MicroStrategy Chairman Michael Saylor has called on Microsoft to abandon traditional financial strategies like stock buybacks and bonds in favor of Bitcoin, which he claims offers better long-term value and reduced risk.

A Radical Proposal for Microsoft’s Capital Allocation

Speaking at the Strategy World 2025 conference, Saylor said, “Microsoft should be powered by digital capital. Bitcoin is the highest-performing uncorrelated asset.” He pointed out that Bitcoin has significantly outperformed Microsoft stock over the past five years, yielding over 950% gains compared to MSFT’s 148%.

Despite this disparity, Saylor criticized Microsoft’s use of its large cash reserves, arguing that the current focus on stock repurchases and low-yield bonds weakens the company’s flexibility and leaves shareholders more exposed to risk. “Buying Bitcoin would be 10x better than buying your own stock,” he said.

Critique of Bonds and Buybacks

Saylor was scathing in his view of bonds, calling them “toxic,” and claimed that stock buybacks “destroy 97% of your capital over 10 years.” Instead, he advocated redirecting funds toward Bitcoin, which he believes could increase Microsoft’s enterprise value by up to $5 trillion.

“Bitcoin…emerged as the alternative to bonds in 2024. That was the point at which the SEC endorsed Bitcoin ETFs,” he noted. “That was kind of year zero. We’re now in year one.”

Bitcoin as the Future of Capital

Saylor characterized Bitcoin as the modern alternative to outdated investment strategies. “Bitcoin is the universal, perpetual, profitable merger partner,” he declared. He believes it is a “dirt cheap, one-time revenue that’s growing 30% to 60% a year.”

Previously, Saylor made a direct pitch to Microsoft’s board, delivering a three-minute presentation with 44 slides urging a strategic shift toward Bitcoin. However, a shareholder proposal to allocate 1% of Microsoft’s cash into Bitcoin was ultimately voted down, following opposition from the board.

Despite the rejection, Saylor’s push highlights a growing debate over how corporations should manage capital in a rapidly changing economic landscape.

Former President Donald Trump has reaffirmed his strong support for cryptocurrency, asserting that the United States must take the lead in digital asset innovation or risk being left behind by global competitors like China. In a recent interview, Trump emphasized crypto’s growing popularity and resilience amid market challenges.

“I Want Crypto,” Trump Declares

Speaking to NBC’s Meet the Press, Trump underlined the urgency for American leadership in the crypto space. When asked about concerns over profiting from his presidential role, Trump steered the conversation toward the strategic importance of digital currencies.

“I want crypto,” he said. “I think crypto is important because if we don’t do it, China is going to. It’s new. It’s very popular. It’s very hot.” Trump noted that even during periods of market turbulence, cryptocurrencies held up better than many traditional financial assets.

Highlighting Adoption and Attacking Biden

According to Trump, the sheer level of adoption and interest in crypto makes it impossible to ignore. He criticized the Biden administration for what he described as inconsistent and politically motivated regulation of the crypto industry.

He accused the current administration of initially cracking down on crypto, only to later relax its stance when it became politically convenient. Trump positioned himself as a consistent supporter of the digital asset space.

Addressing Allegations of Personal Gain

With questions swirling around the Official Trump Token (TRUMP), the former president sought to downplay any suggestion that he is financially benefitting from its existence. He insisted that his interest in crypto predates his latest presidential campaign.

“I’m not profiting from anything,” Trump said. “I haven’t even looked.” He added, “If I own stock in something, and I do a good job, and the stock market goes up, I guess I’m profiting.”

Trump reiterated that he donated his entire presidential salary during his time in office and intends to continue that practice. When pressed on whether he would contribute any potential crypto earnings, he responded candidly: “Should I contribute all of my real estate that I’ve owned for many years if it goes up a little bit because I’m president and doing a good job? I don’t think so.”

Market Decline and Token Performance

Despite Trump’s endorsement, the TRUMP token has seen a significant drop in value since his inauguration. Once boasting a market cap nearing $15 billion, it has since plummeted to around $2 billion, according to CoinMarketCap.

However, the token experienced a brief resurgence last week, surging over 70% on the news that Trump would host an exclusive event for top token holders.

Exclusive Dinner Sparks Controversy

Scheduled for May 22 at Trump National Golf Club, the invitation-only dinner will include the top 220 wallets holding TRUMP tokens. This high-profile gathering has prompted concern across the political spectrum.

Democratic Senators Elizabeth Warren and Adam Schiff have called for an ethics investigation, alleging that the event might be an example of “pay to play” and could signal the monetization of presidential access.

Even some Republicans have voiced discomfort. Senator Cynthia Lummis, known both for her support of Trump and her advocacy for Bitcoin, openly expressed her concerns.

“This is my president that we’re talking about, but I am willing to say that this gives me pause,” Lummis told CNBC.

Balancing Influence and Ethics

As Trump continues to lean into crypto as part of his political messaging, the intersection of personal branding, digital assets, and presidential influence is drawing scrutiny. His outspoken support for crypto may resonate with younger and tech-savvy voters, but it also raises fresh questions about transparency, conflicts of interest, and ethics in governance.

With a high-stakes election looming and digital assets becoming a key part of political and economic discourse, Trump’s crypto push could shape not only campaign rhetoric but also the regulatory landscape ahead.

A major shift has occurred in the crypto investment space as Two Prime, a US-based investment advisory firm, has decided to abandon Ethereum (ETH) in favor of an exclusive focus on Bitcoin (BTC). This move follows ETH’s significant price decline in early 2025, which prompted the firm to reassess its strategy.

From Dual Lending to Bitcoin-Only

Over the past 15 months, Two Prime facilitated $1.5 billion in loans using both Bitcoin and Ether. However, citing Ethereum’s instability and underwhelming performance, the firm announced on May 1 that it would now concentrate entirely on Bitcoin for both asset management and lending operations.

“ETH’s statistical trading behavior, value proposition, and community culture have failed beyond a point that is worth engaging,” Two Prime stated, signaling a complete pivot.

ETH’s Unpredictability a Major Concern

A key reason behind the firm’s decision is what it describes as Ethereum’s loss of predictable trading behavior. As an algorithmic trading firm, Two Prime emphasizes the importance of consistent data patterns for its models.

“Ether no longer trades predictably,” the firm said. “As an algorithmic trading firm, we value data more than narratives… the data suggests ETH has fundamentally changed.”

The firm explained that Ether has decoupled from Bitcoin and now behaves more like a memecoin. They noted ETH experienced “several multi-standard deviation moves” during Q1 2025, in contrast to Bitcoin’s relatively steady behavior.

“It trades now like a memecoin rather than a predictable asset,” the company added. “Even during the turbulence of Q1 2025, Bitcoin remained within its fundamental behavior, whereas ETH saw several multi-standard deviation moves.”

Impact on Algorithmic Trading and Lending

Such volatility poses serious challenges for firms like Two Prime that rely on quantitative strategies. The unpredictability of ETH’s price action not only complicates trading but also undermines ETH-backed lending practices, which rely on certain levels of price stability.

The firm remarked that ETH’s behavior creates a “headache” for algorithmic trading and undermines lending reliability, “even by the high volatility expectations of digital asset markets.”

Criticism Triggers Community Reaction

Two Prime’s harsh assessment of Ethereum didn’t go unnoticed. Some crypto enthusiasts saw the firm’s exit as a contrarian indicator — a possible sign that ETH is nearing a price bottom.

One user commented, “What a retarded essay statement,” referencing the S&P 500’s own 4.7% decline year-to-date. Others questioned Two Prime’s relevance altogether: “Never even heard of them. Seems irrelevant.”

“If this isn’t a bottom signal for ETH idk what is,” another person noted, suggesting that the worst might be over for Ethereum.

Weak ETH ETF Performance Adds Pressure

Adding to ETH’s woes, Two Prime pointed to the underwhelming performance of Ethereum-based ETFs. While Bitcoin ETFs have attracted substantial institutional investment, ETH ETFs have lagged far behind, with BTC ETF purchases outpacing ETH by nearly 24 times.

“The failure of ETH’s ETF creates a reflexive loop whereby institutions like BlackRock dedicate fewer resources to their promotion and sale. BTC has found the mainstream while ETH has floundered,” Two Prime stated.

Despite this, Ethereum still dominates among altcoin ETFs in terms of assets under management (AUM). Recent data shows Ether-based exchange-traded products hold $9.2 billion in AUM, well ahead of Solana and XRP, which have $1.4 billion and $1 billion, respectively.

ETF Landscape Adds to ETH Struggles

Following the US SEC’s approval of spot Ether ETFs in May 2024, the asset saw a muted reception. Investor enthusiasm has waned, and some issuers have backed away — VanEck halted Ether futures ETF trading, WisdomTree withdrew its proposal, and ARK dissolved its futures ETFs for both Bitcoin and Ether in March 2025.

Founded in 2019 by Alexander Blum and Marc Fleury, Two Prime had been active in both Bitcoin and Ethereum lending until this dramatic pivot. Whether their exit marks a low point for ETH or simply reflects a broader trend remains to be seen.

The Blockchain Group (TBG), a publicly traded Bitcoin treasury company, has revealed plans to amass as much as 260,000 Bitcoin over the next decade—a move that could see it hold approximately 1% of the total Bitcoin supply by 2034.

A Long-Term Bitcoin Accumulation Strategy

Outlined in its latest financial disclosure, TBG’s strategy focuses on an incremental acquisition approach. The company aims to increase its current holdings of 620 BTC to between 1,000 and 3,000 BTC by the end of this year. It has set an ambitious mid-term goal of owning 100,000 BTC by 2032 and hopes to reach between 170,000 and 260,000 BTC by 2034.

“If Bitcoin reaches €1-2 million per coin by 2033-2035, holding 210,000 BTC could represent between €210 billion and €420 billion in net asset value,” the report states.

This long-term vision is underpinned by a projection that Bitcoin’s value will appreciate substantially in the coming years. To measure progress, the company is tracking its proprietary “BTC Yield” metric, which saw a dramatic 709% increase in Q1 2025. During this period, its Bitcoin-per-share figure jumped from 41 to 332 satoshis.

Strategic Backing and Funding Pipeline

The firm, which trades under the ticker ALTBG on Euronext Growth Paris, underwent a strategic pivot in November 2024 to become a full-fledged Bitcoin Treasury Company. Since then, it has boosted its Bitcoin reserves significantly—from just 15 BTC in December 2024 to over 620 BTC by April 2025. The increase was achieved via equity placements and Bitcoin-denominated convertible bonds.

TBG’s strategy has attracted support from well-known names in the crypto investment space, including Fulgur Ventures, UTXO Management, and TOBAM. Prominent cryptographer and Blockstream CEO Adam Back has also joined as a strategic advisor.

Despite acknowledging the risks associated with the plan, the company maintains a clear goal: “accumulate as much BTC as possible, as fast as possible, in the most accretive way possible.”

To fund this effort, TBG has projected a capital-raising potential ranging from €150 million to €100 billion over eight years, depending on market conditions and investor appetite. If the roadmap unfolds as planned, TBG could soon become Europe’s top corporate holder of Bitcoin.

Share Price Soars in Six Months

Since adopting its Bitcoin-focused model, TBG’s stock performance has mirrored other successful Bitcoin treasury firms. Its share price surged by 120% within the first month, 265% by the third month, and 474% after six months. This trend draws strong parallels to the early growth patterns of companies like Strategy and Metaplanet, both of which committed to the Bitcoin treasury model before TBG.

“Bitcoin treasury companies are the fastest-growing companies in Europe,” TBG stated.

Currently, Strategy remains the leading publicly listed corporate Bitcoin holder with 553,555 BTC—around 2.6% of the global circulating supply.

In a landmark move that could set a national precedent, Arizona lawmakers have passed two innovative bills designed to integrate Bitcoin and other digital assets into the state’s financial infrastructure. If signed into law, these measures would make Arizona the first U.S. state to establish a formal Bitcoin reserve.

Two Key Bills Receive Legislative Approval

The Arizona House of Representatives passed Senate Bill 1025 and Senate Bill 1373, both of which are now on Governor Katie Hobbs’ desk awaiting final approval. SB 1025 enables the state to allocate up to 10% of its treasury and pension assets into digital assets, including Bitcoin. Meanwhile, SB 1373 lays the foundation for a Digital Assets Strategic Reserve Fund, designed to hold and manage these crypto assets for future use.

Together, the bills represent a strategic pivot toward blockchain-based asset management, aligning Arizona with other crypto-forward states such as Texas, Florida, and New Hampshire.

Funded by Seized Crypto and Future Appropriations

The legislation authorizes the use of seized digital assets as well as future budget appropriations to fund the reserve. These assets will be managed under strict audit protocols, featuring on-chain transparency and risk controls to ensure responsible stewardship.

Supporters argue that integrating Bitcoin into Arizona’s financial strategy could offer protection against inflation and traditional market volatility. The effort marks a bold step into crypto adoption at the state level—one that could ripple across the country if successful.

Bitcoin Prices Surge Amid Legislative Buzz

Shortly after the bills passed, Bitcoin’s price surged to nearly $95,000, a 25% increase from early-April lows. The price jump appears to be driven by renewed institutional interest and speculation over state-level crypto integration.

Crypto analysts view Arizona’s move as a confidence boost for broader adoption, potentially attracting similar initiatives elsewhere. If implemented, the state-backed reserve could serve as a blueprint for how governments can securely incorporate decentralized finance into their public asset strategies.

Governor Hobbs’ Decision Looms

Governor Hobbs has not yet taken a public position on the bills. Previously, she had threatened to veto all legislation over unresolved disability funding disputes. However, that blockade was lifted following a bipartisan deal reached on April 24.

Her final decision could determine whether Arizona takes the lead in Bitcoin adoption or faces a legislative override attempt to push the plan forward. However, it should be noted that she has vetoed dozens of Republican-sponsored bills, including legislation related to crypto and digital assets, so there is a high chance these bills will also be vetoed by Hobbs.

Strategy, the largest corporate holder of Bitcoin, has expanded its cryptocurrency portfolio once again. On Monday, the company revealed it had acquired an additional 15,355 Bitcoin between April 21 and April 27, investing approximately $1.4 billion. The average purchase price was $92,737 per Bitcoin.

The move was made possible through proceeds raised from stock sales. According to a new SEC filing, Strategy sold 4.02 million shares of its Class A common stock (MSTR) and 435,069 shares of its 8.00% Series A preferred stock (STRK), generating the necessary funds.

Growing Holdings and Soaring Value

This latest acquisition brings Strategy’s total Bitcoin holdings to a staggering 553,555 BTC, currently valued around $52.7 billion. Bitcoin’s price surge to roughly $95,300 has significantly boosted the company’s portfolio value, turning a $37.9 billion investment — purchased at an average of $68,459 per Bitcoin — into nearly $15 billion in unrealized gains.

Strategy’s aggressive buying spree shows no signs of slowing. The recent purchase follows a similar move last week when the company announced the acquisition of 6,556 Bitcoin.

Market Response and Future Outlook

Market watchers anticipated this move following a post by Michael Saylor on Sunday, in which he highlighted Strategy’s Bitcoin portfolio tracker — often a precursor to major announcements.

Following the news, Strategy’s stock (MSTR) rose 1.6% in pre-market trading on Monday, building on a 5% gain from the previous Friday. With Bitcoin prices maintaining strength, Strategy’s bold bet on the cryptocurrency appears to be paying off handsomely.

Bitcoin is currently trading well below its intrinsic value, according to Charles Edwards, founder of Capriole Investments. Edwards claims that Bitcoin’s energy value, calculated based on mining costs and energy consumption, is approximately $130,000. This indicates that despite its current market price, Bitcoin is undervalued relative to its underlying energy consumption.

Institutional Buying and Exchange Outflows

On April 24, more than 8,756 BTC (around $830 million) were withdrawn from Coinbase, which could indicate institutional buying or ETF-related purchases. This aligns with recent Bitcoin ETF inflows, with Bloomberg’s ETF analyst Eric Balchunas noting that institutions have engaged in a $3 billion Bitcoin buying spree in recent days.

Binance also saw a significant outflow of 27,750 BTC on April 25, marking the third-largest outflow in the exchange’s history. While such outflows often indicate bullish sentiment, analyst Joao Wedson cautioned that these large withdrawals do not automatically guarantee a continued rally. He pointed out that in 2021, massive outflows did not prevent a market downturn following China’s crypto ban. However, continuous outflows, like during the FTX collapse, often signal a market bottom and potential recovery.

Bitcoin’s Fractal Patterns and the $100,000 Target

Bitcoin’s performance over the past week mirrors similar patterns from Q4 2024, when the cryptocurrency saw a series of significant price increases. As seen in the 1-day chart, Bitcoin has risen by 11% between April 21-25, and analysts suggest that a further 7-10% increase could push Bitcoin above the $100,000 mark in the near future.

While fractal patterns can offer insight into potential price movements, they are not always reliable. Unlike Q4 2024, when Bitcoin rallied without major resistance, the current overhead resistance level at $96,100 could prevent a breakout. However, if Bitcoin can break through this level, a surge above $100,000 could be within reach.

Conclusion

Bitcoin’s recent performance and bullish forecasts suggest it may continue to rise, with potential price targets ranging from $130,000 to $200,000 by the end of 2025. Factors like Bitcoin’s energy value, institutional buying, and the relationship between Bitcoin and gold all play a role in shaping its market dynamics. With strong outflows from exchanges and a weakening US Dollar, Bitcoin appears to be in a favorable position for further growth. However, key resistance levels and market conditions will determine how quickly it can reach new highs.

Bitcoin’s Intrinsic Value and Market Movements in Focus

Bitcoin (BTC) has been trading at a notable 40% discount to its intrinsic value, according to Charles Edwards, the founder of Capriole Investments. Edwards argues that Bitcoin’s true value, based on energy consumption and mining costs, stands at $130,000, significantly higher than its current market price.

Bitcoin’s Energy Value and Discounted Price

Edwards recently shared insights on X, explaining that since Bitcoin’s April 2024 halving event, which reduced block rewards to 3.125 BTC, the cryptocurrency’s energy value has remained significantly above its market price. This suggests that Bitcoin is undervalued, offering potential for substantial price appreciation in the future.

Coinbase, one of the largest cryptocurrency exchanges, experienced a substantial outflow of Bitcoin on April 24, with more than 8,756 BTC (around $830 million) being withdrawn. This negative netflow may signal growing institutional interest or the purchase of Bitcoin via exchange-traded funds (ETFs), which reflect a strong underlying demand for the asset.

Institutional Interest and ETF Activity

The outflows from Coinbase align with recent spot Bitcoin ETF inflows, which have garnered attention from institutional investors. Bloomberg’s ETF analyst Eric Balchunas noted that institutions have been on a $3 billion Bitcoin buying spree, suggesting that large investors are increasingly confident in Bitcoin’s future prospects.

Binance also saw significant Bitcoin outflows on April 25, with 27,750 BTC withdrawn. This marks the third-largest outflow in Binance’s history. While such withdrawals often indicate bullish sentiment, analyst Joao Wedson warned that large outflows do not always lead to sustained price increases. He pointed out that in 2021, significant outflows did not prevent a market decline triggered by China’s crypto ban. However, he also noted that continued outflows over several days, similar to the FTX collapse, could indicate a market bottom and a potential recovery.

Bitcoin’s Fractal Patterns and Price Predictions

Bitcoin’s recent performance mirrors the behavior seen in late 2024, particularly in November, when the cryptocurrency posted significant gains. Bitcoin’s price increased by 11% from April 21 to 25, showing similar buying pressure to previous rallies. If the price maintains this momentum, Bitcoin could see a 7-10% rise over the coming days, potentially pushing the cryptocurrency above the $100,000 mark.

However, analysts caution that fractal patterns, while insightful, are not always reliable. Unlike Q4 2024, when Bitcoin rallied without resistance, Bitcoin currently faces overhead resistance at $96,100. If Bitcoin can overcome this resistance level, a breakout above $100,000 could follow.

The Role of the US Dollar in Bitcoin’s Rally

Bitcoin’s rally is also being influenced by the weakening US Dollar. On April 21, the DXY (US Dollar Index) dropped to a three-year low, which has historically been a bullish indicator for Bitcoin. The DXY’s decline could signal a shift in market conditions that benefits risk assets like Bitcoin. As crypto analyst ‘Venture Founder’ explained:

“Traditionally, DXY going down is very bullish for $BTC, we now have a massive bearish divergence for DXY, which may suggest it goes to 90. The last 2 times this happened triggered a Bitcoin parabolic bull run in the final phase of the bull market (lasting 12 months).”

Conclusion: Bitcoin’s Bullish Prospects

Bitcoin’s recent price activity, its intrinsic value based on energy consumption, and institutional interest through ETF inflows all suggest a bullish outlook for the cryptocurrency. While significant outflows from exchanges like Coinbase and Binance are encouraging, the market faces key resistance levels that could impact Bitcoin’s near-term performance. However, the broader market dynamics, including the weakening US Dollar, indicate that Bitcoin is well-positioned for continued growth. With the potential for Bitcoin to reach $100,000 or beyond, the outlook for 2025 remains optimistic.

Healthcare technology firm Semler Scientific has further deepened its Bitcoin investment, acquiring approximately $10 million worth of the digital asset since February 14, according to a statement released on April 25.

The company confirmed the purchase of 111 Bitcoin at an average price of around $90,000 per coin. Overall, Semler now holds more than 3,300 Bitcoin, valuing its total crypto treasury at about $300 million.

Measuring Bitcoin Yield Performance

Semler highlighted that its Bitcoin acquisitions have contributed to a Bitcoin yield of 23.5% for shareholders so far this year. The Bitcoin yield metric compares the company’s Bitcoin holdings to its number of outstanding shares, helping to demonstrate how Bitcoin exposure per share has grown.

“Semler Scientific uses BTC Yield as a [key performance indicator] to help assess the performance of its strategy of acquiring bitcoin in a manner Semler Scientific believes is accretive to stockholders,” the company explained.

Since initiating this strategy in February, Semler has been aggressively building its Bitcoin position.

Financing the Bitcoin Strategy

The company stated it purchased its Bitcoin treasury for an average price close to $89,000 per coin. With Bitcoin currently trading at around $95,000, Semler’s investment has seen early gains.

To support its Bitcoin acquisitions, Semler has financed the purchases by issuing roughly $125 million in new stock. Additionally, in January, the firm announced plans to raise another $75 million through a private offering of convertible senior notes.

Semler Scientific primarily operates in the healthcare sector, developing diagnostic products that help detect chronic diseases.

Corporate Bitcoin Holdings on the Rise

Semler’s move follows a broader trend among corporations accumulating Bitcoin for their treasuries. Data shows public companies collectively hold approximately $71 billion worth of Bitcoin as of April 25.

Leading the pack is Michael Saylor’s Strategy (formerly MicroStrategy), which boasts a treasury valued at over $50 billion. During the week of April 14 alone, Strategy acquired an additional 6,556 Bitcoin at an average price of $84,785 per coin.

Despite corporations building significant Bitcoin reserves, they still trail behind Bitcoin holdings managed by exchange-traded funds (ETFs), which control about $110 billion in Bitcoin.

Semler’s aggressive Bitcoin strategy mirrors the growing institutional appetite for digital assets, signaling a continuing shift in corporate finance strategies.

Analog, a leader in blockchain interoperability, has secured a $15 million strategic funding commitment from Bolts Capital, further boosting its capital raise to a total of $36 million. This new commitment comes in the form of a significant token purchase, deepening Bolts Capital’s role in Analog’s mission to unify liquidity across the decentralized Web3 landscape.

Fueling Infrastructure for Unified Liquidity

“This $15 million in a strategic funding commitment from Bolts Capital is a major step forward for Analog as we continue building the infrastructure layer for unified liquidity in Web3,” said Victor Young, Founder of Analog.

Analog aims to become the ultimate liquidity hub by enabling frictionless asset movement across chains. The newly secured capital will support the development of innovative tools like the Omnichain Analog Token Standard (OATS), Firestarter, and Zenswap. “With this capital, we’re accelerating the development of groundbreaking solutions like OATS, Firestarter, and Zenswap, which will drive scalable RWA adoption, optimize liquidity, and unlock deeper markets for DeFi applications,” Young added.

A Track Record of Momentum

Before this latest funding, Analog had already raised $21 million from leading investors such as Tribe Capital, Wintermute, NGC Ventures, and the NEAR Foundation. The February 2025 launch of its mainnet and $ANLOG token marked major milestones, with listings now live on platforms including Bitget, Gate.io, KuCoin, MEXC, and Kraken. Stakers are currently enjoying an APY of 82.7%, showcasing high yield opportunities within the ecosystem.

Ecosystem Growth and Cross-Chain Adoption

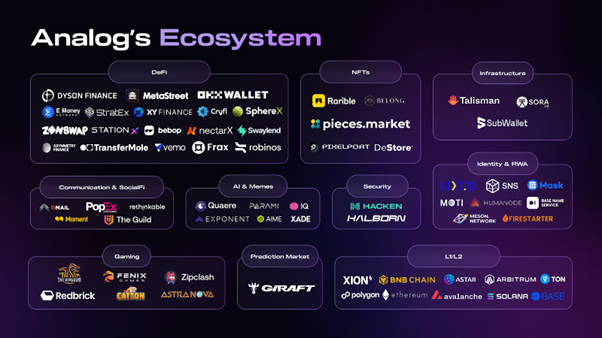

Analog’s ecosystem now features over 60 partners across DeFi, RWA, gaming, and AI. Key collaborators include OKX Wallet, Frax, MetaStreet, and Rarible. On the testnet side, more than 384,000 users have participated, and over 121,000 have already claimed airdrop rewards.

The platform’s expansion is also reflected in community apps like Pixelport, which has brought in nearly 58,000 users. To date, 14,980 NFTs have been bridged across different blockchains, highlighting early interest in omnichain asset utility.

What’s Next

Analog’s product roadmap features several new launches, led by OATS for seamless cross-chain asset transfers. Firestarter, backed by Black Label Ventures, will introduce real-world asset tokenization, while Zenswap—developed with Soramitsu—will enable cross-chain swaps via a single transaction.

“We see Analog as one of the few teams truly solving for interoperability at scale. As more use cases emerge across chains, especially in RWAs, there’s a real need for foundational infrastructure like what Analog is building,” said Managing Director of Bolts Capital. “And we’re excited to support their vision and growth with this $15 million strategic commitment.”

Bitcoin has once again cemented its place in the global financial hierarchy, reaching a market capitalization exceeding $1.8 trillion. This surge propels it ahead of some of the world’s most recognized corporations and commodities, placing it as the fifth largest asset by value.

Outpacing Corporate and Commodity Giants

Recent data from CompaniesMarketCap reveals that Bitcoin’s current market cap puts it just above Alphabet, Google’s parent company, by around $12 billion. The cryptocurrency also now surpasses Amazon, which holds a market valuation of $1.837 trillion, and has edged out silver, a historically significant precious metal, valued at $1.856 trillion.

Now, the next target for Bitcoin is Nvidia, which currently sits in fourth place with a market cap of approximately $2.4 trillion. However, to dethrone gold—the world’s top asset—Bitcoin would need an astronomical rally of over 1,000%.

Price Momentum Builds Amid Economic Shifts

The digital currency has witnessed an impressive 12% jump in value this week alone, now trading above the $93,500 mark. During the Asian trading session on Wednesday, Bitcoin even briefly pushed past $94,000. This rise follows easing global tensions and supportive remarks from President Trump, which calmed market nerves and encouraged investor optimism.

“Digital Gold” Narrative Strengthens

Bitcoin’s trajectory appears to be diverging further from traditional equity markets, enhancing its reputation as a hedge against macroeconomic uncertainty. This trend has been a key factor in reinforcing the asset’s “digital gold” status, especially as investors seek alternatives amid global instability.

Institutional Interest Fuels Momentum

There’s also been a significant uptick in institutional interest. On Tuesday, U.S.-listed spot Bitcoin ETFs recorded their largest single-day net inflow since mid-January, with nearly $913 million pouring in. These funds have now enjoyed three straight days of net inflows, signaling strong investor confidence.

Bitwise CIO Matt Hougan underscored this sentiment, stating, “Bitcoin is rallying because they broke the economy. And the way they’ll ‘fix’ the economy will make Bitcoin rally harder.”

Long-Term Optimism Remains High

Bitcoin developer Adam Back expressed a bullish long-term view, declaring that Bitcoin prices under $100,000 are still “cheap.” This kind of commentary highlights the enduring confidence among industry veterans in Bitcoin’s continued rise.