Amid concerns about a potential denial-of-service (DoS) attack on the Bitcoin network, several prominent Bitcoin maximalists have stepped forward to allay fears, insisting that the network remains secure and robust.

Rumors of a potential DoS attack began circulating when users started noticing delays in Bitcoin transactions. This fueled speculation that malicious actors were attempting to flood the network with low-fee transactions in order to slow it down.

However, Bitcoin maximalists were quick to refute these claims, emphasizing that the network is designed to withstand such attacks. These experts argue that the recent congestion is primarily due to an increase in legitimate trading activities, as well as a higher demand for block space.

Notably, Bitcoin developer Jimmy Song took to Twitter to address the concerns, stating that the network is not under attack and that the delayed transactions are simply a result of increased demand. Song further clarified that Bitcoin’s sophisticated fee system is designed to prevent DoS attacks by prioritizing transactions with higher fees, ensuring that the network remains functional even during periods of high demand.

Other prominent figures in the Bitcoin community, such as Adam Back, CEO of Blockstream, and Jameson Lopp, CTO of Casa, also chimed in to support this stance. They emphasized that the Bitcoin network has demonstrated its resilience over the years and that it is highly unlikely that a DoS attack could be successful in disrupting the network.

While the recent congestion on the Bitcoin network has raised concerns, the reassurances from Bitcoin maximalists have helped to ease fears and reinforce the network’s reputation for security and reliability. Users are encouraged to remain patient during periods of high demand and adjust their transaction fees accordingly to ensure timely processing.

For the second time within a 12-hour timeframe, Binance, the world’s largest cryptocurrency exchange by trading volume, has temporarily halted Bitcoin (BTC) withdrawals. The exchange has assured its users that the suspension is only temporary and is due to network congestion.

On May 7th, Binance first announced that it had suspended Bitcoin withdrawals for a brief period. The exchange cited a “large backlog of outgoing BTC transactions” as the reason for the halt. Within a few hours, the platform resumed its withdrawal services, but only to suspend them again later in the day.

Binance’s CEO, Changpeng Zhao, took to Twitter to address the situation, explaining that the suspensions were necessary to address the congestion and ensure the smooth functioning of the platform. He assured users that their funds were safe and that the situation would be resolved as quickly as possible.

The suspension of Bitcoin withdrawals on Binance has raised concerns among users and the wider cryptocurrency community, with some speculating about the possibility of a security breach or other issues. However, no evidence has been found to support these claims, and Binance has maintained that the issue is purely related to network congestion.

In the past, Binance has experienced similar issues with other cryptocurrencies, such as Ethereum, due to increased trading volumes and congestion on the networks. The exchange has always managed to resolve these issues swiftly, and it is expected that the current situation with Bitcoin withdrawals will be no different.

While the temporary suspension of Bitcoin withdrawals on Binance may cause inconvenience for some users, the platform’s commitment to addressing the issue and ensuring the safety of its users’ funds has been appreciated by the community.

Bitcoin’s price has reached a new high for May, surpassing $29,500, as traders keep a close eye on the potential for a breakout. The leading cryptocurrency has been experiencing significant fluctuations in recent weeks, with both gains and losses seen in the market.

The recent upswing in Bitcoin’s price has been attributed to a combination of factors, including positive market sentiment, increased institutional adoption, and the growing mainstream acceptance of cryptocurrencies. Furthermore, the ongoing discussions around the potential for inflation have led some investors to view Bitcoin as a hedge against inflationary pressures.

As Bitcoin’s price continues its upward trajectory, traders are closely monitoring the market for signs of a breakout, which could potentially push the cryptocurrency to new heights. Some analysts believe that if Bitcoin can maintain its momentum and surpass key resistance levels, it could open the door for substantial gains in the near future.

However, market participants should remain cautious, as the cryptocurrency space is notoriously volatile and can be subject to rapid price fluctuations. While some traders are optimistic about Bitcoin’s prospects, others warn of potential risks and uncertainties that could impact its trajectory.

The recent surge in Bitcoin’s price highlights the growing interest in cryptocurrencies, as well as their potential to play a significant role in the global financial landscape. As traders and investors continue to monitor Bitcoin’s performance, its future trajectory will likely be shaped by ongoing developments in the cryptocurrency ecosystem, regulatory changes, and broader market trends.

A blockchain security firm recently intervened to freeze $160,000 in assets stolen during a rug pull event involving the Merlin DEX platform. The security company’s prompt action demonstrates the effectiveness of countermeasures against malicious activities in the decentralized finance (DeFi) space.

Merlin DEX, a decentralized exchange, fell victim to a rug pull, a type of scam where project founders or developers withdraw liquidity from a project, leaving investors with worthless tokens. In this incident, bad actors were able to make away with a significant amount of funds before the security firm intervened.

Upon detecting the suspicious activity, the blockchain security company swiftly moved to freeze the stolen assets, effectively preventing the scammers from further accessing or moving the funds. This decisive action underscores the importance of robust security measures in safeguarding investments and maintaining trust within the DeFi ecosystem.

While the DeFi space continues to experience rapid growth and attract new investors, it is also increasingly targeted by scammers and other bad actors. This incident serves as a reminder of the risks associated with decentralized finance and the critical role that security firms play in protecting the industry from fraudulent activities.

As the DeFi landscape evolves, the collaboration between projects, investors, and security firms will be essential to minimize threats and ensure the long-term success of the decentralized finance ecosystem.

Coinbase, one of the leading cryptocurrency exchanges, has decided to halt the issuance of new Bitcoin-backed loans via its Borrow service. The exchange made this announcement on its website, but assured customers that existing loans would remain unaffected and continue as per their terms.

The Borrow service, launched by Coinbase in 2020, allowed qualified customers to borrow cash against their Bitcoin holdings. This move to discontinue new loans comes amidst increasing regulatory scrutiny of cryptocurrency lending services and related products. However, the specific reasons for the suspension of new loans have not been provided by the company.

Existing loans will continue to be serviced by Coinbase, with customers required to meet their repayment obligations as stipulated in the loan agreements. The company has emphasized that this change will not impact the other services offered on their platform.

While the decision to cease issuing new Bitcoin-backed loans marks a significant change for Coinbase, the company remains focused on expanding its offerings to cater to the evolving demands of the cryptocurrency market. As the regulatory environment evolves, it is expected that exchanges like Coinbase will continue adapting their services to maintain compliance and support the growth of the crypto ecosystem.

Kraken, one of the largest crypto exchanges in the world, is set to imminently lay off an additional 400 employees, sources told Crypto Intelligence News on Tuesday.

They warned that further job cuts could be on the horizon, as Kraken “still has employees that are surplus to requirements.”

The US-based crypto exchange didn’t respond to a request for comment by Crypto Intelligence News.

The planned job cuts will come amid the crypto market partially recovering, with Bitcoin rallying by around 21 percent in the last three months, according to CoinMarketCap data.

Ethereum, the world’s second-largest cryptocurrency, has seen its price increase by around 14.3 percent over the same period, trading at around $1,871 on 2 May.

In November, Kraken announced that it would be laying off 1,100 employees, which at the time accounted for around 30 percent of its total workforce.

CEO Jesse Powell explained in a blog post that the cuts were necessary to realign the company’s headcount with demand, which had taken a significant hit due to crypto prices tanking.

“We had to grow fast, more than tripling our workforce in order to provide those clients with the quality and service they expect of us,” Powell said.

“This reduction takes our team size back to where it was only 12 months ago.

“I remain extremely bullish on crypto and Kraken,” he added.

And in early February, Kraken announced more lay-offs, with it shuttering its Abu Dhabi office and consequently axing eight employees in the UAE capital.

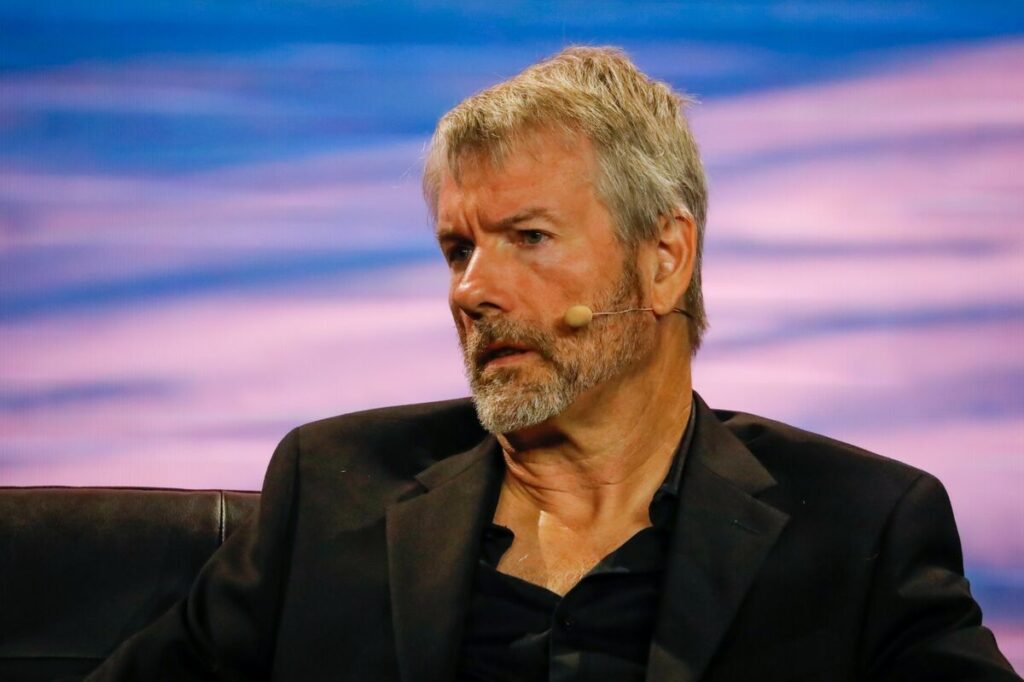

MicroStrategy, the business intelligence software company, continues to display unwavering confidence in Bitcoin as it posts a return to profitability in the first quarter of 2023. The firm’s CEO, Michael Saylor, shared the positive financial results while emphasizing the company’s ongoing dedication to the leading cryptocurrency.

The enterprise software provider has turned a corner from previous financial difficulties, reporting a profit in Q1 2023. This turnaround can be partially attributed to MicroStrategy’s substantial investments in Bitcoin, which have paid off significantly.

In a recent interview, Saylor emphasized that the company’s conviction in Bitcoin is stronger than ever, with no plans to relinquish its position as a primary institutional investor in the digital asset. The CEO also highlighted Bitcoin’s potential as a store of value, stating that it surpasses traditional assets like gold.

Since its initial investment in August 2020, MicroStrategy has consistently increased its Bitcoin holdings, currently owning over 124,946 BTC. This unwavering support has positioned the company as one of the most significant institutional investors in the cryptocurrency space.

MicroStrategy’s commitment to Bitcoin has also influenced other major companies to consider the digital asset as part of their investment strategy. Saylor’s advocacy for Bitcoin’s adoption has encouraged businesses to reevaluate their approach to the evolving world of digital currencies.

In summary, MicroStrategy’s return to profitability in Q1 2023 is a testament to the company’s steadfast belief in Bitcoin’s potential. As one of the foremost institutional investors in the cryptocurrency, the firm’s success serves as a prime example for other businesses considering digital asset investment.

The Federal Deposit Insurance Corporation (FDIC) has cited inadequate governance and a lack of liquidity as the primary reasons behind the failure of Signature Bank.

The FDIC, responsible for maintaining stability and public confidence in the U.S. financial system, has revealed its analysis of the bank’s collapse in a recent report.

According to the FDIC, the downfall of Signature Bank can be traced back to its insufficient internal controls and lack of oversight, which allowed for unsound lending practices to take place. This, in turn, led to the bank’s inability to meet its financial obligations and maintain adequate liquidity levels.

Signature Bank had made considerable investments in the volatile and unpredictable digital asset market, which played a significant role in the erosion of its capital base.

The FDIC’s findings shed light on the importance of sound governance and risk management for financial institutions, especially in the face of new and emerging technologies.

The collapse of Signature Bank serves as a cautionary tale for other banks looking to explore the cryptocurrency space and underlines the need for robust regulatory frameworks to protect consumers and maintain the stability of the financial system.

A former chief financial officer (CFO) has been sentenced to three years in prison for embezzling $5 million from his employer to trade cryptocurrencies and meme stocks. The individual, who has not been named, was convicted of wire fraud and money laundering.

The ex-CFO had stolen the funds from his employer, a technology company, over a two-year period. He used the money to engage in high-risk trading of cryptocurrencies and meme stocks, investments that gained popularity during the pandemic.

The individual’s actions were discovered when the technology company’s management began to notice financial discrepancies in their records. An internal investigation was conducted, revealing the extent of the embezzlement. Subsequently, the case was handed over to law enforcement authorities.

The ex-CFO pleaded guilty to the charges and was sentenced to 36 months in prison, followed by three years of supervised release. Additionally, he has been ordered to pay back the stolen funds in full, amounting to $5 million in restitution.

This case highlights the potential risks and consequences associated with engaging in high-risk investments using embezzled funds. It serves as a warning to others who may be tempted to engage in similar activities, emphasizing the importance of adhering to legal and ethical practices in the financial industry.

The rise of meme stocks and cryptocurrencies has led to increased scrutiny from regulators, as they seek to ensure the stability and integrity of the financial markets. As technology and investment trends continue to evolve, it is crucial that both investors and professionals maintain a strong understanding of the legal and ethical guidelines governing their activities.

Celsius Network, a prominent cryptocurrency lending platform, is facing demands for transparency from its creditors regarding a series of suspicious transactions on FTX, a leading crypto exchange. The creditors are seeking clarity on the nature of these transactions, which could potentially impact their investments.

Several large transfers of CEL tokens, Celsius Network’s native cryptocurrency, have been observed on FTX. These transfers have raised concerns among creditors, who believe that the transactions could indicate potential financial issues or mismanagement within the company. As a result, they are demanding that Celsius Network provide an explanation for the activity.

Celsius Network has yet to issue an official statement addressing the concerns of its creditors. However, the company has a strong track record of maintaining transparency and has previously published comprehensive financial reports for public review. This history suggests that Celsius may respond to the creditors’ demands in due course.

The situation highlights the growing importance of transparency within the cryptocurrency industry, particularly as digital assets become more mainstream and attract increased scrutiny from regulators and investors. Companies operating in the space must strike a balance between protecting sensitive business information and providing sufficient transparency to maintain the trust of their user base.

The outcome of this dispute could have broader implications for the cryptocurrency lending industry. It underscores the need for robust disclosure practices to ensure that all parties involved in digital asset transactions have access to the information they need to make informed decisions.