Spot Bitcoin exchange-traded funds (ETFs) in the United States experienced a significant decrease in net inflows, with only $132 million recorded on March 14.

This represented the lowest level of net inflows in the last eight trading sessions and a drastic 80% reduction from the $684 million recorded on March 13.

The decline on March 14 followed another decrease from the previous day, contrasting sharply with the record single-day inflows of $1.05 billion seen on March 12.

Despite the notable drop, the total inflow into Bitcoin ETFs was $390 million on March 14, factoring in a substantial $257 million in outflows from the Grayscale Bitcoin Trust ETF (GBTC), leading to the net inflow figure of $132 million.

The VanEck Bitcoin Trust ETF and Fidelity’s Wise Origin Bitcoin Fund also saw inflows, albeit modest, at $13.8 million and $13.7 million, respectively.

Despite GBTC’s significant outflows, the overall ETF market managed to maintain positive net flows on that day.

READ MORE: Elizabeth Warren Faces Unprecedented Challenge from XRP Advocate in Upcoming Senate Race

Leading the inflows, BlackRock’s iShares Bitcoin Trust ETF attracted $345 million. Cumulatively, the U.S. spot Bitcoin ETF market has seen impressive inflows, nearing the $12 billion mark after just 44 days of trading activity.

This trend of declining ETF inflows is occurring alongside a downturn in the broader crypto market, highlighted by a drop in BTC prices below $69,000.

The falling ETF inflows were mirrored by BTC price movements, which saw a new all-time high of over $73,000 on March 13 before falling to around $66,000 on March 15.

This price dip resulted in significant liquidations, with CoinGlass reporting that 193,431 traders were liquidated, totaling $682.14 million in the previous 24 hours.

Market analysts suggest that the current volatility, regulatory uncertainty, and macroeconomic considerations are prompting investor caution.

The ongoing decline in ETF inflows and BTC prices is also being watched closely in relation to the upcoming Federal Open Market Committee meeting, which is expected to provide insights into the Federal Reserve’s future interest rate decisions.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Bitcoin’s value experienced a significant drop amidst a tumultuous day in the cryptocurrency market, leading to over $661 million in crypto liquidations and affecting nearly 200,000 traders.

The sharp decline saw Bitcoin‘s price fall by 7.5% from $72,000 to $66,500 within just a few hours of trading on March 15.

Despite a brief recovery to the $68,000 mark, the cryptocurrency faced resistance and dropped to approximately $67,500, marking an 8.3% decrease from its March 14 peak of $73,737.

The bulk of the liquidations, which accounted for 80% or $525.2 million, were long positions, while short-position liquidations amounted to $136.5 million.

This sell-off contributed to a 7.3% reduction in the overall crypto market capitalization, which fell to $2.68 trillion as around $175 billion left the market.

Greeks Live, a crypto derivatives tool provider, commented on a “recent change in market tempo” on March 14, indicating a potential shift in the trend of Exchange-Traded Fund (ETF) inflows.

Pav Hundal, a lead analyst at Swyftx, expressed concerns to Cointelegraph about the potential for a correction into the low $60,000 or high $50,000 range if ETF volumes continue to diminish.

He highlighted worries over hot inflation data and a notable 48% drop in Bitcoin ETF inflow volumes from their 14-day average, which could signify a significant market correction.

On March 14, Bitcoin ETF inflows reached a monthly low of just $133 million, according to Farside Investors.

READ MORE: Solana Surges to Yearly High Amid Memecoin Mania, Outshines Bitcoin in Market Shift

Crypto trader and analyst CrediBULL Crypto, addressing his 380,000 followers on X, suggested that the recent market downturn was anticipated and could lead Bitcoin to drop further to between $63,000 and $64,000.

He noted that the dip had erased most of the accumulated open interest in derivatives markets.

The downturn was seemingly hastened by the release of U.S. economic data, including above-expected Producer Price Index (PPI) figures, indicating potential for sustained high rates by the Federal Reserve.

Additionally, higher-than-anticipated Consumer Price Index (CPI) data compounded concerns about the U.S. economy’s challenges.

Following this data, Asian stock markets also saw declines, dampening hopes for imminent lower interest rates.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Shiba Inu (SHIB) enthusiasts are at a critical moment, closely monitoring the cryptocurrency as it challenges a major resistance level.

Crypto analyst Rekt Capital has highlighted the importance of this juncture, noting that SHIB is currently in a phase of consolidation just below a key resistance point, a hurdle that needs to be overcome for SHIB to continue its upward journey.

Central to Rekt Capital’s analysis is the resistance level at 0.0000332, marked by a blue line on the charts.

This level has posed a significant challenge to SHIB’s upward momentum, leading to a sideways trading pattern. Currently, SHIB’s price is at 0.0000327, inching closer to breaking through this crucial resistance.

For SHIB to unlock its bullish potential, it must break through the 0.0000332 level decisively, turning it into solid support.

READ MORE: Bitcoin Halving Not ‘Fully Priced In’ as Fresh Rally Expected with $100,000 Target

Achieving this would open the door for SHIB to target the next resistance level at 0.0000473, marked by a black line on the charts.

The implications of breaking through the 0.0000332 level are significant. A successful breach could lead to a price increase of over 40% from its current position.

However, failing to surpass this resistance could result in extended consolidation or a potential pullback for SHIB.

The concept of support and resistance levels is dynamic, changing with market conditions and investor sentiment.

Yet, Rekt Capital’s analysis emphasizes the critical importance of the 0.0000332 level in determining SHIB’s short-term direction.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In the rapidly evolving cryptocurrency market, meme coins like DOGE, SHIB, PEPE, and others have been capturing significant attention, particularly in a bullish phase.

Among these, PEPE, the third-largest meme coin by market cap, has notably stood out with an extraordinary performance.

In the last month alone, it has seen an astounding surge of over 840%, drawing considerable interest from investors and traders alike.

As of March 14, 2024, PEPE broke new ground by exiting a consolidation phase it had been in over the past five trading days and hitting a new all-time high at $0.0000108.

This breakout led to a further increase of over 14%, with the coin’s price stabilizing around $0.0000105. Experts analyzing PEPE’s market behavior consider it bullish post-breakout, suggesting potential for further gains.

They predict that if PEPE can maintain its position above the $0.0000105 level, it could climb to $0.000014 in the near future.

However, they also caution about the possibility of a correction or consolidation period, considering the coin’s recent substantial gains.

The 24-hour trading volume for PEPE has seen a 50% increase, reaching approximately $2.4 billion, indicating a heightened interest in the coin.

Over the past week, PEPE has gained over 55%, and over the past month, investors have enjoyed returns exceeding 840%.

A noteworthy event in this saga is the significant profit earned by a savvy trader, known by the address 0x522, who secured over $3.39 million from trading PEPE.

As reported by the on-chain analysis firm SpotOnChain, this trader moved 500 billion PEPE tokens, valued at about $4.26 million, to Binance, the world’s largest cryptocurrency exchange, within the last ten days.

This move resulted in a profit of $3.39 million from a mere 870K investment.

SpotOnChain further revealed that this trader still possesses 100 billion PEPE tokens, now worth approximately $1.07 million.

Additionally, the trader has earned nearly $900K in profits from trading other meme coins like FLOKI and SHIB.

This activity underscores the significant wealth creation in the meme coin sector, further amplified by the approval of the spot Bitcoin ETF, which has led to widespread gains across the meme coin market.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The cryptocurrency market recently witnessed an unprecedented surge, with a remarkable inflow of $80 billion, primarily propelled by the significant performances of Shiba Inu (SHIB) and Dogecoin (DOGE).

Last week, SHIB’s trading volume reached an astonishing $31 billion, surpassing DOGE, which also had a notable volume of $23 billion.

This marked a pivotal moment in the market, indicating a shift towards SHIB’s increasing popularity over the traditionally dominant DOGE.

Shiba Inu’s journey from being an underdog to a market leader is nothing short of dramatic. Its chart showcases a sharp uptrend, demonstrating a rapid increase in value.

This growth is attributed to a mix of investor excitement and favorable market dynamics.

A key bullish signal is the moving averages positioning below the candlesticks, suggesting a strong foundation for further price hikes.

Despite a minor pullback, which analysts see as a potential market correction, SHIB remains well above essential moving averages.

The high trading volume emphasizes strong buyer interest, hinting at continued momentum.

On the other hand, Dogecoin’s narrative is one of stability and optimism. Its price stability above moving averages reflects enduring investor confidence.

The recent consolidation pattern hints at an accumulation phase, potentially setting the stage for future gains, especially if interest in meme coins persists.

The moving averages beneath the price action denote a steady upward trend, though DOGE’s volume has been less volatile compared to SHIB.

This might make DOGE an attractive option for those seeking a more stable investment in the meme coin sector.

Both SHIB and DOGE have showcased remarkable trends, influencing the broader cryptocurrency market. SHIB’s explosive volume and price increase reflect a growing investor interest, challenging DOGE’s position.

Meanwhile, DOGE’s consistent performance speaks to its enduring appeal.

These dynamics underscore the evolving landscape of the cryptocurrency market, where meme coins continue to play a significant role in shaping investor sentiment and market trends.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

DOGAMÍ’s ($DOGA) price is poised to surge as the project is set to announce the listing of its token on a top 5 centralised exchange (CEX) in March, sources familiar with the matter told Crypto Intelligence on Friday.

$DOGA is one of many dog-themed tokens, like Shiba Inu ($SHIB) and Dogecoin ($DOGE), but this token has considerably more upside potential due to its small market cap of just $5.2 million.

DOGAMÍ is currently tradeable on Gate.io and MEXC, but this new CEX listing will give $DOGA huge exposure and potentially attract tens of thousands of new investors in a matter of weeks.

As such, $DOGA’s price could surge over 70% once this new exchange listing is announced, and many investors are ultra-bullish on this token in the medium-to-long run.

$DOGA Price Prediction

Dogami coin is in a good position to breach $0.15 by the end of this year, delivering a 10x return at the current entry price.

However, this is a relatively conservative prediction, and some $DOGA holders are forecasting it to reach a $700 million market cap, which would propel the DOGA token price to almost $1.80.

This would deliver a 120x return to investors who buy in at the current entry price.

Other dog-themed coins, like Shiba Inu and Dogecoin, are also likely to rally in 2024, delivering a 2x-4x return, according to numerous price predictions.

However, both SHIB and DOGE have been facing resistance recently, and it remains to be seen if they will lose momentum as investors switch to smaller memecoins with more potential for huge gains.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

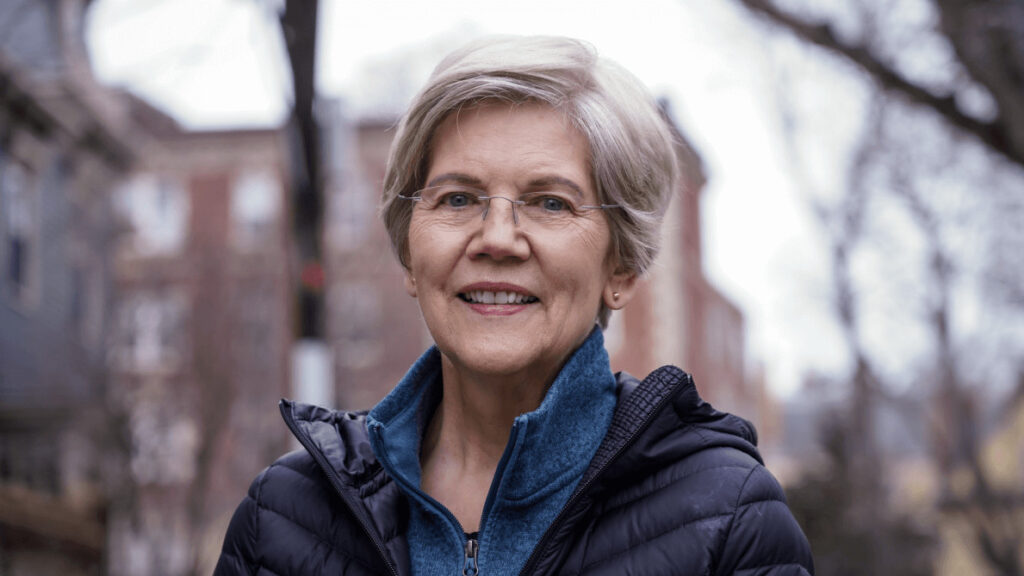

United States Senator Elizabeth Warren is known for her critical stance on the cryptocurrency industry, prompting backlash from various sectors for her actions against digital assets.

In February, the Blockchain Association, along with military and national security professionals, expressed their concerns about Warren’s proposed cryptocurrency legislation, especially her Anti-Money Laundering bill.

They argue that the bill could significantly slow down the blockchain industry’s development in the United States, potentially harming the country’s strategic position, job market, and having minimal impact on the illicit activities it aims to curb.

Kristen Smith, CEO of the Blockchain Association, shared with Cointelegraph the strong industry and congressional support following their letter to Congress, highlighting the industry’s dedication to fostering an innovative environment while addressing regulatory challenges.

Despite opposition, Warren remains steadfast in her critique of the crypto sector.

In a Bloomberg interview, she expressed a desire to work with the industry but criticized its resistance to regulatory measures aimed at curbing illegal activities, implicating the industry in facilitating transactions for drug traffickers, human traffickers, and even contributing to North Korea’s nuclear program.

The crypto community has responded critically to Warren’s regulatory approach.

Danny Lim, from MarginX, criticized the bill for its inefficiency and lack of suitability for the crypto environment, suggesting that traditional finance regulations cannot be directly applied to cryptocurrencies.

Zac Cheah of Pundi X echoed these sentiments, calling for regulations that balance innovation with effective anti-money laundering measures.

Warren’s position could be further challenged by John Deaton, a lawyer and XRP advocate, who announced his candidacy for the Senate in Massachusetts, posing a direct threat to Warren’s seat.

Deaton’s campaign has garnered support from notable figures in the cryptocurrency community, including Cardano founder Charles Hoskinson.

Deaton’s candidacy underscores the growing political influence of the crypto industry and signals a potential shift in the political landscape for those with anti-crypto platforms.

With a significant portion of Boston.com poll respondents viewing Warren as vulnerable to Deaton’s challenge, the upcoming election could mark a pivotal moment in the intersection of cryptocurrency and politics.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

On March 14, the cryptocurrency market witnessed a significant price surge in Solana (SOL), marking its highest point since January 2022.

The currency experienced an increase of approximately 6.70%, reaching $174, outperforming the overall cryptocurrency market, which saw a slight decline of 0.25%.

This rally was primarily fueled by heightened activity on the Solana network, largely due to the enthusiasm surrounding the memecoin project Dogewhatif (WIF).

The project gained traction when its supporters gathered $700,000, vastly exceeding their initial $50,000 goal, to display the token’s logo on the Las Vegas sphere.

This event propelled WIF’s price by 25%, pushing its market cap to $3 billion.

The price of SOL began to climb after the Dogwifhat campaign was announced on March 10, resulting in a more than 24% increase.

This rally gained momentum particularly after the successful WIF crowdfunding.

The involvement of memecoin projects on Solana’s blockchain has been a bullish signal for the network, with research indicating significant activity during these periods.

READ MORE: FLOKI Cryptocurrency Eyes New Highs Amid Token Burns and Analyst Optimism

Solana’s network has also shown signs of increased activity, with the total-value-locked (TVL) reaching its highest since December 2022, at 23.07 million SOL.

This surge is reflective of the platform’s growing utility for decentralized applications (DApps) and transactions, potentially leading to greater SOL demand.

Additionally, Solana’s recent performance against Bitcoin has been notable.

The SOL/BTC pair saw a substantial rise of 32.45% after a dip earlier in the month, with a 6.60% increase on March 14 alone.

This suggests a shift in investor preference from Bitcoin, which has shown signs of being overbought, to altcoins like Solana and XRP, which present a more balanced sentiment.

Technical analysis also supports Solana’s bullish trend, with predictions targeting the $195-200 range by the end of March.

However, the recent rally has pushed Solana’s RSI into the overbought territory, hinting at a possible correction.

If a downturn occurs, SOL could face a drop towards its 0.5 Fibonacci retracement level at $135, a 20% decline from its current price.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The cryptocurrency market has seen significant activity recently, with Bitcoin reaching another all-time high.

Similarly, the Shiba Inu (SHIB) cryptocurrency has been making efforts to reach a new historical peak.

Part of these efforts includes the SHIB community’s continuous attempt to burn SHIB meme coins, aiming to reduce their supply and increase scarcity.

Recent data from the Shibburn tracker indicates that millions of Shiba Inu coins have been burned, showcasing a remarkable surge in the burn rate of 430%.

According to this data, there has been a 429.78% increase in the rate at which SHIB coins are being destroyed, with a total of 15,155,141 meme coins sent to “inferno” wallets across nine transactions.

The most significant transaction moved 10,196,078 SHIB to an unspendable blockchain wallet, followed by smaller transactions moving 1,882,892 and 1,580,028 SHIB to dead-end addresses.

Although this spike in the burn rate is impressive, it’s important to note that the total amount of coins burned in these instances is less than the amount burned in other daily activities within the same week.

READ MORE: Web 3.0 Gaming: Taki Games Set to Launch Genopets Match in April

For example, on March 12, a substantial 386,077,185 SHIB were burned, despite the burn rate only increasing by 29.22%.

The most notable burn event recently occurred on March 9, when the SHIB team itself undertook a massive burn of 13,610,153,841 SHIB.

This event was not limited to SHIB coins; it also included the burning of BONE and LEASH tokens, which are crucial to the Shibarium ecosystem.

These burns were facilitated by Shibarium’s layer-2 solution and the gas fees collected by the developers.

Despite the fluctuation in burn activities, SHIB’s price experienced a 7.80% increase within the last 24 hours, trading at $0.00003382 at the time of reporting.

This activity underscores the community’s dedication to influencing the coin’s value through strategic burns, aiming for a tighter supply and potentially higher prices.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

With only about 34 days left until the Bitcoin halving event, which will slash the Bitcoin issuance rate by half, there’s a buzz in the cryptocurrency market.

Basile Maire, D8X co-founder and former UBS executive director, in an interview with Cointelegraph, emphasized the significant impact this event could have on supply and demand dynamics.

He said, “There seems to be more demand and less supply, so according to the old economic rules, prices have to move up.

“So the question now: is the [Bitcoin halving] priced in? Probably not to the full extent.”

‘This anticipated event is set against the backdrop of Bitcoin’s price surging past $71,000 for the first time on March 11, signaling robust market optimism.

This bullish sentiment is further echoed in the Bitcoin futures market, where expectations are steering towards a remarkable climb to the $100,000 mark by May.

Maire detailed, “The option data says that people expect Bitcoin price to be in the range of $80,000 to $100,000.

READ MORE: Web 3.0 Gaming: Taki Games Set to Launch Genopets Match in April

“For instance, in May, there was quite a spike in open interest for $100,000. While it’s not a big volume [spike]. I still think this means something.”

Adding to the fervor is the upcoming U.S. presidential election, seen by Maire as a potential positive catalyst for the crypto market.

He believes measures to stabilize traditional markets will inadvertently benefit cryptocurrencies, especially with the enhanced linkage through ETFs.

The surge in Bitcoin’s value has also been partly attributed to the inflows from U.S. spot Bitcoin exchange-traded funds (ETFs), as noted by Sergei Gorev, a risk manager at YouHodler.

He highlighted the significant daily purchases by these ETFs, stating, “Spot Bitcoin ETFs buy 10 times more Bitcoin daily than miners produce each day.”

With a total on-chain holding of $60.5 billion as of March 13, and based on recent trends, Bitcoin ETFs are on track to absorb a substantial portion of the BTC supply annually, per Dune data, further underscoring the growing mainstream acceptance and investment in Bitcoin ahead of the halving event.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.