London, United Kingdom, February 5th, 2024, Chainwire

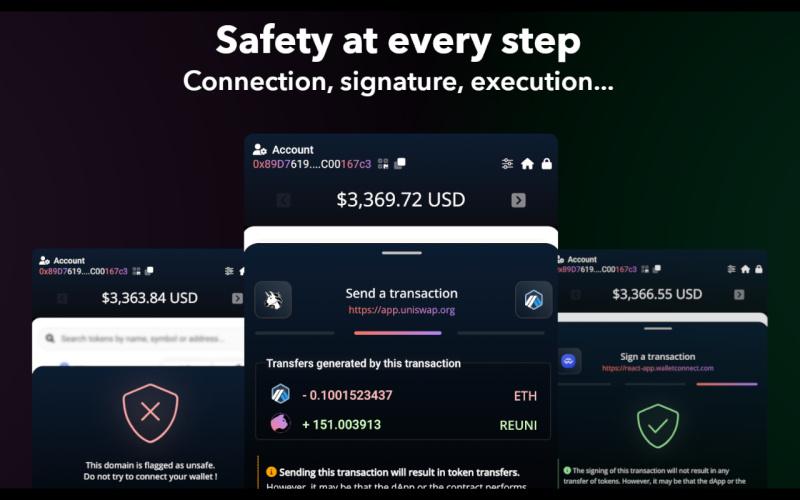

Reunit Wallet, an omnichain wallet built on technology developed by LayerZero & Stargate Finance, is launching a volume-based reward program.

In an effort to stimulate trading activity on its integrated platform and attract new users, Reunit Wallet is implementing a reward system for traders.

Starting now, for every $100 in generated volume, users will receive 1 REUNI. Additionally, if a referral code is used, a 25% bonus will be applied.

Users who share their referral code will also enjoy a 25% bonus on the rewards generated by the traders they’ve referred.

Users who share their referral code will also enjoy a 25% bonus on the rewards generated by the traders they’ve referred.

Furthermore, Reunit Wallet has plans to soon introduce a staking feature for REUNI tokens. Participants in the staking program will receive 50% of the fees generated from transactions made through Reunit Wallet.

Useful links

- Website : https://everywhere.finance

- Twitter / X : https://twitter.com/EverywhereFi

About Reunit Wallet :

Created by a former core-team member of Sushiswap (2020-2022), Reunit Wallet is the first natively omnichain wallet that enables seamless batch transfers across multiple blockchains with a single click. It also offers an integrated trading terminal supporting limit and market orders, providing a comprehensive and seamless trading experience.

Security is a paramount priority for Reunit Wallet, which is why the wallet conducts a comprehensive simulation of each transaction and signature, allowing the user to anticipate the outcomes of their transaction, including token transfer confirmations or the granting of necessary permissions.

Contact

CEO

B.Naïm

contact@everywhere.finance

Grand Cayman, Cayman Islands, February 5th, 2024, Chainwire

After Sui’s TVL surged more than 1500% over the last five months of 2023, its TVL has more than doubled since the start of 2024

Sui, one of the fastest-growing Layer 1 blockchains, continued its impressive DeFi growth, surpassing $500M in Total Value Locked (TVL) and solidifying itself in the top 10 of DeFi ecosystems.

Alongside this torrid ascent of TVL, on-chain activity has exploded as well. Weekly DeFi volume is up 63 percent over the previous period, standing at $745M and placing it in the top 5 most active ecosystems in the past week. Sui’s continued climb demonstrates how its underlying technology is vital in empowering developers to create products that solve real-world challenges and the drive behind top projects expanding into its ecosystem.

Over the past couple of weeks, Sui has announced several partnerships and expansions with industry-leading builders. Most recently, Sui announced that Ondo Finance—the third-largest organization in the real-world asset DeFi sector—is bringing its treasury-backed tokens, tokenized securities, and real-world assets into its ecosystem, as the Sui ecosystem is set to get its first native stablecoin.

Sui also recently announced that Banxa, a leading payments infrastructure provider for the crypto-compatible economy, will add the SUI token to its platform. Also recently announced, a partnership with Oracle Stork provides builders with faster pricing data, offering real-time pricing data across Sui’s ecosystem of developers, DEXs, and lending protocols building on Sui’s blockchain.

“The fact that Sui now stands amongst the top ecosystems in crypto is a testament to Sui’s technology being able to attract top-tier developers and leading projects,” said Greg Siourounis, Managing Director of the Sui Foundation. “The recent partnership and expansion announcements, along with the surging metrics, point to Sui having true staying power. Sui is paving the way for widespread adoption and offers endless possibilities for innovation.”

Sui’s object-centric model, horizontal scalability, and Move Language position it to host the most scalable solutions that have emerged from the blockchain industry to date. Its rapidly rising TVL results from multiple Sui-based protocols and applications leveraging Sui’s strengths.

Sui also saw two ecosystem protocols break $100M TVL for the first time in the network’s history. Navi Protocol now stands at over $114M TVL (up 184% over the last 30 days), while Scallop Lend has surged to over $116M TVL (up 258% over the last 30 days). Cetus ($72M), Aftermath Finance ($58M), and FlowX Finance ($49M) round out the top five projects as measured by TVL.

Contact

Sui Foundation

media@sui.io

Hanoi, Vietnam, January 31st, 2024, Chainwire

Heroes of Mavia, a groundbreaking Web3 AAA mobile base builder strategy game, is now available on iOS and Android app stores. This launch marks a new era in gaming, merging the thrill of strategy gameplay with the innovative aspects of Web3 technology.

After a successful private beta period of three months, which attracted over 350,000 waitlisted enthusiasts and showcased impressive engagement statistics such as 12k daily and 45k monthly active users, Heroes of Mavia is set to captivate the global gaming community. The game boasts a daily average playtime of 24 minutes and a remarkable 42% day 7 retention rate, indicating its compelling gameplay and engaging content.

Coinciding with this eagerly awaited launch, Heroes of Mavia introduces the “Mavia Pioneer Airdrop Program – Turbocharged.” This unique program offers early adopters, who download the game before the $MAVIA token launch on February 6th, an opportunity to participate in the $MAVIA airdrop, thereby immersing them in the world of Web3 gaming rewards.

The Heroes of Mavia community has experienced rapid growth, with its Twitter and Discord channels gaining 45,000 new followers and members in just two weeks, highlighting the game’s burgeoning popularity.

Heroes of Mavia is committed to bridging the gap between traditional gaming (Web2) and the new era of Web3 gaming. Each player is equipped with an in-built on-chain non-custodial wallet, facilitating the minting, purchasing, and trading of unique in-game items (NFTs). This feature not only enhances the gaming experience but also opens doors to the dynamic world of Web3.

The game’s recent partnership with Kick.com solidifies Heroes of Mavia’s position in the Web2 streaming world, broadening its appeal and influence within the gaming community.

Distinctively, Heroes of Mavia’s innovative Web3 model is built for sustainable growth, steering clear of the hyperinflation issues common in many play-to-earn projects. This approach promises a balanced and enriching experience for all players, whether they are long-time Web3 enthusiasts or new entrants to this exciting domain.

About Heroes of Mavia

Heroes of Mavia is a AAA mobile Web3 strategy game available on iOS and Android app stores globally. The game is backed by prominent investors such as Binance Labs, Genblock Capital, Delphi Digital, Mechanism Capital, Bitkraft, Animoca Brands among others. The native Heroes of Mavia tokens $MAVIA is set to launch on February 6th 2024.

To download Heroes of Mavia please visit: https://www.mavia.com/

Follow Heroes of Mavia

Contact

Nania Tran

Nania@mavia.com

Cayman Islands, Cayman Islands, January 31st, 2024, Chainwire

The QRDO Foundation, dedicated to the growth and development of the QRDO ecosystem, has announced a strategic partnership with EQ LAB, a leading blockchain developer lab, to launch the Warden Protocol. This initiative accelerates the upcoming launch of the Warden Protocol, an intent-based interoperability protocol built on Cosmos and based on the Fusionchain primitive.

Introducing the Warden Protocol

The Warden Protocol is a modular intent-centric blockchain built on the Cosmos-SDK. At its most basic level, it enables users to create Spaces and Wallets on various blockchains and govern their activity through on-chain intents. Complex multi-leg transactions can be built, and cross-chain activity protected via complex intents, all enforced on-chain by the Warden Protocol.

For the builders in the space, Warden enables smart contracts to be deployed on Cosmos using Solidity and WebAssembly, and facilitates a modular marketplace of key management solutions, from HSM solutions to multi-party computation providers.

“The Warden Protocol is the next evolution in intent and interoperability primitives,” said a representative for the QRDO Foundation, “joining forces with the EQ LAB team enables us to achieve this ambitious vision and ensures that QRDO token holders see the realization of a truly decentralized and open, intent-centric interoperability and key management protocol.”

Various applications have pledged their support to deploy on Warden, including:

- EQ.finance, a liquid staking hub for Cosmos that puts existing liquid staking tokens to work;

- WARDD, a USD-pegged decentralized stablecoin that provides Warden users with instant access to dollar liquidity;

- Marginly, a pluggable protocol for decentralized funding pools that enable margin trading on any spot DEX; and

- SpaceWard, a SAFE-like platform for wallet management and governance.

EQ LAB will form the core contributor team to the Warden Protocol and will bring an extensive team of 15 core developers to the Warden Protocol.

“We are very pleased to be helping to establish the Warden Protocol as Core Contributors”, said Alex Melikhov, founder of EQ LAB, “as an experienced team of qualified blockchain developers, we see a bright future in the Cosmos ecosystem, and we look forward to seeing incredible value unlocked for both the existing QRDO and Q token holder communities”.

WARD Token

The Warden Protocol plans to introduce the WARD token via a fair launch mechanism. This launch will take place without any pre-mine or investor allocations, with eligibility for both an airdrop and an incentivised WARD-swap extending first to existing QRDO holders. As a nod to the public goods done by various other Cosmos chains, TIA and ATOM stakers will also be eligible, as well as builders and users from other complimentary protocols and chains. Further details will be announced shortly.

The Alfama testnet will go live in the coming weeks, with details for an incentivised testnet to be published shortly.

Contact Information

Warden Protocol

Warden Protocol is a new modular intent-based blockchain based on CosmosSDK that allows users and builders to explore and build cross-chain securely.

About EQ LAB

EQ LAB is an experienced software engineering house specializing in permissionless applications and protocols, acting as a technology partner in a plethora of projects on Cosmos, Ethereum, Arbitrum, Polkadot, and other blockchain platforms.

About QRDO Foundation

QRDO Foundation has been established to focus on accelerating the adoption of open custody, security and interoperability protocols and nurture the value of the QRDO ecosystem.

Contact

PR Team

QRDO Foundation

pr@qrdo.org

New York City, United States, January 30th, 2024, Chainwire

Developers can receive up to $50,000 USDC per project, plus dedicated tech support, introduction to accelerators and investors, marketing support and project consulting.

Cartesi (CTSI), an app-specific rollup protocol with a virtual machine that runs Linux distributions, announced today an allocation for $1 million to the Cartesi Grants Program. The program is dedicated to fostering developer talent and enriching the Cartesi ecosystem by supporting new ideas & dApps, research & integrations, developer tooling and gaming. Independent developers, founding teams, DAOs, communities and collectives can apply starting today, Tuesday, January 30th and have the opportunity to receive up to $50,000 USDC per project, subject to community vote. Through this grants program, Cartesi aims to increase the number of long-term contributors and developers building novel applications on Cartesi.

Areas of focus:

- New ideas & dApps: Applications and experiments built using the Cartesi framework that offers value to the broader ecosystem. Currently, Cartesi is supporting Complex Vouchers, an advanced voucher system for external interactions.

- Research & Integrations: Split into two tracks, Track 1 focuses on research and solutions that integrate Cartesi technology with other innovative technologies. For example, Cartenix uses the Cartesi VM and Nix Package system to leverage reproducible builds in a deterministic and verifiable environment. Having this on-chain provides a much higher level of security and trustlessness for developers.

- Track 2 is dedicated to in-depth research on topics identified as crucial for the advancement of the Cartesi ecosystem. For example, open-source research associated with RISC-V, ZK, and Cartesi.

- Developer tooling: Tools that simplify and enhance the experience for developers building on Cartesi. For example, Drand is a component of a larger set of tools for generating random numbers on Cartesi’s convenience layer. The goal is to create a framework for Cartesi that will make it easy for web3 developers to create dApps using Cartesi.

- Gaming: Games that uniquely leverage the capabilities of Cartesi, such as open-source games that can be reused and built upon, game frameworks, convenience layers, and other infrastructure contributions. Currently under development is Dazzle, a competitive online puzzle RPG that leverages Cartesi Rollups and the Cartesi Machine for high-stake, e-sport-like tournaments.

“This grants program is designed to foster long-term collaboration within the Cartesi ecosystem and increase the convenience and scalability of dApp development for both developers and users,” said Hellenstans.eth, Grants Steward in the Cartesi ecosystem. “The grants program offers financial support and invaluable technical guidance to kickstart any developer’s project.”

Cartesi’s first dApp, Honeypot, launched on the Ethereum mainnet this past summer. This dApp is designed to encourage developers to challenge the security of Cartesi Rollups. The Honeypot fund constantly increases by a compounded 8% weekly and is currently unbroken, holding 139,861 CTSI.

The Cartesi Foundation has committed $1,000,000 in total to the first two waves of the Cartesi Grants Program. During Wave 1, the Grants Program will allocate a maximum of $500,000 USDC, with a further $500,000 USDC available for allocation during Wave 2.

The Cartesi Grants Program’s goal for Wave 1 is to significantly ramp up in speed and scale in future rounds of grant funding by gathering feedback on the grant process and lowering friction for proposers looking to apply for grants. To review the list of projects approved for funding during the pilot, visit governance.cartesi.io. To find out more and apply, please visit the Cartesi Grants Program page on Charmverse.

About Cartesi Foundation

The Cartesi Foundation is a mission-bound organization dedicated to supporting the Cartesi technology and the decentralization of the Cartesi ecosystem. The Foundation’s mission is to be a supporting member of the Cartesi community, through fundings, education programs, grants, strategic alliances, and other focused activities. The Foundation is committed to supporting the development of the Cartesi ecosystem; bringing mainstream scalability and convenience to dApp developers and users. To learn more about Cartesi, visit https://cartesi.io/.

About Cartesi

Cartesi is an app-specific rollup protocol with a virtual machine that runs Linux distributions, creating a richer and broader design space for dApp developers. Cartesi Rollups offer a modular scaling solution, deployable as L2, L3, or sovereign rollups, while maintaining strong base layer security guarantees. To learn more about Cartesi, visit https://cartesi.io/.

Contact

PR Manager

Lauren Bukoskey

Serotonin

lauren@serotonin.co

Sherman Oaks, United States, January 30th, 2024, Chainwire

Shurick Agapitov, a visionary author and the Founder of Xsolla unveiled his groundbreaking new book, “Once Upon Tomorrow,” today. This pioneering work offers a transformative and aspirational vision of the Metaverse, contrasting markedly with mainstream narratives. Agapitov’s book is a thought-provoking journey into the possibilities and potential of the Metaverse, providing a unique perspective diverging from the views often presented at industry conferences and by technology CEOs.

“In ‘Once Upon Tomorrow,’ I present a vision of the Metaverse as a vast, inclusive, and transformative space. It’s not just a digital frontier but a realm where creativity, innovation, and empowerment converge. This book is my invitation to creators, thinkers, and dreamers across the globe to join in shaping a future where technology amplifies human potential and fosters a world of limitless possibilities. The Metaverse, as I see it, is not about control or confinement but about unleashing the collective creativity and entrepreneurial spirit inherent in all of us,” said Shurick Agapitov, Founder of Xsolla and acclaimed author of “Once Upon Tomorrow.”

Once Upon Tomorrow” delves into the untapped potential of the Metaverse, highlighting its capacity to unite emerging and legacy brands, create unforgettable consumer experiences, and enrich cultures globally. Agapitov emphasizes the Metaverse’s role in democratizing opportunities and equal access to cutting-edge technologies. His vision extends beyond mere technological innovation, underscoring the Metaverse’s potential to empower and reward content creators across the globe. The book also highlights the significant impact of the Metaverse on education, offering hope and opportunities for both children and adults worldwide. Agapitov advocates for a decentralized Metaverse moving away from Silicon Valley’s dominance, placing control, profit potential, and freedom in the hands of creative communities.

“Once Upon Tomorrow” is more than just a book about the Metaverse; it’s a roadmap to a future where technology serves humanity in all its diversity, fostering financial, social, and creative inclusivity. Agapitov envisions a future where every consumer-facing industry, from fashion to healthcare and entertainment, is transformed. The book also explores the potential impact of the Metaverse on business-to-business sectors, education, city planning, inter-government relations, and non-profit efforts.

Agapitov’s insight into the evolution of technology, from the early days of Instagram and Snapchat to the future of immersive applications, is a key highlight of the book. He discusses the roles of various technology stakeholders, including internet hosting providers, website developers, cloud computing experts, infrastructure engineers, and the ongoing need for advanced networking and hardware. “Once Upon Tomorrow” is a visionary piece that invites readers to rethink the Metaverse and its limitless potential.

For additional information and to purchase please visit: onceupontomorrow.com

About Shurick Agapitov

As the founder of Xsolla, Inc., Shurick Agapitov is a highly respected innovator and advisor in gaming, Web3, Metaverse, and fintech. His trailblazing video game company integrates blockchain technology, providing developers with advanced tools and services for more effective game operations and sales. With a global presence, including offices in Los Angeles, Berlin, and Seoul, Xsolla, under Shurick’s leadership, is shaping the future of gaming and the Metaverse, fostering a more decentralized and inclusive industry.

For additional information about Shurick Agapitov please visit: themarque.com or LinkedIn.com

Contact

Director

Derrick Stembridge

Xsolla

d.stembridge@xsolla.com

919-971-7855

As digital assets continue to reshape the financial landscape, 2024 promises to be a year full of innovation and opportunity in the dynamic world of cryptocurrencies. The crypto market captivates investors with the appeal of a decentralized economy, encompassing established cryptocurrencies like Bitcoin and developing altcoins. This article focuses on the technological breakthroughs, market performance, and real-world adoption of the top 10 crypto projects. It guides both experienced enthusiasts and curious novices in spotting a good crypto project in 2024.

When considering investments in the crypto market, it is clear that criteria such as market capitalization, trading volume, liquidity, use cases, tokenomics, development teams, community support, security, transparency, and performance play pivotal roles in determining the viability and potential of investments. Through studying past experiences, such as market changes and regulatory scrutiny, we have the necessary information and insight to identify good crypto projects.

Standout Crypto Projects of 2024

SmarDex

SmarDex (SDEX-USD) is a forward-thinking decentralized exchange (DEX) renowned for its focus on maximizing capital efficiency and generating substantial yields. The platform aims to surpass industry leaders like Uniswap by offering the most cost-effective token swaps in the crypto market through innovative impermanent loss reduction techniques and an open-source framework.

In the upcoming months, SmarDex will introduce a game-changing addition to its ecosystem: the USDN stablecoin. This forthcoming launch can potentially disrupt the stablecoin space significantly, propelling SmarDex toward its goal of becoming a fully decentralized DeFi ecosystem. With an intuitive interface and automated yield aggregation, SmarDex can attract substantial liquidity as market conditions evolve. Additionally, with a current market cap of $96 million, SmarDex presents significant growth opportunities as it garners attention from yield-focused DeFi enthusiasts.

HollaEx®

HollaEx®, renowned as a leading white-label exchange, stands as a beacon of unwavering dedication to blockchain software, boasting one of the lengthiest development track records from late 2016. Setting itself apart with a transparent and verifiable development track record on GitHub, this crypto software epitomizes resilience and reliability, unmatched by its peers in the white-label sphere.

The exchange empowers users to create tailored digital asset platforms that cater to diverse business needs swiftly, securely, and efficiently. Its pioneering approach to coin listing, tokenization, and strategic partnerships, including collaborations with industry giants like Amazon’s AWS, DigitalOcean, Banxa, and Intercom, firmly cements HollaEx® as the foremost choice for pioneers venturing into the cryptocurrency arena.

ICONOMI

ICONOMI is a pioneering company registered with the Financial Conduct Authority (FCA). This innovative platform bridges the gap between beginners and seasoned traders, offering an opportunity to replicate trades while gaining knowledge through the communication portal or building your cryptocurrency portfolio.

The company challenges traditional investment frameworks, aiming to elevate cryptocurrency investing to the forefront of mainstream financial markets. ICONOMI offers seamless access to multiple cryptocurrency exchanges, simplifying your investment journey. Whether you’re looking to easily manage your crypto assets or emulate the strategies of proficient traders, ICONOMI is your solution for a hassle-free investment experience.

SOURCE

SOURCE Network empowers users and developers across the globe with a fast, scaleable, and advanced Web3 platform allowing onboarding of traditional fiat into using and spending crypto with ease. SOURCE Pay and all the proprietary on-chain Dapps are being developed for the coming mass adoption of blockchain and Web3 technology.

Built on cutting-edge blockchain technology, SOURCE ensures enterprise integration and expansion, making Web3 fully accessible without requiring crypto expertise. Users, content creators, developers, and individuals worldwide stand to benefit from the robust decentralized Web3 platform. The SOURCE ecosystem promises tremendous value, including enterprise business integration into Web3 and crypto, an expansive metaverse and virtual gaming ecosystem with SOURCEWorld.io, interoperable networks, tokenization, DeFi accessibility, and the dynamic utility of the $SOURCE native network token.

Ringfence

Ringfence stands as the pioneering platform in the realm of generative artificial intelligence (AI), ensuring equitable compensation for creators whose original works (photos, images, videos, documents, and music) are utilized within AI-generated content (AIGC). Numerous creators face the unfortunate reality of lost or foregone revenue in light of the ongoing struggle among international governing bodies to effectively apply intellectual property (IP) laws to generative AI. Ringfence addresses this critical issue by providing a comprehensive solution.

For creators seeking to monetize their content, Ringfence offers a streamlined process to verify ownership and grant authorization for AI utilization of their files to create new AIGC. Furthermore, Ringfence facilitates the minting of AIGC on any Ethereum Virtual Machine (EVM)-compatible blockchain using LayerZero’s OFT standard, enabling seamless transfer of fungible tokens across multiple blockchains without necessitating asset wrapping, middlechains, or liquidity pools.

BestChange

BestChange, a cryptocurrency exchange leader with a 17-year legacy, revolutionizes Bitcoin transactions. With a steadfast commitment to security and simplicity, BestChange offers a curated directory of over 250 trusted exchangers, facilitating safe and seamless cryptocurrency exchanges such as BTC, BCH, LTC, and USDT.

The platform’s intuitive user interface caters to newcomers and experienced traders, streamlining currency conversions easily. Through features like customer reviews, exchange statistics, notifications, and a visual Currency Converter, BestChange empowers users with the knowledge and tools needed to make informed decisions in their crypto transactions. As a pioneer in secure and user-centric exchange platforms, BestChange has set the standard for excellence in the industry for over 16 years.

Flux

Flux is a pioneering force in the realm of Web3 projects in 2024, spearheading a transformative shift in cloud computing. At the forefront of this revolution is Flux Cloud, designed with a paramount focus on scalability, offering a cost-efficient alternative to industry behemoths like Google Cloud and AWS.

Leveraging blockchain technology, Flux not only decentralizes cloud infrastructure and storage but also ensures an unparalleled level of seamlessness and security for users. This groundbreaking approach is poised to challenge the status quo of traditional cloud computing leaders, positioning Flux as a standout contender to watch closely in the unfolding landscape of 2024’s technological advancements.

Streamr

Streamr is pioneering the development of the real-time data protocol for the decentralized web. They focus on creating a scalable, low-latency, and secure peer-to-peer network for efficient data delivery and exchange. As part of their vision, they are constructing The Streamr Hub, a decentralized chat application, and other decentralized applications (dApps) to support DePin projects and global tech stack decentralization efforts.

Founded by experts in real-time data with backgrounds in algorithmic trading and finance markets, Streamr combines technical proficiency with industry knowledge to drive the evolution of decentralized ecosystems. Their commitment to innovation and decentralization positions them as a leading force in reshaping the future of data transmission and decentralized technologies.

BRN Metaverse

BRN Metaverse is a project that aims to connect the metaverse with the real world using technology and a token-based ecosystem. It utilizes concepts such as AI, GameFi, GameNFT, and Web 3.0, offering innovations in these fields. BRN Metaverse offers non-fungible tokens (NFTs) such as in-game inventories, virtual economies, and play-to-earn mechanics in gaming.

BRN Metaverse also provides virtual economies where the value of in-game assets is determined by player demand, rarity, and utility. The project has its own NFT marketplace that offers an easy-to-use, fast, and cost-effective solution for creators and collectors to engage with the growing NFT ecosystem. The project believes that Metaverse has the potential to revolutionize the way we interact with each other and with technology, and it is positioned to become a leading player in the NFT marketplace.

Dracarys

Dracarys Token marks the conclusion of the era dominated by dogs and frogs within the cryptocurrency domain. Embracing the fiery essence of Dracarys, the platform embarks on a fresh journey characterized by passion and humor. Driven by a profound belief in the compelling influence of memes to engage, inspire, and unify the crypto community, the team at Dracarys Token endeavors to redefine cryptocurrency investments with their aptly named token.

Dracarys aims to inject enthusiasm and fun into the landscape of digital asset investments, signifying a pivotal shift in the realm of meme tokens where traditional contenders yield a new reign. Absent of taxes and profit motives, Dracarys derives its strength solely from its investors, eagerly anticipating the one who will stoke its flames and fortify its blaze. This is evident by its recent 19 trillion token burn, out of 20 trillion.

Bottom Line

The crypto scene in 2024 represents the coming together of advanced technology, active market conditions, and careful examination by investors. This is forging a future where digital assets play a vital role in a decentralized economy. After examining these prominent projects, considering lessons from track records, and conducting a comprehensive analysis of aspects that affect investment feasibility, we fully acknowledge the revolutionary capabilities of blockchain technology.

The pursuit of fully harnessing the capabilities of cryptocurrencies is still ongoing, prompting stakeholders to navigate towards a more robust and fair financial landscape by identifying genuine and leading crypto projects.

San Francisco, Puerto Rico, January 29th, 2024, Chainwire

The tea Protocol has announced the launch of its highly anticipated Incentivized Testnet on February 21st, 2024. The tea Protocol seamlessly bridges Web2 open-source codebases to Web3 to enhance their sustainability and provide fair rewards to open-source developers. Additionally, tea provides developers access to its incentivized community of vulnerability reporters and is cross-compatible with major package managers including Homebrew, npm, APT, Crate, PyPI, RubyGems, and pkgx.

Beginning February 21st, 2024, any open-source developer can interact with The tea Protocol and begin earning rewards for their contributions. All community members, including non-developers, will also be encouraged to access The tea Protocol via a series of incentivized activities on the blockchain.

This critical step towards the launch of the tea Protocol will allow all participants to immerse themselves into the fully composable open-source ecosystem created by the tea Protocol.

The Incentivized Testnet: A Stepping Stone to Mainnet Success

The upcoming Incentivized Testnet marks a significant step in the tea Protocol’s journey toward launching a robust Mainnet on the Base blockchain. This Testnet phase is crucial for ensuring a thriving, efficient, and secure network for all participants.

Five Key Features of the Incentivized Testnet to Explore on tea.xyz

- Waitlist Availability: The waitlist for the incentivized testnet, launching on February 21st, offers a limited opportunity for interested users.

- Insight into $TEA Tokenomics: The economic model driving the protocol is detailed, offering clarity and depth of understanding.

- Comprehensive Documentation Access: Extensive resources are available, providing a thorough understanding of the protocol.

- Insight into teaRank for Projects: Projects can ascertain their position within the open-source ecosystem and understand their eligibility for rewards.

- tea Points Accumulation: The ITN presents opportunities for both developers and non-developers to engage in challenges and quests, facilitating the accumulation of tea points.

Joining the Incentivized Testnet and exploring tea.xyz offers an opportunity to be part of a pioneering movement in open-source software. It’s a chance to engage with a forward-thinking community, understand tea’s tokenomics, and utilize the teaRank system for project visibility and rewards.

A Message from Max Howell, tea’s Visionary Founder

Max Howell, the creator of Homebrew and the driving force behind tea, expresses his enthusiasm: “The launch of the incentivized testnet for the tea Protocol is a landmark achievement for open-source developers and advocates worldwide. With the incentivized testnet, tea is not only introducing a technological marvel but also reinforcing its commitment to revitalizing the open-source community.”

About tea

tea is a trailblazing web3 protocol built on Base, the layer-2 blockchain from Coinbase. It is designed to empower open-source software developers to capture the value they create. At the heart of the tea Protocol is the Proof of Contribution algorithm, which measures the value, position, and impact of open-source software projects. Proof of Contribution assigns a dynamic “teaRank” to each project which is used by the protocol to distribute rewards. Proof of Contribution ensures that every layer of a software project, especially foundational elements, is recognized and rewarded for its contribution and promotes healthy competition amongst projects to continually improve their codebase and usage by other projects within the ecosystem.

The communi’tea invites users to explore the forefront of open-source software through its platform. Detailed information is accessible at www.tea.xyz to learn more and connect with tea on Twitter, teaForum, Discord, and Telegram for the latest updates and discussions.

Contact

Head of Marketing

Dan Mulligan

tea

dan@pkgx.dev

GRAND CAYMAN, Cayman Islands, January 29th, 2024, Chainwire

Users will benefit from 0% gateway fees for accessing SUI tokens on Banxa for a limited time.*

(*Fee waiver is not available for UK customers)

Banxa, the leading payments infrastructure provider for the crypto-compatible economy, has announced it will add the SUI token to its platform. The integration will increase access to the Sui blockchain for users across the world, thanks to a suite of Banxa’s global and local payment methods, which have processed over $3 billion in transactions since its launch in 2014. Additionally, Mysten Labs’ Sui Wallet will provide users the opportunity to purchase SUI tokens through Banxa’s on-ramp and once fully integrated, to utilize its off-ramp solution.

For a limited time, there will be no transaction gateway fees for buying SUI on Banxa. Thanks to this integration, users of some of the most established Web3 platforms such as Ledger, OKX, and MetaMask, will now have seamless, and initially, feeless, access to Sui.

“For a long time, fiat on and off ramps have been a source of friction for the crypto industry. That’s why Banxa, a platform that removes that friction, joining the Sui ecosystem is so important,” said Greg Siourounis, Managing Director of the Sui Foundation. “I am excited about the technical possibilities, broad access, and optionality that this integration will offer to the Sui community while simultaneously ensuring KYC compliance at each step.”

As a result of the integration of Banxa into the Sui ecosystem, developers building on Sui will now be able to leverage the powerful features provided by Banxa to add more functionalities and compliance measures to their dApps. For example, the NFT checkout solution will provide an enhanced NFT selling experience for end users. Additionally, developers can improve the overall user experience by reducing friction in the onboarding and offboarding processes. Users are more likely to engage with a dApp that offers a smooth and convenient transition between fiat and crypto.

“We think Sui is the most powerful and performant blockchain in the space,” said Holger Arians, CEO of Banxa. “The rapid growth of the Sui ecosystem since its mainnet launch is something we’re excited to tap into to advance our central objective of increasing the adoption of blockchain technology ”

Contact

Sui Foundation

media@sui.io

Curacao, Curacao, January 29th, 2024, Chainwire

HugeWin Casino, a newly established platform as of January 2024, has quickly garnered attention in the cryptocurrency gambling landscape. Its user-centric approach, coupled with an extensive array of gaming options, underscores its emerging status within the industry.

Extensive Gaming Portfolio

The platform boasts an impressive selection of over 7,000 slot games, providing both traditional and innovative variants. Additionally, it offers a diverse range of over 700 casino games, sourced from 12 renowned game providers, including PragmaticLive, Evolution, and LiveGames. The assortment spans across popular games like poker, roulette, blackjack, and baccarat, including live casino tables, ensuring a comprehensive gaming experience.

Extensive Gaming and Betting Portfolio

HugeWin Casino presents an expansive platform that caters to a wide array of gaming and betting preferences. It boasts a remarkable selection of over 7,000 slot games, offering a blend of traditional and innovative variants. In addition to slots, the platform features a diverse range of over 700 casino games, sourced from 12 esteemed game providers including PragmaticLive, Evolution, and LiveGames. The assortment extends across popular games such as poker, roulette, blackjack, and baccarat, inclusive of live casino tables, ensuring a comprehensive and immersive gaming experience.

Further broadening its spectrum, HugeWin Casino ventures into the sports betting domain, presenting a selection of 35 virtual sports games. This addition caters to the varied interests of its users, encompassing popular sports like football, basketball, and tennis. Complementing its extensive betting options, the platform also offers close to 70 regular games, highlighting popular titles like Zeppelin, Aviator, and Spaceman, thereby enriching the user experience with its multifaceted gaming and betting environment.

Commitment to Transparency and Security

Recognizing the importance of security in the digital gambling domain, HugeWin Casino has secured a Curaçao eGaming license (CEG), emphasizing its dedication to safe and transparent gaming practices. The platform maintains a minimalistic approach towards user data collection, requesting only the essential information for account creation.

Promotions and Tournaments

Understanding the dynamic needs of its users, HugeWin Casino regularly introduces various special events, bonuses, and promotions. The platform hosts two main recurring tournaments: the Weekly Multiplier Tournament and the Monthly Turnover Tournament, with substantial prize pools. Additionally, it offers a range of discounts and bonuses, including daily casino discounts, weekly slot discounts, and a rewarding referral program.

About HugeWin

HugeWin, a recent entrant in the online casino space, aims to become a global leader. Launched in January 2024, the platform is devoted to providing a fun and trustworthy gaming environment.

The platform prioritizes immediate disbursement of earnings, barring instances of suspected fraud. Clients can expect prompt payouts without tedious documentation.

A wide array of betting options is available, with round-the-clock access to any desired match. Live casino sections offer an interactive experience with real croupiers.

For further information about HugeWin Casino’s game offerings, events, and promotions, interested parties are encouraged to visit the official website or follow the platform on X (Twitter) and Telegram.

Disclaimer: HugeWin is the source of this content. This release is for informational purposes only and does not constitute investment advice or an offer to invest. Information provided about HugeWin and its services, including online gambling and cryptocurrency betting, involves significant risks and may not be suitable for all individuals. Users should exercise caution and are encouraged to conduct their own research before participating in any gambling activities. Participation is at the user’s own risk and should be approached with financial prudence.

Contact

Jowi Scholtz

marketing@hugewin.com