chain, “NewChain.”

Contrary to its longstanding affiliation with the Ethereum Virtual Machine (EVM), Christensen’s proposal suggests building NewChain using a fork of Solana’s codebase.

This initiative forms a pivotal part of the fifth and final phase of the MakerDAO “Endgame” upgrade, an undertaking announced in May.

Spanning approximately three years, this phase is slated to culminate in a comprehensive reimagining of the Maker protocol, effectively transferring it onto a distinct stand-alone blockchain.

In a recent post on X (formerly Twitter) on September 1, Christensen endorsed Solana’s codebase as a prime contender for NewChain’s foundation.

The co-founder listed three crucial reasons justifying this choice in a proposal articulated on the MakerDAO forum.

Primarily, he lauded the technical excellence exhibited by Solana’s codebase, extolling its exceptional optimization geared toward facilitating the operation of an exceedingly efficient blockchain.

Christensen emphasized how the design of Solana’s codebase benefited from hindsight, born after the intricacies and challenges of blockchain technology had been comprehensively grasped.

He noted the alignment of this attribute with NewChain’s objective to rectify the technical debt accrued by Maker.

Furthermore, Christensen emphasized the resilience displayed by the Solana ecosystem, having withstood trials such as the FTX blowup and other adversities without succumbing.

READ MORE: Ronaldinho Denies Involvement in Alleged $61 Million Crypto Pyramid Scheme

He believed that this robustness bodes well for the enduring presence of the Solana ecosystem, fostering a repository of skilled professionals accessible to Maker for collaboration, while also serving as an economically viable avenue for NewChain’s construction and maintenance.

Lastly, Christensen underscored the adaptability of the Solana codebase, citing instances where it had been successfully forked and adapted to function as appchains.

He proposed that MakerDAO could follow a similar path in the development of NewChain.

Christensen engaged with questions on Twitter about his preference for Solana’s codebase over the EVM.

While acknowledging the EVM’s significance for user-oriented development, he clarified that the EVM did not align with the specific backend requirements unique to MakerDAO.

NewChain’s role is to serve as a backend infrastructure for SubDAO tokenomics and governance security.

Conversely, the governance token Maker and the stablecoin Dai will persistently operate on Ethereum’s platform, ensuring seamless continuity.

Rune Christensen’s audacious proposal to build NewChain on the Solana codebase signifies a noteworthy departure from MakerDAO’s historical ties to Ethereum.

As the “Endgame” upgrade evolves, the community eagerly awaits the realization of NewChain and its potential impact on the decentralized finance landscape.

Other Stories:

OKX Cryptocurrency Exchange Expands into India, Focusing on Web3 Potential and Local Talent

US Crypto Industry Sees Hope in Court Rulings Restraining SEC

Ethereum Liquid Staking Providers Embrace 22% Cap to Safeguard Decentralization

Bitwise, the asset management company, has taken a surprising step by retracting its application for the Bitcoin and Ether Market Cap Weight Strategy exchange-traded fund (ETF) that was initially submitted to the U.S. Securities and Exchange Commission (SEC) on August 3rd.

Despite the recent optimism in the market due to Grayscale’s victory with the SEC, Bitwise seems to be reconsidering its approach.

The withdrawal of the ETF application was unexpected, with a statement in the filing indicating that the fund’s objective was to provide capital appreciation but with no guaranteed outcome.

Matt Hougan, the Chief Investment Officer of Bitwise, had recently voiced his support for SEC approval of all ETFs in an interview with Bloomberg.

The ETF in question had planned to invest in either Bitcoin futures contracts or Ether futures contracts, based on their respective market capitalizations.

Bitwise had also joined forces with ProShares to launch a similar ETF around the same period.

Bitwise clarified in the withdrawal statement that the Trust no longer intended to pursue the effectiveness of the Fund, and no securities had been or would be sold in relation to the mentioned Post-Effective Amendment to the Trust’s Registration Statement.

The SEC has postponed its decisions on Bitcoin ETF applications from various firms, including WisdomTree, Invesco Galaxy, Valkyrie, VanEck, BlackRock, Bitwise, and Fidelity.

READ MORE: Ronaldinho Denies Involvement in Alleged $61 Million Crypto Pyramid Scheme

As per a filing dated August 31st, the commission has extended the review period for spot Bitcoin ETF applications from WisdomTree, VanEck, Invesco Galaxy, Bitwise, and Valkyrie, along with Fidelity’s Wise Origin Bitcoin Trust and BlackRock’s Bitcoin ETF.

The upcoming SEC deadlines are scheduled for mid-October, but there’s a possibility of further delays to the third batch of deadlines in January or the ultimate decision dates in the subsequent months.

Bitwise had been among the early firms to apply for Bitcoin ETFs with the SEC.

Their initial application in January 2019 aimed to launch a BTC-backed ETF tied to the Bitwise Bitcoin Total Return Index, calculated based on Bitcoin values from exchange transactions.

The proposed ETF was designed to aggregate data from multiple cryptocurrency exchanges, offering a reliable representation of the broader cryptocurrency market.

Additionally, the company intended to have third-party custodians responsible for physically safeguarding the Bitcoin.

This isn’t the first time Bitwise has withdrawn an application.

Earlier this year, the firm submitted an application for an Ethereum Strategy ETF targeting both front-time and back-time Ethereum futures but withdrew it just a week later.

Other Stories:

OKX Cryptocurrency Exchange Expands into India, Focusing on Web3 Potential and Local Talent

US Crypto Industry Sees Hope in Court Rulings Restraining SEC

Ethereum Liquid Staking Providers Embrace 22% Cap to Safeguard Decentralization

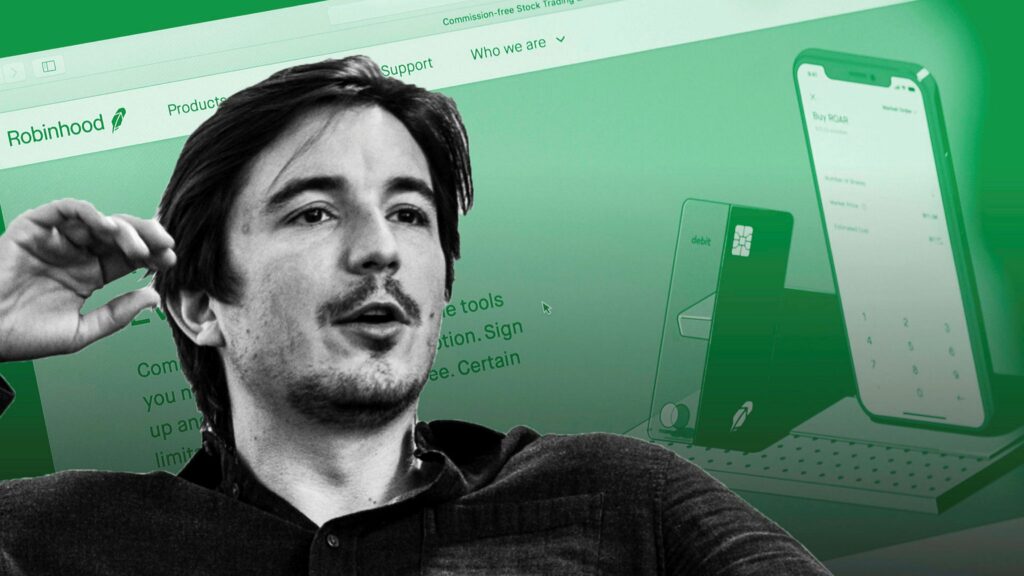

Robinhood, the cryptocurrency and stock trading platform, has made a significant move by acquiring over 55 million shares that were formerly owned by Sam Bankman-Fried, known as SBF, the ex-CEO of FTX.

In a recent blog post on August 31, Robinhood disclosed that it successfully completed the purchase of 55,273,469 shares for an estimated cost of $606 million, following an official filing with the U.S. Securities and Exchange Commission (SEC).

These shares were originally held by Bankman-Fried and Gary Wang through their company Emergent Fidelity Technologies, but were confiscated by the U.S. Department of Justice in January.

The acquisition had been anticipated, as Robinhood’s board of directors had approved the deal in the company’s Q4 2022 report.

An SEC filing on August 30 confirmed that the U.S. District Court for the Southern District of New York had granted approval for the purchase, liberating the shares from any claims, liens, or encumbrances.

The transaction was facilitated through an agreement with the U.S. Marshals Service.

Jason Warnick, the Chief Financial Officer of Robinhood, expressed satisfaction with the successful completion of the share acquisition.

He voiced the company’s eagerness to continue realizing growth plans for the benefit of both its customers and shareholders.

READ MORE: Ronaldinho Denies Involvement in Alleged $61 Million Crypto Pyramid Scheme

Bankman-Fried’s holding company, Emergent Fidelity Technologies, filed for bankruptcy in February, with its financial troubles exacerbated by its involvement with crypto lending firm BlockFi.

The latter faced its own bankruptcy situation following the downfall of FTX.

Notably, BlockFi had initiated legal action to claim ownership over the 55 million Robinhood shares that had been pledged as collateral.

This situation unfolded amid bankruptcy proceedings for FTX, and legal battles involving SBF, BlockFi, and FTX creditor Yonathan Ben Shimon over control of the approximately $600 million worth of Robinhood shares.

Bankman-Fried’s legal team argued that he had a right to these assets to fund his criminal defense.

Following the revocation of his bail on August 11, Bankman-Fried has been in custody, awaiting his first trial scheduled to commence on October 3.

In response to the acquisition news, the value of Robinhood shares on the Nasdaq stock exchange witnessed a rise of around 4%, climbing from $10.85 to $11.34.

Additionally, recent findings from crypto experts unveiled that Robinhood possessed the fifth-largest Ether wallet, with an estimated value surpassing $2.5 billion.

This development further underlines Robinhood’s presence and engagement in the cryptocurrency landscape.

Other Stories:

OKX Cryptocurrency Exchange Expands into India, Focusing on Web3 Potential and Local Talent

Ethereum Liquid Staking Providers Embrace 22% Cap to Safeguard Decentralization

US Crypto Industry Sees Hope in Court Rulings Restraining SEC

Bitwise, the asset management firm, has taken an unexpected step by withdrawing its application for a Bitcoin and Ether Market Cap Weight Strategy exchange-traded fund (ETF) from the United States Securities and Exchange Commission (SEC).

Initially filed on August 3, the move came as a surprise given the recent positive market sentiment following Grayscale’s success with the SEC.

The withdrawal statement contained a cautious tone, stating that while the fund aimed to achieve capital appreciation, there were no guarantees of meeting this investment objective.

Matt Hougan, Bitwise’s chief investment officer, had recently voiced support for SEC approval of all ETFs in a Bloomberg interview.

The ETF in question was designed to invest in either Bitcoin or Ether futures contracts, selected based on their respective market capitalizations.

In conjunction with ProShares, Bitwise had also planned to launch another ETF around the same time.

Bitwise clarified in the withdrawal statement that the Trust had abandoned its plans to pursue the effectiveness of the Fund.

The Trust did not sell or intend to sell any Fund securities as part of the process.

This development aligns with the SEC’s continued delay in deciding on various Bitcoin ETF applications, including those from WisdomTree, Invesco Galaxy, Valkyrie, VanEck, BlackRock, Bitwise, and Fidelity.

READ MORE: BlockFi Advances Fund Recovery Efforts with Court Application

The SEC’s recent filing on August 31 disclosed an extended review timeline for several spot Bitcoin ETF applications.

WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, Fidelity’s Wise Origin Bitcoin Trust, and BlackRock’s Bitcoin ETF face a longer evaluation period.

Upcoming deadlines for the SEC are set for mid-October, but potential delays could push them to the third batch of deadlines in January or to final decisions in the subsequent months.

Bitwise had previously been at the forefront of asset management firms seeking Bitcoin ETF products.

Its initial application in January 2019 aimed to create a BTC-backed ETF tracking the Bitwise Bitcoin Total Return Index, derived from BTC transaction values across various exchanges.

The firm’s proposal sought to provide a reliable representation of the broader cryptocurrency market, with data sourced from multiple cryptocurrency exchanges.

Additionally, third-party custodians were to be responsible for physically holding Bitcoin.

Notably, this is not Bitwise’s first ETF withdrawal. Earlier this year, the company pulled back an application for an Ethereum Strategy ETF.

The ETF had been designed to invest in both front-time and back-time Ethereum futures, but the withdrawal occurred only a week after the initial application was submitted.

Other Stories:

South Korean Parliamentary Subcommittee Rejects Expulsion Motion Over Cryptocurrency Controversy

Bitcoin Holds Strong Above $27,000 as Traders Maintain Bullish Outlook

BlockFi Advances Fund Recovery Efforts with Court Application