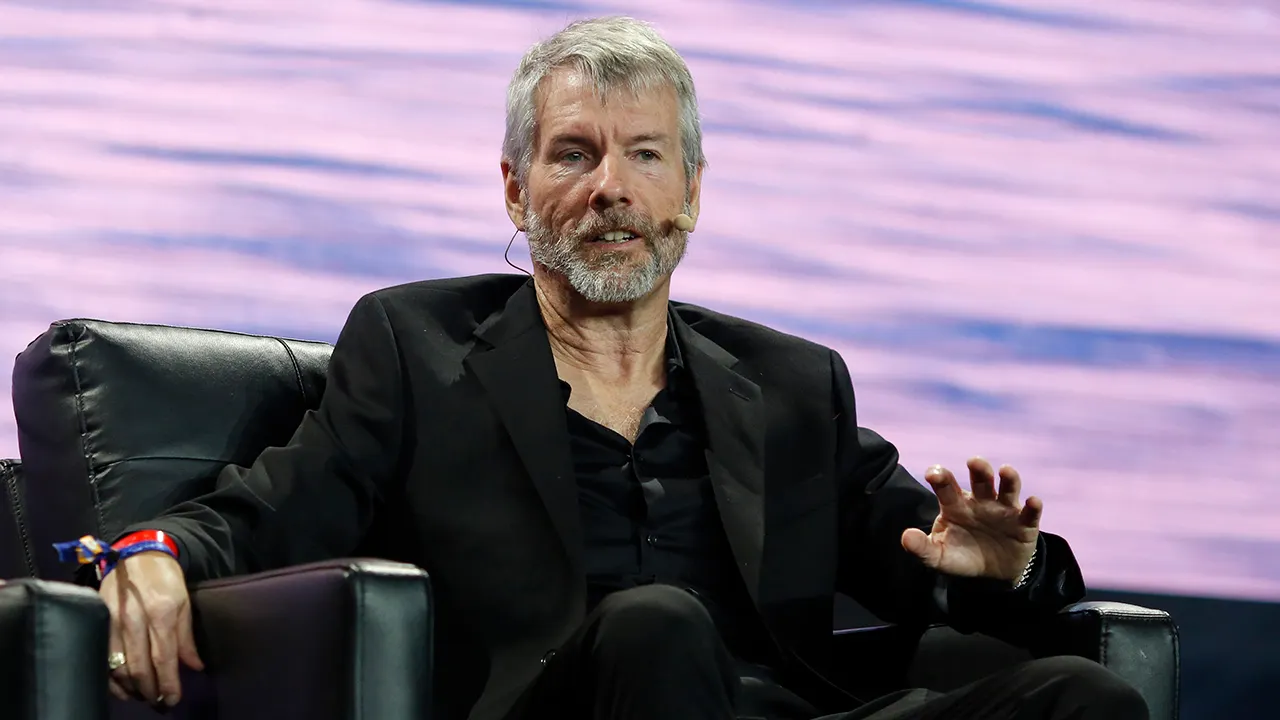

Michael Saylor, executive chair of Strategy, has dismissed reports that the company reduced its Bitcoin holdings during the latest flash crash, calling the claims inaccurate and reaffirming the firm’s long-term accumulation strategy.

His comments arrived after a steep 24-hour price drop that pushed Bitcoin from above $100,000 to below $95,000.

Saylor Says Reports of Bitcoin Selling Are False

In a Friday post on X, Saylor said there was “no truth” to suggestions that Strategy had cut its Bitcoin reserves by about 47,000 BTC — a reduction worth $4.6 billion at current prices.

He emphasized that the company was continuing to purchase Bitcoin, even as volatility intensified and the price fell more than 4% in a single day.

“I think the volatility comes with the territory,” Saylor said in a CNBC interview on Friday.

“If you’re going to be a Bitcoin investor, you need a four-year time horizon and you need to be prepared to handle the volatility in this market.”

Strategy remains the world’s largest corporate Bitcoin holder with a treasury of roughly 640,000 BTC.

However, its dominance has tapered as other institutions increased their accumulation.

Companies including Coinbase and Metaplanet acquired more Bitcoin in October than Strategy, reducing the firm’s lead.

Strategy Stock Declines Amid Market Uncertainty

Shares of Strategy (MSTR) have mirrored some of the weakness seen in the crypto market.

According to Nasdaq data, the stock fell to $205.38 at the time of publication — a drop of more than 17% over the previous five days.

Market analysts noted that declining Bitcoin prices, combined with increased competition in corporate BTC accumulation, have added pressure to the stock.

Government Shutdown Ends, Bitcoin Reaction Mixed

The end of a 43-day U.S. government shutdown brought a temporary boost to financial markets earlier in the week, though it remains unclear whether the resolution will have a lasting influence on Bitcoin’s trajectory.

BTC surged above $106,000 on Sunday amid optimism that lawmakers were nearing a funding deal.

A second rally occurred on Wednesday after the House passed a continuing resolution followed by President Donald Trump signing it into law.

However, data from Nansen showed the rally faded once government operations officially restarted on Thursday.

Bitcoin’s price fell below $100,000 shortly afterward, suggesting that macro relief alone is insufficient to sustain upward momentum in current market conditions.