New York, United States, November 11th, 2025, Chainwire

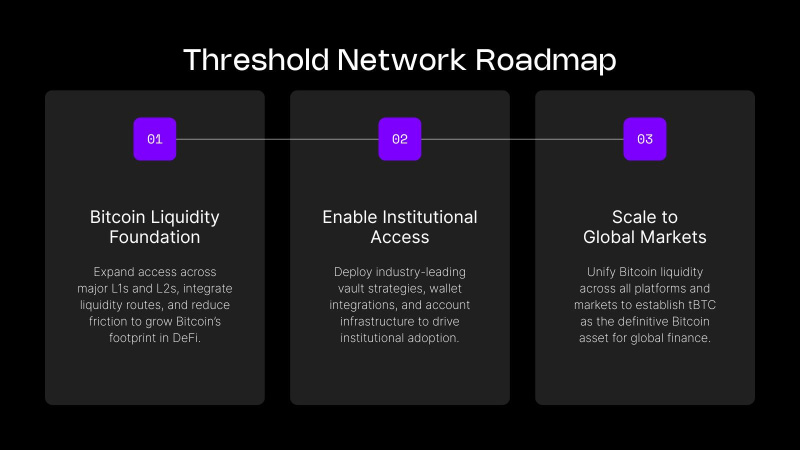

Threshold Network has rolled out protocol upgrades and a refreshed website to reinforce tBTC’s position in Bitcoin onchain markets. This enhances tBTC’s role as the trusted tokenized Bitcoin, bridging Bitcoin’s onchain capital concentration to decentralized financial markets.

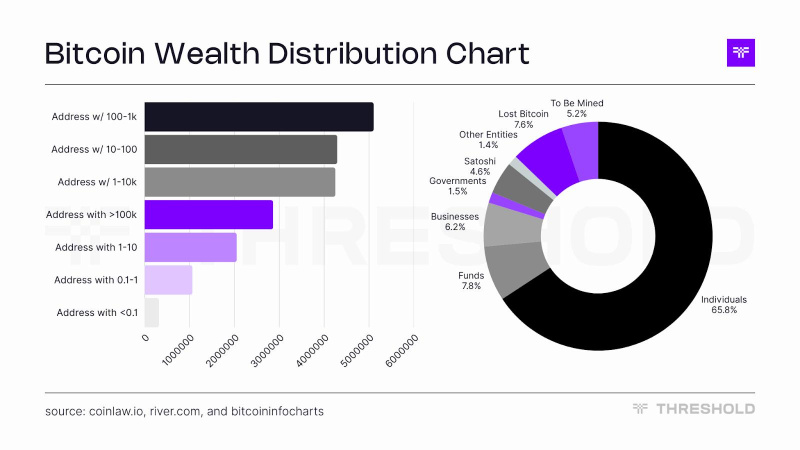

Recent analysis shows that 1M addresses hold over $100k; 157,000 hold over $1 million, and 19,142 addresses hold more than $10 million in Bitcoin. Together, these addresses represent an estimated $500 billion in value, a figure that has accelerated since U.S. spot ETF approvals in 2024. Although individuals control about 65.9% of the total Bitcoin supply, the majority are affluent investors rather than small retail holders.

Since the approval of U.S. spot Bitcoin ETFs, institutional participation has grown rapidly. Institutional holdings reached $414 billion in August 2025, driven by ETF inflows and corporate treasury strategies. Corporate reserves increased 40% in Q3 to $117 billion, while 172 listed companies now hold Bitcoin, collectively owning over 1 million BTC. MicroStrategy remains the largest corporate holder with 640,000 BTC, and as of October 2025, U.S. spot Bitcoin ETFs manage $169.48 billion in assets, representing 6.79% of Bitcoin’s market cap. Threshold sees this shift as an opportunity to shift to institutional positioning.

Renewed Focus: Institutional Access with Bitcoin’s Integrity

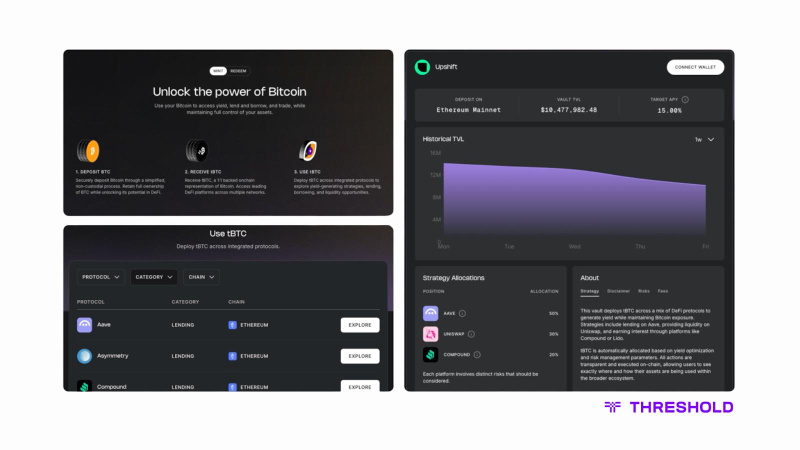

The redesigned Threshold Network website features a clean, minimal layout designed for clarity and accessibility. It represents Threshold’s transition from a single protocol to a comprehensive ecosystem that enables Bitcoin to move freely across financial markets.

The accompanying tBTC app has been upgraded to simplify the Bitcoin-to-DeFi experience. Users can now mint tBTC directly to supported chains with a single BTC transaction, without secondary approvals or unnecessary steps. Redemptions back to Bitcoin mainnet are equally straightforward, mirroring Bitcoin’s simplicity while maintaining full decentralization.

The upgrade also introduces several new features:

- Use tBTC: A new section built to help users discover where they can deploy tBTC or put their Bitcoin to work. It provides a comprehensive overview of tBTC integrations across multiple DeFi protocols.

- Vaults: a new dashboard that consolidates integrated tBTC vault strategies into a single interface. It allows users to access curated, externally managed vault strategies built for ease of use.

- My Activity: This section offers a unified record of all user actions across minting, redeeming, and vault participation. Every transaction is logged onchain, allowing users to easily track their history and monitor performance over time.

The New tBTC App: Simplicity and Precision for Large Scale Adoption

The new tBTC app introduces a simplified interface focused on efficiency, transparency, and security. It allows users to move between Bitcoin and DeFi markets seamlessly while maintaining complete self-custody of their assets.

Streamlined Minting and Redemption

Users can now move effortlessly between Bitcoin and a range of supported networks, including Ethereum, Layer 2s, and non-EVM chains, through a single, seamless process.

This new functionality removes the friction traditionally involved in bringing Bitcoin into DeFi. Users can now mint and redeem tBTC quickly, securely, and without unnecessary costs or approvals.

- Direct minting to supported chains enables capital to flow efficiently into DeFi markets, allowing institutions to deploy Bitcoin liquidity across multiple ecosystems without relying on centralized intermediaries.

- Direct redemption to Bitcoin mainnet gives users confidence that they can always return to native Bitcoin, maintaining trust and liquidity across all use cases.

- No Layer 2 signing required means that even complex transactions can be completed with a single Bitcoin transfer, reducing operational overhead for institutional treasuries and simplifying onboarding for individual users.

Together, these upgrades position tBTC as the most efficient and permissionless access for Bitcoin in DeFi markets.

Gasless Minting on Supported Networks

Gasless Minting on Supported Networks

Gasless minting is now possible on supported networks. Users only need to deposit Bitcoin; no wallet signatures or additional gas fees are required. They simply connect their wallet, send Bitcoin to a single-use address, and receive tBTC on their chosen chain. This feature allows users to utilize Bitcoin capital efficiently without compromising custody or cost.

“This is a major protocol upgrade that represents Threshold’s maturity as a network,” said Callan Sarre, Co-Founder and CPO of Threshold Labs.

“We’ve rebuilt the app to give users a unified experience. Mint, redeem, and deploy Bitcoin faster, with confidence and transparency. The new interface delivers what users, both institutional and individual, have consistently asked for: clarity and control without compromise.”

Building the Future of Bitcoin

Threshold Network, a cross-chain Bitcoin infrastructure protocol that enables BTC to move securely across multiple blockchains, has upgraded its app to support direct minting to supported networks with zero gas fees. The upgrade allows Bitcoin holders to access yield strategies, lending markets, and liquidity provision without first routing transactions through Ethereum Layer 1.

Threshold Network, a cross-chain Bitcoin infrastructure protocol that enables BTC to move securely across multiple blockchains, has upgraded its app to support direct minting to supported networks with zero gas fees. The upgrade allows Bitcoin holders to access yield strategies, lending markets, and liquidity provision without first routing transactions through Ethereum Layer 1.

This release enables users to mint tBTC directly from the Bitcoin network into supported onchain ecosystems, removing the need for L1 bridging and significantly simplifying user onboarding.

“The scale of institutional adoption since ETF approvals has been extraordinary,” said MacLane Wilkison, Co-Founder and CEO of Threshold Labs.

“Our focus is on building the infrastructure that allows institutions, funds, and corporates to interact with Bitcoin onchain securely. As traditional finance integrates Bitcoin into its portfolios, tBTC stands as the bridge that ensures this participation remains decentralized and transparent.”

With tBTC available across major ecosystems, including Ethereum, Arbitrum, Base, Polygon, Sui, Starknet, BOB, and Optimism, Threshold continues to expand its integrations to increase liquidity and, soon, enable access to institutional capital.

Users can explore the new app and website at https://threshold.network

About Threshold Network

Threshold Network is the decentralized protocol behind tBTC, a permissionless 1:1 Bitcoin-backed asset secured by a 51-of-100 threshold signer model. tBTC enables native BTC to move across chains like Ethereum, Base, Sui, Arbitrum, and Starknet without requiring custodians or compromising security. With over 5 years of proven security and about $4.8B in bridge volume, Threshold offers the most battle-tested, trust-minimized Bitcoin infrastructure onchain.

Contact

Head of Marketing

RC Ramos

Threshold Network

contact@tnetworklabs.com

Vaduz, Liechtenstein, November 11th, 2025, Chainwire

First location is in Cyprus, utilizes xMoney stack to facilitate faster payments, many more locations on the horizon.

In a new collaboration aimed at appealing to pizza enthusiasts worldwide, xMoney, the pioneering payments company, is broadening its platform reach by welcoming a new partnership with pizza giant Domino’s in a move set to speed up check-out times and make the payments process more seamless.

The partnership will kick off with Domino’s Cyprus and will focus on services that enable Domino’s franchises to accept fiat payments with credits and digital wallets – Apple Pay and Google Pay – across both web and mobile apps.

It’s a collaboration built on a shared vision for payments being instant, secure, and effortless – across every currency, app, and region – backed by xMoney’s trusted and proven technology.

For consumers, initially those in Cyprus, this means a more enjoyable checkout experience when visiting Domino’s for pizza cravings.

The tech Domino’s will employ leverages xMoney’s embeddable checkout solution, delivering customers a seamless payment experience without redirections – ensuring faster checkout times – while xMoney’s backend securely handles all sensitive payment data.

Domino’s is also positioning itself for Web3 readiness, with xMoney enabling access to cryptocurrency payment solutions through an upgraded fiat-checkout system.

Prior to a full rollout, xMoney will prioritize currencies that deliver lightning-fast confirmations – like USDC’s efficient processing on the Sui blockchain – to ensure a smooth, customer-friendly experience.

“At Domino’s Pizza Cyprus, we’re thrilled to partner with xMoney to take our customers’ online experience to the next level. This partnership is all about making every step – from ordering to payment – faster, simpler, and more secure. With xMoney’s innovative technology, we’re streamlining the way our customers pay so they can spend less time checking out and more time enjoying our great pizza. It’s another step forward in our commitment to combining convenience, innovation, and the quality that makes Domino’s a brand people love.” – Alister Leech, CEO Domino’s Pizza Cyprus

As more Domino’s locations adopt xMoney’s payments technology, the ability for both crypto and fiat payments to be accepted by household brands will continue to increase, ultimately paving the way for the widespread mass adoption of blockchain tech embedded within everyday life.

While the EU-wide rollout of xMoney’s cutting-edge tech integrations will start with Domino’s Cyprus, the game-changing payments technology will soon power stores across the European continent – with an already robust pipeline of additional Domino’s locations locked in and ready to join the revolution.

“The best innovations are the ones people barely notice, because they just work. With xMoney powering payments for Domino’s, customers get faster checkouts, stronger security, and a smoother experience every time they order.” – Gregorios Siourounis, Co-founder & CEO, xMoney

With Domino’s, xMoney is powering transactions and redefining how global brands handle payments, proving that when innovation meets trusted experiences, everyone wins.

About Domino’s

Founded in 1960, Domino’s Pizza is the largest pizza company in the world, with a significant business in both delivery and carryout pizza. It operates a network of company-owned and independent franchise stores in the United States and more than 90 international markets.

About xMoney

xMoney is revolutionizing the payments landscape with strategic European licenses, delivering a seamless, secure, and forward-thinking ecosystem powered by innovative product design, cutting-edge technology, and unwavering compliance. XMN, xMoney’s newly launched token, is natively integrated into the licensed and regulated payment infrastructure – empowering merchants and consumers with lightning-fast, trustworthy transactions underpinned by full regulatory transparency. Now trading on Kraken, KuCoin, MEXC, Bitvavo, Bluefin and other exchanges, XMN is primed for broader adoption with a robust pipeline of integrations ahead.

Contact

Marketing

Alex Rus

xMoney

alex.rus@xmoney.com

Victoria, Seychelles, November 11th, 2025, Chainwire

Bitget, the world’s largest Universal Exchange (UEX), has officially listed XMRUSDT on its futures trading platform. The listing, which became effective on November 11, 2025 (UTC+8), enables users to trade Monero (XMR) against Tether (USDT) with up to 50x leverage. The contract is now available with full compatibility for Bitget’s automated futures trading bots.

The XMRUSDT perpetual futures contract is settled in USDT and features a tick size of 0.01. Funding fees are settled every eight hours, and trading is available 24/7. The launch supports both manual trading and algorithmic strategies through Bitget’s bot functionalities, offering enhanced flexibility and precision for traders.

XMR, known for its emphasis on privacy and untraceability, continues to attract significant attention among decentralized asset advocates. The introduction of XMRUSDT to Bitget’s futures lineup marks another step in expanding access to high-demand crypto assets with advanced trading capabilities.

As part of Bitget’s risk management policy, trading parameters such as tick size, maximum leverage, and maintenance margin rates are subject to adjustment in response to market conditions.

Bitget’s futures offerings include USDT-M, Coin-M, and USDC-M Futures. USDT-M Futures allow traders to use USDT as margin across multiple trading pairs, consolidating account equity, profits, and risks within a unified system.

Users can learn more on Bitget’s website.

About Bitget

Established in 2018, Bitget is the world’s largest Universal Exchange (UEX), serving over 120 million users with access to millions of crypto tokens, tokenized stocks, ETFs, and other real-world assets, while offering real-time access to Bitcoin price, Ethereum price, XRP price and other cryptocurrency prices, all on a single platform. The ecosystem is committed to helping users trade smarter with its AI-powered trading tools, interoperability across tokens on Bitcoin, Ethereum, Solana, and BNB Chain, and wider access to real-world assets. On the decentralized side, Bitget Wallet runs as the leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built-in the platform.

Bitget is driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. In the world of motorsports, Bitget is the exclusive cryptocurrency exchange partner of MotoGP™, one of the world’s most thrilling championships.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Contact

Simran Alphonso

media@bitget.com

us, co, November 11th, 2025, Chainwire

As the digital asset industry continues to expand, cryptocurrency exchanges are evolving to meet increasing global demand. Founded in 2021, Tapbit Exchange has grown into a global leader in futures trading through four years of relentless innovation, robust security, and a user-centric vision.

More than just a trading platform, Tapbit now serves as a vital bridge between traditional finance and the blockchain-powered future, ushering in a new “Golden Era” of futures trading.

Tapbit to Launch Its 4th Anniversary Global Celebration on November 17: A Milestone Shared with Users Worldwide

To commemorate this remarkable milestone, Tapbit will officially host its “4th Anniversary Global Celebration” on November 17, 2025, unveiling a series of exclusive giveaways, community events, and global interactions.

Under the theme “#TAPBITTURNS4,” the celebration will combine online and offline experiences, creating an immersive and engaging atmosphere for users around the world to participate in.

The anniversary campaign will feature multiple highlights, including:

- Zero-Fee Spot Trading – Users can enjoy zero trading fees on select spot pairs permanently, experiencing a smoother and more cost-efficient trading journey.

- Million-Dollar Rewards Gala – Through trading competitions, referral contests, and lucky draws, participants will have the chance to win luxury prizes worth over $1 million, including Mercedes-Benz S 450 4MATIC, Mercedes-Benz E 300 4MATIC EXCLUSIVE, Rolex Submariner, and an Apple full set.

- Global AMA Live Series – Tapbit will partner with industry leaders, renowned KOLs, and blockchain experts to host interactive sessions exploring the future of derivatives trading and emerging Web3 opportunities.

- Charity Appreciation Program – As part of the anniversary celebration, all trading fees generated by users during the event will be allocated to Tapbit Cares, which will then donate these funds to welfare homes, elderly care institutions, and other charitable organizations, highlighting Tapbit’s commitment to social responsibility and community care.

Tapbit stated that its 4th anniversary marks not only a celebration but also a moment of gratitude toward its global community for their continuous trust and support. Through this milestone event, Tapbit aims to further strengthen community engagement, foster a sense of belonging among users, and embody its guiding principle — “User First, Innovation Driven.”

Innovation and Technology: Redefining Futures Trading Standards

Over the past four years, Tapbit has surpassed 500,000 global users and expanded its services to over 200 countries and regions. With a daily spot trading volume of $3.84 billion and futures volume reaching $53.65 billion, Tapbit has achieved a flawless record of zero security incidents—backed by a $50 million insurance fund and bank-grade SSL encryption.

In addition, Tapbit holds licenses from the U.S. National Futures Association (NFA) and the Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA), reinforcing its commitment to global compliance and transparency.

Tapbit now supports over 130 perpetual futures contracts, including major assets like BTC and ETH, as well as trending altcoins. Users can access up to 150x leverage, along with auto stop-loss, trigger orders, and other advanced tools to ensure a seamless and secure trading experience.

Innovative features like One-Click Copy Trading and Smart Trading Bots enable users to follow professional traders’ strategies transparently—viewing their returns and risk metrics in real time. These features have already helped tens of thousands of users earn above-average passive returns.

Tapbit has also enhanced its matching engine to achieve millisecond-level latency and introduced a Demo Trading Mode for beginners—fostering fairness and confidence among all market participants.

User-Centric Vision: Building a Global Trading Community

Tapbit supports over 800 cryptocurrencies and 42 fiat currencies (including USD, EUR, and JPY), with convenient payment options via credit card, bank transfer, and third-party gateways. Its non-mandatory KYC policy (allowing up to 10 BTC daily withdrawals) greatly lowers entry barriers for new users.

Tapbit also offers Tapbit Earn staking products and extensive educational resources for all experience levels. From multi-biometric authentication (MBA) in 2023 to QR code deposit scanning in 2024, every improvement stems from community feedback.

Today, Tapbit ranks among the top exchanges on CoinGecko’s Trust Score index, with an impressive 51%+ user retention rate, underscoring its global community strength.

Looking Ahead: The Golden Era of Futures Trading

After four transformative years, Tapbit continues to set new industry benchmarks with technology, security, and user empowerment. Looking ahead to 2025 and beyond, Tapbit plans to expand into AI-powered trading strategies, Web3 integration, and DeFi derivatives innovation—pushing the boundaries of digital finance.

Miki, Tapbit’s Global Marketing Director, stated:

“Four years of growth have placed Tapbit at the intersection of stability and innovation. Our mission is to make futures trading secure, efficient, and accessible for everyone—transforming it from a high-risk pursuit into a powerful wealth management tool.”

The Tapbit story is still unfolding—ushering in a Golden Era of crypto finance.

About Tapbit

Tapbit is a leading global digital asset trading platform dedicated to delivering a secure, efficient, and innovative trading experience. Its core advantages include zero-fee spot trading, no-KYC quick access, a zero-slippage matching engine, and a $50 million protection fund, ensuring a high-performance, low-barrier, and trustworthy environment for users.

Official Channels:

Website: www.tapbit.com

Twitter / X: @Tapbitglobal

Telegram: @TapbitGlobalOfficial

Contact

Marketing

Garry

Tapbit

zed@tapbit.com

Victoria, Seychelles, November 11th, 2025, Chainwire

Bitget, the world’s largest Universal Exchange (UEX), has introduced three new Stock Index perpetual futures: CSCOUSDT, PEPUSDT, and ACNUSDT. These contracts, based on Cisco Systems Inc. (CSCO), PepsiCo Inc. (PEP), and Accenture plc (ACN), were officially listed on November 10, 2025 (UTC+8), with leverage of up to 10x.

The new listings reflect Bitget’s continued efforts to bridge traditional finance with the digital asset ecosystem. By incorporating globally recognized equities into its derivatives platform, Bitget is enhancing market accessibility and offering traders a wider array of instruments to diversify their strategies.

All three contracts are settled in USDT and follow an isolated margin mode. They support round-the-clock trading from Monday 12:00 AM to Saturday 12:00 AM (UTC-4), with hourly funding fee settlements. Each contract has a minimum tick size of 0.01, and users can take advantage of up to 10x leverage.

The introduction of CSCOUSDT, PEPUSDT, and ACNUSDT further strengthens Bitget’s derivatives portfolio, positioning the platform as a comprehensive gateway for users interested in both crypto-native and equity-linked markets.

Users can learn more on Bitget’s website.

About Bitget

Established in 2018, Bitget is the world’s largest Universal Exchange (UEX), serving over 120 million users with access to millions of crypto tokens, tokenized stocks, ETFs, and other real-world assets on a single platform. The ecosystem is committed to helping users trade smarter with its AI-powered trading tools, interoperability across tokens on Bitcoin, Ethereum, Solana, and BNB Chain, and wider access to real-world assets. On the decentralized side, Bitget Wallet runs as the leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built-in the platform.

Bitget is driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. In the world of motorsports, Bitget is the exclusive cryptocurrency exchange partner of MotoGP™, one of the world’s most thrilling championships.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Contact

Simran Alphonso

media@bitget.com

Dubai, UAE, November 7th, 2025, Chainwire

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, disclosed the October performance of its Private Wealth Management (PWM), highlighting continued stability and strong returns amid a month marked by volatility and global market tension.

Performance Highlights

In the latest Bybit PWM newsletter for October 2025, Bybit PWM demonstrated consistent strength across its portfolio, underscoring the division’s disciplined approach to managing wealth in dynamic markets.

October, often referred to as “Uptober” for its traditionally strong crypto performance, diverged from its usual trajectory this year. Escalating U.S.–China tariff tensions — particularly following the Oct. 11 developments that triggered widespread liquidations — combined with end-of-month Big Tech earnings volatility to create headwinds across digital asset markets.

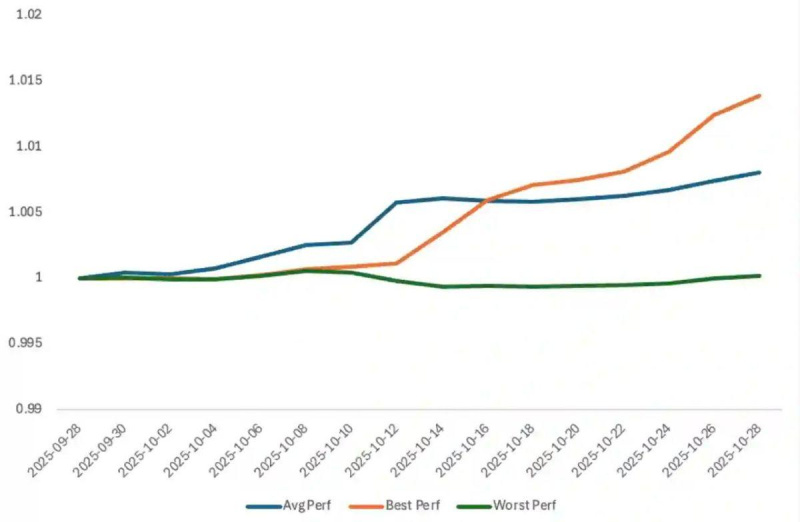

Despite these challenges, Bybit PWM maintained resilient results. Its top-performing fund recorded a 16.94% annual percentage rate (APR), while USDT-based strategies achieved an average APR of 11.56%, and BTC-based strategies averaged 6.81%. Fund assets were aligned as of Sep. 28, 2025, and net asset values were calculated using the Time-Weighted Return (TWR) method, benchmarked against funding arbitrage performance.

Chart: Bybit PWM October 2025 Performance Overview

“Our October performance reaffirms the importance of discipline, diversification, and data-driven strategy in an uncertain environment,” said Jerry Li, Head of Financial Products & Wealth Management at Bybit. “We continue to prioritize stability for our clients while seeking opportunities that deliver consistent yield. Even when broader markets face turbulence, our structured approach allows us to navigate volatility with confidence.”

Bybit PWM’s diversified investment framework, supported by the exchange’s institutional-grade infrastructure, enables high-net-worth clients to access bespoke strategies designed for both wealth preservation and long-term growth.

#Bybit / #CryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Contact

Head of PR

Tony Au

Bybit

media@bybit.com

New York, United States, November 6th, 2025, Chainwire

LeverUp Offers Traders a Flexible and Full-Scale DeFi Platform

LeverUp, a brand-new Liquidity Provider (LP)-free perpetual exchange, has officially launched, offering traders a next-generation DeFi platform built on the layer-1 blockchain Monad. Backed by Makers Fund, LeverUp delivers a decentralized trading experience with uncapped open interest, free liquidity provider perpetuals, and scalability, offering traders zero fees. This partnership will allow LeverUp to utilize its on-chain, transparent trading of perpetuals to the fullest in Monad’s fast and scalable layer-1 blockchain. Users can anticipate more integrations and product updates to be revealed soon.

The current market landscape is marked by limited flexibility and high transaction costs across trading platforms. LeverUp introduces an alternative model that reallocates all protocol fees back to traders, rather than sharing them with liquidity providers. The platform is designed to promote a more transparent and balanced trading environment.

The DeFi landscape continues to offer potential opportunities for traders and investors, but structural inefficiencies persist: liquidity is fragmented across pools and protocols, forcing traders to split their capital and reducing returns, and complicated fee structures create friction and increase risk for users. As a result, the market has become incredibly competitive and complex to navigate as investors look to achieve consistent returns.

LeverUp was built to address these systemic challenges. Built on Monad, LeverUp introduces a new tech stack designed from the ground up to solve the liquidity, fees, and transparency issues while providing best-in-class performance, leverage, etc. LeverUp provides users full transparency where every position, metric, and protocol flow is on-chain and verifiable. Traders can access up to 1001x exposure across crypto majors and real-world assets, powered by an institution-grade risk engine.

LeverUp eliminates constraints usually associated with traditional LPs, and on this platform, open interest scales independently of TVL, liquidity depth, or passive providers, and traders engage directly with the protocol. 100 percent of protocol fees are captured and returned to traders, compounding network value where it belongs.

The platform’s native LVUSD settlement integrates a stablecoin layer, delivering stability, composability, and capital efficiency across the ecosystem. The DeFi platform’s uncapped market depth breaks liquidity ceilings compared to other platforms, enabling unprecedented capital efficiency and truly flexible open interest.

Additional information about LeverUp can be found at LeverUp.gitbook.io. Users can learn more about Testnet at app.leverup.xyz.

About LeverUp

LeverUp is an LP-free perpetuals exchange delivering uncapped open interest, 100% fee redistribution to traders, and leverage up to 1001x. With countless perpetual platforms on the market, LeverUp is a differentiator, offering more flexibility, native LVUSD settlement, uncapped market depth, and full transparency where nothing is hidden and nothing is off-chain. While others race to copy CEX perps—standalone chains and high-throughput order books—LeverUp chose a different lane.

On high-performance public chains, LeverUp’s LP-free design gives traders near-CEX execution and true DeFi composability—so protocols snap together like Lego and network effects compound. The company builds with the ecosystem, not against it.

Contact

Adam Simon

fortyseven communications for Makers Fund

adam@fortyseven.com

Kuala Lumpur, Malaysia, November 6th, 2025, Chainwire

Sonami ($SNMI) today announced the continuation of its presale and the expansion of its ecosystem through the launch of the first Solana Layer 2 token. The project has been developed to address network congestion and reliability challenges often experienced by Solana users during high transaction periods.

Sonami Introduces Layer 2 Efficiency for Solana-Based Transactions

Sonami ($SNMI) is a project developed to tackle performance challenges on the Solana network, such as congestion and maintaining reliability during periods of high activity.

It is the first token launched on Solana Layer 2, allowing Sonami to offload transactions and enhance network efficiency. Through this approach, multiple transactions are bundled into one, helping to reduce congestion.

By processing transactions in this way, $SNMI aims to improve efficiency and security while maintaining high transaction speed and scalability. These attributes make Sonami suitable for high-frequency decentralized applications, including gaming ecosystems that require real-time interactions. It is also designed to support microtransactions and meme coin applications.

The Sonami ecosystem is expected to continue expanding to support the community’s evolving needs.

The Sonami platform is under continued development and has been noted for its growing presale participation. The project’s roadmap outlines further stages of technical and community growth following the conclusion of the presale phase.

Sonami Outlines Presale Roadmap and Token Listing Plans

Transparency has been identified as a key element for participants considering involvement in digital assets. Sonami has released details of its presale structure and subsequent development milestones.

In the initial phase, focused on presale distribution, the project reports ongoing activity and participation. Upon completion of the presale, tokens will be bridgeable to Layer 2, and $SNMI is planned to be listed on decentralized and centralized exchanges.

The third phase of the roadmap will introduce expanded utility for token holders, reflecting Sonami’s focus on speed and reduced network congestion.

Sonami Tokenomics Overview

The Sonami project plans a total supply of 82,999,999,999 $SNMI tokens to support continued ecosystem growth.

Token distribution has been outlined as follows: 15% is allocated for marketing, 20% for the treasury, and 25% for staking incentives and rewards. The remaining 40% is divided between development (30%) and exchange listings (10%) to ensure liquidity and ongoing technical advancement.

As of this release, Sonami reports raising over $2 million during the presale. The current token value is stated at $0.0019 per $SNMI.

About Sonami

The Sonami project is driven by a collective of seasoned blockchain developers and ecosystem architects with deep roots in the Solana ecosystem. The core team brings together talent from leading Web3 infrastructure projects and traditional fintech backgrounds, united by a shared vision of solving scalability challenges at the protocol level.

The Sonami Foundation’s roadmap is ambitious because the problem demands ambitious solutions. The team believes in building transparently, shipping consistently, and letting the technology speak for itself. The future of decentralized applications depends on solving scalability today, and Sonami is committed to being at the forefront of that solution.

Contact

Zakit Mobad

contact@sonami-so.io

Victoria, Seychelles, November 6th, 2025, Chainwire

Bitget, the world’s largest Universal Exchange (UEX), has announced the launch of its latest CandyBomb campaign to celebrate the listing of PLAI. The promotion features a total prize pool of 250,000 PLAI tokens, exclusively available to new users engaging in futures trading during the campaign period.

The promotion runs from November 4, 2025, 8:00 PM to November 11, 2025, 8:00 PM (UTC+8). Eligible participants must complete identity verification and register for the promotion via the CandyBomb page before any trading activity will be counted. Only new futures traders will qualify for the PLAI token rewards, which will be distributed within 1–3 working days after the campaign concludes.

Bitget’s CandyBomb initiatives are designed to incentivize participation in futures markets and provide opportunities for users to explore new digital assets while earning token rewards. The PLAI collaboration underscores Bitget’s ongoing effort to support emerging projects and enhance user engagement through targeted promotions.

The platform has issued a strict set of terms and conditions to maintain fairness, including disqualification of users engaged in fraudulent activity or violations of platform rules. Institutional users, market makers, and sub-accounts are not eligible for this campaign. Bitget also retains full discretion to amend or cancel the promotion at any time.

This latest campaign highlights Bitget’s ongoing push to create accessible and rewarding trading environments for its global user base, reinforcing its position as a frontrunner in the digital asset space.

For more details, users can visit here.

About Bitget

Established in 2018, Bitget is the world’s largest Universal Exchange (UEX), serving over 120 million users with access to millions of crypto tokens, tokenized stocks, ETFs, and other real-world assets on a single platform. The ecosystem is committed to helping users trade smarter with its AI-powered trading tools, interoperability across tokens on Bitcoin, Ethereum, Solana, and BNB Chain, and wider access to real-world assets. On the decentralized side, Bitget Wallet runs as the leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built-in the platform.

Bitget is driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. In the world of motorsports, Bitget is the exclusive cryptocurrency exchange partner of MotoGP, one of the world’s most thrilling championships.

For more information, users can visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, users can contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, users can refer to the Terms of Use.

Contact

Simran Alphonso

media@bitget.com

Greenwich, CT, November 5th, 2025, Chainwire

Leverage Shares by Themes is thrilled to announce the launch of GEMG, a first-to-market single-stock leveraged ETF with exposure to GEMI, available for trading November 5, 2025.

The firm continues to expand its leveraged single-stock ETF lineup across the digital asset ecosystem; the debut of GEMG is hot on the heels of the firm’s recent launches of the Leverage Shares 2X Long BMNR Daily ETF (BMNG) and Leverage Shares 2X Long BLSH Daily ETF (BLSG), which became available for trading on October 27, 2025.

These ETFs are designed to equip investors to amplify returns (up and down) and dynamically participate in the performance of leading companies. The new ETFs are tailored to target a 200% exposure to the daily performance of their underlying stocks, Bullish (BLSH), Bitmine Immersion Technologies (BMNR), and Gemini Space Station (GEMI) at an industry-low management fee for single-stock leveraged ETFs at .75%.*

- GEMG — Leverage Shares 2X Long GEMI Daily ETF

- BLSG — Leverage Shares 2X Long BLSH Daily ETF

- BMNG — Leverage Shares 2X Long BMNR Daily ETF

“As part of the Leverage Shares by Themes offering, these new funds aim to provide investors with amplified exposure to high-growth innovators across a distinct industry;” says Chief Revenue Officer, Paul Marino, “we are committed to growing our leveraged single stock ETF offering with names that meet investor interest.”

These new ETFs bring the Leverage Shares by Themes lineup to 34 leveraged single-stock ETFs, covering major sectors including technology, energy, consumer, and financials. The firm continues to grow its U.S. footprint following the success of its initial suite launched in December 2023.

For more information about these ETFs and other products offered by Leverage Shares by Themes, users can visit www.leverageshares.com/us.

About Themes ETFs:

Themes ETFs was established by the Co-Founders of Leverage Shares in 2023 to offer thematic and sector-based products in the US. Themes Management Company LLC serves as an adviser to the Themes ETFs Trust. Themes ETFs seeks to provide investors with targeted exposure to specific segments of the market via its low-cost ETFs. For more information, visit www.themesetfs.com.

About Leverage Shares:

Leverage Shares is the pioneer and largest issuer of single stock ETPs in Europe.1 The company was launched in 2017 by CEO Jose Gonzalez-Navarro, COO Dobromir Kamburov and General Counsel Tracy Grant (the “Co-Founders”) and has 160+ ETPs offering both leveraged and unleveraged exposure to single stocks, ETFs and commodities across various exchanges in Europe. For more information, please visit www.leverageshares.com

1Source: Leverage Shares, as of 9 October 2024, by AUM and trading volumes.

Investment involves significant risk. Fund does not invest directly in the underlying stock. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund.

BLSG, BMNG, and GEMI are designed to provide investors with amplified returns (up and down) on innovative companies in the technology sector.

*Fee comparison source: Trackinsight.com, Universe of Leveraged and Inverse Single-Asset ETFs, as of 16 January 2025. All Averages are asset-weighted.

Newly launched Funds have risks associated with a limited operating history.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. For periods longer than a single day, the Fund will lose money if the Underlying Stock’s performance is flat, and it is possible that the Fund will lose money even if the Underlying Stock’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day.

Under the Investment Advisory Agreement between the Adviser and the Trust, on behalf of the Fund (the “Investment Advisory Agreement”), the Adviser has agreed to pay all expenses of the Fund, except for the fee paid to the Adviser pursuant to the Investment Advisory Agreement, interest charges on any borrowings, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses.

Bitmine Immersion Technologies, Inc. Investing Risk. Issuer-specific attributes may cause an investment held by the Fund to be more volatile than the market generally. The value of an individual security or particular type of security may be more volatile than the market as a whole and may perform differently from the value of the market as a whole. As of the date of this prospectus, in addition to the risks associated with the software industry, BMNR is subject to many risks that can negatively impact its revenue and viability including, but not limited to, supply or manufacturing delays, increased material or labor costs or shortages, reduced demand for its products, product liability claims, and the ability to attract, hire and retain key employees or qualified personnel. The trading price of BMNR common stock historically has been and is likely to continue to be volatile. Additionally, a large proportion of BMNR’s common stock has been historically and may in the future be traded by short sellers which may put pressure on the supply and demand for its common stock, further influencing volatility in its market price. BMNR is a highly dynamic company, and its operations, including its products and services, may change.

Digital Assets Risk. The Fund(s) is subject to the digital assets risk due to its investment exposure to BMNR, GEMI as BMNR, GEMI holds digital assets in its corporate treasury. The trading prices of many digital assets, including Bitcoin and Ethereum, have experienced extreme volatility and may continue to do so. Extreme volatility in the future, including further declines in the trading prices of Bitcoin or Ether, could have a material adverse effect on the Fund. Bitcoins and Ether are bearer instruments and the loss or destruction of a private key required to access a Bitcoin or Ether may be irreversible. If a private key is lost, destroyed or otherwise compromised and no backup of the private key is accessible, the owner would be unable to access the Bitcoin or Ether corresponding to that private key and the private key will not be capable of being restored by the digital asset network. Digital asset networks and the software used to operate them are in the early stages of development. Given the recentness of the development of digital asset networks, Bitcoin or Ethereum may not function as intended and parties may be unwilling to use Bitcoin or Ethereum, which would dampen the growth, if any, of digital asset networks. Governance of many digital asset networks are by voluntary consensus and open competition. As a result, there may be a lack of consensus or clarity on the governance of the digital asset networks, which may stymie a digital asset network’s utility and ability to grow and face challenges.

There is a lack of consensus regarding the regulation of Bitcoin and Ethereum and their respective markets. As a result of the growth in the size of the Bitcoin or Ether markets, the U.S. Congress and a number of U.S. federal and state agencies (including FinCEN, SEC, OCC, CFTC, FINRA, the Consumer Financial Protection Bureau, the Department of Justice, the Department of Homeland Security, the Federal Bureau of Investigation, the Internal Revenue Service, state financial institution regulators, and others) have been examining the operations of digital asset networks, digital asset users and digital asset markets. Many of these state and federal agencies have brought enforcement actions or issued consumer advisories regarding the risks posed by digital assets to investors. Ongoing and future regulatory actions with respect to digital assets may alter, perhaps to a materially adverse extent, the nature of an investment in a digital asset.

Blockchain Risk. Blockchain companies may be adversely impacted by government regulations or economic conditions. Blockchain technology is new and its uses are in many cases untested or unclear. These companies may also have significant exposure to fluctuations in the spot prices of digital assets, particularly to the extent that demand for a company’s hardware or services may increase as the spot price of digital assets increase. Blockchain companies typically face intense competition and potentially rapid product obsolescence. In addition, many blockchain companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies. Access to a given blockchain may require a specific cryptographic key (in effect a string of characters granting unique access to initiate transactions related to specific digital assets) or set of keys, the theft, loss, or destruction of which, either by accident or as a result of the efforts of a third party, could irrevocably impair a claim to the digital assets stored on that blockchain. Many blockchain companies currently operate under less regulatory scrutiny than traditional financial services companies and banks, but there is significant risk that regulatory oversight could increase in the future. Higher levels of regulation could increase costs and adversely impact the current business models of some blockchain companies. For example, restrictions imposed by foreign governments, including China, on the use and mining of digital assets, may adversely impact blockchain companies and in turn the Fund. These companies could be negatively impacted by disruptions in service caused by hardware or software failure, or by interruptions or delays in service by third-party data center hosting facilities and maintenance providers. Blockchain companies involved in digital assets may face slow adoption rates and be subject to higher levels of regulatory scrutiny in the future, which could severely impact the viability of these companies. blockchain companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology. The customers and/or suppliers of blockchain companies may be concentrated in a particular country, region or industry. Any adverse event affecting one of these countries, regions or industries could have a negative impact on blockchain companies.

PERFORMANCE DISCLOSURE

Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. Returns for performance for one year and under are cumulative, not annualized. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. For additional information, see the fund(s) prospectus.

INVESTMENT RISKS: Investing in the Funds involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Funds.

For periods longer than a single day, the Funds will lose money if GEMI, BLSH or BMNR respectively, has flat performance, and it is possible that the Funds will lose money even if GEMI, BLSH or BMNR’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day if the price of GEMI, BLSH or BMNR falls by more than 50% in one trading day.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about Themes ETFs. To obtain a Fund’s prospectus and summary prospectus call 886-584-3637. A Fund’s prospectus and summary prospectus should be read carefully before investing.

An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps is subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include effects of Compounding and Market Volatility Risk, Inverse Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Index Correlation Risk, Other Investment Companies (including ETFs) Risk, and risks specific to the securities of the Underlying Stock and the sector in which it operates. These and other risks can be found in the prospectus.

Themes Management Company LLC serves as an adviser to the Themes ETFs Trust. The funds are distributed by ALPS Distributors, Inc (1290 Broadway, Suite 1000, Denver, Colorado 80203). Themes ETFs are not sponsored, endorsed, issued, sold, or promoted by these entities, nor do these entities make any representations regarding the advisability of investing in the Themes ETFs. Neither ALPS Distributors, Inc, Themes Management Company LLC nor Themes ETFs are affiliated with these entities.

Contact

Director, Communications & Advisor Relations

Arielle Shternfeld

Themes ETFs

ashternfeld@themesetfs.com

+1 (860) 716-3686