Bitcoin’s recent rally to new all-time highs has been met with heavy selling from long-term holders, raising concerns among analysts that the cryptocurrency could face a deeper correction in the weeks ahead.

Data shows that investors who typically hold Bitcoin for six months or longer have sold more than 241,000 BTC in the past month, worth an estimated $26.8 billion at current prices.

Long-Term Holders Exit Positions

According to CryptoQuant analyst Maartunn, the 30-day rolling supply change for long-term holders (LTHs) has dropped significantly.

“That’s one of the largest drawdowns since early 2025,” Maartunn noted in a recent update.

The selling coincides with Bitcoin reaching an all-time high above $124,500 in August, prompting many seasoned investors to take profits.

Large investors, often referred to as whales, have also added to the pressure by unloading more than 115,000 BTC over the same period.

This trend has compounded the selling pressure and could weigh further on the market.

Institutional Demand Slows

Despite treasury companies now holding a record 1 million BTC, their pace of accumulation has slowed sharply.

Strategy, one of the largest corporate Bitcoin buyers, reduced its purchases from 134,000 BTC in November 2024 to just 3,700 BTC in August 2025.

Other companies also scaled back, acquiring only 14,800 BTC in August compared with 66,000 BTC in June.

CryptoQuant said August purchases fell below 2025 averages of 26,000 BTC for Strategy and 24,000 BTC for other firms.

“Smaller, cautious transactions show institutional demand is weakening,” the firm’s Weekly Crypto Report stated.

Charles Edwards, founder of Capriole Investments, added that the number of companies buying Bitcoin daily has also fallen, a potential sign of “exhausted” institutional interest.

Price Correction and Bear Flag Concerns

The price of Bitcoin has reflected this slowdown.

After peaking at $124,500 on August 16, Bitcoin slid 14% to a seven-week low of $107,500 by the end of the month.

It has since recovered to around $111,500 but remains under pressure.

Chart analysts note that Bitcoin has formed a bear flag pattern on the daily timeframe.

The cryptocurrency recently dropped below the flag’s lower boundary at $112,000, which also aligns with its 100-day simple moving average.

Failure to turn this level into support could see prices fall toward $95,500, marking a potential 14.5% decline from current levels.

Macro Outlook Still Supportive

Not all analysts are bearish.

X user Coin Signals pointed out that the current 13% pullback from the record high is relatively shallow compared with previous drawdowns.

Some forecasts suggest that Bitcoin could still dip below $90,000, but the broader trajectory remains pointed toward new highs in the longer term.

A 30% decline from the August peak would place the bottom around $87,000, which coincides with the realized price for holders who bought within the last six to 12 months.

That level could act as a strong support zone if the sell-off deepens.

For now, the market remains caught between profit-taking from experienced holders and cautious institutional demand on one side, and a still-optimistic long-term outlook on the other.

Tether CEO Paolo Ardoino has dismissed rumors that the stablecoin issuer is selling its Bitcoin holdings to buy gold.

In a Sunday post on X, Ardoino confirmed that the company “didn’t sell any Bitcoin” and reiterated its strategy of allocating profits into assets such as Bitcoin, gold, and land.

The comments addressed speculation by YouTuber Clive Thompson, who cited Tether’s Q1 and Q2 2025 attestation data from BDO.

Thompson suggested a reduction in Tether’s BTC holdings from 92,650 in Q1 to 83,274 in Q2 indicated a sell-off.

However, Samson Mow, CEO of Jan3, clarified that the apparent decline was due to Tether transferring 19,800 BTC to a separate initiative called Twenty One Capital (XXI).

This transfer included 14,000 BTC in June and another 5,800 BTC in July, meaning Tether’s net Bitcoin holdings actually increased when accounted for.

In early June, Tether moved more than 37,000 BTC, valued at around $3.9 billion, to support XXI, a Bitcoin-native financial platform led by Strike CEO Jack Mallers.

“Tether would have had 4,624 BTC more than at the end of Q1 if the transfer is accounted for,” Mow explained.

Ardoino emphasized that the Bitcoin was moved, not sold, adding, “While the world continues to get darker, Tether will continue to invest part of its profits into safe assets.”

Tether, which issues the USDT stablecoin, now holds over 100,521 BTC, valued at approximately $11.17 billion according to BitcoinTreasuries.NET.

El Salvador Diversifies into Gold

Tether’s Bitcoin rumors coincided with El Salvador announcing its first gold acquisition since 1990.

The Central American nation added 13,999 troy ounces of gold, worth $50 million, to its foreign reserves as part of a diversification strategy to reduce reliance on the U.S. dollar.

Previously, El Salvador built a $700 million Bitcoin reserve, holding 6,292 BTC, but a July IMF report indicated no new Bitcoin purchases since February.

Ardoino’s statements aimed to reassure investors that Tether continues to hold and strategically allocate its cryptocurrency assets rather than liquidate them for other investments.

This clarification comes amid ongoing scrutiny of stablecoin issuers’ holdings and their role in the broader crypto ecosystem.

Tether’s approach reflects a mix of traditional and digital assets, balancing Bitcoin, gold, and real estate to manage risk and maintain liquidity.

U.S.-listed spot Ether exchange-traded funds (ETFs) have recorded four straight days of net outflows during the shortened week following Labor Day.

The trend follows a highly positive August in which Ether ETFs attracted $3.87 billion in inflows.

In contrast, Bitcoin ETFs suffered $751 million in outflows over the same month, according to Farside data.

By Friday, Ether funds shed $446.8 million in a single session, bringing the week’s total to $787.6 million.

During the same stretch, Bitcoin ETFs enjoyed $250.3 million in inflows, highlighting diverging investor sentiment.

Market Awaits Rebound

Some traders remain optimistic that the downturn is temporary.

Crypto trader Ted commented: “I’m expecting inflows to return if Ethereum continues this pump.”

Ether has climbed 16.35% in the past month but slipped 2.92% over the past week, trading around $4,301 at press time, according to CoinMarketCap.

Overall market confidence remains mixed, with the Crypto Fear & Greed Index signaling ‘Neutral’ sentiment for two consecutive days.

Long-Term Predictions Remain Bullish

Despite the recent pullback, analysts continue to project strong upside for Ether.

BitMine chairman Tom Lee reiterated his long-term forecast on the Medici Presents: Level Up podcast, stating that ETH could climb to $60,000.

Lee suggested Wall Street’s growing interest in Ether may serve as a “1971 moment,” potentially unlocking historic gains.

BitMine, which holds the world’s largest corporate Ether treasury, now owns $8.04 billion worth of ETH, according to StrategicETHReserve.

Across all treasuries, institutional holdings amount to 2.97% of total supply, valued at $15.49 billion.

Whale Activity Supports Outlook

Blockchain analytics firm Santiment has noted that whale addresses have been steadily increasing their Ether exposure.

“In exactly 5 months, they have added 14.0% more coins,” the company reported, referring to holders with between 1,000 and 100,000 ETH.

This accumulation trend began after ETH’s yearly lows in April and reflects broader institutional appetite, even as ETF flows fluctuate.

With treasury accumulation and whale purchases continuing, analysts argue the latest outflows may be more reflective of short-term adjustments than a long-term shift.

Crypto exchange Gemini, founded by Cameron and Tyler Winklevoss, is strengthening its European presence with the introduction of new staking and derivatives products.

The expansion allows users in the European Economic Area (EEA) to stake Ethereum and Solana, while also trading perpetual contracts denominated in Circle’s USDC stablecoin.

The launch comes after Gemini secured approval under the EU’s Markets in Crypto-Assets Regulation (MiCA) in Malta in August, along with earlier authorization under the Markets in Financial Instruments Directive (MiFID II) in May.

Building a Broader Market Presence

Gemini’s head of Europe, Mark Jennings, said the company now offers a complete set of services in the region.

“Our goal is to be one of the major exchanges in Europe, and now that we have a full suite of products including spot exchange, staking, and perpetuals in the EU from a single interface, we believe that we’re a serious contender,” Jennings explained.

The exchange is pushing deeper into derivatives at a time when spot trading has been losing momentum.

Derivatives Gain as Spot Trading Declines

Despite Bitcoin’s price gains in 2025, spot trading volumes dropped by 32% over the first half of the year, falling to $3.6 trillion in the second quarter.

In contrast, derivatives volumes reached $20.2 trillion, according to TokenInsight.

“The global derivatives market has exploded in recent months,” Jennings said. He added that the sector could be valued at $23 trillion by the end of 2025.

He pointed out that derivatives offer investors sophisticated ways to gain long or short exposure to crypto, particularly as adoption increases and traders seek risk-managed strategies.

Staking Growth Accelerates in the EU

Alongside derivatives, staking has grown rapidly in Europe under the MiCA framework, which regulates the practice indirectly.

CoinLaw data showed institutional staking participation in the EU rose 39% in 2025, compared to 22% growth outside the bloc.

Ethereum staking deposits alone surged 28% to $90 billion, highlighting strong demand for passive income opportunities.

“Staking is becoming increasingly popular in Europe,” Jennings said. “Gemini Staking is available to retail and institutional investors, but we believe it will be popular amongst sophisticated, professional retail investors who are looking to put their crypto funds to use and earn passive income from a single, integrated, centralized exchange.”

Gemini’s Broader Plans

The European product rollout closely follows Gemini’s filing for a U.S. initial public offering.

The company plans to sell 16.67 million shares priced between $17 and $19, targeting up to $317 million in proceeds.

The move underscores Gemini’s ambition to position itself as a leading player both in Europe and globally.

Bitcoin has faced a sharp correction, slipping 14% from its recent all-time high of $124,500 to a seven-week low of $107,400 on Saturday.

The decline has cooled what analysts describe as the “euphoric phase” of the market, with widespread net distribution replacing the bullish momentum.

Market intelligence firm Glassnode said the drop signals “exhaustion” in demand following months of strong inflows that pushed all Bitcoin supply into profit by mid-August.

Cooling After Euphoric Rally

The euphoric phase lasted around three and a half months, with over 95% of the Bitcoin supply in profit.

Glassnode explained that sustaining such conditions typically requires constant capital inflows, which rarely hold over extended periods.

“This behaviour is often captured by the 0.95 quantile cost basis, the threshold above which 95% of supply is in profit,” the firm said.

By August 19, Bitcoin slipped back under this level, a sign that buyers had begun to tire.

Currently, 90% of Bitcoin supply remains in profit, within the $104,100–$114,300 range.

Glassnode noted: “Breaking below $104.1K would replay the post-ATH exhaustion phases seen earlier in this cycle, whereas a recovery above $114.3K would signal demand finding its footing and reclaiming control of the trend.”

Short-Term Holders Under Pressure

The correction has hit short-term holders hardest, with the percentage of supply in profit plunging from above 90% to just 42%.

“Such sharp reversals typically provoke fear-driven selling from top buyers, which is then often followed by exhaustion of the very same sellers,” Glassnode said.

A rebound in price to $112,000 helped lift more than 60% of short-term holder supply back into profit, but analysts warn this remains fragile.

“Only a sustained recovery above $114K–$116K, where over 75% of short-term holder supply would return to profit, could provide the confidence necessary to attract new demand and fuel the next leg higher,” the firm added.

Resistance Levels in Focus

Bitcoin has repeatedly struggled to break past $112,000, showing stiff resistance around the $111,700–$115,500 range.

This zone coincides with the 50-day and 100-day simple moving averages, making it a crucial battleground for bulls and bears.

Trader Daan Crypto Trades observed: “Bitcoin has been consolidating below its previous local range and has failed to retake it. A move back above $112K and holding there would be good in the short term.”

The 20-day exponential moving average, sitting near $112,438, presents another obstacle.

Overcoming these levels could confirm higher lows and potentially set the stage for a renewed attempt at all-time highs.

Ether could be preparing to surprise bearish traders in the coming weeks, with September setting up for what some analysts believe might be a significant market trap.

“It might look bearish at first, but if it plays out, it could be the biggest bear trap I’ve ever seen,” full-time crypto trader and analyst Johnny Woo said on Monday.

Woo suggested that charts could form a head-and-shoulders pattern in September, designed to alarm traders into selling, only for the setup to be invalidated in October.

“This would trap paper-handed traders, forcing them to buy higher,” he explained, adding that this type of pattern has appeared before.

Historical Precedent Offers Clues

According to Woo’s projection, Ether (ETH), currently valued at $4,392, may dip toward support levels near $3,350 during September.

The downside could reverse in October, with momentum building toward a fresh all-time high in November.

A similar sequence unfolded in 2021, when ETH declined by 30% from $3,950 to $2,750 in September, only to recover and post record highs in November.

That historical context is feeding optimism among those who see September’s weakness as a setup rather than a breakdown.

Traders Anticipate Range Movements

Fellow trader “Daan Crypto Trades” expressed a similar perspective, noting that Ether has been consolidating within a tight range.

He wrote on X that ETH has been “chopping everyone up” in the $4,300 to $4,500 zone.

A retest of the lower range, near $4,160 and aligned with the four-hour 200 moving average, could present “an interesting spot” for traders watching key technical signals.

Fundamentals Over Technicals

However, some market professionals are less convinced that short-term chart patterns are worth following.

Henrik Andersson, chief investment officer at Apollo Capital, argued that traders should be cautious about overreliance on historical setups.

“My view is that it’s generally more prudent to focus on fundamental analysis rather than relying on what can often be spurious historical patterns,” Andersson said.

He added that past trends may provide some insight but are not a reliable foundation for predictions in a fast-changing crypto environment.

OKX Singapore CEO Gracie Lin echoed that sentiment, highlighting macroeconomic and structural forces as more relevant drivers of Ether’s future.

“Macro events like US jobs data (out this Friday) and the Fed’s upcoming rate decision will likely bring short-term volatility, but the real story is structural,” Lin said.

She emphasized that Ethereum’s role in powering stablecoin flows and benefiting from regulatory clarity will underpin long-term growth regardless of short-lived pullbacks.

Ether’s Current Price Action

Despite the broader debate, Ether continues to show weakness.

The asset fell to $4,238 during intraday trading before recovering to $4,374 at press time.

That leaves it 11.7% below its all-time high, but analysts point out this retreat is far less severe than earlier September corrections.

Some see that as evidence the market may be preparing for another rebound as October approaches.

Bitcoin continues to struggle around the $108,000 level, with traders facing renewed uncertainty amid signs of large-scale selling and muted market activity during the U.S. Labor Day holiday.

The cryptocurrency traded at $108,711 on Sunday, showing little momentum for a rebound as broader market sentiment weighed heavily on the asset.

Whale Selling and ETF Weakness

Investor confidence has been shaken by reports of long-dormant Bitcoin wallets transferring coins into the market, with some proceeds converted into Ether.

At the same time, inflows to spot Bitcoin ETFs have slowed, removing another source of support for prices.

This negative environment has been compounded by a weak performance in U.S. stock markets, with the Dow, S&P 500, and Nasdaq all closing the week lower.

President Trump’s shifting stance on tariffs and his attempts to exert influence over the Federal Reserve board have also added to the uncertainty.

Market Dynamics and Technical Signals

Some investors remain hopeful that the Fed could begin cutting interest rates as soon as late September or October. However, these expectations have done little to boost short-term sentiment.

From a technical perspective, activity in the perpetual futures market continues to dominate price action.

Data shows significant selling pressure from larger cohorts of traders on platforms like Binance, outweighing buying activity in both spot and futures markets.

Retail investors, however, appear more willing to buy dips, particularly in the $112,000–$111,000 range and again at $107,200. This buying activity marks the first significant upside order book signal since late June, when Bitcoin briefly fell below $98,000.

Key Support Levels

Charts suggest notable downside liquidity remains at $104,000, with shorter-term bids emerging at $105,000, $102,600, and $100,000.

Deeper bids in the $99,000 to $92,000 zone indicate some traders are preparing for further declines.

Despite the dip-buying enthusiasm, overall liquidity conditions favor sellers, making it harder for Bitcoin to establish sustained upward momentum.

With U.S. markets closed for the holiday and large Bitcoin holders continuing to offload positions, analysts believe downside risks will remain in play for the near term.

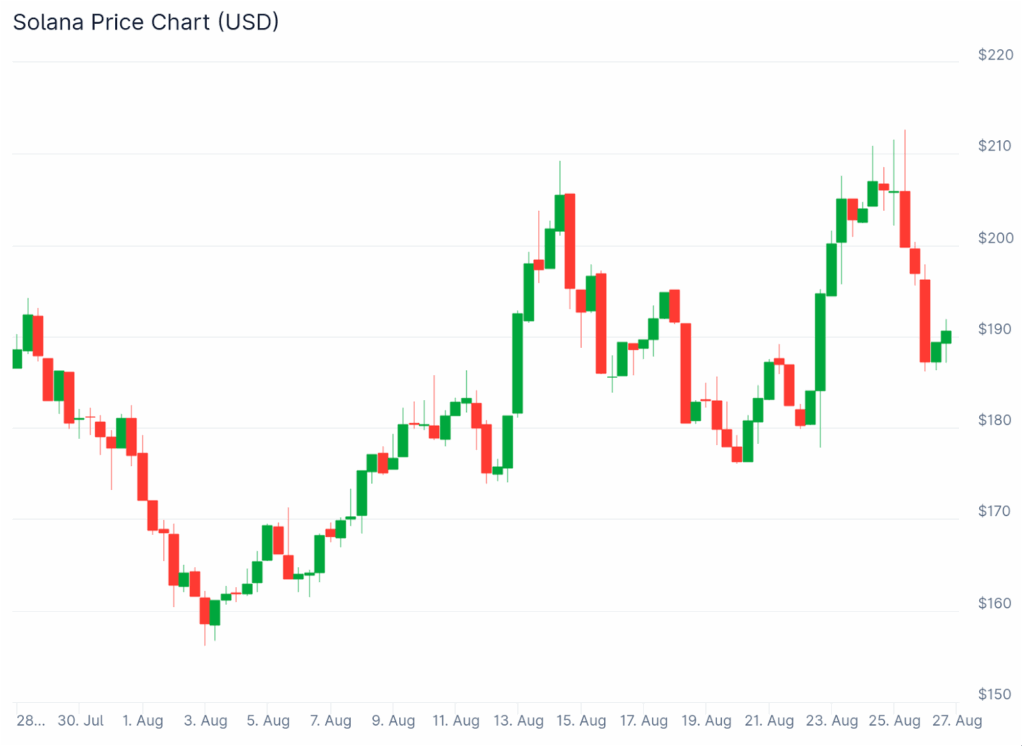

The crypto market has turned its attention to a massive Solana whale accumulation worth $100M.

More than 530,000 SOL was pulled from exchanges into private wallets, hinting at long-term confidence rather than short-term trading.

This comes as analysts anticipate a crypto market catalyst Q4 2025, potentially setting the stage for a wider altcoin season 2025.

But the story isn’t just about Solana. New players like MAGACOIN FINANCE, fully audited by HashEx, are entering the conversation.

Solana Whales and the 2025 Outlook

Large-scale Solana whale accumulation signals that institutional and high-net-worth investors are confident about long-term growth.

In August, around 530,000 SOL tokens, worth $100 million, were moved off exchanges into private holdings. Such moves often reduce selling pressure and set the stage for price appreciation.

ETF talk adds fuel to the story. The SEC’s 2025 Global ETF Outlook highlighted expansion beyond Bitcoin and Ethereum, putting Solana in line for potential spot ETF listings.

Grayscale has also signaled intent to push for a SOL ETF by 2026. These developments could attract mainstream investment, making Solana a contender for the top crypto to invest in 2025.

From a technical perspective, analysts place the Solana price prediction 2025 around $280, provided it clears the $230 resistance zone. With treasury initiatives like Pantera’s $1.25 billion Solana-focused fund, institutional demand could continue to build.

When compared in the Ethereum vs Solana debate, Solana’s speed and efficiency make it attractive, particularly for retail users chasing lower fees during altcoin season 2025.

MAGACOIN FINANCE: The Rising Catalyst for Altcoin Season

Alongside Solana, MAGACOIN FINANCE is drawing increasing attention. Insiders report that whales are not only stacking SOL but also allocating into MAGACOIN.

What’s catching eyes is the project’s projected 11,200% ROI and the fact it has already passed a full audit by HashEx, one of the top blockchain security firms.

This independent verification strengthens trust for retail buyers who see MAGACOIN as a secure, growth-driven alternative.

To sweeten early participation, the project offers a PATRIOT50X bonus code, giving buyers a 50% bonus on entry.

Such mechanics make it appealing to investors looking for the best altcoin to buy now ahead of what could be a strong crypto market catalyst Q4 2025.

For many traders, MAGACOIN FINANCE is being positioned as more than a speculative play—it’s viewed as one of the top crypto to invest in 2025, thanks to its security credentials and ambitious growth forecasts.

Can Q4 2025 Spark the Next Altcoin Season?

With institutions backing Solana and retail investors eyeing projects like MAGACOIN, conditions are aligning for a powerful altcoin season 2025.

Whale movements, ETF expansion, and treasury investments are all bullish signs, but retail-driven growth in audited projects could be just as impactful.

The Ethereum vs Solana rivalry will continue, but the bigger story is how the broader altcoin market responds to new demand drivers.

For anyone hunting for the best altcoin to buy now, the message is clear: watch the whales, track ETF signals, and don’t overlook rising stars like MAGACOIN FINANCE.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Bitcoin has suffered a sharp pullback after hitting its all-time high earlier this year.

The cryptocurrency has fallen more than 13.75% from its record peak of $124,500, now trading at around $108,791.

This drop broke below its multiyear uptrend support, raising concerns of a deeper market correction.

Historical Patterns Raise Red Flags

Bitcoin’s bull markets have traditionally relied on parabolic support curves as a foundation for sustained rallies.

Temporary dips below this curve have not always been fatal, so long as the relative strength index (RSI) maintained its momentum.

Trouble has historically emerged when both parabola and RSI support failed.

In 2013, that scenario triggered an 85% crash from $1,150 to $150.

A similar breakdown in 2017 led to an 84% plunge from nearly $20,000 to $3,100.

Again in 2021, Bitcoin lost both supports and tumbled 77% from $69,000 to roughly $15,500.

The Current Outlook

By late August 2025, Bitcoin slipped under its long-term trendline support.

However, RSI remains above its critical uptrend, leaving some room for optimism.

The key test will come if RSI weakens.

A breakdown there could send Bitcoin toward its 50-week exponential moving average, around $80,000, by year’s end.

Such a move would mirror previous cycle corrections that reset investor sentiment before renewed rallies.

Analysts Suggest Pullback Could Be Temporary

Some analysts argue that the current correction may not signal the end of the bull cycle.

BitBull, a popular crypto market commentator, described the recent breakdown as a possible “fakeout.”

Even a move briefly under $100,000 could fit Bitcoin’s historical pattern of forcing out weaker hands before rebounding, he argued.

That would put the $80,000–$100,000 range as both a bearish target and a potential launchpad for the next upward move.

Cycle Indicators Suggest Room to Grow

Market analyst SuperBro pointed to the Pi Cycle Top model, a long-trusted tool for identifying Bitcoin’s cycle peaks.

The model tracks two moving averages: the 111-day simple moving average and twice the 350-day simple moving average.

When the 111-day line rises to cross above the 350-day x2 line, it has historically marked major cycle tops.

These crossovers were evident in 2013, 2017, and 2021 — each followed by sharp corrections.

At present, however, the crossover has not occurred.

SuperBro believes this indicates Bitcoin has not yet reached its peak and forecasts a possible top at $280,000.

Investor Sentiment at a Crossroads

Despite the pullback, Bitcoin’s long-term cycle signals remain intact.

For now, the correction resembles past volatility episodes that preceded stronger rallies.

If RSI holds and cycle indicators stay supportive, analysts suggest that the latest decline could ultimately prove to be a consolidation phase rather than the start of a long downturn.

Conversations in the meme coin market have picked up again as community members weigh the ever-constant question: Will Dogecoin (DOGE) or Shiba Inu (SHIB) lead the meme coin market in the upcoming bull cycle?

The entire meme coin market is worth around $73 billion, which could grow further should current momentum be sustained into October. Beyond Shiba Inu and Dogecoin, meme coin investors are also spotlighting newer players such as MAGACOIN FINANCE—a secured and fully audited project—in their list of the best meme coins to buy in 2025.

Dogecoin vs Shiba Inu: Who Holds the Edge?

Dogecoin has been holding steady around $0.21–$0.22 after a brief rally to $0.25. Whales have scooped up more than 680 million DOGE this month, showing strong confidence. If DOGE can break above $0.23, analysts say a move toward $0.28 is possible, with ETF speculation adding fuel. Beyond price, Dogecoin’s ecosystem is expanding with upgrades like RadioDoge, designed to boost real-world use cases.

Shiba Inu, on the other hand, has faced a tougher month. Shibarium’s new governance features are promising, but SHIB’s burn rate dropped nearly 99%, raising doubts about its deflationary strength.

Price action has been weak, slipping around 3% to $0.0000124. Still, whales buying more than $1.6 million in SHIB suggest strategic accumulation. With DAO elections, AI partnerships, and even a SHIB-backed stablecoin planned for 2026, SHIB remains on many lists of the best meme coins to buy now despite short-term setbacks.

MAGACOIN FINANCE: Investors Growing, Analysts Watchlist

While older names battle for dominance, MAGACOIN FINANCE is carving out its place among the best meme coins to buy in 2025.

On-chain data shows demand for MAGACOIN FINANCE is growing fast. Analysts who track high upside projects have also noted the attention in the token, predicting it could outperform leaders such as DOGE and SHIB.

With the community growing and attention spreading through the crypto market, investors now have a limited-time opportunity to get into MAGACOIN FINANCE. By using the code PATRIOT50X, early investors can gain an exclusive 50% EXTRA bonus.

For smart investors, MAGACOIN FINANCE may be the best meme coin to buy now as the market slowly recovers.

Why Investors Are Watching Meme Coins Closely

With capital rotating in the crypto market, meme coins remain one of the best strategic plays for investors hoping to ride the next bull cycle wave. With meme coins delivering sporadic returns in previous cycles, history is bound to repeat itself.

While DOGE and SHIB continue to command high community energy and whale-driven momentum, investors say MAGACOIN FINANCE is the meme token quietly gaining traction, especially as the competition for the best meme coins to buy now is heating up.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance