Tokyo, Japan, September 4th, 2023, Chainwire

TOKYO BEAST FZCO, headquartered in Dubai, United Arab Emirates; General Manager: Tomoe Mizutani; (hereinafter “TOKYO BEAST FZCO”) has announced the crypto entertainment project “TOKYO BEAST, gumi Inc.

Headquartered in Shinjuku-ku, Tokyo; Hiroyuki Kawamoto, CEO; (hereinafter “gumi”) as the developer, Turingum K.K., headquartered in Minato-ku, Tokyo; Hiroki Tahara, CEO; (hereinafter “Turingum”) as the technology and financial advisory, using the Polygon protocols as the blockchain network for implementation, to release several modular projects worldwide in 2024.

The announcement was made today, September 4th 2023, at the Korea Blockchain Week conference held in Seoul, Korea.

What is “TOKYO BEAST” all about?

“TOKYO BEAST” is a crypto entertainment project that challenges to create a new entertainment experience by integrating crypto assets.

It is a completely original large-scale project with many experienced staff members who have developed and operated famous Japanese games, and a development budget unparalleled for a web3 game.

The company will provide an innovative and exciting entertainment experience that only “TOKYO BEAST” can provide, evolving Web3 games to a new stage.

・Promotion movie:https://youtu.be/0-QvJeYJ6ds

Features of TOKYO BEAST

Pursuing pure fun

The team believes that it is important to be able to enjoy the game itself, outside of its web 3 features, so the emphasis was to create an authentic worldview, attractive characters, an enthusiastic battle system, and more.

The quality of the game is comparable to that of today’s leading smartphone games. The gaming experience is easy and seamless as the team eliminated barriers to starting the game, such as the initial NFT purchase and wallet connection, and aims to enable a wide range of participation, including general smartphone game users, and not just those confined to the Web3 world.

A series of characters that are attractive both as game characters and as NFT collections

The characters are designed to be interactive with an active role in the game and at the same time, to be recognized outside of the game as an NFT collection with a sophisticated visual style and high rarity. The project founders aim to create something that will be loved widely beyond borders and languages, just like “TOKYO BEAST”.

A fusion experience of the worldview and the crypto ecosystem

“TOKYO BEAST” emphasizes the importance of synchronizing the experience of immersing oneself in the worldview of the game with the real-world crypto ecosystem. “TOKYO BEAST” will provide an experience that unites each modular project and stakeholder in a single worldview, something that has not been done in existing web3 games.

Creating a new entertainment experience by predicting the winner of battles

Under a legitimate scheme, there will be a win/loss prediction function that can be enjoyed inside and outside the game. Users will be able to enjoy predicting the winner of battles using data. Battles will be streamed live simultaneously around the world, and users will be able to enjoy the excitement and frenzy of the experience by watching the battles with other users around the world.

The world of “TOKYO BEAST” continues to expand

All the module projects to be released in the future will be organically intertwined to deliver an unexplored entertainment experience through the synergy of crypto x content. Moreover, the team aims to continue expanding the world of “TOKYO BEAST” and the utility of $TBZ(*1).

As a first step, the following core module projects will be released sequentially worldwide in 2024. * “BASE”, a function to experience the unique economy of the “TOKYO BEAST” token “$TBZ * “FARM”, a function that allows users to experience NFT owner by cultivating “BEAST,” which will serve as data for NFT(*2).

TRIALS”, a function that allows users to experience being a hero who fights with dreams and romance on his/her shoulders.

During the second phase, a module project to provide new entertainment from various aspects to further expand the world of “TOKYO BEAST” and the utility of $TBZ will be mapped out and executed.

Campaign and Event

Early Entry Campaign

Date: September 4, 2023 – October 31, 2023

To celebrate the release of the information, three “Early Entry Campaigns” will be held, in which users can win a “Mystery Box” containing “TOKYO BEAST” tokens and NFTs by following the official X (former Twitter, hereafter “official X”) account, etc.

① Follow Me Campaign

The highest rarity “Mystery Box” will be given away by drawing among those who follow the official X account. The earlier users follow us, the higher your chance of winning.

② Weekly Prediction

If users follow the official X account and participate in the weekly prediction quiz of “TOKYO BEAST” on the official X account, they can receive a high rarity “Mystery Box” by lottery.

③ Strike Jackpot

A jackpot-style campaign will be held during the “Early Entry Campaign”.

Each time a target number of live streaming viewers or Official X followers is reached, a prize will be added to the jackpot, and a drawing will be held on Official X to determine who will win the jackpot. If the jackpot is not opened, the rewards in the pot will be carried over to the next drawing. If the jackpot is opened, the winner will be drawn from the followers of the Official X account and will receive the rewards including those that have been carried over.

*For details on each of the “Early Entry Campaign” campaigns, please refer to the following link: https://medium.com/@TOKYOBEAST/2c7956cb7558

・Polygon × TOKYO BEAST Livestreaming

Polygon and TOKYO BEAST will hold a live streaming event.

Title: Polygon × TOKYO BEAST Livestreaming

Schedule: 2023/9/8 20:00(EST)/ 17:00~ (PST)

URL: https://www.youtube.com/watch?v=rikxEfWuKIM

Speakers:Yoriko Beal (Polygon Head of Business Development Japan)

Naoki Motohashi (TOKYO BEAST Producer)

Shuhei Mise (TOKYO BEAST Global Head)

(*1) $TBZ is TOKYO BEAST’s proprietary IP token.

(*2) NFT stands for Non-Fungible Token. Blockchain technology is used as digital data with a certificate of ownership, making it impossible to tamper with or forge.

===========

Service Name:TOKYO BEAST

Company name: TOKYO BEAST FZCO

Location: 001 – 33228 IFZA Business Park, DDP, Dubai, United Arab Emirates

Representative: Tomoe Mizutani

Official site: http://tokyo-beast.com/

Official X (Twitter): https://twitter.com/TOKYOBEAST_EN

Playable: App Store、Google Play、PC

For inquiries about the press release, please contact TOKYO BEAST FZCO Public Relations:press@tokyobeast.ae

Contact

BD Manager

Tomoe Mizutani

TOKYO BEAST FZCO

press@tokyobeast.ae

Georgetown, Cayman Islands, September 1st, 2023, Chainwire

Kava Chain, a decentralized Cosmos-Ethereum interoperable Layer 1 blockchain, is now available on Fireblocks, an enterprise platform to manage digital asset operations and build innovative businesses on the blockchain. The integration will enable safe and secure access for Fireblocks customers to the expanding Cosmos DeFi ecosystem via the Kava Chain.

“With the integration of Kava Chain onto the Fireblocks Network, we’re excited to bring Kava’s innovative suite of DeFi app protocols and Cosmos DeFi access to our customers,” said Idan Ofrat, Co-founder and Chief Product Officer at Fireblocks. “In the past year, we have seen growing institutional interest in DeFi. Fireblocks’ defense-in-depth security and customizable Transaction Authorization Policy (TAP) allow our customers to safely explore and innovate in the DeFi arena without compromising their compliance and security requirements. We look forward to unlocking more opportunities for our customers in the future.”

Kava Chain has been steadily building and growing through the bear market. However, without a robust connection to an MPC (multi-party computation) custody technology provider, top-tier crypto institutions have not been able to engage with the dApps on-chain. The Fireblocks integration enables over 1,800 leading digital asset and crypto institutions to now custody KAVA tokens and access Kava-native assets, including Cosmos-native USDt — selected by Tether to be issued exclusively on Kava Chain.

This integration not only enhances institutional access to Kava but also allows Fireblocks customers to:

- Engage in DeFi opportunities on platforms within the Kava ecosystem, such as Curve, Kinetix, and Hover.

- Participate in market-making using Cosmos-native USDt on major exchanges.

- Explore new USDt DeFi opportunities on prominent Cosmos appchains.

“Kava Chain’s role in arbitrage market making is becoming increasingly significant. With the Fireblocks integration, centralized exchanges (CEXs) and major market makers have a more capital-efficient option for cross-chain arbitrage,” said Scott Stuart, Co-founder of Kava Chain. “Instead of incurring high gas fees on Ethereum, they can now utilize Kava to transfer USDt between ecosystems efficiently. We’re excited about the future and the value this integration brings to our community!”

For more updates, follow Kava Chain and Fireblocks on X (fka Twitter).

About Kava

Kava Chain (is a secure, lightning-fast Layer-1 blockchain that combines the developer power of Ethereum with the speed and interoperability of Cosmos in a single, scalable network. Committed to fostering innovation and growth, Kava Chain is a trusted choice for developers and users worldwide.

Contact

Marketing Manager

Guillermo

Kava

guillermo.carandini@kava.io

New York, US, September 1st, 2023, Chainwire

In a significant stride towards revolutionizing data privacy and verification, zkPass, the innovative privacy-preserving protocol for private data verification, announces that its Pre-alpha Testnet is open for public testing.

A Glimpse into the Future: zkPass Pre-alpha Testnet

The zkPass Pre-alpha Testnet presents a transformative approach to private data verification. Built on the bedrock of Multi-Party Computation (MPC), Zero-Knowledge Proofs (ZKP), and Three-party Transport Layer Security (3P-TLS), zkPass introduces TransGate—a gateway empowering users to selectively and privately validate their data from any HTTPS website. This encompasses diverse data types, including legal identity, financial records, healthcare information, social interactions, work history, education, and skill certifications. zkPass achieves these verifications securely and privately, obviating the necessity to reveal or upload sensitive personal data to third parties.

The Power of Scalability

zkPass can be readily incorporated into multiple application scenarios, including composable decentralized identity passes, DeFi lending protocols based on off-chain credit, privacy-ensured healthcare data marketplaces, and dating apps featuring verifiable zkSBTs, etc. Wherever there is a need for trust and privacy, zkPass can provide a solution.

By employing cryptographic technologies like MPC, ZKP, and others, zkPass enables users to validate their private data through the verification of their HTTPS-based web session—eliminating the need for file uploads or the exposure of sensitive details.

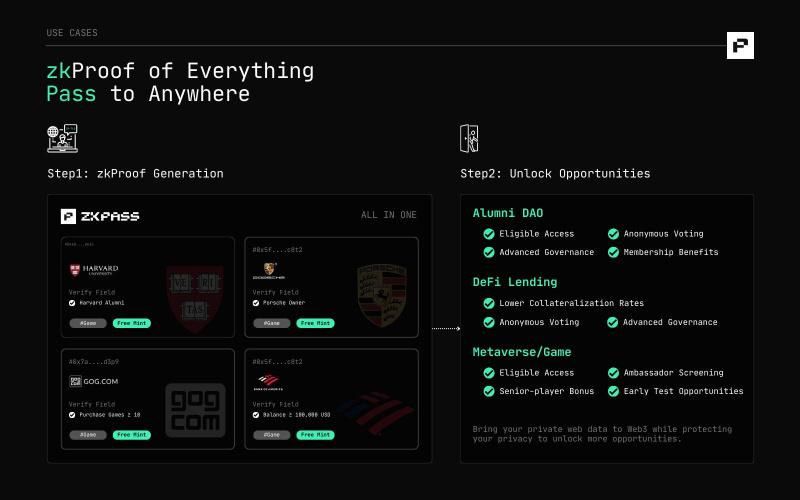

For example, through zkPass, Alice can prove:

- Based on her server response to the Steam/GOG website, she has purchased 10+ games with 100+ hours of gameplay and is not required to disclose any other private information about her account to a third party.

- Based on her server response with the Harvard Alumni website, she has a Bachelor’s degree and is an alumnus of Harvard University, but does not disclose any of her other superfluous personal data.

- Based on her server response with the Porsche website, she owns a Porsche, but does not disclose her frame number, purchase order, or other private data.

- Based on her server response with the bank’s website, she owns assets greater than $100K, but does not disclose any of her specific account assets, transfer records, or other private data.

zkPass can be applied in various scenarios to enhance user experience, trust, and privacy:

- The Metaverse/GameFi program is looking for gaming ambassadors to participate in a test and offer a reward, and they can easily verify that Alice is their target user.

- Alice can seamlessly access the Alumni DAO via her zkPass zkSBT while ensuring privacy and trustworthiness.

- Alice leveraged her RWA ZKPs to establish a reputation for high ratings, which allowed her to access a DeFi lending platform and secure lower mortgage and borrowing rates, ultimately boosting her capital efficiency.

By redesigning the TLS protocol to Three-party TLS, zkPass makes it seamless for any HTTPS-based website to be used as a trusted data source for provenance of zero-knowledge metadata without having to authorize any APIs.

Open Invitation to Shape the Future

zkPass launched its Pre-alpha Testnet in July, receiving an overwhelming response with over 200,000 waitlist signups. Currently, tens of thousands of whitelisted users have already generated more than 100,000 zero-knowledge proofs, each representing their respective private data, identity, or ownership.

User feedback holds immense importance as it helps refine and enhance their solution. The public release of the Pre-alpha Testnet extends a warm invitation to technology enthusiasts, privacy advocates, and individuals who deeply value secure data practices. This invitation aims to shape the future landscape of data privacy alongside zkPass collectively.

Participating in the Pre-alpha Testnet not only grants users early access to an advanced solution but also empowers them to actively contribute towards its improvement. This collaborative effort is a key driver in tailoring zkPass into a privacy-focused protocol that empowers users in an increasingly data-centric world.

How to Get Involved

Getting involved in zkPass’s Pre-alpha Testnet is simple:

- Users can Install the TransGate Extension from Google Chrome Web Store.

- Interested users join pre.zkpass.org to be a part of the Pre-alpha Testnet and experience firsthand the power of private data validation.

More tutorial details can be found on the doc wiki and engage with the zkPass community. Users are invited share their insights, and become an integral part of shaping this groundbreaking technology.

About ZkPass

zkPass is an advanced privacy-preserving protocol for private data verification. It allows users to securely and selectively validate their data from any HTTPS website, making it highly versatile for various applications, including banking and DeFi lending protocols. zkPass is the ideal solution whenever trust and privacy are essential.

Contact

Mason Bennett

info@zkpass.org

Abu Dhabi, UAE, 30 August, 2023 – Valicit Marketplace, the first decentralized ticketing platform built on the Venom blockchain, is thrilled to announce that more than 230,000 tickets were sold to the Numi Stories Club 404 Grand Opening on Venom testnet. The tickets give players early access to multiplayer functionality in the Numi metaverse’s Numi Stories game.

Despite the massive demand, the Valicit Marketplace enabled users to buy or resell tickets with confidence. Using the power of Venom blockchain, Valicit guarantees that every ticket sold is valid and authentic. Through its blockchain-based API solutions,Valicit ensures the authenticity and security of ticket transactions, preventing frauds, scams, and scalping that’s rampant on traditional online ticketing platforms. Additionally, it provides comprehensive control over the secondary market, facilitating both buying and selling of tickets.

Available on Android and iOS, Numi Stories is the ultimate rhythm action mobile game that lets players chart their own narrative, engage with VTubers, embark on dance battles, and tailor their characters using NFTs from the Numi Club. Numi Stories is reminiscent of popular rhythm games like Dance-Dance-Revolution but with a unique RPG twist.

Numi is the first worldwide metaverse platform built on the Venom blockchain for thought leaders, followers, and innovators. Venom emphasizes scalability, security, and user experience, making it an ideal choice for powering Numi. By utilizing blockchain technology, Numi ensures transparency, traceability, and the ownership of digital assets within the metaverse.

Mohammad Binyamin Chaudhry, the Founder & President of Valicit, stated, “Launching on the Venom testnet has been an exhilarating journey for us at Valicit. The ticket sales we’ve witnessed so far have truly been mind blowing, reaffirming our belief in the power of blockchain. This is just the beginning of our journey and we will continue our efforts to shape the future alongside the Venom blockchain.”

Numi CEO Victor Tumasov said, “Numi was thrilled to be chosen as one of the first projects on Venom to be incorporated into the Valicit ticket platform. For us the ability to sell tickets to events in our metaverse is a very interesting possibility that gives us a lot of potential cool use cases. For the first event we have chosen our PvP mode where Venom users will be able to test their mettle against each other in an amazing dance off in our mobile game.”

To be part of this unique experience:

- Launch Valicit’s portal to purchase your ticket with Venom testnet tokens for the Numi Stories’ PvP battle

- After purchasing the ticket, a link will be provided to stories.numi.net. Choose your platform (iOS or Android) and download the game

- Register your Numi ID, connect Venom Wallet, and complete the in-game tutorial

- Enter PvP battle at Club 404, a prominent location on the in-game map, in Numi Stories

- While in-game leaderboards are under development, daily leaderboards will be posted on Twitter

The PvP battle will end on Tuesday, September 5th at 19:59 UTC. The Top 100 players will be awarded with the exclusive NFT premium RadLad set. All NFTs earned can be accessed both in-game and on club.numi.net.

About Valicit

Valicit is a decentralized application taking on the ticketing industry. Through its blockchain-based API solutions, Valicit ensures the authenticity and security of ticket transactions. The platform gives users and event organizers the ability to verify the legitimacy of tickets using blockchain authentication. Additionally, it provides comprehensive control over the secondary market, facilitating both buying and selling of tickets.

About Venom Foundation:

Venom Foundation, operating as a decentralized network licensed by the Abu Dhabi Global Market (ADGM), is at the forefront of driving the advancement of global Web3 projects. As the world’s first compliant blockchain, Venom provides a secure and reliable blockchain with regulatory oversight by the ADGM, Venom serves as a trusted platform for governments, institutions and enterprises, ensuring compliance with regulatory requirements.

To enhance its capabilities, Venom has developed a range of in-house decentralized applications (dApps) and protocols on its blockchain. With features such as dynamic sharding, low fees, high-speed transactions, and scalability, Venom has the potential to serve as the foundational infrastructure for a thriving global ecosystem of Web3 applications. Its exceptional transaction speeds and limitless scalability enable it to meet the evolving needs of a rapidly growing user base.

For media inquiries, please contact: Muhammad Junaid, Principal, junaid@digikraft.io

Disclaimer: This release is for informational purposes only and should not be construed as financial promotion.

Georgetown, Cayman Islands, August 30th, 2023, Chainwire

Multiple core contributors of Quickswap, celebrated for their success on Polygon, have launched their next venture: Kinetix Finance on Kava Chain. Kava Chain is a Layer-1 Cosmos-Ethereum interoperability blockchain. The Kinetix Finance perpetual exchange is tailored for users eager to leverage trade without the limitations of traditional centralized exchanges.

Kinetix’s innovative Perpetual Market allows users to leverage trade on the Kava Chain. The Perpetual Market meets the rising demand for decentralized trading solutions, offering users leveraged exposure to crypto assets like KAVA, axlETH, axlWBTC, ATOM, and USDt all while ensuring utmost transparency and security.

“The Perpetual Market is not just another trading platform — it is a reflection of Kinetix’s dedication to providing decentralized solutions that empower our users. With this platform, we’re offering a unique, secure, and efficient way to leverage trade on the Kava Chain,” said Kinetix team lead Alexi Atlas.

At the heart of Kinetix’s Perpetual Market is the distinctive liquidity pool system, KLP. LPs can offer any of the initial five supported assets: KAVA, axlETH (ETH), axlBTC (BTC), ATOM, and USDT. In return for contributing these tokens, participants receive KLP, a special liquidity token representing the entire basket. This decentralized structure, combined with the protocol’s AMM, facilitates leverage trading, allowing users to borrow based on the value of their collateral.

“Kinetix’s Perpetual Market boasts a suite of features tailored to cater to sophisticated DeFi users. Its decentralized nature guarantees that positions of any size can be taken with clarity and safety,” said Scott Stuart, Kava Chain Co-founder. “And the KLP token is a nod to traditional liquidity pool systems, ensuring familiarity and ease of use for traders.”

For more updates, follow Kava Chain and Kinetix Finance on X (fka Twitter).

About Kava

Kava Chain is a secure, lightning-fast Layer-1 blockchain that combines the developer power of Ethereum with the speed and interoperability of Cosmos in a single, scalable network. Committed to fostering innovation and growth, Kava Chain is a trusted choice for developers and users worldwide.

About Kinetix

Kinetix Finance is building a DeFi Hub featuring perpetual futures trading and the most sophisticated trading instruments on Kava, connecting the major building blocks of decentralized finance. Your best trade, every trade.

Contact

Media Manager

Guillermo Carandini

Kava

g.carandini@kava.io

Does the online casino have a gender? Many people think it’s a male-dominated field, but facts say the opposite. This article will show that the female audience is rapidly increasing and determine the kind of quality casino entertainment each gender prefers.

How Many Women Play in Casinos?

The history of the casino goes back to the 18th century. During these times, gambling houses were visited mainly by men. But with the advent of new technologies and going online, the situation in the world has changed.

Gambling statistics (in 2019) report that the total number of women relative to all online casino users exceeds 17.6% in Canada and 45.8% in Australia! It means that almost each fifth Canadian and each second Australian casino player is female. According to the British Gambling Commission surveys (in 2021), 41.6% percent of United Kingdom women were gambling last month. For men, this percentage is just over 43%. At the same time, the average age of women in the casino is 29 years, and for men – 33 years. It vividly demonstrates the real picture of casino gender and refutes that gambling is male-dominated.

Psychology of Online Gambling

After online casinos appeared, this kind of entertainment became much more accessible to females. Like men, they see gambling as a vibrant alternative Universe for a unique experience. According to the YouGov UK research about the reasons to play (in 2021), more than 40% of women and men agreed that this is a common fun activity. Over 27% of women chose that they like to fantasize about winning. Over 20% of men selected it as getting the experience of what they bet on. Besides, five times more men than women identified the casino as a reliable way to show skills and earn money.

Another difference is that women are less dependent on casinos. The British Gambling Commission study found that men are about seven times more likely to have addiction problems. They see the casino as a source of income or competition because of keeping going for the reward when losing a streak. Besides, men’s large bets with aggressive strategies also express it. Women, in turn, play for a long time, bet little, and enjoy the process differently.

What games do men and women prefer?

The main question remains how the preferences of players of different sexes differ. Men love table games such as BlackJack or Poker because they prefer competitive activities and often play according to the chosen strategy. Women choose games of luck such as Lottery or Bingo. In addition, they are attracted by colorful Slots with fruits or any other theme. They rarely act according to a specific plan, so these games are perfect for them.

Some activities appeal to both women and men. For example, Roulette is a game with a moment of randomness but a certain probability of a ball falling out. This combination of sheer luck and clear strategy has proven to be universal in terms of gender casinos.

Crypto Casino and Genders

The above facts argue that men have ceased filling the casino space. But one more variable should be added to this equation – cryptocurrency. Since modern online casinos allow you to place bets in many currencies, the gender distribution, in this case, changes significantly.

The spoiler is that this situation will not change. It is difficult to deny the clear predominance of the number of male crypto enthusiasts. The percentage of women with an account on platforms like BetFury is very low. Although, according to statistics, more than 40% of those interested in buying Bitcoin were women. Therefore, more women will soon play in the casino and bet on cryptocurrencies.

So, we can conclude that women are interested in investing and the cryptocurrency market no less than men. By the way, apart from the 8,000 Slots and Original games with one of the highest RTPs on the market, you can also participate in Staking on BetFury. BetFury has an internal token – BFG. It’s listed on many crypto exchanges: PancakeSwap, Biswap, etc. The token has over 55,000 holders, and more than 3B BFG are in circulation. To start investing, you only need a minimum of 100 BFG.

Communication Ways on Social Media

Social media is one of the most important means of attracting an audience to the casino environment. Among them are Twitter, Telegram, TikTok, YouTube, and others. So, Twitter has 43.6% of women, Telegram has 41.4%, and TikTok has 57%. Let’s now define the relationship between general statistics and gambling.

The BetFury platform has collected data on gender from social media. The study showed that the clear leaders in the female audiences are TikTok (28%) and Twitter (32.09%). Therefore, most women often go to the casino from these social networks.

Analyzing this data makes it possible to identify the content attracting females the most. These are fascinating videos, funny memes, short info posts, and interactive, that is, a news feed with short facts and a visual component.

To sum up, the potential of attracting a female target audience to the casino is great since it’s a high-quality type of entertainment. Women are increasingly interested in cryptocurrency, looking for ways to make money and have a good time. Therefore, the online gambling audience will become more diverse soon, and no one will say that the casino is a male-dominated area.

Georgetown, Cayman Islands, August 28th, 2023, Chainwire

Stargate, the leading omnichain liquidity layer, and native asset bridge with over $18 billion in lifetime transaction volume, has now deployed on Kava Chain, the Cosmos-Ethereum interoperable Layer 1. This integration will expand the reach of Tether’s Cosmos-native USDt issued exclusively on the Kava Chain, to the Ethereum ecosystem and beyond.

Stargate’s success in connecting Ethereum networks is unmatched, with 300x more TVL than the next most-used bridge. Deploying Stargate on the Kava Chain gives DeFi users the most secure and efficient way to move USDt between the Cosmos and Ethereum ecosystems.

The integration ensures that users from any of Stargate’s chains have access to USDt on Kava Chain and every app-chain on Cosmos’s Internet of Blockchains. Ease-of-use features like single-click transfers and swaps, combined with unified liquidity and instant guaranteed finality, make traversing USDt capital efficient and simple. Stargate’s native asset transaction capabilities ensure a more direct and efficient connection to the Cosmos ecosystem.

“Kava Chain’s growth since becoming the exclusive native USDt hub for Tether has been impressive, with 90 million native USDt issued,” said Scott Stuart, Kava Chain Co-founder. “With Kava Chain now on Stargate, both retail and institutional users who previously had restricted access to certain features on Kava, now have an even broader spectrum of opportunities with USDt.”

Stargate’s involvement, combined with the Kava Chain’s USDt integration, promises to drive growth, increase exposure to liquidity, and open the Kava Chain and Cosmos ecosystems to wider markets, unprecedented usage for the first time.

About the Kava Chain

The Kava Chain is a secure, lightning-fast Layer-1 blockchain that combines the developer power of Ethereum with the speed and interoperability of Cosmos in a single, scalable network. Committed to fostering innovation and growth, the Kava Chain is a trusted choice for developers and users worldwide.

For more updates, follow Kava Chain on X (fka Twitter).

About Stargate

Stargate is a fully composable liquidity transport protocol that lives at the heart of Omnichain DeFi. With Stargate, users & dApps can transfer native assets cross-chain while accessing the protocol’s unified liquidity pools with instant guaranteed finality.

Contact

Media manager

guillermo carandini

Kava

guillermo.carandini@kava.io

[August 26, 2023] – Evadore emerges as an innovative ReFi regenerative finance project alongside a worldwide eco-movement, aiming to forge a more sustainable path for future generations and proffer solutions to global environmental challenges.

Notably, ReFi stands out as a financial system with a clear mission: contributing significantly to global improvement. With the escalating impacts of climate change and the growing harm inflicted upon the environment and wildlife by human actions, the urgency is evident. Evadore is set to initiate a worldwide campaign in collaboration with ReFi, facilitating nations to integrate their economic and state management systems within the ReFi framework.

The team has strategically fostered partnerships with prominent institutions within the blockchain industry, including top-tier exchanges, wallets, and service providers. Remarkably, the project is using state-of-the-art blockchain technology to coordinate the building of a financial infrastructure that will support sustainable growth while reducing reliance on fossil fuels.

In a statement made by expert Jimmy Rocks from the team of Evadore, he mentioned that “ Evadore promotes the ReFi financial paradigm in a world where conventional energy sources like oil, natural gas, and coal are becoming less competitive economically and have dwindling reserves. This cutting-edge framework has the world’s best interests at heart. Additionally, the ambitious worldwide movement spearheaded by Evadore and supported by the ReFi strategy aims to encourage countries to adopt a unified economic and political structure as climate change and the human ecological impact worsen.”

Moving forward, Evadore has set sail for an optimistic tomorrow. The project is confident in its ability to lead blockchain initiatives that benefit the environment. Evadore is set to undergo rapid iterative improvements that will allow it to more effectively control its growing carbon footprint and meet the ever-changing needs of the decentralized ecosystem.

With a strategic outlook, Evadore is poised to extend its sphere of influence into developing markets, including emerging economies and regions where blockchain technology remains in its infancy. This strategic maneuver aims to foster the proliferation of Evadore’s adoption, stimulate the growth of the decentralized ecosystem, and contribute to a greener world.

The platform’s commitment remains steadfast: eco-friendly solutions that are swift and inclusive, transcending boundaries.

About Evadore

Evadore is a pioneering ReFi regenerative finance project and global eco-movement dedicated to forging a sustainable path for future generations and pioneering solutions to global environmental challenges. By leveraging strategic partnerships and cutting-edge blockchain technology, Evadore endeavors to reshape the financial landscape while diminishing reliance on fossil fuels. Through visionary expansion and technological innovation, Evadore aspires to be the premier blockchain platform championing a greener world.

Contact

Name: Timothy Walker

Email: info@evadore.io

Company: Evadore

Location: United Kingdom

Zug, Switzerland, August 22nd, 2023, Chainwire

The Camino Network Foundation announced that its Web3 travel ecosystem Camino Network has passed a security audit with outstanding results carried out by the prestigious cybersecurity firm, Hexens. The full report can be found here.

Launched earlier this year, Camino Network is a public and permissioned Web3 blockchain for the global travel industry that anyone can build on. It will transform the travel industry by enabling participants to build and deploy decentralized applications powered by smart contracts, ushering in a new era of travel-related products and services.

Camino Network is a consortium blockchain backed by dozens of major travel industry players, including established brands such as Lufthansa, EuroWings, Hahn Air and Sunnycars.

Because the security of Camino Network has always been a top priority, it set out to find a reliable and trustworthy partner to audit its extensive codebase and provide recommendations on fixing any vulnerabilities.

The Camino Network Foundation ultimately chose to partner with Hexens, which has extensive experience in auditing blockchain infrastructure and smart contract code, having previously served noted projects including Polygon Labs, Celo, Lido and others.

Hexens uses the established methodologies and workflows in the industry to identify vulnerabilities and offer recommendations, and is also recognized as a pioneer in the development of new bug-finding techniques.

Hexens’ audit of Camino Network’s L1 codebase identified nine minor issues, each of which were promptly addressed by the team to ensure the integrity of the network. The absence of any major vulnerabilities underscores the commitment to high-quality coding practices and prioritization of robust security.

Following the audit, the Foundation has contracted Hexens to actively contribute to its security on an ongoing basis. The partnership will help to reassure the travel community that ecosystem security will always remain one of Camino Network’s highest priorities.

To that end, Camino Network is inviting white-hat hackers to test the strength of its network through an official bug bounty program, offering up to $50,000 in rewards for the discovery of critical vulnerabilities. Full details of the program and the incentives on offer are available now at https://hackenproof.com/camino-network/camino-protocol.

Camino Network has further increased the security of its network with the introduction of a fully-compliant KYC/KYB process. It ensures that only verified organizations and individuals are able to deploy smart contracts on Camino Network, preventing malicious actors from participating. Moreover, the governing Camino Network Foundation and Consortium also possess the authority to suspend suspicious smart contracts and validators through a democratic voting process, providing a novel layer of oversight that further enhances network security.

Camino Network officially launched its mainnet in April with support from more than 150 Web3, travel and travel technology partners. Its initial group of validators has since expanded to 26 live consortium members across eight countries and three continents, with several groundbreaking use cases to go live in the next weeks such as the Web3 hotel booking platform Sleap.

About Camino Network Foundation

Camino Network Foundation is a non-profit organization based in Zug, Switzerland, driving the development of a blockchain-based ecosystem in the global travel industry. The Camino Network Foundation supports the development of Camino Network, the first Layer 1 blockchain built specifically for the travel industry by travel technology experts.

Contact

Avishay Litani

avishay@marketacross.com

London, United Kingdom, August 21st, 2023, Chainwire

Shiba Memu, a dynamic new cryptocurrency meme coin supported by AI, is causing a stir as its presale surpasses the impressive $2 million fundraising milestone. This remarkable achievement was further spurred by the recent news it would list on BitMart, a renowned crypto exchange, all within the first month of the presale’s launch.

The inception of the Shiba Memu AI stems from the team’s previous experiences with exorbitant marketing agency fees. This motivated Shiba Memu to develop a self-promoting AI solution capable of adapting to various practical applications.

Presently at $0.021700 per token, Shiba Memu’s price experiences scheduled increments every 24 hours due to the team’s well-crafted smart contract. This mechanism is particularly appealing to presale supporters, as it ensures that the token purchase price remains lower than the eventual listing price on exchanges. For instance, if purchased today at $0.021700, the increase by the end of the 60-day presale would amount to 10%.

Those interested can acquire SHMU tokens via the official Shiba Memu website.

The Surge of Shiba Memu: Unleashing AI Potential

Shiba Memu’s remarkable success can be attributed to its untapped AI potential. In its nascent stages, the AI employs Natural Language Processing (NLP) and Sentiment Analysis to scour the web, primarily focusing on social platforms, for mentions of Shiba Memu. It tailors its promotions accordingly, transforming the brand from a simple cute dog meme to an amusing and engaging one, infused with a sharp sense of humor. The project’s forthcoming AI dashboards scheduled for Q4 further stimulate investor interest in meme coins with tangible utility.

The project’s tokenomics demonstrate a robust structure, with 85% of tokens allocated to the presale, 10% to exchange listing liquidity, and 5% to development. This allocation empowers SHMU holders to actively participate in the future development of the dApp.

Crypto Community Propels Shiba Memu’s Soaring Engagement

In the recent video shared by influencer, CryptoPRNR, Shiba Memu was featured among the top four cryptocurrencies predicted to perform well in the next bull run. Additionally, Shiba Memu was also showcased as the best meme coin to buy in 2023 on investing website Invezz. This recognition highlights the project’s strategic advancements and AI-driven capabilities, solidifying its position as a competitive player in the crypto market. The inclusion of Shiba Memu in this selection also reflects the growing interest and attention directed towards AI-powered crypto projects within the broader cryptocurrency community.

The Shiba Memu presale is approaching its closing date on the 1st of September. At this juncture, the price is set to reflect an increase of 119% from its launch price, moving from $0.011125 to $0.024400.

About Shiba Memu

Shiba Memu (SHMU) is a fresh dog-themed crypto meme coin that supports a platform utilizing AI to promote itself and generate buzz in online communities. This technology is poised to gain traction within the blockchain industry in the coming years, establishing Shiba Memu’s position as an industry innovator. The innovative AI technology behind the project demonstrates true innovation in the meme coin sector, offering small and medium-sized businesses access to effective marketing solutions that could significantly cut costs and provide a competitive advantage.

To learn more, or to buy SHMU, visit: Website | Whitepaper | Socials

Contact

Shiba Memu Team

Shiba Memu

contact@shibamemu.com