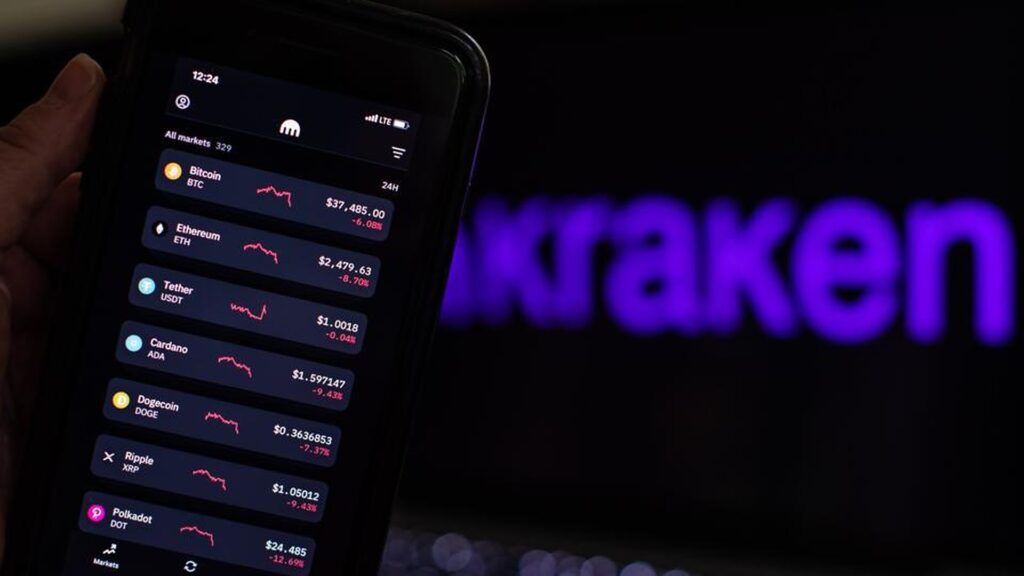

On June 6, Kraken, a leading cryptocurrency exchange, reported issues with several cryptocurrency funding gateways, including Bitcoin, Ethereum, and ERC-20, leading to operational delays. A message posted on Kraken’s status page revealed that deposits and withdrawals were delayed, without specifying the cause. By 8:35 am UTC, the situation seemed to have normalized with all updates regarding the issue removed from the status page.

Meanwhile, Kraken’s futures platform was scheduled for a 10-minute downtime at 10:30 am UTC due to site maintenance. In other news, Kraken, currently under pressure from the US Internal Revenue Service (IRS) to surrender customer data, has objected to the IRS’s demands, describing them as an “unjustified treasure hunt.” The exchange has requested the San Francisco courts to intervene, arguing that the IRS’s claims are unwarranted.

In April, Kraken became the third cryptocurrency exchange in Ireland to receive authorization to operate as a virtual asset service provider, joining Gemini and Coinbase.

In a recent initiative against malicious actors, Nick Percoco, Kraken’s chief security officer, worked with a popular streamer to set up a counterfeit crypto account on the exchange, aiming to lure and catch fraudsters in its ecosystem. Cointelegraph has contacted Kraken for additional details regarding the aforementioned funding gateways issue.

Several analysts have predicted that the price of Flasko (FLSK) will rally in the coming 18-24 months, but is this token a good investment for retail crypto traders. Read on to find out more about Flasko, including our price prediction and an overview of the platform.

What is Flasko?

In an innovative approach to wine and spirits investment, a new platform, Flasko, was launched in 2022 to offer users the chance to invest in high-end alcoholic beverages using non-fungible tokens (NFTs). The goal is to enable potential investors to purchase NFTs, each representing a certain amount of a bottle or case of alcoholic beverages, that can either be held onto or sold at a profit.

The unique aspect of Flasko’s approach lies in the fractionalization of the NFTs, allowing investors to purchase a part-NFT. This concept is similar to buying a fraction of an ether (ETH) token on a cryptocurrency exchange. Despite the fractionalization, part-NFT holders maintain their investments on the specific part of the tokenized item.

The system’s whitepaper describes the daily monitoring and analysis of the market by their experts to identify the products with the most potential for long-term growth. Flasko offers a range of wines, whiskeys, and champagnes, which are stored in insured and licensed-bonded warehouses.

One of the key features of Flasko’s system is the ability for users to purchase either a fraction or the entirety of an NFT, and have the represented alcoholic beverage delivered to their specified address free of charge. The NFTs represent individual investments or even a basket of various alcoholic beverages. These NFTs and their fractions are tradable via the Flasko platform, allowing users to buy and sell their investments.

Flasko price prediction and ROI

Flasko’s website claims that wine, whiskey, and champagne investments have delivered a 28% return on investment (ROI) in recent years. However, potential investors should conduct their own research to verify these claims and understand the implications for their prospective investments.

It’s important to understand that past performance does not guarantee future results. The value of these drinks could possibly stagnate or decline in the coming years. Therefore, investors are urged to exercise caution and carry out thorough research before committing their funds to such investments.

Every blockchain and blockchain-based network requires its own native cryptocurrency, and Flasko is no different. It features the Flasko token (FLSK), which serves to keep the system operational.

Owners of the Flasko cryptocurrency can use it to purchase the system-created NFTs and stake their Flasko tokens for rewards. Additionally, those holding a certain amount of Flasko, the specifics of which have yet to be announced, will gain access to in-person events.

However, there is ambiguity regarding the blockchain on which the Flasko cryptocurrency is based, making it unclear whether we are referring to the Flasko token or the Flasko coin. While every coin is a token, not all tokens are coins. At the time of writing, we have sought clarification from Flasko but received no immediate response.

The Flasko token is not yet available on the open market but is currently in the presale stage. During the presale, 35% of the total supply of one billion tokens will be up for sale. Other allocations include 12.5% for exchange listings, 17.5% for marketing, and 14% for the development team. Protocol community investments will receive 15%, while 5% goes to platform partnerships, and 0.5% will be directed towards charitable causes. The presale end date remains unspecified.

After the presale concludes and Flasko (FLSK) enters the open market, transactions will incur a tax. Purchases will carry a 7% tax, distributed between marketing (4%), liquidity pool (2%), and token burn (1%). Sales, on the other hand, will have a 14% tax, with distribution to marketing (9%), the liquidity pool (3%), and token burn (2%) intended to maintain a reasonably high price.

In summary

Flasko presents an innovative and unique opportunity to invest in high-end alcoholic beverages via fractional NFTs. Despite the promising prospects, potential investors should conduct their own due diligence and remain cognizant of potential risks. The evolution of Flasko’s business model and tokenomics will certainly be interesting to follow in the coming months.

The Bored Ape Yacht Club (BAYC) represents one of the most fascinating phenomena in the realm of non-fungible tokens (NFTs). Its unique approach has paved the way for innovative applications of blockchain technology in the field of digital art and virtual communities.

Launched in April 2021 by Yuga Labs, BAYC is a collection of 10,000 uniquely designed, cartoonish ape NFTs that were initially sold for about 0.08 Ethereum each. However, their value has skyrocketed since their release due to the high demand, becoming prized possessions in the digital world.

Bored Ape utility & benefits

The appeal of BAYC NFTs stems from their art, rarity, and utility. Each ape is procedurally generated from a set of traits, leading to a range of unique outcomes. Traits vary in rarity, which influences the ape’s value and desirability.

Beyond owning a unique piece of digital art, Bored Ape owners receive access to various benefits. For instance, BAYC has taken the concept of “utility” in NFTs to another level by incorporating real-world experiences and exclusive digital content accessible only to ape owners.

One of the most significant aspects of BAYC NFTs is the sense of community they foster. Each ape owner automatically becomes a member of the Bored Ape Yacht Club.

This membership grants access to a plethora of online and offline events, exclusive digital merchandise, and other exciting benefits. Additionally, BAYC has a strong presence on social media platforms where the community thrives, sharing ape sightings, discussing potential value, and speculating on the future of the club.

Further accentuating their value, BAYC NFTs also have commercial rights. The owner has the ability to monetize their NFT in any way they see fit, a groundbreaking development that has prompted discussions on intellectual property rights in the digital age. For instance, some owners have used their apes to create merchandise or even to brand their companies.

The Bored Ape Kennel Club

In a notable development, BAYC introduced “The Bored Ape Kennel Club” in June 2021, offering a free dog NFT to each Bored Ape owner. These companion NFTs further increased the demand and value of the original Bored Ape NFTs. In addition, they released a mutant serum NFT that can be used to mutate your ape, thus increasing the NFT’s uniqueness and potential value.

BAYC is not merely a collection of digital images; it represents a pioneering initiative in the expanding universe of NFTs. The successful blend of art, exclusivity, and utility has propelled BAYC NFTs into the mainstream, turning them into valuable digital assets. They’ve redefined the concept of ownership in the digital world, sparking widespread interest and debate about the future of art, culture, and community in the blockchain era.

It is critical, however, to remember that like any other investment, buying BAYC NFTs comes with its risks. The NFT market is still new, highly speculative, and volatile. Therefore, potential investors should carry out diligent research and consider the financial implications before getting involved.

The Bored Ape Yacht Club has significantly impacted the NFT landscape by infusing a unique blend of art, community, and real-world utility. The project’s success serves as a testament to the potential of NFTs and sets a benchmark for future endeavors in the space.

The dispute between bankrupt cryptocurrency exchange FTX and the insolvent crypto lender Genesis has intensified, with FTX now contesting Genesis’ claim that FTX is entitled to zero reimbursement. Just last month, FTX was seeking nearly $4 billion from Genesis as part of their respective bankruptcy proceedings.

In a recent court filing in the New York Bankruptcy Court, FTX debtors raised objections to Genesis’ estimation that their claims amounted to nothing. FTX debtors alleged that they were not given any advanced notice nor were they involved in the mediation process before Genesis filed its estimation procedures motion, in which it proposed a null claim.

The FTX debtors deny the assertion by Genesis that they were kept informed throughout the proceedings. They contest the assertion in Genesis’ motion that they were working swiftly with all interested parties to draft a plan structure. FTX stresses that, as the largest unsecured creditors in Genesis’ Chapter 11 cases, their involvement in mediation is vital.

Genesis maintains that their zero-claim estimation is critical to avoid delays and move forward promptly with the confirmation of their Chapter 11 plan. However, FTX argues that without their involvement, the mediation process is wasting estate resources.

In a separate development, on May 3, FTX, invoking bankruptcy laws that allow it to reclaim “avoidable transfers” within the 90-day period before bankruptcy is declared, sought nearly $4 billion from Genesis. FTX debtors have since requested that the court lift the automatic stay on legal proceedings against Genesis, a common measure in bankruptcy proceedings.

This motion is slated to be heard on June 15. It follows an announcement by Digital Currency Group (DCG), Genesis Capital’s parent company, that it couldn’t fulfil its outstanding intercompany obligations that would otherwise help repay creditors.

Meanwhile, DCG has been in a mediation period with Genesis in response to creditors’ demands. Earlier this year, the company suggested a settlement plan that would provide Genesis creditors with an 80% recovery of funds post Chapter 11 bankruptcy declaration.

The US House Financial Services Committee and House Agriculture Committee have proposed a draft discussion that may pave the way for certain crypto assets to be classified as digital commodities. This draft bill seeks to bring regulatory clarity to cryptocurrency firms in the US and presents an alternative to the current regulatory approach by the SEC.

It prohibits the SEC from blocking digital asset platforms from registering as regulated alternative trading systems, while encouraging these platforms to offer digital commodities and payment stablecoins.

The proposed bill offers a framework allowing specific digital assets to be classified as digital commodities if they are functional, decentralized, and obliges the SEC to supply an analysis of any counter-arguments against a firm being considered decentralized. The bill also pushes the SEC to update its rules to let broker-dealers custody digital assets given certain requirements, and to modernize regulations related to digital assets.

Paul Grewal, chief legal officer at Coinbase, praised the bill as it lays a strong foundation for regulatory jurisdiction and definitions. However, he emphasized the need for a thorough review before formal introduction. Meanwhile, the bill, presented by Republicans Patrick McHenry and Glenn Thompson, hasn’t included inputs from Democrats. Despite occasional bipartisan support for crypto regulation, it’s uncertain how far this proposed legislation can progress in a divided Congress.

At the time of this report, both houses of Congress had approved legislation to prevent the US government from defaulting by raising the debt ceiling, with President Biden expected to sign the bill into law on June 2.

Since the start of April, the price of Ethereum (ETH) has experienced a downward trend, diverging from a pivotal long-term resistance level. However, projections from the wave count and short-term market activity imply a likely upward swing in the future.

Ethereum’s main token, ETH, was established by Vitalik Buterin on the Ethereum blockchain. Although the long-term weekly outlook is primarily bearish, it is also marked by certain contrasting indicators.

In the first week of April, Ethereum reached its yearly peak at $2,151, seemingly surpassing the resistance barrier around $1,950.

Nonetheless, a dramatic drop in the subsequent week resulted in a price below this resistance level, effectively solidifying it as a robust resistance area (highlighted by the red icon).

As a result, the earlier price surge is now considered void, and the bearish trend is substantiated due to the inability of buyers to maintain the upward momentum. The closest support zone is identified at $1,600.

Yet, the weekly Relative Strength Index (RSI) maintains a bullish outlook. The RSI is a valuable tool for traders, used to determine whether a market is oversaturated or underperforming, thus guiding their buying or selling decisions.

An RSI score over 50, along with a rising trend, points towards a market favoring the bulls, whereas a score under 50 signals the opposite. At present, an RSI reading over 50 is suggestive of a bullish trend in motion.

A Brighter Picture in the Short-Term The technical analysis from a short-term, six-hour timeframe provides a more optimistic perspective, largely owing to the wave count.

The dominant wave count infers that Ethereum is currently in a long-term second wave (white). As such, a noteworthy upward climb is anticipated following the completion of the current market correction.

The short-term wave count suggests that Ethereum is in a complex W-X-Y corrective structure, thereby influencing the shape of the channel.

If this count is accurate, the price will descend towards the 0.382-0.5 Fib retracement support level, falling between $1,600 and $1,725. This trajectory also aligns with the channel’s support line.

Upon reaching this point, a significant upward surge, potentially boosting the ETH price to a minimum of $2,500, is predicted.

Bitcoin mining is becoming increasingly environmentally friendly and sustainable, with the level of emissions continuously decreasing.

For the first time, the intensity of emissions from Bitcoin mining has fallen below 300g/KWh, marking an all-time low.

Climate technology venture investor and environmental activist Daniel Batten published his observations on May 29th. He highlighted that the Bitcoin network has managed to halve its emission intensity in a little over three years.

He emphasized, “No other industry is achieving such a rapid reduction in its emission intensity.”

Compared to its energy usage, Bitcoin mining now generates fewer greenhouse gases.

The decline in emissions is largely attributed to the use of more sustainable energy sources for Bitcoin mining and the increased efficiency of mining hardware, which contributes to a lower emission intensity.

There has been a noticeable trend of Bitcoin mining operators gravitating towards countries with sustainable energy offerings, like those found in Scandinavia. Jaran Mellerud, a researcher, noted on May 29th that electricity prices in Nordic countries continue to be negative.

Mellerud stated, “Bitcoin miners in Finland and the northern regions of Norway and Sweden continue to be compensated for their electricity consumption.”

However, there is a downside as the Bitcoin network hash rate is nearing its maximum levels, which poses a challenge for miners. As per Blockchain.com data, the total hash rate currently stands at 365 EH/s (exahashes per second).

The network difficulty, a metric determining the competition among miners, is also at its highest level of 49T.

These factors adversely impact profitability, which is currently low. The Hash Rate Index reports that the hash price is at a meager $0.075 per terahash per second per day.

The hash price momentarily peaked to $0.128 amid the memecoin creation frenzy earlier in the month but has since receded. Over the past year, the hash price has experienced a 44% decline due to falling BTC prices and escalating energy costs.

Despite these challenges, Bitcoin prices have seen an uptick today. The cryptocurrency has increased by 3.1%, surpassing $28,000 for the first time in two weeks. However, since mid-March, BTC prices have remained somewhat stagnant.

Cryptocurrency tax regulations in the United Kingdom are an essential consideration for any individual or business involved in cryptocurrency trading. Her Majesty’s Revenue and Customs (HMRC), the UK’s tax authority, has provided guidance on how cryptocurrencies, or as they term them, “cryptoassets,” are taxed.

How are cryptocurrencies defined in the UK?

To begin, it’s crucial to understand how HMRC classifies cryptocurrencies. They recognise three types of cryptoassets: exchange tokens (like Bitcoin), utility tokens, and security tokens. The tax treatment depends on the nature and use of the token. For our purposes, we will mainly focus on exchange tokens, which are most commonly used for trading.

HMRC does not consider cryptocurrencies as currency or money. Instead, they are viewed as a form of property. As a result, the buying, selling, and even trading of cryptoassets can have tax implications. Specifically, two types of taxes are most relevant to crypto trading in the UK: Capital Gains Tax (CGT) and Income Tax.

CGT is the primary tax applied to profits made from buying and selling cryptocurrencies. When a person disposes of a cryptoasset – either by selling it, exchanging it for another cryptocurrency, using it as payment, or gifting it – they may be required to pay CGT on any gains they have made.

The taxable gain is the difference between the purchase price (plus associated costs) and the sale price (minus any transaction costs). However, each individual has an annual tax-free allowance for capital gains, known as the Annual Exempt Amount. For the 2022/23 tax year, this was £12,300. If the total taxable gains in the tax year are below this amount, there is no CGT to pay.

If the total gain exceeds the Annual Exempt Amount, CGT is due. The rate of tax depends on the individual’s income and the asset type. As of my knowledge cutoff in September 2021, the tax rate for individuals is 10% for basic rate taxpayers and 20% for higher and additional rate taxpayers. For businesses, the Corporation Tax rate applies.

Calculating gains and losses from crypto trading

The calculation of gains or losses can be complex due to the volatility of cryptocurrencies and the fact that they are often traded in pairs. When calculating the gain or loss for CGT purposes, the Sterling value of the cryptocurrency at the time of acquisition and disposal must be used.

In some cases, trading cryptoassets may be considered a trade, much like trading in shares or property. If the level of activity, nature of the sales, and decision-making process indicate a financial trade, the profits may be subject to Income Tax instead of CGT. This might be the case for individuals who are regularly day trading or swing trading cryptoassets.

Income Tax would also apply to individuals who receive cryptoassets as a form of payment or through mining, transaction confirmation, or airdrops. The amount of Income Tax due depends on the individual’s Income Tax band, with rates ranging from 20% to 45%.

HMRC also has rules on ‘Pooling’ for cryptoassets. Instead of tracking the gain or loss for each transaction, cryptoassets of the same type and acquired in the same way can be ‘pooled’ together. Each pool calculates its own ‘allowable cost’ – the total cost of the pooled tokens plus any allowable costs. When a token is disposed of from the pool, a proportion of the pooled allowable cost is deducted to work out the gain.

In terms of record-keeping, HMRC requires individuals and businesses to keep records of each cryptoasset transaction for at least 5 years after the tax year they relate to. This should include the type of cryptoasset, date of the transaction, if they were bought or sold, number of units, value of the transaction in pound sterling, and the cumulative total of units held.

Summary

In summary, the tax implications of crypto trading in the UK can be complex and depend on a variety of factors. HMRC’s guidelines offer a starting point, but given the complexity, seeking advice from a tax advisor or professional well-versed in cryptoassets can be extremely beneficial. It is also essential to stay updated with any changes to tax legislation and HMRC guidelines regarding cryptoassets, as these may change over time.

The European Systematic Risk Board (ESRB), an EU financial watchdog, is advising restrictions on cryptocurrency leverage to preserve the financial stability of the overall market. Historical precedent suggests that firms often collapse under high-leveraged bets, leading to broader market cash shortages and potential recessions.

The ESRB’s suggestion, as reported by Reuters, primarily targets investment funds, exchanges, and similar entities involved in cryptocurrency trading. High-leveraged trades, even for retail investors, can result in a total loss of initial capital—a phenomenon known as liquidation. Given the high volatility of cryptocurrencies, traders frequently face significant liquidation losses, with a recent 24-hour period seeing over $82 million lost.

“Systemic risks could arise quickly and suddenly,” warned the ESRB. “If the rapid growth trends observed in recent years were to continue, crypto-assets could pose risks to financial stability.” The board’s concerns are not unique; Japan’s Financial Service Agency has already enforced similar limitations, restricting investors from borrowing more than twice their investment amount for leverage trades. This conservative approach may have contributed to FTX’s Japanese entity enabling withdrawals earlier this year.

While the ESRB oversees the broader market and works to mitigate systemic risks, it lacks the direct authority to enforce crypto leverage limitations. Instead, its role is to propose these recommendations for inclusion in future versions of the EU’s Market in Crypto-Assets (MiCA) legislation.

Last week, all 27 EU member states unanimously approved the MiCA rules, slated to take effect from July 2024. With the ESRB’s recommendations, the European Union may see more comprehensive crypto regulations in the near future.

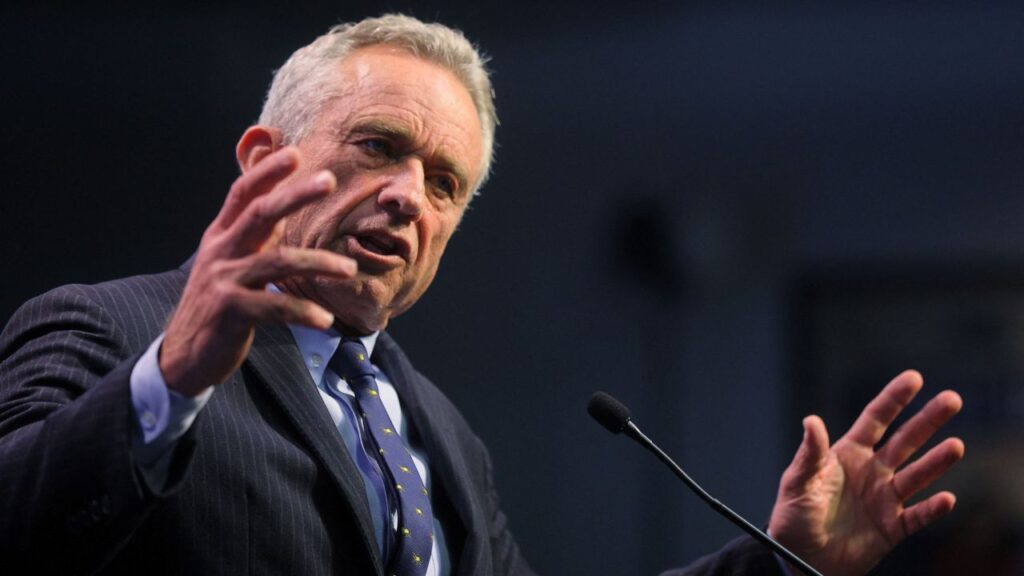

In a landmark move, two U.S. presidential contenders, Vivek Ramaswamy and Robert F. Kennedy Jr., have declared their intention to accept Bitcoin (BTC) donations for their campaigns. Kennedy, a potential Democratic candidate, broke the news at the Bitcoin 2023 convention, making his campaign the first in U.S history to publicize cryptocurrency acceptance.

Kennedy further promised to promote neutral energy regulations, addressing concerns around the energy-intensive process of Bitcoin mining. He committed to ensure that Bitcoin won’t be classified as a security, advocating a more welcoming regulatory environment for cryptocurrency enterprises. Additionally, he indicated a potential presidential pardon for Silk Road founder, Ross Ulbricht, raising a note of interest among crypto libertarians.

Matching Kennedy’s progressive approach, Republican candidate Vivek Ramaswamy also announced his campaign’s acceptance of BTC donations. He publicized this through a tweet featuring a BitPay donation link, inviting supporters to donate up to $6,600 worth of crypto. He also urged for the upcoming 2024 elections to focus on fiat currency discussions.

In addition to Bitcoin, BitPay’s platform accepts several other cryptocurrencies like Bitcoin Cash, Ether, Litecoin, and Dogecoin. Ramaswamy also offered a unique incentive: anyone who donates to his campaign can mint a commemorative Non-Fungible Token (NFT) using the Proof of Attendance Protocol (POAP).

In sum, these moves showcase the increasing integration of cryptocurrency in mainstream politics, with prospective leaders acknowledging its significance in democratic processes and pledging to foster an inclusive crypto environment.