Crypto exchange-traded products (ETPs) have experienced another week of significant outflows, with $508 million exiting the market. This marks the second straight week of substantial withdrawals, raising concerns about investor sentiment and the future of institutional involvement in digital assets.

Why Are Investors Withdrawing from Crypto ETPs?

The recent trend of outflows comes amid increased market uncertainty, regulatory developments, and macroeconomic factors that have influenced investor sentiment.

One major driver behind these outflows is the cooling enthusiasm for Bitcoin and Ethereum after their recent rallies. As prices consolidate or decline, some investors are moving capital to less volatile assets, reducing exposure to crypto-backed financial products.

Additionally, regulatory concerns continue to weigh on the market. The U.S. Securities and Exchange Commission (SEC) has maintained a strict stance on crypto regulation, causing hesitation among institutional investors who rely on clarity before making long-term commitments.

Bitcoin ETPs Lead the Outflows

A large portion of the $508 million outflows came from Bitcoin-focused ETPs. Investors who had previously entered the market during Bitcoin’s rally to new all-time highs may now be cashing out as the asset experiences corrections.

“We’ve seen increased selling pressure in Bitcoin ETPs, which suggests that some investors are locking in profits after the recent bull run,” noted an institutional market analyst.

Ethereum-based ETPs also saw declines, although at a smaller scale. Altcoin-focused products, including those tied to Solana and other Layer 1 networks, experienced relatively minor movements in comparison.

Broader Implications for Institutional Investment

While outflows from ETPs indicate short-term caution, the long-term outlook for institutional crypto investment remains mixed. Some analysts believe that these movements are temporary and could reverse once market conditions stabilize.

Crypto ETPs have been a gateway for traditional investors to gain exposure to digital assets without directly holding cryptocurrencies. A continued trend of outflows could signal broader hesitation among institutions, while a reversal in sentiment could bring fresh capital into the market.

What’s Next for Crypto ETPs?

Investors will be watching for signs of renewed inflows, particularly if Bitcoin and Ethereum regain bullish momentum. If macroeconomic conditions improve and regulatory clarity emerges, institutional interest in crypto ETPs may rebound.

For now, the trend of withdrawals suggests that market participants are reassessing their positions, potentially waiting for a stronger confirmation of crypto’s long-term price direction before re-entering.

Bitcoin exchange-traded funds (ETFs) have recorded significant outflows totaling $1.14 billion over the past two weeks. The sell-off comes as global financial markets face increasing uncertainty, with geopolitical tensions between the U.S. and China adding to investor caution.

Investor Sentiment Shifts as Bitcoin Pulls Back

After experiencing strong inflows earlier in the year, Bitcoin ETFs are now seeing a reversal as traders and institutions take profits. The outflows coincide with Bitcoin’s price correction, which has seen the asset struggle to maintain momentum after reaching record highs.

Some analysts suggest that investors are reallocating capital into traditional assets, particularly amid rising concerns over global economic instability.

“Bitcoin ETFs have been a popular investment vehicle, but with geopolitical risks increasing, some investors are choosing to reduce exposure to volatile assets,” one analyst explained.

Impact of US-China Trade Tensions on Crypto Markets

The ongoing trade disputes between the U.S. and China have created economic uncertainty, affecting various financial markets, including cryptocurrencies. Bitcoin, often seen as a hedge against inflation and geopolitical risks, has faced mixed reactions in this environment.

While some investors view Bitcoin as a safe-haven asset, others are moving away from riskier investments amid economic instability. The result has been a shift in Bitcoin ETF flows, reflecting broader sentiment changes in global finance.

ETF Market Trends and Institutional Behavior

The $1.14 billion in outflows suggests that some institutional investors are adjusting their portfolios in response to market conditions. However, it remains unclear whether this trend will persist or if inflows will return once uncertainty eases.

Bitcoin ETFs have played a crucial role in bringing institutional capital into the crypto space, and any prolonged decline in demand could influence Bitcoin’s price trajectory. However, previous trends have shown that ETF interest can fluctuate based on market cycles and macroeconomic developments.

Conclusion

The recent outflows from Bitcoin ETFs highlight the impact of broader financial market trends on crypto investments. As U.S.-China trade tensions continue to evolve, investors will closely monitor how Bitcoin and ETF markets react.

For now, Bitcoin remains a key asset in the global financial landscape, but its price and institutional adoption will likely be influenced by ongoing geopolitical and economic developments.

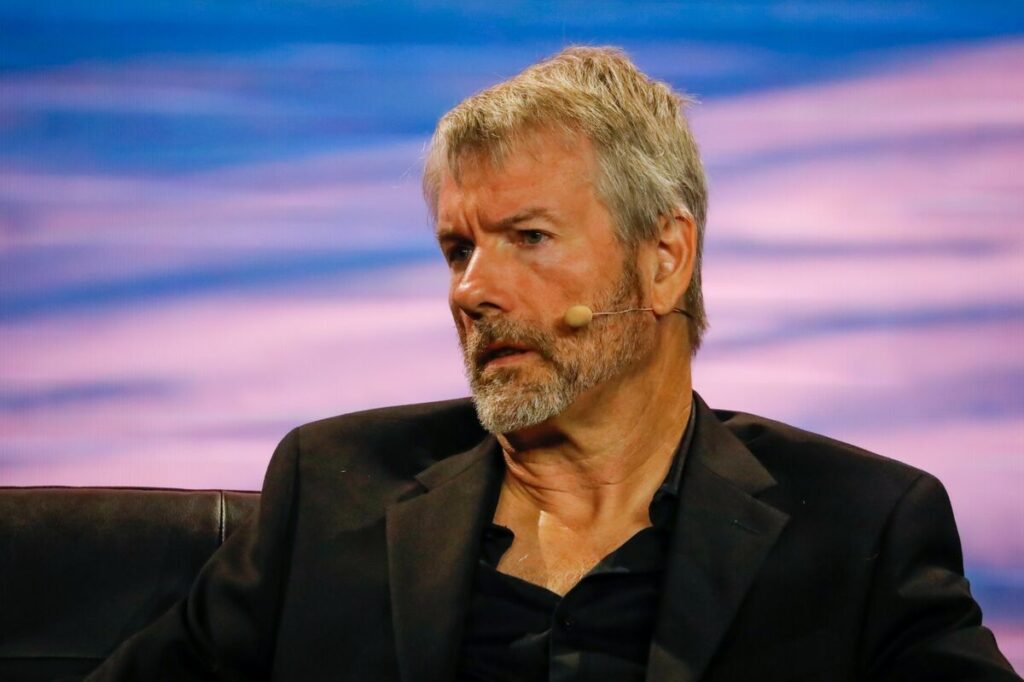

MicroStrategy, the business intelligence firm led by Michael Saylor, has successfully completed a $2 billion convertible note offering, with the proceeds expected to be used for further Bitcoin acquisitions. The move reinforces the company’s ongoing commitment to accumulating Bitcoin as a core component of its corporate strategy.

MicroStrategy’s Bitcoin Investment Strategy

Since 2020, MicroStrategy has positioned itself as one of the largest institutional holders of Bitcoin. Under Michael Saylor’s leadership, the company has aggressively acquired BTC, viewing it as a superior store of value compared to traditional assets.

With this latest $2 billion fundraising, the company intends to expand its Bitcoin holdings even further. Given the recent price movements of Bitcoin, the purchase could have a significant impact on market sentiment.

Details of the Convertible Note Offering

The convertible notes issued by MicroStrategy have a maturity date set for 2030, with an annual interest rate of 2.25%. Investors purchasing these notes will have the option to convert them into shares of MicroStrategy stock at a predetermined price.

According to a company statement, the offering was oversubscribed, reflecting strong investor interest in MicroStrategy’s Bitcoin strategy.

“The demand for our convertible notes demonstrates the confidence investors have in our long-term Bitcoin vision,” Saylor stated.

Potential Impact on Bitcoin’s Price

MicroStrategy’s Bitcoin acquisitions have historically influenced the crypto market, often triggering short-term price increases. Given that this $2 billion investment will likely be deployed in purchasing Bitcoin over the coming weeks, analysts speculate that it could provide additional bullish momentum for BTC.

However, some skeptics warn that such aggressive Bitcoin buying strategies come with risks, particularly if Bitcoin experiences significant price volatility. If the market enters a prolonged correction, MicroStrategy’s highly leveraged position could face challenges.

Institutional Interest in Bitcoin Remains Strong

Despite concerns about Bitcoin’s recent volatility, institutional interest in the asset remains strong. Several major firms have either increased their Bitcoin holdings or introduced new investment vehicles that provide exposure to BTC.

The completion of MicroStrategy’s convertible note offering signals continued institutional confidence in Bitcoin’s long-term potential. Other companies may follow suit, seeking alternative ways to gain exposure to digital assets.

Conclusion

MicroStrategy’s successful $2 billion convertible note offering underscores its unwavering commitment to Bitcoin. While the move is seen as a bullish sign for the cryptocurrency market, it also highlights the risks associated with heavily leveraging corporate finances for Bitcoin acquisitions.

As the company moves forward with its latest BTC purchase, all eyes will be on how the market reacts and whether MicroStrategy’s continued accumulation will further fuel Bitcoin’s price trajectory.

Bybit has managed to restore nearly half of its Ether reserves after suffering a massive $1.4 billion hack on Feb. 21, marking the largest cryptocurrency theft in history. The attack targeted liquid-staked Ether (stETH), Mantle Staked ETH (mETH), and various ERC-20 tokens, causing an industry-wide shock.

According to CryptoQuant data, Bybit’s Ether reserves rebounded significantly within two days of the breach. The exchange now holds over 201,600 Ether, about 45% of the 439,000 ETH it possessed before the attack. Following the exploit, reserves had plunged to just 61,000 ETH.

Support and Spot Buying Fuel Recovery

A significant factor in Bybit’s resurgence has been aggressive spot buying. The exchange reportedly purchased 106,498 ETH worth $295 million through over-the-counter (OTC) trades, as per Lookonchain data.

In addition, major crypto platforms and industry leaders rallied to support Bybit. Binance transferred 50,000 ETH, Bitget contributed 40,000 ETH, and HTX Group co-founder Du Jun provided 10,000 ETH, among other donations.

Industry Confidence Remains Strong

Despite the turmoil, Bybit maintained operational stability, processing over 350,000 withdrawal requests within 10 hours post-exploit, according to CEO Ben Zhou. This responsiveness helped retain user confidence, reinforcing the exchange’s credibility.

Emergency Funding and Asset Impact

Bybit secured approximately $390 million in emergency liquidity, with major contributions including $127 million from Binance-affiliated investors and $53 million from a single whale wallet. However, DefiLlama data indicates that Bybit’s total assets dropped by more than $5.3 billion in the wake of the attack.

An independent proof-of-reserve audit by Hacken, however, confirmed that Bybit’s reserves still exceed its liabilities. “Despite the significant loss, Bybit’s reserves remain strong and fully back user funds,” Hacken stated.

The Hack’s Origins and Investigation

Investigators, including Arkham Intelligence and ZachXBT, have traced the attack to the North Korean Lazarus Group. Similarities between this hack and previous incidents, such as the $230 million WazirX breach and the $58 million Radiant Capital exploit, suggest a recurring method of deception.

Security expert Meir Dolev explained that Bybit’s Ethereum multisig cold wallet was compromised through a misleading transaction, tricking signers into approving a malicious smart contract logic change. “This allowed the attacker to gain control of the wallet and move all ETH to an unknown address,” Dolev told Cointelegraph.

The North Korean-affiliated Lazarus Group, identified as the prime suspect behind the $1.4 billion Bybit hack, may also be linked to recent Solana memecoin scams, according to onchain investigator ZachXBT.

Bybit suffered the largest hack in crypto history on Feb. 21, losing over $1.4 billion in digital assets. Security firms, including Arkham Intelligence, have traced the breach to Lazarus Group.

Links to Solana-Based Memecoin Fraud

ZachXBT’s investigation revealed that the hacker received $1.08 million from the Bybit exploit, which was bridged to Solana via a suspicious address. “The attacker transferred USDC to Solana, consolidating funds across multiple wallets previously linked to memecoin scams,” ZachXBT noted.

Additionally, onchain analysis showed that some of the same wallets involved in the Bybit breach were also implicated in the $29 million Phemex hack in January.

Solana’s Increasing Fraud Cases

Solana has been plagued by memecoin scams, including rug pulls on the Pump.fun platform. Investor confidence was further shaken by the collapse of the Libra (LIBRA) token, allegedly orchestrated by insiders who siphoned $107 million, leading to a 94% price crash and wiping out $4 billion in market value.

According to Glassnode data, Solana’s monthly capital inflow has turned negative, declining by 5.9%. Additionally, the number of active addresses on the network has dropped nearly 40% from November 2024 levels, signaling a slowdown in activity.

Solana’s Future Amidst Rising Scams

Despite recent challenges, blockchain researcher Aylo believes Solana’s resilience will drive long-term growth. “While bad actors have exploited Solana, these issues may ultimately contribute to the blockchain’s evolution,” Aylo shared in a Feb. 18 X post.

The United States Securities and Exchange Commission (SEC) has officially ended its probe into NFT marketplace OpenSea, marking a significant win for the digital collectibles industry.

“The SEC is closing its investigation into OpenSea. This is a win for everyone who is creating and building in our space,” OpenSea founder Devin Finzer announced on Feb. 21.

Impact on the NFT Market

The decision comes shortly after the SEC dropped its lawsuit against Coinbase. The investigation, which began in August 2024, alleged OpenSea operated as an unregistered securities marketplace.

Industry leaders have welcomed the news, with Magic Eden’s Chris Akhavan calling it a win for the broader NFT sector. Pseudonymous crypto commentator Beanie suggested it could serve as a catalyst for the next NFT bull market.

Meanwhile, OpenSea is preparing to launch its SEA token, with details yet to be finalized. However, the marketplace recently faced criticism over its airdrop reward system, prompting a temporary pause amid user concerns.

Two newly launched cryptocurrency exchange-traded funds (ETFs) holding a combination of Bitcoin and Ether have seen modest inflows since their recent debuts, according to data from Cointelegraph.

Franklin Templeton’s Franklin Crypto Index ETF (EZPZ) has attracted around $2.5 million in net assets since launching on Feb. 20, while Hashdex’s Nasdaq Crypto Index US ETF (NCIQ) has gathered just over $1 million since its Feb. 14 debut.

By comparison, Franklin Templeton’s spot Bitcoin ETF (EZBC) saw significantly higher interest, pulling in approximately $50 million on its first day in January 2024, with Bitwise Bitcoin ETF (BITB) reaching nearly $240 million on its debut.

Diversification Limits and Regulatory Barriers

The two ETFs aim to provide investors with exposure to a diverse crypto index. However, due to regulatory restrictions, they currently hold only Bitcoin and Ether, which dominate their portfolios. The hope is to expand to other cryptocurrencies pending regulatory approval.

A broader ETF, the Grayscale Digital Large Cap Fund, already includes assets like Solana and XRP but has yet to be exchange-traded. The SEC continues to evaluate various applications, with analysts expecting more ETF approvals in 2025.

BlackRock’s Bitcoin exchange-traded fund (ETF) now commands a significant 50.4% share of the total U.S. Bitcoin ETF market. The asset management giant currently holds over $56.8 billion worth of Bitcoin, contributing to a combined total of $112 billion managed by all U.S. Bitcoin ETF issuers, according to Dune data.

Bitcoin ETFs Face Sell-Off

Despite BlackRock’s dominance, the overall Bitcoin ETF market has experienced a three-day selling streak. On February 20, Bitcoin ETFs saw cumulative net outflows of $364 million, with BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounting for $112 million, as per Farside Investors data.

Bitcoin’s Price Remains Resilient

Despite ETF outflows, Bitcoin’s price has remained relatively stable, climbing back above $99,300 on February 21.

Marcin Kazmierczak, co-founder of RedStone, believes that ETFs are not the primary force driving Bitcoin’s price movements.

“This indicates that other forces — such as broader market liquidity, institutional accumulation, or macroeconomic trends — are also at play,” he told Cointelegraph.

Price Action Raises Concerns

While Bitcoin has shown resilience, some experts worry about prolonged range-bound trading. Samson Mow, CEO of Jan3, suggested the price movement may be manipulated.

“It seems like it’s some sort of price suppression,” Mow stated at Consensus Hong Kong 2025, adding that Bitcoin’s price has been peaking and then moving sideways in an unnatural manner.

Bitcoin bulls pushed the price close to $100,000 at the Wall Street open on February 21, reaching $99,500 on Bitstamp.

However, a pattern of selling pressure emerged as U.S. markets opened, contrasting with gains seen in Asia and Europe.

Market Liquidity and Resistance Levels

Trading resource Material Indicators noted shifting liquidity dynamics as Bitcoin recovered from a recent dip. “Whether this develops into a bull trap or a bonafide breakout remains to be seen,” analysts stated, emphasizing the importance of the $100K resistance level.

Traders Weigh In on Bitcoin’s Future

Popular trader CRG observed that bears were attempting to cap gains at a key midpoint in Bitcoin’s multimonth trading range. Meanwhile, Rekt Capital highlighted a bullish divergence forming on Bitcoin’s Relative Strength Index (RSI), suggesting potential upside momentum.

U.S. Dollar Weakness Provides Tailwind

Bitcoin and other risk assets received support from a weakening U.S. dollar, with the U.S. Dollar Index (DXY) dropping to 106.38, its lowest level since December 2024. Analysts believe this could provide a favorable environment for further Bitcoin gains.

Cryptocurrency exchange Bybit has reportedly lost over $1.4 billion in liquid-staked Ether (stETH) and MegaETH (mETH) in a massive hack, according to on-chain security analyst ZackXBT.

Bybit co-founder and CEO Ben Zhou confirmed that the breach involved an unauthorized transfer from the exchange’s multisignature wallet to a warm wallet. The transaction was disguised as legitimate but contained malicious code that altered the smart contract logic, allowing funds to be siphoned off.

Zhou reassured users, stating, “Please rest assured that all other cold wallets are secure. All withdrawals are NORMAL. I will keep you guys posted as more develops.”

Rising Security Threats in Crypto

The hack adds to a growing list of security breaches in the crypto industry, which has seen an uptick in attacks throughout 2024 and early 2025. Security experts have urged users to blacklist addresses linked to the exploit to prevent further losses.