Avalanche’s AVAX token recorded a sharp upswing on Tuesday, rallying more than 10% to trade above $33 despite a broader downturn across the cryptocurrency market.

The move has pushed AVAX nearly 22% higher from its recent local low of $29, with institutional interest and ecosystem growth playing a central role in driving momentum for the layer-1 blockchain.

Institutional demand strengthens outlook

The Avalanche Foundation has ramped up efforts to secure institutional capital, unveiling a series of treasury-building initiatives earlier this month.

In early September, the foundation revealed plans to raise $1 billion through two separate U.S.-based crypto treasury companies, which would allow them to purchase millions of AVAX tokens from reserves at discounted rates.

One of the vehicles, steered by Hivemind Capital and advised by Anthony Scaramucci, is seeking to raise $500 million via a Nasdaq-listed PIPE transaction. On Monday, AgriFORCE Growing Systems confirmed its rebrand to Avax One and announced plans to raise $550 million to construct a treasury centered on AVAX.

A second vehicle, involving Dragonfly Capital, is also targeting $500 million through a special purpose acquisition vehicle. Together, these efforts are expected to lock up significant amounts of AVAX, applying consistent upward pressure on the token’s price.

Institutional exposure to Avalanche has also expanded through new financial products. Sweden-based Vitune launched a crypto exchange-traded product (ETP) offering Finnish investors access to AVAX in February. VanEck followed with an application to launch an Avalanche ETF in March, while Grayscale recently filed to convert its Avalanche Trust into an ETF.

This institutional wave has helped fuel confidence in AVAX, keeping its rally intact even as most digital assets retraced in recent days.

Network growth adds fuel to rally

On-chain activity has also reinforced AVAX’s strength.

Avalanche’s Octane upgrade in April reduced C-Chain fees by 98%, spurring daily transactions to 1.4 million by the second quarter, a 493% increase compared with the prior quarter. Active wallet addresses rose 57% in the same period, reaching 46,397.

In late August, Avalanche led all blockchains in weekly transaction growth, recording a 66% jump to reach a record 2.22 million daily transactions. Although activity has since moderated, counts remain robust above 1.2 million transactions daily, according to Nansen.

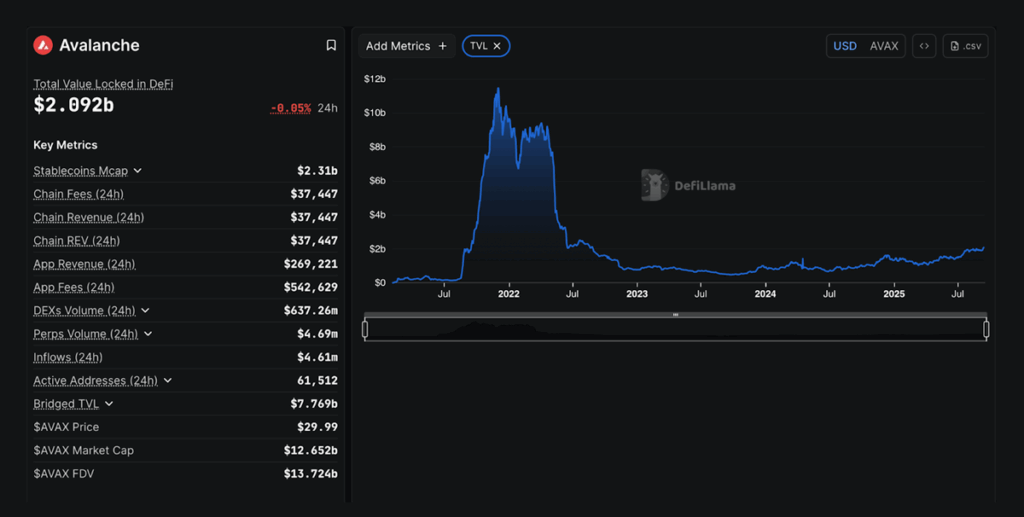

The total value locked (TVL) on Avalanche has more than doubled since April, climbing from $1 billion to $2.23 billion by Tuesday. Protocols like Aave, with $515 million locked, have contributed significantly. Meanwhile, the stablecoin market cap on Avalanche has soared to $2.16 billion, marking an 81% increase over the past month, according to DefiLlama.

Rising TVL and stablecoin adoption underscore the blockchain’s expanding role in decentralized finance, improving liquidity and strengthening long-term utility.

Technical setup signals bullish continuation

From a charting perspective, AVAX appears to be forming a rounded bottom pattern on the daily timeframe — a traditional bullish reversal formation.

The token has been gradually building a U-shaped base since July, when it traded near $17. A 17% jump from Monday’s lows near $29, coupled with a more than 100% spike in trading volume, suggests increasing conviction among buyers.

This structure sets up two potential upside targets. The first lies near the neckline at $55, about 61% above current levels. If AVAX closes decisively above that price, a measured projection points to a longer-term target of $212, a potential 511% gain from today’s market value.

While such projections remain speculative, the combination of institutional inflows, strong on-chain activity, and technical momentum has positioned AVAX as a rare standout in a shaky crypto market.

BNB surged more than 10% over the weekend, reaching a record level above $1,080 while the broader cryptocurrency market remained relatively flat.

The rally has put the Binance-linked token in price discovery, fueling speculation about whether it can extend its upward trajectory in the weeks ahead.

Short-Term Risks From Overbought Levels

The latest rally pushed BNB’s relative strength index (RSI) into overbought territory on the four-hour chart.

This typically signals the risk of a cooling-off period or correction.

The token has already slipped nearly 3% from its intraday peak of $1,083.50.

Technical indicators point toward a potential retest of the 20-period exponential moving average (EMA) on the four-hour chart, which currently sits near $1,012.

That level also aligns with the 0.236 Fibonacci retracement zone, strengthening the case for a short-term pullback.

If selling pressure intensifies, the correction could extend deeper, with support at the 50-period EMA around $974.

Analyst Sees Strong Support at $970

Despite the overbought risks, analysts remain optimistic about BNB’s broader trend.

Market commentator Gael Gallot pointed out that BNB’s ability to stay above $970 is a sign of resilience, citing surging trading volumes and long positions dominating the derivatives market.

“BNB broke the 1000 mark and set a new high at 1074 before settling near support at 987 to 990,” Gallot noted.

“Trading volume hit 3.28 billion during the move, and momentum remains strong with a long short ratio of 17.71, showing bullish positioning.”

This $970 zone also coincides with the lower boundary of BNB’s ascending channel pattern, which has guided price action since June.

Historically, each retest of this trendline has triggered rebounds ranging between 20% and 35%.

October Target Above $1,150

If this pattern repeats, BNB could be on track to surpass $1,150 in October.

That would represent a 10% gain from current levels, even if the token first consolidates closer to the $970 support.

The channel’s historical reliability adds weight to this projection.

At the same time, the breakout has revived comparisons to earlier BNB rallies.

In 2020–2021, the token skyrocketed more than 2,600% after breaking through an ascending triangle pattern.

Year-End Prospects Point to $1,250 and Beyond

On longer-term charts, BNB is forming what analysts describe as a bullish cup-and-handle structure.

The recent move above the 1.618 Fibonacci extension near $1,037 has flipped that level into support.

Upside targets now include $1,250, projected from the cup-and-handle breakout, and potentially $1,565, based on the 2.618 Fibonacci extension.

If momentum holds, BNB could see its strongest phase of the cycle in the final months of the year.

On-Chain Indicators Support Optimism

BNB’s on-chain data appears to support the bullish technical outlook.

The Net Unrealized Profit/Loss (NUPL) metric has returned to the optimism-anxiety zone.

This level was last observed during the 2020–2021 bull market, when BNB rallied from under $50 to more than $600.

The metric suggests that most holders are in profit and lean optimistic, conditions often associated with mid-cycle strength.

While short-term corrections are still possible, both technical and on-chain signals indicate that BNB could be gearing up for its most decisive rally since the last major bull run.

The AVAX price rally has caught many by surprise. The layer-1 Avalanche chain’s native crypto had been struggling to keep up with the likes of SOL and BNB for months, but it now appears to be breaking through resistance on its way to potentially hitting a six-month high.

The rally has pushed $AVAX to above $30 for the first time in several years, marking a 300% return from its 2022 lows of under $10. However, a return to a new all-time high remains a long way off, and some AVAX price predictions suggest it won’t be coming anytime soon.

The LivLive crypto presale has also launched, bringing a new opportunity to the market with its native $LIVE token, which will act as a means of exchange and reward in the project’s augmented reality (AR) ecosystem.

AVAX Rallies: Can It Hit $50 in 2025?

The AVAX rally has outpaced the broader market, especially other cryptocurrencies with market capitalizations above $10 billion. The AVAX has surged from its 2025 low of $16.50 to over $30, adding several billion dollars to its market cap and pushing it into the top 20 coins by cap on CoinGecko.

Avalanche is a high-speed blockchain network designed for scalability and interoperability. It uses a unique consensus mechanism that enables rapid transaction finality, making it one of the fastest and most efficient smart contract platforms in the market. AVAX, the network’s native token, has a maximum supply capped at 720 million.

The AVAX token was hit hard during the 2022 bear market, which saw its price collapse from over $140 to under $10. At the depths of the downturn, many believed Avalanche might never fully recover.

Since then, AVAX has rallied more than 300% from its bear market low, though it still trades at around 80% below its all-time high. Another concern is that the total value locked (TVL) on Avalanche has not grown in line with price, which is one reason why some AVAX predictions remain cautious about the token reaching $50 in the near future.

Avalanche total value locked. Source: DeFiLlama

$LIVE Presale Offers 12x on Launch and M2E Crypto Rewards

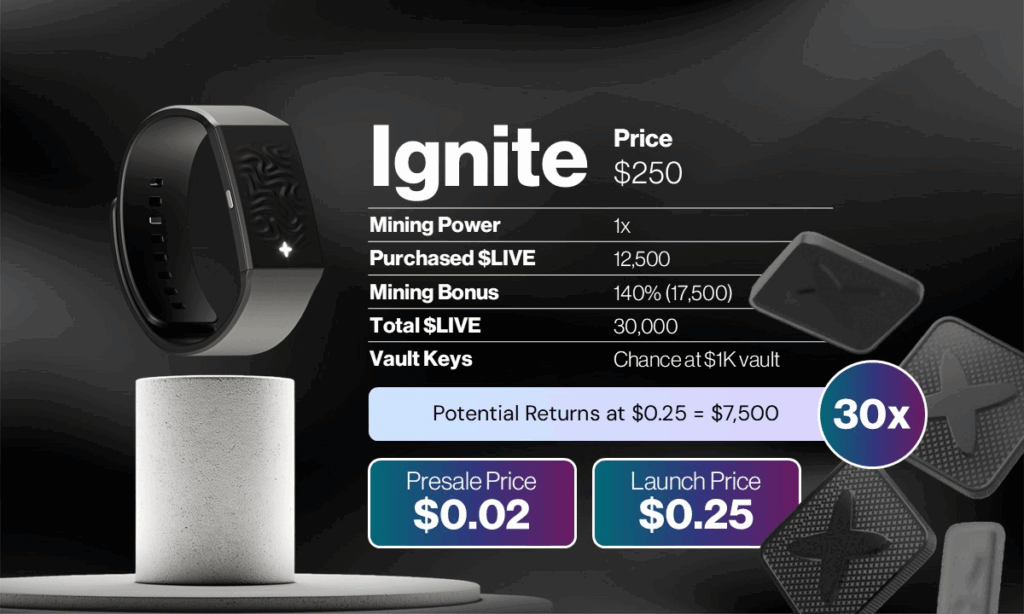

The $LIVE crypto presale is currently trading at $0.02 with a launch price of $0.25, offering just over 12x potential returns for presale buyers. The presale is slightly different from the standard presale model, where users simply swap BTC, ETH, or USDC for tokens. Instead, buyers can purchase bundles that include a token allocation, an NFT key to access a virtual giveaway, bonus mining allocations, and a physical wristband that unlocks the LivLive AR world.

LivLive is an augmented reality ecosystem that merges AI, blockchain, and gamification to reward real-world actions with M2E crypto prizes. Players armed with the app synced LivLive wristbands can complete quests such as posting service reviews, visiting their favourite shops, or conquering gym sessions to earn $LIVE tokens and real-world assets (RWAs). Businesses and brands also benefit by launching quests that serve as interactive and verifiable marketing campaigns.

The $LIVE token follows a transparent distribution model with a hard-capped supply of 5 billion. New supply is introduced post-launch through mining allocations tied to presale bundles, incentivizing activity and ensuring a sustainable economy.

For example, the $250 IGNITE bundle includes 12,500 tokens plus a 140 percent mining bonus of 17,500 tokens, totaling 30,000 tokens. At the launch price of $0.25, this allocation could be worth $7,500, representing a 30x return.

LivLive’s Business Integration: Driving Demand for $LIVE

The $LIVE token will act as a means of exchange across the LivLive ecosystem, where businesses, brands, and users interact through quests and events. The idea of the LivLive AR gamified world is to give businesses the opportunity to launch interactive and verifiable marketing campaigns that players enjoy participating in while earning crypto rewards.

The LivLive protocol integrates AI, move-to-earn (M2E) mechanics, gamification, and proof-of-presence wristbands to ensure that campaigns are both authentic and effective. Businesses can create in-game quests, such as rewarding users for visiting a new café, attending a fitness class, or leaving a review at a local bar.

Players completing M2E crypto quests verify their presence through their wristbands, while AI ensures that quests and rewards are personalized to user behavior. To run these campaigns, businesses will need to buy and use $LIVE tokens, creating ongoing demand and adding real economic value to the ecosystem.

Final Thoughts on the AVAX Trading Action and $LIVE Presale

The AVAX trading action has been positive for several months now, marking a huge change in sentiment since the 2022 bear market pushed the layer-1 crypto under $10. Whether AVAX can hit $50 this year is hard to predict, but most price prediction experts believe that it is unlikely.

The $LIVE presale has positioned itself as the leading crypto in the AR and M2E market, offering real utility and opportunities to traders, Web3 gamers, and businesses. The $LIVE token is trading for $0.02 with a launch price of $0.25, offering a potential 12x return.

The U.S. market is set to welcome its first exchange-traded funds (ETFs) based on XRP and Dogecoin, marking a milestone for altcoin investment products.

Fund issuer REX-Osprey confirmed that the XRP ETF is expected to debut this week, while a Dogecoin ETF will follow shortly after.

XRP ETF to Trade Under XRPR

The REX-Osprey XRP ETF, set to trade under the ticker XRPR, will provide spot exposure to XRP, currently the third-largest cryptocurrency by market capitalization.

The fund has cleared the Securities and Exchange Commission’s (SEC) 75-day review window and is slated to begin trading on Friday, barring unforeseen delays.

The launch falls under the Investment Company Act of 1940, which allows funds to automatically take effect after 75 days unless the SEC raises objections.

This pathway differs from the Securities Act of 1933, which governs spot Bitcoin ETFs and involves a more complex approval process.

Market Views and Demand

Industry experts see the launch as a key test for demand.

“This will be another good litmus test for ‘33 Act spot XRP ETF demand,” said Nate Geraci, President of ETF consultancy Nova Dius.

He noted that futures-based XRP ETFs are already nearing $1 billion in assets.

Dogecoin ETF Follows Suit

Dogecoin is also set for its first U.S.-listed ETF.

“As of now, the Doge ETF DOJE is slated for a Thursday launch,” Bloomberg ETF analyst Eric Balchunas said.

The REX-Osprey Dogecoin ETF will also operate under the 1940 Act framework.

It marks the first memecoin ETF in the country and reflects growing acceptance of alternative cryptocurrencies in mainstream investment channels.

Track Record and Other Products

REX-Osprey has been active in the altcoin ETF space.

In July, the company launched a Solana staking ETF, though investor appetite has been limited, with just $274 million in assets since launch.

In late August, REX-Osprey also filed for a BNB staking ETF.

A Pipeline of Crypto ETFs

The new launches are part of a broader wave of crypto ETFs under review.

According to Bloomberg analyst James Seyffart, more than 90 such products are currently awaiting SEC approval.

Among them is Canary Capital’s Litecoin ETF, which is expected to receive a final decision in early October.

Bitwise has also filed for a spot Avalanche ETF, joining VanEck and Grayscale as contenders for approval.

However, the SEC has delayed decisions on other filings, including Bitwise’s Dogecoin ETF and Grayscale’s Hedera ETF, extending deadlines until November 12.

The imminent arrival of XRP and Dogecoin ETFs is expected to set the tone for how regulators and investors approach the next wave of altcoin investment vehicles.

Bitcoin entered the new trading week under pressure, with prices circling weekend lows of around $115,000 as investors looked ahead to a pivotal U.S. Federal Reserve meeting.

The world’s largest cryptocurrency avoided sharp volatility but remained on watch for signals that could shape its near-term direction.

Cautious Market Moves

Data from TradingView showed Bitcoin dropping toward $115,000 after peaking at $116,800 during Friday’s Wall Street session — its highest level since late August.

“Pretty clear price is being walked down here yet again going into a new week,” trader Skew wrote on X, adding that there was “some pretty decent bid depth & liquidity just below $115K.”

“Time to pay attention,” he concluded.

Other analysts emphasized that Bitcoin’s short-term goal was not a breakout, but rather regaining stability at key support levels.

Traders Focus on $114K Support

Popular analyst Rekt Capital explained that the immediate task was for Bitcoin to reclaim $114,000 as a firm base.

“The goal isn’t for Bitcoin to break $117k in the short-term,” he wrote.

“The goal is for Bitcoin to reclaim $114k into support first. Because that’s what would enable the premium-buying necessary to get price above $117k later on.”

Despite short-term uncertainty, Rekt Capital maintained that Bitcoin’s bull market remained intact and that fresh all-time highs were likely still ahead.

He added that a weekly close above $114,000 would be considered “bullish.”

Fed Rate Cut Expectations Dominate

Beyond Bitcoin, the spotlight was firmly on the Federal Reserve’s upcoming policy decision.

Markets were near-unanimous in predicting a 0.25% rate cut, a move that could further support risk assets, including cryptocurrencies.

Analysts argued that improving U.S. economic data, looser financial conditions, and broad participation from cyclical industries all point to continued economic expansion.

In a recent update, trading firm Mosaic Asset Company struck an optimistic tone.

“The combination of improving leading indicators, ongoing loose financial conditions, and strong market breadth that includes participation by cyclical industries favors an ongoing economic expansion in my opinion,” its author wrote.

“That supports the earnings outlook which is ultimately good for stock prices at the same time the Fed is set to resume rate cuts. That could make for an excellent trading environment into next year.”

Dogecoin has staged a powerful rally, gaining nearly 40% in just seven days, far outperforming the wider cryptocurrency market, which rose around 8% in the same timeframe.

The price of DOGE now sits close to $0.296, up from $0.21 earlier this month, as traders point to strong technical and onchain signals suggesting further growth.

Bullish Technical Breakout

On the weekly chart, Dogecoin has broken out of a multimonth symmetrical triangle, a continuation pattern that typically signals further upside.

Trading volumes surged during the breakout, more than tripling compared to average levels, indicating strong momentum behind the move.

Chart projections suggest Dogecoin could rise as high as $0.60, a gain of about 95% from current levels, by October.

Some analysts, including CryptoKing and CryptoGoos, have issued more conservative targets near $0.45, which aligns with resistance from a broader multiyear triangle.

Key Support Levels to Watch

Dogecoin’s relative strength index (RSI) remains below the overbought threshold of 70, giving bulls further room to push higher.

Still, traders warn that DOGE must hold above its 50-week exponential moving average, currently near $0.227, to sustain the bullish setup.

A decisive drop below this level could trigger a deeper correction toward the 200-week EMA around $0.215.

Signs of More Growth Potential

Beyond technical patterns, onchain indicators point to additional upside.

Dogecoin’s MVRV Z-Score, which measures whether an asset is over- or undervalued compared to historical holder costs, currently sits at 1.35.

In past cycles, similar readings have preceded major rallies, including last November’s 230% surge.

By contrast, extreme highs — such as the Z-Score exceeding 20 during DOGE’s all-time peak near $0.70 in 2021 — signaled overheated conditions.

The modest current reading suggests that investors are not sitting on excessive unrealized profits, leaving more room for price appreciation.

Can Dogecoin Repeat Historic Rallies?

With momentum building, comparisons are being made to past explosive moves, particularly last year’s triple-digit surge.

Analysts say the current setup leaves open the possibility of another significant rally if key supports hold and broader crypto sentiment remains positive.

While risks remain — including sudden market corrections and broader macroeconomic factors — Dogecoin’s breakout has strengthened the case for further gains in the coming weeks.

Blockchain-powered prediction market Polymarket is reportedly gearing up for a return to the United States, with investors suggesting its valuation could soar as high as $10 billion.

The development underscores a surge of enthusiasm around decentralized prediction markets and the broader crypto sector.

From $1 Billion to $10 Billion?

According to sources cited by Business Insider, Polymarket is actively exploring a US comeback while pursuing a new funding round.

The latest financing effort could more than triple the company’s valuation since June, when it was pegged at $1 billion.

One investor has already priced Polymarket at up to $10 billion, reflecting heightened expectations for the company’s growth.

Back in June, the firm raised $200 million in a round led by Peter Thiel’s Founders Fund, a venture capital powerhouse known for its early bets on OpenAI, Paxos, and Palantir.

Political Forecasting Boosts Growth

Polymarket rose to prominence during the 2024 US presidential election, when its trading activity surged.

The platform’s prediction markets gained credibility after accurately anticipating Donald Trump’s victory, attracting significant attention from traders and the media alike.

Data from analytics platform Dune shows that user activity reached record levels during the election period, with monthly active traders climbing rapidly.

Navigating CFTC Challenges

Despite its popularity, Polymarket was barred from operating in the US in 2022 after settling with the Commodity Futures Trading Commission (CFTC).

That setback pushed the company to focus on international users while it sought a pathway back into the American market.

In July, Polymarket took a key step forward by acquiring Florida-based derivatives exchange QCX.

This move provided a regulatory foothold in the US and positioned the company for compliance.

The CFTC followed up in September with a no-action letter granting QCX relief from certain reporting and recordkeeping requirements for event contracts.

CEO Shayne Coplan welcomed the decision, saying it effectively gave Polymarket “the green light to go live in the USA.”

Rival Platforms Also Expanding

Polymarket’s renewed push comes at a time of intensifying competition.

Rival platform Kalshi has been making headlines of its own, reportedly working toward a $5 billion valuation through a new funding round.

Earlier this year, Paradigm led a $185 million raise for Kalshi, which was valued at $2 billion at the time.

Kalshi’s momentum was helped by a 2024 court ruling that allowed it to list political-event contracts, a move that survived a CFTC appeal.

The legal victory cemented its ability to offer politically themed markets under existing US regulations.

A Growing Market for Predictions

Market analysts note that both Polymarket and Kalshi remain among the most active prediction platforms, though user activity has tapered since the election.

Still, fresh momentum is emerging.

The kickoff of the National Football League season has driven significant volumes, with analyst Tarek Mansour pointing out that Kalshi alone processed $441 million since Week 1.

He wrote, “NFL Week 1 is equal to a US election,” underscoring how sports markets are filling the gap left by election cycles.

For Polymarket, the combination of regulatory progress, strong investor interest, and proven user demand could make its US return one of the most closely watched moves in the crypto sector this year.

The U.S. Securities and Exchange Commission (SEC) has once again delayed rulings on a wave of cryptocurrency exchange-traded fund (ETF) proposals, adding to an already crowded pipeline of pending applications.

New Deadlines Set for Proposals

In fresh filings this week, the SEC extended deadlines for funds tied to Ethereum, Solana, and XRP.

Franklin Templeton’s Ethereum staking amendment is now set for a decision by November 13, while its Solana and XRP ETF proposals face a November 14 deadline.

Meanwhile, BlackRock’s bid to allow staking in its iShares Ethereum Trust has been pushed to October 30.

The filings only confirm the delays and do not signal how the SEC may ultimately rule. The Commission is using the maximum time permitted before a final decision.

SEC’s Changing Approach to Crypto

The extensions come as the SEC attempts to redefine its approach to digital assets under Chair Paul Atkins.

Since President Donald Trump’s administration began in January, the agency has taken a more open stance, introducing “Project Crypto” to modernize securities rules and create a unified framework for digital asset trading, lending, and staking.

At a global finance roundtable in Paris this week, Atkins underscored the shift. “Crypto’s time has come,” he told delegates.

ETF Applications Continue to Mount

Despite the more pro-crypto rhetoric, ETF decisions remain in limbo.

On Tuesday, the SEC postponed reviews of the Bitwise Dogecoin ETF and the Grayscale Hedera ETF, pushing both deadlines to November 12.

The Commission also issued multiple extensions in August, covering filings for the Truth Social Bitcoin and Ethereum ETF, the 21Shares and Bitwise Solana ETFs, and the 21Shares Core XRP Trust.

Other pending proposals include WisdomTree’s XRP Fund and the Canary PENGU ETF, both delayed until October.

By late August, reports indicated that at least 92 crypto-related ETF applications were sitting with the regulator.

The backlog highlights the SEC’s struggle to balance political momentum, market demand, and regulatory caution in one of the fastest-growing corners of finance.

Cboe Global Markets has announced plans to launch continuous futures contracts for Bitcoin (BTC) and Ether (ETH), bringing a popular decentralized finance (DeFi) product into US markets for the first time.

The exchange operator, which is part of the Chicago Board Options Exchange, said on Tuesday that the contracts are scheduled to begin trading on November 10, pending regulatory review.

Unlike standard futures that require traders to roll their positions into new contracts as they expire, continuous futures will provide long-dated exposure with a 10-year expiration period. This structure is designed to reduce the need for constant position management, a challenge that often deters traditional investors from crypto markets.

Perpetual-Style Contracts for Regulated Markets

Cboe explained that the product will function similarly to perpetual contracts, which have become a dominant form of crypto trading in offshore and DeFi markets due to their lack of expiry dates.

The contracts will be cash-settled and aligned to spot prices through transparent funding mechanisms.

“Perpetual-style futures have gained strong adoption in offshore markets. Now, Cboe is bringing that same utility to our US-regulated futures exchange,” said Catherine Clay, Global Head of Derivatives at Cboe.

Growing Appetite for Perpetuals

Perpetual contracts currently dominate Bitcoin derivatives markets. Research from Kaiko indicates they account for 68% of Bitcoin’s total trading volume in 2025, reflecting widespread trader preference for this format.

CoinMarketCap data shows open interest in perpetual futures has reached $876 billion this year, underscoring their role in driving liquidity and leverage.

By introducing continuous futures, Cboe hopes to attract US traders who have previously turned to offshore exchanges for these products.

A Return to Crypto Expansion

This launch marks a significant step for Cboe, which first introduced Bitcoin futures in 2017 but later scaled back its crypto derivatives efforts.

The renewed push follows a friendlier regulatory environment under the Trump administration, with US agencies showing greater openness to new crypto products.

Other US platforms have already made moves. Bitnomial launched perpetual futures in April, becoming the first exchange to do so under US oversight. Coinbase followed in July with nano Bitcoin and Ether perpetual futures, expanding its offerings to retail-focused traders.

Cboe’s entry into the space suggests growing competition and regulatory acceptance for products that bridge traditional finance with digital assets.

SwissBorg has revealed that hackers drained nearly $41 million worth of Solana (SOL) tokens from its Earn program after exploiting a vulnerability in Kiln’s staking API.

The Switzerland-based crypto wealth management firm confirmed the incident on X, clarifying that the breach was isolated to its Solana Earn product. Other services, including its main app and additional Earn programs, were unaffected.

The stolen funds amount to roughly 193,000 SOL, according to blockchain records. The exploit highlights once again the vulnerabilities that arise when relying on third-party staking infrastructure.

API Weakness at the Center

The source of the breach was traced back to Kiln, SwissBorg’s staking partner that supports yield-generating products on networks such as Solana and Ethereum.

An API, or application programming interface, functions as the bridge that connects two systems. By exploiting this communication channel, attackers were able to manipulate requests and redirect funds away from user deposits.

Blockchain data later flagged the compromised wallet on Solscan as the “SwissBorg Exploiter,” cautioning users not to interact with it.

Company Response and User Protection

Despite the large sum lost, SwissBorg stressed that the hack has not threatened its financial position or overall operations.

CEO Cyrus Fazel addressed users directly during an X Space shortly after the news broke. He confirmed the breach only affected Solana deposits in the Earn program, which accounts for just 1% of the company’s user base and around 2% of its assets.

“It’s a big amount of money, but it doesn’t put SwissBorg at risk,” a spokesperson added.

SwissBorg assured customers that affected deposits would be reimbursed, saying that its treasury could cover losses immediately if necessary. The company is also collaborating with global authorities, crypto exchanges, and white-hat hackers to track down the attackers, and has already succeeded in blocking some related transactions.

A Learning Experience for SwissBorg

Calling the incident “a bad day for SwissBorg,” Fazel said it would ultimately serve as a critical learning moment for the platform.

The Earn program had been designed to simplify staking for retail investors, letting them earn rewards without setting up validators or engaging with complex DeFi protocols. By outsourcing infrastructure to Kiln, SwissBorg streamlined access but also inherited new risks.

The company now faces the challenge of tightening security while maintaining accessibility for users seeking passive income through staking.