VILNIUS, Lithuania, December 9th, 2025, Chainwire

BTCC, the world’s longest-serving cryptocurrency exchange, today announced the integration of its perpetual futures pairs on TradingView, a charting platform with over 100 million users globally. The integration enables traders to access BTCC’s 400+ futures pairs directly through TradingView’s charting and trading platform.

The partnership addresses our users’ growing demand for seamless trading experiences that combine execution capabilities with advanced market analysis. TradingView, which is recognized for its comprehensive and powerful market analysis features, provides traders with professional charting tools, customizable indicators, and real-time market data. Through the integration, BTCC users can now react swiftly to market movements, refine their strategies, and execute perpetual futures trades within a single platform.

The integration comes at a time of significant growth for BTCC. The exchange previously announced its Q3 2025 Growth Report, where it recorded $1.15 trillion in trading volume during the quarter and currently offers more than 400 perpetual futures pairs, all of which are now accessible on TradingView. This move builds on the exchange’s recent momentum, including its partnership with 2023 Defensive Player of the Year and 2x NBA All-Star Jaren Jackson Jr. as global brand ambassador.

“This integration combines TradingView’s analytical tools with BTCC’s range of perpetual futures pairs and deep liquidity,” said Marcus Chen, Product Manager at BTCC. “Our focus is on equipping traders with the resources they need to execute their strategies effectively, and this collaboration reinforces our commitment to professional-grade derivatives trading experiences.”

Getting Started on TradingView

Users can connect their BTCC accounts to TradingView in three simple steps:

- Step 1: On the TradingView platform, log in to your account. Then go to the Chart page and navigate to the Trading Panel section.

- Step 2: Select BTCC from the broker list, then click “Connect”.

- Step 3: Once connected, traders can instantly trade BTCC’s perpetual futures pairs across Bitcoin, Ethereum, Solana, XRP, Dogecoin, and hundreds of other cryptocurrency pairs directly from the TradingView platform.

This TradingView integration marks another step in BTCC’s continued efforts to deliver a user-centric trading experience. As the industry’s longest-serving crypto exchange, BTCC remains focused on expanding access to professional tools while setting standards for platform reliability and performance.

About TradingView

TradingView is the world’s most popular charting platform and the industry’s forefront for financial visualization solutions. 100M+ traders worldwide use it as the go-to destination to chart, chat, and trade financial markets. TradingVIew’s product portfolio includes best-in-class charts, versatile commercial libraries, a social network, and many more tools for retail and business audiences.

About BTCC

Founded in 2011, BTCC is a leading global cryptocurrency exchange serving over 10 million users across 100+ countries. Partnered with 2023 Defensive Player of the Year and 2x NBA All-Star Jaren Jackson Jr. as global brand ambassador, BTCC delivers secure, accessible crypto trading services with an unmatched user experience.

Official website: https://www.btcc.com/en-US

Contact

Aaryn Ling

press@btcc.com

Hong Kong, Hong Kong, December 9th, 2025, Chainwire

Cronos Labs today introduced Cronos One (one.cronos.org), a unified onboarding hub that simplifies how first-time and cross-chain users enter the Cronos ecosystem. The platform consolidates bridging, wallet top-ups and on-chain identity verification into a single seamless experience designed for the next generation of Web3 users.

At the heart of the launch is Cronos Verify, a gasless and privacy-preserving on-chain attestation that links a user’s wallet to a verified Crypto.com account. This reflects a broader shift in Web3 toward verifiable attestations and decentralized identity standards, which are increasingly used to strengthen Sybil resistance and enable fairer incentive structures. With frameworks like EAS (Ethereum Attestation Service) gaining momentum, on-chain attestations are increasingly becoming the foundation for loyalty systems, gated utilities and cross-dApp verification signals.

Through Cronos Verify, partners such as Moonlander, Delphi, Tectonic and VVS Finance are offering benefits including trading fee rebates, prediction vouchers, exclusive launchpad access and gasless transactions. These features help ensure that rewards reach real users while giving dApps confidence in the integrity of their user base.

The launch also follows the start of the Cronos x402 Hackathon, where developers are already experimenting with agent-driven transactions and programmable payment flows that rely on verified identity signals. As developer interest grows in AI-assisted and automated transactions, verifiable attestations like Cronos Verify are becoming an essential layer for safe and scalable agentic infrastructure.

Cronos One represents meaningful progress on the Cronos 2025–2026 roadmap and delivers on the commitment to make the ecosystem more accessible, more verifiable and ready for institutional-grade applications. This builds on recent infrastructure advancements including a 10x reduction in gas fees, sub-second block times and expanding adoption of identity-powered features across dApps.

“Across Web3, on-chain privacy-preserving attestations are emerging as a critical foundational building block for more use cases,” said Mirko Zhao, Head of Cronos Labs. “Cronos One gives users a frictionless starting point and provides developers with the personhood verification they need to build fairer incentives, stronger loyalty and smarter on-chain applications.”

Cronos One is now available at one.cronos.org, with additional partners and verification-based utilities planned for upcoming phases.

About Cronos Labs

Cronos is a leading blockchain ecosystem, supported by Crypto.com and more than 500 application developers and contributors representing an addressable user base of more than 150 million people around the world. Cronos’ mission is to to build the DeFi infrastructure that makes tokenized markets open, compliant and usable by billions.

The Cronos universe encompasses 3 chains: Cronos EVM, the leading Ethereum-compatible blockchain built on the Cosmos SDK; Cronos POS, a leading Cosmos chain for payments and NFTs; and Cronos zkEVM, a new high performance layer 2 network secured by Ethereum.

Cronos ranks among the top 15 blockchain ecosystems, encompassing more than 6 billion dollars of user assets. Since inception, it has securely settled more than 100 million transactions.

Transaction fees are paid in Cronos ($CRO), a blue chip cryptocurrency.

Cronos is supported by Cronos Labs, a Web3 start-up accelerator focused on DeFi, GameFi and the development of the Cronos ecosystem.

For more information, visit https://cronos.org or follow @cronos_chain on X.

Contact

Danielle Hrin Kuek

danielle.hrin@cronoslabs.org

Zug, Switzerland, December 9th, 2025, Chainwire

TrustLinq, a Swiss-regulated payments company, is addressing one of the most widely recognised problems in cryptocurrency: large amounts of crypto are held globally but cannot be used easily within the traditional financial system. The lack of a reliable and compliant path from crypto into global bank networks has left billions effectively inactive. TrustLinq provides a regulated infrastructure layer that enables cryptocurrency holdings to fund fiat-denominated transactions in more than 70 currencies through established settlement channels without the need of having a bank account.

According to recent industry estimates, approximately 580 million individuals and businesses worldwide hold cryptocurrency, while only around 15,000 merchants accept it directly. This represents less than 0.003% global real-world usability. Analysts have consistently identified this gap as a major structural issue, leaving large amounts of cryptocurrency effectively unusable within traditional financial systems. TrustLinq operates within this space, providing a regulated infrastructure layer that enables cryptocurrency holdings to fund fiat-denominated transactions across global banking networks.

The platform is built within a Swiss-regulated framework and incorporates structured operational controls, secure asset-handling processes and multi-jurisdiction settlement connectivity. These elements create an infrastructure layer that is difficult to reproduce due to regulatory, technical and procedural requirements. The configuration is designed to support predictable, transparent and scalable cryptocurrency-funded fiat transactions across borders.

“Global participation in cryptocurrency continues to grow, but the connection between decentralised assets and traditional financial systems has remained limited,” said Sharon Gal Franko, CEO of TrustLinq. “TrustLinq was built to provide an infrastructure layer that bridges cryptocurrency with established fiat settlement networks in a regulated and controlled environment.”

TrustLinq is accessible to individuals and businesses in eligible jurisdictions. Supported cryptocurrencies at launch include USDT on ERC20 and TRC20, USDC and EURC. Additional settlement routes, technical integrations and platform capabilities are under development as part of the company’s roadmap.

Payments industry specialists have identified the emergence of a new infrastructure category designed to enable cryptocurrency to move from self-custody into traditional financial systems without acting as an exchange, wallet provider, processor or remittance service. TrustLinq operates within this developing segment, which is increasingly recognised as its own category in financial technology. The model is referred to as Self-Custodial Crypto to Third-Party Fiat Settlement and describes an infrastructure layer that allows users to retain control of their digital assets while initiating fiat-denominated transfers to third-party recipients through regulated settlement networks. TrustLinq introduces an operational layer that bridges digital assets with traditional banking frameworks, addressing a gap not covered by existing payment or crypto models.

About TrustLinq

TrustLinq is a Swiss-regulated financial intermediary bridging cryptocurrency and traditional banking. The platform enables individuals and businesses holding cryptocurrency to send fiat payments to anyone, anywhere in the world, across 70+ currencies. Operating under Swiss regulation and compliant with Swiss AML, TrustLinq seamlessly enables crypto-to-fiat and executes payments globally while maintaining local payment efficiency via methods including SEPA, SWIFT, Faster Payments, ACH, and upcoming debit card solutions. The company prioritises security, compliance, and user control through a non-custodial intermediary model that does not hold client funds.

For more information, users can visit https://trustlinq.com

Contact

Sharon Gal Franko

press@trustlinq.com

Hong Kong, China, December 8th, 2025, Chainwire

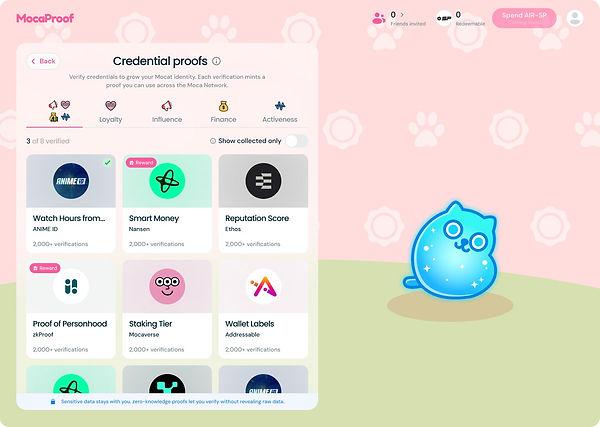

Moca Network, a flagship project by Animoca Brands to build the world’s largest chain-agnostic decentralized digital identity network, today announced the beta launch of MocaProof, a gamified digital identity verification and reward platform that leverages blockchain to simplify and advance data privacy and self-sovereignty.

MocaProof enables privacy-preserving credential verification for participants to prove ownership, participation, and qualifications on various on-chain and off-chain ecosystems, without the need to disclose raw data or identifiable information.

MocaProof is integrated with Moca Network’s AIR Kit and Moca Chain to enable reusable, interoperable, and verifiable identity data across its network of platforms, providing zero-knowledge proof, decentralized data storage, on-chain monetization, and single sign-on.

Kenneth Shek, project lead of Moca Network, said: “MocaProof establishes a foundation for verifiable, privacy-preserving digital identity, allowing users and enterprises to participate in credential-based ecosystems without compromising data ownership or compliance standards. MocaProof is where identity is created and reputation is accrued, enabling composable reward distribution through verified credentials.”

MocaProof allows users to explore and verify credentials in its credential proof marketplace across categories including influence, finance, loyalty, and activity. All credentials available through the credential proof marketplace are issued by verified partners and validated using zkProofs, ensuring both the integrity and interoperability of private data.

MocaProof includes a virtual companion named Mocat, a cute and friendly character within the Mocaverse. Mocat provides users of MocaProof with a personal visualization of their verified credentials. As a user verifies more credentials through MocaProof, their Mocat evolves with different traits that represent the growth and rarity of the user’s verified data. The evolution of a Mocat will also unlock rewards, depending on the Mocat’s rarity.

In addition, it is intended that MocaProof will integrate an incentive framework that enables users who verify their credentials through MocaProof to claim rewards starting from the official launch. Verified users can earn MOCA Coin (MOCA), airdrops of tokens provided by Moca Network’s partners, AIR SP (the stablecoin-backed loyalty points that can be spent in AIR Shop, Moca Network’s verifiable loyalty platform), and more.

MocaProof beta launch is currently available on the Moca Chain Testnet, and is scheduled to transition to mainnet later in 2026. To commemorate the launch of MocaProof, a month-long campaign featuring NFT-related credentials and an NFT competition will feature a reward pool equivalent to US$50,000. For more information, users can visit app.moca.network.

About Moca Network

Moca Network is building the world’s largest chain-agnostic decentralized identity network, with privacy-preserved infrastructure for identity verifications, and interoperability of users and data across industries and ecosystems. As the premier identity ecosystem created by Animoca Brands, Moca Network brings together over 600 portfolio companies, more than 700 million addressable users, and a diverse range of enterprise partners. Moca Network utilizes MOCA Coin as its utility and governance token.

Moca Network Blog: https://moca.network/blog/

Website: https://moca.network

Telegram: https://t.me/MocaverseCommunity

Discord: http://discord.gg/MocaverseNFT

Contact

Liane Lau

press@animocabrands.com

Dubai, UAE, December 8th, 2025, Chainwire

- Follows first-of-its-kind pilot run with Franklin Templeton, Zodia Custody, Avalanche, and CMS demonstrates enforceable bilateral credit within digital assets custody

- Debut at Abu Dhabi Finance Week 2025 showcases a breakthrough in institutional credit infrastructure

SemiLiquid, a custody-native infrastructure layer for institutional credit, today announced the launch of its Programmable Credit Protocol (PCP) at Abu Dhabi Finance Week 2025. The groundbreaking infrastructure enables institutions to activate credit against digital and tokenized assets held in custody – without transferring collateral, marking a critical advancement in the evolution of digital capital markets. Developed and launched in Abu Dhabi, the protocol is now planned to be rolled out globally, underscoring the emirate’s rise as a leading hub for digital assets and a launchpad for financial innovation.

The launch is backed by a successful pilot conducted with Franklin Templeton, Zodia Custody, Avalanche, Presto Labs, M11 Credit, Oasis Foundation & CMS. As part of the pilot, Franklin Templeton’s daily-yielding tokenized money-market fund, BENJI, was used as collateral, which remained encumbered throughout the loan lifecycle, under pre-agreed terms and automated triggers. This simulated proof-of-concept allowed institutions to retain full daily yield while granting lenders enforceable security over the assets – eliminating counterparty risk without any collateral movement.

“Programmable assets require programmable credit,” said Rico van der Veen, Co-Founder and CEO of SemiLiquid. “PCP delivers the missing rail that institutions need – a standardized, custody-native & shared legal framework that merges the trust of traditional finance with the efficiency of programmable assets. This marks a shift from incremental upgrades to foundational infrastructure for institutional credit. Abu Dhabi Global Market’s environment has enabled us to develop our solution within a risk-aware framework optimized for digital asset innovation. ”

“SemiLiquid’s PCP brings together innovative industry leaders in an effort to address the inefficiencies in institutional credit,” said Anoosh Arevshatian, Chief Product Officer at Zodia Custody. “Through our participation, Zodia Custody hopes to establish custodial infrastructure as the trust layer for scalable and programmable credit.”

“Programmable credit demonstrates how institutional lending can operate natively within custody without compromising enforceability, compliance, or settlement speed. Avalanche’s high-performance, institutional-grade infrastructure, combined with SemiLiquid’s programmable credit protocol, creates a clear path to scaling institutional adoption – developed in a region that has become a launchpad for next-generation on-chain financial markets,” said Khalid Dannish, Head of MENA at Ava Labs.

“Private credit is going digital, and this pilot proves how it can be done legally and compliantly,” said Matthew Nyman, Digital Assets Lead at CMS. “CMS is proud to support the infrastructure bringing automated, custody-native credit to institutional markets.”

While tokenised assets are projected to reach $10 trillion by 2030, credit infrastructure has remained trapped in legacy workflows. More than 70% of institutional bilateral financing still involves bespoke, deal-by-deal paperwork & collateral transfers across fragmented accounts and systems, creating counterparty risk and friction that prevent tokenized assets from functioning as scalable, financeable collateral.

SemiLiquid’s pilot has shown that the technology & legal framework is mature and institutions are ready. The company is advancing to Phase II, launching in early 2026, which will expand integrations across additional custodians, collateral types, and jurisdictions. Future capabilities will include under-collateralized lending supported by verified solvency attestations & and a unified framework for enforceability across markets.

“Credit is the lifeblood of capital markets,” added Rico van der Veen, Co-Founder and CEO of SemiLiquid. “With PCP, programmable credit has arrived – and it’s ready for institutional deployment.”

For more information, users can visit https://pcp.co/

Media Contact:

About SemiLiquid:

SemiLiquid delivers the infrastructure powering the next evolution of institutional credit. Built on custody-native rails, its Programmable Credit Protocol (PCP) standardizes and automates bilateral lending – bringing the trust of traditional finance and the efficiency of programmable markets to a unified, compliant, and interoperable credit ecosystem.

About Zodia Custody

Zodia Custody is an institution-first digital assets platform with support from Standard Chartered, in association with Northern Trust, SBI Holdings, National Australia Bank, and Emirates NBD. Through the combination of its custody, treasury, and settlement solutions, Zodia Custody enables institutional investors around the globe to realise the full potential of the digital assets future – simply, safely, and without compromise. Zodia Custody is registered with the Financial Conduct Authority, Central Bank of Ireland, Commission de Surveillance du Secteur Financier, and holds a licence with the Hong Kong Companies Registry.

Zodia Custody implements the requirements of the 5AMLD and applies the same standards as Standard Chartered relating to AML, FCC, and KYC. It implements the requirements of the FATF Travel Rule. Zodia Custody Limited is registered in the UK with the FCA as a crypto asset business under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017. Zodia Custody (Ireland) Limited is registered with the Central Bank of Ireland as a VASP under Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (as amended). Zodia Custody (Ireland) Limited was established in Ireland in August 2021. Zodia Custody (Ireland) Limited is registered with the CSSF in Luxembourg as a Virtual Asset Service Provider in accordance with article 7-1 (2) of the law dated 12 November 2004 on the fight against money laundering and terrorist financing, as amended. Zodia Custody (Hong Kong) Limited is registered with the Registry for Trust and Company Service Provider with License Number TC009245 under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), Cap. 615 in respect of its custodial activities in digital assets.

For further information on Zodia Custody, users can visit: https://zodia-custody.com/

Contact

Account Manager

Vinita Kullai

YAP Global

vinita@yapglobal.com

Bengaluru, India, December 8th, 2025, Chainwire

India Blockchain Week (IBW) Conference, the 2-day headline conference anchoring the India Blockchain Week series of 100+ Web3 events in Bengaluru, is delighted to share that its 2025 edition has been a roaring success, underscoring India’s ascent as a global Web3 innovation hub. Despite high taxation and no clear legal framework, India has been the number one country for crypto adoption for three years in a row with 115 million users.

Taking place at the Sheraton Grand Bengaluru Whitefield Hotel & Convention Center from December 2-3, the IBW2025 Conference welcomed 3500+ attendees from over 40 countries. It attracted Web3 builders, investors, legal professionals, and other stakeholders, enabling them to explore the future of blockchain, AI, RWAs, and regulatory developments.

Throughout the week, there were 80+ side events, workshops, parties etc hosted by Indian & global blockchain industry players, offering attendees the opportunity to network, share ideas, forge partnerships, try out new products, and engage with community members.

India Web3 Landscape Report

Hashed Emergent, the organizers of the flagship IBW2025 Conference, released the 4th annual India Web3 Landscape Report at the main stage. Prepared in collaboration with knowledge partners CoinSwitch, DevFolio, Pi42, Jetking, Growth Protocol, and TriLegal, the report sheds light on startups, investment, adoption, developer ecosystem, and policy and regulations. Some of the key highlights include:

- Indian Web3 startups secured $653 million in funding in the first ten months of 2025, up 16% from $564 million for the full year 2024.

- India is home to 1250+ Web3 startups across finance, infrastructure and entertainment. They have collectively raised $3.5 billion to date, underscoring the depth of builders across multiple sub sectors.

- India strengthened its role as a Web3 hub in 2025 ranking #1 in blockchain adoption for the third straight year and the 2nd-largest developer market. Builders are pushing the frontiers in AI, DePIN, L1/L2s, RWAs and stablecoins.

- In 2025, centralized exchanges saw a sharp acceleration in activity. Spot volumes in blue-chip crypto tokens rose 114%, alongside a 27% increase in new traders.

- Young investors (18–35) now make up ~75% of active users and half of total trading volumes. Metros still dominate with 64% of invested value with Delhi alone contributing nearly one-fifth while rising access is steadily pulling tier-2 cities deeper into the market.

- In 2025, women traders grew nearly twice as fast as men across Tier-1, Tier-2 and Tier-3 cities, signaling a broader, more inclusive investor base.

- Global Web3 investors continue to show strong conviction in India’s potential supported by ecosystem funds even though domestic funds remain cautious.

Tak Lee, CEO of Hashed Emergent, said, “India’s market has already demonstrated extraordinary readiness for the next phase of Web3. What we must now focus on, together, is creating the right environment for this innovation to scale responsibly. Builders are moving fast, global investors are doubling down, and India’s digital public infrastructure has created a foundation few countries possess. By working collaboratively across industry and policy, we can design frameworks that protect consumers while enabling India to engineer the open, AI-enabled financial systems that will shape the next era of global commerce. When talent, capital, and regulation move with shared intent, India has the momentum and capability to define the future.”

Other Key Highlights

- COINS Act: Hashed Emergent revealed a model law called the COINS Act (Crypto-Systems Oversight, Innovation, and Strategy Act 2025) that aims to deliver legal certainty, consumer protection and innovation acceleration, transforming India into a global hub for rights-grounded, decentralized finance rather than an afterthought in foreign jurisdictions.

- Cardano Hackathon Asia 2025: The IBW Edition of the Cardano Hackathon Asia 2025 gave startup teams an opportunity to turn their ideas into impactful, ready-to-launch projects. About 400 developers joined in-person. The hackathon not only offered a total prize pool of $65K but also brought expert builders from across the Cardano ecosystem to guide startup teams from start to finish.

- IBW Demo Day: Sponsored by Aptos, Avalanche, Polygon, 0G, Coinswitch and NS.com, the IBW Demo Day took place on Day 2 of the conference, with 10 startups showcasing their innovation to investors, entrepreneurs, and the media for an investment of $530K by Hashed Emergent. Pandora Exchange, a one-stop trading hub for all DeFi needs, emerged the winner. Separately, 0G Labs provided a $6k grant to Kodeus and a $4k grant to Grovio.ai during the Demo Day.

The IBW2025 Conference organizers are thankful to all the attendees who traveled to Bengaluru to participate in the most significant Web3 event in India. They also express their sincere gratitude to the 100+ speakers who took part in giving keynotes or panels at the conference.

The IBW organizers would like to thank the sponsors who made it all possible. This year, the event was backed by Aptos Foundation, Binance, Cardano, Polygon, Coinbase, Tether, Bitget, Ledger, 0G, Bybit, Coinswitch, Bullbit, A7A5, NS.com, BitGo, XDC, Endless Domains, XYO, Coinscope.gg, KGen, Limocoin, Scribble, MINA, Liminal, USDT Marketplace, NPCI, Weilliptic, RNS, Metaspace, Pi42, and The reliable jobs.

About India Blockchain Week (IBW)

India Blockchain Week (IBW) is a movement unifying the Indian web3 ecosystem and a platform to connect with the global community. It is India’s biggest pan-industry series of blockchain and web3 events, spanning from December 1-7 2025 across Bangalore, India. IBW is a week-long array of 100+ web3 events, including flagship events such as the headline IBW Conference, Demo Day and many other side-events, networking events, workshops, parties etc hosted by Indian & global blockchain industry stakeholders.

The IBW Conference is the two-day headline event anchoring India Blockchain Week (IBW) on December 2-3, 2025 at the Sheraton Grand, Bangalore and hosted by Hashed Emergent – a web3 venture capital firm dedicated to accelerating the mass adoption of web3 in India.

For more information about IBW, visit: Website | X | LinkedIn | Telegram

About Hashed Emergent

Hashed Emergent is the venture capital arm of Hashed, backing builders from India and emerging markets shaping the on-chain frontier. It invests at the earliest stages of a web3 startup’s journey, using its expertise, experience, and network to amplify their growth and success. The team is rooted in the cultural hubspots of web3 in emerging markets, spanning across Bangalore, Seoul, Singapore, Lagos and Dubai. Hashed Emergent drives web3 focused ecosystem and community expansion in these markets through its purpose-built initiatives.

Contact

Irshad Ahmed

irshad@hashed.com

New York, United States, December 8th, 2025, Chainwire

$SNMI Pioneers Transaction Bundling Technology to Future-Proof Solana Ecosystem Against Peak Demand

Sonami ($SNMI), the first Layer 2 token built on the Solana blockchain, today announced its mission to dramatically enhance network reliability and transaction efficiency during periods of high demand. Sonami’s solution leverages cutting-edge Layer 2 transaction bundling to minimize congestion and support the continued growth of high-frequency decentralized applications (dApps) on Solana.

The move addresses a critical scaling challenge: while Solana is celebrated for its speed, the network can experience congestion during moments of high activity, such as meme coin surges, NFT mints, or rapid-fire decentralized trading. These episodes, while signaling strong user interest, can stress the network, leading to delayed transactions and inconsistent user experiences.

Sonami aims to solve this by evolving the scaling architecture. Its Layer 2 network uses transaction bundling to intelligently group multiple user interactions into a single, optimized transaction that is ultimately processed on Solana’s Layer 1. This significantly reduces the network load, ensuring scalability without compromising the base chain’s speed or security.

“The expectation in Web3 is quickly shifting from ‘fast most of the time’ to ‘fast all the time’,” said Zakit Mobad, founder of Sonami Foundation. “Sonami is committed to being the performance multiplier that unlocks Solana’s full potential. By integrating a Layer 2 solution, we ensure developers can build more ambitious real-time apps and users can enjoy a seamless experience, even during periods of high market volatility.”

A Stronger Ecosystem for Next-Gen dApps

The project confirms its focus on real-world use cases where split-second interactions matter most, including:

- Real-time multiplayer gaming.

- High-volume decentralized trading.

- Microtransaction-powered utility applications.

Growth and Roadmap

The Sonami presale phase continues, signaling proactive development. The project is focusing on its upcoming Token Generation Event (TGE) and subsequent planned listings on both decentralized and centralized exchanges (DEX/CEX) after the presale concludes. This expansion ensures the ecosystem is resilient and ready for its next era of mainstream adoption.

About Sonami ($SNMI)

Sonami is a pioneering Layer 2 project built on the Solana blockchain, driven by a collective of seasoned blockchain developers and ecosystem architects. The team is united by a shared vision of solving scalability challenges at the protocol level. Sonami’s core mission is to enhance Solana’s transaction efficiency and reliability, ensuring the network remains resilient, capable, and ready for its mainstream future.

Website | X | Instagram | Telegram

Contact

David Dylan

contact@sonami-so.io

Belize City, Belize, December 8th, 2025, Chainwire

As Bitcoin MENA 2025, Solana Breakpoint 2025 and the Global Blockchain Show bring a packed Web3 summit week to the UAE this December, BC.GAME will host Breakpoint Eve: Stay Untamed with BC | MAKING IT RAIN on Wednesday, December 10 at WHITE Abu Dhabi (Yas Bay Waterfront). With sign-ups now exceeding 1,200, the event is shaping up to be one of the largest and most anticipated parties during the peak Bitcoin MENA and Breakpoint window.

BC.GAME has been operating for eight years as a crypto entertainment and community platform focused on gaming, sports and culture-led experiences in Web3. Its global profile includes ambassador collaborations with multi-platinum pop artist Jason Derulo, an official principal partnership with Leicester City FC, and a growing competitive presence through BC.GAME Esports, featuring CS2 stars s1mple and electronic.

Music lineup

The party will be headlined by international DJs Mari Ferrari and DubVision, following the official schedule across a full 21:30–03:00 run.

Special guests

BC.GAME Esports players s1mple and electronic are listed for special appearances, adding CS2 star power to the summit-week nightlife programme.

KOL attendance

BC.GAME’s KOLs will also be in attendance, adding a strong creator layer to the summit-week crowd mix.

On-site highlights

The official event information indicates interactive moments and live prize draws, including iPhone 17 Pro / iPhone 17, Labubu collectibles, and $BC-branded merchandise.

Event details

- Event: Breakpoint Eve: Stay Untamed with BC | MAKING IT RAIN

- Date: Wednesday, December 10, 2025

- Venue: WHITE Abu Dhabi, Yas Bay Waterfront

- Time: 21:30–03:00

- DJ lineup: Mari Ferrari, DubVision

- Special guests: s1mple, electronic

About BC.GAME

BC.GAME is a crypto entertainment and community platform founded in 2017. It provides a wide selection of online entertainment experiences supported by crypto-native features and a global community ecosystem. Built for a digital-first audience, BC.GAME combines product scalability, user-focused design and ongoing innovation to serve players across key international markets. The platform continues to expand its offerings and community experiences in line with the evolving Web3 landscape.

Contact

Pr manager

Olivia Dixon

BC.GAME

oliviadi@bcgame.com

Singapore, Singapore, December 5th, 2025, Chainwire

Hotstuff Labs today announced the public testnet for Hotstuff L1, a DeFi Layer 1 blockchain powered by DracoBFT, a custom-built consensus protocol. Hotstuff L1 is a purpose-built chain that pairs a highly performant on-chain order book with a programmable finance routing layer where validators act as last-mile gateways to trading, payments, and fiat rails.

Unlike general-purpose chains, Hotstuff L1 is designed as an Uber-style routing layer where validators deliver real-world financial access on demand.

Hotstuff Labs is backed by top-tier investors, including Delphi Digital, Dialectic, Stake Capital, Tykhe Ventures, and the founders of leading DeFi protocols such as 1inch, Safe, Biconomy, Socket, and more.

Julien Bouteloup, Founder of Stake Capital Group, said, “Hotstuff Labs is building a performant chain that links trading, payments, and real-world settlement into one coherent layer. The vision is to enable validators to become active financial access points. That aligns perfectly with how we see the future of infrastructure: decentralised, compliant, and directly plugged into the global economy.”

Validators as Financial Access Points

Beyond trading, Hotstuff L1 is architected so validators can opt in as permissioned financial service providers. On Hotstuff, validators aren’t just for consensus, they act as global financial access points for both the core trading engine and end users.

- For the core trading engine, stablecoin rails enable access to offchain liquidity.

- For end users, validators unlock last-mile connectivity for fiatcrypto on/off-ramps, payments, and FX use cases.

Deep integrations with leading payment platforms, on/off-ramps, banking partners, and card programs baked into the chain enable validators to earn by:

- Powering fiat stablecoin on/off-ramps

- Enabling regional payment and remittance rails

- Issuing or supporting cards and local accounts

- Serving as last-mile connectivity into different currencies and regions

The chain matches users to specific validators based on stake, performance history, and quality-of-service much like a routing layer combined with lightweight zero-knowledge proofs for trustless verification of both on-chain and off-chain actions.

“Most chains validate blocks. Hotstuff validates and delivers trustless access to money. It’s the Uber for financial validators, routing every flow to the right provider,” said Vyom Sharma, Co-Founder & CEO of Hotstuff Labs. “We’re building a Layer 1 that can connect a trader in Asia, a remittance corridor in LATAM, and a card issuer in Europe on the same settlement fabric”.

Hotstuff Public Testnet: Now Open

The Hotstuff L1 public testnet is live and open to:

- Traders & Quants – can test early perp and spot trading, multi-venue vaults, and market infrastructure built directly on the core L1.

- Builders, Fintechs & Stablecoin Infrastructure Providers – can partner with Hotstuff Labs to enable new trading primitives, payments, FX, and settlement use cases.

- Validators & Node Operators – can run DracoBFT nodes, benchmark performance, and experiment with financial service modules.

Get Started

- Website: https://hotstuff.trade

- X (Twitter): https://x.com/tradehotstuff

- DracoBFT Whitepaper: https://hotstuff.trade/DracoBFT.pdf

- Community & Integrations: https://discord.gg/tradehotstuff

About Hotstuff Labs

Hotstuff Labs is building Hotstuff L1, a purpose-built DeFi Layer 1 for programmable finance, powered by the DracoBFT consensus engine and a modular execution fabric. With deep experience across finance, consensus, trading, cryptoeconomics, and protocol design, the team is creating a global routing layer that enables performant on-chain trading and connects payments, remittances, and fiat rails on a single, coherent chain.

For press & partnerships: https://x.com/hotstuff_labs

Contact

Hotstuff Labs

press@hotstufflabs.com

Dubai, United Arab Emirates, December 5th, 2025, Chainwire

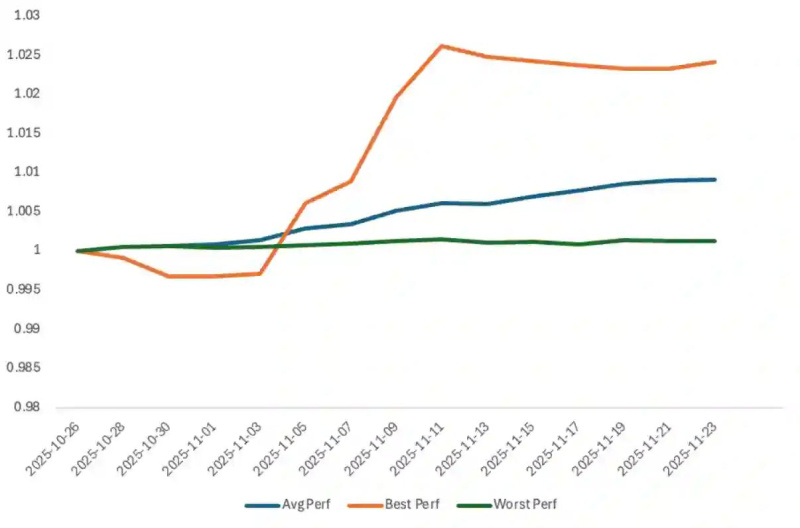

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, showcases the latest monthly performance update of its Private Wealth Management (PWM) division, with the top-performing fund recording 29.72% APR in November 2025. With wild swings across markets in the past month, Bybit PWM continued to deliver robust returns for high-net-worth clients with a disciplined, multi-strategy, and data-informed approach.

Performance Highlights

In the latest Bybit PWM newsletter for November 2025, Bybit PWM demonstrated consistent strength across its portfolio:

- USDT-based strategies: Average APR of 9.8%

- BTC-based strategies: Average APR of 18.09%

“Our clients depend on us to navigate volatile market conditions while maintaining focus on long-term wealth creation,” said Jerry Li, Head of Financial Products & Wealth Management at Bybit. “The November results demonstrate that disciplined, professional wealth management can deliver consistent returns and help our customers rise above market sentiments and distractions.”

Fig. Bybit PWM Strategy Return Trend

Source: Bybit Private Wealth Management November 2025 newsletter

Fund performance was calculated using Time-Weighted Return (TWR) methodology with assets aligned as of October 25, 2025, and benchmarked against funding arbitrage performance.

Bybit PWM provides high-net-worth clients with exclusive, customized wealth management services tailored to the unique demands of digital asset investors. The platform offers:

- Bespoke investment strategies and asset allocation

- Professional risk management and portfolio oversight

- Access to curated private funds and Bybit’s institutional-grade trading infrastructure

- Dedicated relationship management and expert guidance

For details of Bybit PWM’s September performance, users may visit: Bybit Private Wealth Management: November 2025 Newsletter

Bybit PWM is currently offering a special year-end opportunity for our eligible VIP clients. For a limited time, the minimum subscription requirement for the PWM solution has been halved to 250,000 USDT.

Qualified investors interested in exploring Bybit Private Wealth Management services may visit: Bybit Private Wealth Management

#Bybit / #TheCryptoArk / #IMakeIt

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Contact

Head of PR

Tony Au

Bybit

tony.au@bybit.com