The Philippines’ financial regulatory body has announced plans to restrict access to Binance, the leading global cryptocurrency exchange, due to concerns regarding its unauthorized operations within the nation.

This action is in response to the platform’s provision of investment services, such as leveraged trading and crypto savings accounts, without the necessary licenses, infringing on the Securities Regulation Code.

In collaboration with the National Telecommunication Commission (NTC), the Securities and Exchange Commission (SEC) of the Philippines aims to block Binance’s website and online trading services.

This decision was outlined in a document by the SEC dated March 25.

SEC Chairperson Emilio B. Aquino emphasized the risk posed to the security of Filipino investors’ funds if access to these platforms remains unrestricted, stating, “The SEC has identified the aforementioned platform and concluded that the public’s continued access to these websites/apps poses a threat to the security of the funds of investing Filipinos.”

To mitigate immediate disruptions, the implementation of this ban will be phased over three months, allowing investors sufficient time to close their positions with Binance.

Additionally, the SEC has approached Google and Meta to prevent Binance-related advertisements from reaching Filipino audiences.

READ MORE: StaFi Liquid Staking Protocol Launches Testnet Awaiting StaFi 2.0 Mainnet Launch

This regulatory action against Binance in the Philippines adds to the exchange’s growing list of global regulatory challenges.

Notably, in December 2023, Binance and its former CEO, Changpeng “CZ” Zhao, were fined $2.7 billion and $150 million, respectively, by a U.S. court following a CFTC lawsuit.

This legal battle, initiated in March 2023, accused Binance of contravening U.S. law by operating an illegal derivatives exchange without authorization.

The repercussions for CZ have been significant, with his agreement in November to resign from his leadership role at Binance amid a broader settlement with various U.S. regulatory bodies, including the Department of Justice and the CFTC.

Moreover, CZ admitted guilt to numerous civil infractions and a criminal charge related to violations of Anti-Money Laundering statutes.

While he awaits sentencing for money laundering charges, currently scheduled for April 30, CZ remains on a $175 million release bond.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

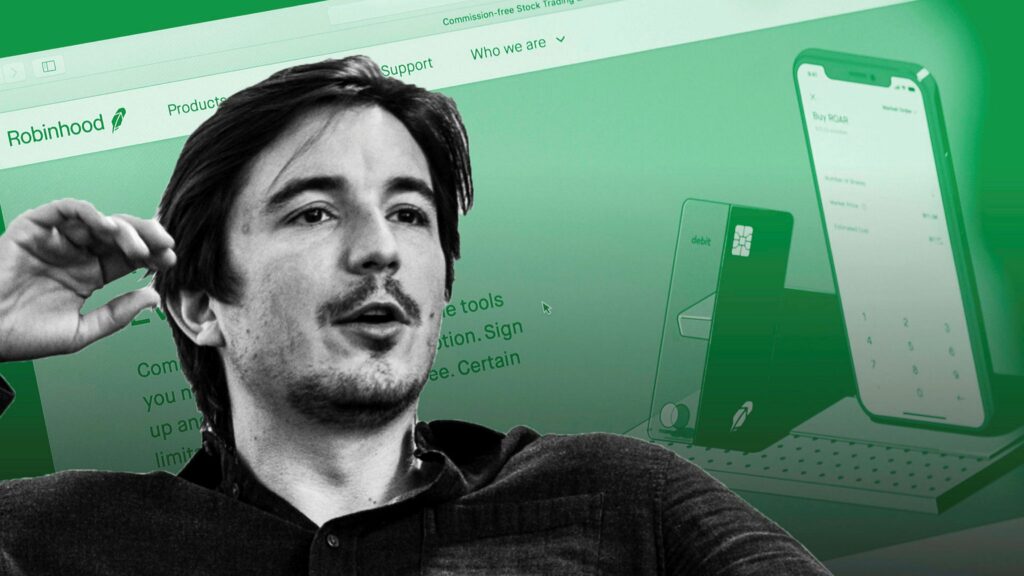

Robinhood, the esteemed American trading platform renowned for its stock and cryptocurrency services, has announced the launch of its much-anticipated Android version of its self-custody crypto wallet on March 20, 2024.

The announcement, delivered through Johann Kerbrat, the crypto general manager at Robinhood via his X account, heralds a pivotal expansion in the company’s cryptocurrency services.

This new development is particularly significant for Android users, who represent about 70% of the global mobile operating system market, thereby markedly broadening the accessibility of cryptocurrency tools.

The Android version of the wallet mirrors its iOS counterpart, which was introduced in 2023 and quickly gained traction, with extensive downloads in over 140 countries.

A noteworthy feature of the Android wallet is its support for the widely favored meme coin, Shiba Inu (SHIB), which highlights Robinhood’s commitment to catering to the varied interests of crypto enthusiasts.

Robinhood’s initiative to launch a self-custody crypto wallet for Android users aligns with its mission to democratize cryptocurrency trading.

By enabling users to have full control over their private keys, the wallet allows for the direct storage, sending, and receiving of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others across several blockchains.

READ MORE: SEC Delays Decision on Ether ETFs, Casting Doubt on Approval Odds Amidst Growing Skepticism

Moreover, it integrates with the 0x API and LI.FI for users interested in swapping cryptocurrencies within the Ethereum, Arbitrum, and Polygon networks, offering a smooth and flexible experience.

This advancement is also significant against the backdrop of Robinhood’s centralized exchange platform, where Shiba Inu emerges as a dominant asset.

According to Arkham Intelligence, Robinhood users possess an impressive 39.60 trillion SHIB tokens, equating to a collective value exceeding $1.06 billion, positioning Shiba Inu as the third most-held cryptocurrency on the platform, trailing only behind Bitcoin and Ethereum.

The inclusion of Shiba Inu support in the Robinhood Android wallet underscores the platform’s dedication to providing comprehensive services for crypto traders and enthusiasts.

By facilitating access to self-custody solutions, Robinhood is taking a substantial step towards enhancing the accessibility and adoption of cryptocurrency trading for a broader audience, further solidifying its role in the expanding digital currency landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

In Argentina, the recent surge in Bitcoin demand reflects the population’s attempts to safeguard their savings amid the peso’s rapid devaluation.

Bloomberg highlighted this trend on March 20, citing a report from Lemon Cash, a cryptocurrency exchange, which recorded an unprecedented interest in Bitcoin.

In the week ending March 10, nearly 35,000 Argentines turned to Bitcoin, marking a twofold increase in the cryptocurrency’s weekly purchase rate compared to the previous year.

The Argentine peso has suffered a significant decline over the past year, with its value against the US dollar plummeting fourfold, from 0.0049 USD in March 2023 to 0.0012 USD.

This depreciation has been a key driver for many Argentines to look for more stable investment alternatives, such as Bitcoin.

Lemon Cash isn’t the only platform experiencing increased demand for cryptocurrencies.

Other major Argentine exchanges like Ripio and Belo have reported similar trends. Belo’s CEO, Manuel Beaudroi, observed a shift in preference from stablecoins to Bitcoin, attributing this change to the cryptocurrency’s recent price rally.

Beaudroi explained, “The user decides to buy Bitcoin when they see the news that the currency is going up, while stablecoin is more pragmatic and many times used for transactional purposes, as a vehicle to make payments abroad.”

Furthermore, he mentioned that Belo has witnessed a tenfold increase in transactions involving Bitcoin and Ether in early 2024 compared to the same timeframe in the previous year.

Despite the burgeoning interest in Bitcoin, there’s still a notable inclination towards stablecoins.

Argentines are reportedly bypassing well-known exchanges to purchase USD stablecoins through “crypto caves,” unregulated markets that offer an escape from stringent currency controls and inflation.

The adoption of digital currency in Argentina is gradually extending beyond investment purposes.

In December 2023, Diana Mondino, minister of foreign affairs, international trade, and worship, announced a decree facilitating the use of Bitcoin and other cryptocurrencies under specific conditions as part of economic reform efforts.

This led to a groundbreaking rental agreement in Rosario, where a tenant agreed to pay their rent in Bitcoin, showcasing the growing practical use of digital currencies in everyday transactions.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The Floki Inu development team has announced its 2024 roadmap, highlighting ambitious plans to expand the utility and features of the dog-themed memecoin.

Among the key initiatives is the introduction of regulated digital banking accounts, allowing users to create and manage their finances using FLOKI tokens.

This development aims to bridge the gap between traditional banking and cryptocurrencies, offering SWIFT payments and SEPA IBANs through a partnership with a licensed fintech firm in countries including Canada, Spain, Dominica, Australia, and the UAE.

Another significant step is the planned integration with the Venus decentralized finance (DeFi) protocol.

This move is expected to improve liquidity and enable FLOKI holders to use their tokens as collateral for borrowing assets like Maker (DAI), Circle’s USDC stablecoin, BNB (BNB), and Ether (ETH).

By embedding Venus Markets directly into Floki’s user interface, the team seeks to provide seamless access to DeFi services, thus deepening Floki Inu’s integration with the ecosystem.

The roadmap also unveils the forthcoming Floki Debit Card, designed to link digital banking accounts to a physical card.

This will allow users to easily convert and spend their FLOKI tokens in traditional currencies such as the euro (EUR) and U.S. dollars (USD), promoting the adoption of cryptocurrency in everyday transactions.

Further, Floki Inu’s initiative to list its native token on the Venus Core Pool awaits governance approval.

READ MORE: Bitcoin Rallies Amid Fed’s Interest Rate Decision, Showcasing Resilience Against ETF Outflows

This strategy is crafted to bolster liquidity and mirror the financial dynamics of well-established cryptocurrencies, enhancing the utility of FLOKI tokens.

The development team is also preparing to launch a cross-chain trading bot for Telegram and Discord, utilizing FLOKI tokens for transactions across major blockchain networks.

This bot is part of a strategy to reduce the token’s supply through a deflationary mechanism, where half of the transaction fees are used to purchase and burn FLOKI tokens.

Finally, the highly anticipated Valhalla mainnet launch is set to introduce an array of features including on-chain gaming, a PlayToEarn system, customizable NFTs, and an expansive metaverse environment.

This represents a major milestone in Floki Inu’s journey towards creating a comprehensive utility and gaming platform.

Amid these developments, the Hong Kong Securities and Futures Commission issued a warning about Floki Inu’s staking programs, indicating they are not authorized for public sale in Hong Kong despite offering annualized returns between 30% and over 100%.

This caution underscores the importance of regulatory compliance in the rapidly evolving cryptocurrency landscape.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

IFTTT (If This Then That), a third-party auto-posting service, has been implicated in a recent scam outbreak on X involving bogus posts that prompted users to invest in a fake meme token named “PACKY” by sending Solana’s SOL to a particular wallet address.

The scam notably affected the X profiles of notable figures in the crypto and tech industries, including a16z adviser Packy McCormick, Coinbase product director Scott Shapiro, and Twitch co-founder Justin Kan, all of whom found their accounts hijacked to promote the fraudulent token.

Packy McCormick was among the first to alert his followers, stating, “This is not me.

“Account hacked. Working to get it fixed. Don’t click any links from me or (obviously) send money to a random address.”

His account had previously posted claims about creating the PACKY memecoin with ambitious marketing strategies and plans for CEX listings, accompanied by a Solana wallet address.

McCormick later revealed the intrusion’s source was IFTTT, a service he had linked to his Twitter account years earlier, advising others to revoke permissions to such apps to prevent similar incidents.

Blockchain investigator ZachXBT and other affected individuals, including Justin Kan, echoed this analysis, highlighting the security risks posed by outdated third-party app connections.

Scott Shapiro’s compromised account also spread misinformation about a collaboration with Coinbase’s CEO to launch the PACKY token, leading him to comment on the danger of having old, connected third-party applications and stressed the importance of revoking their access.

The incident further extended to others in the digital space, including Rainbow co-founder Mike Demarais, Asymmetric Finance’s Joe McCann, and digital artist Bryan Brinkman, all victims of the scam through their IFTTT-linked X accounts.

Brinkman issued an apology and offered to assist those who fell for the scam, underscoring the lesson that even with robust security measures like 2FA and Yubikey, vulnerabilities can still be exploited.

As this wave of scams shakes the X platform, highlighting ongoing concerns over cybersecurity in the social media domain, IFTTT’s role in this specific series of hacks remains a critical point of contention, with the company yet to respond to inquiries regarding the incident.

The prevalence of scams and hacking on X, as exemplified by this event and even a breach of the SEC’s official account, underscores the persistent challenge of ensuring digital security amidst the platform’s vast landscape of users and applications.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Coinbase has recently underscored the remarkable evolution of Dogecoin, from a meme-inspired currency to a mainstay in the cryptocurrency domain.

This recognition of Dogecoin’s “enduring popularity” is leading the exchange to introduce futures trading for the cryptocurrency.

In its communications with the United States Commodity Futures Trading Commission (CFTC) on March 7, Coinbase Derivatives expressed intentions to unveil cash-settled futures contracts for Dogecoin, along with Litecoin and Bitcoin Cash, aiming for an April 1 launch date.

Highlighting an unconventional path to market expansion, Coinbase mentioned its strategy to leverage the “self-certification” process for these futures contracts, adhering to CFTC’s regulatory framework, without waiting for formal approval.

The company stated, “Coinbase Derivatives […] hereby submits for self-certification its initial listing of the Dogecoin Futures contract to be offered for trading on the Exchange on or after April 1, 2024.”

This move reflects Coinbase’s belief in Dogecoin’s significant transformation and its established role within the crypto industry.

The price of DOGE, in response to these developments, surged by 17%, showcasing its trading value at $0.15.

The decision to list futures contracts for Dogecoin, Litecoin, and Bitcoin Cash sparked varied reactions among market observers and social media commentators.

Some analysts perceive this as a strategic attempt by Coinbase to challenge the Securities and Exchange Commission (SEC) in its classification of crypto assets.

Bloomberg exchange-traded fund analyst James Seyffart suggested on X (formerly Twitter) that this could be a maneuver to prevent these cryptocurrencies from being classified as securities, especially those based on the Bitcoin’s proof-of-work consensus mechanism.

Seyffart’s observation points to a broader strategy of influencing how regulatory bodies view crypto assets following the approval of spot Bitcoin ETFs.

Coinbase’s venture into the derivatives market traces back to its 2022 acquisition of FairX, a CFTC-regulated derivatives exchange, aiming to democratize the derivatives trading landscape for its vast retail customer base.

This initiative is part of Coinbase’s broader mission to make derivative markets more accessible and understandable for everyday investors, further cementing its position as a pioneering platform in the cryptocurrency trading arena.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The Pyth oracle’s integration with Merlin Chain, a Layer 2 solution on Bitcoin that combines ZK-Rollup technology, a decentralized oracle network, and BTC fraud detection modules, marks a significant leap forward. This move underscores Pyth Price Feeds’ position as a critical resource for developers in the burgeoning Bitcoin ecosystem.

“The team is looking forward to join hands with Pyth, a leading oracle, to help build the foundation of Merlin Chain. With the price feeds and market data Pyth provides, we are now ready to welcome the next generation of Bitcoin and DeFi to Merlin Chain,” Jeff, Founder of BitmapTech and Merlin Chain, said.

With Pyth Price Feeds going live on Merlin Chain, developers now have unrestricted access to over 400 real-time data feeds from a vast array of asset classes, enhancing the security and functionality of diverse smart contract applications, including trading, lending, and borrowing platforms. Pyth’s unique pull oracle architecture offers an efficient way for applications to obtain the latest price data, ensuring accuracy and timeliness for end-users.

Merlin Chain stands out as a Layer 2 enhancement for Bitcoin, focusing on enriching Bitcoin’s Layer 1 assets, protocols, and products with advanced technologies. As a branch of Bitmap Tech, Merlin Chain brings significant credibility and innovation to the Bitcoin ecosystem, highlighted by its successful BRC-420 “Blue Box” collection among the Ordinals.

The Pyth Network, known for delivering secure, low-latency financial data, gathers proprietary data from leading exchanges and trading firms, making it a backbone for smart contracts and decentralized applications. In a relatively short span, Pyth has managed to secure over $2 billion in value, now supporting more than $3 billion across numerous markets. With its comprehensive coverage across cryptocurrencies, stocks, ETFs, forex pairs, and commodities, Pyth has become instrumental in powering over $120 billion in trading volume across more than 50 blockchain ecosystems.

The Uzbekistan National Agency for Prospective Projects (NAPP) announced an increase in monthly fees for cryptocurrency market participants on March 19, 2024.

This move revises an initial directive from the Ministry of Justice back in September 2022, aimed at enhancing the financial contributions from the crypto sector to state revenues.

This decision comes after NAPP’s evaluation of the sector’s profitability, leading to a new fee structure affecting crypto exchanges and retailers alike.

Crypto exchanges in Uzbekistan will now incur a monthly fee of 740 basic reference values (BRV), equivalent to about 251.6 million Uzbekistani som ($20,015), a significant hike from the previous 400 BRV or 136 million som ($10,819).

The BRV, a unit used for calculating various financial obligations like taxes and fines, has thus become a more substantial burden for these businesses.

Similarly, the fees for crypto retailers have risen sharply to 185 BRV per month, translating to 62.9 million som ($5,003), up from a mere 20 BRV or about 6.8 million som ($540) previously.

NAPP’s rationale behind these adjustments is to double the revenue from the crypto sector while ensuring these changes do not adversely affect the service providers’ financial health.

The revised fee system is set to be implemented on June 20, giving stakeholders three months to adjust.

This regulatory adjustment follows a Memorandum of Understanding between NAPP and Tether, focusing on fostering blockchain innovations within Uzbekistan, such as stablecoins and digital asset tokenization.

Although the finer details of this partnership remain confidential, Tether has expressed its commitment to working with local authorities to develop a conducive legal and regulatory environment for crypto assets.

Additionally, this development is in line with NAPP’s legal action against Binance for operating without a proper license and failing to settle fines. Uzbekistan mandates that all crypto exchanges operate with a license and house their trading servers within the country.

This policy, enforcing licensed operation of crypto services, was established in 2023, with the first batch of licenses awarded in November 2022.

Prior to this, Uzbekistan had already restricted access to major international crypto exchanges like Binance, FTX, and Huobi over unlicensed activities accusations.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

Kyle Davies, co-founder of the now-defunct crypto hedge fund Three Arrows Capital (3AC), expressed no regret over the billions in investor funds lost due to the company’s bankruptcy.

In a March 19 episode of the Unchained Podcast, Davies maintained that the failure of 3AC and the subsequent backlash did not tarnish his professional reputation.

He stated, “Am I sorry for a company going bankrupt? No. Like, companies go bankrupt all the time,” highlighting his lack of remorse with laughter.

Discussing future endeavors, Davies hinted at advising potential successors on how to better manage a bankruptcy scenario, suggesting a nonchalant approach to the dissolution of his hedge fund.

He also revealed his intention to steer clear of Singapore, fearing possible incarceration, and noted that he has been moving between Europe and Asia, with a recent stay in Portugal.

In April 2023, amidst the fallout, Davies and his partner Su Zhu initiated OPNX, a venture combining bankruptcy claims processing with a crypto exchange.

Davies praised the launch as “very impressive,” asserting his enduring respect within the cryptocurrency community.

However, the venture was short-lived, with OPNX announcing its closure by February 14.

Davies countered claims of non-cooperation with the liquidators, Teneo, overseeing 3AC’s dissolution, describing such allegations as overstated.

He argued that portraying them as uncooperative was a strategic move by the liquidators to reclaim more assets.

READ MORE: Binance Offers Up to $5 Million Reward for Insider Trading Tips Amid Memecoin Listing Controversy

Despite these assertions, Davies and Zhu faced subpoenas via Twitter on January 5, 2023, for evading communication and not sufficiently cooperating with the liquidation process.

In the wake of 3AC’s collapse in 2022, a British Virgin Islands court froze $1.14 billion of Davies and Zhu’s assets.

Teneo has estimated the outstanding debt to 3AC creditors at approximately $3.3 billion and is actively seeking $1.3 billion directly from the co-founders.

This pursuit comes after allegations that Davies and Zhu engaged in excessive borrowing against investor funds post-insolvency.

Adding to their challenges, Singapore’s central bank imposed nine-year prohibition orders against Davies and Zhu in September of the previous year for alleged breaches of the nation’s securities regulations while at the helm of 3AC.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.

The recent surge in popularity and value of meme coins such as Shiba Inu (SHIB), Dogwifhat (WIF), and BOME has sparked concerns from Ki Young Ju, CEO of CryptoQuant.

Ju argues that the viral and speculative nature of these cryptocurrencies poses a significant threat to the integrity and advancement of the cryptocurrency sector.

He points out the detrimental effect of these billion-dollar meme coins on legitimate projects that aim to innovate within the industry.

Ju’s frustration stems from the speculative frenzy similar to the initial coin offering (ICO) boom, which ended in substantial losses for many investors.

Ju counters the argument that meme coins might serve as an entry point for newcomers into the crypto space by highlighting the risks associated with their speculative nature.

He draws parallels with the ICO craze of 2018, noting that many projects failed to deliver real value.

READ MORE: Bitcoin Nears $60K Amid Weekend Sell-Off; Market Eyes ETF Resurgence and Futures Gap for Recovery

Ju is particularly critical of the lack of industry leadership advocating for genuine product development, observing a worrying trend towards gambling rather than innovation and the creation of tangible solutions.

Despite some viewing meme coins as an introduction to cryptocurrency, Ju warns of their potential harm, emphasizing the need for leadership in the industry.

He admires figures like Changpeng Zhao, the former CEO of Binance, for their commitment to driving the industry forward with innovative and substantial products.

The discussion also touches on Zhao’s current situation, awaiting a court decision while being restricted from leaving the United States, underscoring the importance of responsible leadership in the cryptocurrency field.

Ju’s commentary reflects a call for a shift in focus towards sustainable development and away from speculative ventures that could undermine the crypto industry’s legitimacy.

To submit a crypto press release (PR), send an email to sales@cryptointelligence.co.uk.