Las Vegas has long been regarded as the capital of casino entertainment in the United States, and its renowned reputation is recognized worldwide. A new analysis has now confirmed this status, officially naming it the top spot for casino experiences in the country. This ranking is not just based on opinion. It stems from a detailed examination of several factors that assess the quality and scope of a city’s gaming offerings. The results show that Las Vegas’s top position is built on a powerful combination of choice, accessibility, and a complete entertainment environment. The city’s ability to offer something for everyone, from the casual visitor to the serious player, is what truly sets it apart from all other destinations.

Sheer Volume of Options

The most apparent reason for Las Vegas’s dominance is the incredible number of choices available to any visitor. The city is home to a massive concentration of casinos. There are giant resorts on the Strip. There are more locally focused properties downtown and beyond. This sheer volume creates a highly competitive environment. Every casino works hard to attract and keep customers. For the visitor, this competition is a huge benefit. It leads to better service, more attractive properties, and constant innovation.

This commitment to a high standard of gaming is not exclusive to the Strip. It also extends to the online experience.

Players seeking the same high-quality experience will find it at BetMGM Casino online, where they’ll be spoiled for choice by a vast selection of games, a true reflection of the energy synonymous with Sin City. Nevada, home to the world-renowned Las Vegas, boasts a staggering 200+ casinos, offering a truly diverse range of games. With that many places to try your hand, and over 138,000 slot machines on the go, not to mention more than 4400 table games to challenge your luck, the pickings are endless. And let’s be clear, no other spot in the country even comes close to these kinds of numbers.

Unmatched Game Variety

The vast number of games in Las Vegas is not just about quantity. It is also about quality and variety. The city’s casinos offer an unmatched selection. This selection caters to every possible taste and budget. You can find thousands of different slot machine titles. There are classic three-reel games. There are also the latest video slots with complex stories and bonus rounds. Las Vegas is often the first place where new and innovative slot machine concepts are introduced to the public.

If you prefer table games, you will find dozens of tables for the classics. It includes all the variations of blackjack, craps, roulette, and baccarat. Apart from the usual titles, Las Vegas casinos also have poker rooms with daily tournaments as well as large bingo halls. With a wide array of sportsbooks that allow you to wager on games globally, the fantastic variety guarantees that there is a betting game for every player. This is true no matter their preference or skill level. If you choose to spend an hour on the penny slots or join a high-stakes poker table, Las Vegas has a seat for you.

An Open and Welcoming Atmosphere

Another factor that contributes to Las Vegas’s top ranking is the accessibility of its casinos. In many places around the world, there are strict entry requirements or fees to gain access to the casino floor. In Las Vegas, there are no such barriers. The casino floors are open to the public. Anyone 21 or older can walk in off the street and start playing. This creates a welcoming and exciting atmosphere.

This open-door policy encourages exploration. Visitors can easily wander from one grand resort to another. They can experience the different themes and ambience of each property without any hassle. This freedom is a big part of the Las Vegas experience. You can spend an afternoon casino hopping. You can enjoy the sights and sounds of each unique place. The standard minimum age of 21 also clearly defines the city as a destination for adult entertainment. This helps shape the overall visitor experience. This combination of openness and an adult-focused environment has proven to be a successful formula for decades.

A Complete Entertainment Package

What truly elevates the Las Vegas casino experience is that the gambling is just one part of a much larger entertainment world. The city’s major casinos are not just buildings with slot machines. They are massive, integrated resorts that offer a complete vacation experience. The experience is about more than just the games themselves.

Within these resorts, visitors can discover a stunning array of additional attractions. Las Vegas is home to one of the best dining scenes in the world. It has a considerable number of restaurants run by celebrity chefs. It is also famous for its live entertainment. There are spectacular Cirque du Soleil productions. There are also long-running residencies with some of the biggest music stars on the planet. The resorts also feature high-end shopping malls. They have incredible nightclubs. They also have luxurious pools and spas. This approach means that a trip to Las Vegas can be a complete entertainment getaway. A visitor can spend their time enjoying all these other amenities. They can see the casino floor as just one more amazing attraction to explore. The city has also become a hub for sports, with professional teams that draw huge crowds and add another layer of excitement to the town.

The Winning Hand for Las Vegas

The recent analysis confirms what millions of visitors already knew. Las Vegas offers a casino experience that is unmatched in the United States. Its top ranking is built on a solid foundation of incredible choice. It boasts a vast number of casinos and an impressive variety of games. The city’s open and accessible atmosphere makes everyone feel welcome. The complete entertainment package offered by its integrated resorts provides an authentic vacation experience. It is this powerful combination of factors that solidifies its status as America’s gaming capital.

- Region-specific user data helps you make informed decisions

- Traffic data reveals consumer value and trust from real people

- User-traffic analysis identifies potential personal finance opportunities

A staggering 6.04 billion people were online by October 2025, which is 73.2% of the world’s entire population. User-traffic data isn’t just an afterthought anymore. It has become vital to understand how services are adopted, which brands consumers trust, and where people spend money online.

Understanding what user-traffic data can teach you about better spending habits can mean the difference between strategic purchases and wasted dollars if you’re focused on personal finance. Traffic trends can highlight concentrated attention and genuine value, whether choosing e-commerce platforms, streaming services, or money management tools.

Region-Specific Data Helps You Make Better Decisions

Many popular sites and online services have substantial US user traffic, even though they’re based in jurisdictions outside the country. Streaming services, cloud software providers, financial apps, and even entertainment providers operate under regulatory conditions from foreign officials. This often allows broader access to services that aren’t easily available in your home country, lower fees using global payment methods for cross-border transactions, and greater user privacy through technologies like blockchain, as one example.

The platforms still provide consumer protections regulated by offshore authorities like those found at PokerScout.com. For instance, the operators running offshore poker games like Razz, Omaha, Texas Hold’em, 7-Card Stud, and even tournaments still have to use random number generators when shuffling cards and other methods to ensure player protection and fairness. Some sites accept crypto payments to improve privacy and security using blockchain technology, which doubles as a provably fair gaming mechanism.

There are actually many offshore gambling regulators that follow strict rules set in different jurisdictions, some including Curaçao, Malta, Estonia, and Gibraltar. Understanding user-traffic data from different regions can open your spending habits and access to new opportunities you can’t enjoy in your home country. However, it can also reveal whether these opportunities are safe for users from the US, as many sites have to conduct regular audits. Others use transparent policies to ensure users understand what to expect, which matters when using sites registered and regulated in other jurisdictions.

Traffic Patterns Predict Consumer Value and Trust

Consumer trust is important when looking for smarter ways to spend. A recent report shows that 90% of executives believe consumers trust their business, while only 30% of consumers actually do. The trust gap can be closed by consumers focusing on the user-traffic data that reveals how many people actually visit a website, how they interact with the products once there, and whether users stick around or abandon carts. Numbers like monthly visitors and the site’s ranking on Google don’t build trust alone.

Engagement metrics paint the full picture, which includes bounce rates, time on the page, and repeat visits. These numbers tell the real story of how many consumers already trust a specific business. For example, personal financial tools with millions of downloads but low engagement metrics reveal that the product doesn’t work or the services aren’t trustworthy. The initial curiosity exists enough to encourage downloads, but users don’t stick around.

Anyone focused on spending cleverly will use this data as intelligence to make informed decisions about what’s useful or popular. Budgeting apps with slower growth but higher churn rates could be hyped due to extra marketing efforts, but the user traffic data reveals how the app fails to convert consumers to repeated and loyal users. It’s also important to note traffic changes after specific technology or service upgrades.

For instance, many businesses are using blockchain to overcome trust breakdowns among consumers. Watch the metrics after the site deploys these solutions to see whether transparency is used comprehensively to regain user trust. Other changes in user traffic data could become apparent after pricing updates, policy renewals, or advanced feature integrations.

Every metric tracked will offer tangible insights about consumer value and trust, which online reviews can’t always promise due to fake reviews. PWC suggests that 100% of industries are using AI today. The marketing sector is one major player using the intelligent tools to track user-traffic data in real-time so that they can more accurately allocate budgets, increase conversions, and forecast future trends. Data is the source of trust today.

Traffic Data Reveals Hidden Opportunities and Better Habits

Analyzing user-traffic data helps people identify hidden spending patterns and gain insights into broader behavioral habits with possible opportunities behind them. Many businesses use time-series forecasting methods to determine how much cash they need to have available for seasonal trends and cyclical patterns. You could use the same methods to forecast possible trends based on changing user traffic patterns and spending habits if you plan to invest in certain products or services.

Smart spending habits include knowing when to invest in ideas, and user-traffic data can reveal when there’s a sudden increase in spending in certain niches, industries, or specific products. E-commerce and financial platforms gather tons of navigational and transactional data that could provide insights. These data points can include how often users return to specific products, which pages lead to the highest transactions, and spending totals for specific items. Consumption patterns are an excellent guideline for investments.

Strategic investment moves often originate from tangible data. For example, Micron’s latest strategy to move from consumer-based to commercial products is based on numbers and data. The company’s revenue grew by 49% between 2024 and 2025 after it focused more on enterprise and AI products. These numbers aligned with the company’s ability to forecast demand changes using various data points, one of which was user-traffic data from enterprise users relying on AI tools.

Another way you could use this information is to guide your spending habits. Financial institutions often use behavioral analysis to determine how users interact with money, their frequency of high-value purchases, and their response to balance notifications. These metrics could highlight ways you could better manage money daily. Beyond investment potential and smarter budgeting, you could even use these insights to identify more affordable travel habits, seasonal deals, and competitive pricing that reduces your expenses.

Forex trading is one of the most in-demand and fascinating trading options in the world. You might think that it’s rather straightforward because you’re constantly trying to leverage between different currencies to make as much of a profit as possible. However, the forex market is dependent and influenced by many other elements, such as political, social and governmental changes. Every regulation or process change creates an upward or downward movement of a currency. As many people have noticed, these changes seem to be happening at a faster pace, which is especially noticeable in stock, gold and silver. Yet, somehow, these rapid changes have kept the forex market more secure and stable and the liquidity measure is still there. The global forex market is the world’s largest financial market, with recent figures showing an average daily trading volume of around $6.6 trillion to $9.5 trillion. This volume is much larger than other markets, being roughly 30 times larger than the combined U.S. stock and bond markets. Can you imagine something so large and instrumental?

Now, the question that most people ask themselves is how and why the forex market is able to stay liquid, even during times of turbulence around the world. And the answer to that is a lot more varied and intricate than you might think. There are many elements that come together to create the reality of the forex market today. If you’d like to understand this more, then keep reading and you’ll find out more.

Why Forex Liquidity Stays Consistent Even When the World Doesn’t

The forex market operates differently from most financial markets. While stocks rely heavily on specific exchanges, forex is decentralised and runs around the clock across major financial hubs worldwide. That structure alone keeps liquidity flowing because trading never stays stuck in one place.

Liquidity remains strong because forex is built on global currency demand, international trade, cross-border banking, central bank interventions and investment flows from institutions. Those forces don’t disappear when markets become uncertain. In fact, uncertainty often increases currency activity. When investors feel nervous, they shift money into currencies they trust or out of currencies tied to riskier regions. That movement keeps the market alive and, in many cases, even more liquid than usual. Interesting how that works, wouldn’t you say? It can sound pretty confusing, that’s true. Having a trusted trading broker on your side as you’re navigating these markets can be helpful.

While uncertainty might make stock markets jittery, it can push forex activity higher. When large volumes of money move internationally, liquidity naturally strengthens. Just because one commodity looks like it’s going down, doesn’t mean that this is the same with every other commodity. This is something you must keep in mind.

The Sheer Size of Forex Keeps It Liquid

One of the biggest reasons forex liquidity stays solid is simple: scale. The forex market is the largest financial market in the world, with daily trading volumes measured in the trillions. Yes, you heard that correctly. Trillions. Because of this scale, you benefit from tight spreads, faster order execution, less slippage under normal conditions and more opportunities to trade different currency pairs.

When a market is this big, individual events rarely shut down trading activity. News can trigger volatility but it rarely dries up liquidity completely. That’s why forex is often described as one of the most resilient and accessible financial markets, even during global shake-ups.

Institutional Players Help Keep the Market Moving

As much as retail traders influence sentiment, institutions are the real liquidity providers in forex. Banks, hedge funds, multinational corporations, central banks and large investors make up a huge portion of daily trading volume.

Institutional traders hedge currency exposure, trade based on global economic data, react to central bank policy changes, move capital across borders and execute massive orders regularly.

Those activities happen regardless of global uncertainty. A corporation still needs to convert currencies to pay international suppliers. A central bank still needs to intervene during a currency imbalance. A hedge fund still needs to rebalance positions based on interest rate changes. There are many things that these establishments need to do to help the financial market move forward and every time they put their hand in something, this impacts the liquidity of the forex market.

Why Liquidity Matters for You as a Trader

Strong liquidity can make your trading experience feel smoother and more predictable, even when market conditions aren’t calm. You’re able to execute trades quickly and at prices close to what you expect.

Good liquidity helps you enter and exit trades without major delays, which is excellent because delays can be costly. It also reduces unexpected slippage and keeps transaction costs manageable. Plus, you can trade with tighter spreads and manage risk more effectively.

When liquidity is stable, you’re less likely to see extreme price gaps or erratic movement caused by thin trading. It doesn’t eliminate risk but it gives you a more even playing field, especially compared to markets with lower volume.

Liquidity Isn’t the Same as Stability: A Common Misunderstanding

One of the biggest mistakes traders make is assuming that strong liquidity automatically means stable prices. That’s not how it works. Liquidity ensures smooth execution but it doesn’t guarantee predictable price movement.

You can still experience sharp volatility, sudden reversals, rapid breakouts, news-driven spikes and emotional reactions in the market. Forex liquidity helps maintain order but volatility can still shake things up quickly. It’s important to understand that you can have liquid markets and unpredictable movement at the same time.

Why Uncertainty Sometimes Boosts Liquidity Instead of Weakening It

Global uncertainty typically pushes more money into forex, not less. When things feel unstable, traders adjust their positions, investors move into safe-haven currencies and corporations shift capital to protect themselves from currency swings.

During periods of uncertainty, you often see:

- Higher trading volume

- Increased hedging

- Stronger activity around central bank decisions

- Faster price movements

- More interest in major currency pairs

This surge in activity increases liquidity because more orders are entering the market. Even though the atmosphere feels tense, the actual trading conditions can still remain robust.

Safe-Haven Currencies Keep the Market Busy

Safe-haven currencies play a huge role in maintaining liquidity during stressful economic periods. When global sentiment shifts, traders naturally move toward currencies known for stability and resilience.

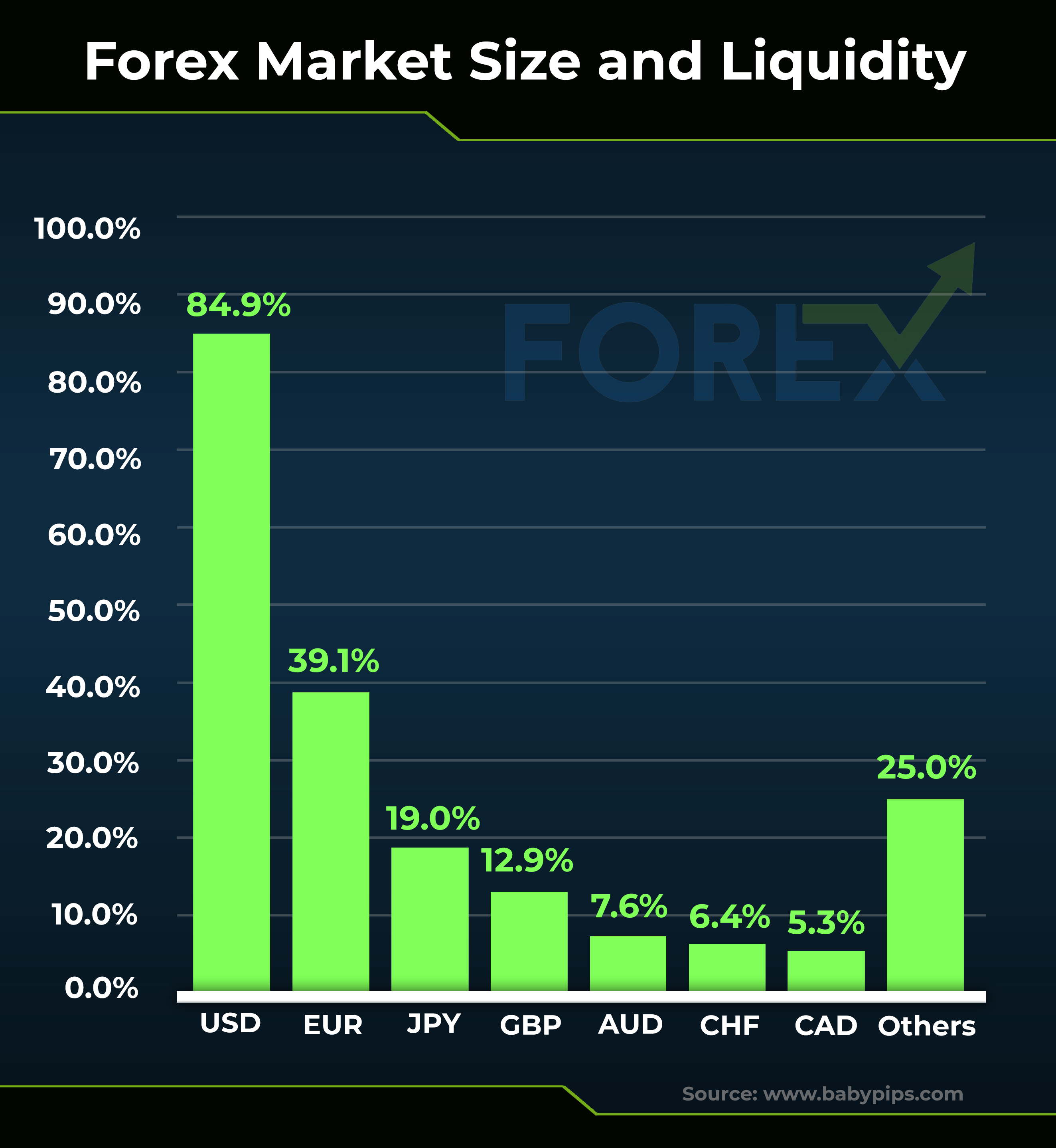

You just need to think about the countries that are seen as ‘financially savvy’ to understand which currencies would match. Think America’s USD, Japan’s JPY and Switzerland’s CHF. These currencies attract increased trading volume when the world becomes unpredictable. In fact, according to the International Monetary Fund (IMF), the U.S. dollar makes up about 62% of the world’s official foreign exchange reserves. According to the 2025 Triennial Survey of turnover in OTC FX markets, the US dollar continued to dominate global FX markets, making up 89.2% of all trades. This was an increase from 88.4% in 2022. The share of the euro fell to 28.9% (from 30.6%) and that of the Japanese yen was stable at 16.8%. The share of sterling declined to 10.2% (from 12.9%). The shares of the Chinese renminbi and the Swiss franc rose to 8.5% and 6.4%, respectively.

That movement adds liquidity to the market, especially in major pairs like USD/JPY and USD/CHF. It is clear to see the currency distribution in the market below:

Forex Keeps Moving Because the World Doesn’t Stop

Currencies aren’t optional parts of the global economy. Every country needs them to function, trade and run its financial system. Because of that, currency exchange never truly pauses.

No matter what’s happening in the world, governments still collect and spend money and businesses still trade internationally. Plus, investors still move capital and banks still process cross-border transactions.

This constant motion feeds directly into the forex market’s liquidity. Even if the world feels unpredictable, daily operations don’t disappear. Money keeps moving and that movement keeps the market alive.

The Role Central Banks Play in Supporting Liquidity

Central banks influence liquidity more than most traders realize. They constantly monitor financial stability and step in when necessary to keep markets functioning. Their actions can include adjusting interest rates, injecting liquidity into the banking system, managing currency reserves and stabilizing exchange rates during extreme volatility.

Even when uncertainty rises, central banks work behind the scenes to ensure currency markets stay orderly.

When Liquidity Can Temporarily Thin Out

Even though forex liquidity is known for its strength, there are still moments when it can tighten temporarily. These situations are rare but worth understanding so you know what to expect.

Liquidity can thin during major holidays, off-hours outside key sessions, unexpected geopolitical emergencies, large-scale economic announcements and periods of extreme volatility. During those moments, you may see slightly wider spreads or more slippage than usual. It doesn’t mean the market is shutting down; it just means trading is momentarily uneven.

How You Can Navigate the Market When Uncertainty Is High

Even though liquidity remains strong during uncertain periods, you still need a thoughtful approach to protect yourself from unnecessary risk. A few simple adjustments can make a big difference:

- Trade during the most active sessions

- Pay attention to economic calendars

- Keep position sizes reasonable

- Use stop-loss orders

- Avoid trading emotionally

- Wait for confirmation before entering trades

You have no control over global uncertainty, but you do have control over how you respond to it.

Liquidity Won’t Disappear But Your Strategy Still Matters

Image source: https://unsplash.com/photos/macbook-pro-on-brown-wooden-table-HASoyURgPMY

The forex market has built a reputation for resilience and it continues to prove that even when the world feels unpredictable, liquidity remains strong. You can count on the market’s scale, its institutional activity and its global nature to keep things moving smoothly.

But strong liquidity doesn’t replace careful planning. It doesn’t eliminate volatility and it doesn’t guarantee success. What it does give you is a more reliable environment to trade in, no matter what’s happening worldwide. But you still need to engage with responsibility, tact and care.

Artificial intelligence is entering a new phase defined not by chatbots but by full stack creative and productivity ecosystems. While many companies are still trying to perfect single purpose apps, Famous Labs is taking a very different approach. It is building an interconnected universe of AI products designed to help anyone create, build and scale faster than ever.

Best known for its platforms Famous.ai and SuperCool Famous Labs is emerging as one of the most fascinating operators in the new wave of what it calls Synthetic Intelligence. This is AI that does not just generate ideas but autonomously produces finished output including apps, videos documents, graphics research and more.

A Multi Product Strategy Built for Modern Creators and Operators

Most AI companies focus on a single tool. Famous Labs is building an ecosystem.

Famous.ai The App Builder Powered by Synthetic Intelligence

Famous.ai helps entrepreneurs, agencies and operators build real functional apps without writing code. Users simply describe what they want and Famous.ai generates a working product complete with interface backend logic workflows and exportable files.

SuperCool Autonomous File Creation Across Every Format

SuperCool functions like a digital production studio on demand. Users generate full documents, pitch decks books Excel models audio files scripts and long form content instantly. It is built for speed, breadth and reliability so ideas turn into finished assets in minutes.

Why This Ecosystem Approach Matters

Most modern creators need more than one tool. A founder building a product needs an app builder, a pitch deck creator, a research engine, a writing tool, a video generator and a marketing suite.

Famous Labs is one of the few companies building all of these under a unified vision so users never need to stitch together disconnected services.

The belief is simple

AI should not give you pieces

AI should give you outcomes

The Rise of Synthetic Intelligence

The Famous Labs team describes its technology as Synthetic Intelligence a step beyond traditional AI. It autonomously produces

- Real apps

- Motion videos

- Long form written content

- Research and analysis

- Presentations

- Financial and business models

- Marketing workflows

- Downloadable creative files

This evolution from AI that helps to AI that builds is reshaping how creators agencies and solo operators work.

Who Is Using It

Famous Labs products appeal to

- Creators launching digital products

- Agencies producing client assets at scale

- Startups building MVPs

- Educators and analysts generating research

- Ecommerce brands needing rapid content

- Operators seeking automation without engineering teams

The ecosystem creates a unique advantage. Users can move from idea to creation to launch without switching platforms.

The Bigger Picture

We are entering a world where creation is no longer limited by technical skill. The next era of digital entrepreneurship will belong to people who can turn ideas into real outputs quickly.

Famous Labs is positioning itself as the operating system for that world. Its focus is not hype but usability speed and empowering the millions of people ready to build if the tools finally meet them where they are.

Where to Learn More

Famous.ai

https://famous.ai

SuperCool

https://supercool.com

Microcaps do not move like normal stocks when their floats shrink to the size of a matchstick. They behave like pressure chambers. Prices do not glide. They lurch. They jump. They collapse and rebound with the velocity of a compressed spring. When SMX (NASDAQ: SMX) surged toward $490, it entered a zone where liquidity disappeared and every marginal order carried exaggerated influence. A few thousand shares can move a stock 10%. A small sell block can create a waterfall. This environment is not built for smooth transitions or orderly price discovery.

Retail traders sometimes assume these moves must mean something sinister. They imagine a coordinated short attack. They picture remote desks hammering the bid, manufacturing synthetic supply, and driving the stock to ruin. That theory collapses when you consider the structure of SMX. The float is tiny. The financing is clean. There are no toxic instruments left that reward downward pressure. The selling pressure today did not originate in a dark corner. It originated in the mechanics of a low float experiencing a dramatic reset.

Once the stock rocket soared through triple digits, the market reached a point where market makers had no choice but to step in. Their job is to keep the market functional. When order flow overwhelms the book, they short intraday to fill liquidity gaps. These shorts are temporary. They are not synthetic permanent supply. They are a regulatory function that keeps the stock from collapsing instantly when buyers disappear. This is the natural response to an overheated market, not a coordinated attack.

Why High Volume Does Not Mean New Shares

One million shares traded, and traders immediately asked where they came from. They imagined a secret issuance or stealth dilution. In a low float environment, that question has a simple answer. Traders recycled the same inventory over and over. Market makers filled orders with borrowed or temporary supply. Hedge desks offset exposure. Every share may trade ten, twenty, or fifty times in a single session. Reported volume does not mean new shares exist. It means the same shares moved back and forth in rapid succession.

This type of volume spike appears dramatic because investors often misunderstand what “volume” truly measures. It counts transactions, not unique shares. If one trader sells one thousand shares to another trader, then that trader sells the same one thousand shares to a third party, the tape prints two thousand in volume. Multiply that by hundreds of participants, and the total grows exponentially. Even though the outstanding share count remains fixed, the total prints climb into seven figures.

There was no dilution today. There was no issuance. There was no equity line draw. There was nothing that expanded supply. The entire event was the natural result of a small float colliding with a liquidity reset. This is why the price drop does not signal structural damage. It signals temporary imbalances clearing themselves out through normal market mechanics. And it may also present a tremendous opportunity for reentry.

Temporary Shorts Must Eventually Be Bought Back

Market makers do not get to stay short indefinitely. Anything created intraday through liquidity provision must be flattened. When the chaos ends, the unwind begins. This is not optional. This is required. Flattening means buying back shares. Buying back shares means upward pressure. This is why low float dumps often see sharp stabilization or partial rebounds once the imbalance clears. The selling phase is temporary. The resolution phase is structural.

This is why retail traders should not mistake the first leg of a drop for its final direction. The first leg is created by order flow imbalance. The second leg is created by the unwind of the very positions that caused the drop. When downward momentum dries up, the market’s function shifts from filling sell orders to clearing short exposure. That clearance creates its own demand cycle, often stronger than expected.

The flattening process will not necessarily return the stock to $300 or higher immediately. What it will do is remove the artificial weight caused by temporary shorts. Once that clears, price discovery returns. A stock like this rarely stays pinned at its lowest print because nothing permanent caused the drop. No new shares came to market. No toxic conversion was triggered. No long-term structure changed. What dropped the stock is not the same force that keeps it down.

Retail Is Still Intact

Retail holders often panic during violent moves because they assume they have been diluted or flooded with synthetic supply. In this case, neither is true. Nothing changed in the underlying share structure. The financing terms did not shift. The ownership cap remains intact. The equity line remains optional. The notes remain non-toxic. No mechanism exists here to print unlimited shares or reset conversion levels lower. Retail is not sitting in front of a dilution steamroller. Retail is sitting inside a volatility wave.

The price movement from $490 to its current $125 looks dramatic, but the float itself caused the magnitude, not a hidden opponent. Stocks with limited supply behave this way when momentum arbitrages come unwound. Retail traders who understand float mechanics recognize this as a temporary structural event, not a shift in long-term value. That distinction matters because it changes how rational holders interpret the aftermath.

When the dust settles, the stock will find a new equilibrium. That equilibrium may be well above the low because the downward force was not organic. It was mechanical. The unwind that follows is upward by design. Once market makers complete their flattening and liquidity returns to normal, the stock begins trading on fundamentals and sentiment again. Retail has every reason to remain confident because nothing about today has altered the structure that underpins value.

Volatility Is Not Treachery

The most important message for any trader trying to decode today’s tape is simple. Volatility is not treachery. Microfloats do not follow the etiquette of large caps. They amplify both directions. What happened yesterday and today was, and is, the system doing exactly what it always does when a stock with almost no float spikes, gets ahead of its own liquidity, and snaps back to a manageable range.

There is no conspiracy here. No unseen dilution. No malicious short regime. This was liquidity, not sabotage. It was unwinding, not poisoning. It was structural, not sinister. Traders who understand this dynamic see the opportunity beneath the noise. When the imbalance clears, the upward path reopens.

Artificial intelligence is reshaping how digital transactions are monitored, verified, and protected, and the online gambling sector is one of the clearest examples of this shift. As more users move toward mobile and browser-based wagering, payment providers and gambling operators are turning to AI to reduce fraud, flag suspicious activity, and strengthen data security. Machine-learning models are increasingly being adopted across financial services to strengthen transaction integrity, and these same advancements are now making their way into gambling payment systems.

AI’s Role in Strengthening Fraud Detection

AI tools help online gambling platforms analyze thousands of micro-signals within a transaction, device behavior, login patterns, and session frequency to spot inconsistencies humans would miss. For users, this means fewer false declines and smoother verification when funding accounts or withdrawing. In early operational reports across the industry, platforms that use AI-driven monitoring describe fewer chargeback attempts and improved system responsiveness, which helps payment processors stay ahead of emerging fraud tactics.

To reflect this shift, the sector has seen a growing number of reviewers compiling evaluations of digital gambling platforms, including a huge accumulation of promos that were thoroughly reviewed. These reviews often highlight where AI-enhanced systems are contributing to safer, more reliable user transactions.

How AI Enhances Data Protection and Compliance

As gambling becomes increasingly digital, the ability to safeguard user data is essential. According to reporting on financial-technology security advancements, AI-based payment systems allow operators to encrypt information more strategically and monitor for potential breaches in real time. These capabilities help support compliance with strict data-handling regulations in regions where online wagering is legal.

AI also improves risk scoring for transactions involving new accounts or unfamiliar devices. This automated decision-making reduces the need for manual reviews and enables operators to respond quickly to threats without slowing down legitimate payments. For users, the result is a more stable and predictable system, where identity checks feel less intrusive yet remain secure.

AI and Real-Time Payment Verification

One of the biggest advantages of AI in online gambling is its ability to validate payments instantly. Machine-learning models can assess withdrawal requests, verify account ownership, and scan for abnormal behavior within milliseconds. This is especially important for platforms operating across multiple jurisdictions, each with different regulatory requirements.

Modern payment systems increasingly rely on automated decisioning powered by machine-learning applications, reflecting the ongoing AI trends, and at the same time helping gambling operators reduce waiting times and ensure faster approval of withdrawals and transactions.

A More Secure Future for Digital Gambling

AI is not eliminating risk in online gambling, but it is narrowing the window for fraud and making payment systems far more efficient. With more operators incorporating automated decisioning, predictive analytics, and behavioral risk scoring, users benefit from safer transactions and faster verification.

The ongoing integration of AI into payment infrastructure suggests the industry is moving toward a more accountable, transparent system. As fintech and digital payment systems evolve, it’s becoming clear that AI will remain central to how gambling platforms protect user transactions and shape the next generation of online gaming experiences.

In 2025, choosing a reliable Virtual Private Network (VPN) is essential for protecting privacy, securing personal data, and accessing global content, including sports streaming. With cyber threats increasing and streaming platforms tightening restrictions, the right VPN can make a significant difference in speed, security, and overall online experience. As more websites track user activity and governments introduce stricter digital regulations, having a trustworthy VPN has shifted from being optional to becoming a core part of everyday online protection. The best VPNs today not only safeguard your identity but also ensure uninterrupted streaming, faster browsing, and greater freedom across the internet.

Below are the five best VPN services in 2025, evaluated on performance, features, and overall value.

1. ExpressVPN – Best Overall VPN (Editor’s Pick)

Overview

ExpressVPN remains the #1 Best VPN provider in 2025 thanks to its unmatched combination of speed, security, and ease of use. It’s also ranked as the Best VPN for 2025 by CNET. Its Lightway protocol delivers fast and stable connections ideal for streaming, gaming, torrenting, and general browsing. The VPN reliably unblocks major streaming platforms with minimal buffering and strong global server performance.

TrustedServer technology, which runs servers entirely on RAM, ensures that no data is ever stored or retained. A strict no-logs policy, kill switch, split tunneling, and strong device support make ExpressVPN the most complete premium service available.

Exclusive DEAL (73% off with 4 Months Free – $3.49 per month)

Pros

- Extremely fast and stable global speeds

- Excellent streaming and unblocking capabilities

- Strong privacy with RAM-only servers

- Very easy to use across all devices

- Highly reliable kill switch and split tunneling

Cons

- Slightly more expensive than competitors

- Fewer simultaneous device connections than some rivals

2. Private Internet Access (PIA)

Overview

Private Internet Access ranks second due to its high degree of customizability, large server network, and transparency. PIA allows users to tailor encryption levels for speed or maximum security, making it appealing to advanced users and torrenters. Its open-source applications add trust and accountability, giving users full visibility into the VPN’s code.

PIA includes built-in ad and malware blocking, a strong no-logs policy, and support for up to ten simultaneous devices. While not always the fastest on long-distance connections, its flexibility and feature set make it one of the most dependable VPNs of 2025.

Exclusive DEAL (83% off with 2 Months Free – $2.19 per month)

Pros

- Highly configurable encryption and VPN settings

- Massive server network for strong global coverage

- Open-source apps for added transparency

- Great value with long-term pricing

- Supports many simultaneous connections

Cons

- Not as fast as ExpressVPN on some international servers

- Interface can feel complex for beginners

3. CyberGhost

Overview

CyberGhost secures the third spot for offering a wide server network, streaming-optimized servers, and strong privacy features at an affordable price. It provides a simple, beginner-friendly interface while still offering quality performance for streaming, browsing, and general online security.

With servers dedicated to streaming and torrenting, CyberGhost makes it easy for less technical users to connect to the best option for their needs. It uses AES-256 encryption, has a clear no-logs policy, and offers automatic Wi-Fi protection, ensuring secure connections in public settings.

Exclusive DEAL (83% off with 2 Months Free – $2.19 per month)

Pros

- Large server network across many countries

- Dedicated streaming and torrenting servers

- Very easy to use for beginners

- Strong privacy protection and encryption

- Good pricing for long-term plans

Cons

- Not as customizable as PIA

- Speeds can vary depending on server selection

4. NordVPN

Overview

NordVPN ranks fourth for its advanced security features, fast NordLynx protocol, and extensive server options. It includes specialty servers for double VPN routing, Onion over VPN, and P2P activity, giving users advanced privacy control. NordVPN’s speeds are consistently strong, making it ideal for gaming, streaming, and everyday browsing.

The service includes a kill switch, split tunneling, ad blocking, and a firm no-logs policy. It works across all major platforms, including desktops, mobile devices, and smart TVs, with easy-to-navigate apps.

Pros

- Strong security features, including double VPN

- Fast NordLynx protocol for high-speed connections

- Great for streaming, gaming, and downloads

- Wide server coverage with specialty servers

- Reliable privacy protections

Cons

- More expensive than budget VPNs

- Some advanced features may overwhelm new users

5. Surfshark

Overview

Surfshark is the fifth-best VPN of 2025, offering excellent value with unlimited device connections, strong encryption, and an intuitive interface. It includes security features such as CleanWeb for blocking ads and trackers, a kill switch, and a no-logs policy. Surfshark maintains strong speeds on most servers, making it a dependable option for streaming and browsing.

Its affordability, combined with its feature set, makes Surfshark a suitable choice for families, households with many devices, or users on a budget who still want top-tier security.

Pros

- Unlimited simultaneous device connections

- Excellent value for its price

- Strong privacy and encryption features

- CleanWeb blocks ads, trackers, and malware

- User-friendly apps

Cons

- Not as consistently fast as ExpressVPN

- Some features are locked behind higher-tier plans

Frequently Asked Questions About VPNs

1. What is a VPN and why do I need one?

A VPN, or Virtual Private Network, encrypts your internet connection and routes it through a secure server. This protects your data from hackers, keeps your online activity private, and allows you to access content restricted by region. In 2025, VPNs are essential for secure browsing, especially on public Wi-Fi networks.

2. Can a VPN slow down my internet connection?

Using a VPN can slightly reduce speed due to encryption overhead and server distance. However, top VPNs like ExpressVPN and PIA optimize their networks to minimize speed loss. Selecting a server near your location or using faster protocols like Lightway or WireGuard can reduce latency.

3. Are VPNs legal?

VPNs are legal in most countries, including the US, UK, Canada, and EU nations. Some countries, such as North Korea or Turkmenistan, restrict VPN use. It is always important to understand local laws before using a VPN in restrictive regions.

4. Can I use a VPN for streaming?

Yes, VPNs are widely used to bypass geo-restrictions and access streaming platforms. Leading VPNs like ExpressVPN, CyberGhost, and PIA offer servers specifically optimized for streaming services like Netflix, Disney+, Hulu, and BBC iPlayer.

5. How many devices can I connect to a VPN?

The number of simultaneous connections varies by provider. ExpressVPN allows up to 14 devices, PIA and Surfshark offers unlimited connections. Choosing a VPN with sufficient device support ensures all your gadgets remain protected.

6. Does a VPN keep my online activity completely anonymous?

While VPNs provide strong privacy and encrypt your connection, complete anonymity cannot be guaranteed. VPNs hide your IP address and location from websites and ISPs, but other factors like cookies, trackers, or browser fingerprinting can still reveal information. Combining a VPN with good privacy practices maximizes protection.

- Gaming revenue in the United States rose by 7.2% to hit $18.96 billion in Q3 of 2025.

- Traditional gaming recorded the most revenue in Q3, while iGaming recorded the most growth of all gaming verticals.

- The data shows that with expansions and technological innovation, gaming revenue in America could increase in the coming year.

The American Gaming Association (AGA) posted its revenue report, where gaming revenue rose by 7.2% year-on-year (YoY) to reach almost $19 billion. According to the AGA, this report from Q3 2025 is the 19th time that quarterly revenue rose YoY, and it is also the highest Q3 revenue ever recorded in American gaming.

Gaming is one of the most lucrative sectors in America’s entertainment industry, and since the start of 2025, states like Nevada, New Jersey, Pennsylvania, and Michigan have been breaking revenue records. This pattern has continued in Q3 2025.

Breaking Down The Numbers

The report also shows that online gaming and sports betting were the highest-gaining verticals in the gaming industry. Traditional gaming revenue increased by 3.5% to almost $13 billion, while sports betting and iGaming increased by 6.85% and 29.6% to $3.45 billion and $2.69 billion.

The gaming revenue for Q3 was affected by a slow September, where sports betting and brick-and-mortar casinos saw their revenue decrease YoY. Despite the dip, the overall Q3 report is impressive, indicating that there is still more room for growth in the industry.

Some of this growth is linked to how big the iGaming sector has become. More Americans like the convenience of playing online, so new casinos online keep entering the market. These newer platforms focus on players who want something a bit different from the big brands, with updated features and clearer reward systems.

Revenue From Casino Table Games and Slots

At the national level, the revenue from slots grew by 4.0% YoY while generating about $9.5 billion. Table games also grew 1.3% YoY and generated about $2.5 billion in revenue in Q3.

Land-based casinos saw their combined revenue increase by 3.5% to almost $13 billion. The revenue from these casinos grew YoY in July and also in August before shrinking in September.

Across the states, Nebraska, Virginia, and Illinois were the biggest gainers as 22 out of the 27 traditional casino markets saw their revenue go up on a YoY basis. Nebraska posted revenue growth of 63.5% while Virginia and Illinois recorded growth of over 35.5% and 20.4% respectively.

The sustained growth of traditional casinos shows that both online and traditional casinos can coexist and support the growth of the gaming sector and overall entertainment industry.

iGaming Continues to Expand

iGaming is one of the fastest-growing gaming verticals in America, and although some states have yet to legalize it, the data shows that they are missing out on significant revenue, which can be channeled in the form of taxes to benefit their economy.

In Q3, iGaming generated almost $3 billion from all seven states where it has been legalized. Compared to the revenue from Q3 2024, iGaming revenue grew by 29.6%. Out of all the seven states, Delaware gained the most as its iGaming revenue for Q3 grew by almost 89%.

With states like New Jersey, Pennsylvania, and Michigan setting new monthly records, total iGaming revenue in the country on a year-to-date basis stood at $7.82 billion, which is 29.7% higher than the revenue from Q1-Q3 2024. Pennsylvania broke its previous record of $238 million, which was set in March, by achieving $251 million in October. That record may also be broken in Q4.

Sports Betting Income Contracts Slightly

There was a sharp decline in sports betting revenue in September, and it caused the Q3 revenues for sports betting to contract slightly. The hold rate for sports betting in September fell to 8.36% while revenue declined by 21.15%.

Despite the weak performance in September, revenue from Q3 sports betting grew by 6.6% to reach a new record of $3.5 billion. Sports betting in Q3 also increased by 13.9% as the AGA reported that Americans spent $33 billion on sporting bets between July and September.

States With The Biggest Gains

Based on the commercial gaming revenue, 33 states saw their revenue increase in Q3. Some of the biggest gainers are Connecticut (24.6%), District of Columbia (23.7%), Illinois (17.0%), Michigan (18.2%), Nebraska (63.5%) and West Virginia (16.4%) while Oregon, Maine, North Carolina and Tennessee recorded declining revenues. The lowest was Oregon with 16.3% decline. The gaming sector in each of these states is good for their economy since it not only provides jobs to residents, but the state also generates taxes.

Revenue Generated from Taxes

An increase in revenue usually translates to an increase in tax payments, and in Q3, commercial operators paid about $4 billion in gaming taxes, which led to a 7.4% increase YoY. The taxes in this bracket exclude sports betting taxes and annual tax levies, which are paid to the national government.

What This Means For The Future

The gaming sector has faced some of the biggest regulatory challenges in 2025, but despite these challenges, revenue keeps increasing. This increase in revenue shows that the gaming sector has potential for the future.

Apart from being resilient, it also brings investments. Positive revenue number means that investors will be more open to backing operators and also introduce new innovations. These innovations would, in turn, lead to financial growth, which would push the gaming sector to break new revenue records.

Experts predict that with a strong finish in Q3, the total gaming revenue could cross $70 billion for the second year in a row. With brick-and-mortar casinos still leading the charge and more people warming up to online casinos, experts believe 2025 will end as a record-breaking year for gaming in America.

The 7.2% increase in Q3 revenue is a good sign for the gaming market in 2025. Lawmakers would need to focus on creating an enabling environment for the gaming industry to thrive and also attract more investment in the final quarter of 2025 and in 2026.

Bank of America plans to let its advisers talk openly about regulated crypto allocations next year, giving eligible clients the option to place a modest 1 to 4 percent of their portfolios into digital assets. The update applies across Merrill, Bank of America Private Bank, and Merrill Edge, which means a large number of investors will soon have access to guidance that previously required a client to start the conversation.

Before this policy change, advisers could respond to questions about digital assets but were discouraged from bringing them up unprompted. That arrangement left crypto in a kind of gray zone: available, but tucked away unless someone went looking for it. With more than 15,000 advisers now allowed to approach the topic as part of broader planning, digital assets will sit closer to traditional areas like equities and commodities. Even so, Bank of America continues to point out that crypto swings harder than most asset classes, so any allocation should be sized with care rather than excitement.

Away from financial markets, digital currencies continue appearing across daily online habits. People use them for subscription platforms, small retail purchases, and gaming services. Bitcoin casinos are part of that trend, operating with fast payments and support for a range of coins. Given the technology backing these decentralized currencies, coins like USDC, AVAX, and Polygon now play meaningful roles across different digital environments (source: https://casinobeats.com/online-casinos/bitcoin-casinos/). When adoption grows in these areas, it becomes easier to see why major banks feel more comfortable treating crypto as a legitimate point of discussion.

The bank’s recommended 1 to 4 percent range leaves room for different comfort levels. Investors who prefer a cautious entry can take the minimum route, while those prepared for sharper movements may choose something higher within the approved range. Bank officials continue to highlight the importance of knowing how unpredictable these markets can be. The emphasis is on understanding exposure, not chasing eye-catching numbers or the next big story.

A defining part of the updated approach is its reliance on regulated exchange-traded products instead of direct token storage. On January 5, 2026, advisers will begin covering four spot Bitcoin ETFs: BlackRock’s IBIT, Grayscale’s Bitcoin Mini Trust, Fidelity’s FBTC, and Bitwise’s BITB. These products have handled strong trading volume in the U.S. and allow clients to gain price exposure without managing digital wallets or private keys.

Bank of America’s move lands in familiar territory for other financial institutions. Morgan Stanley, Fidelity, BlackRock, and Vanguard have all released guidance in recent months, even while Bitcoin cooled from its early October high above 126,000 dollars. The asset remains down roughly ten percent for the year, yet interest continues at both professional and retail levels, suggesting that many investors now see crypto as a long-term consideration rather than a quick speculation.

The timing lines up with broader improvements in the country’s digital asset infrastructure. Regulated ETFs have helped reduce custody concerns and made price exposure simpler. Meanwhile, blockchain based tools and payments continue appearing across online commerce and entertainment. With those pieces in place, Bank of America’s updated approach treats digital assets as one element in a wider collection of choices. It acknowledges the growing presence of crypto across markets and online behavior while keeping client suitability front and center.

WhiteBIT, the largest European crypto exchange by traffic, has officially launched in the U.S. market. The platform whitebit.us is now accessible to millions of Americans.

WhiteBIT US is a separate, independent company within the global fintech ecosystem W Group, which currently serves 35 million clients worldwide.

The U.S. team, with offices in New York and Miami, plans to implement a business strategy focused on gradual expansion, functional development, and building strong, trust-based relationships with customers. In particular, during the launch in the U.S., the exchange’s native coin, WBT, has already been included in five S&P crypto indices, including the S&P Cryptocurrency Large Cap Index and the Cryptocurrency Broad Digital Asset (BDA) Index.

What are WhiteBIT’s expectations and plans for the U.S. market? What challenges have been encountered, and how will the local product evolve? We spoke with Volodymyr Nosov, the founder and president of W Group.

1. WhiteBIT has announced its entry into the US market. What are your business expectations for this market?

The U.S. is the largest cryptocurrency market in the world by key indicators, including capital volume and financial infrastructure. It generates the largest amount of institutional liquidity, with a high level of mass crypto adoption and enormous overall potential.

In the past year, the North American market generated more than $2.2 trillion in revenue, and the volume of cryptocurrency transactions in the region in 2025 increased by nearly 50% compared to the previous year.

Approximately 10–25% of Americans own cryptocurrency, and the U.S. ranks second globally in crypto adoption, according to Chainalysis, trailing only India.

Naturally, entering the U.S. market aligns with our long-term strategy. The growth opportunities here are enormous. Over the past year, the U.S. has made an incredible leap in blockchain innovation, and such momentum inspires us as we integrate into this market.

So we expect active development and anticipate strong results within a reasonable timeframe.

2. The U.S. market is highly competitive. How have you organized your business here, and what is your strategy?

We have obtained the Money Transmitter License (MTL) because our expansion in the U.S. must meet the highest standards. As we continue to grow, the number of licenses we hold will increase, as we aim to operate across the entire U.S. territory.

As for the organization of the business, WhiteBIT U.S. is an independent company, separate from WhiteBIT Global, with its own autonomous team, compliance, and legal structure. There will also be a separate supervisory board.

We plan to create new job opportunities in the U.S., expand our team, and develop innovative products that will strengthen the technological standing of the U.S. globally.

It’s a huge market, and there is much to be done. Particularly attractive for development are California, with its large population and strong tech orientation; New York, a financial hub with high standards for the crypto industry; Florida, known for its numerous pro-crypto initiatives; Wyoming, which has progressive blockchain legislation; and others.

3. What challenges have you faced in entering the U.S. market? Was it difficult, and how expensive was it?

One of the key challenges is to enter the U.S. market with competitive products. Our team has been working actively on this. The competition in the U.S. is immense, requiring an extremely innovative approach.

Additionally, the U.S. regulatory landscape is one of the most complex and dynamic in the world. Licenses are issued at the state level, and each state has its own regulatory rules, procedures, and requirements for applicants, including AML and KYC. Obtaining the Money Transmitter License required significant effort.

Adapting the product to the local market also demands substantial resources. Competition in the U.S. is fierce, requiring a highly innovative approach.

Financially, it is certainly a high-cost project. We are moving step by step, and our strategic plan is to raise around $2.5 billion in the U.S. over the next few years to scale operations, conduct marketing, develop products, and compete effectively.

4. How do you plan to earn the trust of American users and investors?

Our presence in the U.S. is the result of seven years of work by a team of top engineers and technical specialists. We have come to the U.S. to strengthen our leadership and to play big. And, of course, we introduced ourselves at Times Square.

We bring seven years of experience to the American audience. Our highest priority is security. WhiteBIT ranks in the top three globally for security among crypto exchanges, according to CER.live, and is the first crypto exchange in the world to achieve the highest level of certification under the Cryptocurrency Security Standard (CCSS), Level 3.

WhiteBIT has a powerful technical core capable of processing over a million orders per second, making it one of the fastest exchanges in the industry.

We are proceeding gradually. Currently, users have access to spot trading, instant exchange, and on/off-ramp services.

Over time, functionality will expand—particularly with fiat integrations, KYB (corporate onboarding), and institutional services, including custodial solutions and liquidity offerings.

5. We know your launch is accompanied by a communication video on Times Square.

New York is the financial heart of the world, where global capital converges. WhiteBIT maintains an office here. Naturally, launching our communication at Times Square is a powerful symbol of our readiness to operate at the level of the world’s financial center, side by side with the best in our field, the titans of financial business.

Our branding campaign launched at the end of November to mark WhiteBIT’s 7th anniversary and our new pivotal stage of development: entry into the American market. It highlights one of our core values — innovation and the trust placed in it. The campaign includes several short films showing how people’s daily lives improve through blockchain technology and how innovation creates a new digital economy.

Ultimately, our mission is to create accessible and secure modern financial tools that make users’ lives easier.

6. Parallel to the launch in the U.S. market, WBT has been included in 5 S&P indices. What prospects do you see as a result of this?

Yes, since the end of November, our native coin, WBT, has been included in five S&P indices: Broad Digital Asset, BDA Ex-MegaCap, LargeCap, LargeCap Ex-MegaCap, and Financials. This is the result of our professional team’s work and a very positive signal for both our coin and the market as a whole. It confirms the strong institutional relevance of WBT.

For example, inclusion in the S&P Cryptocurrency LargeCap Index reflects WBT’s substantial market capitalization (currently over $13 billion) and the coin’s high liquidity.

For us, it is especially important that WBT is no longer viewed merely as a currency or asset; it is now recognized as a recommended instrument for serious financial decisions. We expect WBT to soon appear in the portfolios of major fintech investors and hedge funds, which will further strengthen its liquidity and market capitalization.

It is crucial for us to build bridges between Web2 and Web3. Today, WBT’s role as a “bridge” between the crypto market and more traditional financial instruments — such as ETFs, funds, and index products — has become even more significant.

7. How quickly did WhiteBIT scale, and how was the W Group ecosystem formed?

WhiteBIT began as a local startup in Ukraine. Over time, it grew into the largest cryptocurrency exchange in Europe by user traffic. Today, WhiteBIT serves over 8 million customers across 150 countries. In 2024, annual trading volume on WhiteBIT reached $2.7 trillion.

Around WhiteBIT, we have built the W Group fintech ecosystem, which includes our own blockchain, Whitechain; the cryptocurrency payment gateway Whitepay; the marketplace white.market for trading CS2 skins; and two projects in Georgia — the first fully digital local bank, HashBank, and the first non-banking financial institution, PayUniCard.

We also run media projects: the ByHi Show, the world’s first entertainment show about the blockchain industry, and The Coinomist, an analytical and news platform covering the cryptocurrency market.

Today, our global group of companies employs over 1,300 people. WhiteBIT USA will also create many job opportunities, attracting top specialists from around the world and strengthening blockchain development in the U.S. market, as well as its technological role globally.

8. In which other markets does WhiteBIT operate?

Our products are popular in many countries, including Australia, Turkey, Georgia, Kazakhstan, Croatia, Italy, Argentina, Brazil, and others.

In total, we offer users a well-developed product line, and we are especially proud of our utility coin, WBT. Its value has increased more than 27 times since its launch. By the way, in October this year, WBT entered the top 9 most efficient cryptocurrencies, performing even in bear market conditions (according to Yahoo Finance), and was also ranked among the top 12 coins on CoinDesk.

9. You have many notable partnerships — VISA, Juventus FC, FACEIT. What can you tell us about plans for partnerships with U.S. companies or financial institutions?

Collaboration with strong partners helps us reinforce our positions in international markets while influencing the financial habits of millions of users, advancing their personal financial culture, and introducing them to the most innovative financial tools.

As for the U.S., we certainly plan to develop partnerships with local companies and key stakeholders. This market is extremely important for us, and we aim for deep integration of our services into the local financial infrastructure.

I cannot reveal details yet, but we have ambitious plans to build impactful partnership stories.

10. What impact do you expect WhiteBIT’s entry into the U.S. market to have on the overall development of the W Group ecosystem, and how might this change your role in the global crypto market?

The primary impact of WhiteBIT U.S. on our W Group ecosystem is that time-tested technologies and a strong American company will help elevate blockchain products to a new level, not only in the U.S. but also worldwide.

The primary goal of any business is to grow in volume and quality metrics. The U.S. is actively shaping financial and technological innovation and is one of the world’s largest and most lucrative markets.

Developing in the U.S. will allow us to attract new users, strengthen trust in our ecosystem from both retail customers and institutional investors, as well as regulators.

We are always open to development and want to achieve more. One of our goals is to become a public company and pursue an IPO.

11. Finally, I’d like to ask about ICTC 2025 by WhiteBIT, which has become a significant event in crypto trading. What is the goal of this event, and do you plan to continue organizing ICTC in 2026?

For the first time in history, we organized a live international crypto trading championship. We gathered top traders and demonstrated their skills in real-time, in front of a large audience. There were teams and individual players, and the viewers could see everything — strategies, decisions, and the whole process.

We set ourselves a big goal: to make crypto trading as exciting as major esports tournaments and attract a huge audience. Additionally, ICTC gave our community a chance to participate — one of the eight participants was chosen through a global qualifying round, showing that anyone with the right talent and passion can reach the top.

For us, it was essential to set a new standard for crypto trading events. In an unprecedented moment, the winner’s name was displayed on LED screens during the “El Clásico” football match — a combination of esports excitement, cryptocurrency, and world-class football.

With ICTC, we have set a global standard for live events in the cryptocurrency world. And yes, we plan to continue this in 2026.