After a recent reverse split, SMX (SMX) now trades with roughly 1,050,000 shares outstanding. That tight structure shaped the entire trajectory of its surge from $5 in November to $490 last Friday. Before breaking down the synthetic mechanics behind that move, the fundamentals deserve credit.

SMX has had a transformative 2025. The company expanded across plastics circularity, aerospace metals, textiles, hardware-level supply chain verification, and national authentication platforms. It delivered real commercial progress through six major partnerships. In other words, the business improved, and the market noticed.

But fundamentals alone rarely lift a microcap into triple-digit prices this fast. The behavior of the order flow signals that structural pressure was a major contributor. Retail traders rarely buy 100-share lots once a stock crosses $100, and they almost never buy meaningful size at $200, $300, or $400. Those rarely become lottery wins, for which SMX offered a ticket last week for $5. Price-insensitive buying usually belongs to participants who have no choice.

SMX Attracted Eyes for the Right Reasons

That doesn’t diminish SMX’s operational progress. It simply means the short side likely played a major role in amplifying the move. The volume reinforces that view. SMX traded roughly 3.8 million shares on Friday and about 6.5 million on Thursday. For a one-million-share float, that’s not a retail stampede. If this were purely retail-driven momentum, volume would usually explode. That’s because retail buys, sells, rebuys, sells, chases, buys, sells, etc. It creates a lot of circular volume.

Instead, Thursday and Friday stayed tight and controlled, which matches the behavior of forced buy-ins rather than speculative buying. It’s also likely the short position isn’t fully unwound yet.

Synthetic shorting explains why this unfolded the way it did. Synthetic positions were never the intention of SEC rules. They’re the accidental outcome of a system built on lending revenue, automation, and rehypothecation. Brokers earn interest when they lend shares. They’re allowed to lend the same share multiple times as long as positions remain collateralized. One real share can be lent, re-lent, and lent again. Synthetic supply multiplies. No regulator can realistically monitor thousands of microcaps constantly issuing new shares. Over time, the system drifted far beyond how it was designed to function. Here’s an example in SMX’s case.

The Loophole That Shorts Can Exploit…In This Case, Not

If SMX drew down from its $111 million ELOC and issued, say, 100,000 new shares in December, those shares wouldn’t simply add 100,000 shortable shares. They’d become the seed for several million synthetic short shares because each share can be borrowed and reborrowed repeatedly. That’s how small dilution events create disproportionate downward pressure. But this is where timing becomes everything.

If SMX issued zero new shares in December, which seems to be the intent, the float would stay locked at roughly 1,050,000 shares. With no fresh inventory, no broker can borrow new shares, no new shares can be rehypothecated, and synthetic short positions are exposed with nowhere to hide. When T+2 settlement hits, brokers who can’t deliver real shares are pushed into immediate forced buy-ins.

They can’t delay settlement. They can’t rely on future shares. They can’t avoid the clearing house. The squeeze still happens with zero dilution in December. In fact, it becomes even stronger because nothing weakens the structural pressure. This is how you get the rapid cascade from $20 to $40 to $80 to $200 and eventually $490 as synthetic layers collapse and brokers are forced to buy at rising prices.

What Happens Next Year?

Now consider the January scenario. Assume SMX doesn’t touch the facility at all in December. Then on January 5, the company sells 100,000 new shares. Those shares don’t settle into the float until January 7 or 8. But by January, the December squeeze has already played out. The synthetic short positions have collapsed. The forced buy-ins have already been completed. Shorts who failed to deliver in December already had to buy real shares at elevated prices. They couldn’t wait for potential January dilution. They couldn’t postpone settlement. They had to unwind into the market on the market’s terms.

So when the 100,000 shares settle in January, they don’t rescue December shorts, they don’t unwind December’s price action, they don’t erase the December squeeze, they don’t help brokers who already covered at $200 to $490, and they don’t instantly rebuild synthetic supply.

January dilution, if any, arrives in a clean market, not a pressured one. Rehypothecation takes time. It requires a borrowable supply, a willing broker, calm conditions, and multiple layers of re-lending. Immediately after a forced unwind, none of that exists. This is why delaying dilution until January protects the dilution period itself. The company gets capital with far less dilution than expected, the shorts get no bailout, and the stock’s structure remains intact.

SMX Holds the Cards AND Controls the Deal

With over $100 million available through its new facility, SMX now faces a choice. If it raises money through a structure that prevents share lending, such as placements with institutions that do not lend their inventory, the company can block rehypothecation before it begins.

Shares that cannot be lent cannot multiply into synthetic supply. If SMX times any use of its facility only after synthetic positions have collapsed, the company can add new shares without recreating the pressure that fueled years of downward distortion. The best time to dilute is after the unwind, not during it. Dilution after the collapse doesn’t rescue shorts, doesn’t weaken the pressure that already occurred, and doesn’t immediately rebuild the synthetic machinery. It allows SMX to strengthen its balance sheet, fuel its platform engine, and expand its strategic mission without destabilizing its stock price.

This combination of strategy and timing gives SMX something most microcaps never achieve: control. Control over capital formation, control over borrowing dynamics, and control over the structural forces that usually work against small companies. SMX earned this moment. Now it needs to protect it.

Vanguard recently announced that beginning December 2, 2025, Vanguard customers with brokerage accounts can now purchase certain, regulated, third-party mutual funds and ETFs that are associated with cryptocurrency. This marks a big moment in Vanguard’s history, especially after years of firm resistance to cryptocurrency. The development is a clear shift in their stance, yet the company is still handling digital assets with plenty of caution.

Vanguard claimed for many years that cryptocurrency is too volatile to possibly considered appropriate to hold in a long-term retirement account. This has been the rationale for denying requests to list things like spot Bitcoin ETFs and other similar products.With the new policy in place, Vanguard now treats crypto-linked funds the same way it handles other non-traditional asset classes.

What This Means for Investors

Vanguard oversees $11 trillion in assets and serves tens of millions of clients. Many of these investors prefer to keep their holdings under one roof for tax planning, reporting, and convenience. Until now, anyone interested in crypto exposure through regulated products often needed a second account at a different brokerage. The new policy removes that extra step and allows clients to pursue this exposure inside familiar systems.

Some investors may also look to independent market overviews in light of these updates, like Best Altcoins to Invest in, to get a clearer sense of which emerging assets are gaining traction. For example, in December 2025, Ethereum continues to hold a leading position among altcoins. It benefits from an active community of developers and steady progress on upgrades intended to support decentralized applications. Bitcoin Hyper has drawn interest for its attempt to provide a faster and more scalable environment for activity tied to the Bitcoin network. Maxi Doge, or MAXI, remains driven by online culture and community participation, attracting traders who follow short-term momentum and social-driven trends.

These examples illustrate how different the altcoin space can be in purpose and temperament. Some projects focus on infrastructure, others focus on culture and community sentiment. Investors who explore these areas can gain an additional sense of the range of assets that now fit within the larger crypto market.

Why Vanguard Updated Its Policy

Vanguard stated that the current group of crypto-linked funds has met its internal requirements related to liquidity, regulatory oversight, and the operational work needed to support trading. The firm noted that its brokerage systems can now handle these products with consistency and without additional strain.

Points to Consider

The updated policy does not guarantee that every crypto fund will appear on the platform. Vanguard will still decide which products meet its standards. Crypto-linked funds involve noticeable price swings, and altcoins vary widely in purpose, stability, and community interest. Tokens such as Bitcoin and Ethereum highlight the variety of approaches that define the market.

Investors who choose to add exposure may benefit from a measured approach. Vanguard’s change gives them another regulated option, but the fundamental risks of digital assets remain. A careful assessment of personal risk tolerance and investment goals still plays the central role in determining whether crypto-linked funds belong in a portfolio.

WhiteBIT’s coin (WBT) has been officially included in the S&P Cryptocurrency Broad Digital Market (BDM) Index, marking a significant milestone for both WhiteBIT and the broader fintech landscape of Central and Eastern Europe.

The S&P BDM Index — curated by S&P Dow Jones Indices — tracks the performance of leading digital assets that meet strict institutional criteria, including liquidity, market capitalization, governance, transparency, and risk controls. The addition of WhiteBIT coin reinforces the platform’s growing role in the global crypto economy and highlights the industry’s shift toward regulated, infrastructure-level players.

Beyond the inclusion in the Broad Digital Market Index, WhiteBIT’s native coin, WBT, has also been added to four additional S&P Dow Jones digital-asset indices, underscoring its emergence as a mature, institutionally relevant asset.

WBT now appears within several key benchmark families:

- S&P Cryptocurrency Broad Digital Asset (BDA) Index

- S&PCryptocurrency Financials Index

- S&P Cryptocurrency LargeCap Ex-MegaCap Index

- S&P Cryptocurrency LargeCap Index

These classifications require a multi-quarter record of liquidity stability, transparent price formation, and consistent market-cap behavior.

As the industry matures, index providers are expanding coverage beyond protocol-layer tokens, increasingly acknowledging the systemic role of exchanges and financial-infrastructure platforms. WhiteBIT’s coin presence in the BDM Index positions the company within the global map of institutional-grade digital-asset providers.

“Being recognized by S&P DJI is more than an index inclusion — it signals that crypto infrastructure from our region has reached global institutional standards,” said Volodymyr Nosov, CEO of WhiteBIT “This is a turning point not only for our company but also for the evolution of compliant crypto services worldwide.”

This expanded representation marks an important shift for WBT: from a utility token into a component integrated into global benchmark structures used by investment firms, ETF/ETN designers, and quantitative research platforms. Its presence in multiple institutional models means that WBT is now incorporated into the analytical frameworks that guide long-term allocation strategies, diversified exposure construction, and risk-adjusted portfolio modelling.

Market Performance: Resilient Growth and a New All-Time High

WBT’s inclusion comes after a period of stability and upward movement, reaching a new all-time high of $62.96 on November 18, 2025, despite broader market declines and changes external analyses noted WBT’s resilience. These factors contributed to meeting S&P’s criteria for classification.

Being part of S&P indices gives WBT a clear benchmark, making it easier to use in future financial products and long-term investment strategies.

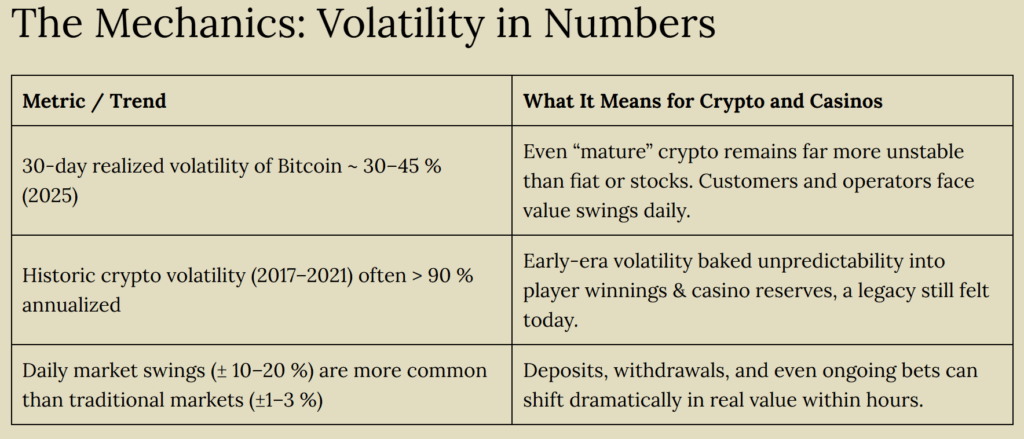

The volatility inherent to cryptocurrencies is more than a buzzword. It fundamentally influences how crypto casinos operate, how players behave, and how the broader market evolves. According to data, the 30-day realised volatility of major digital currencies such as Bitcoin has ranged roughly between 30 and 45% in 2025, which is still far higher than traditional assets like stocks or fiat currencies. This persistent volatility shapes several critical dimensions in crypto gaming.

The Mechanics: Volatility in Numbers

A high-volatility environment like this forces both operators and players to think beyond “win or lose”. They must also factor in currency risk.

Impact on Crypto Casinos: Revenue, Risk, and Stability

- Revenue & Cash-flow Stress: For casinos holding large crypto treasuries (deposits, player funds, reserves), price dips can erode their real-world value, potentially leading to insolvency risks or reduced ability to honour bonuses and payouts.

- Payout Uncertainty: Players might win a jackpot, but if the token collapses before withdrawal or conversion, the actual fiat value of that win could fall dramatically.

- Operational & Confidence Risks: Frequent swings can impair payment processing, create delays, or undermine trust, especially if users perceive the casino as financially unstable or unreliable.

- Push Toward Risk Mitigation: Some operators may increasingly favour or offer stablecoins (pegged to fiat) to reduce volatility exposure for both the casino and players.

In essence, volatility forces crypto casinos to adopt more rigorous financial and risk-management frameworks or face business instability.

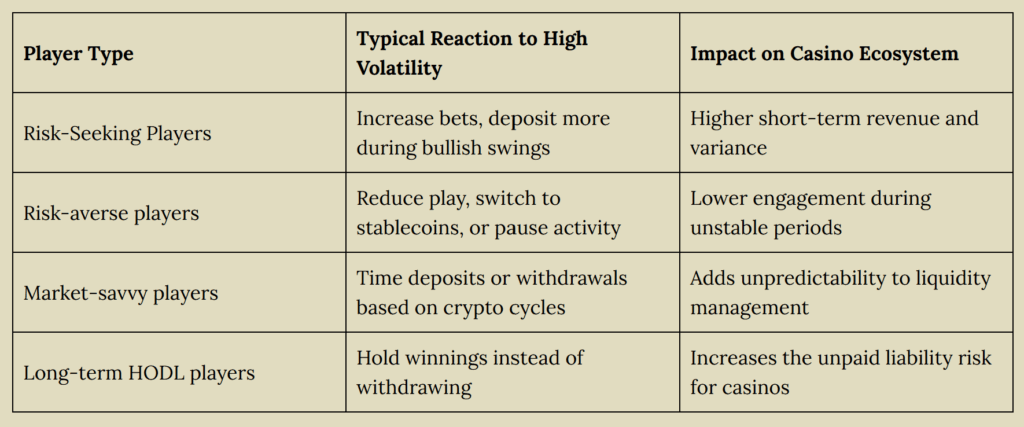

Player Behaviour: From Gambling to Market-Driven Play

Volatility doesn’t just affect casinos. It fundamentally changes how players gamble.

- Speculation + Gaming Hybrid: For some players, betting becomes inseparable from trading. They might place bets when markets are bullish, hoping for multiplied gains, or wait for market dips to deposit “cheap” tokens.

- HODL-style Winnings: Rather than immediately convert winnings to fiat, many choose to “HODL”. That would mean to keep the crypto, hoping for future appreciation. This, however, adds unpredictable risk.

- Risk-avoidance or Reduced Activity: Volatile swings may deter risk-averse players, especially if they fear that even a win could vanish in value before withdrawal.

- Strategic Timing: Experienced crypto-savvy gamblers may time deposits and withdrawals according to market cycles, effectively blending investing strategy with gaming behaviour

Market Stability & the Future of Crypto Casinos

The volatility of crypto markets, while risky, also acts as a powerful filter and driver of evolution in the crypto-casino industry.

- Selective Pressure: Only operators with strong financial management and liquidity resilience will thrive. Volatile markets weed out poorly capitalized casinos.

- Innovation Toward Stability: Use of stablecoins, hedging strategies, dynamic bonus/payout engineering, and risk-adjusted reserve models becomes more common to protect both casinos and players.

- Changing User Base: As gambling meets trading, casinos attract more “crypto-native” users; those familiar with markets, comfortable with swings, and willing to take on an extra layer of risk.

- Potential Regulatory Interest: As crypto-casinos grow, regulators may pay more attention, especially given volatility-driven risks to consumers. This could shape future compliance standards and transparency.

“When crypto markets surge, we often see a wave of aggressive deposits and high-stakes play; players feel capitalised and optimistic.” — Jonas Kyllönen, Crypto Casino Expert at Mr. Gamble.

Paavo Salonen, another Casino Expert at Mr. Gamble, added: “Volatility also demands that operators, like us, build strong liquidity buffers. A sudden crypto crash can turn yesterday’s profits into today’s solvency risk.”

According to Mr. Gamble’s analytics investigated over recent years, crypto volatility remains one of the top challenges, but also one of the main catalysts for innovation in gaming design, reserve management, and payout mechanisms.

Crypto volatility is a double-edged sword for the future of crypto casinos: It adds an extra layer of risk, destabilises payouts and operations, and challenges both players and operators to adapt. Yet, the very same volatility drives innovation, leading to more sophisticated financial infrastructure, hybrid models blending trading and gambling, and a new breed of crypto-native players.

Kyrgyzstan has officially launched USDKG, a gold-backed stablecoin pegged 1:1 to the U.S. dollar, with an initial issue of $50 million. The token is issued on Tron and fully audited by ConsenSys Diligence, with future expansion slated to include Ethereum support.

The issuer, OJSC Virtual Asset Issuer, is a state-owned entity under the Ministry of Finance, operating within the legal framework established by the 2022 Law on Virtual Assets of the Kyrgyz Republic. The initiative represents a first-of-its-kind model in Central Asia, merging sovereign oversight with blockchain transparency.

The launch ceremony was attended by Sadyr Japarov, President of the Kyrgyz Republic, Almaz Baketaev, Minister of Finance, and Biibolot Mamytov, CEO of Gold Dollar, the project’s operator. During the event, the dignitaries pressed a symbolic “Launch Issuance” button, officially initiating the circulation of USDKG tokens.

The issuance of USDKG is carried out by a company with 100% state participation, ensuring a high level of investor trust and institutional reliability. A total of 50,000,000 USDKG tokens have been issued, each fully backed by physical gold reserves. Operational control — including gold management — is delegated to a private company registered in the Kyrgyz Republic, under a contractual agreement with the USDKG issuer.

This separation of responsibilities ensures independent operational oversight and positions USDKG outside the classification of a Central Bank Digital Currency (CBDCs). The company responsible for managing USDKG’s gold reserves, has outlined plans to expand the backing to $500 million in the next phase, with a long-term target of $2 billion.

The stablecoin is fully compliant with FATF KYC/AML standards, and redemptions require standard identity verification. It is designed to facilitate financial inclusion.

Kyrgyzstan is among the first nations in the region to establish a comprehensive digital-asset regulatory framework, setting a precedent for state-supervised virtual currencies. Government representatives emphasized that such initiatives aim to enhance economic transparency and trade efficiency, rather than serve any geopolitical agenda. Officials also noted that USDKG complements, rather than competes with, the national monetary system.

The project reframes traditional narratives around state-issued and commodity-backed digital assets. Its gold collateral serves as a verifiable, inflation-resistant foundation, aligning with a growing market preference for transparent, real-asset-backed stablecoins. By combining physical reserves with on-chain verification, USDKG introduces a model of measurable stability uncommon in the current stablecoin landscape. The state-backed structure provides a clear regulatory framework built on accountability and public oversight.

The Kyrgyz initiative underscores a broader trend toward responsible digital-asset innovation in emerging markets. The government’s focus on regulatory discipline, transparency, and tangible reserves signals a pragmatic approach to blockchain-based modernization.

With USDKG, Kyrgyzstan positions itself as a regional first-mover in regulated asset-backed digital currencies — both bridging traditional finance and blockchain infrastructure and maintaining full sovereign oversight.

While many are cautious about real estate or unsure where to invest amid global turbulence, collectible cars remain a stable — and prestigious — way to preserve and grow capital.

We’re talking about rare cars — not just expensive ones, but those with unique history, design, and limited production. From the Ferrari 250 GTO to the Mercedes SL73 AMG, these cars are bought not only for pleasure but also as long-term investment tools. Why? Because their value steadily increases.

According to the Knight Frank Wealth Report, investments in collectible cars rank among the top 5 most profitable alternative asset classes in Europe, with an average annual return of 24–26%. That’s higher than most stock indices and even real estate. Moreover, the classic car market shows low correlation with traditional assets, making it particularly attractive in uncertain times.

In an age of geopolitical tension and high inflation, historic cars have become true “mobile vaults.”

To measure profitability, investors use CAGR (Compound Annual Growth Rate) — the average annual growth rate of value. The formula: (FinalValue/ InitialValue) (1 / n) – 1

So who are these investors with gasoline in their veins and spreadsheets in their heads? Let’s look at the most charismatic and calculating owners of automotive masterpieces, focusing on style, capital, and returns.

- Bill Gates

Bill Gates isn’t just the co-founder of Microsoft — he’s one of the most systematic investors on the planet. He backs startups making synthetic meat with the same enthusiasm he has for nuclear energy. He also personally lobbied for the U.S. law that allowed the import of rare cars, just so he could get his hands on a Porsche 959. In his world, if there’s a law against luxury, it’s probably a bug — not a feature.

Bill Gates is known not only for his technology investments but also for his rare car collection. His garage includes various classic cars, with a strong focus on rare, high-performance vehicles. According to Hotcars media, Gates’ collection is often cited at around 23 vehicles. Among the cars he reportedly owns are notable models like the Porsche 959, which he lobbied to have imported to the U.S. His collection is also said to include a Ferrari 348, a Rolls-Royce Corniche, and a 1999 McLaren F1, considered one of the most iconic supercars ever made.

Key Car from the Collection:

McLaren F1

- Purchase Price (1999): ~$1M

- Current Value (2025): ~$20M

- Profit (1999–2025): ~$19M

- CAGR (1999–2025): ≈ 15.6% annually

- Future Value (2035 Est. Base @8% CAGR): ~$43M

- Profit (2025–2035 Est.): ~$23M

- Future Value (2035 Est. Bull @10% CAGR): ~$52M

- Bull Profit (2025–2035 Est.): ~$32M

Total Collection (est.)

- Current Value: ~$45M

- Average Car Value: ~$1.8M+ (driven up by McLaren F1)

- Total Profit (1999–2025): ~$44M

- Total Profit (2025–2035 Est. @7% CAGR): ~$44M

- Bull Profit (10% CAGR): ~$72M

Note: The difference between historical profit (up to 2025) and forward-looking estimates (to 2035) comes from projecting an additional 10 years of growth. The longer the horizon, the higher the cumulative profit due to compounding CAGR.

2. Volodymyr Nosov

Volodymyr Nosov is a European billionaire and entrepreneur, founder of one of the largest crypto exchanges in Europe – WhiteBIT. His net worth grew from zero to $7 billion faster than most people register a wallet. Nosov has an entire collection of rare cars, showcased in his video project WBT Garage, where he shares unique features, and investment potential of his automotive treasures. His private garage today counts around 150 cars worth an estimated $35 million, making it one of the most valuable personal collections in Europe.

He invests in cars consciously and strategically, expecting significant appreciation. One example is his Mercedes SL73 AMG, purchased for about $300K. Just a few years later, it’s already worth three times more. This car is exceptionally rare: while 85 units were originally planned for production, the actual number was just 35, as Volodymyr notes in his new WBT Garage episode. Of these, 18 went to the Sultan of Brunei, leaving only 17 available on the global market.

In the second episode of WBT Garage, Volodymyr talks about the Ferrari Dino 246 GT, a legendary model with a V6 engine, produced from 1969 to 1973. With only 38,000 km on the odometer and in original condition, this car has become a true collector’s item, now fetching prices at auction starting at €700,000. Thanks to its unique history and exceptional characteristics, the Dino continues to rise in value, making it a lucrative investment asset.

Key Car from the Collection:

Mercedes SL73 AMG

- Purchase Price (2020): ~$300K

- Current Value (2025): ~$900K

- Profit (2020–2025): ~$600K

- CAGR (2020–2025): ≈ 60% annually

- Future Value (2035 Est. Base @7% CAGR): ~$1.77M

- Profit (2025–2035 Est.): ~$870K

- Future Value (2035 Est. Bull @10% CAGR): ~$2.34M

- Bull Profit (2025–2035 Est.): ~$1.44M

Total Collection (150 cars)

- Current Value: ~$35M

- Average Car Value: ~$233K

- Total Profit (2020–2025): ~$20M

- Total Profit (2025–2035 Est. @7% CAGR): ~$34M

- Bull Profit (10% CAGR): ~$56M

3. David MacNeil

David MacNeil made his fortune in the automotive world, founding WeatherTech, a U.S. manufacturer of high-end custom-fit car accessories, from floor mats to trunk liners. With his fortune, he turned his attention to collecting rare and high-performance vehicles.Known for his impressive car collection, MacNeil owns around 14 cars (according to Agent4Stars), with a total value estimated at ~$150M based on the same source. His collection includes some of the most iconic and valuable cars in automotive history.

Among the standout models in his collection are the Ferrari 250 GTO (purchased for $70 million), the Bugatti Divo, and a range of Ferraris including the Ferrari F40, Ferrari Enzo, and Ferrari 250 GT Lusso. These cars represent a blend of engineering excellence, racing legacy, and timeless design, making them not just prized possessions, but also significant investments.

MacNeil’s approach to collecting is strategic. He doesn’t just seek out rare cars for the sake of rarity, his acquisitions reflect a deep appreciation for automotive history and engineering achievement. The Ferrari 250 GTO alone is considered one of the most coveted cars in the world, and its purchase for $70 million in 2018 was a record-breaking move.

Key Car from the Collection:

Bugatti Divo

- Purchase Price (2019): ~$5.8M

- Current Value (2025): ~$6.5M

- Profit (2019–2025): ~$700K

- CAGR (2019–2025): ≈ 5.3% annually

- Future Value (2035 Est. Base @4.5% CAGR): ~$10.1M

- Profit (2025–2035 Est.): ~$3.6M

- Future Value (2035 Est. Bull @6% CAGR): ~$11.6M

- Bull Profit (2025–2035 Est.): ~$5.1M

Total Collection

- Current Value: ~$150M

- Average Car Value: ~$10.7M

- Total Profit (2019–2025): ~$20M+

- Total Profit (2025–2035 Est. @4.5% CAGR): ~$91M

- Bull Profit (6% CAGR): ~$131M

4. Elon Musk

Co-founder of PayPal, CEO of Tesla, and founder of SpaceX is known not only for his revolutionary companies but also for his bold and sometimes eccentric lifestyle. Unsurprisingly, his car collection mirrors that energy: rare, theatrical, and high-performing. From driving a McLaren F1 with Peter Thiel until the suspension gave out, to buying a real James Bond submarine car, his garage is just as futuristic as his rocket fleet.

Musk’s collection is eclectic, with a strong emphasis on high-performance vehicles, but also includes unique and eccentric models. Media reports mention around 10 cars publicly known, with an estimated value of $50M–$75M, but there is speculation that Musk’s actual collection could already exceed 100 vehicles.

Key Car from the Collection:

Lotus Esprit Submarine Car

- Auction Price (2013): £550,000 ≈ ~$865K (GBP/USD ≈ 1.57)

- Current Value (2025): ~$2M

- Profit (2013–2025): ~$1.14M

- CAGR (2013–2025): ≈ 8.7% annually

- Future Value (2035 Est. Base @8% CAGR): ~$4.3M

- Profit (2025–2035 Est.): ~$2.3M

- Future Value (2035 Est. Bull @10% CAGR): ~$5.2M

- Bull Profit (2025–2035 Est.): ~$3.2M

Total Collection

- Current Value: ~$62.5M (mid-case, excluding potential hidden cars)

- Average Car Value: ~$5M

- Total Profit (2013–2025): ~$30M+

- Total Profit (2025–2035 Est. @7% CAGR): ~$60M

- Bull Profit (9% CAGR): ~$85M

5. Bernard Arnault

Among the world’s top five richest individuals, Bernard Arnault is the mastermind behind LVMH, the global luxury empire. Known for shaping modern luxury through brands like Louis Vuitton, Dior, and Hennessy, Arnault’s taste for refinement naturally extends to his car collection. From gold-plated Bugattis to ultra-rare Mercedes-Benz racers, he doesn’t just wear luxury — he drives it.

Arnault’s collection is a true reflection of his appreciation for luxury, featuring high-performance cars and rare models that reflect both his personal taste and his status. His collection includes cars like the Bugatti Veyron Grand Sport Vitesse, Mercedes-Benz SLR McLaren Stirling Moss Edition, and Bugatti Sang Noir, each a testament to his pursuit of automotive excellence. There is no public information confirming the exact number of cars, but rumors suggest he owns around 10 vehicles. Based on estimates, their combined value is approximately ~$60M.

Key Car from the Collection:

Bugatti Veyron Grand Sport Vitesse

- Purchase Price (2015): ~$1.9M

- Current Value (2025): ~$2.6M

- Profit (2015–2025): ~$0.7M

- CAGR (2015–2025): ≈ 3.2% annually

- Future Value (2035 Est. Base @3.2% CAGR): ~$3.6M

- Profit (2025–2035 Est.): ~$1M

- Future Value (2035 Est. Bull @5% CAGR): ~$4.2M

- Bull Profit (2025–2035 Est.): ~$1.6M

Total Collection

- Current Value: ~$60M

- Average Car Value: ~$5M

- Total Profit (2015–2025): ~$8M+

- Total Profit (2025–2035 Est. @3.2% CAGR): ~$22M

- Bull Profit (5% CAGR): ~$38M

6. Evert Louwman

Evert Louwman transformed his family’s automotive business into one of the world’s most respected museums: the Louwman Museum in The Hague. Unlike most billionaire collectors who focus on rarity and value alone, Louwman built a cultural treasury that preserves the entire story of the automobile. He personally curated many of the exhibits with Managing Director Kooyman, dividing the collection thematically: steam, electric and hybrid pioneers, brass-era icons, racing machines, cycle cars, aerodynamic experiments, and vehicles owned by historic figures.

The collection holds some of the world’s most important automobiles: from a Ford Model T and Volkswagen Beetle to design legends like the Chrysler Airflow and the Talbot-Lago teardrop coupe by Figoni et Falaschi. One of Louwman’s most meaningful finds is a 1936 Toyota AA discovered in Siberia. To highlight Dutch heritage, the museum owns 13 of the 16 surviving Spykers, including the world’s first six-cylinder, all-wheel-drive racer (1903). Today, the Louwman Museum has over 270 cars, with an estimated total value in the hundreds of millions of dollars.

But it isn’t only about cars. The museum integrates automobilia — posters, stained glass, trophies, toys, cigarette cases, and fine artworks by Carlo Demand, Peter Helck, Walter Gotschke and F. Gordon Crosby. Entire workshops, early garages, bicycles, and even the original Spyker machine tools are part of the display. The museum closes not with a gift shop but with a reconstructed early 20th-century town square, complete with storefronts and a café tied to the Louwman family’s original Dodge distributorship.

Key Car from the Collection:

Jaguar D-Type (Le Mans Winner 1957)

- Purchase Price (1999): ~$2.7M

- Current Value (2025): ~$22M (based on Hagerty data, with a highest sale recorded at $21,780,000)

- Profit (1999–2025): ~$19.3M

- CAGR (1999–2025): ≈ 8.6% annually

- Future Value (2035 Est. Base @8% CAGR): ~$47.5M

- Profit (2025–2035 Est.): ~$25.5M

- Future Value (2035 Est. Bull @10% CAGR): ~$57.1M

- Bull Profit (2025–2035 Est.): ~$35.1M

Total Collection

- Current Value: estimated ~$300M

- Average Car Value: ~$1.1M

- Total Profit (1999–2025): ~$200M+

- Total Profit (2025–2035 Est. @5% CAGR): ~$189M

- Bull Profit (7% CAGR): ~$295M

Style. Capital. And the undeniable truth: “While market volatility may affect your assets, rare vintage cars like the Ferrari 250 GTO consistently grow in value.”

No one can predict how your investment portfolio will perform in the next decade, but the one thing that remains certain is that the Ferrari 250 GTO will continue to appreciate.

What sets it apart from traditional investments is that you can experience the returns firsthand — driving a piece of history. A unique blend of tangible enjoyment and exceptional financial growth.

Crypto mining burns through electricity like there’s no tomorrow. Bitcoin alone uses more power than Argentina (150+ TWh yearly), while old-school Ethereum consumed about 112 TWh before switching to proof-of-stake in 2022. We’re talking about computers solving complex math problems 24/7 to validate transactions and create new coins, which is the whole proof-of-work system that makes Bitcoin work but also makes environmentalists lose sleep.

| Cryptocurrency | Annual Energy Use (TWh) | Country Equivalent |

|---|---|---|

| Bitcoin | 150+ | Argentina |

| Ethereum (pre-merge) | 112 | Netherlands |

| Bitcoin Cash | 1.5 | Malta |

The problem isn’t just the electricity, it’s where that electricity comes from. 65% of Bitcoin mining happens in China, Kazakhstan, and Russia, countries that run mostly on coal. Miners chase cheap electricity, and cheap electricity usually means fossil fuels. So every transaction pumps more CO2 into the atmosphere, and we’re not talking small numbers here, Bitcoin produces 73 million tons of CO2 yearly.

Sustainable Solutions

But here’s where it gets interesting. Some miners figured out they could set up shop next to hydroelectric dams in Norway or geothermal plants in Iceland, running their operations on 100% renewable energy.

El Salvador mines Bitcoin using volcano power (seriously), and Paraguay runs mining farms on excess hydroelectric capacity that would otherwise go to waste.

The real game-changer though? Proof-of-stake. Ethereum cut its energy use by 99.95% when it switched from mining to staking, and now you don’t need warehouses full of graphics cards to participate, just stake your coins and help validate transactions. Cardano, Solana, and Algorand built this efficiency in from day one, using about as much energy as a few hundred homes instead of entire countries.

Regulation, Innovation, and What’s Next

Some countries started taxing mining operations based on their carbon output, while others like China straight-up banned it. Meanwhile, companies like Tesla started buying carbon credits to offset their Bitcoin holdings, and new projects let you track the carbon footprint of your crypto wallet in real-time.

The weirdest part? Blockchain might actually help fight climate change. Companies now tokenize carbon credits on-chain, making them easier to trade and verify, and some mining operations capture methane from landfills to power their rigs, turning greenhouse gas into Bitcoin while preventing it from hitting the atmosphere.

Crypto doesn’t have to destroy the planet, but right now Bitcoin’s proof-of-work system absolutely does.

Your best bet is supporting proof-of-stake networks, trading through the lowest fee crypto exchange with minimal infrastructure overhead, and pushing for regulations that reward green mining.

Or just wait for Bitcoin to finally admit defeat and switch to proof-of-stake. Though honestly, don’t hold your breath on that one.

San Francisco, United States, October 30th, 2025, Chainwire

Hetu, a pioneer in decentralized science (DeSci) and financial infrastructure, today unveiled Hetu 3.0, an Ethereum-based AI-Native Monetary Stack that transforms verified intelligence into programmable capital — turning verified intelligence into liquid capital, bridging crypto liquidity with the AI economy, and introducing the first sovereign, society-owned AI currency.

Ethereum-Based AI-Native Money Stack

Built directly on Ethereum, Hetu 3.0 introduces a tri-layered architecture that converts verified intelligence into liquid, composable capital.

At its foundation lies $HETU, a fair-launched, deflationary 21 million-supply base asset anchoring liquidity and credit across the intelligence network — the Bitcoin of autonomous cognition.

Flowing through it is $AIUSD, a zero-fee, millisecond-settlement stablecoin backed by AI infrastructure revenue and yielding 8–12% for human and agent-level payments.

Circulating between them is $FLUX, a real-time audit and reward layer powered by Proof of Causal Work (PoCW), encoding proof, credit, and reputation into a unified on-chain cashflow financing standard.

Together, these currencies form a closed, auditable loop: verified work becomes $FLUX credit, settles through $AIUSD, and consolidates into $HETU’s long-term value base — the financial spine of the intelligence economy.

Society-Owned AI Bitcoin — Toward a Sovereign Intelligence Currency

Hetu 3.0 redefines sovereign AI money — not as a currency of states or corporations, but as one belonging to the collective network of intelligence itself.

By tying issuance to verified causal work rather than artificial scarcity, Hetu makes value a direct expression of verified understanding.

In this system, intelligence becomes monetary, capable of verifying, financing, and sustaining itself.

Value arises not from possession, but from comprehension — from that which is understood, aligned, and shared.

Sovereignty thus emerges from epistemic truth, not political authority — forming a monetary order grounded in verification and trustless knowledge.

Bridging Crypto Liquidity to AI — via X402 and EIP-8004

Hetu builds the missing bridge between Ethereum’s capital base and AI-native yield.

EIP-8004 introduces verifiable agent identity and agent-to-agent settlement, allowing each autonomous actor to record proof, performance, and reputation directly on-chain.

X402 extends this framework by channeling ETH and stablecoin liquidity into productive AI yield — where $AIUSD powers real-time payments and $FLUX tokenizes future revenue.

Together, the two standards form an on-chain cashflow financing loop, connecting Ethereum liquidity to verified AI productivity — turning capital markets into the circulatory system of the intelligence economy.

From Scarcity to Abundance — Redefining the Meaning of Money

The industrial economy was built on scarcity — finite supply, accumulation, and zero-sum exchange.

The intelligence economy begins from abundance, where value derives from verified cognition and understanding rather than ownership or extraction.

Proof of Causal Work (PoCW) rewards traceable reasoning and verifiable contribution, while Proof of Semantic Alignment (PoSA) ensures intent and output remain coherent and meaningful.

Together, they transform money into a semantic feedback loop between truth, trust, and intelligence — where liquidity flows toward meaning, not speculation.

In this new order of abundance, understanding becomes yield, and alignment becomes capital.

A New Monetary Order

Hetu 3.0 is more than a protocol upgrade — it marks the emergence of a new monetary order.

Here, money is issued by verified intelligence rather than by power; liquidity gravitates toward meaning rather than scarcity; and every aligned cognitive act becomes a unit of capital.

By combining an EVM-compatible causal-DAG with Proof of Causal Work, Hetu bridges Ethereum liquidity with the AI economy, enabling autonomous agents to verify outputs, transact instantly, and finance future work.

In this paradigm, money ceases to be a static medium of exchange — it becomes a living language of intelligence: a self-verifying, self-financing, and self-evolving foundation for the civilization to come.

“By combining an EVM-compatible causal DAG with Proof of Causal Work, Hetu 3.0 bridges Ethereum liquidity with the AI economy — enabling autonomous agents to verify output, transact instantly, and finance future work.”

— Jialin Li, Co-Founder, Hetu Protocol

About Hetu

Hetu builds Deep Intelligence Money — the first AI-Native Monetary Stack unifying verification, settlement, and financing for the intelligence economy.

Powered by PoCW and PoSA, and anchored on EIP-8004 and X402, Hetu 3.0 runs on an EVM-compatible causal-DAG ledger capable of 210K TPS, 400 ms finality, and 1 ms real-time audits across more than 1,000 AI markets.

By uniting Ethereum’s liquidity with verified intelligence, Hetu lays the foundation for a self-verifying, self-financing, and self-evolving civilization of money.

Website: hetu.org

X (Twitter): @hetu_protocol

Lightpaper: docsend.com/view/x9p3pf9vkseknvt9

Contact

CMO

Stephanie Yu

AdvaitaLabs

stephanie@advaita.xyz

Willemstad, Curaçao, October 29th, 2025, Chainwire

Whale.io has announced that the first airdrop for Crock Dentist NFT holders is scheduled for this weekend, following strong early performance of the recently launched Whale Originals title.

The limited collection of 1,000 Crock Dentist NFTs has already seen significant adoption, with more than 300 unique holders. Early secondary market activity is underway on Magic Eden, where the first NFTs have been listed, bought, and sold, establishing initial pricing and liquidity for the collection.

Real-Time Stats and Airdrop Projections

Whale.io has rolled out live game statistics for Crock Dentist, offering full transparency into key performance indicators. The dashboard, accessible directly on the platform, displays real-time turnover, wager volume, and player activity. This data confirms the game has generated over $250,000 in turnover since launch. The game’s 98% Return to Player (RTP) structure allocates the 2% house edge entirely to fund airdrops for NFT holders.

Based on current metrics, Whale.io estimates the first airdrop will exceed $5,000 in $WHALE tokens. With each NFT entitled to 0.1% of the total distribution.

Users who have not yet minted will miss the upcoming airdrop. Minting remains open on Whale.io, but with supply capped at 1,000 and over 30% already claimed, availability is limited.

Social Campaigns Offer Free NFT Entry

To broaden access, Whale.io has launched targeted social campaigns on X (@WhaleGames_en), where users can win Crock Dentist NFTs through engagement activities such as retweets, game-related quizzes, and community challenges.

The $WHALE token powers multiple functions within the ecosystem, including gameplay, battle pass purchases, and staking. Following TGE, expanded utilities will further integrate the token across Whale.io’s offerings.

About Whale.io

Whale.io is an online casino and sportsbook platform specializing in proprietary Whale Originals games and transparent, blockchain-based reward systems. The platform combines traditional gaming entertainment with community-owned value through NFTs and native tokenomics.

Discover the future of Whale.io Casino and Whale Token by checking them out here:

Website: https://whale.io/nft

Socials: https://linktr.ee/whalesocials_tg

Contact

Whale Spokesperson

Whale

Whale.io

support@whale.io

London, United Kingdom, October 29th, 2025, Chainwire

$BOS token to go live both as an ERC-20 on EVM chains and as a CNT on Cardano.

Today, BOS (BitcoinOS), the unifying operating system transforming Bitcoin for digital economies, has officially launched the $BOS token at $200 million FDV, trading is live on Binance Alpha along with Kucoin, Gate, Kraken US, Bitget, MEXC, and PancakeSwap DEX.

The $BOS token is positioned to fulfill critical functions, serving as the incentive layer to ensure that the BOS network remains secure, performant and decentralized. While computation and verification happen on Bitcoin, a specialized node network is required to:

- Generate ZK proofs from computation

- Monitor the system for fraudulent activity

- Submit challenge transactions to Bitcoin when fraud is detected

- Provide verification services for non-technical users

BOS aims to maximum value accrual by operating a buy-and-burn mechanism. As the BOS network grows and more chains integrate, more computation will be required due to increase in transactions, resulting in more $BOS token payments.

This creates a BTC-native economy where $BOS token holders effectively earn BTC-denominated returns as the network grows. The more activity on BOS, the more BTC flows into buying and burning $BOS tokens, creating deflationary pressure while rewarding network participants.

Since inception, BOS has announced integrations with key projects from several ecosystems, notably Cardano, Litecoin, Arbitrum, Mode Network, RISC Zero, Merlin Chain and Nubit. BOS has also demonstrated a series of significant technological innovations that unlocks $2.2 trillion worth of Bitcoin liquidity across ecosystems and institutions. Highlights include an industry-first bridgeless cross-chain asset transfer, the launch of Charms, the first protocol for programmable tokens on Bitcoin, and the introduction of Grail Pro, an institutional-grade protocol that allows institutional BTC yield generation while retaining self-custody.

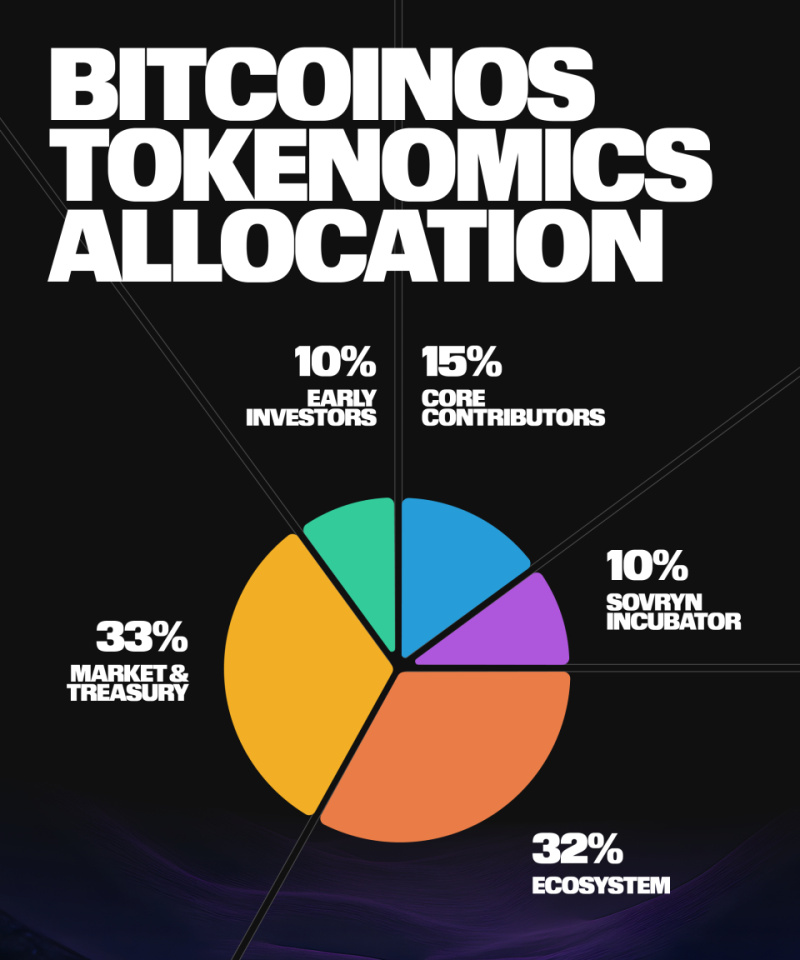

The BOS Tokenomics comprises a total supply of 21 billion tokens, a symbolic nod to Bitcoin’s supply. Distribution of the tokens are as follows:

Successful pre-sale and airdrop campaigns were conducted earlier in the year, accounting for 3% of the total token allocation.

Successful pre-sale and airdrop campaigns were conducted earlier in the year, accounting for 3% of the total token allocation.

Those who participated in the pre-sale will be able to claim their tokens when trading begins, followed by other early supporter communities including Cardano and EVM ecosystems.

About BitcoinOS

BitcoinOS (BOS) is the first platform enabling programmability on Bitcoin without modifying its base protocol. Through zero-knowledge proof technology, BOS unlocks smart contracts, DeFi applications, and cross-chain interoperability—all secured by Bitcoin’s unmatched network security.

More: bitcoinos.build

Contact

Media Contact

Candice Teo

candice@espoircommunications.com