The parliamentary ethics subcommittee in South Korea has voted against the expulsion of Kim Nam-kuk, a former member of the Democratic Party, the main opposition group.

This decision was reported by the local news agency Yonhap on August 30.

On August 29, the subcommittee dismissed the motion to expel Kim Nam-kuk, with a 3-3 split between the ruling People Power Party (PPP) and the Democratic Party (DP).

The motion required a majority vote to be approved, which did not materialize.

This move comes after Kim faced significant backlash earlier this year due to revelations that he possessed over $4.5 million worth of Wemix (WEMIX) tokens, developed by South Korean blockchain game creator Wemade.

The Wemix tokens had been tradable on major South Korean exchanges until a local court ordered their removal from platforms in late 2022.

Kim’s ownership of Wemix tokens raised serious concerns about potential conflicts of interest, misuse of insider information, and potential involvement in money laundering.

This controversy played a role in expediting the creation of a legal framework mandating that officials disclose their cryptocurrency holdings, including assets like Bitcoin (BTC), in South Korea.

READ MORE: Argo Blockchain Shows Resilience with 50% Reduction in Half-Year Losses

The requirement for cryptocurrency holdings disclosure is not unique to South Korea.

In July, the country’s Financial Services Commission introduced a new bill stipulating that all companies issuing or possessing cryptocurrencies must disclose their holdings starting from 2024.

In another cryptocurrency-related development, the city of Cheongju in South Korea announced in mid-August that it would initiate the seizure of cryptocurrencies from local tax defaulters.

This initiative compels cryptocurrency exchanges such as Upbit and Bithumb to report on these individuals who have failed to meet their tax obligations.

In conclusion, South Korea’s parliamentary ethics subcommittee’s rejection of the motion to expel Kim Nam-kuk, despite concerns surrounding his cryptocurrency holdings, reflects the ongoing debate and regulatory efforts in the country regarding the transparency and accountability of cryptocurrency-related activities.

This decision aligns with broader initiatives to enhance disclosure and monitoring of cryptocurrency assets within South Korea’s regulatory framework.

Other Stories:

Europe Welcomes First-Ever Bitcoin ETF

Shibarium Surpasses 100,000 Wallets in 24 Hours Post-Relaunch

Anticipation Grows as Bitcoin Halving Nears, Experts Predict Surge Beyond $100,000

Decentralized exchange (DEX) platform dYdX is set to unlock approximately $14.02 million worth of its native DYDK tokens, distributing them across its community treasury, as well as offering rewards to traders and liquidity providers.

Scheduled for August 29, dYdX plans to release 6.52 million tokens, equivalent to 3.76% of the total circulating supply of DYDX.

Among these, a portion of 2.49 million DYDX tokens, valued at $5.36 million, will be assigned to the community treasury.

This fund will support various initiatives, including grants for contributors, community-driven projects, and liquidity mining efforts.

The remaining 4.03 million DYDX tokens will be divided between liquidity provider rewards and trading rewards.

Liquidity providers are set to receive 1.15 million tokens, totaling $2.47 million, while trading rewards will be granted 2.88 million tokens valued at $6.18 million.

This initiative follows a previous unlock event on August 1, which followed a similar fund allocation pattern.

Insights from TokenUnlocks reveal that investors hold the largest share at 27.7%, trailed by trading rewards at 20.2%, and the community treasury at 16.2%.

READ MORE: Hashdex Challenges Status Quo with Innovative Approach in Pursuit of Bitcoin ETF Approval

DYDX has a total token supply capped at 1 billion tokens, with over 75% of these tokens currently locked.

Antonio Juliano, the founder of DYdX, has recently advised cryptocurrency entrepreneurs to explore opportunities in international markets beyond the United States.

Juliano underlines that crypto startups could experience accelerated growth in more accommodating foreign markets.

He suggested that, given the challenges and compromises associated with serving US customers, crypto builders should temporarily divert their focus away from the US market and consider re-entry after 5-10 years.

Juliano emphasizes that a substantial portion of the crypto market is situated overseas, thus encouraging innovators to discover product-market fit and innovate in these regions before returning to the US market with increased leverage.

Juliano’s perspective arises from the sluggish progress of US crypto regulation.

He believes that the crypto sector’s influence on US policy would strengthen with further growth and development.

Other Stories:

Casino Gender: Which Games Do Men and Women Prefer?

Former FTX CEO Sam Bankman-Fried’s Legal Team Deems Trial Preparations Inadequate

Three Former Team Members Accused of $16 Million Theft from Pepecoin (PEPE) Multisig Wallet

Argo Blockchain, a prominent player in the mining industry, grappled with adverse market conditions and intense competition, culminating in a reported loss of $18.8 million during the first half of 2023.

This figure marked a significant improvement, showcasing a 50% reduction compared to the $39.6 million loss in the same period in 2022.

The company’s efforts to enhance its financial position were evident as it successfully curtailed its debt by $4 million over the course of 2023, leaving a total debt of $75 million.

This achievement underscores a remarkable $68 million debt reduction since June 2022, when the company’s debt had reached $143 million.

Revenues followed a downward trajectory, declining by 31% in comparison to the first half of 2022.

Argo attributed this decline, which resulted in $24 million in revenue midway through 2023, to a drop in the value of Bitcoin (BTC) as well as an upswing in the global hash rate and the resultant network difficulty.

The mining company’s operational statistics indicated a slight increase of 1% in mined BTC, totaling 947 BTC, during the initial half of the year, in contrast to the same period in 2022. It’s noteworthy that the global hash rate surged by 78% in 2023.

As of June 2023, Argo’s financial statement displayed $9.1 million in cash holdings along with 46 BTC.

A pivotal moment in the latter part of 2022 saw Argo secure $7.5 million in gross proceeds through a share placement, attracting both institutional and retail investors.

Although facing the specter of bankruptcy in late 2022, Argo’s interim results for 2023 indicate a resolute intent to enhance its total hash rate capacity to 2.8 exahashes per second (EH/s).

READ MORE: Casino Gender: Which Games Do Men and Women Prefer?

This expansion plan entails deploying 1,628 BlockMiners at its mining facilities located in Quebec.

Furthermore, the company revealed its ongoing discussions regarding the sale of “certain non-core assets” as part of its strategy to mitigate overall debt.

Notably, a transformative sequence of transactions transpired between Argo and Galaxy Digital, involving the sale of the Helios mining facility and associated property for $65 million in December 2022.

This was followed by a strategic refinancing move, resulting in a new $35 million, three-year asset-backed loan with Galaxy, effectively reducing Argo’s total indebtedness by $41 million and streamlining its operational structure.

Matthew Shaw, Chairman of Argo’s board, emphasized the importance of maintaining a sizable fleet of over 27,000 miners, with a significant portion operating through an agreement with Galaxy at the Helios site.

These developments unfolded subsequent to Argo’s financial predicament in late 2022, which prompted the collaboration with Galaxy.

The aftermath of this partnership saw the resignation of Argo’s former CEO, Peter Wall.

Other Stories:

Hashdex Challenges Status Quo with Innovative Approach in Pursuit of Bitcoin ETF Approval

Three Former Team Members Accused of $16 Million Theft from Pepecoin (PEPE) Multisig Wallet

Former FTX CEO Sam Bankman-Fried’s Legal Team Deems Trial Preparations Inadequate

Hong Kong’s HashKey cryptocurrency exchange is gearing up to introduce Bitcoin and Ether trading services for retail clients from August 28, as reported by local media.

A unique feature of this offering is that investors can allocate a maximum of 30% of their total net worth to cryptocurrencies on the platform.

This milestone achievement was made possible after HashKey successfully upgraded two significant licenses granted by the Securities and Futures Commission (SFC) of Hong Kong, becoming the first crypto exchange in the region to gain regulatory approval for extending crypto trading services to retail investors.

The initial license, classified as Type 1, empowered HashKey to establish a virtual asset trading platform within the boundaries of Hong Kong’s securities regulations.

The second license, referred to as Type 7, bestowed the exchange with the authority to furnish automated trading services to both individual and institutional users.

Following suit, OSL, another crypto platform, also secured the SFC’s green light to introduce retail trading services for Bitcoin and Ether.

This strategic move has positioned Hong Kong as one of the pioneering jurisdictions that officially permit cryptocurrency retail trading in accordance with the law.

READ MORE: New DeSo Network Friend.tech Generates Over $1 Million in 24 Hours

Hong Kong embarked on a journey to cultivate a crypto-friendly atmosphere within its borders in 2023. Financial Secretary Paul Chan expressed the government’s and regulators’ commitment to fostering a flourishing crypto and fintech ecosystem.

In March, over 80 crypto firms expressed their intent to establish a presence in the region.

The Hong Kong Monetary Authority (HKMA) further endorsed this stance by urging banks to facilitate services for cryptocurrency enterprises.

By May, HKMA unveiled a licensing structure for crypto platforms, with a deadline set for June 1.

Subsequently, a few crypto platforms received the nod to extend crypto trading facilities to both retail and institutional clientele by August.

The significance of a robust regulatory framework that safeguards investor interests is particularly evident in Hong Kong’s case.

HashKey’s decision to limit retail traders to Bitcoin and Ether underscores the exchange’s commitment to meeting their needs while ensuring prudential standards are maintained.

Despite attempts to solicit comments, HashKey remained unresponsive to inquiries from Cointelegraph as of the time of publication.

Other Stories:

Bitget Cryptocurrency Exchange Enhances KYC Procedures to Align with Global Regulations

Ordinal Inscriptions Maintain Dominance on Bitcoin Network Despite Price Dip

UK Prime Minister Allocates £100 Million to Acquire Computer Chips for AI Advancement

Yuga Labs, the creator of the Bored Ape Yacht Club (BAYC), is preparing to reduce its support for OpenSea due to the imminent removal of the Operator Filter, a tool designed to enforce on-chain royalties.

Introduced in November 2022, the Operator Filter allowed creators to limit secondary sales of nonfungible tokens (NFTs) to marketplaces that upheld creator royalties, effectively excluding platforms like Blur.

Nonetheless, OpenSea disclosed on August 17 that it would discontinue the tool by the end of the month.

The rationale cited a lack of widespread adoption within the ecosystem, instances of platforms bypassing the tool, and opposition from creators.

Responding to this decision, Yuga Labs CEO Daniel Alegre posted an announcement on X (previously known as Twitter), revealing the gradual phasing out of their reliance on OpenSea’s Seaport marketplace smart contract.

In his statement, Alegre outlined that Yuga Labs would initiate the process of winding down support for Seaport across upgradable contracts and new collections.

The objective is to complete this transition by February 2024, aligning with OpenSea’s strategy.

Alegre underlined Yuga Labs’ commitment to safeguarding creator royalties and ensuring fair compensation for their creative efforts.

The BAYC community responded positively to Alegre’s announcement, with prominent content creators and NFT project founders, including EllioTrades and Alex Becker, voicing their support.

READ MORE: Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

The CEO and co-founder of the Forgotten Runes Wizards Cult NFT project, dotta, lauded Yuga Labs for taking a leading role in championing the cause of creator royalties.

This move also garnered interest from Luca Netz, CEO of the Pudgy Penguins NFT project, who commended Yuga Labs and suggested they might follow suit.

Netz indicated a willingness to engage in dialogue about enforcing creator royalties, as highlighted in a post by Coinbase NFT.

The question of whether to uphold and enforce creator royalties has ignited debates within the NFT community over the past year.

Initially, enforcing creator royalties was the norm during the NFT boom in 2021.

However, platforms like Blur disrupted the scene in October 2022, gaining significant market share by offering zero trading fees and an optional creator royalty payment structure.

Consequently, trading fees and royalty percentages experienced a general decline as marketplaces competed for user adoption.

The NFT community now finds itself divided between proponents of the cost-effective trading approach offered by platforms like Blur, advocating for diverse creator compensation models, and those advocating unwaveringly for royalty payments as a necessity.

Other Stories:

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Stellar Development Foundation Invests in MoneyGram International

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

Shiba Inu’s layer-2 Shibarium network has successfully resumed block production after a temporary suspension of transactions that lasted nearly a full day.

The block explorer Shibariumscan.io confirms that the layer-2 blockchain, Shibarium, is back online and actively generating blocks.

The pause in operations was triggered by an unexpected surge in traffic shortly after the mainnet launch, which prompted the network to activate a fail-safe mode to protect user funds.

Lead developer Shytoshi Kusama has reassured the community that despite the challenges posed by the heightened blockchain traffic, the security of funds remains uncompromised.

Both the bridge and the chain are reported to be functioning seamlessly, and Kusama is optimistic about a smooth restart for Shibarium.

A recent blog post by Shiba Inu developer Kaal Dhairya, dated August 18th, has outlined the project’s strategy to address the surge in traffic.

Plans include scaling operations to accommodate the increased activity on Shibarium. Regular updates on the network’s status will be provided to users.

It’s worth noting that Shibarium is built on the foundation of Polygon, a blockchain network.

The Shiba Inu project has taken proactive steps to ensure a safe restart.

READ MORE: Coinbase’s ‘Stand with Crypto Alliance’ Gains Momentum Amidst Lawmaker Engagement Push

They have secured insurance coverage worth $2 million to mitigate any potential challenges related to fund retrieval.

This announcement has instilled confidence in the community, leading to the resumption of block production on the network.

The development team is maintaining vigilant oversight to monitor the network’s performance.

Despite these positive developments, the ShibArmy community has expressed concerns about the spread of fear, uncertainty, and doubt (FUD), which can have a negative impact on the project’s reputation.

Nevertheless, community members remain optimistic and supportive of the network’s efforts to address the temporary transaction pause.

In terms of price movements, Shiba Inu (SHIB) has shown fluctuation within the past 24 hours, with a trading range spanning from a low of $0.0000076 to a high of $0.0000093.

Concurrently, the price of BONE has experienced a 15% decline, settling at $1.18, while LEASH has seen a 5% drop in the same timeframe, currently valued at $430.

Other Stories:

Former US President Donald Trump’s Ethereum Wallet Surges to $2.8 Million

Stellar Development Foundation Invests in MoneyGram International

Silvergate Bank Undergoes Executive Shake-Up Amid Crypto Transition and Legal Challenges

SoFi Bank, headquartered in San Francisco, has reported an impressive surge in its cryptocurrency holdings, disclosing nearly $170 million in its Q2 earnings report.

This marks a substantial escalation compared to the previous quarter and underscores the bank’s growing involvement in the crypto market.

With an extensive customer base of over six million individuals, SoFi has established itself as a prominent player in the United States banking landscape.

Of the total crypto investments amounting to $166 million, SoFi Bank’s portfolio encompasses $82 million in Bitcoin (BTC) and $55 million in Ethereum (ETH).

Additionally, Dogecoin (DOGE) claims the third spot with an allocation nearing $5 million, while Cardano (ADA) holdings total $4.5 million.

Notably, the bank’s investor presentation highlighted its impressive feat of onboarding more than 500,000 new customers, expanding its support to facilitate trading for over 22 different cryptocurrencies.

Beyond mere crypto holdings, SoFi offers its clientele the ability to buy and sell a diverse array of cryptocurrencies, leveraging its strategic partnership with the Coinbase crypto exchange.

This move is aligned with the bank’s earlier initiative, commencing crypto services in September 2019.

Interestingly, SoFi evolved into a full-fledged bank in February 2022 when it obtained a banking license, distinguishing itself as one of the limited traditional banks delving into the crypto realm.

Despite its strides in the crypto domain, SoFi’s crypto venture has encountered resistance from regulatory quarters.

READ MORE: XRP Price Fails to Reach Anticipated Levels Despite Favorable Court Ruling

In November 2022, a U.S. Senate committee raised concerns about the bank’s adherence to banking laws, spotlighting a looming deadline in January 2024.

SoFi Bank’s response to these concerns remains pending, as Cointelegraph’s outreach for clarity regarding its compliance deadline and potential implications for crypto holdings did not yield a response at the time of publication.

The integration of the cryptocurrency sector with conventional banking has long been deemed a pivotal milestone for mainstream adoption.

However, the crypto industry weathered a tumultuous 2022, which was further exacerbated by the collapse of several banks focused on crypto affairs in 2023.

In response, U.S. legislators hurriedly intervened to safeguard customers’ assets, albeit at the cost of disrupting the synergistic relationships between crypto and traditional finance.

As the regulatory landscape grapples with assigning accountability, the future trajectory of this evolving partnership remains uncertain.

Other Stories:

Governments Remain Wary About Worldcoin Amid Privacy Concerns

Binance’s Proof-of-Reserves Discloses Strong Financial Position

PayPal’s Ethereum-Based Stablecoin PYUSD Divides Crypto Community

The Bored Ape Yacht Club (BAYC) is a collection of 10,000 unique Bored Ape NFTs (Non-Fungible Tokens) that serve as a membership card for an exclusive club. The NFTs exploded in popularity in the latter part of 2021, providing owners with access to virtual events, parties, and other benefits. However, the project also became the subject of controversy, particularly regarding allegations of racism.

Bored Ape Yacht Club’s Popularity

Bored Ape Yacht Club became one of the most coveted NFT projects, with prices for individual apes soaring into the hundreds of thousands of dollars, or even more. Celebrities, athletes, and wealthy collectors jumped on board, touting their membership in this virtual club. The popularity of the club has led to several collaborations and merchandising opportunities, making BAYC more than just a collection of digital assets but rather an influential brand in the burgeoning NFT space.

Racist & Nazi Allegations

The racism allegations against BAYC began to surface as the community grew. Critics pointed to certain elements within the artwork and community that they felt propagated racial stereotypes and biases. Some of the illustrations were claimed to perpetuate harmful stereotypes, sparking heated debates both within the BAYC community and outside of it.

In August 2022, some artists even accused backers of the Bored Ape Yacht Club of having ties to neo-Nazis.

Community Response

Reactions to the allegations were mixed within the BAYC community. Some members acknowledged that certain aspects could be interpreted as insensitive or offensive, calling for changes or updates to the art. Others argued that the allegations were a misunderstanding or an overreaction, insisting that the illustrations were not intended to be offensive.

The developers and founders of BAYC were put in a complex position, as making changes to the NFTs would be a difficult proposition given the decentralized and immutable nature of blockchain technology. Altering the content of an NFT after it has been minted is a contentious issue and could potentially lead to legal challenges.

BAYC’s Response

BAYC’s team was relatively slow to respond to the allegations, but they eventually issued statements acknowledging the concerns and outlining their stance. They expressed their commitment to fostering an inclusive community and stated that they would be taking steps to ensure that all members felt welcome and respected.

READ: 2023 Ranking: 4 Best Crypto Projects To Buy

However, some critics felt that the response was inadequate and that more direct action was required to address the underlying issues. The debate over the allegations continued to simmer, with some arguing that the incident was indicative of broader problems within the NFT space related to diversity and inclusion.

Impact and Reflection

The controversy surrounding the Bored Ape Yacht Club serves as a stark reminder of the complexities that can arise when blending art, technology, and community. The situation highlights the challenges of navigating cultural sensitivities in a global and diverse user base, particularly within a new and rapidly evolving field like NFTs.

Despite the allegations, BAYC remains a powerful player in the NFT world, but the episode has left lingering questions about the responsibilities of developers and community leaders. The controversy prompts reflection on how to foster inclusive and respectful spaces within the world of digital assets.

The incident also underscores the need for clearer guidelines and ethical standards in the creation and promotion of NFTs. As the NFT market continues to grow, the lessons learned from the BAYC experience may help shape how future projects approach these complex issues. Whether or not the allegations are found to have merit, they serve as an important reminder that digital art and communities must strive to be conscious of and responsive to diverse perspectives and concerns.

Decentralized exchange LeetSwap, which runs on Coinbase’s Base network, has declared a temporary halt on trading activities due to concerns over a possible exploit.

The exchange made this announcement via a tweet on August 1st, after discovering potential compromises in some of its liquidity pools.

As a precautionary measure, LeetSwap suspended trading to conduct a thorough investigation into the matter.

To aid in resolving the issue, the exchange has enlisted the assistance of on-chain security experts in an attempt to recover the locked liquidity.

Although LeetSwap did not divulge detailed information about the incident, a number of blockchain experts have offered their insights into how the exploit might have occurred.

According to Igor Igamberdiev, the head of research at algorithmic market maker Wintermute, the attacker may have taken advantage of an exposed smart contract function.

By leveraging this vulnerability, the attacker would have been able to artificially increase the price of a token, thereby draining wrapped Ether (ETH) worth $1,828 from LeetSwap’s liquidity pools.

Igamberdiev estimated that the attacker gained approximately 342.5 ETH, equivalent to over $630,000.

Several blockchain security firms, including PeckShield, Beosin, BlockSec, and CertiK, have corroborated Igamberdiev’s theory about the exploit and the amount that was siphoned.

READ MORE: Liquid Staking Tokens Poised to Dethrone Ethereum’s Ether (ETH) as Dominant DeFi Asset

LeetSwap subsequently provided an update approximately an hour and a half after the trading halt, stating that they are actively collaborating with security experts to explore options for recovering the locked liquidity on their platform.

This incident marks the second controversy related to the Base network on the same day. Earlier, a developer of a memecoin called BALD, which was inspired by Coinbase CEO Brian Armstrong, removed liquidity for the token, causing its price to plummet.

The move sparked accusations of an exit scam, which the project developer vehemently denied.

In response to the exploit, LeetSwap has taken swift action and has engaged with industry experts to ensure the safety and integrity of its platform.

Users and the broader cryptocurrency community are keenly monitoring the situation as the investigation unfolds, awaiting further updates from the exchange and security teams involved.

As the decentralized exchange space continues to evolve, the incident serves as a stark reminder of the importance of robust security measures to protect user funds and assets.

Other Stories:

SEC Chairman Gary Gensler Raises Alarm Over Widespread Fraud in Crypto Market

BNB Smart Chain (BSC) Hit by Copycat Attacks

Bitcoin’s Reduced Volatility Sparks Anticipation for Exciting Long-Term Bull Signal

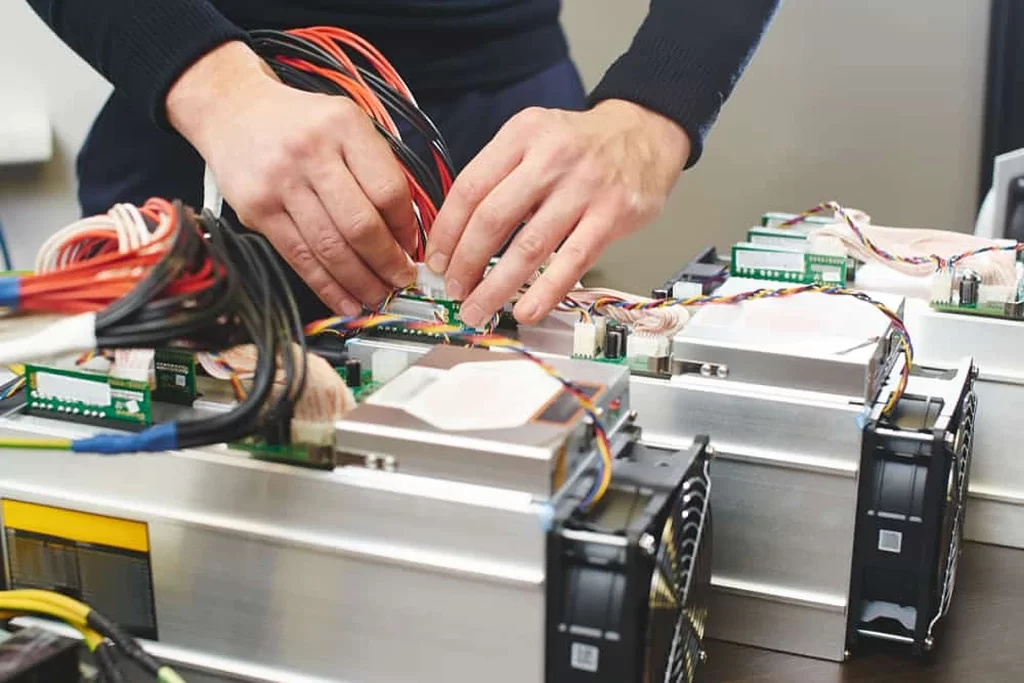

In Miri, Borneo, authorities have taken decisive action against an illegal cryptocurrency mining operation, thanks to a tip-off from the public.

The operation, discovered by Sarawak Energy, involved 34 cryptocurrency mining servers that were illicitly powered through cable tapping, using stolen electricity.

Following the tip-off, a swift crackdown ensued, resulting in the seizure of all equipment used in the illegal mining endeavor, including servers and tapping cables.

Local police have initiated an investigation into the matter, marking a significant victory against cryptocurrency-related crimes on the island.

According to Sarawak Energy’s estimates, the operation was siphoning approximately 6,000 Malaysian ringgits per month (equivalent to $1300) worth of stolen electricity.

This incident sheds light on the persistent issue of energy theft, despite the fact that Sarawak offers some of the lowest energy prices in Malaysia.

Interestingly, this was not the only instance of cryptocurrency mining illegalities in the region.

Earlier in 2023, another public tip-off led to the seizure of more than 137 cryptocurrency mining servers in the nearby state of Senadin, where Miri is situated.

Meanwhile, the global cryptocurrency market, particularly Bitcoin (BTC), has been experiencing a prolonged bear market that has strained many mining operations.

READ MORE: SEC Suffers Setback as Court Overturns Ruling on SPIKES Index Securities Classification

Consequently, numerous mining firms and operators have resorted to selling BTC in unprecedented amounts to cope with the challenging market conditions.

On the other hand, the Bitcoin mining ecosystem has reached significant milestones in terms of network hash rate, which hit all-time highs in 2023, along with record network difficulty levels.

While this generally indicates the network’s resilience and increased competition among miners, it also poses challenges for smaller operators lacking the economies of scale enjoyed by larger players.

Operators benefiting from lower electricity prices tend to be more profitable, which is a contributing factor driving illegal mining operators to resort to stealing electricity from the grid.

By eliminating electricity costs, unlawful operators can generate profits and offset hardware expenses more easily.

As authorities continue their efforts to combat illegal cryptocurrency mining, the incident in Miri serves as a reminder of the importance of public vigilance and cooperation in safeguarding communities from such illicit activities.

Additionally, the broader cryptocurrency mining landscape must find ways to support smaller operators and address the challenges posed by volatile market conditions, ensuring a more sustainable and secure future for the industry.

Other Stories:

Margot Robbie’s Comparison of Bitcoin to Ken from Barbie Ignites Debate

Blockchain Could Save Financial Institutions $10 Billion by 2030: Ripple-FPC Report

Tech Firms Call on European Union to Support Open-Source AI in New Regulations