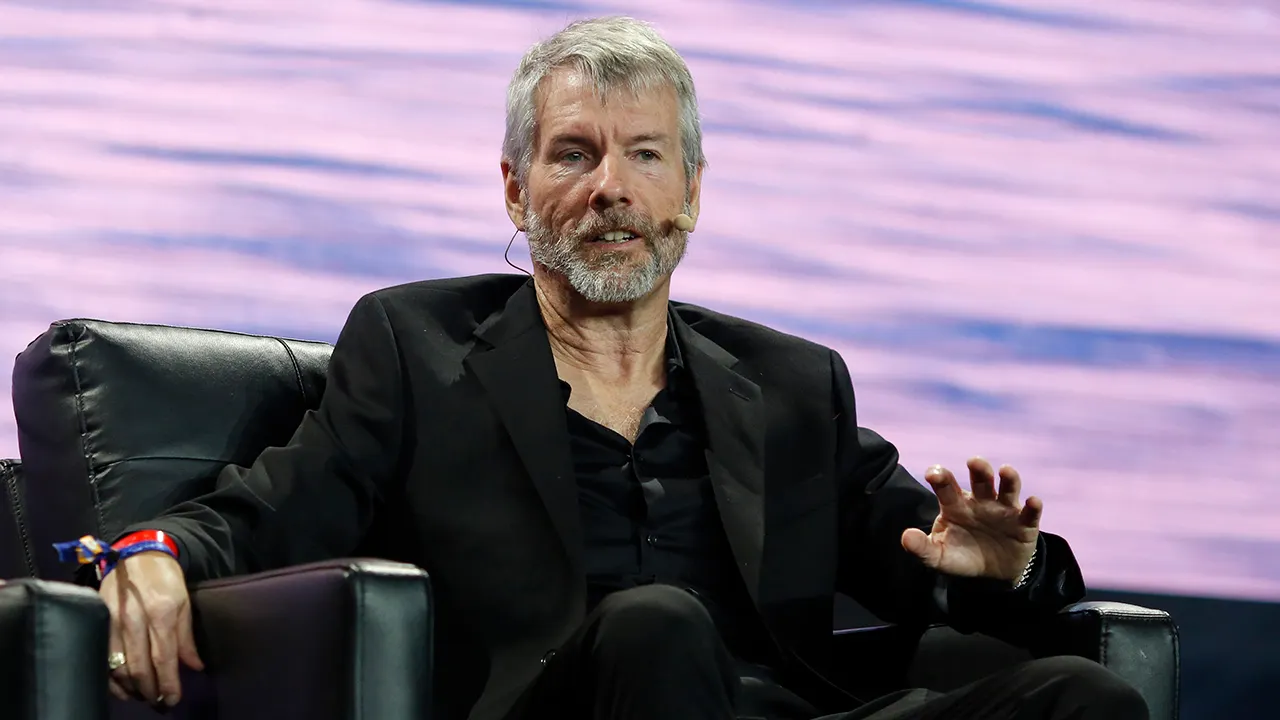

Michael Saylor’s Strategy, the largest public Bitcoin holder globally, has increased its holdings past 700,000 BTC following a major purchase.

The company acquired 22,305 Bitcoin for $2.13 billion last week, according to filings with the US Securities and Exchange Commission.

The purchase price averaged $95,284 per BTC, with Bitcoin briefly climbing above $97,000 midweek.

This acquisition pushed Strategy’s total Bitcoin holdings to 709,715 BTC, purchased at a total of around $53.92 billion with an average cost of $75,979 per coin.

Largest Purchase Since February 2025

The latest purchase marks the company’s largest single acquisition since February 2025, when it bought 20,356 BTC for approximately $2 billion.

Earlier this month, on January 12, Strategy announced a smaller purchase of 13,627 BTC worth $1.3 billion, which had been its biggest acquisition since July of the previous year.

The acceleration in Bitcoin buying highlights Strategy’s ongoing commitment to expanding its digital treasury holdings.

Market Impact

Strategy’s stock (MSTR) experienced gains alongside Bitcoin’s recent price movement, rising past $185 amid a multi-month high for the cryptocurrency.

The momentum followed a decision by Morgan Stanley Capital International not to exclude digital treasury companies from its market index in early January, adding further investor confidence.

With Strategy continuing its accumulation strategy, market observers are watching closely for potential ripple effects on Bitcoin’s broader market sentiment.

This latest acquisition reinforces the company’s status as the world’s largest institutional Bitcoin holder and signals its long-term conviction in the asset class.