Grayscale has described Chainlink as a central force in the next major phase of blockchain adoption, calling the project the “critical connective tissue” that links decentralized systems with established financial infrastructure.

In a recent report, the asset manager said Chainlink’s expanding suite of tools positions it as foundational middleware for tokenization, cross-chain interoperability and applications that rely on real-world data.

The firm argued that Chainlink’s capabilities now stretch far beyond providing oracle feeds.

“A more accurate description of Chainlink today would be modular middleware that lets on-chain applications safely use off-chain data, interact across blockchains, and meet enterprise-grade compliance needs,” Grayscale wrote.

The report added that this broad utility has pushed LINK into the top tier of non-layer-1 crypto assets by market capitalization, excluding stablecoins.

Tokenization Seen as Chainlink’s Biggest Opportunity

Grayscale noted that tokenization remains the clearest area where Chainlink’s value becomes evident.

Most traditional assets are still recorded on centralized ledgers, meaning they must be tokenized and connected to external data before they can operate in a programmable blockchain environment.

“We expect Chainlink to play a central role orchestrating the process of tokenization, and it has announced a variety of partnerships, including with S&P Global and FTSE/Russel, that should help it do so,” the report continued.

The market for tokenized assets has expanded sharply, rising from $5 billion to more than $35.6 billion since early 2023, according to data from RWA.xyz.

Banks, Asset Managers and Chainlink Complete Cross-Chain Settlement Pilot

Chainlink’s technology has already been used in early tokenization pilots involving major institutions.

In June, Chainlink, JPMorgan’s Kinexys network and Ondo Finance carried out a cross-chain delivery-versus-payment settlement between a permissioned payment network and a public blockchain test environment.

The pilot connected JPMorgan’s Kinexys Digital Payments network with Ondo Chain’s testnet for tokenized real-world assets.

Using the Chainlink Runtime Environment as the coordination layer, the test successfully exchanged Ondo’s OUSG tokenized US Treasurys fund for fiat settlement without either asset leaving its native chain.

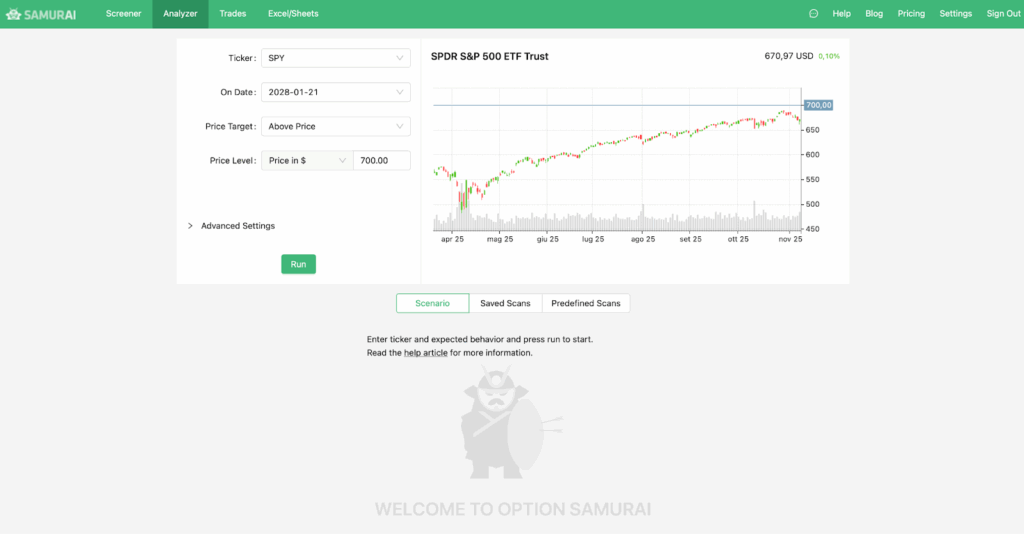

Every trader has asked the same question at some point: “What’s the best option strategy for this stock right now?” Option Samurai’s Analyzer feature gives you a direct, data-driven answer. Instead of running separate scans or manually testing trades, you can define a stock scenario – and the Analyzer will find the optimal strategy automatically.

Whether you’re expecting a rally, a pullback, or range-bound action, this tool compares every supported strategy side by side, calculating expected value, probability of profit, and return using real options data.

Define Your Stock Scenario

Start by entering your ticker, price target, and date, like this:

You can choose between directional or range-based targets, such as:

- Above or Below a certain price

- Between two price levels

- Outside a range

As you input your scenario, a chart updates showing recent price action and the target range you’re planning for. This makes it easier to visualize your thesis before running the analysis.

Let the Analyzer Do the Work

Once you define your scenario, Option Samurai uses its next-gen screening options tools to scan all supported strategies – calls, puts, spreads, condors, covered calls, and more – and calculates which one offers the best balance between expected return and probability of profit.

Each strategy appears on its own card, showing:

- Expected P/L and risk (calculated with a Monte Carlo simulation)

- Probability of profit (from the Black–Scholes model)

- Return on risk and breakeven levels

- A P&L chart with your target, breakeven, and expiration lines clearly marked

You can even slide between prioritizing maximum return or maximum probability of profit – letting you tailor results to your own risk profile.

Hover over the chart to compare different trades or even benchmark them against a simple buy & hold position.

Explore Related Scans and Saved Ideas

Below the main results, you’ll find two additional tabs:

- Saved Scans: Lists all the custom scans where your ticker already appears – helpful if you’ve found setups for it before.

- Predefined Scans: Shows all the built-in scans that currently include that stock.

Both are clickable, so you can jump directly from the Analyzer into the screener for deeper filtering or customization.

This feature is especially useful when you’ve analyzed a specific stock and want to see how it also fits across different strategies in your saved workflows.

Bonus: Fine-Tune Advanced Settings

For traders who like precision, the Analyzer includes advanced simulation controls to adapt results to your style:

- Include unbalanced spreads – expands the search to asymmetrical iron condors or butterflies.

- Bid/ask level – switch between mid or conservative pricing.

- Volatility source – use implied, realized, or custom volatility.

- Drift – simulate bullish or bearish directional bias, or link to the risk-free rate automatically.

These settings allow you to test realistic market conditions instead of textbook ones – especially valuable if you trade events or short-term volatility.

Turn Analysis into Action

Once you’ve found your preferred trade, click “Trade” to open it directly in your Trade Log or send it to your connected broker.

You can tweak strikes, expiration, or quantity – and instantly see how the expected value and probability metrics update. It’s the fastest way to go from idea to execution using real data and clearly defined risk.

Final Thoughts: From Scenario to Strategy in One Click

Option Samurai’s Analyzer takes the guesswork out of options strategy selection.

By running Monte Carlo simulations and comparing every possible trade side by side, it helps you find the most efficient strategy for your price outlook – long, short, or neutral.

Instead of asking “Which strategy should I use?” you’ll know exactly which one fits your scenario, risk tolerance, and timeframe.

Start your free trial today (no credit card required) and discover the most effective option strategy for any stock, any outlook, and any market condition – instantly.

Danielle Sassoon, one of the U.S. attorneys involved in prosecuting former FTX CEO Sam Bankman-Fried, testified Thursday in a Manhattan court amid allegations tied to a deal made with ex-FTX executive Ryan Salame.

The hearing, held in the U.S. District Court for the Southern District of New York, centered on whether prosecutors had improperly induced Salame’s guilty plea — and whether Michelle Bond, his then-girlfriend, was promised that she would not be charged.

Sassoon was asked about her role in Salame’s guilty plea, which resulted in a sentence of more than seven years in prison. According to court papers, her team indicated they would “probably not continue to investigate [Salame’s] conduct” if he pleaded guilty.

Bond’s legal team argues that this statement effectively pressured Salame into pleading guilty so that she would avoid prosecution. Bond faces campaign finance charges related to a $400,000 payment allegedly made via FTX funds, which her attorneys describe as part of a “sham consulting agreement.”

During her testimony, Sassoon struck back at the idea that she offered any sort of deal. “I’m not in the business of gotcha or tricking people into pleading guilty,” she declared.

Sassoon also suggested that Salame’s lawyers used the notion of non-prosecution of Bond as a “negotiating tactic,” rather than a genuine promise. She said, “if the lawyers truly believed it was a credible claim, they would have made it directly to me.”

Bond has pleaded not guilty to counts including conspiracy to make unlawful campaign contributions, receiving excessive contributions, and acting as a conduit for funds.

The hearing continues to draw attention because Bond is one of the last remaining defendants connected to the criminal fallout from FTX’s collapse in November 2022.

Salame, for his part, began serving his sentence in October 2024. Other former FTX executives — including Caroline Ellison, Nishad Singh, and Gary Wang — have also pleaded guilty; the latter two received time-served sentences.

Sam Bankman-Freid, meanwhile, remains incarcerated after being convicted and sentenced to 25 years in prison in August 2023.

Bond’s lawyers are seeking dismissal of her charges, arguing that prosecutors improperly leveraged Salame’s plea to bring criminal liability against her.

In 2025, Instagram has quietly become one of the most important visibility channels for Web3 creators, crypto educators, NFT artists, and blockchain brands. It’s no longer just a social platform — it’s a trust engine.

In a space where credibility determines whether people invest, mint, or join a community, engagement tools have become a key part of building digital reputation. The right like-tools help crypto pages amplify authority, validate social proof, and position themselves competitively in an attention-driven ecosystem.

Below are the platforms crypto creators consistently rely on to strengthen legitimacy, increase reach, and support long-term community growth

Summary: 5 Top-Rated Services for Instagram Likes

- Superviral – Real likes with fast delivery and high retention

- Regsocial – Smart targeting with optional gradual delivery

- TokoLikes – Unique packages tailored to content creators

- ViralHQ – Multi-platform boosting with solid analytics

- MediaMister – Longstanding service with deep customization

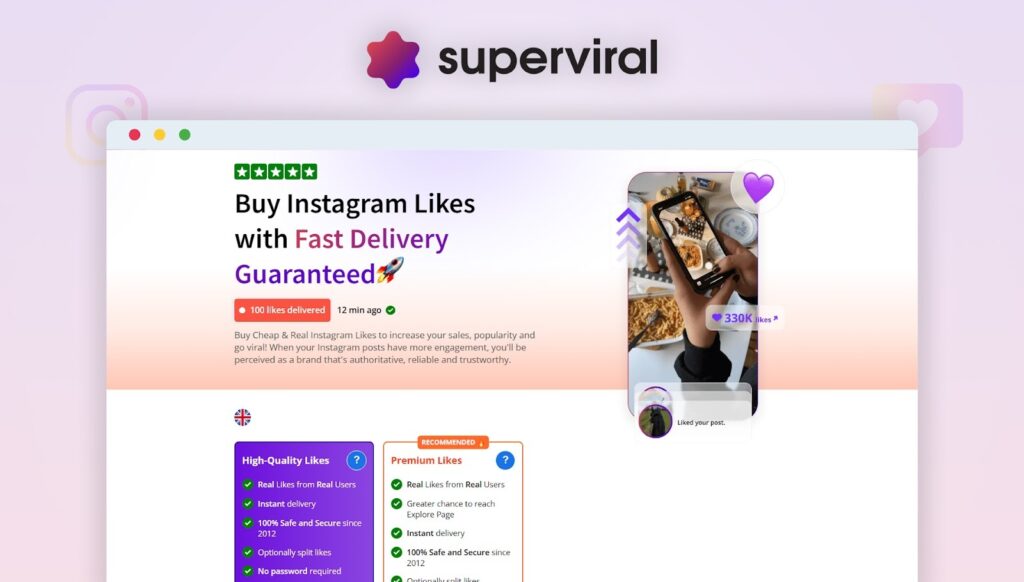

1. Superviral – Fast Likes That Don’t Look Bought

Superviral has become the go-to for creators who want fast, high-quality likes that actually help visibility, not hurt it. What separates it from the pack is how real the engagement looks — the likes come from active, authentic-looking profiles that blend into your existing stats.

Superviral doesn’t ask for your login, supports niche-based targeting, and delivers likes within minutes of posting. Whether you’re trying to test a new content type or kickstart a campaign, it’s quick, clean, and safe.

A hidden perk? Many creators use Superviral for boosting not just new content, but old posts that need reviving. It’s a great tactic when trying to increase reach on evergreen content or get older carousel posts back into circulation.

Crypto educators and project pages often use this strategy to revive important announcement posts or keep key educational threads circulating during token updates.

Why people love it:

- Instant delivery with real users only

- No password needed; fast checkout

- Built-in targeting for niche and content type

- Great for boosting both new and old posts

- 42% average boost in post reach (internal stats)

⭐ Rating: 4.9/5

2. RegSocial – Reliable Likes With Real Engagement Flow

RegSocial focuses on providing authentic-looking likes with a gradual delivery system, perfect for creators who want to avoid suspicious activity spikes. Their emphasis on organic pacing means your engagement grows in a way that feels natural to both followers and Instagram’s algorithm.

One standout feature is their ability to target by content type and niche, which helps boost the visibility of your most relevant posts. The dashboard is clean and lets you track every boost in real time, so you’re never left guessing.

Their customer support is also a major win — users highlight fast replies, helpful guidance, and a proactive approach to solving issues. It’s a hands-on platform that actually feels like a partner in your growth.

For blockchain brands and Web3 thought leaders, the gradual delivery style mirrors natural organic growth — helping maintain trust in a niche where authenticity is essential.

Key features:

• Organic-paced delivery for safer engagement

• Smart targeting based on niche and content category

• Realtime tracking and history logs

• Intuitive interface built for creators

• Users saw up to 39% lift in engagement within 2 weeks

⭐ Rating: 4.6/5

3. TokoLikes – Creator-Focused Like Packages

TokoLikes is lesser-known but loved among influencers and creatives because it caters to content categories like fashion, tech, fitness, or memes. Each like package is tailored to your post style — not just dumped from random accounts.

It’s also one of the few services where you can bundle likes with comment boosts, which is helpful when you’re aiming for better overall engagement ratios.

Their behind-the-scenes team constantly adapts the system for algorithm changes, so what worked last year still works now. It’s not just a tool — it evolves.

It’s also a favourite among NFT artists and DeFi creators who want engagement patterns optimised for niche-heavy audiences such as gaming, trading, or AI-generated art.

Standout highlights:

- Custom bundles for niche content

- Combine likes, saves, and comments

- Responsive to IG algorithm updates

- Works well for creatives building niche followings

- 29% higher engagement when bundling likes + saves

⭐ Rating: 4.5/5

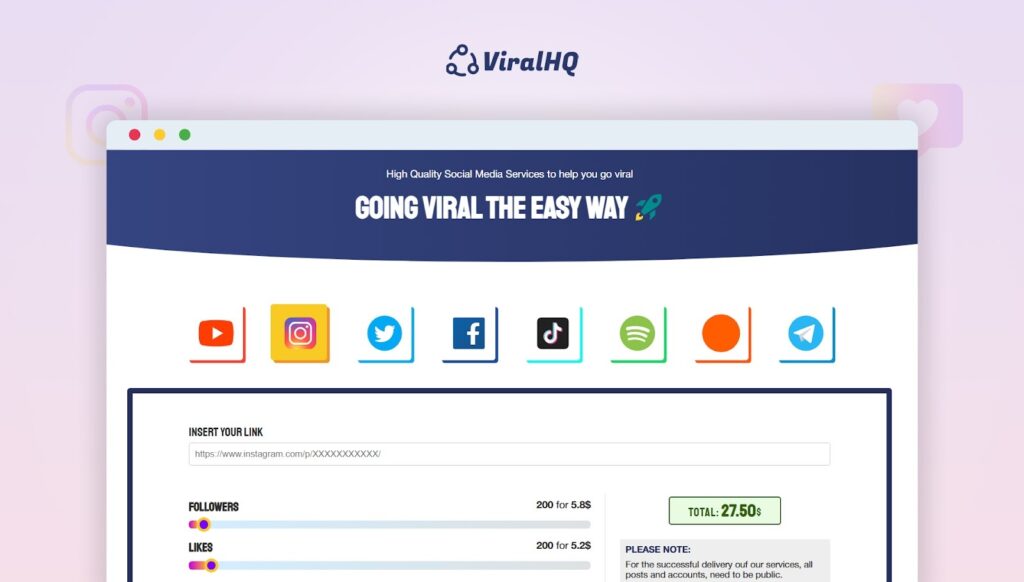

4. ViralHQ – Multi-Platform Power, Real IG Performance

If you’re active across TikTok, IG, and YouTube, ViralHQ is a solid one-stop solution. But its Instagram likes feature stands out on its own for flexibility, analytics, and reliable results

Web3 teams launching mints, token announcements, or cross-platform campaigns value this multi-platform setup because it mirrors how crypto communities operate across several ecosystems at once..

You can run timed boosts (ideal for product drops or event launches), and the platform includes built-in insight reports showing how your post performed after the boost. This level of feedback is rare for services in this space.

Creators appreciate how easy it is to track ROI — especially for those running ads alongside organic growth efforts.

Why it’s powerful:

- IG + TikTok + YT services under one roof

- Timed boosting for campaigns

- Analytics dashboard for performance tracking

- Excellent for brands running multi-platform strategy

- 31% average improvement in profile activity post-boost

⭐ Rating: 4.4/5

5. MediaMister – Custom Packages for the Data-Driven

MediaMister has been around for years and earns respect for being transparent, customizable, and reliable. You can choose exactly how many likes, when you want them, and from which region.

It’s not the flashiest platform, but it’s built for people who like control and clarity. No guessing games — just results.

The likes themselves are solid, and it’s particularly popular among marketing agencies managing multiple accounts or long-term campaigns.

Crypto agencies and DAO-led marketing teams especially benefit from the high control MediaMister offers, since regional targeting helps focus on markets where blockchain adoption is strongest

Core advantages:

- Full customization of likes and delivery

- Long track record of stable performance

- Regional filters for precise targeting

- Popular among agency-level users

- 34% engagement retention rate over 14 days

⭐ Rating: 4.3/5

Final Thoughts

In the fast-moving Web3 landscape, visibility and credibility are currency. These Instagram like tools help crypto creators, NFT artists, and blockchain brands strengthen their digital presence, support community trust, and compete in an oversaturated content market.

Whether boosting educational content, reviving key announcements, or amplifying launch campaigns, tools like Superviral, RegSocial, and ViralHQ provide the engagement signals needed to stand out — especially in an industry where reputation determines conversion.

Tech and crypto markets saw renewed optimism in after-hours trading on Wednesday after Nvidia delivered quarterly results that surpassed expectations, helping to ease concerns that investor enthusiasm for artificial intelligence had grown overheated.

The semiconductor giant reported record revenue of $57 billion for the third quarter ended Oct. 26, a 62% climb year-over-year and significantly above the $54.7 billion expected by analysts.

Nvidia also announced quarterly profit of $31.9 billion, up 65% from last year, with full-year forecasts indicating demand for AI-related products remains robust.

The upbeat report arrived amid a stretch of weakness for tech equities, as investors feared the sector’s rapid AI-driven gains could be unsustainable.

Crypto and Tech Stocks Move Higher After Hours

Shares of Nvidia climbed more than 5% to $196 in post-market trading after closing the session at $186.52.

The positive earnings surprise triggered a broader rebound across crypto-linked companies, with Coinbase, Strategy and Circle Internet Group all seeing modest after-hours increases following declines earlier in the day.

Crypto exchange Bullish also gained about 1% after the bell, reversing a portion of its 3.7% drop despite reporting its strongest quarter since going public.

Major tech stocks including Apple, Microsoft, Alphabet, Amazon and Meta likewise moved higher in extended trading, reflecting improved sentiment across the broader sector.

Bitcoin and Ether Recover from Intraday Lows

The upbeat earnings report provided a lift to Bitcoin, which has suffered more than 10% losses over the past week during a broader market downturn.

Bitcoin dipped to $88,540 late Wednesday, its first time below $89,000 since late April.

The world’s largest cryptocurrency later climbed back toward $91,500 shortly after Nvidia released its earnings, easing some downward pressure.

Ether experienced a similar trajectory, falling to $2,873 — its lowest level since mid-July — before recovering above $3,000.

Analysts say the correlation between crypto assets and tech stocks appears to have strengthened as investors continue to treat both sectors as high-risk plays responsive to macro conditions.

Nvidia’s robust results, they say, may offer short-term relief to markets that have been rattled by concerns over rate policy, slowing growth and potential froth in AI-driven valuations.

This year marks WhiteBIT’s seventh anniversary, a milestone that reflects its journey from a single European cryptocurrency exchange to a global force in digital finance. Over the past seven years, WhiteBIT has expanded its user base, services, markets, and partnerships, setting new standards in the crypto industry.

Introducing W Group: A Global Fintech Ecosystem

In 2025, WhiteBIT proudly introduces W Group, a global fintech ecosystem built on the values of security, professionalism, and innovation, serving 35 million users worldwide with a total capitalization of $38.9 billion.

W Group unites seven companies:

- WhiteBIT — the largest European centralized crypto exchange by traffic

- Whitepay — SaaS company that provides cryptocurrency solutions

- Whitechain — Low-cost, fast and secure EVM blockchain platform

- white.market — An innovative P2P marketplace for CS2 skins trading

- The Coinomist — Analytical platform and news portal about the crypto industry

- ByHi show — educational entertainment show about the blockchain industry

- PayUniCard — The first non-banking institution in Georgia

“Our vision is a world where blockchain empowers everyone—making finance simple, secure, and part of everyday life. We believe that mass adoption of blockchain will unlock new opportunities, drive innovation, and create a more inclusive financial future. At W Group, we are committed to building the tools that make this future possible for everyone, everywhere,” said Volodymyr Nosov, Founder and President of W Group.

The W Group brings together a team of 1,300 professionals across 15 locations in Lithuania, Estonia, Spain, Italy, Croatia, Kazakhstan, Australia, Georgia, Turkey, Ukraine, UK, British Virgin Islands, Argentina, Brazil, and Hong Kong, reflecting its commitment to global reach and trusted service.

Seven Years, Millions in Trust

At the center of W Group remains the WhiteBIT exchange, which serves 8 million users across 150 countries, facilitating $2.7 trillion in annual trading volume, and has seen its native WhiteBIT Coin (WBT) grow 27-fold since launch, underscoring user confidence and steady adoption. Over the past year, the WhiteBIT exchange accelerated its global expansion, expanding to Australia, Kazakhstan, Croatia, Italy, Argentina, and Brazil.

Guys, meet Harry!

— WhiteBIT (@WhiteBit) November 19, 2025

He lives in 2025 but sends money like it’s still 1825 — because “apps are complicated” and his nerves have limits.

Harry, come on. The future’s already here: fast, digital, WhiteBIT-powered… and pigeon-free.

WhiteBIT. 7 years. Millions in trust:… pic.twitter.com/gbDKTZy6j8

To mark its anniversary, WhiteBIT is launching a global brand campaign centered on trust in modern technology. Through three ironic short films, the campaign humorously explores everyday doubts about crypto— and how WhiteBIT has earned the trust of millions.

Security remains central to this trust. WhiteBIT ranks among the top three most reliable exchanges with an AAA rating from CER.live and was the first crypto exchange to achieve the highest Cryptocurrency Security Standard (CCSS) Level 3 certification.

Setting Industry Firsts

WhiteBIT has had a landmark year with major firsts. It hosted the first International Crypto Trading Cup (ICTC 2025), which brought top traders together on one stage in a live-streamed competition, setting a new standard for crypto trading events. In an unprecedented moment, the winner’s name was displayed on the LED screens during the El Clásico football match — blending the excitement of esports, crypto, and world-class football.

WhiteBIT also held the first-ever metaverse graduation ceremony for students of its “Blockchain Technologies” program at Ukrainian National University of “Kyiv-Mohyla Academy”, The company also held the first metaverse graduation ceremony for students of the “Blockchain Technologies” program at Kyiv-Mohyla Academy, issuing NFT certificates on Whitechain as the company’s commitment to education and pioneering digital experiences.

SportsFi Leadership

WhiteBIT solidified its position at the intersection of sports and crypto, becoming Juventus FC’s sleeve partner and official cryptocurrency exchange partner. As part of this collaboration, WhiteBIT launched the Crypto Fan Zone for Juventus supporters. This partnership leverages digital finance to enhance fan engagement and integrates crypto into sports, setting new standards for how SportsFi can connect clubs and communities globally.

Product and Institutional Growth

WhiteBIT continues to expand its product suite and strengthen its ecosystem. The WhiteBIT Nova debit card processed over $50 million in transactions in the first year. New features — Flexible Crypto Lending and Hedge Mode — give users additional control, while WhitePool is among top 15 global mining pools, increasing its hashrate from 7 to 10.5 EH/s. The company also introduced WB Check, a tool that enables seamless asset transfers without requiring the recipient to onboard to the platform.

On the institutional side, WhiteBIT now serves over 1,300 institutional clients with solutions including Crypto-as-a-Service, OTC trading, liquidity provision, custody, wallet-address generation, and Portfolio Margin. WhiteBIT also hosted an exclusive Institutional Night at the FC Barcelona Museum, bringing select financial leaders together for a private discussion on the future of stablecoin adoption.

Looking Ahead

From a single European exchange to a global ecosystem, WhiteBIT’s journey demonstrates its commitment to innovation and trust in crypto and blockchain. With W Group, the company remains focused on building secure, user-friendly, and comprehensive solutions for retail and institutional clients alike.

Author: Mark Travoy

Crypto investment products saw their heaviest weekly outflows since February, with $2 billion exiting global exchange-traded products amid falling risk appetite.

CoinShares reported on Monday that crypto ETPs experienced a 71% surge in outflows compared with the prior week, marking the third consecutive week of withdrawals and bringing the three-week total to $3.2 billion.

Monetary Uncertainty and Whale Selling Pressure the Market

James Butterfill, head of research at CoinShares, attributed the outflows to shifting expectations around monetary policy and selling activity from large crypto-native investors.

These factors pushed total assets under management in crypto ETPs down to $191 billion, a notable decline from the October peak of $264 billion.

United States Leads the Outflow Trend

The U.S. accounted for the overwhelming majority of withdrawals, totaling $1.97 billion.

Germany, however, was one of the few markets to see inflows, accumulating $13.2 million, diverging from the broader global pattern.

Outflows Spread Across Multiple Regions

Several other jurisdictions also recorded significant capital flight.

Switzerland saw $39.9 million in outflows, while Sweden lost $21.3 million.

Hong Kong, Australia and Canada posted combined redemptions of $23.9 million.

Bitcoin and Ether ETPs Hit the Hardest

Bitcoin investment products faced nearly $1.4 billion in outflows last week, representing around 2% of total Bitcoin ETP assets.

Ether funds experienced close to $700 million in redemptions, equating to roughly 4% of their total assets.

Smaller Altcoin ETPs Not Spared

Solana ETPs lost $8.3 million, and XRP products saw $15.5 million in outflows, highlighting broad-based weakening across single-asset offerings.

Investors Shift to Diversified and Short-Bias Products

While single-asset funds experienced selling pressure, multi-asset ETPs attracted $69 million in new inflows over the past three weeks.

The trend suggests investors are seeking broader market exposure and lower volatility as macro uncertainty rises.

Short-bitcoin products also gained traction, posting $18.1 million in inflows over the same period, reflecting a modest increase in hedging behavior.

Dogecoin and Shiba Inu underwent sharp volatility on Sunday as the broader crypto market endured another risk-off wave driven by ETF outflows, concerns related to the AI-linked tech bubble, and reduced liquidity across speculative assets.

Meme-tokens saw some of the day’s most aggressive swings, with DOGE staging a forceful rebound and SHIB recovering after initially breaking a key support level.

Although the macro environment dominated sentiment, large-holder behavior diverged between the two assets.

Dogecoin experienced renewed institutional accumulation following two weeks of heavy whale positioning.

Shiba Inu, meanwhile, saw retail-led selling intensify before buyers re-entered the market at intraday lows.

DOGE finished the session up 3.0% at $0.1641.

The token had dropped sharply earlier in the day, falling to $0.1551 before recovering on surging volume.

Trading activity spiked to 613 million during the support test, a level 186% higher than its 214 million average.

DOGE’s rebound pushed the asset above $0.1640, establishing an ascending intraday trendline.

Later trading kept the token within a narrow consolidation range between $0.1638 and $0.1643.

Analysts noted that the higher-lows pattern formed during the recovery signals improving momentum despite market-wide weakness.

SHIB declined 2.0%, slipping from $0.000009233 to $0.000009045.

Heavy selling around 08:00 GMT pushed volumes to 412.35 billion tokens, roughly 67% above typical levels.

The asset bottomed at $0.000008975 before snapping back in a rapid V-shaped recovery.

Around 32.34 billion tokens traded during the reversal, lifting SHIB to $0.000009082 and reclaiming short-term resistance at $0.000009060.

Technical indicators showed divergent setups for the two tokens.

DOGE maintained an intact ascending trendline, with institutional demand supporting the $0.155–$0.161 range.

Key resistance remains at $0.1650, followed by $0.1680.

Analysts say a break above these levels would confirm a short-term bullish continuation.

SHIB preserved triple-tested support at $0.000009020 and reclaimed minor resistance, though its broader daily downtrend — defined by lower highs — remains intact.

A decisive close above $0.000009240 is needed to confirm stabilization.

A fall below $0.000008975 would expose the token to further downside toward the mid-$0.00000870 region.

Market analysts said DOGE’s structure favors further upside if momentum continues, while SHIB remains at a tactical inflection point.

The V-shaped recovery boosts short-term confidence, but longer-term trend reversal will require stronger follow-through.

Imperium Comms, a PR, SEO and publisher management agency specializing in the blockchain and crypto space, has announced the launch of its new editorial placement service, allowing clients to submit guest posts, thought leadership articles, and press releases to leading business, crypto, tech, and casino/iGaming news outlets through a unified platform.

This expansion marks a significant enhancement of the agency’s integrated communications offering, enabling companies to secure high-authority guest posts, op-eds, and thought leadership articles in top-tier publications that influence key decision-makers and high-intent audiences.

Companies and key opinion leaders interested in submitting a business, crypto, tech or casino guest post or sponsored article should direct their query to J.clifford@imperium-comms.com.

A Strategic Step to Strengthen Brand Authority

The new service is designed for organisations aiming to elevate their visibility in competitive sectors. Imperium Comms – which has a publisher management division and has exclusive media deals with several leading publications, including Reuters – has established relationships with a broad roster of mainstream business publications, fast-growing tech and crypto news platforms, and major casino and iGaming industry outlets.

Through these partnerships, clients will gain access to premium editorial opportunities, enabling them to showcase expertise, build trust, and enhance their online presence through authoritative mentions and coverage.

The agency noted that the expansion reflects growing demand from brands seeking credible, strategic media coverage that supports both PR visibility and SEO performance.

Existing clients of Imperium Comms include financial services companies, tech startups, partnered PR agencies which outsource accounts to them, and governmental clients, such as the Kurdish Regional Government.

Thought Leadership, Op-Eds & Executive Profiles

As part of the new offering, Imperium Comms will deliver a full suite of content formats for publication, including:

- Executive thought leadership articles

- Opinion editorials

- Industry commentary

- Market analysis pieces

- Founder interviews and profile stories

- Strategic guest posts

Each article is crafted by seasoned editors and strategists to ensure high editorial value and alignment with publisher guidelines.

Expanding Opportunities for Businesses Seeking to ‘Write for Us’

Write for Us

A dedicated component of the service focuses on organisations looking to publish expert content through “write for us” opportunities on high-authority tech, crypto, business and casino news sites.

Imperium Comms will manage the full process — topic development, editorial creation, and placement — ensuring each piece meets publication standards while reinforcing the client’s brand positioning and search ranking performance.

This approach helps businesses bypass the complex and time-consuming process of securing guest post placements while guaranteeing alignment with the editorial tone and compliance requirements of major platforms.

Guest Posts Across Business, Tech, Crypto & iGaming Verticals

The agency’s media network spans multiple high-value sectors:

- Mainstream business outlets covering entrepreneurship, tech, finance, leadership, and corporate strategy.

- Cryptocurrency and blockchain news platforms, ideal for exchanges, Web3 startups, DeFi projects, and institutional players.

- Tech news sites, covering everything from AI to Web 3.0.

- Casino and iGaming news sites that target operators, affiliates, game providers, and industry executives.

This broad range ensures that brands in dynamic, fast-moving industries can position themselves effectively and reach audiences with strong buying intent.

A Full-Service PR Solution for Modern Brands

With this launch, Imperium Comms continues to evolve as a comprehensive communications partner offering:

- PR and media outreach

- Content creation

- Editorial strategy

- SEO-driven publications

- Guest post acquisition

- Reputation building initiatives and crisis management

Coinbase is reintroducing U.S. retail investors to regulated crypto fundraising through a new platform dedicated to primary token offerings, marking the first such opportunity since the 2018 ICO boom.

The American exchange announced it will launch the initiative later this month, aiming to restore public participation in early-stage crypto projects under strict compliance controls.

The first token to debut on the new platform will be from Monad, a blockchain protocol whose sale will run from November 17 to 22, as Bitzo reported.

Coinbase plans to host roughly one token sale per month going forward, creating a structured, recurring schedule for new digital asset launches.

A Fairer Model for Token Distribution

Each token sale will be open for one week, during which verified users can submit purchase requests.

Once the sale period ends, Coinbase’s allocation system will prioritize smaller buyers first, gradually expanding to fill larger orders.

This approach, the company said, is meant to ensure broader participation and prevent large investors from dominating the process.

Coinbase has also added a mechanism to discourage rapid speculative selling.

Users who immediately offload their tokens after launch will see their allocation potential reduced in future offerings.

The exchange described the system as a way to promote fairer distribution and reduce “dumping” behavior that has historically plagued public token sales.

Compliance and Settlement in USDC

Only verified Coinbase users will be eligible to participate, and all purchases will be settled in USDC, the dollar-backed stablecoin issued by Circle.

Token issuers listing through the platform will face a six-month lockup period, preventing project founders and affiliates from selling or transferring tokens on secondary markets without Coinbase’s prior approval and public disclosure.

This restriction aims to maintain price stability and protect investors from insider selling shortly after launch.

Participation will be free for retail buyers, but token issuers will pay a fee based on the total amount of USDC raised, along with any associated listing costs.

Renewed Access for U.S. Retail Investors

The move represents a major milestone for the U.S. crypto sector, where retail access to regulated public token offerings has been virtually nonexistent since 2018.

Coinbase’s regulated approach seeks to fill a long-standing gap between private fundraising rounds—typically reserved for venture capitalists—and the broader investing public.

By implementing compliance safeguards and transparent rules, the platform could set a precedent for how token sales are conducted in the United States going forward.

Remembering the ICO Boom and Its Collapse

Coinbase’s new offering arrives years after the spectacular rise and fall of the Initial Coin Offering (ICO) era.

ICOs emerged in 2017 as a novel method for blockchain startups to raise capital directly from the public by selling newly minted tokens.

By the first half of 2018, ICOs had raised an estimated $13.7 billion, more than double the total collected in 2017.

However, the boom quickly attracted regulatory attention.

In 2017, the U.S. Securities and Exchange Commission (SEC) signaled that some tokens could qualify as securities under the Howey test, bringing them under existing investment laws.

A 2018 report by Ernst & Young examined over 140 major ICOs and revealed that 86% of tokens were trading below their launch prices within a year, while nearly a third had lost almost all their value.

The combination of regulatory crackdowns, investor losses, and a deep crypto bear market effectively ended the ICO frenzy.

Coinbase’s Attempt to Modernize the ICO Model

By introducing transparency, compliance oversight, and anti-dumping mechanisms, Coinbase appears to be reviving the ICO model with institutional-grade safeguards.

If successful, the platform could usher in a new era of compliant token fundraising, bridging the gap between the innovation of crypto’s early days and the regulatory expectations of today’s markets.

Earlier this month, Coinbase clashed with several US banks over a key stablecoin interest rule as part of the recently passed GENIUS Act.