Semiconductor and IoT module developer Sequans Communications has announced plans to raise $384 million to fund a strategic investment in Bitcoin, underscoring growing corporate interest in using the cryptocurrency as a treasury asset.

The company said it would raise the funds through a combination of equity and convertible debt, with $195 million in equity issuance and $189 million in convertible debentures.

Sequans is collaborating with Swan Bitcoin, a firm that specializes in Bitcoin treasury management, for the execution of this plan.

“Our bitcoin treasury strategy reflects our strong conviction in bitcoin as a premier asset and a compelling long-term investment,” said Sequans CEO Georges Karam.

Corporate Bitcoin Adoption Accelerates

Sequans joins a growing list of companies diversifying their treasuries with Bitcoin.

Over the weekend, Nakamoto Holdings raised $51.5 million for the same purpose, while Metaplanet added 1,111 BTC to its balance sheet on Monday, putting it just shy of Tesla’s Bitcoin holdings.

According to BitcoinTreasuries.NET, roughly 240 companies now hold Bitcoin on their balance sheets.

That figure has nearly doubled in recent weeks.

Together, these firms control around 4% of the global Bitcoin supply.

Market Veteran Sees Trend Shift

Adam Back, CEO of Blockstream and a prominent figure in the early Bitcoin community, commented on the trend on X (formerly Twitter).

“Time to dump ALTs into BTC or BTC treasuries,” Back posted, referring to an emerging pattern where institutions are shifting away from altcoins and favoring Bitcoin.

He characterized the surge in Bitcoin-focused treasuries as a new kind of “alt-season.”

Big Tech Stays on the Sidelines

Despite the growing momentum, many major technology firms are still hesitant.

Amazon, Meta, and Microsoft have refrained from adding Bitcoin to their treasuries, largely due to concerns over its price volatility and ongoing regulatory uncertainty.

Unlike traditional assets, Bitcoin’s market swings can expose shareholders to risks that typical corporate treasuries are designed to avoid.

Strategy Remains the Largest Holder

MicroStrategy, now known as Strategy, continues to dominate corporate Bitcoin holdings.

The company holds approximately 592,345 BTC, valued at about $60.2 billion at current prices.

Strategy has consistently used convertible debt to acquire Bitcoin, underscoring its commitment to a long-term accumulation strategy.

Growing Institutional Confidence

While the debate over Bitcoin’s role in corporate finance continues, the rising number of firms entering the space suggests that institutional confidence in the cryptocurrency is growing.

Sequans’ move marks another major step in the ongoing integration of Bitcoin into mainstream financial strategy.

PANAMA CITY, June 20, 2025 /PRNewswire/ — Flipster, a global cryptocurrency trading platform, has partnered with the Aptos Foundation to accelerate stablecoin adoption and enhance multichain capital access worldwide — empowering traders with faster, more accessible, and more flexible ways to participate in global blockchain ecosystems and seize market opportunities across different chains.

As a key milestone of this partnership, Flipster now supports USDT deposits and withdrawals via the Aptos network. This integration adds another high-speed, low-friction option for stablecoin transfers on Flipster, giving users greater mobility across networks. It also enables seamless access to the Aptos ecosystem and participation in Aptos-based protocols.

“Aptos was purpose-built to power the future of global finance,” said Ash Pampati, Head of Ecosystem at the Aptos Foundation. “Through Flipster’s integration of USDT on Aptos, we’re unlocking new levels of access, speed and opportunities for users around the world, allowing them to engage with decentralized finance in faster, more impactful ways.”

“Stablecoins are how traders stay agile,” said Youngsun Shin, Head of Product and Partnerships at Flipster. “They have become essential infrastructure for modern trading, enabling lower-cost capital movement across ecosystems and unlocking new market efficiencies for global users. With USDT transfers on Aptos now live on Flipster, users gain another high-performance rail to deploy capital swiftly and seamlessly.”

Flipster has also recently listed $APT on its spot market, providing users with direct access to the Aptos token and a new entry point into its growing ecosystem.

To celebrate the partnership, Flipster is introducing a series of limited-time campaigns designed to deepen user engagement with the Aptos ecosystem:

- $30,000 USDT Launchpool (June 19–24): Verified users who stake $APT can earn USDT rewards, with bonus multipliers based on trading volume or VIP tier.

- $20,000 USDT Referral Program (June 19–24): New and existing users can earn up to 10 USDT by inviting friends who complete identity verification.

- New User Bonus (Ongoing): Eligible participants can earn up to 150 USDT by completing onboarding tasks through the Flipster Rewards Hub.

The Flipster-Aptos partnership reflects a shared vision for a more connected and capital-efficient trading ecosystem — where stablecoins play a pivotal role in enabling frictionless access to cross-chain ecosystems, liquidity, and opportunities across global markets.

To learn more or join the campaign, visit https://flipster.io/en/marketing/flipster-aptos-rewards.

About Flipster

Flipster is the zero-friction exchange built for traders who move fast and demand precision. With deep liquidity, ultra-tight spreads, and instant execution, Flipster performs even in fast-moving markets — no lag, no slippage. Every trade is tuned for precision — with zero wasted ticks.

Learn more at flipster.io or follow X.

About Aptos Foundation

Aptos Foundation is dedicated to supporting the development of the Aptos protocol and driving engagement with the Aptos ecosystem. By unlocking a blockchain with seamless usability, Aptos Foundation aims to bring the benefits of decentralization to the masses.

About Aptos

Aptos is a high-performance proof-of-stake layer-one blockchain. Aptos’ breakthrough technology, scalable infrastructure, and user safeguards are designed to power the next generation of financial systems by offering unparalleled high throughput and low latency that can scale to billions of users.

Press

Dubai, UAE, June 20th, 2025, Chainwire

In the rapidly evolving Web3 landscape, Meta Earth is carving a bold path with ME Network 2.0, a modular blockchain ecosystem designed to redefine decentralized economies. Launched on May 19, 2025, at block height 6,624,500, this upgrade marks the Odyssey phase, a pivotal moment of technical breakthroughs and community-driven growth. With a robust suite of technical advancements, generous Airdrop rewards, enhanced ME Pass 3.0 features, and a lineup of high-profile 2025 events, Meta Earth is inviting users worldwide to join its transformative journey. Here’s why ME Network 2.0 marks a pivotal shift—and what it means for those looking to participate.

ME Network 2.0: A Technical Powerhouse

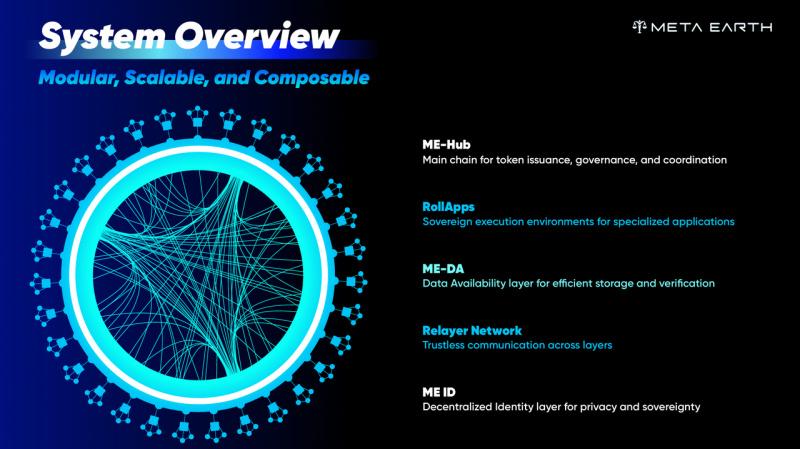

ME Network 2.0 introduces a modular architecture that decouples the execution layer (RollApp), settlement layer (ME-Hub), and data availability layer (ME-DA), delivering unmatched scalability, security, and ecosystem compatibility. This three-layer design enables sovereign Rollup chains to process transactions in parallel with customizable virtual machines (EVM/WASM), slashing storage costs by 98% through data availability sampling (DAS) and 2D erasure coding. The result is skyrocketing throughput, optimized costs, and rapid iteration for decentralized applications (DApps).

The network’s economic model is equally revolutionary. MEC, the native token, unifies all layers, with cross-chain mappings (MEC-CI for RollApp gas fees and governance, MEC-DA for the data layer) replacing native tokens to create a closed value loop. Users pay only local RollApp gas fees, while Sequencers handle cross-layer costs, streamlining transactions. The decentralized Sequencer network, powered by CometBFT consensus, enhances security with slashing mechanisms for malicious nodes, fraud proofs, and zero-knowledge proof (ZKP) compression via the Groth16 algorithm, cutting gas costs by 90%. A Watch Relayer monitors anomalies in real time, ensuring robust protection.

Cross-chain communication is another standout feature. The Multi-Blockchain Communication (MBC) protocol addresses Optimistic Rollup pain points, enabling instant withdrawals through market maker prepayments and incentivizing fraud detection. EVM compatibility, via Ethermint integration, supports Solidity 0.6.0–0.8.17 and tools like MetaMask, while dual EVM/WASM virtual machines bridge Ethereum and Cosmos ecosystems. A DID-based identity system stores only certificate hashes on-chain, encrypting private data off-chain for privacy and enabling cross-chain verification.

Additional improvements include dynamic gas pricing to counter Sybil attacks, optimized relayers for trustless communication, and enhanced security requiring two-thirds honest nodes. The ME-DA layer’s initial validator nodes, staked with 552,900 MEC from regional treasuries (India, China, ME_EARTH, USA), underscore community-driven governance, with future allocations guided by transparent DAO proposals. These advancements position ME Network 2.0 as a scalable, secure foundation for the next generation of Web3 applications.

Airdrop Rewards: Embarking on the Odyssey

Airdrop Rewards: Embarking on the Odyssey

ME Network 2.0 Odyssey isn’t just about technology—it’s about empowering users. Meta Earth’s Airdrop reward system, accessible via ME Pass, offers six ways to earn MEC, catering to both novices and veterans:

- Unconditional Basic Income (UBI): Users who complete KYC for their ME ID receive 1 permanently staked MEC, yielding daily passive income at 12.5% APY. Verification must be completed in ME Pass to begin earning.

- Daily Check-In Rewards: Users can check in daily to earn MEC—starting at 0.0001 MEC (gas-free for the first check-in), increasing by 0.0001 MEC/day to a cap of 0.003 MEC/day (30x). Missed check-ins can be made up within 7 days for a small fee.

- Staking Rewards: MEC can be staked in ME Pass’s “Assets” section, with a 360-day lock offering up to 25% APY. Flexible lock periods are also available for tailored returns.

- Community Rewards: Joining any Meta Earth node community for a one-time 0.01 MEC reward, enabling users to integrate into the broader ecosystem.

- Referral Rewards: By sharing a ME Pass invite link, users earn 0.1 MEC per new user who completes KYC.

- Monthly Airdrop: ME ID holders automatically receive 0.01 MEC monthly, deposited directly into their ME Pass wallet.

These rewards make participation rewarding and inclusive, encouraging users to grow their MEC holdings while fueling ecosystem expansion.

ME Pass 3.0: The Gateway to Web3

ME Pass 3.0, the cornerstone of user interaction, has been revamped to enhance the Web3 experience. Its sleek new UI offers seamless navigation, while bolstered security features, including multi-factor authentication and passkey setup, protect users’ assets. Users can now manage NFTs—displaying, transferring, and browsing collections—directly in the app. Cross-chain transactions between the ME-Hub and RollApps streamline asset movement, and a new “Explore” section introduces ME Mini-Programs and an app marketplace for richer content discovery. Community features like real-time messaging, large group chats, and end-to-end encryption foster engagement, making ME Pass 3.0 a powerful tool for Web3 exploration.

2025: Discovering Meta Earth Offline

Meta Earth is taking its vision global with a series of high-profile offline events in 2025, offering opportunities to connect with the community and explore ME Network 2.0 firsthand:

- Istanbul Blockchain Week (June): Attendees can join the event in Turkey for insights into Web3 innovation.

- WebX Asia 2025, Tokyo, Japan (August): Participants will have the opportunity to explore Meta Earth’s latest advancements in Asia’s leading crypto hub.

- TOKEN2049, Singapore (October): A premier gathering to connect with global Web3 leaders and explore emerging trends in the space.

These events will feature demos, workshops, and networking, showcasing Meta Earth’s technology and rewarding opportunities. Stay tuned for details on how to participate.

About Meta Earth

ME Network 2.0’s technical prowess—modular scalability, cost efficiency, and cross-chain interoperability—sets a new standard for decentralized networks. Coupled with inclusive Airdrop rewards and an intuitive ME Pass 3.0, Meta Earth is democratizing Web3 access. As MEC demand grows with ecosystem expansion, its deflationary model and diverse use cases (staking, fees, storage) promise long-term value appreciation.

To Get Involved Today: Users can download the ME Pass, complete KYC to unlock rewards, and join the Meta Earth community for updates. Users and welcome to join their 2025 events to experience the future of Web3 firsthand. With Meta Earth, it’s ME, My Way!

Stay Connected with Meta Earth

Users can stay updated on Meta Earth’s official social media and communities for the latest information:

Website|X|Telegram |Discord| Instagram| Youtube |TikTok| Linkedin

Contact

BD Manager

Penny

Meta Earth

bd@mec.me

Berlin, Germany, June 18th, 2025, Chainwire

BitVault, a DeFi protocol aiming to redefine Bitcoin’s role in stablecoin infrastructure, has announced the close of a $2 million pre-seed round. Strategic investors include GSR, Gemini, Auros, and Keyrock, among others—joining BitVault in building what it calls the “next era of BTC-backed money”: an institutionally-aligned alternative to fiat-pegged stablecoins.

The raise supports the launch of bvUSD, BitVault’s overcollateralized stablecoin backed by Bitcoin derivatives, and sbvUSD, its yield-bearing variant powered by institutional trading strategies by GSR.

BitVault will serve as a core stablecoin protocol on Katana, a new DeFi-first chain incubated by Polygon Labs and GSR prioritizing deep liquidity and user rewards, leveraging a licensed fork of Liquity V2 to enable permissioned borrowing, user-set interest rates, and automated liquidation infrastructure.

“Bitcoin was built for moments of fracture. BitVault was built to make it usable,” said Michael Kisselgof, Core Contributor of BitVault and VaultCraft. “We specifically onboarded GSR, Auros, and Keyrock as strategic investors that can also execute high yielding, non-directional strategies to create demand and deep liquidity for BTC-backed money.”

Stablecoins at an Inflection Point

BitVault arrives amid rising demand for crypto-native stability in a fragmented global monetary environment. Unlike fiat-backed stablecoins like USDC or algorithmic options like Ethena’s USDe, bvUSD is collateralized by BTC derivatives.

Only whitelisted institutional borrowers can mint bvUSD in bulk, while anyone can mint bvUSD using stablecoins—mitigating risks associated with overleveraged or anonymous borrowing. DeFi users can earn yield by staking bvUSD into sbvUSD, which leverages delta-neutral and arbitrage strategies managed by GSR, a globally recognized crypto investment firm specializing in market making, OTC trading, and options..

“We’re seeing growing interest in BTC-backed stablecoins, especially those designed to integrate seamlessly into DeFi ecosystems,” said Alain Kunz, Director from GSR, who participated in the round. “BitVault’s approach with experience in institutional-grade yield strategies positions it well for success. We’re particularly excited about its deployment on Katana, a DeFi centric chain we helped incubate. BitVault adds to Katana’s evolving ecosystem by introducing a new layer of stablecoin utility, enabling BTC to take on a more productive role within Katana’s high-yield DeFi stack.”

From Liquity to Katana

BitVault is a friendly fork of Liquity V2, re-engineered for institutional use under a licensed deployment agreement with Liquity AG. The protocol blends automated, governance-free mechanisms with a permissioned borrowing layer, offering stability while retaining core DeFi primitives like direct redemption and composable yield strategies.

Its upcoming VCRAFT token will govern future protocol parameters and serve as a rewards mechanism for stability providers and liquidity contributors.

The launch on Katana, incubated by Polygon Labs and GSR, positions BitVault at the heart of an emerging liquidity and settlement network across the EVM chain. Initial integrations include Vault infrastructure, Morpho money markets, Sushi AMMs, and a multichain “Bits” points campaign tied to VCRAFT distribution.

What’s Next

BitVault is scheduled for mainnet deployment on Katana in June 2025, with broader integrations across DeFi ecosystems and centralized liquidity venues in the works. The team plans to expand its stablecoin suite to support additional BTC-based collateral assets and is actively onboarding institutional borrowers.

About BitVault

BitVault is a DeFi protocol that offers a crypto-native solution for money through its BTC-backed stablecoin, bvUSD, and a yield-bearing staked stablecoin, sbvUSD. The protocol is designed to provide an institutional-grade, capital-efficient stablecoin with user-set interest rates, multi-collateral backing, and enhanced liquidity mechanisms.

For media inquiries or partnership information:

press@bitvault.finance

Contact

BitVault Team

BitVault.Finance

info@bitvault.finance

New York, USA, June 18th, 2025, Chainwire

TAC, a purpose-built blockchain for EVM dApps to access TON and Telegram ecosystem, has raised a total of $11.5 million across its seed and strategic rounds. The newly closed $5 million strategic round, led by Hack VC, reinforces institutional belief in TAC’s mission to enhance blockchain functionality inside Telegram, the most user-rich environment in crypto.

“At Hack VC, we invest in teams building the future of the internet,” said Ed Roman, Managing Partner at Hack VC. “TAC is an exceptional team with a deep understanding of infrastructure and growth backed by years of experience building in the space. Leading this strategic round reflects our conviction in TAC’s ability to shape how Ethereum dApps reach global users through Telegram and TON.”

TAC is nearing its mainnet launch, now underway in a phased rollout. In the current DevMainnet phase, blue-chip DeFi protocols like Curve, Morpho, and Euler are already deploying, with over 20 leading applications preparing for Mainnet integration. This early traction ensures that once TAC goes live publicly, the ecosystem will launch with deep liquidity, proven DeFi primitives, and immediate user utility inside Telegram.

“TAC is committed to giving EVM developers the tools and reach to deploy their applications into Telegram’s billion-user ecosystem,” said Pavel Altukhov, Co-Founder and CEO of TAC. “This strategic round accelerates our mission to bring Ethereum applications to everyday users and lays the groundwork for the next wave of TON-native consumer apps.”

TAC’s pre-mainnet liquidity bootstrapping campaign, The Summoning, has drawn significant interest from leading funds, liquidity providers, and infrastructure players across the industry. With over $700M in total value locked (TVL) secured ahead of public Mainnet launch, this institutional-grade backing reflects deep confidence in TAC’s role as a DeFi layer for TON. Crucially, this liquidity will power core DeFi applications from day one, enabling real yield and market functionality at launch

“Going live on Telegram and TON via TAC can allow Curve to reach the new audience who aren’t yet on DeFi,” said Michael Egorov, Founder of Curve. “TAC chose a great approach of bringing battle-tested EVM applications there. We are happy to be one of the first to deploy and bring Curve to these new users”

Curve, Morpho, and Euler have already built dedicated Telegram Mini Apps (TMAs), making their products natively accessible in Telegram. In parallel, popular consumer TMAs are beginning to integrate DeFi functionality on the backend, distributing yield and financial tools to non-crypto users. TAC sees this convergence within the superapp Telegram as the path to mass adoption.

About TAC

TAC is a purpose-built blockchain for EVM dApps to access TON and Telegram Ecosystem’s 1B+ user base. TAC makes it seamless for Ethereum dApps to be deployed on TON. EVM functionality and liquidity brought to the TON ecosystem enable builders to focus on consumer use cases.

Website | X | Discord | Telegram | Linkedin

Contact

PR

CC Chen

TAC

marketing@tac.build

NEW YORK, June 3, 2025 /PRNewswire/ — Monarq Asset Management (“Monarq”), a leading multi-strategy investment firm, formerly known as MNNC Group, today announced a strategic investment from FalconX, a leading institutional digital asset prime broker. The investment will accelerate Monarq’s growth as it scales its team, product offerings, and institutional client base.

With a track record dating back to 2017 and experience navigating multiple market cycles, Monarq is led by alumni from prestigious firms like LedgerPrime, Tower Research, and BlockTower. The firm deploys quantitative, delta-neutral, and directional strategies across both centralized and decentralized venues, focused on delivering consistent, risk-adjusted returns in all market conditions.

“We are pleased to welcome FalconX as a strategic investor,” said Shiliang Tang, CEO and Managing Partner of Monarq. “With FalconX’s strategic support, we are well positioned to scale our proprietary quantitative models, grow our team of portfolio managers and technologists, and bring institutional-grade asset management to a broader set of investors.”

The investment strengthens FalconX’s ability to serve clients seeking actively managed digital asset strategies and further diversifies its business lines.

“We saw a rare combination of quantitative finance and derivatives expertise in Monarq, grounded in the infrastructure and risk discipline expected of top-tier institutional managers,” said Raghu Yarlagadda, Co-Founder and CEO of FalconX. “As institutional capital allocates more meaningfully into digital assets, the search for differentiated, risk-adjusted returns is intensifying — and we believe institutions will increasingly turn to actively managed platforms as the asset class continues to mature.”

The investment comes amid a period of significant growth in the alternative investment space, with increasing allocation from institutional investors, family offices, and high-net-worth individuals seeking diversified returns in a complex market environment.

About Monarq Asset Management

Monarq Asset Management, formerly MNNC Group, is a multi-strategy digital asset investment manager focused on generating consistent, risk-adjusted returns through all market conditions. Managed by former executives from firms such as LedgerPrime, Tower Research, and BlockTower Capital, the team offers extensive experience in quantitative trading, volatility strategies, and digital market structure.

Leveraging a foundation of delta-neutral and directional strategies, Monarq utilizes a disciplined, data-centric investment approach spanning centralized and decentralized markets. By integrating institutional-grade financial rigor with native blockchain infrastructure, the firm is positioned to meet the evolving demands of today’s sophisticated institutional investors.

About FalconX

FalconX is a leading digital asset prime brokerage for the world’s top institutions. We provide comprehensive access to global digital asset liquidity and a full range of trading services. Our 24/7 dedicated team for account, operational and trading needs enables investors to navigate markets around the clock. FalconX Bravo, Inc., a FalconX affiliate, was the first CFTC-registered swap dealer focused on cryptocurrency derivatives.

FalconX is backed by investors including Accel, Adams Street Partners, Altimeter Capital, American Express Ventures, B Capital, GIC, Lightspeed Venture Partners, Sapphire Ventures, Thoma Bravo, Tiger Global Management and Wellington Management. FalconX has offices in Silicon Valley, New York, London, Hong Kong, Bengaluru, Singapore and Valletta. For more information visit falconx.io or follow FalconX on X and LinkedIn.

“FalconX” is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and FalconX entity capabilities. For more information about which legal entities offer particular products and services, please see the disclosure on our public website, incorporated herein, or reach out to your relationship contact.

Castries, Saint Lucia, June 2nd, 2025, Chainwire

PrimeXBT, a global multi-asset broker, has expanded its regulated offerings with approval from the Financial Sector Conduct Authority (FSCA) in South Africa to provide crypto services. This development strengthens PrimeXBT’s presence in one of Africa’s leading financial markets and supports the company’s broader mission to advance regulated crypto access worldwide.

With this updated licence in place, PrimeXBT is now offering traders a secure and trusted environment to deposit, withdraw, trade, and convert digital assets. South African clients gain access to crypto-funded accounts on MT5, PXTrader, and Crypto Futures, with support for BTC, ETH, USDT, and USDC margin trading, including CFD trading on stocks, indices, forex, crypto and commodities. Traders can also benefit from on-platform tools to instantly exchange crypto to crypto or stablecoins with USD.

“This expansion not only benefits South African traders but also represents our broader commitment to global crypto adoption under trusted regulatory framework,” said Sihle Tuta, Head of Region at PrimeXBT South Africa. “At PrimeXBT, we aim to lead by example, delivering an all-in-one trading experience that prioritises trust, access, and innovation. As one of the few regulated brokers offering both crypto and traditional financial instruments, we bring these markets together through a unified platform built for diverse trading strategies.”

In addition to expanding its trading services, PrimeXBT continues to invest in trader education and financial literacy across the world. The broker offers online learning resources, webinars, and market insights tailored to various levels of trading experience. As part of its global CSR initiatives, PrimeXBT also supports community-focused projects with a strong emphasis on education and skills development.

This addition to PrimeXBT’s regulated operations further strengthens its reputation as a compliant and forward-thinking broker. As demand for regulated crypto access grows, PrimeXBT is well-positioned to serve traders with a platform that blends security, flexibility, and innovative market access.

To learn more, users can visit the PrimeXBT website.

About

PrimeXBT is a global multi-asset broker trusted by over 1,000,000 traders in 150+ countries, offering a next-generation trading experience that bridges traditional and digital finance. Clients can trade CFDs on Stocks, Indices, Commodities and Crypto, as well as Crypto Futures and Forex. PrimeXBT also enables clients to buy and sell cryptocurrencies, store them in secure built-in wallets, and instantly exchange crypto to crypto or fiat to crypto, all within one integrated environment. Since 2018, PrimeXBT has made investing more accessible by lowering barriers to entry and providing secure, easy access to financial markets. This accessibility extends across its native web and mobile platforms, MetaTrader 5, and a variety of funding options in crypto, fiat, and local payment methods. Committed to putting clients first, PrimeXBT empowers traders of all levels with innovative tools and industry-leading conditions, delivering a better way to trade.

Disclaimer: The content provided here is for informational purposes only and is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. The Company does not accept clients from the Restricted Jurisdictions as indicated on its website. Some products and services, including MT5, may not be available in your jurisdiction. The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.

Contact

PrimeXBT

pr@primexbt.com

George Town, Grand Cayman, May 30th, 2025, Chainwire

Zircuit, the chain where innovation meets security, announced the launch of non-custodial wallet top-ups for Crypto.com Visa Cards. This new integration enables users to seamlessly fund their cards via Zircuit.

Now live in the Crypto.com App, this feature allows users to connect a non-custodial wallet to their Crypto Wallet and transfer ZRC via Zircuit Chain. Users can convert the assets into supported tokens like USDC or ETH as needed to complete the top-up process. This makes it easier than ever to spend crypto wherever Visa is accepted.

“At Zircuit, we’re committed to expanding the possibilities of crypto in the real world,” said Dr. Martin Derka, co-founder of Zircuit. “This integration with Crypto.com brings us one step closer to that future, offering users the freedom of self-custody and the convenience of everyday spending.”

How it works:

- Users connect their non-custodial wallet to the Crypto Wallet in the Crypto.com App via Zircuit Chain.

- Funds are sent directly from the connected wallet, converted to fiat, and used to top up the Crypto.com Visa Card

- If needed, assets are auto-converted to supported tokens like USDC or ETH.

Users can visit crypto.com/en/product-news/top-up-with-zircuit for step-by-step instructions or access the FAQ for more information.

About Zircuit

Zircuit: Where innovation meets security, designed for everyone. Zircuit offers developers powerful features while giving users peace of mind. Designed by a team of web3 security veterans and PhDs, Zircuit combines high performance with unmatched security. Experience the safest chain for DeFi and staking. To learn more about Zircuit, users can visit zircuit.com, and follow them on Twitter/X @ZircuitL2

Contact

Head of Communications

Jennifer Zheng

Zircuit

jen@zircuit.com

Victoria, Seychelles, May 16th, 2025, Chainwire

Bitget, the world’s leading cryptocurrency exchange and Web3 company, is thrilled to announce the launch of Spot Margin Trading for the Nexpace (NXPC)-USDT pair. This strategic move marks a significant milestone in empowering users with advanced trading tools and bolstering innovation in the decentralised gaming ecosystem.

Nexpace (NXPC), a prominent player in the Web3 gaming industry, is transforming the digital entertainment landscape with its decentralised, player-centric platform. The integration of NXPC into Bitget’s Spot Margin offering enables traders to borrow funds to amplify potential gains, thus enhancing market liquidity and trading flexibility for the NXPC ecosystem.

Commenting on the development, Gracy Chen, CEO at Bitget, said “Bitget is excited to support the growth of decentralised gaming by enabling spot margin trading for the NXPC token. We believe Nexpace’s vision aligns with the future of interactive digital economies, and we are committed to offering our users diversified trading options and early access to game-changing projects.”

To celebrate the listing of new coins, Bitget will randomly distribute spot margin interest vouchers or position vouchers to users. Spot margin interest vouchers can be used to offset part or all of the borrowing interest in margin trades. Position vouchers allow users to open margin trade positions without using their own funds. Users can claim vouchers in the Coupons Center.

With this launch, Bitget continues its commitment to supporting high-potential Web3 projects by providing greater exposure and access to sophisticated financial instruments. Spot Margin Trading allows users to trade NXPC with leverage, enabling them to take both long and short positions, and to participate more actively in market movements.

For more information on NXPC on Bitget, users can visit here.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 120 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

About Nexpace (NXPC)

Nexpace is a decentralised gaming platform that leverages blockchain to give players true ownership, governance rights, and seamless in-game economies. NXPC is the utility and governance token driving the platform’s vibrant ecosystem and community-driven growth.

For media queries: media@bitget.com

Contact

Public Relations

Media

Bitget

media@bitget.com

Abu Dhabi, UAE, May 15th, 2025, Chainwire

MapleStory Universe brings player-owned economies to life as a blockchain-powered expansion of the 23-year old MMORPG IP, powered by its proprietary NXPC token

Now live on Bitget, Bithumb, Binance, Bybit, Gatei.o, KuCoin, Upbit – NXPC ranks among the most successful Web3 gaming token debuts

NEXPACE, the Web3 IP-expansion initiative backed by Nexon, today announced the official launch of MapleStory N, a blockchain-powered MMORPG. Together with the game, NEXPACE also debuted the NXPC token, integral to the MapleStory Universe (MSU) ecosystem, on seven leading exchanges, including Bitget, Bithumb, Binance, Bybit, Gateio, KuCoin, Upbit. This joint milestone marks a major step forward for NEXPACE’s MSU, bringing the iconic 23-year-old gaming IP to the blockchain for the first time.

MapleStory N blends the nostalgic 2D visuals and classic gameplay of the original MapleStory IP with new blockchain-native features such as NFTs, on-chain item mechanics, and open marketplaces. Players can complete quests, battle monsters, all while earning, crafting and trading assets that hold real world value. The broader MSU platform also introduces Synergy Apps, allowing fans, creators, and builders to develop their own content and decentralized applications. This reflects the legacy of the original MapleStory IP franchise, where user-generated games and creations flourished.

The NXPC token further marks a major evolution of MapleStory’s decades-old in-game economy by enabling true asset ownership and player-driven item markets. With MSU’s Fusion-Fission model, players can redeem NXPC for collections of NFTs (Fission) and exchange collections of NFTs back into NXPC (Fusion), creating a self-balancing system that curbs oversupply and supports long-term value. Beyond gameplay, NXPC powers a broader contributor reward system, incentivizing builders and creators to develop user-generated contributions that expand and enrich the MSU IP ecosystem.

Sunyoung Hwang, CEO of NEXPACE, explained, “The launch of MapleStory N and the NXPC marks a major evolution in how games are played and valued. MSU addresses long-standing issues in traditional gaming like item inflation and developer-controlled ecosystems, by giving real ownership to players. NXPC enables users to participate in a decentralized, self-sustaining ecosystem that rewards creativity, contribution, and engagement over speculation. Together, they form the engine of a community-led digital economy, reshaping how games are enjoyed and remembered.”

As the first implementation of NEXPACE’s virtual IP universe, MapleStory N and MSU sets the foundation for future blockchain-powered gaming experiences. Backed by Nexon’s portfolio of globally recognized gaming IPs, NEXPACE’s protocol is designed to support the expansion of these titles through decentralized economy and community-led creativity, evolving the gaming worlds beyond the traditional models.

The excitement surrounding MSU’s first blockchain game was clearly reflected in the recent OpenSea Primary Drop Campaign, held from May 6 to 12, which saw over 1 million mints. Built on a custom Layer 1 chain using Avalanche, powered by AvaCloud, the campaign also drove Avalanche Network to record its highest number of Unique Active Wallets since the campaign’s launch day. MapleStory N is now live and available on PC.

MSU is now reshaping the Web3 gaming landscape, launching its NXPC token across seven major exchanges and showcasing one of the most impactful blockchain gaming debuts in recent years.

About NEXPACE

NEXPACE, an innovative blockchain company based in Abu Dhabi, pioneers an IP-expansion initiative powered by blockchain technology and NFTs to build a community-driven ecosystem. With a mission to redefine interactive entertainment, NEXPACE creates a vibrant space for exploring, sharing, and engaging with diverse content and gameplay crafted by community members.

At the heart of NEXPACE’s ecosystem are principles of transparency, security, and trust, empowering creators to freely share their ideas and enabling users to enjoy immersive experiences. By fostering a culture of creative expression, NEXPACE envisions a secure, collaborative environment that unites ecosystem participants in a thriving digital community.

For more information, users can visit: Website | Medium | X/Twitter | Discord

Contact

MapleStory Universe PR Manager

Bee Shin

Wachsman

bee.shin@wachsman.com